UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of

1934

(Amendment No. 3)*

FXCM

Inc.

(Name of Issuer)

Class

A Common Stock

(Title of Class of Securities)

302693

106

(CUSIP Number)

David

S. Sassoon

c/o FXCM, Inc.

55 Water Street, New York, NY 10041

(646) 432-2986

(Name, Address and Telephone

Number of Person

Authorized to Receive Notices and Communications)

January

28, 2015

(Date of Event which Requires Filing of

this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note : Schedules filed in paper format shall include

a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies

are to be sent.

* The remainder of this cover page shall be filled

out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page

shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act")

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

| CUSIP No. 302693 106 |

13D |

Page 2 of 7 Pages |

| 1. |

NAMES OF REPORTING PERSONS

Eduard Yusupov |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see

instructions)

(a)

¨

(b) x |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS (see instructions)

OO |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) or 2(e)

¨ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7. |

SOLE VOTING POWER

3,889,451 |

| |

|

8. |

SHARED VOTING POWER

0 |

| |

|

9. |

SOLE DISPOSITIVE POWER

3,889,451 |

| |

|

10. |

SHARED DISPOSITIVE POWER

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

3,889,451 |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (see instructions)

¨

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.6% |

| 14. |

TYPE OF REPORTING PERSON (see instructions)

IN |

| |

|

|

|

|

| CUSIP No. 302693 106 |

13D |

Page 3 of 7 Pages |

| 1. |

NAMES OF REPORTING PERSONS

Leya Yusupov, as trustee of various trusts |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see

instructions)

(a)

¨

(b)

x |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS (see instructions)

OO |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) or 2(e)

¨ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7. |

SOLE VOTING POWER

0 |

| |

|

8. |

SHARED VOTING POWER

2,965,615 |

| |

|

9. |

SOLE DISPOSITIVE POWER

0 |

| |

|

10. |

SHARED DISPOSITIVE POWER

2,965,615 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

2,965,615 |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (see instructions)

¨ |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.9% |

| 14. |

TYPE OF REPORTING PERSON (see instructions)

IN |

| |

|

|

|

|

| CUSIP No. 302693 106 |

13D |

Page 4 of 7 Pages |

| 1. |

NAMES OF REPORTING PERSONS

Mikhail Yusupov, as trustee of various trusts |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see

instructions)

(a)

¨

(b)

x |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS (see instructions)

OO |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) or 2(e)

¨ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7. |

SOLE VOTING POWER

0 |

| |

|

8. |

SHARED VOTING POWER

2,965,615 |

| |

|

9. |

SOLE DISPOSITIVE POWER

0 |

| |

|

10. |

SHARED DISPOSITIVE POWER

2,965,615 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

2,965,615 |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (see instructions)

¨ |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.9% |

| 14. |

TYPE OF REPORTING PERSON (see instructions)

IN |

| |

|

|

|

|

| CUSIP No. 302693 106 |

13D |

Page 5 of 7 Pages |

Amendment No. 3 to Statement on Schedule

13D

This Amendment No. 3 (this “Amendment”) amends and

supplements the statement on Schedule 13D filed by the Reporting Persons (as defined below) with the Securities and Exchange Commission

on January 23, 2012, as amended on February 26, 2013 and April 11, 2014 (collectively, the “Schedule 13D”). Capitalized

terms used but not otherwise defined herein shall have the meanings ascribed to such terms in the Schedule 13D. Except as otherwise

specified in this Amendment, all previous Items remain as previously reported in the Schedule 13D and are unchanged.

Item 2. Identity and Background.

Item 2 of the Schedule 13D is hereby amended and restated as

follows:

This Schedule 13D is being filed by Eduard Yusupov, and by Leya

Yusupov and Mikhail Yusupov, as trustees of various trusts for the benefit of the Yusupov family. Eduard Yusupov, Leya Yusupov

and Mikhail Yusupov are referred to herein as the “Reporting Persons”.

Eduard Yusupov is a citizen of the United States and is a Director

of the Issuer and is also the Global Head of Dealing and a Managing Director at the Issuer. Leya Yusupov is a citizen of the United

States and is a Dealer in the Dealing division of the Issuer. The Issuer is an online provider of foreign exchange trading and

related services to domestic and international retail and institutional customers and offers customers access to global over-the-counter

foreign exchange markets. The principal business address of Eduard Yusupov and Leya Yusupov is c/o FXCM Inc., 55 Water Street,

Floor 50, New York, NY 10041.

Mikhail Yusupov is a citizen of the United States and is a broker

at Phi Capital Management, which provides an electronic platform for foreign exchange trading, with a principal business address

of c/o Phi Capital Management, 11 Broadway, New York, NY 10004.

During the last five years, none of the Reporting Persons has

been convicted in any criminal proceeding (excluding traffic violations or similar misdemeanors) or has been a party to a civil

proceeding of any judicial or administrative body of competent jurisdiction as a result of which such person was or is subject

to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal

or state securities laws or finding of any violation with respect to such laws.

