TRIVEST VCT PLC

Interim Results for the six months ended 31 March 2007

Chairman's Statement

I am pleased to present the Company's Interim Results for the six months ended

31 March 2007.

Portfolio

At 31 March 2007, the Company's NAV per share was 111.73 pence (30 September

2006: 112.89 pence).

Whilst the Net Asset Value (NAV) overall has fallen marginally to 111.73 pence

over the last six months, it should be noted that positive progress in the MPEP

portfolio has been counterbalanced by a fall in the share price of several of

the quoted technology stocks within the Foresight portfolio. However these

figures are after the final dividends totalling 3.75 pence per share have been

accounted for and paid. Thus, after stripping out those dividends, the overall

net assets actually rose during the period.

The UK economy has continued to grow strongly across the board despite a

tighter monetary policy. This positive economic background has provided a good

backdrop for the majority of our investee companies, a significant number of

which are showing good progress in sales and/or profitability.

Both the FTSE 100 and AIM All-Share Indices showed strong growth over the six

month period to 31 March 2007 (despite the correction in markets in March of

this year), which has contributed to the continued activity in the M&A market

in the UK and Europe.

In the Foresight portfolio among the quoted holdings, Corero (formerly Mondas),

ANT and smartFOCUS all achieved strong trading progress. Oxonica, currently the

largest holding in the portfolio, recently reported its annual results.

Subsequently, however, the company announced that the results of a trial for

its fuel additive with Petrol Ofisi had proved inconclusive which caused

Oxonica on 27 April 2007 to request a temporary suspension of its share price

pending clarification of the position. This may impact materially upon the

valuation of this investment. The Board and Investment Manager are monitoring

this situation closely.

Overall, the MPEP portfolio has performed well with strong trading performances

being shown by some of the older investments; foremost among these are HWA,

Brookerpaks, Image Source and Original Additions, all of which have now

returned income to TriVest in excess of the original cost of investment. The

past six months has seen two companies added to the portfolio, namely, in

December 2006, �790,912 was invested into PXP Holdings, a company formed on the

�14 million management buy out ("MBO") of Pinewood Structures, a leading UK

manufacturer and supplier of timber frame components to the housebuilding

market. This was followed by a �550,852 investment in the MBO of Racoon

International, the UK's foremost supplier of hair extensions to professional

salons. Overall, the value of the MPEP portfolio has increased by a further �

2.2 million, including acquisitions of �1.3 million, since the year-end and at

31 March 2007 stands at almost �21 million, or 167% of current cost.

Within the Nova portfolio, NexxtDrive has been developing technology to

increase fuel efficiency and performance of both conventional and hybrid

vehicles. During the period TriVest made a further investment of �212,014 in

NexxtDrive as part of a �1.3 million funding round. This company is considering

an IPO. Elsewhere, Tikit, an AIM-quoted company, specialising in providing

consultancy services and software solutions to law firms, enjoyed strong

revenue growth, improved margins and increased profits. This has been reflected

in a 45.3% increase in their share price during the period. IDOX, an AIM-quoted

company providing knowledge management software and solutions to the public

sector, has reorganized itself, and has focused on account management and

pricing structures. This has been reflected in a positive start to 2007 with

the share price increasing by 34.7%.

Revenue account

For the period under review, the revenue return available for distribution to

shareholders was �283,866 (31 March 2006; �199,160). As in previous years, the

Board does not propose to declare an interim dividend but expects to be able to

propose a final dividend for the year ending 30 September 2007.

Investment company status

The Company revoked its investment company status on 30 November 2005. This

enables the Company to make distributions out of capital gains that have

started to be realised as the portfolio matures.

Share buy-backs

During the six months ended 31 March 2007, the Company bought back 300,000

Ordinary Shares (representing 0.67% of the shares in issue at the beginning of

the period) at a total cost of �249,330 (net of expenses). These shares were

subsequently cancelled by the Company.

Dividend Investment Scheme

184 Shareholders, who between them hold a total of 2,034,908 Ordinary Shares

representing 5.2% of the Company, are members of the Dividend Investment

Scheme. 68,881 shares were issued to them on 15 February 2007 in respect of the

Dividend.

