SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to

Section 14(c) of

the Securities Exchange Act of 1934

Check

the appropriate box:

|

£

|

Preliminary

Information Statement

|

|

|

|

|

£

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

|

|

|

S

|

Definitive

Information Statement

|

NYBD HOLDING, INC.

(Name

of Registrant as Specified In Its Charter)

Payment

of Filing Fee (Check the appropriate box):

|

S

|

None

required

|

|

|

|

|

£

|

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

|

|

|

|

1.

|

Title of

each class of securities to which transaction applies:

|

|

|

2.

|

Aggregate

number of securities to which transaction applies:

|

|

|

3.

|

Per unit

price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth amount on which filing

fee is calculated and state how it was determined):

|

|

|

4.

|

Proposed

maximum aggregate value of transaction:

|

|

|

5.

|

Total fee

paid:

|

|

|

|

|

£

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

£

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of the filing.

|

|

|

|

|

|

|

1.

|

Amount previously

paid:

|

|

|

2.

|

Form, Schedule

or Registration Statement No.:

|

|

|

3.

|

Filing Party:

|

|

|

4.

|

Date Filed:

|

NYBD

HOLDING, INC.

2600

West Olive Avenue, 5F

Burbank,

California 91505

(855)

710-5437

NOTICE

OF ACTION TAKEN BY WRITTEN CONSENT OF OUR MAJORITY STOCKHOLDERS

To

Our Stockholders:

We

are writing to advise you that certain common and preferred stockholders, owning approximately 80% of the preferred stock and

60% of the common stock, have approved by written consent in lieu of a stockholders’ meeting, the proposal to change our

corporate name from NYBD HOLDING, INC. to PLEASANT KIDS, INC. On June 18, 2014, our board of directors approved the above proposal.

PLEASE

NOTE THAT THE NUMBER OF VOTES RECEIVED FROM STOCKHOLDERS BY WRITTEN CONSENT IS SUFFICIENT TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT

FOR THESE ACTIONS UNDER FLORIDA LAW AND NO ADDITIONAL VOTES WILL CONSEQUENTLY BE NEEDED TO APPROVE THE ACTIONS

.

No

action is required by you. The accompanying Information Statement is furnished only to inform stockholders of those actions taken

by written consent described above before they take effect in accordance with Rule 14c-2, promulgated under the Securities Exchange

Act of 1934, as amended. This Information Statement is first being mailed to you on or about July 20, 2014, and we anticipate

the effective date of the proposed actions to be August 9, 2014, the record date, or as soon thereafter as practicable in accordance

with applicable law, including the Florida Revised Statutes.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The

accompanying Information Statement is for information purposes only and explains the actions taken by written consent. Please

read the accompanying Information Statement carefully.

|

July 15, 2014

|

Very truly yours,

|

|

|

|

|

|

ROBERT RICO

|

|

|

Robert Rico

|

|

|

Chief Executive Officer

|

NYBD

HOLDING, INC.

2600

West Olive Avenue, 5F

Burbank,

California 91505

(855)

710-5437

INFORMATION

STATEMENT PURSUANT TO SECTION 14(c) OF THE

SECURITIES

EXCHANGE ACT OF 1934 AND REGULATION 14C THEREUNDER

This

Information Statement is being sent by first class mail to all record and beneficial owners of the common stock, $0.001 par value

per share and the preferred stock, $0.001 par value per share, of NYBD HOLDING, INC., a Florida corporation, which we refer to

herein as “NYBD,” “company,” “we,” “our” or “us.” The mailing date

of this Information Statement is on or about July 20, 2014. The Information Statement has been filed with the Securities and Exchange

Commission (the “

SEC

”) and is being furnished, pursuant to Section 14(c) of the Securities Exchange

Act of 1934, as amended (the “

Exchange Act

”), to notify our stockholders of actions we are taking pursuant

to written consents of a majority of our stockholders in lieu of a meeting of stockholders.

On

July 15, 2014, the record date for determining the identity of stockholders who are entitled to receive this Information Statement,

we had 2,159,006,729 shares of common stock issued and outstanding and 10,000,000 shares of Series A preferred stock outstanding.

Each share of Series A preferred stock had 25 votes. The common stock and the preferred stock vote separately on all issues submitted

to shareholders and a majority of the outstanding Series A preferred stock and a majority of the outstanding shares of common

stock are required to approve the amendment to change our name to Company.

