UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of October 2014

Commission File Number: 1-15256

OI S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of

registrant’s name into English)

Rua General

Polidoro, No. 99, 5th floor/part – Botafogo

22280-001 Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive offices)

(Indicate by

check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F: x Form 40-F: ¨

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)):

Yes: ¨

No: x

(Indicate by check mark if the registrant is submitting the Form 6-K in

paper as permitted by Regulation S-T Rule 101(b)(7)):

Yes: ¨

No: x

(Indicate by check mark whether the registrant by furnishing the

information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes: ¨

No: x

If “Yes” is marked, indicate below the file number assigned to

the registrant in connection with Rule 12g3-2(b):

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description of Document |

|

|

| 1 |

|

Excerpt of the Minutes of the 62nd Meeting of the Board of Directors of Oi S.A., held on October 15, 2014 (English translation). |

|

|

| 2 |

|

Material Fact, dated October 15, 2014 (English translation). |

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Date: October 15, 2014

|

|

|

|

|

| OI S.A. |

|

|

| By: |

|

/s/ Bayard De Paoli Gontijo |

|

|

Name: |

|

Bayard De Paoli Gontijo |

|

|

Title: |

|

Chief Financial Officer |

2

Exhibit 1

Oi S.A.

CORPORATE

TAXPAYERS’ REGISTRY

(CNPJ/MF) No. 76.535.764/0001-43

BOARD OF TRADE (NIRE) 33.30029520-8

PUBLICLY-HELD COMPANY

EXCERPT

OF ITEMS (5) AND (7) FROM THE MINUTES OF THE 62ND MEETING OF THE BOARD OF DIRECTORS HELD ON OCTOBER 15, 2014

In my role as a secretary of

the meeting of the Board of Directors, I hereby CERTIFY that items (5) and (7) of the Agenda of the Minutes of the 62nd Meeting of the Board of Directors of Oi S.A., held on October 15, 2014, at 10:00 a.m., at Praia de

Botafogo, No. 300, 11th floor, suite 1101, Botafogo, in the City of Rio de Janeiro, State of Rio de Janeiro, reads as follows:

“With respect

to item (5) of the Agenda, Bayard De Paoli Gontijo proposed a reverse share split of the Company’s shares at a 10:1 ratio, including the cancellation of 9 common shares and 6 preferred shares held in treasury, as well

as the auctioning of the fractional shares resulting from the reverse share split. The members of the Board of Directors unanimously approved the proposal and authorized the necessary measures to implement the proposal, including the calling of a

general shareholders’ meeting.”

“With respect to item (7) of the Agenda, pursuant to article 150 of Law

No. 6,404/76, the following were appointed, in order to complete the currently mandated term lasting until the General Shareholders’ Meeting of 2016: Pedro Guimarães e Melo de Oliveira Guterres, Portuguese,

married, economist, bearer of Identity Card (RNE) No. V760804-Y, registered under the individual taxpayers’ registry (CPF/MF) No 234.716.148-26, resident and domiciled in the City and State of Rio de Janeiro, with his business address at Rua

Borges de Medeiros, No. 633, apartment 301, zip code 22430-041, to occupy the position of vacated by Shakhaf Wine. Next, as a result of a request for leave submitted by João Manuel de Melo Franco as effective member and there being no

alternate, the following members were appointed, in order to complete the currently mandated term lasting until the General Shareholders’ Meeting of 2016: (i) as an effective member of the Board of Directors of the Company,

Rafael Luís Mora Funes, Spanish, married, business administrator, bearer of Identity Card (RNE) No. V688348-Q, registered under the individual taxpayers’ registry (CPF/MF) No. 233.678.448-37, with his business

address at Av. Das Nações Unidas, No. 11541, 14th floor, zip code 04578.907, in the City and State of São Paulo, and (ii) as an alternate member, João Manuel de Melo Franco,

Portuguese, married, engineer, bearer of passport No. L298888, valid until April 29, 2015, registered under the individual taxpayers’ registry (CPF/MF) No. 062.846.747-83, with his business address at Rua Borges de Medeiros,

No. 633, apartment 301, zip code 22430.041, in the City and State of Rio de Janeiro. The members of the elected Board of Directors declared they are not involved in any of the crimes defined by law that would prevent them from performing the

duties for which they were appointed, and provide the statement addressed in section 4 of article 147 of Law No. 6,404/76.”