Valuation policy

Quoted stocks are now valued at bid prices, rather than mid-market prices in

accordance with new accounting standards. It is worth commenting that the Fund

does hold a number of relatively early stage AIM listed stocks with limited

marketability. In such cases, the price at which a sizeable block of shares

could be traded, if at all, may vary significantly from the market price used.

TriVest website

May I remind you that the Company has its own website which is available at

www.trivestvct.co.uk.

Colin Hook

Chairman

Investment Portfolio Summary

as at 31 March 2007

Total cost at Valuation at Additional Valuation at

31 March 2007 30 September investments 31 March 2007

2006 in the period (unaudited)

(audited)

� � � �

Foresight Venture

Partners

Oxonica plc 2,136,763 7,245,512 - 6,083,892

Specialist in the

design, manipulation

and engineering of

properties of

materials at the

nano-scale

Aquasium Technology 700,000 1,059,610 - 1,581,176

Limited

Design, manufacture

and marketing of

bespoke electron beam

welding and vacuum

furnace equipment

smartFOCUS Group plc 366,667 1,856,969 - 1,375,504

Provider of analytic

software to support

targeting and

execution of marketing

campaigns

Camwood Limited 1,028,181 1,669,520 - 1,028,181

Provider of software

repackaging services

Alaric Systems Limited 595,803 595,763 - 595,763

Software development,

implementation and

support in the credit/

debit card

authorisation and

payments market

Sarantel Group plc 1,670,252 798,621 - 587,221

Antennae for mobile

phones and other

wireless devices

Corero plc (formerly 600,000 238,255 - 524,327

Mondas plc)

Specialist provider of

software solutions to

the banking and

securities and

education markets

Aigis Blast Protection 272,120 333,320 - 333,320

Limited

Specialist blast

containment materials

company

DCG Datapoint Group 312,074 311,853 - 311,853

Limited

Design, supply and

integration of data

storage solutions

ANT plc 462,816 393,958 - 262,638

Provider of embedded

browser/email software

for consumer

electronics and

internet appliances

Rapide Communications 379,983 66,667 - 40,000

Limited

Mobile phone software

company

Other investments in 339,285 - - -

the portfolio *

--------------- --------------- --------------- ---------------

8,863,944 14,570,048 - 12,723,875

--------------- --------------- --------------- ---------------

Matrix Private Equity

Partners LLP

HWA Limited (trading 69,105 3,348,323 - 4,140,454

as Holloway White

Allom)

Specialist contractor

in the high-value

residential and

heritage property

refurbishment market

Image Source Group 1,000,000 3,232,667 - 3,525,992

Limited

Royalty free picture

library

Youngman Group Limited 1,000,052 2,368,418 52 2,768,443

Manufacturer of

ladders and access

towers

Original Additions 1,000,000 3,127,944 - 2,714,557

(Beauty Products)

Limited

Manufacturer and

distributor of beauty

products

BBI Holdings plc 496,119 1,227,231 - 1,337,958

Manufacturer of gold

conjugate for the

medical diagnostics

industry

Tottel Publishing 514,800 759,048 - 829,207

Limited

Specialist law and tax

imprint

PXP Holdings Limited 790,912 - 790,912 790,912

(Pinewood Structures)

