UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2015

Commission File Number: 001 - 36130

voxeljet AG

(Exact Name of Registrant as Specified in Its Charter)

Paul-Lenz-Straße 1a

86316 Friedberg

Germany

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Other Events

On May 12, 2015, voxeljet AG issued a press release announcing its financial results for the first quarter ended March 31, 2015.

Exhibits

99.1 voxeljet AG Press Release.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

voxeljet AG |

|

|

|

|

|

|

|

|

By: |

/s/ Rudolf Franz |

|

|

|

|

|

|

|

|

Name: |

Rudolf Franz |

|

|

|

Title: |

Chief Financial Officer |

|

|

|

|

|

Date: May 12, 2015 |

|

|

3

EXHIBIT INDEX

99.1 voxeljet AG Press Release.

4

voxeljet AG Reports Financial Results for the First Quarter Ended March 31, 2015

Friedberg, Germany, May 12, 2015 — voxeljet AG (NYSE: VJET) (the “Company”, or “voxeljet”), a leading provider of high-speed, large-format 3D printers and on-demand parts services to industrial and commercial customers, today announced consolidated financial results for the first quarter ended March 31, 2015.

Highlights — First Quarter 2015

· Total revenues increased 104.1% to kEUR 5,589 from kEUR 2,739

· Gross margin was 33.6% compared to 39.4%

· Systems revenues increased 114.7% to kEUR 2,817 from kEUR 1,312

· Services revenues increased 94.3% to kEUR 2,772 from kEUR 1,427

· Reaffirm full year 2015 revenue guidance

Dr. Ingo Ederer, Chief Executive Officer of voxeljet, commented, “I am pleased with our first quarter results which reflect the increased adoption of 3D printing in industrial and commercial applications. Demand for both our systems and on-demand printed parts remains robust. We sold four printers in the quarter compared to two printers in last year’s same quarter and generated record revenues in both sand and plastic parts.”

Dr. Ederer continued, “We began printing parts at our service facility in Detroit in the first quarter of 2015 and our direct operating presence in that market is creating greater awareness of voxeljet’s capabilities and is driving customer interest across North America. We are off to a good start for the year and we reaffirm our full year 2015 guidance of revenue between kEUR 23,000 and kEUR 24,000 for the group.”

First Quarter 2015 Results

Revenues for the first quarter of 2015 increased by 104.1% to kEUR 5,589 compared to kEUR 2,739 in the first quarter of 2014.

Revenues from our Systems segment, which focuses on the development, production and sale of 3D printers, increased 114.7% to kEUR 2,817 in the first quarter of 2015 from kEUR 1,312 in last year’s first quarter. The Company delivered four printers (two new and two used) in the first quarter of 2015. This compared to two new printers that were delivered in last year’s first quarter. Systems revenues also include all revenues from consumables, spare parts and maintenance. Systems revenues represented 50.4% of total revenues in the first quarter of 2015 compared to 47.9% in last year’s first quarter.

Revenues from our Services segment, which focuses on the printing of on-demand parts for our customers, increased 94.3%, to kEUR 2,772 in the first quarter of 2015 from kEUR 1,427 for the same quarter last year. This was mainly due to the revenue contribution from our subsidiary voxeljet UK Ltd. (“voxeljet UK”), which contributed kEUR 912 of revenues in the Services segment for the first quarter of 2015. We also continued to

benefit from the expansion of our service center in Germany (completed in April 2014), where Service revenues increased nearly 30% compared to last year’s first quarter.

Cost of sales was kEUR 3,710 for the first quarter of 2015 compared to kEUR 1,660 for the first quarter of 2014. Embedded in cost of sales was expenses related to our Long Term Cash Incentive Plan (“LTCIP”) of kEUR 213 in the first quarter of 2015 compared to kEUR 56 in the first quarter of 2014. The LTCIP was initiated in October 2013.

Gross profit was kEUR 1,879 in the first quarter of 2015 compared to kEUR 1,079 in the first quarter of 2014. The gross profit margin decreased to 33.6% in the first quarter of 2015 from 39.4% in the first quarter of 2014.

