RNS Number:0604P

TriVest VCT PLC

20 December 2001

TriVest VCT plc

Preliminary Results Announcement

Chairman's Statement

I am pleased to present the first Annual Report of the Company for the period

from 6th September 2000 to 30th September, 2001.

You will recall that the Offer opened on 18th October 2000 and closed on 6th

April 2001 having raised a total of #41,801,516.

The objective of the Company is to provide its Shareholders with an attractive

return, by maximising the stream of dividend distributions from the income and

capital gains generated from a diverse portfolio of investments selected by

our three specialist managers, GLE, LICA and VCF Partners.

At 30th September, 2001 the Company's net asset value per share was 92.04

pence. This compares with a subscription price of 100 pence and an initial net

asset value (after expenses of issue) of 94.52 pence per share.

In the period under review, the tragic events of 11th September, 2001 and the

economic climate and difficult stock market, both prior to and following these

terrorist actions, has inevitably dominated the environment in which the

Company operates. The venture capital and private equity market has, if

anything, been as heavily hit as quoted technology stocks in that the general

sentiment for investing has been unfavourable. A "wait-and-see" mood has

prevailed. It is difficult to foresee this sentiment changing very rapidly

although clearly in due course exciting opportunities to invest should present

themselves and probably on more favourable terms.

As can be expected at this stage in its life, the Company's portfolio is still

comprised mainly of cash and short-dated Gilt-edged securities. However, in

the period under review, each of our three venture capital investment

managers, GLE, LICA and VCF Partners, has been active in carefully identifying

attractive companies in which TriVest can participate as an investor.

Considerable emphasis is being placed by the Company and its Managers on the

"due diligence" process. The Manager's report regularly and in detail to your

Board on the progress of their individual portfolios. In addition, your Board

has already taken the opportunity to visit the management of a number of the

Company's investments in order to assess personally their performance.

At 30th September, 2001 the Company had made investments in 13 venture capital

companies with a total cost of #8,722,624. A further #4,030,435 has been

earmarked for investment in 7 companies. Summary descriptions of each of these

investments can be found below and the entire portfolio has been valued in

accordance with BVCA guidelines.

The Company's revenue earnings were 1.67 pence per share and your Board is

recommending a final dividend per ordinary share in respect of the period

under review of 1.2 pence to be paid to shareholders on the register on 18

January 2002.

Despite the recent events in New York and Washington and the turbulent

development capital market over the last year, your Board are pleased with the

progress that the Company has made. We remain confident that the Company and

its Managers have the capability and experience to take advantage of good

investment opportunities which may arise in these difficult markets. We are

convinced that the multi-manager approach can only benefit the Company and its

Shareholders at this time.

David Atterton, Chairman.

20 December 2001.

Statement of Total Return

(incorporating the Revenue Account of the Company)

for the period from 6 September 2000 to 30 September 2001

Period ended 30 September 2001

Notes Revenue Capital Total

# # #

Unrealised gains and (losses) on - (782,897) (782,897)

investments

Realised gains and (losses) on - 112,584 112,584

investments

Income 1,240,092 - 1,240,092

Investment management fees 3 (168,395) (505,183) (673,578)

Other expenses (373,105) - (373,105)

----------- ------------ ------------

Return on ordinary activities 698,592 (1,175,496) (476,904)

before taxation

Tax on ordinary activities (157,001) 101,037 (55,964)

------------ ----------- -----------

Return on ordinary activities 541,591 (1,074,459) (532,868)

after taxation

Dividend 6 (501,618) - (501,618)

----------- ----------- -----------

Transfer to reserves 39,973 (1,074,459) (1,034,486)

----------- ----------- -----------

Return per Ordinary Share 1.67p (3.32)p (1.65)p

All revenue and capital items in the above statement derive from continuing

operations.

No operations were acquired or discontinued in the period.

