Career Education Corporation (NASDAQ: CECO) today reported total

revenue of $542.9 million, and net income of $12.1 million, or

$0.15 per diluted share, for the fourth quarter of 2010 compared to

total revenue of $507.5 million and net income of $30.7 million, or

$0.36 per diluted share, for the fourth quarter of 2009. For the

full year 2010, total revenue of $2.12 billion, and net income of

$157.8 million, or $1.95 per diluted share increased from total

revenue of $1.83 billion and net income of $81.2 million, or $0.94

per diluted share, for the full year 2009.

“Our financial performance both in the fourth quarter and in

2010 was in line with our expectations,” said Gary E. McCullough,

President and Chief Executive Officer. “While private sector

postsecondary education is in a period of heightened scrutiny and

uncertainty, we view this as a period of opportunity in which we

will continue to enhance our programs, processes and systems to

better meet the needs of our diverse student population.”

The Company believes it is useful to present non-GAAP financial

measures, which exclude certain significant items, as a means to

understand the performance of its core business. On a non-GAAP

basis, earnings per diluted share from continuing operations were

$0.81 in the fourth quarter 2010 as compared to $0.74 in the fourth

quarter of 2009. For the years ended December 31, 2010 and 2009,

earnings per diluted share from continuing operations (non-GAAP

basis) were $3.00 and $1.95, respectively. (See tables below and

the GAAP to non-GAAP reconciliation attached to this press release

for further details.)

CONSOLIDATED RESULTS

Quarter Ended December 31, 2010

- Total revenue was $542.9 million for

the fourth quarter of 2010, a 7.0 percent increase from $507.5

million for the fourth quarter of 2009.

- Operating income was $20.7 million for

the fourth quarter of 2010, versus operating income of $98.6

million for the fourth quarter of 2009. The operating margin was

3.8 percent for the fourth quarter of 2010, compared to an

operating margin of 19.4 percent for the fourth quarter of

2009.

- Income from continuing operations for

the quarter ended December 31, 2010 was $15.3 million, or $0.19 per

diluted share, compared to $62.7 million, or $0.74 per diluted

share, for the quarter ended December 31, 2009.

- The operating results for the fourth

quarter 2010 and 2009 include significant items as summarized

below:

Earnings per Significant Items Diluted (In Millions)

Share Impact

Three Months

Ended December 31, 2010

Trade Name Impairment $ 67.8 $ 0.55 Legal Settlement 0.8 0.01

Severance 7.7 0.06

TOTAL $ 76.3

$ 0.62

Three Months

Ended December 31, 2009

Remaining Lease Obligations for Vacated Space $ 14.3 $ 0.11

Performance-based Compensation Related to Plan Outperformance (2.2

) (0.02 ) Termination of Insurance Policies (12.0 )

(0.09 )

TOTAL $ 0.1 $ -

- In connection with our annual

impairment testing, we recorded an impairment charge related to our

Le Cordon Bleu trade name which reduced its carrying value from

$139.6 million to $71.8 million. The fair value of the trade name

is calculated based upon our expected future operating results for

our Culinary Arts segment.

- Excluding the significant items in the

table above, operating income was $97.0 million in the fourth

quarter 2010, a 1.7 percent decrease from $98.7 million in the

fourth quarter of 2009. The operating margin was 17.9 percent

during the fourth quarter 2010 as compared to 19.4 percent during

the fourth quarter 2009.

Year Ended December 31, 2010

- Total revenue was $2.12 billion for the

year ended December 31, 2010, compared to $1.83 billion for the

year ended December 31, 2009.

- Operating income increased to $246.4

million for the year ended December 31, 2010, from $229.0 million

for the year ended December 31, 2009. The operating margin

decreased slightly to 11.6 percent for the year ended December 31,

2010, from 12.5 percent for the year ended December 31, 2009.

- Income from continuing operations for

the year ended December 31, 2010, was $166.6 million, or $2.06 per

diluted share, compared to $149.5 million, or $1.73 per diluted

share, for the year ended December 31, 2009.

