Natural Gas Prices Surge -- Chesapeake Energy and Cheniere Energy Look to Benefit

May 17 2012 - 8:20AM

Marketwired

Natural gas prices have surged recently after being in a long

slump. Recent advances in technology have unlocked new reserves and

seen production skyrocket as a result. The United States Natural

Gas Fund is up nearly 20 percent over the last month, showing signs

of a long awaited recovery for the industry. The Paragon Report

examines investing opportunities in the Natural Gas Industry and

provides equity research on Chesapeake Energy Corporation (NYSE:

CHK) and Cheniere Energy, Inc. (NYSE: LNG).

Access to full reports can be found at:

www.ParagonReport.com/CHK

www.ParagonReport.com/LNG

Natural gas futures on Tuesday rose 2.8 percent to $2.50 /mmBtu.

The Energy Information Administration (EIA) is set to release

weekly gas inventory date Thursday. According a recent article in

the Wall Street Journal it is anticipated that the data will show

inventories rose significantly less than the year-ago level of 86

billion cubic feet and the five-year average of 91 bcf, on

increased demand from electrical utilities, who have recently

switched from coal to gas.

"Narrowing in the surplus ... [is] a more important driver of

natural gas pricing than the huge absolute supply level," said Jim

Ritterbusch, president of Ritterbusch & Associates. As a result

of this mentality, he said, "We are leaving open the possibility of

a further price advance to around the $2.61 area."

Paragon Report releases regular market updates on the Natural

Gas Industry so investors can stay ahead of the crowd and make the

best investment decisions to maximize their returns. Take a few

minutes to register with us free at www.ParagonReport.com and get

exclusive access to our numerous stock reports and industry

newsletters.

Chesapeake's 1.5 million acres in the Permian Basin is estimated

to be $6.82 billion, $1.82 billion more than previous estimates,

based on prices Concho Resources Inc. paid for oil fields in the

same area. "This is probably going to be the biggest Permian asset

sale in quite a long time and perhaps a long time into the future,"

Chesapeake's CEO Aubrey McClendon said on a recent conference call.

"For a company that wants to get bigger in the Permian or wants to

get in the Permian, this is the best opportunity."

Cheniere Energy Partners L.P. recently announced that it has

agreed to sell $1.5 billion in stock to the Blackstone Group L.P.

Blackstone has agreed to buy 100 million units for $15 each, a 40

percent discount to Cheniere's Monday closing price. "Financing is

the last milestone we need to complete in order to proceed with the

construction of the first two trains of our Liquefaction Project at

Sabine Pass," said Cheniere Chief Executive Charif Souki.

Paragon Report provides Market Research focused on equities that

offer growth opportunities, value, and strong potential return. We

strive to provide the most up-to-date market activities. We

constantly create research reports and newsletters for our members.

The Paragon Report has not been compensated by any of the

above-mentioned companies. We act as independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at: www.ParagonReport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

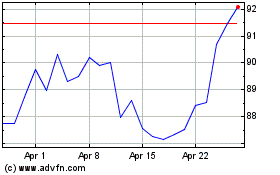

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2024 to May 2024

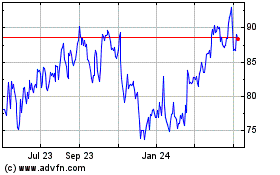

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From May 2023 to May 2024