Designer, manufacturer

and supplier of timber

frames for buildings

Ministry of Cake 721,280 556,169 - 760,428

(Holdings) Limited

Manufacturer of

desserts and cakes for

the food service

industry

Racoon International 550,852 - 550,852 550,852

Holdings Limited

(formerly Castlegate

435 Limited)

Supplier of hair

extensions, hair care

products and training

British International 500,000 500,000 500,000

Holdings Limited

Helicopter service

operator

Brookerpaks Limited 55,000 621,555 - 426,317

Importer and

distributor of garlic

and vacuum-packed

vegetables

VSI Limited 388,853 388,842 11 388,853

Provider of software

for CAD and CAM

vendors

Blaze Signs Holdings 360,969 360,969 360,969

Limited

Manufacturer and

installer of signs

Campden Media Limited 334,880 334,880 - 344,124

Magazine publisher and

conference organiser

Pastaking Holdings 292,405 292,405 292,405

Limited

Manufacturer and

supplier of fresh

pasta meals

B G Consulting Group 1,153,976 128,344 - 273,128

Limited/Duncary 4

Limited

Technical training

business and

outplacement careers

consultancy

Vectair Holdings 215,914 215,914 - 222,080

Limited

Provider of air care

and sanitary washroom

products

SectorGuard plc 150,000 150,000 - 150,000

Provision of manned

guarding, mobile

patrolling, and alarm

response services

Letraset Limited 650,000 622,737 - 102,691

Manufacturer and

distributor of graphic

art products

Inca Interiors Limited 350,000 50,000 - 50,000

Supplier of quality

kitchens to house

developers

Other investments in 1,719,785 - - -

the portfolio *

--------------- --------------- --------------- ---------------

12,314,902 18,285,446 1,341,827 20,529,370

--------------- --------------- --------------- ---------------

Nova Capital

Management Limited

Tikit Group plc 500,000 960,868 - 1,421,737

Provider of

consultancy services

and software solutions

for law firms

Biomer Technology 137,170 753,837 - 753,837

Limited

Developer of

biomaterials for

medical devices

NexxtDrive Limited 812,014 468,750 212,014 738,264

Developer of patented

transmission

technology

IDOX plc 737,625 366,083 - 509,333

Developer of products

for document, content

and information

management

--------------- --------------- --------------- ---------------

2,186,809 2,549,538 212,014 3,423,171

--------------- --------------- --------------- ---------------

--------------- --------------- --------------- ---------------

TOTAL 23,365,655 35,405,032 1,553,841 36,676,416

========= ========= ========= =========

* 'Other investments in the portfolio' comprises those investments that have

been valued at nil and from which the Directors only expect to receive small

recoveries: Monactive Limited in the Foresight portfolio and F H Ingredients

Limited, The Hunter Rubber Company Limited and Stortext-FM Limited in the MPEP

portfolio.

Investment Managers' Review

Foresight Venture Partners (Foresight)

During the period markets generally experienced benign trading conditions with

particular benefit to mid and large cap stocks. Technology stocks, however,

continued to remain out of favour and the Company's quoted technology

investments suffered accordingly with several companies dropping in value

during the period, often despite good underlying progress.

Among the portfolio's quoted holdings, Oxonica, Corero (formerly Mondas), ANT

and smartFOCUS achieved strong trading progress.

Oxonica, currently the largest holding in the portfolio, recently reported its

annual results which showed an eightfold increase in sales to �10.2 million and

reduced operating losses to �3,245,000 (2005: �4,504,000) and were in line with

market expectations for the year ended 31 December 2006. Revenue and cash flow

were positively impacted by the Petrol Ofisi and Becton Dickinson contract wins

in the second half of the year and, as a result, the company's year end cash

position was ahead of expectations. More recently, however, the share price has

eased following an announcement that the results of a trial for its fuel

additive with Petrol Ofisi at the second data point had proved inconclusive.

This has since led to the temporary suspension of the share price until the

position of the company has been determined.

Corero recently announced that it had made strong progress for the year ended

31 December 2006, achieving record revenues and profits. The Blue Curve

division (formerly a Foresight portfolio company) had a particularly successful

year, more than doubling its revenues compared to 2005. Significant licence

revenues have been derived both from existing customers, and from new clients

added during the year. The company produced operating profits of approximately

�400,000 on revenues of approximately �6.3 million in the year ended 31

December 2006, which is a turnaround of just under �1.2 million from the �

770,000 operating loss incurred in the previous year. It also reported that all

business units were profitable. Corero has also substantially improved its

working capital position and operating cashflow is positive, putting it in an

excellent position to take advantage of the momentum built during the year and

the opportunities that have been created across all its business units.

