As filed with the Securities and Exchange Commission on September 22, 2016

|

|

Registration No. 333-212880

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 1

TO

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Adamis Pharmaceuticals Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

82-0429727

|

|

|

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

11682 El Camino Real, Suite 300

San Diego, CA 92130

(858) 997-2400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Dennis J. Carlo, Ph.D.

Chief Executive Officer

11682 El Camino Real, Suite 300

San Diego, CA 92130

(858) 997-2400

(Name, address including zip code, and telephone number, including area code, of agent for service)

With copies to:

C. Kevin Kelso, Esq.

Weintraub Tobin Chediak Coleman Grodin, Law Corporation

400 Capitol Mall, Suite 1100

Sacramento, CA 95814

(916) 558-6000

(916) 446-1611 - Facsimile

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “

large accelerated filer”

, “

accelerated filer”

and “

smaller reporting company

” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

Non-accelerated filer ☐

(do not check if smaller

reporting company)

|

Smaller reporting company ☒

|

CALCULATION OF REGISTRATION FEE

Title of Each Class of

Securities to be Registered

|

|

|

Amount

to be

Registered (1)

|

|

Proposed Maximum

Aggregate

Offering Price (2)

|

|

|

Amount of

Registration Fee

|

Common Stock underlying Series A-2

Convertible Preferred Stock

|

|

|

1,724,137

|

|

|

$

|

4,827,583.60

|

(2)

|

|

$

|

487

|

|

|

Common Stock underlying Warrants

|

|

|

1,724,137

|

|

|

$

|

4,827,583.60

|

(2)

|

|

$

|

487

|

|

Warrants to purchase shares of Series A-2

Preferred or Common Stock

|

|

|

1,724,137

|

|

|

$

|

4,999,997.30

|

(3)

|

|

$

|

504

|

|

|

Common Stock underlying Warrants

|

|

|

1,000,000

|

|

|

$

|

2,800,000.00

|

(2)

|

|

$

|

282

|

|

|

TOTAL:

|

|

|

6,172,411

|

|

|

$

|

17,455,164.50

|

|

|

$

|

1,760

|

(4)

|

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “

Securities Act

”), the shares of common stock offered hereby also include an indeterminate number of additional shares of common stock as may from time to time become issuable by reason of stock splits, stock dividends, recapitalizations or other similar transactions.

|

|

|

(2)

|

With respect to the shares of common stock offered by the selling stockholders named herein, estimated at $2.80 per share, the average of the high and low prices as reported on the Nasdaq Capital Market on August 2, 2016, for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act.

|

|

|

(3)

|

With respect to the warrants offered by the selling stockholders named herein, estimated at $2.90 per warrant, which is the exercise price of the warrants, for purposes of calculating the registration fee pursuant to Rule 457(g) under the Securities Act.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities or accept an offer to buy these securities until the Securities and Exchange Commission declares the registration statement effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 22, 2016

PRELIMINARY PROSPECTUS

ADAMIS PHARMACEUTICALS CORPORATION

4,448,274 Shares of Common Stock

Warrants to Purchase 1,724,137 Shares of Series A-2 Convertible Preferred Stock or Common Stock

This prospectus relates to the resale or other disposition from time to time of the following securities to be offered by the selling stockholders identified in this prospectus, including their transferees, pledgees, donees or successors: (i) up to 1,724,137 shares (the “

Conversion Shares

”) of our common stock issuable upon the conversion of previously issued Series A-2 Convertible Preferred Stock (the “

Series A-2 Preferred

”), (ii) up to 1,724,137 shares (the “

Warrant Shares

”) of our common stock that are issuable upon the exercise of warrants issued to the initial holders of shares of Series A-2 Preferred to purchase shares of our common stock or Series A-2 Preferred (the “

Warrants

”), (iii) up to 1,724,137 Warrants, and (iv) up to 1,000,000 shares of our common stock issuable upon the exercise of a warrant (the “

BSB Warrant

”), to the extent exercisable, issued to one of the selling stockholders to purchase shares of our common stock. The Warrants have an exercise price of $2.90 per share, and may be exercised during the period ending July 11, 2021. The BSB Warrant has an exercise price of $0.0001 per share and is exercisable in the circumstances described in the BSB Warrant.

The selling stockholders may, from time to time, sell, transfer, or otherwise dispose of securities on any stock exchange on which the securities may be listed, market or trading facility on which the securities may be traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. See “Plan of Distribution” which begins on page 11.

We are not offering any shares of our common stock for sale under this prospectus. We will not receive any of the proceeds from the sale of common stock or the Warrants by the selling stockholders. However, we will generate proceeds in the event of a cash exercise of the Warrants by the selling stockholders.

All expenses of registration incurred in connection with this offering are being borne by us. All selling and other expenses incurred by the selling stockholders will be borne by the selling stockholders.

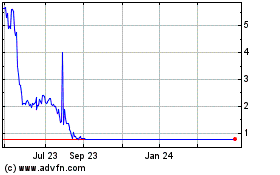

Our common stock is quoted on the Nasdaq Capital Market under the symbol “ADMP.” On September 21, 2016, the last reported sale price of our common stock as reported on the Nasdaq Capital Market was $3.31 per share.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Investing in our securities involves risks. You should review carefully the risks and uncertainties described under the heading “Risk Factors” contained herein and in our Annual Report on Form 10-K for the year ended December 31, 2015, as well as our subsequently filed periodic and current reports, which we file with the Securities and Exchange Commission and which are incorporated by reference into the registration statement of which this prospectus is a part. You should read the entire prospectus carefully before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is __________, 2016.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “

SEC

” or the “

Commission

”) using a “shelf” registration or continuous offering process.

You should read this prospectus and the information and documents incorporated by reference carefully. Such documents contain important information you should consider when making your investment decision. See “Where You Can Find More Information” and “Incorporation of Documents by Reference” in this prospectus.

This prospectus may be supplemented from time to time to add, to update or change information in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You should rely only on the information contained or incorporated by reference in this prospectus, any applicable prospectus supplement or any related free writing prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement, as well as information we have filed with the SEC that is incorporated by reference, is accurate as of the date on the front of those documents only, regardless of the time of delivery of this prospectus or any applicable prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

Unless otherwise stated or the context requires otherwise, references in this prospectus to “Adamis,” the “company” or the “Company,” “we,” “us,” or “our” refer to Adamis Pharmaceuticals Corporation and our subsidiaries, taken together.