Item 3. Source and Amount of Funds or Other Consideration.

The first two paragraphs of Item 3 of the Schedule 13D

are hereby amended and restated as follows:

Eduard Yusupov beneficially owns 3,733,356 units of FXCM Holdings

LLC (“FXCM Holdings”), all of which are held directly, all of which were formerly held by either Eduard Yusupov or

the Eduard Yusupov 2010 GRAT or the Eduard Yusupov 2012 GRAT. Leya Yusupov and Mikhail Yusupov each beneficially owns 2,965,615

units of FXCM Holdings as co-trustees over trusts established for the benefit of the Yusupov family, which trusts received these

units of FXCM Holdings from the Eduard Yusupov 2010 GRAT or the Eduard Yusupov 2012 GRAT, which originally received such units

from Eduard Yusupov. These units were originally received in a reclassification of the outstanding limited liability company interests

of FXCM Holdings effected prior to the initial public offering of the Class A Common Stock of the Issuer.

In addition to the units of FXCM Holdings reported herein, Eduard

Yusupov also holds 156,095 shares of Class A Common Stock that he acquired by exchanging units of FXCM Holdings he previously held

into Class A Common Stock on a one-for-one basis.

Item 4. Purpose of Transaction.

Item 4 of the Schedule 13D is hereby amended by adding the following

at the end thereof:

Eduard Yusupov had pledged 1,200,000 units of FXCM Holdings

with a broker as collateral for a margin loan. Due to events in the currency markets on January 15, 2015, the broker foreclosed

on such units by exercising its right under the pledge agreement to cause Mr. Yusupov to exchange such units into 1,200,000 shares

of Class A Common Stock. A portion of such shares were sold to satisfy the obligations under the margin loan.

Item 5. Interest in Securities of the Issuer.

Item 5 of the Schedule 13D is hereby amended and restated as

follows:

The ownership percentages set forth below are based on 47,160,590

shares of the Issuer’s Class A Common Stock outstanding as of November 6, 2014, as reported by the Issuer on its Quarterly

Report on Form 10-Q for the quarterly period ended September 30, 2014, filed by the Issuer with the Securities and Exchange Commission

on November 7, 2014, plus the number of shares of Class A Common Stock that may be received upon exchange of units of FXCM Holdings

beneficially owned by the Reporting Persons, as applicable.

(a) As a result of the Exchange Agreement, (i) Eduard

Yusupov may be deemed to beneficially own a total of 3,889,451 shares of Class A Common Stock (based on 156,095 shares of Class

A Common Stock held directly and 3,733,356 shares of Class A Common Stock that may be received in exchange of units of FXCM Holdings

by him directly), representing 7.6% of the total number of shares of Class A Common Stock outstanding and (ii) each of Leya Yusupov

and Mikhail Yusupov may be deemed to beneficially own 2,965,615 shares of Class A Common Stock (based on the shares of Class A

Common Stock that may be received in exchange of units of FXCM Holdings), representing 5.9% of the total number of shares of Class

A Common Stock outstanding.

(b) Eduard Yusupov has the sole power to vote and dispose of

the shares of Class A Common Stock that he beneficially owns and each of Leya Yusupov and Mikhail Yusupov has shared power to vote

and dispose of the shares of Class A Common Stock that each beneficially owns.

(c) The chart below reflects the transactions effected

by the Reporting Persons in the shares of Class A Common Stock during the past 60 days:

| Date | |

Nature of Transaction | |

Number of Shares of Class A

Common Stock Acquired or (Sold) | | |

Weighted Average Price

per Share | |

| January 28, 2015 | |

Open Market Sale | |

| (448, 905) | | |

$ | 2.41 | |

| January 29, 2015 | |

Open Market Sale | |

| (595,000 | ) | |

$ | 2.27 | |

The above transactions were effected by Eduard Yusupov in connection

with the margin loan described above.

(d) Other than the Reporting Persons, no other person

is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of the

Reporting Persons’ securities.

(e) Not applicable.

| CUSIP No. 302693 106 |

13D |

Page 7 of 7 Pages |

SIGNATURE

After reasonable inquiry and to the best

of the undersigned’s knowledge and belief, the undersigned certifies that the information set forth in this statement is

true, complete and correct.

| |

/s/ Eduard Yusupov |

| |

Eduard Yusupov |

| |

|

| |

/s/ Leya Yusupov |

| |

Leya Yusupov, as trustee of various trusts |

| |

|

| |

/s/ Mikhail Yusupov |

| |

Mikhail Yusupov, as trustee of various trusts |

Date: January 30, 2015

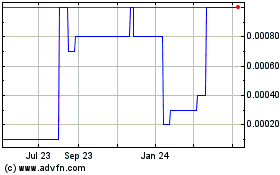

Global Brokerage (CE) (USOTC:GLBR)

Historical Stock Chart

From Feb 2025 to Mar 2025

Global Brokerage (CE) (USOTC:GLBR)

Historical Stock Chart

From Mar 2024 to Mar 2025