The majority of the members of the Board of Directors was present and affixed their signatures: José Mauro

Mettrau Carneiro da Cunha; Armando Galhardo N. Guerra Junior; Renato Torres de Faria; Rafael Cardoso Cordeiro; Sergio Franklin Quintella; Alexandre Jereissati Legey; Cristiano Yazbek Pereira; Fernando Marques dos Santos; José Valdir Ribeiro

dos Reis; Carlos Augusto Borges; Marcelo Almeida de Souza; and Pedro Guimarães e Melo de Oliveira Guterres (alternate).

Rio de

Janeiro, October 15, 2014.

José Augusto da Gama Figueira

Secretary

2

Exhibit 2

Oi S.A.

Corporate Taxpayers’ Registry (CNPJ/MF)

No. 76.535.764/0001-43

Board of

Trade (NIRE) No. 33.30029520-8

Publicly-Held Company

MATERIAL FACT

Reverse Split of Shares and ADSs of Oi S.A.

Oi S.A. (“Oi” or the “Company,” Bovespa: OIBR3, OIBR4; NYSE: OIBR and OIBR.C), pursuant to art. 157, §4º of Law No.

6,404/76 and CVM Instruction No. 358/02, informs its shareholders and the market in general that:

The Board of Directors of Oi approved, on this date, a

proposal to be submitted to an extraordinary shareholders’ meeting that will take place on November 18, 2014, in order to vote on the reverse split of common shares and preferred shares of the Company, in a 10:1 ratio, as a result of which each

lot of 10 shares of each class shall be grouped into one single share of that same class.

The Company’s common shares and preferred shares

represented by American Depositary Shares (“ADSs”) that are traded on the New York Stock Exchange (“NYSE”) will also be grouped using the same ratio to be used for the common shares and the preferred shares in Brazil, as a result

of which each ADSs will continue to represent one common share or preferred share, as the case may be.

Timeline for the creation of lots of 10 shares

and the procedures to be adopted with respect to fractions resulting from the reverse split

Once the reverse split has been approved by the

shareholders’ meeting of the Company, there will be a 30-day period counted from the date of the publication of the notice to the shareholders to be published after such shareholders’ meeting, during which shareholders of common shares or

preferred shares that may be interested in can adjust their shareholding position, by class, to obtain lots composed of multiples of 10 shares, by trading on the São Paulo Stock Exchange (BM&FBOVESPA – Bolsa de Valores,

Mercadorias e Futuros) (“BM&FBOVESPA”), and maintain their position as shareholders of the Company with a at least one share after the reverse split is completed.

Exhibit 2

After the 30-day period is completed, any remaining fractions of shares resulting from the reverse split will be grouped in whole numbers and sold at auction

on the BM&FBOVESPA, with the resulting proceeds from the sales of such fractions made available to the previous holders of such fractions after the financial settlement of the sales.

Additional information about the timeline and conditions for the adjustment of the shareholding positions and the auction of the fractions and distribution of

the resulting proceeds will be disclosed in due time, through a notice to shareholders.

The Company will keep its shareholders and the market in general

informed of any relevant subsequent events related to the topics discussed in this Material Fact.

Rio de Janeiro, October 15, 2014.

Oi S.A.

Bayard De Paoli

Gontijo

Chief Executive Officer, Chief Financial Officer and Investor Relations Officer

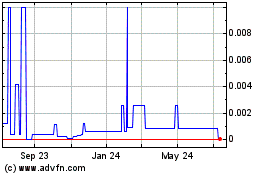

OI (CE) (USOTC:OIBRQ)

Historical Stock Chart

From May 2024 to Jun 2024

OI (CE) (USOTC:OIBRQ)

Historical Stock Chart

From Jun 2023 to Jun 2024