- The operating results for the years

ended December 31, 2010 and 2009 include the following significant

items:

Earnings per Significant Items Diluted (In Millions)

Share Impact

Year Ended

December 31, 2010

Trade Name Impairment $ 67.8 $ 0.55 Legal Settlement 40.8 0.33

Severance 7.7 0.06

TOTAL $ 116.3

$ 0.94

Year Ended

December 31, 2009

Asset Impairment $ 2.5 $ 0.02 Severance 1.5 0.01 Remaining Lease

Obligations for Vacated Space 14.3 0.11 Performance-based

Compensation Related to

Plan Outperformance

23.1 0.17 Termination of Insurance Policies (12.0 )

(0.09 )

TOTAL $ 29.4 $ 0.22

- Excluding the significant items in the

table above, operating income was $362.7 million for the year ended

December 31, 2010 and $258.4 million for the year ended December

31, 2009, an increase of 40.4 percent. Operating margin was 17.1

percent and 14.1 percent for the years ended December 31, 2010 and

2009, respectively.

CONSOLIDATED CASH FLOWS AND FINANCIAL POSITION

Cash Flows

• Net cash flows provided by operating activities totaled $272.3

million for the year ended December 31, 2010, compared to $288.3

million for the year ended December 31, 2009. Operating cash flows

remained relatively constant as compared to the prior year as

strong cash flow driven by increased net income was offset by

payment of prior year annual incentive compensation and the impact

of student receivables growth and related payment performance.

• Capital expenditures increased to $127.3 million during the

year ended December 31, 2010, from $74.1 million for the year ended

December 31, 2009. Capital expenditures increased to 6.0 percent of

total revenue during the year ended December 31, 2010 as compared

to 4.0 percent for the year ended December 31, 2009 as a result of

investments made in the Company’s new campus support center.

Financial Position

• As of December 31, 2010 and December 31, 2009, cash and

cash equivalents and short-term investments totaled $449.2 million

and $484.7 million, respectively.

Stock Repurchase Program and Treasury Stock

During 2010, the Company repurchased approximately 5.4 million

shares of its common stock for approximately $154.9 million at an

average price of $28.54 per share. The Company did not repurchase

shares of its common stock during the fourth quarter 2010. Under

the Company’s previously authorized stock repurchase program, stock

repurchases may be made on the open market or in privately

negotiated transactions from time to time, depending on factors

including market conditions and corporate and regulatory

requirements. As of December 31, 2010, approximately $290.5 million

was available under the Company’s stock repurchase program.

During January 2011, the Company repurchased an additional

3.7 million shares of its common stock for $79.9 million at an

average price of $21.47 per share through the Company’s 10b5-1

repurchase program announced by the Company on November 15,

2010.

Our unaudited consolidated balance sheet reflects the correction

of an error related to the recording of the treasury share

retirement which occurred in the fourth quarter 2007. The impact of

this correction was to increase additional paid-in-capital and

reduce retained earnings by $417.9 million, respectively. All

periods presented have been adjusted accordingly. This correction

does not impact operating income, net income or total stockholders’

equity.

STUDENT POPULATION AND NEW STUDENT

STARTS

Student Population

Total student population by reportable

segment as of December 31, 2010 and 2009, was as follows:

As of December 31, % Change

2010 2009 2010 vs. 2009

Student

Population

University 62,400 59,300 5% Health Education 29,000 24,200 20%

Culinary Arts 13,100 10,900 20% International 12,300 10,900 13%

Total Student Population

116,800 105,300 11%

New Student Starts

New student starts by reportable segment

during the fourth quarter of 2010 and 2009, were as follows:

For the Three Months Ended December 31,

% Change

2010 2009 2010 vs. 2009

New Student

Starts

University 16,510 18,550 -11% Health Education 6,270 5,510 14%

Culinary Arts 1,390 1,430 -3% International 3,570 2,950 21%

Total New Student Starts

27,740 28,440 -2%

CONFERENCE CALL INFORMATION

Career Education Corporation will host a conference call on

Friday, February 18, 2011 at 10:00 a.m. Eastern time. Interested

parties can access the live webcast of the conference call at

www.careered.com in the Investor Relations section of the website.

Participants can also listen to the conference call by dialing

800-580-9478 (domestic) or 630-691-2769 (international) and citing

code 28756801. Please log-in or dial-in at least 10 minutes prior

to the start time to ensure a connection. An archived version of

the webcast will be accessible for 90 days at www.careered.com in

the Investor Relations section of the website. A replay of the call

will also be available for seven days by calling 888-843-7419

(domestic) or 630-652-3042 (international) and citing code

28756801.

