Barnes Group Inc. (NYSE: B), a diversified global manufacturer

and logistical services company, today reported financial results

for the third quarter 2010. The Company reported net income of

$15.1 million, or $0.27 per diluted share, compared to $10.9

million, or $0.20 per diluted share in the third quarter of 2009.

Barnes Group’s third quarter 2010 sales totaled $289.9 million, an

increase of 11.4 percent from $260.3 million in the third quarter

of 2009.

($ millions; exceptper share data)

Three months ended September 30, Nine

months ended September 30, 2010 2009

Change 2010 2009

Change Net Sales $289.9 $260.3 $29.6 11.4% $849.9

$777.7 $72.2 9.3% Operating Income $24.8 $14.6 $10.3 70.6%

$68.2 $49.2 $19.0 38.7% % of Sales 8.6% 5.6% - 3.0 pts. 8.0% 6.3% -

1.7 pts. Net Income $15.1 $10.9 $4.2 38.7% $41.8 $32.8 $9.0 27.3% %

of Sales 5.2% 4.2% - 1.0 pts. 4.9% 4.2% - 0.7 pts. Net Income Per

Diluted Share $0.27 $0.20 $0.07

35.0% $0.75 $0.61

$0.14 23.0%

“Continued improvements in the current economic climate,

particularly within our industrial and automotive end markets, led

to double-digit sales growth for the second consecutive quarter,”

said Gregory F. Milzcik, President and Chief Executive Officer,

Barnes Group Inc. “This increase in sales, paired with our

continued focus on maintaining an efficient cost structure and

productivity, contributed to a meaningful improvement to our third

quarter operating profit.

“We also experienced continued growth in our backlog and strong

order rates, which position us well to build upon our success as we

move into the fourth quarter,” Milzcik said. “While we are seeing

strong growth in Precision Components and increased activity within

our distribution and aerospace aftermarket businesses, we continue

to remain cautious. Our 2010 diluted earnings per share guidance

has been tightened to $0.95 to $1.00 given current and anticipated

market conditions.”

Logistics and Manufacturing Services

- Third quarter 2010 sales at Logistics

and Manufacturing Services were $138.9 million, an increase of 5.8

percent from $131.3 million in the same period last year. The

increase in sales was driven primarily by revenue growth in the

North American distribution businesses as macro-economic

conditions, including industrial production, continued to improve.

The European-based distribution business experienced a slight

decline in sales compared to the same period last year mainly due

to the negative impact of foreign exchange. Aerospace aftermarket

reported an increase in sales over the prior year period reflecting

modest improvement in maintenance, repair and overhaul activity and

new product introduction. Foreign exchange negatively impacted

third quarter 2010 sales by $1.5 million.

- Operating profit was $10.8 million,

compared with $11.9 million in the third quarter of 2009. This

primarily results from increased personnel costs related to

expanding the sales force and improving productivity in the

distribution businesses. Operating profit was also impacted by

higher product and freight costs. Higher sales helped partially

offset the impact of these trends. Operating margin was 7.8 percent

compared to 9.0 percent in the prior year.

Precision Components

- Order rates within Precision Components

experienced an increase over the prior year and outpaced sales for

the fourth consecutive quarter. Third quarter 2010 sales were

$154.0 million, up 18.4 percent from $130.0 million in the same

period last year. Year-over-year sales growth continued to be

driven by improved market demand primarily from the industrial

manufacturing businesses in North America and Europe and from

improvements in the transportation industry, including automotive.

Sales in the aerospace original equipment manufacturing business

were relatively flat compared to the third quarter of 2009. Foreign

exchange negatively affected sales by $1.2 million in the third

quarter.

- Operating profit for the third quarter

of 2010 increased significantly to $14.0 million, as compared with

$2.7 million in the third quarter of 2009. The higher operating

profit was due primarily to the increase in 2010 sales levels, as

well as a lower fixed cost structure, and a focus on lean

initiatives to improve operating efficiency. Sales gains helped

offset higher personnel costs and expenses associated with

increases in new product introductions. Included in Precision

Components third quarter 2009 results are $3.4 million (pre-tax)

for restructuring charges related to moving operations in two

facilities that provided a more cost effective manufacturing

footprint. Operating margin was 9.1 percent compared to 2.1 percent

in the prior year.

Additional Information

- Other income, net of other expenses,

decreased $2.0 million in the third quarter of 2010, compared to

the same period of 2009 primarily as a result of a $1.5 million

gain in 2009 on the repurchase of certain convertible notes.

Year-to-date, other income, net of other expenses, decreased $4.8

million, primarily as a result of a $3.8 million gain in 2009 on

the repurchase of certain convertible notes.