The

common stock and Series A preferred stock constitute the sole outstanding classes of NYBD voting securities. Each share of common

stock entitles the holder thereof to one vote on all matters submitted to stockholders. Each share of preferred stock entitles

the holder to 25 votes on all matters submitted to stockholders. The preferred and common stock vote separately all matters submitted

to stockholders. A majority of the outstanding shares of each is required to amend our articles of incorporation and change our

name to PLEASANT KIDS, INC.

NO

VOTE OR OTHER CONSENT OF OUR STOCKHOLDERS IS BEING SOLICITED IN CONNECTION WITH THIS INFORMATION STATEMENT. WE ARE NOT ASKING

YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

On

July 2, 2014, certain stockholders who beneficially owned 8,000,000 or approximately 80% of the outstanding shares of Series A

preferred stock and certain stockholders who beneficially owned 1,295,404,037 or approximately 60% of the outstanding shares of

the common stock consented in writing to change our corporate name from NYBD HOLDING, INC. to PLEASANT KIDS, INC.

Also

on June 18, 2014, our board of directors approved the above action, subject to approval by the stockholders. No other corporate

actions to be taken by written consent were considered.

We

are not aware of any substantial interest, direct or indirect, by security holders or otherwise, that is in opposition to matters

of action being taken with the exception of Haim Yeffet, one of our directors. In addition, pursuant to the laws of Florida, the

actions to be taken by majority written consent in lieu of a special stockholders meeting do not create appraisal or dissenters’

rights.

Our

board of directors determined to pursue stockholder action by majority written consent of those shares entitled to vote in an

effort to reduce the costs and management time required to hold a special meeting of stockholders and to implement the above action

in a timely manner.

Under

Section 14(c) of the Exchange Act, actions taken by written consent without a meeting of stockholders cannot become effective

until 20 days after the mailing date of this definitive Information Statement, or as soon thereafter as is practicable. We are

not seeking written consent from any stockholders other than as set forth above and our other stockholders will not be given an

opportunity to vote with respect to the actions taken. All necessary corporate approvals have been obtained, and this Information

Statement is furnished solely for the purpose of advising stockholders of the actions taken by written consent and giving stockholders

advance notice of the actions taken.

TABLE OF CONTENTS

|

|

Page

|

|

|

|

|

FORWARD-LOOKING STATEMENTS

|

5

|

|

|

|

|

QUESTIONS AND ANSWERS

|

5

|

|

|

|

|

SUMMARY

|

6

|

|

|

|

|

OUTSTANDING VOTING SECURITIES AND CONSENTING STOCKHOLDERS

|

6

|

|

Security Ownership of Certain Beneficial Owners and Management

|

7

|

|

|

|

|

NAME CHANGE

|

8

|

|

Reason for the Proposal

|

8

|

|

Amendment to Articles of Incorporation

|

8

|

|

No Appraisal Rights

|

8

|

|

|

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

9

|

|

|

|

|

EFFECTIVE DATE

|

9

|

|

|

|

|

MISCELLANEOUS MATTERS

|

9

|

|

|

|

|

CONCLUSION

|

9

|

FORWARD-LOOKING INFORMATION

This Information Statement and other

reports that we file with the SEC contain certain forward-looking statements relating to future events performance. In some cases,

you can identify forward-looking statements by terminology such as "may,” “will” “should,” “expect,”

“intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,”

"potential,” “continue,” or similar terms, variations of such terms or the negative of such terms. These

statements are only predictions and involve known and unknown risks, uncertainties and other factors, including those risks discussed

elsewhere herein. Although forward-looking statements, and any assumptions upon which they are based, are made in good faith and

reflect our current judgment, actual results could differ materially from those anticipated in such statements. Except as required

by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements

to conform these statements to actual results.

QUESTIONS AND ANSWERS

Q: Why did I receive this Information

Statement?

A: Stockholders owning a majority of

the outstanding Series A preferred stock and a majority of the outstanding common stock took action to change our corporate name

by written consent in lieu of a stockholders’ meeting. Federal securities laws require that our other stockholders

receive this Information Statement before the action can become effective.

Q: What actions did the stockholders

take?

A: The stockholders executed written

consents approving the proposal that we change our corporate name from NYBD HOLDING, INC. to PLEASANT KIDS, INC. Pursuant to SEC

rules and regulations, these actions require notification to all of our stockholders.

Q: What action do I need to take as

a stockholder?