Balance Sheet

As at 30 September 2001

as at 30 September 2001

# # #

Fixed Assets

Investments 16,034,927

Current Assets

Debtors and prepayments 515,195

Other assets 1,730,436

Cash at bank 21,315,917

-------------

23,561,548

Creditors: amounts falling due within

one year

Corporation tax 48,266

Other creditors 378,418

Accruals 694,688

-------------

(1,121,372)

Net current assets 22,440,176

-------------

Net assets 38,475,103

-------------

Capital and reserves

Called up share capital 418,015

Share premium account 39,091,574

Capital reserve - realised (291,562)

Capital reserve - unrealised (782,897)

Revenue reserves 39,973

-------------

38,475,103

-------------

NAV per share 92.04p

Summarised Cash Flow Statement

Period

ended

30th September

2001

Operating activities # #

Investment income received 725,400

Dividend income -

Investment management fees paid (411,302)

Other cash payments (72,094)

-------------

Net cash inflow from operating activities 242,004

Taxation

UK Corporation tax paid

Investing activities

Acquisition of investments (25,448,624)

Disposal of investments 8,743,384

-------------

(16,705,240)

Dividends

Payment of dividend -

Cash outflow before financing and liquid -------------

resource management (16,463,236)

Financing

Issue of ordinary shares 39,509,589

Management of liquid resources

Increase in monies held pending investment (1,730,436)

-------------

Increase in cash for the period 21,315,917

-------------

Notes

1. The revenue column of the statement of total return is the profit and loss

account of the Company.

2. All revenue and capital items in the above statement of total return derive

from continuing operations.

3. In accordance with the policy statement published under "Management

Administration" in the Company's prospectus dated 13 October 2000, the

Directors have charged 75% of the investment management expenses to

capital reserve.

4. The basic return per Ordinary Share is based on the net revenue from

ordinary activities after tax of #541,591 and is based on 32,332,375

Ordinary Shares, being the weighted average number of Ordinary Shares in

issue during the period.

5. The financial information set out in these statements does not constitute

the Company's statutory accounts for the period ended 30 September 2001

but is derived from those accounts. Statutory accounts will be delivered

to the Registrar of Companies following the Company's Annual General

Meeting to be held on 13 February 2002. The auditors have reported on

these accounts; their reports were unqualified and did not contain

statements under Section 237(2) or (3) of the Companies Act 1985.

6. The Company proposes to pay a final dividend of 1.2p per share

on 18 February 2002 to all shareholders on the register on 18 January

2002.