ABOUT CAREER EDUCATION CORPORATION

The colleges, schools and universities that are part of the

Career Education Corporation (“CEC”) family offer high-quality

education to a diverse student population of more than 116,000

students across the world in a variety of career-oriented

disciplines through online, on-ground and hybrid learning program

offerings. The more than 90 campuses that serve these students are

located throughout the United States and in France, Italy, the

United Kingdom and Monaco, and offer doctoral, master’s, bachelor’s

and associate degrees and diploma and certificate programs.

CEC is an industry leader whose institutions are recognized

globally. Those institutions include, among others, American

InterContinental University (“AIU”); Brooks Institute; Colorado

Technical University (“CTU”); Harrington College of Design; INSEEC

Group (“INSEEC”) Schools; International University of Monaco

(“IUM”); International Academy of Design & Technology

(“IADT”); Istituto Marangoni; Le Cordon Bleu North America (“LCB”);

and Sanford-Brown Institutes and Colleges. Through its schools, CEC

is committed to providing high-quality education, enabling students

to graduate and pursue rewarding career opportunities.

For more information, see CEC’s website at www.careered.com. The

website includes a detailed listing of individual campus locations

and web links to CEC’s colleges, schools, and universities.

Except for the historical and present factual information

contained herein, the matters set forth in this release, including

statements identified by words such as “anticipate,” “believe,”

“plan,” “expect,” “intend,” “project,” “will,” “potential” and

similar expressions, are forward-looking statements as defined in

Section 21E of the Securities Exchange Act of 1934, as

amended. These statements are based on information currently

available to us and are subject to various risks, uncertainties and

other factors that could cause our actual growth, results of

operations, financial condition, cash flows, performance, business

prospects, and opportunities to differ materially from those

expressed in, or implied by, these statements. Except as expressly

required by the federal securities laws, we undertake no obligation

to update such factors or to publicly announce the results of any

of the forward-looking statements contained herein to reflect

future events, developments, or changed circumstances or for any

other reason. These risks and uncertainties, the outcome of which

could materially and adversely affect our financial condition and

operations, include, but are not limited to, the following:

availability of Title IV and other student financial aid or loans

for our students; Congress’ willingness or ability to maintain or

increase funding for Title IV programs; the impacts of the U.S.

Department of Education’s new and pending regulations addressing

certain aspects of administration of Title IV federal financial aid

programs (including among other matters, gainful employment,

certain compensation related to recruiting and admission of

students, more stringent state approval criteria that may affect

current state approval and licensing processes applicable to

postsecondary education institutions and distance learning

programs) on our business practices, costs of compliance and of

developing and implementing changes in operations, student

recruitment or enrollment, program offerings that may have

significant or material effects on our operations, business and

profitability; potential higher bad debt expense or reduced revenue

associated with requiring students to pay more of their educational

expenses while in school or with directly providing extended

payment plans to our students; increased competition; the

effectiveness of our regulatory compliance efforts; impairment of

goodwill and other intangible assets as we continue to redefine the

company and manage our brands and marketing to improve

effectiveness and reduce costs; charges and expenses associated

with exiting excess facility space; our ability to comply with

accrediting agency requirements or obtain accrediting agency

approvals for existing or new programs; the outcome of any reviews

and audits conducted by accrediting, state and federal agencies;

our dependence on information technology systems; our ownership or

use of intellectual property; costs and impacts of regulatory,

legal and administrative actions, proceedings and investigations,

governmental regulations, and class action and other lawsuits; our

ability to manage and continue growth; and other factors discussed

in our Annual Report on Form 10-K for the year ended

December 31, 2009, our Quarterly Reports on Form 10-Q for the

most recent fiscal quarters, and from time to time in our current

reports filed with the Securities and Exchange Commission.

