ICOP Digital, Inc. (NASDAQ: ICOP), an industry-leading company

engaged in advanced mobile video technology solutions, today

announced financial and operational results for the three and 12

months ended December 31, 2009.

Key Operational

Highlights

- ICOP experienced three consecutive quarters of increased

revenues in the last three quarters of 2009.

- Availability of early stimulus funds for the purchase of law

enforcement equipment has begun to flow to agencies, and is

expected to increase based on federally allocated funding.

- 81% of all purchase orders processed during the year

represented re-orders from existing customers engaged in fleet

deployments of the ICOP Model 20/20-W. This compared to 61% in

2008. Based on the estimated number of current customer patrol cars

yet to be equipped with the Company's digital surveillance

solution, potential future sales to the Company's existing customer

base is an estimated $100 million.

- ICOP responded to 45 Requests for Proposals (RFPs) during 2009;

of the contracts awarded to date, ICOP has achieved a 47% closing

ratio.

- In March of 2009, ICOP announced that it had been awarded a

contract to equip vehicles for the Ministry of Interior in Saudi

Arabia, with the ICOP Model 20/20-W; ICOP shipped 100 units in

support of this pilot deployment project, and integrated servers

into five Ministry of Interior headquarters offices and 15

precincts across Riyadh, establishing the platform to support the

installation of additional ICOP units. This deployment has proven

to be highly successful, and follow-on orders are anticipated in

the near future.

- In July 2009, the Company entered into an agreement with JPS

Communications Inc., a wholly owned subsidiary of Raytheon Company

("Raytheon"). This five year agreement enables Raytheon to co-brand

and market ICOP's mobile video solutions to all of their existing

markets, including public safety, fire/EMS, transportation and

military customers worldwide. ICOP announced the sale of their

first units through this partnership in September 2009 to a

strategic location for the U.S. Army in Camp Zama, Japan. Many

subsequent orders have been received from Raytheon. Raytheon and

ICOP are working together on several large potential projects at

this time.

- The Company announced a sale to the Highway Patrol in the State

of Querétaro, in Mexico. The Company foresees significant growth in

sales to Mexico, in addition to other key global markets for

2010.

- On March 16, 2010, ICOP was issued patent number US 7,680,947

B2 by the U.S. Patent and Trademark office for a technology used in

ICOP LIVE™. This is an important differentiating technology as it

provides the delivery of real-time situational awareness to an

unlimited numbers of simultaneous first responders.

- ICOP 20/20 VISION, a mobile video solution which is managed

through the vehicle laptop, was successfully launched in 2009,

which was developed in response to market demand from large cities

and counties. The product has been well received by the law

enforcement community.

- Also in 2009, the Company released an 802.11n wireless upload

solution, which provides upload speeds up to four times faster than

the older industry-standard 802.11g technology.

- The Company filed a $25 million shelf registration statement on

Form S-3 with the Securities and Exchange Commission (SEC) on

October 16, 2009, which was approved by the SEC on October 23,

2009. The Company has the option of selling securities off this

shelf registration statement for three years, but is not required

to sell any securities at any time in that three year period. On

February 3, 2010, ICOP completed a registered direct offering of

3.5 million shares of our common stock, raising gross proceeds of

approximately $1.34 Million, before placement agent's fees and

other offering expenses.

ICOP will host a teleconference today, beginning at 4:15 PM

Eastern, and invites all interested parties to join management in a

discussion regarding the Company's financial results, corporate

progression and other meaningful developments. The conference call

can be accessed via telephone by dialing toll free 888-296-4302 or

via webcast accessible on www.ICOP.com. For those unable to

participate at that time, a replay of the webcast will be available

for 90 days at www.ICOP.com.

Financial highlights for

the three months ended December 31, 2009 compared to the three

months ended December 31, 2008:

- Revenues increased 5% to $2.6 million from $2.5 million.

- Total operating expenses increased 19% to $2.7 million from

$2.3 million.

-

- Sales, general and administrative costs were $2.5 million, up

27% from $2.0 million.

- Research and development costs fell 36% to $186,000 from

$293,000.

- Net loss increased to $1.8 million, or $0.08 per basic and

diluted share, as a result of an inventory impairment, from $1.5

million, or $0.21 per basic and diluted share.

Financial highlights for

the 12-months ended December 31, 2009 compared to the 12-months

ended December 31, 2008.

- Revenues totaled $8.4 million, down 22% from $10.9

million.

- Total operating expenses declined 9% to $9.1 million from $10.0

million.

-

- Sales, general and administrative costs declined $530,000, or

6% year over year.

- Research and development costs dropped 31% to $784,000 from

$1.1 million.

- Net loss was $5.5 million, or $0.40 per basic and diluted

share, a decrease from $5.9 million, or $0.79 per basic and diluted

share.

- Net cash used in operating activities increased 38% to $4.6

million from $3.3 million.

- On June 5, 2009, the Company completed a public offering,

generating gross proceeds of approximately $3.4 million.

As of December 31, 2009, ICOP had $3.2 million in cash, cash

equivalents and accounts receivable; inventory valued at

approximately $2.1 million and prepaid and other expenses of $1.9

million. ICOP's net working capital as of that date was $4.7

million and total shareholders' equity stood at approximately $5.9

million.

Dave Owen, ICOP Chairman and CEO, stated, "While economic

conditions were challenging in 2009, ICOP advanced on many fronts

throughout the year including: fortifying our sales and management

team, expanding our international market presence, cultivating

strategic partnerships with Fortune 200 companies and making

significant enhancements to our products. We have seen a quarter

over quarter increase in sales over the last three consecutive

quarters. This focused and consistent commitment to succeed in the

market place despite economic obstacles positions ICOP favorably

for the coming year."