ABOUT THE COMPANY

Company Overview

Adamis Pharmaceuticals Corporation (“we,” “us,” “our,” “Adamis” or the “company”) is a specialty biopharmaceutical company focused on developing and commercializing products in the therapeutic areas of respiratory disease, allergy and immunology. Our current specialty pharmaceutical product candidates include the Epinephrine Injection PFS syringe product for use in the emergency treatment of anaphylaxis, APC-1000 and APC-5000 for the treatment of asthma and chronic obstructive pulmonary disease, and APC-2000 for the treatment of bronchospasms. Our U.S. Compounding, Inc. subsidiary, which is registered as a drug compounding outsourcing facility under Section 503B of the U.S. Food, Drug & Cosmetic Act and the U.S. Drug Quality and Security Act, provides prescription compounded medications, including compounded sterile preparations and non-sterile compounds, to patients, physician clinics, hospitals, surgery centers and other clients throughout most of the United States. Our goal is to create low cost therapeutic alternatives to existing treatments. Consistent across all specialty pharmaceuticals product lines, we intend to submit Section 505(b)(2) New Drug Applications, or NDAs, or Section 505(j) Abbreviated New Drug Applications or ANDAs, regulatory approval filings with the U.S. Food and Drug Administration, or FDA, whenever possible, in order to potentially reduce the time to market and to save on costs, compared to those associated with Section 505(b)(1) NDAs for new drug products. We also have a number of biotechnology product candidates and technologies, including therapeutic vaccine and cancer product candidates and technologies. To achieve our goals and support our overall strategy, we will need to raise a substantial amount of funding and make significant investments in equipment, new product development and working capital.

Our principal executive offices are located at 11682 El Camino Real, Suite 300, San Diego, CA 92130, and our telephone number is (858) 997-2400. Our website address is:

www.adamispharmaceuticals.com

. We have included our website address as a factual reference and do not intend it to be an active link to our website. The information that can be accessed through our website is not part of this prospectus, and investors should not rely on any such information in deciding whether to purchase our common stock.

RISK FACTORS

An investment in our common stock involves risks. Prior to making a decision about investing in our common stock, you should consider carefully the risks together with all of the other information contained or incorporated by reference in this prospectus, including any risks described in the section entitled “Risk Factors” contained in any supplements to this prospectus, in our Annual Report on Form 10-K for the year ended December 31, 2015, and in our subsequent filings with the SEC. Each of the referenced risks and uncertainties could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities. Additional risks not known to us or that we believe are immaterial may also adversely affect our business, operating results and financial condition and the value of an investment in our securities.

DESCRIPTION OF PRIVATE PLACEMENT OF SERIES A-2 CONVERTIBLE PREFERRED STOCK AND WARRANTS

On July 11, 2016, we completed a private placement financing transaction. Pursuant to a Purchase Agreement (the “

Purchase Agreement

”) and a registration rights agreement (the “

Registration Rights Agreement

”), we issued 1,724,137 shares (the “

Series A-2 Shares

”) of a series of preferred stock, Series A-2 Convertible Preferred Stock (the

“Series A-2 Preferred

”), and warrants (“

Warrants

”) to purchase up to 1,724,137 shares (“

Warrant Shares

”) of common stock or Series A-2 Preferred, and received gross cash proceeds of approximately $5,000,000, excluding transactions costs, fees and expenses. The Series A-2 Shares and Warrants were sold in units, with each unit consisting of one Series A-2 Share and one Warrant, at a purchase price of $2.90 per unit. The closing per share price of the common stock on the Nasdaq Capital Market on the closing date was $3.18. Each Series A-2 Share is convertible into shares of common stock (the “

Conversion Shares

”), at an initial conversion rate of 1-for-1, at any time at the discretion of the holder. The exercise price of the Warrants is $2.90 per share, and the Warrants are exercisable for five years. The purchasers were the initial selling stockholders named in this prospectus, other than Bear State Bank, N.A.

Series A-2 Preferred Stock

The Series A-2 Preferred was established pursuant to a Certificate of Designation of Preferences, Rights and Limitations of Series A-2 Convertible Preferred Stock filed with the Delaware Secretary of State. The rights, preferences, privileges, and restrictions applicable to the Series A-2 Preferred are described below.

Conversion

. Each share of the Series A-2 Preferred is convertible into common stock at an initial conversion rate of 1-for-1. The conversion rate of the Series A-2 Preferred is subject to proportionate adjustments for stock splits, reverse stock splits and similar events, but is not subject to adjustment based on price anti-dilution provisions. The Series A-2 Preferred automatically converts into common stock upon the occurrence of certain “Fundamental Transactions,” as described below.

Dividends

. In addition to stock dividends or distributions for which proportionate adjustments will be made, holders of Series A-2 Preferred are entitled to receive dividends on shares of Series A-2 Preferred equal, on an as-if-converted-to-common-stock basis, to and in the same form as dividends actually paid on shares of the common stock when, as and if such dividends are paid on shares of the common stock. No other dividends are payable on shares of Series A-2 Preferred.

Voting Rights

. Except as provided in the Certificate of Designation or as otherwise required by law, the holders of Series A-2 Preferred are entitled to vote with the holders of outstanding shares of common stock, voting together as a single class, with respect to all matters presented to the stockholders for their action or consideration. In any such vote, each holder is entitled to a number of votes equal to the number of shares of common stock into which the Series A-2 Preferred held by such holder is convertible, after taking into account the Beneficial Ownership Limitation described below. The Company may not, without the consent of holders of a majority of the outstanding shares of Series A-2 Preferred, alter or change adversely the powers, preferences or rights given to the Series A-2 Preferred or alter or amend the Certificate of Designation.

Liquidation Rights

. Upon any liquidation, dissolution or winding-up of the Company, whether voluntary or involuntary, the holders of Series A-2 Preferred are entitled to receive,

pari passu

with the holders of common stock, out of the assets available for distribution to stockholders an amount equal to such amount per share as would have been payable had all shares of Series A-2 Preferred been converted into common stock immediately before such liquidation, dissolution or winding up, without giving effect to any limitation on conversion as a result of the Beneficial Ownership Limitation.

Beneficial Ownership Limitation.