Investment Portfolio Summary

Cost at Valuation at % of

portfolio

acquisition 30 Sept 2001 By value

GLE Development Capital Limited

T J Brent Limited #900,000 #900,000 5.61%

Specialist contractor to the water

utility sector

Letraset Limited #500,000 #500,000 3.12%

Graphic arts products

Total #1,400,000 #1,400,000

------------- -------------

LICA Development Capital Limited

Machinery and Automated Systems

Technology

Limited (MAST) #1,000,000 #950,000 5.92%

Development of Vertical Turning and

Machining Centres

Le Sac Limited #1,000,000 #1,000,000 6.24%

Manufactures plastic packing for powder

/

granular products and liquids

Trident Publishing Limited #705,000 #705,000 4.40%

Book publishing in the Maritime sector

i-documentsystems group plc #517,624 #666,667 4.16%

Document storage systems

Zynergy Group Limited #1,300,000 #640,000 3.99%

Commercialising new materials for

medical

devices

Watkins Books Limited #500,000 #500,000 3.12%

Supplier of books in Alternative

Sciences,

Heath, Philosophy and related sectors

Tikit Group plc #500,000 #478,260 2.98%

Consultancy, services and software

solutions for

law firms

Total #5,522,624 #4,939,927

------------- -------------

VCF Partners

ANT Limited #1,000,000 #1,000,000 6.24%

Provider of embedded browser/email

software

For consumer electronics and internet

appliances

Heritage Image Partnerships Limited #300,000 #300,000 1.87%

On-line image library

Monactive Limited (formerly Xpert

Client

Systems Ltd) #250,000 #250,000 1.56%

Software management tools that monitor

usage of

software versus licences held

iDesk plc #250,000 #125,000 0.78%

Helpdesk services and software,

Electronic

Billing Services

Total #1,800,000 #1,675,000

------------- -------------

Managers' Totals #8,722,624 #8,014,927

Fixed interest portfolio #8,020,000 50.01%

TOTAL #16,034,927 100.00%

-------------

Managers' Review

GLE Development Capital

T J Brent Limited

T J Brent is a specialist water utility contractor. Its principal activity

involves the laying and refurbishment of pipes, connection of houses to the

mains, and the installation and replacement of water meters. TriVest invested

#900,000 in T J Brent in December 2000. The business continues to trade in

line with business plan at the operating level. Whilst the company has lost a

significant contract in the period compensatory gains have been achieved in

other areas.

The investment remains valued at cost. No audited accounts have been produced

since the Company was incorporated on 24 July 2000. #38,492 was received as

income from loan stock during the period out of a total of #55,607 receivable.

TriVest owns 8.45% (7.6% post-dilution) of the total equity of the Company

which comprises 100% ordinary shares.

Letraset Limited

In June 2001 TriVest invested #500,000 in Letraset Limited, formerly Creative

Opportunities Limited.

The principal activity of Letraset is the production and worldwide

distribution of graphic arts products. The products are sold to end users via

a network of specialist distributors in each of the major developed markets.

Since investment, activities have been consolidated onto one site.

The company has traded in line with business plan despite a downturn in demand

from the US. The company has a pipeline of new product launches which serve to

underpin the sales growth strategy.

No audited accounts have been produced since the Company was incorporated on 9

October 2000 and TriVest's investment continues to be valued at cost. TriVest

owns 17.35% of the total equity of the Company which comprises 100% ordinary

shares. #11,967 was receivable as income from loan stock during the period.

LICA Development Capital Limited

Machinery and Automated Systems Technology Limited (MAST)

MAST is engaged in developing and manufacturing specialist machine tools,

including a Mini-Millennium Vertical Turning & Machining Centre and LeSac's

third generation specialist packaging machinery for which it is the exclusive

supplier.

An investment of #1,000,000 was made by TriVest into MAST in February 2001 to

provide funding for product development and manufacturing for these products.

Information provided in the latest audited accounts for the period to 31

December 2000 is as follows: Turnover #1,373,032; Profit before Tax #23,466;

Net Assets #120,166. The valuation on the loan stock is at cost and a 50%

provision has been made against the equity in respect of production delays

that resulted in sales not achieved during the period. TriVest owns 24.99% of

the total equity of MAST which comprises 100% ordinary shares. #3,000 was

received as income from loan stock during the period.

LeSac Limited

LeSac is commercialising a unique packaging system that offers significant

advantages over existing solutions through a combination of lower material

content, increased space utilisation and lower environmental tax levies.

LeSac's third generation product addresses the higher compliance requirements

of the EU Packaging Waste Directive for the recovery and re-cycling of

packaging waste as well as creating cost savings and value added opportunities

for its customers.

In February 2001, TriVest made an investment of #1,000,000 in LeSac Limited to

provide additional working capital and production capacity for the Company.

Information provided in the latest audited accounts for the year ended 31

December 2000 is as follows: Turnover #226,266; Loss before Tax #764,707; Net

Liabilities #173,149. The valuation is at cost. TriVest owns 9.34% of the

total equity of LeSac which comprises 100% ordinary shares. #43,534 was

receivable as income from loan stock during the period.

Trident Publishing Limited

Trident publishing is a Newco which has been formed especially for the MBO

acquisition of Chatham Publishing, the leading, independent, maritime

publisher. The Company is a specialist in the military and historical

publishing sector.