ANT increased revenues by 48% to �3.7 million, reduced operating losses to �1.4

million (2005: �2.2 million) and announced an important new relationship with

Scientific Atlanta. SmartFOCUS recently announced strong revenue growth for

2006 with an increase of approximately 52% compared to 2005. It made a profit

of �918,000 in 2006 compared to a loss of �19,000 in 2005. SmartFOCUS repaid

its �333,333 loan to TriVest during the period under review.

Sarantel, although achieving a 43% increase in sales to �4.0m for the year to

30 September 2006, saw flat sales in the second half of that year and incurred

increased losses of �6.1 million from �5.3 million a year earlier. The company

is winning new orders but at a slower rate than originally envisaged.

Within the unquoted portfolio, the most significant movements were an increase

in the valuation of Aquasium Technology (�521,566) which continues to be

profitable and benefited from an increase in the price-earning sector multiple

of engineering companies and a decrease in the valuation of Camwood (�641,339).

Camwood's profits declined as it continued to invest in its new product

offerings. Following the recent release of Microsoft Vista, the company expects

an increase in demand for its products and services in 2007/8.

Matrix Private Equity Partners LLP (MPEP)

In the six months to 31 March 2007 MPEP added two new investments to the

portfolio. In December, �791k was invested into PXP Holdings, a company formed

on the �14 million management buy out ("MBO") of Pinewood Structures, a leading

UK manufacturer and supplier of timber frame components to the housebuilding

market. This was closely followed by a �551k investment in the MBO of Racoon

International, the UK's foremost supplier of hair extensions to professional

salons.

The creation of value within the portfolio is very encouraging. The older

investments have continued to show strong trading performance; foremost among

these are HWA, Brookerpaks, Image Source and Original Additions, all of which

have now returned income to TriVest in excess of the original cost of

investment.

In October, Brookerpaks repaid a total of �512k, comprising TriVest's loan

stock together with a repayment premium. In early April after the period end,

Image Source repaid TriVest's loan investment, together with a premium,

totalling �834k. This was closely followed by Original Additions re-structuring

its capital in a �12 million transaction which returned �1.7 million to TriVest

in dividends and capital against its investment cost of �1 million; TriVest

continues to retain its 11% equity stake in the company.

In all of these investments TriVest now holds valuable minority shareholdings

at low residual cost. In total, these three transactions have returned income

of almost �890k above cost to TriVest.

Also pleasing has been the early trading performance of TriVest's more recent

investments, with a number, including Youngman, PastaKing, Blaze Signs and

Vectair, exceeding profitability anticipated at the time of investment. The

only disappointment has been the investment in FH Ingredients, where poor

implementation of a major capital expenditure programme soon after the

investment led to cash pressures and efforts to re-finance the company have

proved unsuccessful; its operating subsidiary entered into administration on 26

January 2007. Full provision had already been made against this �403k

investment.

The MPEP portfolio now comprises investments in 23 companies, almost all of

which are MBOs. The value of the portfolio has increased by a further �2.2

million, including new acquisitions of �1.3 million, since the year end and at

31 March 2007 stands at almost �21 million, or 167% of current cost (31 March

2006: 159%).

Nova Capital Management Limited (Nova)

There are four investments in the portfolio as at 31 March 2007. No investments

were made into any new companies in the period under review. The emphasis of

Nova's work has been on value improvement within the existing financial

resources of each company unless there is clear evidence that new investment

will make a significant difference.

Tikit, an AIM quoted company, specialising in providing consultancy services

and software solutions to law firms, performed well in 2006, consolidating on

the acquisitions it made in 2004 and 2005. It enjoyed strong revenue growth,

improved margins and increased profits. This has been reflected in a 62%

increase in their share price during the period. We remain optimistic about its

long term prospects.

IDOX, an AIM quoted company providing knowledge management software and

solutions to the public sector also enjoyed some improvement following a

disappointing prior period. The company has reorganized itself, and has focused

on account management and pricing structures. This has been reflected in a

positive start to 2007. The share price has increased by 27%, although this

continues to be below the level of TriVest's initial investment.

Biomer is a company concerned with the development of novel polymers for

product applications in cardiovascular and other interventional medical

devices. The company has signed a worldwide licence agreement for nitinol stent

coatings with Memry Corporation, which represents an important landmark in the

company's development.