The Company may not effect any conversion of the Series A-2 Preferred, and a holder does not have the right to convert any portion of the Series A-2 Preferred or exercise a Warrant held by the holder, to the extent that, after giving effect to the conversion set forth in a notice of conversion or such exercise of the Warrant, such holder would beneficially own in excess of the holder Beneficial Ownership Limitation, or such holder, together with such holder’s affiliates, and any persons acting as a group together with such holder or affiliates, would beneficially own in excess of the Affiliates Beneficial Ownership Limitation. The “holder Beneficial Ownership Limitation” is 4.99% of the number of shares of the common stock outstanding immediately after giving effect to the issuance of shares of common stock issuable upon conversion of Series A-2 Preferred, or upon exercise of the Warrant, held by the applicable holder. The “affiliates Beneficial Ownership Limitation” is 9.99% of the number of shares of the common stock outstanding immediately after giving effect to the issuance of shares of common stock issuable upon conversion of Series A-2 Preferred, or upon exercise of the Warrant, held by the applicable holder and its affiliates (the holder Beneficial Ownership Limitation together with the affiliates Beneficial Ownership Limitation collectively referred to as the

“Beneficial Ownership Limitation

”). A holder may, with 61 days prior notice to the Company, or immediately upon notice from the holder to the Company at any time after the public announcement or other disclosure of a Fundamental Transaction, elect to increase or decrease or remove one or both of the holder Beneficial Ownership Limitation and the affiliates Beneficial Ownership Limitation; provided, however, that in no event may either the holder Beneficial Ownership Limitation or the affiliate Beneficial Ownership Limitation be 20.00% or greater.

Failure to Deliver Conversion Shares

. If the Company fails to timely deliver shares of common stock upon conversion of the Series A-2 Preferred within the time period specified in the Certificate of Designation, or fails to timely deliver shares upon exercise of a Warrant (generally, within three trading days after delivery of the notice of conversion or exercise), and if the holder has not exercised its Buy-In rights as described below with respect to such shares, then the Company is obligated to pay to the holder, as liquidated damages, an amount equal to $100 per business day (increasing to $200 per business day after the tenth business day) for each $10,000 of Conversion Shares or Warrant Shares for which the Series A-2 Preferred or Warrant is converted or exercised which are not timely delivered. If the Company makes such liquidated damages payments, it is not also obligated to make Buy-In payments with respect to the same Conversion Shares or Warrant Shares.

Compensation for Buy-In on Failure to Timely Deliver Shares

. If the Company fails to timely deliver the Conversion Shares or Warrant Shares to the holder, and if after the required delivery date the holder is required by its broker to purchase (in an open market transaction or otherwise) or the holder or its brokerage firm otherwise purchases, shares of common stock to deliver in satisfaction of a sale by the holder of the Conversion Shares or Warrant Shares which the holder anticipated receiving upon such conversion or exercise (a “

Buy-In

”), then the Company is obligated to (A) pay in cash to the holder the amount, if any, by which (x) the holder’s total purchase price (including brokerage commissions, if any) for the shares of common stock so purchased, minus any amounts paid to the holder by the Company as liquidated damages for late delivery of such shares, exceeds (y) the amount obtained by multiplying (1) the number of Conversion Shares or Warrant Shares that the Company was required to deliver times (2) the price at which the sell order giving rise to such purchase obligation was executed, and (B) at the option of the holder, either reinstate the portion of the Series A-2 Preferred and equivalent number of Conversion Shares or Warrant Shares for which such conversion or exercise was not honored (in which case such conversion or exercise shall be deemed rescinded) or deliver to the holder the number of shares of common stock that would have been issued had the Company timely complied with its exercise and delivery obligations.

Subsequent Rights Offerings; Pro Rata Distributions

. If the Company grants, issues or sells any common stock equivalents pro rata to the record holders of any class of shares of common stock (the “

Purchase Rights

”), then a holder of Series A-2 Preferred or Warrants will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which the holder could have acquired if the holder had held the number of shares of common stock acquirable upon conversion of the Series A-2 Preferred or exercise of the Warrants (without regard to any limitations on conversion). If the Company declares or makes any dividend or other distribution of its assets (or rights to acquire its assets) to holders of common stock, then a holder of Series A-2 Preferred or Warrants is entitled to participate in such distribution to the same extent as if the holder had held the number of shares of common stock acquirable upon complete conversion of the Series A-2 Preferred or exercise of the Warrants (without regard to any limitations on conversion).

Fundamental Transaction.

If, at any time while the Series A-2 Preferred is outstanding, (i) the Company, directly or indirectly, in one or more related transactions effects any merger or consolidation of the Company with or into another person pursuant to which the shares of capital stock of the Company outstanding immediately prior to such merger or consolidation are converted into or exchanged for shares of another corporation or entity and represent, or are converted into or exchanged for equity securities that represent, immediately following such merger or consolidation, less than a majority, by voting power, of the equity securities of (1) the surviving or resulting party or (2) if the surviving or resulting party is a wholly owned subsidiary of another party immediately following such merger or consolidation, the parent of such surviving or resulting party, (ii) the Company, directly or indirectly, effects any sale of all or substantially all of its assets in one or a series of related transactions, (iii) any tender offer or exchange offer (whether by the Company or another person) is completed pursuant to which holders of common stock are permitted to sell, tender or exchange their shares for other securities, cash or property and has been accepted by the holders of 50% or more of the outstanding common stock, or (iv) the Company, directly or indirectly, in one or more related transactions consummates a stock or share purchase agreement or other business combination (including, without limitation, a reorganization, recapitalization, spin-off or scheme of arrangement) with another person whereby such other person acquires more than 50% of the outstanding shares of common stock (not including any shares of common stock held by the other person or other persons making or party to, or associated or affiliated with the other persons making or party to, such stock or share purchase agreement or other business combination) (each a “

Fundamental Transaction

”), then the Series A-2 Preferred automatically converts and the holder will receive, for each Conversion Share that would have been issuable upon such conversion immediately prior to the occurrence of such Fundamental Transaction (subject to the Beneficial Ownership Limitation), the number of shares of common stock of the successor or acquiring corporation or of the Company, if it is the surviving corporation, and any additional consideration (the “

Alternate Consideration

”) receivable as a result of such Fundamental Transaction by a holder of the number of shares of common stock for which the Series A-2 Preferred is convertible immediately prior to such Fundamental Transaction (subject to the Beneficial Ownership Limitation). For purposes of any such conversion, the determination of the conversion ratio will be appropriately adjusted to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect of one share of common stock in such Fundamental Transaction. If holders of common stock are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the holder will be given the same choice as to the Alternate Consideration it receives upon automatic conversion of the Series A-2 Preferred following such Fundamental Transaction.

Warrants

Exercise

. The Warrants are exercisable by means of cash. However, if at any time commencing 120 days after the initial issuance date of the Warrants there is no effective registration statement registering, or no current prospectus available for the resale of, all of the Warrant Shares held by the holder (and all of the Conversion Shares beneficially held by the holder (in each case without giving effect any restrictions on exercise or conversion), or if the Company has not provided any certifications required to be provided by the Registration Rights Agreement regarding the availability of the registration statement of which this prospectus is a part for resales of all of the Warrant Shares and all of the Conversion Shares beneficially held by the holder (in each case without giving effect any restrictions on exercise or conversion) that has been requested by the holder, then a holder may also exercise a Warrant at the holder’s election, in whole or in part, at such time by means of a net exercise of the Warrant on a cashless basis.