CAREER EDUCATION CORPORATION AND SUBSIDIARIES

UNAUDITED CONSOLIDATED BALANCE SHEETS (In thousands)

As of December 31, (1) 2010 2009

(Restated)

ASSETS CURRENT ASSETS: Cash and cash

equivalents $ 289,482 $ 284,334 Short-term investments

159,671 200,379

Total cash and cash equivalents and

short-term investments

449,153 484,713 Student receivables, net 62,287 57,795

Receivables, other, net 4,132 5,255 Prepaid expenses 45,990 40,748

Inventories 13,142 11,259 Deferred income tax assets, net 31,665

12,774 Other current assets 6,246 8,790 Assets of discontinued

operations 6,742 7,501

Total current assets

619,357 628,835

NON-CURRENT

ASSETS: Property and equipment, net 366,775 304,028 Goodwill

381,476 377,515 Intangible assets, net 118,763 180,520 Student

receivables, net 12,522 21,455 Deferred income tax assets, net

5,092 3,187 Other assets, net 37,816 23,178 Assets of discontinued

operations 19,055 25,124

TOTAL

ASSETS $ 1,560,856 $

1,563,842 LIABILITIES AND STOCKHOLDERS'

EQUITY CURRENT LIABILITIES: Current maturities of

capital lease obligations $ 783 $ 880 Accounts payable 56,013

51,100 Accrued expenses: Payroll and related benefits 73,608 87,763

Advertising and production costs 18,846 21,436 Income taxes 8,069

17,849 Earnout payments 17,439 18,009 Other 98,113 45,923 Deferred

tuition revenue 176,102 184,336 Liabilities of discontinued

operations 15,100 14,713 Total current

liabilities 464,073 442,009

NON-CURRENT LIABILITIES: Capital lease obligations, net of

current maturities 1,223 2,262 Deferred rent obligations 103,996

90,676 Earnout payments 7,690 23,680 Other liabilities 11,761

18,612 Liabilities of discontinued operations 37,576

64,558 Total non-current liabilities 162,246

199,788

SHARE-BASED AWARDS SUBJECT

TO REDEMPTION 153 521

STOCKHOLDERS' EQUITY:

Preferred stock - - Common stock 812 954 Additional paid-in capital

576,853 662,865 Accumulated other comprehensive (loss) income (81 )

8,408 Retained earnings 356,991 471,184 Cost of shares in treasury

(191 ) (221,887 ) Total stockholders' equity

934,384 921,524

TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY $ 1,560,856 $

1,563,842 (1) In December 2010,

the Transitional Schools segment ceased to exist as we completed

the teach out of our last remaining Transitional School, AIU-Los

Angeles, CA. As a result, all current and prior period results have

been recast as a component of discontinued operations.

CAREER EDUCATION CORPORATION AND SUBSIDIARIES UNAUDITED

CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per

share amounts and percentages)

For the Three Months Ended December

31, (1)

% of % of Total Total 2010

Revenue 2009 Revenue REVENUE:

Tuition and registration fees $ 526,636 97.0 % $ 491,399 96.8 %

Other 16,293 3.0 % 16,056 3.2 % Total

revenue 542,929 507,455

OPERATING EXPENSES: Educational services and facilities

164,931 30.4 % 165,587 32.6 % General and administrative 266,073

49.0 % 226,048 44.5 % Depreciation and amortization 19,762 3.6 %

17,176 3.4 % Goodwill and asset impairment 71,475

13.2 % - 0.0 % Total operating expenses

522,241 96.2 % 408,811 80.6 % Operating income

20,688 3.8 % 98,644 19.4 %

OTHER INCOME (EXPENSE): Interest income 491 0.1 % 404 0.1 %

Interest expense (302 ) -0.1 % (193 ) 0.0 % Miscellaneous income

(expense) 182 0.0 % (2 ) 0.0 % Total other

income 371 0.1 % 209 0.0 %

PRETAX INCOME 21,059 3.9 % 98,853 19.5 % Provision

for income taxes 5,749 1.1 % 36,151 7.1

%

INCOME FROM CONTINUING OPERATIONS 15,310 2.8 %

62,702 12.4 % Loss from discontinued operations, net of tax

(3,208 ) -0.6 % (32,022 ) -6.3 %

NET

INCOME $ 12,102 2.2 %

$

30,680 6.0 %

NET INCOME (LOSS) PER SHARE -

DILUTED: Income from continuing operations $ 0.19 $ 0.74 Loss

from discontinued operations (0.04 ) (0.38 ) Net

income per share $ 0.15 $ 0.36

DILUTED

WEIGHTED AVERAGE SHARES OUTSTANDING 79,776

85,300 (1) In December

2010, the Transitional Schools segment ceased to exist as we

completed the teach out of our last remaining Transitional School,

AIU-Los Angeles, CA. As a result, all current and prior period

results have been recast as a component of discontinued operations.