NexxtDrive is developing technology which will increase fuel efficiency and

performance of both conventional and hybrid vehicles. During the period TriVest

made a further investment of �212,014 in NexxtDrive as part of a �1.3 million

funding round. At the period end, TriVest's total holding was valued at �

738,264 which includes �325,000 of convertible loan. NexxtDrive is currently

considering an IPO on the AIM market, subject to market conditions for a

company at its current stage of development.

Unaudited Profit and Loss Account

for the six months ended 31 March 2007

Six months ended 31 March 2007

(unaudited)

Revenue Capital Total

� � �

Unrealised gains/(losses) on - 752,297 752,297

investments

Net gains/(losses) on realisation - 160,181 160,181

of investments

Income 703,103 - 703,103

Investment management fees (114,298) (342,892) (457,190)

Other expenses (228,203) - (228,203)

-------------- -------------- --------------

Profit/(loss) before taxation 360,602 569,586 930,188

Tax on ordinary activities (76,736) 76,736 -

-------------- -------------- --------------

Profit/(loss) for the financial 283,866 646,322 930,188

period

-------------- -------------- --------------

Basic and diluted earnings per 2.38p

share:

All the items in the above

statement derive from continuing

operations.

There were no other recognised

gains or losses in the period.

Six months ended 31 March 2006

(unaudited)

Revenue Capital Total

� � �

Unrealised gains/(losses) on - (893,173) (893,173)

investments

Net gains/(losses) on realisation - (19,022) (19,022)

of investments

Income 596,717 - 596,717

Investment management fees (119,952) (359,854) (479,806)

Other expenses (216,430) - (216,430)

-------------- -------------- --------------

Profit/(loss) before taxation 260,335 (1,272,049) (1,011,714)

Tax on ordinary activities (61,175) 61,175 -

-------------- -------------- --------------

Profit/(loss) for the financial 199,160 (1,210,874) (1,011,714)

period

-------------- -------------- --------------

Basic and diluted earnings per (2.50)p

share:

Year ended 30 September 2006

(audited)

Revenue Capital Total

� � �

Unrealised gains/(losses) on (4,074,141) (4,074,141)

investments

Net gains/(losses) on realisation - 1,556,784 1,556,784

of investments

Income 1,135,895 - 1,135,895

Investment management fees (233,097) (699,292) (932,389)

Other expenses (458,520) - (458,520)

-------------- -------------- --------------

Profit/(loss) before taxation 444,278 (3,216,649) (2,772,371)

Tax on ordinary activities (101,347) 101,347 -

-------------- -------------- --------------

Profit/(loss) for the financial 342,931 (3,115,302) (2,772,371)

period

-------------- -------------- --------------

Basic and diluted earnings per (6.98)p

share:

Unaudited Note of Historical Cost Profits and Losses

For the six months ended 31 March 2007

.

Six months Six months Year ended

ended ended

30 September

31 March 2007 31 March 2006 2006

(unaudited) (unaudited) (audited)

� � �

Profit/(loss) on ordinary 930,188 (1,011,714) (2,772,371)

activities before taxation

(Less)/add unrealised (gains)/ (752,297) 893,173 4,074,141

losses on investments

(Less)/add realisation of (93,579) (4,417,530) (4,059,632)

revaluation (losses)/gains of

previous years

-------------- -------------- --------------

Historical cost profit/(loss) on 84,312 (4,536,071) (2,757,862)

ordinary activities before

taxation

========= ========= =========

Historical cost (loss)/profit for (1,382,310) (5,779,578) (4,062,494)

the period after taxation and

dividends

========= ========= =========

Unaudited Balance Sheet

as at 31 March 2007

31 March 2007 31 March 2006 30 September

2006

(unaudited) (unaudited) (audited )