Adjustments to Exercise Price

. The Warrants provide for proportional adjustment of the number and kind of securities purchasable upon exercise of the Warrants and the per share exercise price upon the occurrence of certain events such as stock splits, combinations, reverse stock splits and similar events.

Call Provisions

. Provided (i) there is an effective registration statement that covers resale of all of the Warrant Shares, or (ii) all of the Warrant Shares may be sold pursuant to Rule 144 upon cashless exercise without restrictions including without volume limitations, each such event referred to as a Trigger Condition, the Company has the option to “call” the exercise of any or all of the Warrants, referred to as a Warrant Call, from time to time by giving a Call Notice to the holder. The Company’s right to exercise a Warrant Call commences five trading days after either of the Trigger Conditions has been in effect continuously for 15 trading days. A holder has the right to cancel the Warrant Call up until the date the called Warrant Shares are actually delivered to the holder, such date referred to as the Warrant Call Delivery Date, if the Trigger Condition relied upon for the Warrant Call ceases to apply. In addition, a Call Notice may be given not sooner than 15 trading days after the Warrant Call Delivery Date of the immediately preceding Call Notice.

We may give a Call Notice only within (i) if a holder and its affiliates beneficially own 2% or less of the outstanding common stock, then 10 trading days after any 20-consecutive trading day period during which the daily volume weighted average price (“

VWAP

”) of the common stock is not less than 250% of the exercise price for the Warrants in effect for 10 out of such 20-consecutive trading day period, and (ii) if holder and its affiliates beneficially own more than 2% of the outstanding common stock, five trading days after any 30-consecutive trading day period during which the VWAP of the common stock is not less than 250% of the exercise price then in effect for 25 out of such 30-consecutive trading day period. During the Call Period, the holder may exercise the Warrant and purchase the called Warrant Shares. If the holder fails to timely exercise the Warrant for a number of Warrant Shares equal to number of called Warrant Shares during the Call Period, the Company’s sole remedy will be to cancel an amount of called Warrant Shares equal to such shortfall, with the Warrant no longer being exercisable with respect to such Warrant Shares. The “Call Period” is a period of 30 trading days following the date on which the Call Notice is deemed given and effective; the Call Period will be extended for one trading day for each trading day during the Call Period during which the VWAP of the common stock is less than 225% of the exercise price then in effect.

Fundamental Transactions

. If, at any time while the Warrants are outstanding we engage in a Fundamental Transaction, then, upon any subsequent exercise of a Warrant, the holder will have the right to receive, for each Warrant Share that would have been issuable upon such exercise immediately prior to the occurrence of such transaction, the number of shares of common stock of the successor or acquiring corporation or of the Company, if it is the surviving corporation, and any additional Alternate Consideration, receivable as a result of such transaction by a holder of the number of shares of common stock for which the Warrant is exercisable immediately prior to such transaction. For purposes of any such exercise, the determination of the exercise price will be appropriately adjusted to apply to such Alternate Consideration.

If such a transaction is (1) an all cash transaction, (2) a “Rule 13e-3 transaction” as defined in Rule 13e-3 under the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”), or (3) a transaction involving a person or entity not traded on a national securities exchange or trading market, then the Company or any successor entity will, at the holder’s option which shall be exercised as of the consummation of the transaction, purchase the Warrant from the holder by paying to the holder concurrently with the consummation of the transaction for each Warrant Share that would be issuable upon such exercise immediately prior to the occurrence of such transaction, the higher of (i) an amount of cash equal to the Black Scholes Value, calculated as provided in the Warrant, of the remaining unexercised portion of the Warrant on the date of the consummation of such transaction, or (ii) the positive difference between the cash per share paid in such transaction minus the then-in-effect exercise price. The Company will cause any successor entity in a transaction in which the Company is not the survivor to assume in writing all of the obligations of the Company under the Warrant and the other transaction documents prior to such transaction.

Other

Registration

. Under the Registration Rights Agreement, we have agreed to file a registration statement with the SEC by August 26, 2016 to register the resale of the shares issuable upon conversion of the Series A-2 Preferred and exercise of the Warrants, and to have the registration statement declared effective by October 25, 2016 (or later in certain circumstances). The transaction documents provide for a variety of monetary penalties, which could be material, if the registration statement is not filed or declared effective by the times contemplated in the transaction documents, or does not continue to be effective and available thereafter. Each of the Company and each investor has agreed to indemnify the other party and certain affiliates against certain liabilities related to the registration statement.

Indemnification.

Under the transaction documents, we agreed to indemnify, hold harmless, reimburse and defend the investors and certain related persons and entities against any claim, cost, expense, liability, obligation, loss or damage (including legal fees) of any nature, incurred by or imposed upon the investors or any such person which results from, arises out of or is based upon (i) any breach of any representation, warranty or covenant by us in any of the transaction documents, or (ii) any action instituted against such indemnified party arising out of or resulting from the execution, delivery, performance or enforcement of the transaction documents.

BEAR STATE WARRANT

On March 28, 2016, the Company entered into a Loan and Security Agreement (the “

Loan Agreement

”) with Bear State Bank, N.A., a national banking association (“

Lender

,” “

Bear State

” or “

BSB

”). Pursuant to the Loan Agreement, Lender agreed to loan to the Company from time to time up to an aggregate of $2,000,000, subject to the terms and conditions of the Loan Agreement, and the Company entered into a related Line of Credit Promissory Note (the “

Note

”) to evidence amounts that the Company may borrow from Lender under the Loan Agreement.

Under the Loan Documents (as defined below), the Company agreed to pay accrued and unpaid interest on amounts that it borrows and that are represented by the Note commencing on April 1, 2016, and on the first day of each July, October and January, through and including March 1, 2017. The entire outstanding principal balance, and all accrued and unpaid interest and all other sums payable pursuant to the Note, the Loan Agreement, or any of the other Loan Documents, are due and payable on March 1, 2017 (the “

Maturity Date

”), unless sooner provided. The Company may repay any amounts that it borrows under the Loan Agreement at any time.

As part of the collateral to secure its obligations to Lender under the Loan Agreement and all documents executed in connection with or pursuant to Loan Agreement, including the Note and all other security agreements, documents, agreements, and other instruments contemplated by the Loan Agreement or in connection with the Loan Agreement (the “

Loan Documents

”), the Company issued a warrant to Lender (the “

BSB Warrant

”) allowing Lender to purchase up to 1,000,000 shares (the “

BSB Warrant Shares

”) of the Company’s common stock at an exercise price equal to $0.0001 per share.