A: You are not required to take any

action. The actions approved by written consent can take effect after 20 days from the date of mailing this Information

Statement.

Q: Am I entitled to appraisal rights?

A: No. You are not entitled to appraisal

rights in accordance with Florida law in connection with the actions taken by written consent.

Q: Where can I find more information

about the company?

A: As required by law, we file annual,

quarterly and current reports and other information with the SEC that contain additional information about our company. You

can inspect and copy these materials at the public reference facilities of the SEC’s Washington, D.C. office, 100 F Street,

NE, Washington, D.C. 20549 and on its Internet site at

http://www.sec.gov

.

Q: Who can help answer my questions?

A: If you have questions about the company

after reading this Information Statement, please contact us in writing at our principal executive offices at 2600 West Olive Avenue,

5F, Burbank, California 91505, telephone 855-710-5437.

SUMMARY

This summary sets forth certain selected information contained

in this Information Statement that may be important to you to better understand transactions referred to in this summary. This

summary also provides cross-references to the location in the Information Statement of the information summarized.

NYBD HOLDING, INC.

Business Development Summary

We were incorporated as NYBD HOLDING, INC.

in the state of Florida on September 21, 2005 with the name League Now HOLDING Corporation. On February 27, 2013, the Company consummated

a share exchange with New York Bagel Deli, Inc. (“NYBD”). Under the terms of the share exchange, NYBD received

28,500,000 shares of the Company’s common stock for 100% of the issued and outstanding capital of NYBD. As a result of the

transaction, the shareholders of NYBD became the majority owners of the Company and NYBD became a wholly-owned subsidiary. Concurrent

with the share exchange, the Company agreed to sell its subsidiary (the operations of League Now) to John Bianco the Company’s

former CEO in exchange for the assumption by Mr. Bianco of all associated liabilities with the exception of a convertible note

held by Asher Enterprises Inc. in the amount of $75,000. On September 20, 2013, the Company entered into a share exchange agreement

with Pleasant Kids, Inc. whereby the Company issued 10,000,000 preferred shares and 1,000 common shares for all of the outstanding

shares of Pleasant Kids, Inc. As a result of the share exchange, Pleasant Kids, Inc. became a wholly owned subsidiary of the Company.

In connection with the closing of the share exchange agreement, Haim Yeffet, a director and shareholder of NYBD HOLDING, Inc. returned

13,000,000 shares of the common stock and 100,000 shares of the Series A Preferred Stock of NYBD HOLDING, Inc. to the treasury

of NYBD HOLDING, Inc. Mr. Haim received 2,000,000 shares of Series A Preferred Stock, assumed the outstanding debt of NYBD HOLDING,

Inc., with the exception of the Asher convertible notes, and kept all of the assets of NYBD HOLDING, Inc. For accounting purposes,

the share exchange was treated as a reverse merger. The new operations of the Company will be solely those of Pleasant Kids, Inc.

The historical balances and results of operations will be those of Pleasant Kids, exclusive of NYBD HOLDING, Inc. Pleasant Kids,

Inc. was incorporated on July 15, 2013 under the laws of the state of Florida.

Pleasant Kids, Inc. is engaged in the

business of producing, marketing and distributing naturally balanced alkalized water for children, including and not limiting to

organic natural juices.

We are a reporting company under the

Securities Exchange Act of 1934, as amended, and our public filings can be accessed at

www.sec.gov

. Our common

stock is listed for quotation on the OTC-QB under the trading symbol “NYBD”.

Name Change

Our board of directors has determined

that it is in our best interest to change our corporate name from NYBD HOLDING, INC. to PLEASANT KIDS, INC.

OUTSTANDING VOTING SECURITIES AND

CONSENTING STOCKHOLDER

As of July 15, 2014 we had 10,000,000

shares of Series A preferred stock issued outstanding and 2,159,006,729 shares of common stock issued and outstanding. Each share

of Series A preferred stock has 25 votes. Accordingly, in order to amend our articles of incorporation, 5,000,001 shares of Series

A preferred stock will have to approve of the amendment to change our name. Further, we have 2,159,006,729 shares of common stock

outstanding and 1,079,503,365 shares of common stock will have to approve the amendment to change our name. In summary, a majority

of the outstanding shares of the Series A preferred stock AND a majority of the outstanding shares of common stock both have to

approve the amendment in order to amend the articles of incorporation and have our name changed to PLEASANT KIDS, INC.