Gross profit for our Systems segment increased to kEUR 772 in the first quarter of 2015 from kEUR 397 in the first quarter of 2014. The gross profit margin for this segment decreased to 27.4% in the first quarter of 2015 compared to 30.3% in the first quarter of 2014. Systems sales in the first quarter of 2015 included two used printers which generally have a lower gross margin compared to that of new printers. In addition, one of the two new printers sold in the first quarter of 2015 was a beta-system which was sold to a customer at a discount and contributed to the lower overall gross margin in the Systems segment. Higher headcount costs related to our growth strategy also affected the cost of sales. As of March 31, 2015, 41 people were employed in the Systems segment, compared to 26 as of March 31, 2014. In the first quarter of 2015, cost of sales in the Systems segment related to the LTCIP was kEUR 119 compared to kEUR 32 in the prior year period.

Gross profit for our Services segment increased to kEUR 1,107 in the first quarter of 2015 from kEUR 682 in the first quarter of 2014. The gross profit margin for this segment decreased to 39.9% in the first quarter of 2015 from 47.8% in the first quarter of 2014. The decrease in gross margin was related to increased headcount costsin pursuit of our growth strategy. As of March 31, 2015, 34 people were employed in our Services segment, compared to 16 as of March 31, 2014, an increase of more than 100%. Product mix in the first quarter of 2015 was less favorable compared to the first quarter of 2014 due in part to our subsidiary voxeljet UK, which prints on-demand parts for the film and entertainment industry. Gross margins in services to customers in this industry are generally lower due to more costly finishing and post-printing process requirements. In the first quarter of 2015, cost of sales in the Services segment related to the LTCIP was kEUR 94 compared to kEUR 24 in the prior year period.

Selling expenses were kEUR 1,416 for the first quarter of 2015 compared to kEUR 693 in the first quarter of 2014. The increase of kEUR 723 was the result of our expanded global sales effort as we increased our headcount and attended more trade shows and fairs compared to the prior year period. Headcount (for employees performing sales and marketing functions) increased at the end of the first quarter of 2015 by 10 to 31 employees compared to 21 at the end of the first quarter 2014.

Administrative expenses were kEUR 1,619 for the first quarter of 2015 compared to kEUR 614 in the first quarter of 2014. This increase of kEUR 1,005 was primarily due to increased headcount related to the pursuit of our growth strategy and costs associated with being a publicly-traded company. Headcount (for employees performing administrative functions) increased at the end of the first quarter of 2015 by 23 to 42 employees compared to 19 at the end of the first quarter 2014.

Research and development (“R&D”) expenses increased to kEUR 1,560 in the first quarter of 2015 from kEUR 848 in the prior year period, as we continued to invest heavily in R&D with a number of active projects in various stages of development. Those investments are intended to strengthen our leadership in technology.

Our operating expenses for the first quarter of 2015 were affected by the LTCIP. Selling, administrative and R&D expenses related to the LTCIP were kEUR 114 (Q1 2014: kEUR 35), kEUR 69 (Q1 2014: kEUR 17) and kEUR 187 (Q1 2014: kEUR 47), respectively.

Other operating expenses in the first quarter of 2015 were kEUR 206 compared to kEUR 78 in the prior year period. This was mainly due to expenses from foreign currency exchange amounting to kEUR 100 (Q1 2014: kEUR 3).

Other operating income was kEUR 1,456 for the first quarter of 2015 compared to kEUR 551 in the first quarter of 2014. This was mainly due to gain from foreign currency transactions amounting to kEUR 924. In addition, other operating income included the release of deferred income amounting to kEUR 304, which included kEUR 230 resulting from the early termination of one sale and leaseback contract.

Operating loss was kEUR 1,466 in the first quarter of 2015, compared to an operating loss of kEUR 603 in the prior year period. Our operating loss in the first quarter of 2015 was the result of an increase in our operating expenses caused by increased headcount related to the pursuit of our growth strategy and costs related to being a publicly-traded company, including compensation expenses related to the LTCIP of kEUR 583. The personnel expenses related to the LTCIP for the first quarter of 2014 were kEUR 156. Regarding the LTCIP, management adjusted its judgement of the probability of achieving the targets for the second performance period. This led to a change in estimate resulting in higher personnel expenses through cost of sales and other operating expenses. The change in estimate recognized in the first quarter of 2015 amounted to kEUR 337.

Net loss for the first quarter of 2015 was kEUR 1,630, or EUR 0.49 per share, as compared to net loss of kEUR 711, or EUR 0.22 per share, in the first quarter of 2014.

Business Outlook

We reaffirm our revenue guidance in a range of between kEUR 23,000 and kEUR 24,000 for the year ending December 31, 2015.