BSB Warrant

The BSB Warrant is only exercisable by Lender following the occurrence of an event of default under the Loan Documents and Lender’s notice to the Company that it is accelerating all amounts owed by the Company under the Loan Documents. In such event, Lender may exercise the BSB Warrant to acquire BSB Warrant Shares in a number that Lender in good faith believes will, upon sale of such shares, be sufficient to cure or payoff the Company’s obligations under the Loan Documents. The BSB Warrant may be exercised by means of a cashless net exercise.

Beneficial Ownership Limitation

.

Under the terms of the BSB Warrant, the Company shall not effect any exercise of the BSB Warrant, and Lender does not have the right to exercise any portion of the BSB Warrant, to the extent that after giving effect to such exercise, the Lender would beneficially own in excess of the holder and Beneficial Ownership Limitation (as defined in the BSB Warrant), or Lender, together with Lender’s affiliates and any persons acting as a group together with Lender or any of such affiliates, would beneficially own in excess of the Affiliates Beneficial Ownership Limitation (as defined in the BSB Warrant). For purposes of the BSB Warrant, the “holder Beneficial Ownership Limitation” is 4.99% of the number of shares of common stock outstanding immediately after giving effect to the issuance of shares of common stock upon exercise of the BSB Warrant; and the “affiliates Beneficial Ownership Limitation” is 9.99% of the number of shares of common stock outstanding immediately after giving effect to the issuance of shares of common stock upon exercise of the BSB Warrant (such limitations under the BSB Warrant referred to collectively as the “

Beneficial Ownership Limitation

”). Lender may, with 61 days prior notice to the Company, or immediately upon notice at any time after the public announcement or other disclosure of a “Fundamental Transaction” (as defined in the BSB Warrant), elect to increase or decrease or remove one or both of such limitations; provided, however, that in no event may the Lender exercise the BSB Warrant if the number of shares issuable upon exercise (plus all other shares of common stock issuable by the Company in other transactions subject to Nasdaq Rule 5635(d)(2) exceeds 19.9% of the outstanding shares of common stock on the issuance date of the BSB Warrant, unless such issuance has been approved by the Company’s stockholders. The BSB Warrant and all rights thereunder are transferable in whole, but not in part, only to an affiliate of the Lender in connection with the transfer and assignment by Lender to such affiliate of all of Lender’s rights and obligations under the Loan Documents.

The Company has agreed to file a registration statement with the SEC to register the resale of any common stock that may be issued upon the exercise of the BSB Warrant by Lender.

Additional information concerning the Loan Agreement, the other Loan Documents and the BSB Warrant is contained in the Company’s Report on Form 8-K filed with the SEC on March 29, 2016, and in the Company’s other subsequent filings with the SEC.

Loans

In connection with our acquisition of USC in April 2016, we entered into a Loan Amendment, Forbearance and Assumption Agreement (the “

Loan Amendment Agreement

”) with the Lender and certain other parties. Pursuant to the Loan Amendment Agreement, we were added as a “Borrower” under the existing loan agreements and related loan documents between USC (and certain other entities) and Lender (the “

Existing Loan Documents

”), and assumed all of the rights, duties, liabilities and obligations as a Borrower and a party under the Existing Loan Documents. The principal amount of debt obligations under the Existing Loan Documents was approximately $5,722,500.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, and any prospectus supplement that we may file, contains forward-looking statements. In some cases, you can identify forward-looking statements by terminology, such as “expects,” “anticipates,” “intends,” “estimates,” “plans,” “believes,” “seeks,” “may,” “should”, “could” or the negative of such terms or other similar expressions. Such statements may include, without limitation, statements relating to: our expectations for growth; estimates of future revenue; our sources and uses of cash; our liquidity needs; our ability to obtain sufficient funding to support our planned activities; our current or planned clinical trials or research and development activities; product development timelines; our future products; regulatory matters; anticipated dates for commencement of clinical trials; anticipated completion dates of clinical trials; anticipated dates for meetings with regulatory authorities and submissions to obtain required regulatory marketing approvals; anticipated dates for commercial introduction of products; anticipated expenses and expense levels; guidance on future periods; and other statements concerning our future operations and activities. Such forward-looking statements include those that express plans, anticipation, intent, contingency, goals, targets or future development and/or otherwise are not statements of historical fact. These forward-looking statements are based on our current expectations and projections about future events, and they are subject to risks and uncertainties, known and unknown, that could cause actual results and developments to differ materially from those expressed or implied in such statements.

These statements involve estimates, assumptions and uncertainties that could cause actual results to differ materially from those anticipated by such statements. Whether these future events will occur, and whether we will achieve our business objectives, are subject to numerous risks. There are a number of important factors that could cause actual results to differ materially from the results anticipated by these forward-looking statements. These important factors include those that we discuss under the heading “Risk Factors” and in other sections of our Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC, as well as in our other reports filed from time to time with the SEC that are incorporated by reference into this prospectus. You should read these factors and the other cautionary statements made in this prospectus and in the documents we incorporate by reference into this prospectus as being applicable to all related forward-looking statements wherever they appear in this prospectus or the documents we incorporate by reference into this prospectus. Any forward-looking statements are qualified in their entirety by reference to such factors and cautionary statements discussed throughout this prospectus or incorporated by reference herein. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward-looking statements. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

You should read this prospectus and any accompanying prospectus supplement and the documents that we reference herein and therein and have filed as exhibits to the registration statement of which this prospectus is part, completely and with the understanding that our actual future results may be materially different from what we expect. You should assume that the information appearing in this prospectus and any accompanying prospectus supplement is accurate as of the date on the front cover of this prospectus or such prospectus supplement only. Because the risk factors referred to elsewhere in the prospectus could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and except as may be required by applicable law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of the information presented in this prospectus and any accompanying prospectus supplement, and particularly our forward-looking statements, by these cautionary statements.