CAREER EDUCATION CORPORATION AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS (In

thousands, except per share amounts and percentages)

For the Year Ended December 31, (1)

% of % of Total Total 2010

Revenue 2009 Revenue REVENUE:

Tuition and registration fees $ 2,042,383 96.1 % $ 1,760,237 96.0 %

Other 81,853 3.9 % 73,559 4.0 % Total

revenue 2,124,236 1,833,796

OPERATING EXPENSES: Educational services and facilities

639,123 30.1 % 606,014 33.0 % General and administrative 1,095,519

51.6 % 931,118 50.8 % Depreciation and amortization 71,372 3.4 %

65,204 3.6 % Goodwill and asset impairment 71,829 3.4

% 2,500 0.1 % Total operating expenses

1,877,843 88.4 % 1,604,836 87.5 % Operating

income 246,393 11.6 % 228,960 12.5 %

OTHER INCOME (EXPENSE): Interest income 1,180 0.1 %

2,372 0.1 % Interest expense (377 ) 0.0 % (225 ) 0.0 %

Miscellaneous expense (319 ) 0.0 % (706 ) 0.0 % Total

other income 484 0.0 % 1,441 0.1 %

PRETAX INCOME 246,877 11.6 % 230,401 12.6 %

Provision for income taxes 80,287 3.8 % 80,894

4.4 %

INCOME FROM CONTINUING OPERATIONS

166,590 7.8 % 149,507 8.2 % Loss from discontinued

operations, net of tax (8,817 ) -0.4 % (68,288 ) -3.7

%

NET INCOME $ 157,773 7.4 %

$ 81,219 4.4 %

NET INCOME (LOSS) PER

SHARE - DILUTED: Income from continuing operations $ 2.06 $

1.73 Loss from discontinued operations (0.11 ) (0.79

) Net income per share $ 1.95 $ 0.94

DILUTED WEIGHTED AVERAGE SHARES OUTSTANDING

80,850 86,418 (1)

In December 2010, the Transitional Schools segment ceased to

exist as we completed the teach out of our last remaining

Transitional School, AIU-Los Angeles, CA. As a result, all current

and prior period results have been recast as a component of

discontinued operations.

CAREER EDUCATION CORPORATION AND

SUBSIDIARIES UNAUDITED CONSOLIDATED STATEMENTS OF OPERATING

INCOME BY QUARTER (In thousands)

For the 2010 Quarters Ended, (1)

March 31 June 30 September 30 December

31 Full Year REVENUE: Tuition and

registration fees $ 509,508 $ 509,129 $ 497,110 $ 526,636 $

2,042,383 Other 19,918 18,610 27,032

16,293 81,853 Total revenue 529,426 527,739

524,142 542,929 2,124,236

OPERATING

EXPENSES: Educational services and facilities 159,162 156,918

158,112 164,931 639,123 General and administrative 264,140 256,920

308,386 266,073 1,095,519 Depreciation and amortization 16,678

17,149 17,783 19,762 71,372 Goodwill and asset impairment -

- 354 71,475 71,829 Total operating

expenses 439,980 430,987 484,635

522,241 1,877,843

OPERATING INCOME $

89,446 $ 96,752 $ 39,507

$ 20,688 $ 246,393 For

the 2009 Quarters Ended, (1) March 31

June 30 September 30 December 31 Full

Year REVENUE: Tuition and registration fees $

414,632 $ 419,814 $ 434,392 $ 491,399 $ 1,760,237 Other

17,133 17,038 23,332 16,056 73,559

Total revenue 431,765 436,852 457,724

507,455 1,833,796

OPERATING EXPENSES:

Educational services and facilities 145,068 146,981 148,378 165,587

606,014 General and administrative 218,169 235,173 251,728 226,048

931,118 Depreciation and amortization 15,963 16,259 15,806 17,176

65,204 Goodwill and asset impairment - - 2,500

- 2,500 Total operating expenses 379,200

398,413 418,412 408,811 1,604,836

OPERATING INCOME $ 52,565 $

38,439 $ 39,312 $ 98,644

$ 228,960 (1) In December 2010,

the Transitional Schools segment ceased to exist as we completed

the teach out of our last remaining Transitional School, AIU-Los

Angeles, CA. As a result, all current and prior period results have

been recast as a component of discontinued operations.