The primary drivers of the Company’s anticipated revenue growth for the year ending December 31, 2015 are expected to be: (1) increased global Systems sales; (2) continued Services revenue growth at its facility in Friedberg, Germany; (3) contribution from Voxeljet of America Inc., the Company’s Services facility in Canton, Michigan, which began operating in January 2015; and (4) a full year’s contribution from voxeljet UK, the Company’s Services facility outside London, England. Based on these factors, the Company expects Services revenue growth to outpace Systems revenue growth in 2015.

Our total backlog of 3D printer orders at March 31, 2015 was kEUR 2,643, which represents six 3D printers. This compares to backlog of kEUR 4,178, representing seven 3D printers, at December 31, 2014. As production and delivery of our printers is generally not characterized by long lead times, backlog is more dependent on the timing of customers’ requested deliveries.

At March 31, 2015, we had cash and cash equivalents of kEUR 7,879 and held kEUR 39,065 of investments in five bond funds which are included in current financial assets on our consolidated statement of financial position.

Long Term Cash Incentive Plan (LTCIP)

On October 2, 2013, we announced that we would be implementing, effective on January 1, 2013, a long-term cash incentive plan (the “LTCIP”) for senior management and other key personnel. An initial grant of the awards under the LTCIP was made to participants on October 2, 2013. Personnel expenses incurred in the first three months of 2015 related to the LTCIP amounted to kEUR 583. The first tranche of awards granted under the LTCIP was settled in May 2014.

Webcast and Conference Call Details

The Company will host a conference call and webcast to review the results for the first quarter of 2015 on Wednesday, May 13th at 8:30 a.m. Eastern Time. Participants from voxeljet will include its Chief Executive Officer, Dr. Ingo Ederer, and its Chief Financial Officer, Rudolf Franz, who will provide a general business update and respond to investor questions.

Interested parties may access the live audio broadcast by dialing 1-877-705-6003 in the United States/Canada, or +1-201-493-6725 for international, Conference Title “voxeljet AG First quarter 2015 Financial Results Conference Call.” Investors are requested to access the call at least five minutes before the scheduled start time in order to complete a brief registration. An audio replay will be available approximately two hours after the completion of the call at 1-877-870-5176 or +1-858-384-5517, Replay Conference ID number 13607605. The recording will be available for replay through May 20, 2015.

A live webcast of the call will also be available on the investor relations section of the Company’s website. Please go to the website (http://www.voxeljet.de/en/) at least fifteen minutes prior to the start of the call to register, download and install any necessary audio software. A replay will also be available as a webcast on the investor relations section of the Company’s website.

Exchange rate

This press release contains translations of certain U.S. dollar amounts into Euros at specified rates solely for the convenience of readers. Unless otherwise noted, all translations from U.S. dollars to euros in this press release were made at a rate of USD 1.0759 to EUR 1.00, the noon buying rate of the Federal Reserve Bank of New York for the euro on March 31, 2015.

About voxeljet

voxeljet is a leading provider of high-speed, large-format 3D printers and on-demand parts services to industrial and commercial customers. The Company’s 3D printers employ a powder binding, additive manufacturing technology to produce parts using various material sets, which consist of particulate materials and proprietary chemical binding agents. The Company provides its 3D printers and on-demand parts services to industrial and commercial customers serving the automotive, aerospace, film and entertainment, art and architecture, engineering and consumer product end markets. For more information, visit http://www.voxeljet.de/en/.

Cautionary Statement on Forward-Looking Statements

This press release contains forward-looking statements concerning our business, operations and financial performance. Any statements that are not of historical facts may be deemed to be forward-looking statements. You can identify these forward-looking statements by words such as ‘‘believes,’’ ‘‘estimates,’’ ‘‘anticipates,’’ ‘‘expects,’’ ‘‘plans,’’ ‘‘intends,’’ ‘‘may,’’ ‘‘could,’’ ‘‘might,’’ ‘‘will,’’ ‘‘should,’’ ‘‘aims,’’ or other similar expressions that convey uncertainty of future events or outcomes. Forward-looking statements include statements regarding our intentions, beliefs, assumptions, projections, outlook, analyses or current expectations

concerning, among other things, our results of operations, financial condition, business outlook, the industry in which we operate and the trends that may affect the industry or us. Although we believe that we have a reasonable basis for each forward-looking statement contained in this press release, we caution you that forward-looking statements are not guarantees of future performance. All of our forward-looking statements are subject to known and unknown risks, uncertainties and other factors that are in some cases beyond our control and that may cause our actual results to differ materially from our expectations, including those risks identified under the caption “Risk Factors” in the Company’s Annual Report on Form 20-F and in other reports the Company files with the U.S. Securities and Exchange Commission, as well as the risk that our revenues may fall short of the guidance we have provided in this press release. Except as required by law, the Company undertakes no obligation to publicly update any forward-looking statements for any reason after the date of this press release whether as a result of new information, future events or otherwise.