Because the actions were approved by

the written consent of stockholders holding a majority of our outstanding shares, no proxies are being solicited with this Information

Statement.

Florida corporate law provides in substance

that unless a company’s articles of incorporation provide otherwise, stockholders may take action without a meeting of stockholders

and without prior notice if a consent or consents in writing, setting forth the action so taken, is signed by stockholders having

not less than the minimum number of votes that would be necessary to take such action at a meeting at which all shares entitled

to vote thereon were present.

The consenting stockholders are the

beneficial owners of 8,000,000 or approximately 80% of the outstanding Series A preferred stock and the owners of 1,295,404,037

or approximately 60% of the outstanding shares of common stock. The consenting stockholders voted in favor of the proposed actions

described herein pursuant to written consents dated July 2, 2014. No consideration was paid for the consents. The consenting stockholders

are set forth below.

|

Name

|

|

Number of

|

|

Percentage of

|

|

Number of

|

|

Percentage of

|

|

Beneficial Owner

|

|

Common Shares

|

|

Ownership

|

|

Preferred Shares

|

|

Ownership

|

|

|

|

|

|

|

|

|

|

|

|

Ahmad Alrabiah

|

|

213,352,031

|

|

9.8%

|

|

0

|

|

0.0%

|

|

|

|

|

|

|

|

|

|

|

|

Lee Carney

|

|

251,265,651

|

|

11.6%

|

|

0

|

|

0.0%

|

|

|

|

|

|

|

|

|

|

|

|

Gary Laprise

|

|

236,529,212

|

|

10.9%

|

|

0

|

|

0.0%

|

|

|

|

|

|

|

|

|

|

|

|

Todd Denzik

|

|

278,289,112

|

|

12.8%

|

|

0

|

|

0.0%

|

|

|

|

|

|

|

|

|

|

|

|

Mohammed Eddessa

|

|

312,257,561

|

|

14.4%

|

|

0

|

|

0.0%

|

|

|

|

|

|

|

|

|

|

|

|

Calvin Lewis

|

|

75,000,000

|

|

3.5%

|

|

3,000,000

|

|

30.0%

|

|

|

|

|

|

|

|

|

|

|

|

Robert Rico

|

|

125,000,000

|

|

5.8%

|

|

5,000,000

|

|

50.0%

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS

|

|

1,491,693,567

|

|

68.8%

|

|

8,000,000(1)

|

|

80.0%

|

|

|

(1)

|

Each share of preferred stock has 25 votes, however, the Series A

preferred stock and the common stock cannot vote as a single unit on matters submitted to shareholders of record. Each must vote

separately and a majority of the outstanding shares of each is necessary in order to pass the amendment to change the corporate

name to PLEASANT KIDS, INC.

|

Security Ownership of Certain Beneficial

Owners and Management

As of the date of this filing, the following

table sets forth certain information with respect to the beneficial ownership of our Common Stock by (i) each shareholder known

by us to be the beneficial owner of more than five percent (5%) of our Common Stock, (ii) by each of our current directors and

executive officers as identified herein, and (iii) all of the Company’s directors and executive officers as a group. Each

person has sole voting and investment power with respect to the shares of Common Stock, except as otherwise indicated. Beneficial

ownership is determined in accordance with the rules of the Commission and generally includes voting or investment power with respect

to securities. Shares of Common Stock and non-qualified Company Options, Company Warrants, and convertible securities

that are currently exercisable or convertible into shares of the Company's Common Stock within sixty (60) days of the date of this

document, are deemed to be outstanding and to be beneficially owned by the person holding the Company Options, Company Warrants,

or convertible securities for the purpose of computing the percentage ownership of the person, but are not treated as outstanding

for the purpose of computing the percentage ownership of any other person.

|

Name and Address

|

|

Number of

|

|

Percentage of

|

|

Number of

|

|

Percentage of

|

|

Beneficial Owner

|

|

Common Shares

|

|

Ownership

|

|

Preferred Shares

|

|

Ownership

|

|

|

|

|

|

|

|

|

|

|

|

Robert Rico

4775 Collins Ave., Suite 4205

Miami Beach, FL 33140

|

|

125,000,000

|

|

5.8%

|

|

5,000,000

|

|

50.0%

|

|

|

|

|

|

|

|

|

|

|

|

Calvin Lewis

4779 Collins Ave, Suite 1907

Miami Beach, FL 33140

|

|

75,000,000

|

|

3.5%

|

|

3,000,000

|

|

30.0%

|

|

|

|

|

|

|

|

|

|

|

|

Kenneth C. Wiedrich

31579 Mendocino Court

Temecula, CA 92592

|

|

0

|

|

0.0%

|

|

0

|

|

0.0%

|

|

|

|

|

|

|

|

|

|

|

|

Haim Yeffet

155 E. Flagler

Miami, FL 33131

|

|

50,000,000

|

|

2.3%

|

|

2,000,000

|

|

20.0%

|

|

|

|

|

|

|

|

|

|

|

|

All officers and directors as a

group (4 individuals)