CAREER EDUCATION CORPORATION AND SUBSIDIARIES UNAUDITED

CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands)

For the Year Ended December 31, 2010

2009 CASH FLOWS FROM OPERATING ACTIVITIES: Net

income $ 157,773 $ 81,219 Adjustments to reconcile net income to

net cash provided by operating activities: Goodwill and asset

impairment 71,829 2,500 Depreciation and amortization expense

71,624 67,596 Bad debt expense 106,324 56,718 Compensation expense

related to share-based awards 17,318 16,516 Loss on disposition of

property and equipment 457 1,291 Deferred income taxes (17,007 )

(8,702 ) Changes in operating assets and liabilities: Accrued

expenses and deferred rent obligations (25,055 ) 81,239 Deferred

tuition revenue (12,653 ) 29,570 Student receivables, net of

allowance for doubtful accounts (98,920 ) (66,961 ) Other operating

assets and liabilities 569 27,265 Net

cash provided by operating activities 272,259

288,251

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchases of available-for-sale investments (291,864 ) (617,032 )

Sales of available-for-sale investments 332,445 668,281 Purchases

of property and equipment (127,283 ) (74,087 ) Acquisition of the

rights to the Le Cordon Bleu brand (16,852 ) (26,331 ) Business

acquisition, net of acquired cash (6,194 ) - Other 88

(132 ) Net cash used in investing activities (109,660

) (49,301 )

CASH FLOWS FROM FINANCING

ACTIVITIES: Purchase of treasury stock (154,913 ) (201,119 )

Issuance of common stock 3,109 2,797 Tax benefit associated with

stock option exercises 223 237 Payments of assumed loans upon

business acquisition (4,279 ) - Payments of capital lease

obligations (1,013 ) (1,066 ) Net cash used in

financing activities (156,873 ) (199,151 )

EFFECT OF FOREIGN CURRENCY EXCHANGE RATE CHANGES ON CASH

AND CASH EQUIVALENTS: (1,316 ) 415

NET INCREASE IN CASH AND CASH EQUIVALENTS 4,410 40,214

DISCONTINUED OPERATIONS CASH ACTIVITY INCLUDED ABOVE: Add:

Cash balance of discontinued operations, beginning of the year 738

1,945 Less: Cash balance of discontinued operations, end of the

year - 738

CASH AND CASH EQUIVALENTS, beginning of the year

284,334 242,913

CASH AND CASH

EQUIVALENTS, end of the year $ 289,482 $ 284,334

CAREER EDUCATION CORPORATION AND SUBSIDIARIES

UNAUDITED SELECTED SEGMENT INFORMATION (In thousands, except

percentages)

For the Three Months Ended December

31, (1) 2010 2009

REVENUE: University $ 281,008 $ 269,009 Health Education

119,352 102,486 Culinary Arts 94,003 91,058 International 48,698

45,070 Corporate and Other (132 ) (168 )

Total

$ 542,929 $ 507,455

OPERATING INCOME

(LOSS): (2) (4) University (3) $ 69,018 $ 61,292 Health

Education (3) 16,594 16,020 Culinary Arts (3) (5) (63,546 ) 12,328

International 12,139 8,903 Corporate and Other (3) (6)

(13,517 ) 101

Total $ 20,688 $ 98,644

OPERATING MARGIN (LOSS): University 24.6 %

22.8 % Health Education 13.9 % 15.6 % Culinary Arts -67.6 % 13.5 %

International 24.9 % 19.8 %

Total

3.8 % 19.4 % (1)

In December 2010, the Transitional Schools segment ceased to

exist as we completed the teach out of our last remaining

Transitional School, AIU-Los Angeles, CA. As a result, all current

and prior period results have been recast as a component of

discontinued operations.

(2) Prior period financial

results have been revised to account for a change in the allocation

of shared service costs. Previously, shared service costs were

allocated to our segments as a percentage of revenue. Improved data

and analytical capabilities have allowed us to now allocate shared

service costs based upon usage and consumption factors.

(3) Fourth quarter 2009 includes pretax expense of $14.3

million related to the present value of the remaining lease

obligations for vacated space within Corporate and Other ($5.3),

University ($5.2), Culinary Arts ($2.9) and Health Education

($0.9).

(4) During the fourth quarter 2010, a pretax

charge of $7.7 million was recorded in association with a reduction

in force to be completed during the first quarter of 2011.

(5) Fourth quarter 2010 includes pretax expense of $67.8

million related to trade name impairment and $1.4 million related

to goodwill impairment within Culinary Arts.