Contact

Investors and Media

Anthony Gerstein

Director, Investor Relations and Business Development

anthony.gerstein@voxeljet.com

+1-646-484-1086

voxeljet AG

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

|

|

|

Notes |

|

03/31/2015 |

|

12/31/2014 |

|

|

|

|

|

|

(€ in thousands) |

|

|

|

|

|

|

unaudited |

|

|

|

|

Current assets |

|

|

|

57,755 |

|

58,509 |

|

|

Cash and cash equivalents |

|

7 |

|

7,879 |

|

8,031 |

|

|

Financial assets |

|

3, 7 |

|

39,523 |

|

41,142 |

|

|

Trade receivables |

|

7 |

|

2,844 |

|

3,148 |

|

|

Inventories |

|

|

|

6,426 |

|

5,247 |

|

|

Income tax receivables |

|

|

|

88 |

|

65 |

|

|

Other assets |

|

4 |

|

995 |

|

876 |

|

|

|

|

|

|

|

|

|

|

|

Non-current assets |

|

|

|

23,452 |

|

22,586 |

|

|

Financial assets |

|

7 |

|

252 |

|

247 |

|

|

Intangible assets |

|

|

|

1,210 |

|

1,315 |

|

|

Goodwill |

|

5 |

|

1,413 |

|

1,558 |

|

|

Property, plant and equipment |

|

6 |

|

20,541 |

|

19,466 |

|

|

Other assets |

|

4 |

|

36 |

|

— |

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

|

|

81,207 |

|

81,095 |

|

|

|

|

Notes |

|

03/31/2015 |

|

12/31/2014 |

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

8,420 |

|

5,567 |

|

|

Deferred income |

|

|

|

603 |

|

469 |

|

|

Trade payables |

|

7 |

|

3,018 |

|

2,326 |

|

|

Financial liabilities |

|

7 |

|

1,297 |

|

1,241 |

|

|

Other liabilities and provisions |

|

8 |

|

3,502 |

|

1,531 |

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities |

|

|

|

3,295 |

|

4,228 |

|

|

Deferred income |

|

|

|

647 |

|

826 |

|

|

Deferred tax liabilities |

|

|

|

— |

|

213 |

|

|

Financial liabilites |

|

|

|

2,025 |

|

2,263 |

|

|

Other liabilities and provisions |

|

8 |

|

623 |

|

926 |

|

|

|

|

|

|

|

|

|

|

|

Equity |

|

|

|

69,492 |

|

71,300 |

|

|

Subscribed capital |

|

|

|

3,720 |

|

3,720 |

|

|

Capital reserves |

|

|

|

75,671 |

|

75,671 |

|

|

Accumulated deficit |

|

|

|

(9,720 |

) |

(8,090 |

) |

|

Accumulated other comprehensive loss |

|

|

|

(179 |

) |

(1 |

) |

|

Total equity and liabilities |

|

|

|

81,207 |

|

81,095 |

|

voxeljet AG

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS (UNAUDITED)