ICOP DIGITAL, INC.

Condensed Balance Sheet

(Audited)

December 31,

------------------------

2009 2008

----------- -----------

Assets

Current assets:

Cash and cash equivalents $ 1,171,943 $ 99,192

Accounts receivable, net of allowances of

$100,457 and $121,173

at December 31, 2009 and 2008, respectively 2,009,591 1,775,741

Inventory, at lower of cost or market 2,094,168 3,568,596

Prepaid Expenses 98,351 209,545

Other Assets 1,759,004 549,867

----------- -----------

Total current assets 7,133,057 6,202,941

Property and equipment, net of accumulated

depreciation $1,411,988 and $1,230,779

at December 31, 2009 and 2008, repsectively 1,463,765 2,024,318

Other assets:

Deferred patent costs 95,906 87,621

Investment, at cost 25,000 25,000

Security deposit 18,258 18,258

----------- -----------

Total other assets 139,164 130,879

----------- -----------

Total assets $ 8,735,986 $ 8,358,138

=========== ===========

Liabilities and Shareholders' Equity

Current liabilities:

Accounts payable $ 370,998 $ 643,124

Accrued liabilities 476,761 596,854

Notes payable 629,985 780,000

Due to factor 686,965 602,009

Unearned revenue - current portion 233,175 178,147

----------- -----------

Total current liabilities 2,397,884 2,800,134

Other liabilities:

Unearned revenue - long term portion 420,009 288,836

Shareholders' equity:

Preferred stock, no par value; 5,000,000 shares

authorized, no shares issued

and outstanding at December 31, 2009 and 2008 - -

Common stock, no par value; 50,000,000 shares

authorized, 23,602,944 and 7,286,385

issued and outstanding at December 31, 2009 and

2008, respectively 36,469,313 30,338,572

Accumulated other comprehensive income 3,465 272

Retained deficit (30,554,685) (25,069,676)

----------- -----------

Total shareholders' equity 5,918,093 5,269,168

----------- -----------

Total liabilities and shareholders' equity $ 8,735,986 $ 8,358,138

=========== ===========

ICOP DIGITAL, INC.

Condensed Statements of Operations

(Audited)

Years Ended December 31,

--------------------------

2009 2008

------------ ------------

Sales, net of returns and allowances $ 8,423,365 $ 10,859,850

Cost of sales 4,689,302 6,689,758

------------ ------------

Gross profit 3,734,063 4,170,092

Operating expenses:

Selling, general and administrative 8,302,104 8,830,394

Research and development 783,908 1,131,199

------------ ------------

Total operating expenses 9,086,012 9,961,593

Operating Loss (5,351,949) (5,791,501)

Other income (expense):

Gain on derecognition of liabilities 52,765 -

Loss on disposal of property and equipment (5,830) (33,361)

Interest income 74 28,589

Loss on extended warranties (1,406) -

Interest expense (203,263) (125,906)

Other income 24,600 -

------------ ------------

Loss before income taxes (5,485,009) (5,922,179)

Income tax provision - -

------------ ------------

Net Loss $ (5,485,009) $ (5,922,179)

============ ============

Basic and diluted net loss per share $ (0.40) $ (0.79)

============ ============

Basic and diluted weighted average common

shares outstanding 13,550,875 7,472,032

About ICOP Digital, Inc. ICOP Digital,

Inc. (NASDAQ: ICOP) is a leading provider of mobile video solutions

(i.e. in-car video) for Law Enforcement, Military, and Homeland

Security markets, worldwide. ICOP solutions help the public and

private sectors mitigate risks, reduce losses, and improve security

through the live streaming, capture and secure management of high

quality video and audio. www.ICOP.com

Forward-Looking Statements This document

contains forward-looking statements. You should not rely too

heavily on forward-looking statements because they are subject to

uncertainties and factors relating to our operations and business

environment, all of which are difficult to predict and many of

which are beyond our control. The Company may experience

significant fluctuations in future operating results due to a

number of economic, competitive, and other factors, including,

among other things, our reliance on third-party manufacturers and

suppliers, government agency budgetary and political constraints,

new or increased competition, changes in market demand, and the

performance or reliability of our products. This, plus other

uncertainties and factors described in our most-recent annual

report and our most-recent prospectus filed with the Securities and

Exchange Commission, could materially affect the Company and our

operations. These documents are available electronically without

charge at www.sec.gov.

Add to Digg Bookmark with del.icio.us Add to Newsvine

For more information, contact: Melissa K. Owen, Dir. of

Communications 16801 West 116th Street Lenexa, KS 66219 USA Phone:

(913) 338-5550 Fax: (913) 312-0264 Email Contact www.ICOP.com For

Investor Relations: DC Consulting, LLC Daniel Conway, Chief

Executive Officer Phone: (407) 792-3332 Email Contact Email

Contact

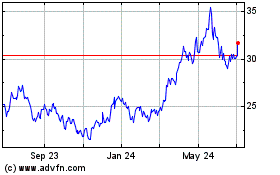

iShares Copper and Metal... (NASDAQ:ICOP)

Historical Stock Chart

From Jun 2024 to Jul 2024

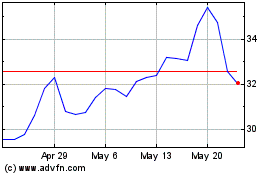

iShares Copper and Metal... (NASDAQ:ICOP)

Historical Stock Chart

From Jul 2023 to Jul 2024