USE OF PROCEEDS

We are registering shares of our common stock, and the Warrants, pursuant to registration rights granted to the selling stockholders. We will not receive any of the proceeds from any sale or other disposition of the Warrants or the common stock covered by this prospectus. All proceeds from the sale of the Warrants or the common stock will be paid directly to the selling stockholders. We will receive proceeds upon the cash exercise of the Warrants for which underlying Warrant Shares are being registered hereunder. Assuming full cash exercise of the Warrants at the exercise price of $2.90 per underlying Warrant Share, and assuming no further adjustments to the exercise price, we would receive proceeds of approximately $5,000,000. We currently intend to use the cash proceeds from any Warrant exercise for working capital and general corporate purposes, including repayment of existing or future indebtedness. We may also use a portion of the cash proceeds to acquire or invest in complementary businesses, technologies, product candidates, or other intellectual property, although we have no present commitments or agreements to do so. The amount and timing of our actual use of proceeds may vary significantly depending upon numerous factors, including the actual amount of proceeds we receive and the timing of when we receive such proceeds. In addition, the terms of the Warrants provide that they may be exercised on a cashless basis if at the time of exercise, the shares of common stock underlying the Warrants are not subject to a registration statement or there has been a failure to maintain the effectiveness of a registration covering such shares, or if we fail to provide any certifications to the selling stockholders that we are required to provide pursuant to the Registration Rights Agreement. We will not receive any cash proceeds as a result of Warrants that are exercised on a cashless basis pursuant to such terms of the Warrants. We cannot assure you that any Warrants will be exercised or that such exercises will be cash exercises rather than net cashless exercises. With respect to the BSB Warrant, we would not receive any substantial proceeds from the exercise of the BSB Warrant. However, the net proceeds from the sale by Lender of BSB Warrant Shares are required by the terms of the BSB Warrant to be applied to reduce the amount of our obligations to Lender under the Loan Documents.

SELLING STOCKHOLDERS

The shares of common stock being offered by the selling stockholders are issuable to the selling stockholders, other than BSB, pursuant to the terms of the Series A-2 Preferred and the Warrants, and in the case of BSB, pursuant to the terms of the BSB Warrant. We are registering the Warrants and the shares of common stock in order to permit the selling stockholders to offer the Warrants, Conversion Shares, Warrant Shares and BSB Warrant Shares for resale from time to time. Except for the ownership of the Series A-2 Shares and Warrants that we issued pursuant to the Purchase Agreement and except for the transactions described above in the sections of this prospectus entitled “Private Placement of Series A-2 Convertible Preferred Stock and Warrants” and “Bear State Warrant,” and except as described in the next two paragraphs,

the selling stockholders have not had any material relationship with us or our affiliates within the past three years.

On August 19, 2014, we completed a private placement financing transaction with certain parties, including funds advised by Sio Capital Management, LLC, which acts as an investment advisor to certain of the selling stockholders identified in the table below, in which we issued 1,418,439 shares of Series A Convertible Preferred Stock (“

Series A Preferred

”) and warrants to purchase up to 1,418,439 shares of common stock, and received gross cash proceeds of approximately $5,000,000, excluding transactions costs, fees and expenses. The Series A Preferred and warrants were sold in units, with each unit consisting of one Series A Preferred and one warrant, at a purchase price of $3.525 per unit. Each share of Series A Preferred is convertible into shares of common stock, at an initial conversion rate of 1-for-1, at any time at the discretion of the holder. The exercise price of the warrants is $3.40 per share, and the warrants are exercisable for five years. In accordance with the transaction agreements, the Company filed a registration statement with the SEC to register the resale from time to time of shares of common stock underlying the Series A-1 Preferred and the warrants, and such registration statement has become effective.

On January 26, 2016, we amended these warrants to allow such warrants to be exercisable, at the election of the holder, into either Common Stock or Series A-1 Preferred.

On January 26, 2016, we completed a private placement transaction with a small number of accredited investors, including selling stockholders advised by Sio Capital Management, LLC, pursuant to which we issued 1,183,432 shares of Series A-1 Convertible Preferred Stock (“

Series A-1 Preferred

”) and warrants to purchase up to 1,183,432 shares of common stock or Series A-1 Preferred, and received gross cash proceeds of approximately $5,000,000, excluding transaction costs, fees and expenses. The shares of Series A-1 Preferred and warrants were sold in units, with each unit consisting of one share and one warrant, at a purchase price of $4.225 per unit. The Series A-1 Preferred is convertible into shares of common stock at an initial conversion rate of 1-for-1 (subject to stock splits, reverse stock splits and similar events) at any time at the discretion of the investor. The exercise price of the warrants is $4.10 per share, and the warrants are exercisable for five years. In accordance with the transaction agreements, the Company filed a registration statement with the SEC to register the resale from time to time of shares of common stock underlying the Series A-1 Preferred and the warrants, and such registration statement has become effective.

The table below lists the selling stockholders and other information regarding the beneficial ownership of common stock by each of the selling stockholders, based on 20,886,829 shares of common stock outstanding. The second column lists the number of shares of common stock beneficially owned by each selling stockholder, including based on its beneficial ownership of the Series A-2 Shares and Warrants, Series A Preferred and Series A-1 Preferred (together with the Series A-2 Preferred, sometimes referred to collectively as the “

Series Preferred

”), other warrants and other shares of our common stock beneficially owned by the selling stockholder as of the date of this prospectus, assuming conversion of Series A-2 Shares and other shares of Series Preferred and exercise of warrants on that date held by the selling stockholder, but subject to and giving effect to the 9.99% affiliate Beneficial Ownership Limitation (as defined below). The third column lists the shares of common stock being offered by this prospectus by the selling stockholders, without regard to the Beneficial Ownership Limitation or any maximum percentage ownership limitations or other limitations on conversions of Series A-2 Shares or exercises of the Warrants, and for holders of Series A-2 Shares or Warrants consists of shares of common stock issuable upon conversion of such Series A-2 Shares or exercise of the Warrants (or, if the Warrant Shares consist of shares of Series A-2 Preferred, upon conversion of such Warrant Shares). The fourth column lists the number of Warrants being offered by this prospectus by the selling stockholders. The fifth column lists the number of shares of common stock anticipated to be beneficially owned by the selling stockholders following the offering, assuming the sale of all of the securities offered by the selling stockholders pursuant to this prospectus. The selling stockholders may sell all, some or none of their securities in this offering. See “Plan of Distribution.”

Beneficial ownership is determined in accordance with the rules of the SEC. In computing the number of shares beneficially owned by a selling stockholder, shares issuable upon conversion of the Series A-2 Shares or exercise of the Warrants, or upon conversion of Series Preferred or other warrants held by that selling stockholder, are included with respect to that selling stockholder, subject to the Beneficial Ownership Limitation. To our knowledge, subject to community property laws where applicable, each person named in the table has sole voting and investment power with respect to the shares of common stock set forth opposite such person’s name.

Under the terms of the Company’s Certificate of Designation of Preferences, Rights and Limitations of Series A-2 Convertible Preferred Stock, and under the terms of the Warrants, the number of shares of common stock into which the Series A-2 Preferred is convertible, and the number of shares of common stock into which the Warrants beneficially held by each selling stockholder are exercisable, as applicable, are limited pursuant to the terms of the Series A-2 Preferred and the Warrants to that number of shares of common stock which would result in the named stockholder having aggregate individual beneficial ownership of, with respect to the Series A-2 Preferred and the Warrants, 4.99% individually (the “

individual Beneficial Ownership Limitation

”) and together with any affiliated stockholders 9.99% (the “

affiliate Beneficial Ownership Limitation

”), of the total issued and outstanding shares of common stock (together, referred to as the “

Beneficial Ownership Limitation

”). Similar provisions apply with respect to the Series A Preferred, Series A-1 Preferred, and warrants to purchase shares of Series A Preferred and Series A-1 Preferred.