|

|

|

|

|

Quarter Ended March 31, |

|

|

|

|

Notes |

|

2015 |

|

2014 |

|

|

|

|

|

|

(€ in thousands except share and

share data) unaudited |

|

|

Revenues |

|

9, 10 |

|

5,589 |

|

2,739 |

|

|

Cost of sales |

|

|

|

(3,710 |

) |

(1,660 |

) |

|

Gross profit |

|

9 |

|

1,879 |

|

1,079 |

|

|

Selling expenses |

|

|

|

(1,416 |

) |

(693 |

) |

|

Administrative expenses |

|

|

|

(1,619 |

) |

(614 |

) |

|

Research and development expenses |

|

|

|

(1,560 |

) |

(848 |

) |

|

Other operating expenses |

|

|

|

(206 |

) |

(78 |

) |

|

Other operating income |

|

|

|

1,456 |

|

551 |

|

|

Operating loss |

|

|

|

(1,466 |

) |

(603 |

) |

|

Finance expense |

|

|

|

(103 |

) |

(125 |

) |

|

Finance income |

|

|

|

4 |

|

17 |

|

|

Financial result |

|

|

|

(99 |

) |

(108 |

) |

|

Loss before income taxes |

|

|

|

(1,565 |

) |

(711 |

) |

|

Income taxes |

|

|

|

(65 |

) |

— |

|

|

Net loss |

|

|

|

(1,630 |

) |

(711 |

) |

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss) |

|

|

|

(178 |

) |

36 |

|

|

Total comprehensive loss |

|

|

|

(1,808 |

) |

(675 |

) |

|

Weighted average number of ordinary shares outstanding |

|

|

|

3,720,000 |

|

3,120,000 |

|

|

Loss per share - basic/ diluted (EUR) |

|

|

|

(0.49 |

) |

(0.22 |

) |

voxeljet AG

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY (UNAUDITED)

|

(€ in thousands) |

|

Subscribed capital |

|

Capital

reserves |

|

Accumulated

deficit |

|

Accumulated other

comprehensive

income (loss) |

|

Total equity |

|

|

Balance at January 1, 2014 |

|

3,120 |

|

46,038 |

|

(3,758 |

) |

— |

|

45,400 |

|

|

Loss for the period |

|

— |

|

— |

|

(711 |

) |

— |

|

(711 |

) |

|

Net changes in fair value of available for sale financial assets |

|

— |

|

— |

|

— |

|

36 |

|

36 |

|

|

Balance at March 31, 2014 |

|

3,120 |

|

46,038 |

|

(4,469 |

) |

36 |

|

44,725 |

|

|

(€ in thousands) |

|

Subscribed capital |

|

Capital

reserves |

|

Accumulated

deficit |

|

Accumulated other

comprehensive

income (loss) |

|

Total equity |

|

|

Balance at January 1, 2015 |

|

3,720 |

|

75,671 |

|

(8,090 |

) |

(1 |

) |

71,300 |

|

|

Loss for the period |

|

— |

|

— |

|

(1,630 |

) |

— |

|

(1,630 |

) |

|

Net changes in fair value of available for sale financial assets |

|

— |

|

— |

|

— |

|

(103 |

) |

(103 |

) |

|

Foreign currency translations |

|

— |

|

— |

|

— |

|

(75 |

) |

(75 |

) |

|

Balance at March 31, 2015 |

|

3,720 |

|

75,671 |

|

(9,720 |

) |

(179 |

) |

69,492 |

|

voxeljet AG

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

|

|

|

Three months ended March 31, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

(€ in thousands) |

|

|

Cash Flow from operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss for the period |

|

(1,630 |

) |

(711 |

) |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

743 |

|

407 |

|

|

Proceeds from customer loans |

|

637 |

|

40 |

|

|

Changes in deferred income taxes |

|

(213 |

) |

— |

|

|

Deferred income |

|

(44 |

) |

(553 |

) |

|

|

|

|

|

|

|

|

Change in working capital |

|

1,252 |

|

(1,034 |

) |

|

Trade and other receivables and current assets |

|

151 |

|

(717 |

) |

|

Inventories |

|

(1,597 |

) |

(407 |

) |

|

Trade payables |

|

842 |

|

580 |

|

|

Other liabilities and provisions |

|

1,880 |

|

(554 |

) |

|

Income tax payable/receivables |

|

(24 |

) |

64 |

|

|

|

|

|

|

|

|

|

Total |

|

745 |

|

(1,851 |

) |

|

|

|

|

|

|

|

|

Cash Flow from investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from disposal of property, plant, equipment and intangible assets |

|

1 |

|

— |

|

|

Payments to acquire property, plant, equipment and intangible assets |

|

(1,151 |

) |

(1,024 |

) |

|

Payments to acquire/ proceeds from sale of financial assets |

|

919 |

|

(20,010 |

) |

|

|

|

|

|

|

|

|

Total |

|

(231 |

) |

(21,034 |

) |

|

|

|

|

|

|

|

|

Cash Flow from financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Repayment from bank overdrafts and lines of credit |