� � �

Non current assets

Investments 36,676,416 39,574,724 35,405,032

--------------- --------------- ---------------

Current assets

Debtors and prepayments 920,424 1,235,863 936,772

Investments at fair value 6,041,018 5,601,089 5,969,440

Cash at bank 53,516 48,838 2,027,094

--------------- --------------- ---------------

7,014,958 6,885,790 8,933,306

Creditors: amounts falling due (251,808) (95,030) (188,060)

within one year

--------------- --------------- ---------------

Net current assets 6,763,150 6,790,760 8,745,246

--------------- --------------- ---------------

Net assets 43,439,566 46,365,484 44,150,278

--------------- --------------- ---------------

Capital and reserves

Called up share capital 388,788 396,099 391,099

Share premium account 136,594 60,973 60,974

Capital redemption reserve 30,441 22,441 27,441

Special reserve 24,509,138 26,756,241 25,025,881

Revaluation reserve 13,464,704 16,140,070 12,618,828

Profit and loss account 4,909,901 2,989,660 6,026,055

--------------- --------------- ---------------

Equity shareholders' funds 43,439,566 46,365,484 44,150,278

--------------- --------------- ---------------

Net asset value per share 111.73p 117.06p 112.89p

Unaudited Cash flow Statement

For the six months ended 31 March 2007

Six months ended Six months Year ended

ended

31 March 2007 31 March 2006 30 September

2006

(unaudited) (unaudited) (audited)

� � �

Operating activities

Net revenue on activities before 360,602 260,335 444,278

taxation

Capitalised fees (342,892) (359,854) (699,292)

Transaction costs (148) (17,524) (27,071)

(Increase)/decrease in debtors 16,348 (115,721) (151,700)

(Decrease)/increase in creditors 63,748 (99,308) (6,278)

--------------- --------------- ---------------

Net cash inflow/(outflow) from 97,658 (332,072) (440,063)

operating activities

Equity dividends paid (1,466,622) (1,243,507) (1,304,632)

Tax Refund

Taxation paid

Acquisitions of investments (1,553,841) (1,492,138) (2,410,773)

Disposals of investments 1,195,083 29,552 3,857,334

Management of liquid resources (71,578) 744,784 376,433

Financing (174,278) (584,014) (977,438)

--------------- --------------- ---------------

Decrease in cash for the period (1,973,578) (2,877,395) (899,139)

--------------- --------------- ---------------

Reconciliation of net cash flow to

movement in net debt

Decrease in cash for the period (1,973,578) (2,877,395) (899,139)

Net funds at the start of the 2,027,094 2,926,233 2,926,233

period

--------------- --------------- ---------------

Net funds at the end of the period 53,516 48,838 2,027,094

--------------- --------------- ---------------

Unaudited reconciliation of Movements in Shareholders' Funds

for the six months ended 31 March 2007

Six months Six months Year ended

ended ended

30 September

31 March 2007 31 March 2006 2006

(unaudited) (unaudited) (audited)

� � �

Opening shareholders' funds 44,150,278 49,386,890 49,386,890

Restated for application of new - (182,171) (182,171)

accounting policies

--------------- --------------- ---------------

At 1 October 2006 44,150,278 49,204,719 49,204,719

--------------- --------------- ---------------

Net share capital bought back / (174,278) (584,014) (977,438)

subscribed for in the period

Profit/(loss) for the period 930,188 (1,011,714) (2,772,371)

Dividends paid in period (1,466,622) (1,243,507) (1,304,632)

--------------- --------------- ---------------

Closing Shareholders' funds 43,439,566 46,365,484 44,150,278

--------------- --------------- ---------------

NOTES

1. The accounts have been prepared under the historical cost convention,

modified to include the revaluation of investments, and in accordance with

the Companies Act 1985, with applicable accounting standards in the United

Kingdom and with the Statement of Recommended Practice, `Financial

Statements of Investment Trust Companies', revised December 2005.

2. Investments are stated at "fair value through profit and loss", in

accordance with the International Private Equity and Venture Capital

Valuation ("IPEVCV") guidelines. Purchase and sales of quoted investments

are recognised on the trade date where a contract of sale exists whose

terms require delivery within a time frame determined by the relevant

market. Purchases and sales of unlisted investments are recognised when the

contract for acquisition or sale becomes unconditional.

The fair value of quoted investments is the bid price of those investments at

the close of business on 31 March 2007.