When we refer to “selling stockholders” in this prospectus, we mean those persons listed in the table below, as well as their transferees, pledgees or donees or their successors. The selling stockholders may sell all, a portion or none of their securities at any time. The information regarding shares beneficially owned after the offering assumes the sale of all securities offered by the selling stockholders. Except as otherwise indicated, each selling stockholder has sole voting and dispositive power with respect to such securities.

|

|

|

Shares

Beneficially

Owned

Prior to Offering

|

|

|

Shares

to be

Offered (5)

|

|

|

Warrants

to be

Offered

|

|

|

Shares

Beneficially

Owned

After Offering

|

|

|

Name of Selling Stockholder

|

|

Number

|

|

|

Percentage

|

|

|

Number

|

|

|

|

|

|

Number

|

|

|

Percentage

|

|

|

Funds advised by Sio Capital Management, LLC

|

|

|

2,086,594

|

(1)

|

|

|

9.9

|

%

|

|

|

3,063,446

|

|

|

|

1,531,723

|

|

|

|

2,086,594

|

(6)

|

|

|

9.9

|

%

|

|

Philco Investments, Ltd. (2)

|

|

|

156,000

|

|

|

|

*

|

%

|

|

|

40,000

|

|

|

|

20,000

|

|

|

|

116,000

|

|

|

|

*

|

%

|

|

Walleye Trading LLC (3)

|

|

|

608,906

|

|

|

|

2.9

|

%

|

|

|

344,828

|

|

|

|

172,414

|

|

|

|

264,078

|

|

|

|

1.3

|

%

|

|

Bear State Bank, N.A. (4)

|

|

|

1,000,000

|

|

|

|

4.8

|

%

|

|

|

1,000,000

|

|

|

|

—

|

|

|

|

0

|

|

|

|

*

|

|

|

*

|

|

Less than one percent of the outstanding shares.

|

|

|

|

|

|

(1)

|

|

Based on information provided to the Company by the named stockholder. The total number of shares of common stock, Series A Preferred, Series A-1 Preferred, Series A-2 Preferred, Series A Warrants, Series A-1 Warrants and Series A-2 Warrants, held by each of the following entities and determined without reference to the Beneficial Ownership Limitation, is as follows: Compass Offshore MAV Limited, 29,765, 0, 0, 268,582, 0, 270,791, and 268,582, respectively; Sio Partners, LP, 204,356, 0, 0, 380,819, 810,922, 247,629 and 380,819, respectively; Compass MAV LLC, 39,500, 0, 0, 356,431, 0, 302,520 and 356,431, respectively; and Sio Partners Master Fund, LP, 282,149, 0, 0, 525,891, 607,517, 362,492 and 525,891, respectively. As of the date of the information in the table, no shares of Series A Preferred or Series A-1 Preferred were outstanding. Based on information provided by the named stockholder and the number of outstanding shares of Common Stock stated above, the number of shares issuable upon conversion of Series Preferred or exercise of the Warrants or other warrants held by holders of Series Preferred, after giving effect to the Beneficial Ownership Limitation, is 1,530,824 shares. Excludes 4,134,493 shares of Series A Preferred, Series A-1 Preferred and Series A-2 Preferred and warrants to purchase shares of common stock or Series A-1 or A-2 Preferred, that are not convertible into common stock or exercisable within 60 days of the date of the table, by virtue of the Beneficial Ownership Limitation. Sio Capital Management, LLC serves as investment advisor of Sio Partners, LP, Compass MAV LLC, Compass Offshore MAV Limited, and Sio Partners Master Fund LP. Sio GP, LLC is the general partner of Sio Partners, LP and Sio Partners Master Fund, LP. Michael Castor, as principal of Sio GP, LLC and director of Sio Partners Offshore, Ltd., has voting and investment control over the securities beneficially owned by each of the foregoing stockholders. Each of Sio Capital Management, LLC, Sio GP, LLC and Michael Castor disclaims beneficial ownership over the securities held of record by stockholders, except to the extent of its or his pecuniary interest therein. The business address of the stockholders is Sio Capital Management, LLC, 535 Fifth Avenue, Suite 910, New York, NY 10017.

|

|

|

|

Pursuant to Rule 13d-4 under the Exchange Act, each of the stockholders disclaims beneficial ownership of any and all shares of Common Stock that are issuable upon any conversion or exercise of the Series A-2 Preferred or Warrants or other shares of Series Preferred or warrants if such conversion or exercise would cause the stockholder’s aggregate beneficial ownership to exceed or remain above the applicable Beneficial Ownership Limitation. As a result, each stockholder disclaims beneficial ownership of any shares not shown as beneficially owned in the table above. The business address of the stockholders is Sio Capital Management, LLC, 535 Fifth Avenue, Suite 910, New York, NY 10017.

|

|

|

|

|

|

(2)

|

|

Based on information provided to the Company by the named stockholder. Includes 116,000 shares of Common Stock owned by the named stockholder. Includes 20,000 shares issuable upon conversion of Series A-2 Preferred, giving effect to the Beneficial Ownership Limitation, and 20,000 shares issuable upon exercise of Warrants held by the named stockholder to purchase 20,000 shares of Series A-2 Preferred and/or Common Stock which are exercisable within 60 days of the date of the table. Larry Waldman, as Managing Member of Philco Investments Ltd, has voting and investment control over the securities beneficially owned by Philco Investments Ltd. Mr. Waldman disclaims beneficial ownership over the securities held of record by the named stockholder, except to the extent of its or his pecuniary interest therein. The business address of the stockholder is 4500 Cooper Road, Suite 301, Cincinnati, OH 45242.

|

|

|

|

|

|

(3)

|

|

Based on information provided to the Company by the named stockholder. Includes 264,078 shares of Common Stock owned by the named stockholder, which is a registered broker-dealer. Includes 172,414 shares issuable upon conversion of Series A-2 Preferred, giving effect to the Beneficial Ownership Limitation, and 172,414 shares issuable upon exercise of Warrants held by the named stockholder to purchase 172,414 shares of Series A-2 Preferred and/or Common Stock which are exercisable within 60 days of the date of the table. Peter Goddard, the Chief Executive Officer of Walleye Trading LLC, has voting and investment control over the securities beneficially owned by Walleye Trading LLC. Mr. Goddard disclaims beneficial ownership over the securities held of record by the stockholder, except to the extent of its or his pecuniary interest therein. The business address of the stockholder is 2800 Niagara Lane, Plymouth, MN 55447.