|

— |

|

(59 |

) |

|

Repayments from sale and leaseback |

|

(456 |

) |

(992 |

) |

|

Repayment of finance lease obligations |

|

(36 |

) |

— |

|

|

Repayment of long-term debt |

|

(50 |

) |

(1,232 |

) |

|

Payment of shares issuance costs |

|

— |

|

(519 |

) |

|

|

|

|

|

|

|

|

Total |

|

(542 |

) |

(2,802 |

) |

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents |

|

(28 |

) |

(25,687 |

) |

|

|

|

|

|

|

|

|

Cash and cash equivalents at beginning of period |

|

8,031 |

|

33,459 |

|

|

|

|

|

|

|

|

|

Changes to cash and equivalents due to foreign exchanges rates |

|

(124 |

) |

— |

|

|

Cash and cash equivalents at end of period |

|

7,879 |

|

7,772 |

|

|

|

|

|

|

|

|

|

Supplemental Cash Flow Information |

|

|

|

|

|

|

Interest (received) paid net |

|

78 |

|

99 |

|

voxeljet AG

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. Preparation of financial statements

Our consolidated interim financial statements include the accounts of voxeljet AG, which is listed on the New York Stock Exchange, and its wholly-owned subsidiaries Voxeljet of America Inc. and voxeljet UK Ltd., which are collectively referred to herein as the ‘Group’ or the ‘Company.’

Our consolidated interim financial statements were prepared in compliance with all applicable measurement and presentation rules contained in International Financial Reporting Standards (‘IFRS’) as set forth by the International Accounting Standards Board (‘IASB’) and Interpretations of the IFRS Interpretations Committee (‘IFRIC’). The designation IFRS also includes all valid International Accounting Standards (‘IAS’); and the designation IFRIC also includes all valid interpretations of the Standing Interpretations Committee (‘SIC’). Specifically, these financial statements were prepared in accordance with the disclosure requirements and the measurement principles for interim financial reporting purposes specified by IAS 34.

The IASB issued a number of new IFRS standards which will become effective for the Company’s financial year beginning on January 1, 2016.

|

Standard |

|

Effective date |

|

Descriptions |

|

IFRS 10, IAS 28 |

|

01/2016 |

|

Amendment Sale or Contribution of Assets between Investor and its Associate or Joint Venture |

|

IFRS 10,12, IAS 28 |

|

01/2016 |

|

Amendments Investment Entities |

|

IFRS 14 |

|

01/2016 |

|

Regulatory Deferral Accounts |

|

IAS 1 |

|

01/2016 |

|

Amendment Disclosure Initiative |

|

IAS 16, IAS 38 |

|

01/2016 |

|

Property, Plant and Equipment |

|

IFRS 11 |

|

01/2016 |

|

Amendment Accouting for Acquisitions of Interests in Joint Operations |

|

IAS 27 |

|

01/2016 |

|

Amendment Equity Method in Separate Financial Statements |

|

IAS 16, IAS 41 |

|

01/2016 |

|

Amendment Agriculture: Bearer Plants |

|

Improvements to IFRS (2012- 2014) |

|

01/2016 |

|

IFRS 5, 7, IAS 19, 34 |

|

IAS 38 |

|

01/2016 |

|

Amendments Clarification of Acceptable Methods of Depreciation and Amortisation |

The IASB issued a number of new IFRS standards which will become effective for the Company’s financial year beginning on January 1, 2017 and January 1, 2018, respectively.

|

Standard |

|

Effective date |

|

Descriptions |

|

IFRS 15 |

|

01/2017 |

|

Revenue from Contracts with Customers |

|

IFRS 9 |

|

01/2018 |

|

Financial Instruments |

Company has not yet determined what impact the new standards, amendments or interpretations will have on the financial statements, as the concerned aspects are not relevant for the Company.

The interim financial statements as of and for the three months ended March 31, 2015 and 2014 were authorized for issue by the Management Board on May 12, 2015.

2. Summary of significant accounting policies

The principal accounting policies applied in the preparation of these interim financial statements are set out in the financial statements as of December 31, 2014, which can be found in the Company’s Annual Report on Form 20-F that was filed with the U.S. Securities and Exchange Commission. These policies have been applied to all financial periods presented.

3. Financial assets

The financial assets as of March 31, 2015 primarily consisted of shares of five bond funds (kEUR 39,065) and two customer loans (kEUR 458). The investments in the bond funds are measured at fair value, and any unrealized gain or loss in the value of such shares is recorded as other comprehensive income on our consolidated statement of comprehensive loss.