|

|

250,000,000

|

|

11.6%

|

|

10,000,000

|

|

100.0%

|

NAME CHANGE

The Board of Directors has approved,

subject to stockholders’ approval, an amendment to our Articles of Incorporation to change our name proposal to change our

name from NYBD HOLDING, INC. to PLEASANT KIDS, INC. The Board of Directors has determined that this amendment is advisable and

in the best interests of us and our stockholders to be more reflective of our current business operations.

Reason for the Proposal

We have changed our business from

operating

two deli restaurants that

speci

alized i

n

providin

g

a

wide variety of bagels and cream cheese spread toppings along with a full service juice bar and large salad bar

to the business

of producing, marketing and distributing naturally balanced alkalized water for children, including and not limiting to organic

natural juices.

Amendment to Articles of Incorporation

In connection with the name change,

we will file with the State of Florida an amendment to our articles of incorporation to reflect the change our corporate name from

NYBD HOLDING, INC. to PLEASANT KIDS, INC.

No Appraisal Rights

Under Florida Corporations Law, stockholders

are not entitled to appraisal rights with respect to the proposed Reverse Stock Split and amendment to our articles of incorporation.

WHERE YOU CAN FIND MORE INFORMATION

We file periodic reports and other information

with the SEC, which reports and other information are available for inspection at the SEC’s Public Reference Room at 100

F Street, N.E., Washington, D.C. 20549. You may call the SEC at 1-800-SEC-0330 for information about these facilities.

Copies of such information may be obtained by mail, upon payment of the SEC’s customary charges, by writing to the SEC at

100 F Street, N.E., Washington, D.C. 20549. The SEC also maintains a web site on the Internet at www.sec.gov that contains reports,

proxy statements and other information about NYBD that we file electronically with the SEC.

EFFECTIVE DATE

Pursuant to Rule 14c-2 under the Exchange

Act, the above actions to effect the name change will not be effective until a date at least twenty (20) days after the date on

which the definitive Information Statement has been mailed to the stockholders. We anticipate that the actions contemplated

hereby will be effected on or about August 9, 2014.

MISCELLANEOUS MATTERS

The entire cost of furnishing this Information

Statement is being borne by the company. We will request brokerage houses, nominees, custodians, fiduciaries and other

like parties to forward this Information Statement to the beneficial owners of the common stock held of record by them and will

reimburse such persons for their reasonable charges and expenses in connection therewith. The board of directors has fixed the

close of business on July 15, 2014, as the record date for the determination of Stockholders who are entitled to receive this Information

Statement.

This Information Statement is being

mailed on or about July 20, 2014 to all stockholders of record as of the record date.

CONCLUSION

As a matter of regulatory compliance,

we are sending you this Information Statement that describes the purpose and effect of the above actions. Your consent

to the above action is not required and is not being solicited in connection with this action. This Information Statement

is intended to provide our stockholders information required by the rules and regulations of the Securities Exchange Act of 1934,

as amended.

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY. THE ATTACHED MATERIAL IS FOR INFORMATIONAL PURPOSES ONLY.

|

|

BY ORDER OF THE BOARD OF DIRECTORS

|

|

|

|

|

July 15, 2014

|

ROBERT RICO

|

|

|

Robert Rico

|

|

|

Chief Executive Officer

|

-9-

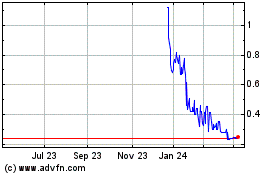

Cuentas (PK) (USOTC:CUEN)

Historical Stock Chart

From Apr 2024 to May 2024

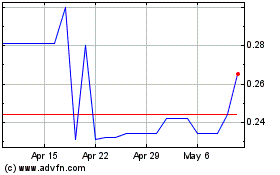

Cuentas (PK) (USOTC:CUEN)

Historical Stock Chart

From May 2023 to May 2024