|

|

|

|

|

|

(4)

|

|

Based on information provided to the Company by the named stockholder. Includes 1,000,000 shares of Common Stock that may be acquired upon exercise of the BSB Warrant by the selling stockholder. The BSB Warrant is not currently exercisable and may only be exercised following an event of default by the Company under the Loan Documents. Mark McFatridge, as Chief Executive Officer of Bear State Bank, N.A. has voting and investment control over the securities beneficially owned by Bear State Bank, N.A. Mr. McFatridge disclaims beneficial ownership over the securities held of record by the stockholder, except to the extent of its or his pecuniary interest therein.

|

|

|

|

|

|

(5)

|

|

Determined without reference to any Beneficial Ownership Limitations. Consists of shares of Common Stock issuable upon conversion of the Series A-2 Shares or exercise of the Warrants (or, if the Warrants are exercised to acquire shares of Series A-2 Preferred, then upon conversion of such shares of Series A-2 Preferred).

|

|

|

|

|

|

(6)

|

|

Gives effect to the Beneficial Ownership Limitation.

|

PLAN OF DISTRIBUTION

Each selling stockholder has informed us that it does not, as of the date of this prospectus, have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the securities.

The selling stockholders which, as used herein, includes donees, pledgees, transferees or other successors-in-interest selling securities received after the date of this prospectus from a selling stockholder as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of their securities on any stock exchange on which the securities may be listed, market or trading facility on which the securities may be traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The selling stockholders may use any one or more of the following methods when disposing of shares or interests therein:

|

|

●

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

●

|

block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

●

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

●

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

●

|

privately negotiated transactions;

|

|

|

●

|

short sales effected after the date the registration statement of which this Prospectus is a part is declared effective by the SEC;

|

|

|

●

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

●

|

broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per share;

|

|

|

●

|

a combination of any such methods of sale; and

|

|

|

●

|

any other method permitted by applicable law.

|

The selling stockholders may, from time to time, pledge or grant a security interest in some or all of the securities owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the securities, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the 1933 Act amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus. The selling stockholders also may transfer the securities in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our securities or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The selling stockholders may also sell our securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the selling stockholders from the sale of the securities offered by them will be the purchase price of the securities less discounts or commissions, if any. Each of the selling stockholders reserves the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of securities to be made directly or through agents. We will not receive any of the proceeds from this offering. Upon any exercise of the warrants by payment of cash, however, we will receive the exercise price of the warrants. With respect to the BSB Warrant, upon any exercise of the BSB Warrant by the Lender/and the sale of shares that are issued on exercise of the BSB Warrant, the proceeds from the sale of those shares will be applied to reduce the amount of the Company’s indebtedness and obligations to the Lender under the Loan Documents.

The selling stockholders also may resell all or a portion of shares of our common stock in open market transactions in reliance upon Rule 144 under the 1933 Act, provided that they meet the criteria and conform to the requirements of that rule.

The Warrants that the selling stockholders may offer will be new issues of securities with no established trading market. Any underwriters may make a market in these securities, but will not be obligated to do so and may discontinue any market making at any time without notice. We cannot guarantee the liquidity of the trading markets for any securities. We do not intend to apply to list the Warrants on the Nasdaq Capital Market or on any other national securities exchange or nationally recognized trading system, and we do not expect that a market for the Warrants will develop.

The selling stockholders and any underwriters, broker-dealers or agents that participate in the sale of the securities or interests therein may be “underwriters” within the meaning of Section 2(11) of the 1933 Act. Any discounts, commissions, concessions or profit they earn on any resale of the securities may be underwriting discounts and commissions under the 1933 Act. Selling stockholders who are “underwriters” within the meaning of Section 2(11) of the 1933 Act will be subject to the prospectus delivery requirements of the 1933 Act.

To the extent required, the securities to be sold, the names of the selling stockholders, the respective purchase prices and public offering prices, the names of any agents, dealer or underwriter, any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

In order to comply with the securities laws of some states, if applicable, the securities may be sold in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states the securities may not be sold, unless it has been registered or qualified for sale or an exemption from registration or qualification requirements is available and is complied with.

We have advised the selling stockholders that the anti-manipulation rules of Regulation M under the 1934 Act may apply to sales of shares in the market and to the activities of the selling stockholders and their affiliates. In addition, to the extent applicable we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling stockholders for the purpose of satisfying the prospectus delivery requirements of the 1933 Act. The selling stockholders may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the 1933 Act.

We have agreed to indemnify the selling stockholders against liabilities, including liabilities under the 1933 Act and state securities laws, relating to the registration of the securities offered by this prospectus.

We have agreed with the selling stockholders to keep the registration statement of which this prospectus constitutes a part effective until the earlier of (1) such time as all of the securities covered by this prospectus have been disposed of pursuant to and in accordance with the registration statement, or (2) the date on which all of the securities may be sold without restriction pursuant to Rule 144 of the 1933 Act.

LEGAL MATTERS

The validity of the issuance of the securities offered hereby will be passed upon for us by Weintraub Tobin Chediak Coleman Grodin, Law Corporation, Sacramento, California.

EXPERTS

The financial statements as of December 31, 2015 and 2014 and for the year and nine-month transition period in the period ended December 31, 2015 and 2014, respectively, incorporated by reference in this prospectus and registration statement, have been so included in reliance on the report of Mayer Hoffman McCann P.C., an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting. The financial statements as of December 31, 2015 and 2014 and for the two years in the period ended December 31, 2015, of U.S. Compounding, Inc., incorporated in this prospectus and registration statement by reference to the Report on Form 8-K filed with the SEC on July 28, 2016, have been so included in reliance on the report of Hudson Cisne & Co. LLP, an independent accounting firm, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 under the Securities Act, with respect to the securities covered by this prospectus. This prospectus and any prospectus supplement which form a part of the registration statement, do not contain all of the information set forth in the registration statement or the exhibits and schedules filed therewith. For further information with respect to us and the securities covered by this prospectus, please see the registration statement and the exhibits filed with the registration statement. Any statements made in this prospectus or any prospectus supplement concerning legal documents are not necessarily complete and you should read the documents that are filed as exhibits to the registration statement or otherwise filed with the SEC for a more complete understanding of the document or matter. A copy of the registration statement and the exhibits filed with the registration statement may be inspected without charge at the Public Reference Room maintained by the SEC, located at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for more information about the operation of the Public Reference Room. The SEC also maintains an Internet website that contains reports, proxy and information statements and other information regarding registrants that file electronically with the SEC. The address of the website is

http://www.sec.gov

.