- The Company’s effective tax rate for

the first nine months of 2010 was 17.7 percent compared to 5.1

percent in 2009. Included in the 2009 year-to-date tax expense is a

$1.6 million tax benefit related to the third quarter 2009

restructuring actions. Changes to the Company’s tax rate are

largely based on changes in the projected mix of income between

taxing jurisdictions.

- Barnes Group generated $47.0 million in

cash from operations for the first nine months of 2010, compared to

$125.7 million in 2009. Cash flow in 2010 includes additional

investments in working capital driven by increased customer

demand.

Conference Call

The Company will conduct a conference call with investors to

discuss third quarter 2010 results at 8:30 a.m. ET today, October

29, 2010. A webcast of the live call and an archived replay will be

available on the Barnes Group investor relations link at

www.BGInc.com.

Barnes Group Inc. (NYSE:B) is a diversified global manufacturer

and logistical services company focused on providing precision

component manufacturing and operating service support. Founded in

1857, over 4,800 dedicated employees at locations on four

continents worldwide are committed to achieving consistent and

sustainable profitable growth. For more information, visit

www.BGInc.com. Barnes Group, the Critical Components People.

This release may contain certain forward-looking statements as

defined in the Private Securities Litigation and Reform Act of

1995. Forward-looking statements are made based upon management’s

good faith expectations and beliefs concerning future developments

and their potential effect upon the Company and can be identified

by the use of words such as “anticipated,” “believe,” “expect,”

“plans,” “strategy,” “estimate,” “project,” and other words of

similar meaning in connection with a discussion of future operating

or financial performance. These forward-looking statements are

subject to risks and uncertainties that may cause actual results to

differ materially from those expressed in the forward-looking

statements. The risks and uncertainties, which are described in our

periodic filings with the Securities and Exchange Commission,

include, among others, uncertainties arising from the behavior of

financial markets; future financial performance of the industries

or customers that we serve; changes in market demand for our

products and services; successful integration of acquired

businesses; introduction of new products or transfer of work;

changes in raw material prices and availability; foreign currency

exposure; our dependence upon revenues and earnings from a small

number of significant customers; uninsured claims; and numerous

other matters of global, regional or national scale, including

those of a political, economic, business, competitive,

environmental, regulatory and public health nature. The Company

assumes no obligation to update our forward-looking statements.

BARNES GROUP INC. CONSOLIDATED STATEMENTS OF INCOME

(Dollars in thousands, except per share data)

Unaudited Three

months ended September 30, Nine months ended September

30, 2010 2009 % Change 2010

2009 % Change Net sales $ 289,901 $ 260,339

11.4 $ 849,930 $ 777,690 9.3 Cost of sales 184,989 170,491

8.5 540,833 503,369 7.4 Selling and administrative expenses

80,079 75,291 6.4 240,915

225,161 7.0 265,068 245,782

7.8 781,748 728,530 7.3

Operating income 24,833 14,557 70.6 68,182 49,160 38.7

Operating margin 8.6 % 5.6 % 8.0 % 6.3 % Other income 56

1,545 (96.4 ) 290 4,205 (93.1 ) Interest expense 5,177 5,293 (2.2 )

15,273 17,234 (11.4 ) Other expenses 829 293

NM 2,451 1,558 57.3

Income before income taxes 18,883 10,516 79.6 50,748 34,573 46.8

Income taxes (benefit) 3,779 (373 ) NM

8,992 1,778 NM Net income $

15,104 $ 10,889 38.7 $ 41,756 $ 32,795

27.3 Common dividends $ 4,373 $ 4,357 0.4 $

13,159 $ 21,220 (38.0 ) Per common share: Net

income: Basic $ 0.27 $ 0.20 35.0 $ 0.75 $ 0.61 23.0 Diluted 0.27

0.20 35.0 0.75 0.61 23.0 Dividends 0.08 0.08 - 0.24 0.40 (40.0 )

Average common shares outstanding: Basic 55,346,517

54,257,791 2.0 55,428,865 53,462,672 3.7 Diluted 55,839,970

54,563,199 2.3 56,048,170 53,710,453 4.4 Notes: 2009 third

quarter Other income included a $1,485 gain on the purchase of

certain convertible debt and income taxes included the related tax

expense of $563. 2009 year-to-date Other income included a $3,773

gain on the purchase of certain convertible debt and income taxes

included the related tax expense of $1,431.