Unquoted investments are stated at fair value by the Directors in accordance

with the following rules, which are consistent with the IPEVCV guidelines:

i. Investments which have been made in the last 12 months are at fair value

which, unless another methodology gives a better indication of fair value,

will be at cost;

ii. Investments in companies at an early stage of their development are valued

at fair value which, unless another methodology gives a better indication

of fair value, will be cost;

iii. Where investments have been held for more than 12 months or have gone

beyond the stage in their development in (i) or (ii) above, the shares may

be valued by applying a suitable price-earnings ratio to that company's

historic, current or forecast earnings (the ratio used being based on a

comparable listed company or sector but the resulting value being

discounted to reflect lack of marketability). Where overriding factors

apply, alternative methods of valuation will be used. These will include

the application of a material arms-length transaction by an independent

third party, discounted cash flow, or a net asset basis;

iv. Where a value is indicated by a material arms-length transaction by a third

party in the shares of a company, this value will be used;

v. Where fair value cannot be reliably measured under paragraphs (i)-(iv)

above, an investment is held at the most recent carrying value, reduced

where there is evidence of impairment by the estimated extent of

impairment.

Capital gains and losses on investments, whether realised or unrealised are

shown in the Profit and Loss Account.

Although the Company holds more than 20% of the equity of certain companies, it

is considered that the investments are held as part of an investment portfolio.

Accordingly, and as permitted by FRS 9 `Associate and Joint Ventures', their

value to the Company lies in their marketable value as part of that portfolio.

It is not considered that any of our holdings represents investments in

associated companies.

3. In accordance with the policy statement published under "Management and

Administration" in the Company's prospectus dated 13 October 2000, the

Directors have charged 75% of the investment management expenses to the

capital reserve.

4. All revenue and capital items in the above Profit and Loss account derive

from continuing operations

5. Earnings for the six months ended 31 March 2007 should not be taken as a

guide to the results for the full year.

6. Earnings and return per share

Six months Six months ended Year ended

ended

31 March 2006 30 September 2006

31 March 2007

� � �

Total earnings after 930,188 (1,011,714) (2,772,371)

taxation:

Basic earnings per share 2.38 (2.50) (6.98)

--------------- --------------- ---------------

Net revenue from ordinary

activities

before taxation 283,866 199,160 342,931

Revenue return per share 0.73 0.49 0.86

--------------- --------------- ---------------

Net unrealised capital 752,297 (893,173) (4,074,141)

gains/(losses)

Net realised capital 160,181 (19,022) 1,556,784

gains/(losses)

Capital expenses (266,156) (298,679) (597,945)

--------------- --------------- ---------------

Total capital return 646,322 (1,210,874) (3,115,302)

Capital return per share 1.65 (2.99) (7.84)

--------------- --------------- ---------------

Weighted average number 39,081,898 40,522,780 39,694,960

of shares in issue in the

period

7. Net asset value per Ordinary Share is based on net assets at the end of the

period, and on 38,878,803 (31 March 2006: 39,609,922, 30 September 2006:

39,109,922) Ordinary shares, being the number of Ordinary shares in issue

on that date.

8. The information for the year ended 31 March 2007 does not comprise full

financial statements within the meaning of Section 240 of the Companies Act

1985. The financial statements for the year ended 30 September 2006 have

been filed with the Registrar of Companies. The auditors have reported on

these financial statements and that report was unqualified and did not

contain a statement under Section 237(2) of the Companies Act 1985.

9. Copies of the Interim Report to Shareholders for the six months ended 31

March 2007 will be sent to all Shareholders shortly. Further copies will be

available free of charge from the Company's registered office, One Jermyn

Street, London SW1Y 4UH.

END

Touchstar (LSE:TST)

Historical Stock Chart

From Jun 2024 to Jul 2024

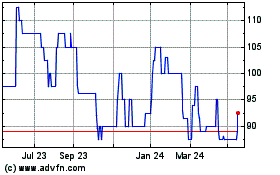

Touchstar (LSE:TST)

Historical Stock Chart

From Jul 2023 to Jul 2024