(6)

Fourth quarter 2010 includes pretax expense of $2.3 million related

to an asset impairment charge for one of our investments within

Corporate and Other. The prior year quarter results include a

pretax charge of $5.3 million related to vacated space which was

offset by a reduction of $12.0 million related to the termination

of certain insurance policies.

CAREER EDUCATION

CORPORATION AND SUBSIDIARIES UNAUDITED SELECTED SEGMENT

INFORMATION (In thousands, except percentages)

For the Year Ended December 31, (1) 2010

2009 REVENUE: University $ 1,159,291 $

1,018,194 Health Education 441,608 362,692 Culinary Arts 387,884

332,236 International 136,076 121,188 Corporate and Other

(623 ) (514 )

Total $ 2,124,236

$ 1,833,796 OPERATING INCOME

(LOSS):(2) (3) University (4) $ 282,013 $ 195,081 Health

Education 52,028 42,072 Culinary Arts (5)¥ (66,813 ) 14,873

International 21,828 18,853 Corporate and Other (6) (42,663

) (41,919 )

Total $ 246,393

$ 228,960 OPERATING MARGIN

(LOSS): University 24.3 % 19.2 % Health Education 11.8 % 11.6 %

Culinary Arts -17.2 % 4.5 % International 16.0 % 15.6

%

Total 11.6 % 12.5

%

(1) In December 2010, the Transitional Schools

segment ceased to exist as we completed the teach out of our last

remaining Transitional School, AIU-Los Angeles, CA. As a result,

all current and prior period results have been recast as a

component of discontinued operations.

(2) Prior

period financial results have been revised to account for a change

in the allocation of shared service costs. Previously, shared

service costs were allocated to our segments as a percentage of

revenue. Improved data and analytical capabilities have allowed us

to now allocate shared service costs based upon usage and

consumption factors.

(3) During the fourth quarter

2010, a pretax charge of $7.7 million was recorded in association

with a reduction in force to be completed during the first quarter

of 2011.

(4) During 2010, University recorded $7.3

million of pretax legal expenses related to the settlements of

legal matters and a $0.3 million asset impairment charge for one of

our leased facilities within the University reportable segment. The

prior year results include a $5.2 million pretax expense related to

the present value of the remaining lease obligations for vacated

space.

(5) 2010 includes pretax expense of $67.8

million related to trade name impairment and $1.4 million related

to goodwill impairment. Culinary Arts also recorded a $40.8 million

pretax charge related to the settlement of a legal matter and

additional bad debt expense for increases in reserve rates related

to our student extended payment plans. The prior year results

include $2.9 million pretax expense related to the present value of

the remaining lease obligations for vacated space.

(6) Fourth quarter 2010 includes pretax expense of $2.3

million related to an asset impairment charge for one of our

investments within Corporate and Other. The prior year results

include pretax charges including an additional $11.3 million for

performance- based compensation related to plan outperformance and

$5.3 million related to vacated space which were offset by a

reduction of $12.0 million related to the termination of certain

insurance policies.

CAREER EDUCATION CORPORATION AND

SUBSIDIARIES UNAUDITED SELECTED UNIVERSITY SEGMENT

INFORMATION (Dollars in thousands)

For the Three Months Ended December 31, For the Year

Ended December 31, 2010 2009 2010

2009 REVENUE: CTU $ 123,236 $ 105,520 $

465,315 $ 368,621 AIU 98,647 99,767 448,581 409,043 Art &

Design 59,125 63,722 245,395

240,530

Total University $

281,008 $ 269,009 $

1,159,291 $ 1,018,194

OPERATING INCOME: CTU $ 39,603 $ 31,352 $ 133,881 $ 79,889

AIU 22,905 20,604 118,959 90,127 Art & Design 6,510

9,336 29,173 25,065

Total University $ 69,018

$ 61,292 $ 282,013

$ 195,081 OPERATING MARGIN: CTU

32.1 % 29.7 % 28.8 % 21.7 % AIU 23.2 % 20.7 % 26.5 % 22.0 % Art

& Design 11.0 % 14.7 % 11.9 % 10.4

%

Total University 24.6 %

22.8 % 24.3 % 19.2

% As of December 31, STUDENT

POPULATION: 2010 2009 CTU 30,900 27,300 AIU

20,000 20,300 Art & Design 11,500 11,700

Total University 62,400

59,300 For the three months ended December

31, NEW STUDENT STARTS: 2010 2009 CTU

8,740 9,800 AIU 6,230 7,210 Art & Design 1,540

1,540

Total University 16,510

18,550 CAREER EDUCATION

CORPORATION AND SUBSIDIARIES UNAUDITED RECONCILIATION OF

GAAP TO NON-GAAP ITEMS (1) (In millions, except per

share amounts)