BARNES GROUP

INC. OPERATIONS BY REPORTABLE BUSINESS SEGMENT

(Dollars in thousands) Unaudited

Three months ended September 30,

Nine months ended September 30, 2010 2009 %

Change 2010 2009 % Change Net Sales

Logistics and Manufacturing Services $ 138,937 $ 131,309 5.8 $

412,679 $ 410,546 0.5 Precision Components 154,012 130,041

18.4 446,397 371,560 20.1 Intersegment sales (3,048 )

(1,011 ) NM (9,146 ) (4,416 ) NM Total

net sales $ 289,901 $ 260,339 11.4 $ 849,930 $

777,690 9.3 Operating profit Logistics and

Manufacturing Services $ 10,799 $ 11,871 (9.0 ) $ 29,296 $ 38,777

(24.5 ) Precision Components 14,034

2,686 NM 38,886 10,383 NM

Total operating profit 24,833 14,557 70.6 68,182 49,160 38.7

Interest income 56 54 2.7 211 371 (43.2 ) Interest expense

(5,177 ) (5,293 ) (2.2 ) (15,273 ) (17,234 ) (11.4 ) Other

income (expense), net (829 ) 1,198 NM

(2,372 ) 2,276 NM Income before income taxes $

18,883 $ 10,516 79.6 $ 50,748 $ 34,573

46.8 Notes: 2009 third quarter Other income (expense), net

included a $1,485 gain on the purchase of certain convertible debt.

2009 year-to-date Other income (expense), net included a $3,773

gain on the purchase of certain convertible debt.

BARNES

GROUP INC. CONSOLIDATED BALANCE SHEETS (Dollars in

thousands) Unaudited

September 30,2010

December 31,2009

Assets Current assets Cash and cash equivalents $ 23,724 $

17,427 Accounts receivable 189,693 160,269 Inventories 211,902

190,792 Deferred income taxes 9,040 23,630 Prepaid expenses and

other current assets 14,577 10,562 Total

current assets 448,936 402,680 Deferred income taxes

40,344 30,650 Property, plant and equipment, net 219,755 224,963

Goodwill 381,421 373,564 Other intangible assets, net 294,193

303,689 Other assets 18,964 16,444 Total

assets $ 1,403,613 $ 1,351,990

Liabilities and

Stockholders' Equity Current liabilities Notes and overdrafts

payable $ 8,012 $ 4,595 Accounts payable 97,014 85,588 Accrued

liabilities 80,189 73,538 Long-term debt - current 107,322

25,567 Total current liabilities 292,537 189,288

Long-term debt 241,679 321,306 Accrued retirement benefits

106,100 118,693 Other liabilities 36,894 37,990

Stockholders' equity 726,403 684,713 Total

liabilities and stockholders' equity $ 1,403,613 $ 1,351,990

BARNES GROUP INC. CONSOLIDATED STATEMENTS OF CASH

FLOWS (Dollars in thousands) Unaudited

Nine months ended September 30, 2010

2009 Operating activities: Net income $ 41,756 $

32,795 Adjustments to reconcile net income to net cash from

operating activities: Depreciation and amortization 38,988 38,558

Amortization of convertible debt discount 4,251 4,558 Loss on

disposition of property, plant and equipment 253 813 Gain on

repurchase of convertible notes -- (3,773 ) Stock compensation

expense 5,619 3,279 Withholding taxes paid on stock issuances (287

) (610 ) Changes in assets and liabilities: Accounts receivable

(27,671 ) 14,694 Inventories (19,492 ) 50,757 Prepaid expenses and

other current assets (5,420 ) 4,378 Accounts payable 11,359 4,615

Accrued liabilities 5,906 (3,054 ) Deferred income taxes 4,469

(2,741 ) Long-term retirement benefits (12,155 ) (16,503 ) Other

(579 ) (2,030 ) Net cash provided by operating

activities 46,997 125,736

Investing activities:

Proceeds from disposition of property, plant and equipment 1,384

981 Capital expenditures (22,463 ) (24,847 ) Other (2,393 )

(1,737 ) Net cash used by investing activities

(23,472 ) (25,603 )

Financing activities: Net change

in other borrowings 3,384 (4,861 ) Payments on long-term debt

(243,658 ) (181,242 ) Proceeds from the issuance of long-term debt

241,667 94,900 Proceeds from the issuance of common stock 3,871

5,621 Common stock repurchases (9,014 ) (314 ) Dividends paid

(13,159 ) (21,220 ) Other (160 ) (797 ) Net

cash used by financing activities (17,069 ) (107,913 )

Effect of exchange rate changes on cash flows (159 )

1,043 Increase (decrease) in cash and cash

equivalents 6,297 (6,737 ) Cash and cash equivalents at

beginning of period 17,427 20,958

Cash and cash equivalents at end of period $ 23,724 $

14,221

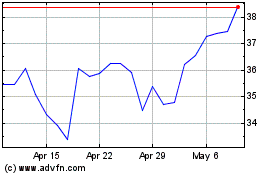

Barnes (NYSE:B)

Historical Stock Chart

From Apr 2024 to May 2024

Barnes (NYSE:B)

Historical Stock Chart

From May 2023 to May 2024