4. Other assets

The other assets at March 31, 2015 primarily included kEUR 541 of prepaid expenses and kEUR 188 VAT refund claim.

5. Business Combination Propshop

On October 1, 2014, voxeljet AG acquired 100% of the outstanding shares of Propshop (Model Makers) Limited (“Propshop”, which we renamed voxeljet UK Ltd. (“voxeljet UK”)) for €1.0 million in cash. voxeljet UK mainly renders 3D printing services for the film and entertainment industry in the UK. In addition, the Company entered into an earn out agreement with revenue and earnings targets for each of the years 2015, 2016 and 2017 with the former owner of Propshop; payments under the earn out agreement could total up to €1.5 million in the aggregate and would be recorded as compensation.

voxeljet performed a preliminary purchase price allocation as of December 31, 2014 with respect to certain separately identified intangible assets. As of March 31, 2015, the Company adjusted the purchase price allocation according to the fair values of the intangible assets and deferred taxes. Intangible assets have been reduced by kEUR 118 with a corresponding increase of the goodwill and deferred tax adjustments decreased goodwill by kEUR 263. The acquired assets and liabilities comprise the following items based on the adjusted purchase price allocation:

|

|

|

October 1, 2014 |

|

|

|

|

(€ in thousands) |

|

|

|

|

Fair value |

|

|

Current assets |

|

514 |

|

|

Cash and cash equivalents |

|

2 |

|

|

Trade receivables |

|

211 |

|

|

Inventories |

|

301 |

|

|

Non-current assets |

|

3,936 |

|

|

Intangible assets |

|

1,134 |

|

|

Property, plant and equipment |

|

2,802 |

|

|

Total assets |

|

4,450 |

|

|

|

|

|

|

|

Current liabilities |

|

3,466 |

|

|

Financial liabilities |

|

1,542 |

|

|

Trade liabilities |

|

1,126 |

|

|

Accruals |

|

200 |

|

|

Bank overdraft |

|

71 |

|

|

Other liabilties |

|

527 |

|

|

Non-current liabilities |

|

1,430 |

|

|

Financial liabilities |

|

1,430 |

|

|

Total liabilities |

|

4,896 |

|

|

|

|

|

|

|

Net assets (liabilities) acquired |

|

(446 |

) |

|

|

|

|

|

|

Purchase price |

|

967 |

|

|

|

|

|

|

|

Goodwill |

|

1,413 |

|

The intangible assets acquired in the business combination consist of order backlog (kEUR 48), customer list (kEUR 622) and digital library (kEUR 464).

The order backlog was amortized until December 31, 2014. The customer relations and digital library are amortized over a period of three years.

The excess of the purchase price over the assets acquired and liabilities assumed is reported as goodwill of €1.4 million. The goodwill results from synergies which relate to the expanded competencies obtained by voxeljet in the UK market and the skills of the voxeljet UK workforce.

6. Property, plant and equipment

|

|

|

03/31/2015 |

|

12/31/2014 |

|

|

|

|

(€ in thousands) |

|

|

Land, buildings and leasehold improvements |

|

11.172 |

|

11.212 |

|

|

Plant and machinery (includes assets under finance lease) |

|

6.709 |

|

6.486 |

|

|

Other facilities, factory and office equipment |

|

1.543 |

|

1.240 |

|

|

Assets under construction and prepayments made |

|

1.117 |

|

528 |

|

|

|

|

|

|

|

|

|

Total |

|

20.541 |

|

19.466 |

|

|

|

|

|

|

|

|

|

Leased assets included in Property, Plant and Equipment: |

|

2.135 |

|

2.282 |

|

|

Printing machines |

|

1.777 |

|

2.246 |

|

|

Other factory equipment |

|

358 |

|

36 |

|

No impairment of non-financial assets was recorded in the three-month period ended March 31, 2015.