For the Three Months

Ended December 31, 2010 2009 Operating

Earnings per Operating

Earnings per

Income

Diluted Share (2)

Income

Diluted Share (2)

As Reported $ 20.7 $ 0.19 $ 98.6 $ 0.74 Reconciling

Items: Trade Name Impairment (3) 67.8 0.55 - - Legal Settlement (4)

0.8 0.01 - - Severance (5) 7.7 0.06 - - Remaining Lease Obligations

for Vacated Space - - 14.3 0.11 Performance-based Compensation

Related to Plan Outperformance (6) - - (2.2 ) (0.02 ) Termination

of Insurance Policies (7) - - (12.0 )

(0.09 )

Adjusted to Exclude Significant Items $

97.0 $ 0.81 $ 98.7

$ 0.74 Diluted Weighted Average

Shares Outstanding 79,776 85,300

For the Year Ended December 31, 2010

2009 Operating Earnings per Operating

Earnings per Income

Diluted Share (2)

Income

Diluted Share (2)

As Reported $ 246.4 $ 2.06 229.0 $ 1.73 Reconciling

Items: Asset Impairment (3) 67.8 0.55 2.5 0.02 Legal Settlement (4)

40.8 0.33 - - Severance 7.7 0.06 1.5 0.01 Remaining Lease

Obligations for Vacated Space - - 14.3 0.11 Performance-based

Compensation Related to Plan Outperformance (6) - - 23.1 0.17

Termination of Insurance Policies (7) - -

(12.0 ) (0.09 )

Adjusted to Exclude Significant Items

$ 362.7 $ 3.00 $ 258.4

$ 1.95 Diluted Weighted

Average Shares Outstanding 80,850

86,418 (1) The Company believes

it is useful to present non-GAAP financial measures which exclude

certain significant items as a means to understand the performance

of its core business. As a general matter, the Company uses

non-GAAP financial measures in conjunction with results presented

in accordance with GAAP to help analyze the performance of its core

business, assist with preparing the annual operating plan, and

measure performance for some forms of compensation. In addition,

the Company believes that non-GAAP financial information is used by

analysts and others in the investment community to analyze the

Company's historical results and to provide estimates of future

performance and that failure to report non-GAAP measures could

result in a misplaced perception that the Company's results have

underperformed or exceeded expectations. Non-GAAP financial

measures when viewed in a reconciliation to corresponding GAAP

financial measures, provides an additional way of viewing the

Company's results of operations and the factors and trends

affecting the Company's business. Non-GAAP financial measures

should be considered as a supplement to, and not as a substitute

for, or superior to, the corresponding financial results presented

in accordance with GAAP.

(2) Earnings per share is

based on Income from Continuing Operations.

(3)

Fourth quarter 2010 includes a $67.8 million pretax trade name

impairment within Culinary Arts. The $2.5 million asset impairment

in 2009 resulted from the carrying value exceeding the fair value

for one of our owned facilities.

(4) A $40.8 million

charge was recorded in Culinary Arts related to the settlement of a

legal matter; of which $0.8 million was recorded in the fourth

quarter.

(5) During the fourth quarter 2010, a pretax

charge of $7.7 million was recorded in association with a reduction

in force to be completed during the first quarter of 2011.

(6) The fourth quarter of 2009 performance-based

compensation related to plan outperformance represents the year-end

adjustment to the estimated payout based upon full-year results.

The full year outperformance by segment was: Corporate - $11.3,

University - $5.4, Health Education - $4.3, and Culinary Arts -

$2.1 million.

(7) A $12.0 million payment was

received in the fourth quarter 2009 related to the termination of

certain insurance policies.

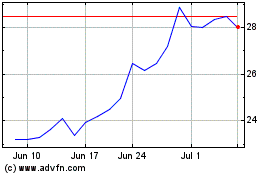

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Apr 2024 to May 2024

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From May 2023 to May 2024