7. Financial instruments

The fair value of a financial instrument is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The fair values and carrying amounts of financial assets categorized as loans and receivables and available for sale securities for the considered reporting periods were as follows:

|

|

|

03/31/2015 |

|

12/31/2014 |

|

|

|

|

|

|

(€ in thousands) |

|

|

|

|

|

|

carrying

amount |

|

fair value |

|

carrying

amount |

|

fair value |

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

|

|

|

|

|

Financial assets (restricted cash) |

|

252 |

|

252 |

|

247 |

|

247 |

|

Level 1 |

|

|

Current assets |

|

|

|

|

|

|

|

|

|

|

|

|

Trade receivables |

|

2,844 |

|

2,844 |

|

3,148 |

|

3,148 |

|

Level 1 |

|

|

Financial assets (customer loan) |

|

458 |

|

458 |

|

1,074 |

|

1,079 |

|

Level 2 |

|

|

Financial assets (bond funds) |

|

39,065 |

|

39,065 |

|

40,068 |

|

40,068 |

|

Level 1 |

|

|

Cash and cash equivalents |

|

7,879 |

|

7,879 |

|

8,031 |

|

8,031 |

|

Level 1 |

|

The fair value of customer loans included in financial assets was determined using a discounted cash flow model based on observable inputs from the relevant forward interest rate yield curve plus an appropriate risk premium. The fair value of available for sale financial assets represents the quoted price.

The fair values of carrying amounts of financial liabilities for the considered reporting periods were as follows:

|

|

|

03/31/2015 |

|

12/31/2014 |

|

|

|

|

|

|

(€ in thousands) |

|

|

|

|

|

|

carrying

amount |

|

fair value |

|

carrying

amount |

|

fair value |

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

financial liabilities (long-term debt) |

|

700 |

|

690 |

|

752 |

|

750 |

|

Level 2 |

|

|

financial liabilities (finance lease obligation) |

|

1,326 |

|

1,263 |

|

1,511 |

|

1,515 |

|

Level 2 |

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

financial liabilities (bank overdraft) |

|

448 |

|

448 |

|

448 |

|

448 |

|

Level 1 |

|

|

financial liabilities (long-term debt) |

|

204 |

|

232 |

|

203 |

|

198 |

|

Level 2 |

|

|

financial liabilities (finance lease obligation) |

|

645 |

|

726 |

|

590 |

|

593 |

|

Level 2 |

|

|

Trade payables |

|

3,018 |

|

3,018 |

|

2,326 |

|

2,326 |

|

Level 1 |

|

The fair value of long-term debt was determined using discounted cash flow models based on the relevant forward interest rate yield curves. The fair value of finance lease obligations was determined using discounted cash flow models on market interest rates available to the Company for similar transactions at the relevant date.

Due to their short maturity and the current low level of interest rates, the carrying amounts of credit lines and bank overdrafts approximate fair value.

8. Other liabilities and provisions

Other liabilities and provisions comprise of advance payments received, amounting to kEUR 1,097 at March 31, 2015 (December 31, 2014: kEUR 294). In addition, as of March 31, 2015, the amount related to the LTCIP included in other liabilities and provisions on our consolidated statement of financial position was kEUR 1,340 compared to kEUR 751 as of December 31, 2014

9. Segment reporting

The following table summarizes segment reporting. The sum of the amounts of the two segments equals the total for the Group in each of the periods.

|

|

|

Quarter Ended March 31, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

(€ in thousands) |

|

|

|

|

SYSTEMS |

|

SERVICES |

|

SYSTEMS |

|

SERVICES |

|

|

Revenues |

|

2,817 |

|

2,772 |

|

1,312 |

|

1,427 |

|

|

Gross profit |

|

772 |

|

1,107 |

|

397 |

|

682 |

|

|

Gross profit in % |

|

27.4 |

% |

39.9 |

% |

30.3 |

% |

47.8 |

% |

10. Revenues

The Group’s revenues by geographic region were as follows:

|

|

|

Quarter Ended March 31, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

(€ in thousands) |

|

|

EMEA |

|

5,129 |

|

2,286 |

|

|

Americas |

|

255 |

|

391 |

|

|

Asia Pacific |

|

205 |

|

62 |

|

|

Total |

|

5,589 |

|

2,739 |

|

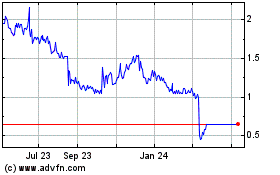

Voxeljet (NASDAQ:VJET)

Historical Stock Chart

From Apr 2024 to May 2024

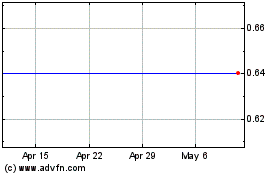

Voxeljet (NASDAQ:VJET)

Historical Stock Chart

From May 2023 to May 2024