TriVest made an investment of #705,000 in Trident in May 2001 and the Company

is on target with its original projections. The Company's year-end is 30

September and no audited accounts have been finalised since the incorporation

of the company. TriVest owns 36.84% of the total equity of the Company which

comprises 100% ordinary shares. The valuation is at cost. #14,405 was

receivable as income from loan stock during the period.

i-documentsystems group plc

i-documentsystems group plc ("i-dox") is an established and fast growing

software company which specialises in the development of products for

document, content and information management. The Group's principal product is

Image-Gen, a sophisticated web-based software package which allows a complex

paper-based process, such as the local authority planning application process,

to be converted into a straightforward and robust electronic process leading

to significant savings in cost and time. Image-Gen is a proven product which

has been "live" as a web-based system since 1995. i-dox has recently secured

business in Glasgow and Gosport relating to Building Control and Tax/Benefits

respectively. i-dox is thus achieving diversification of product deployment as

was envisaged at flotation.

TriVest made an investment of #517,624 in this fast growing software company

in December 2000. Now quoted on AIM, the value of TriVest's investment as at

30 September 2001 was #666,667. Information provided in the latest audited

accounts for the year ended 31 October 2001 is as follows: Turnover #

1,201,192; Loss before Tax #1,181,273; Net Assets #2,667,086. TriVest owns

3.2% of the total equity of i-documentsystems which comprises 100% ordinary

shares. No income was received from the investment during the period.

Zynergy Group Limited

Zynergy is a rapidly expanding global medi-tech organisation exploiting its

fully-developed materials, coatings and other similar technologies. These

revolutionary technologies enable and enhance Zynergy's existing proprietary

products in high-value sectors, namely minimally-invasive cardiology,

balloons, stents and orthopaedics as well as other critical areas, with

respiratory and urology products to follow.

On 20 September 2000 the Company acquired the entire issued share capital of

Blastrelease Limited now called Zynergy Orthopaedics Limited. During 2000 the

Company set up two new ventures. Zynergy Interventional Cardiology was

established to manufacture and market catheters and stents for the

interventional cardiology market and Zynergy Precision Extrusion was

established as a joint venture with Precision Extrusion Inc. to manufacture

and market tubing using the proprietary polymers of Zynergy Core Technology.

The Group will continue to invest in the medical sector.

TriVest invested #1,000,000 in Zynergy Group Limited in February 2001 and an

additional #300,000 in September 2001 to provide working capital and capital

for product development. Information provided in the latest audited accounts

for the period to 31 December 2000 is as follows: Turnover #2,179,080; Loss

before Tax #4,066,393, Net Assets #5,709,570. The valuation of the loan stock

is at cost. The valuation of the equity has however been decreased by #660,000

to take account of the effect of a current Rights Issue and Offer. TriVest

owns 1.9% of the total equity of the Company which comprises 100% ordinary

shares. #31,096 was receivable as income from loan stock during the period.

Watkins Books Limited

In March 2001, TriVest made an investment of #500,000 in Watkins Books

Limited. Watkins is the pre-eminent UK supplier of books and information in

the alternative sciences, health, philosophy and related sectors.

Its business is organised in four distinct divisions: Watkins Bookshop and

Watkins Esoteric Centre; Watkins Readings; Watkins Website and Mail Order; and

Watkins Publishing which are all currently under development. The original

Watkins bookshop in Cecil Court has been refurbished with an increased sales

area and three additional shops are being developed. The Watkins website is

due to be launched in the first quarter of 2002 and mail order sales are

rising sharply. 40 publishing titles have been commissioned of which 50% have

progressed to publication.

Information provided in the audited accounts for the period to 31 March 2000

is as follows: Turnover #333,716; Loss before tax #35,137; Net Assets #73,868.

The valuation is at cost. TriVest owns 12.5% of the total equity of the

Company which comprises 100% ordinary shares. #20,416 was receivable as income

from loan stock during the period.

Tikit Group plc

Tikit provides consultancy services and software solutions primarily to IT

departments of the top 200 law firms. Tikit also resells third party software

applications where it considers these to be 'best of breed'.

Tikit has developed a proficient technical skillbase focussed on the

requirements of major legal practices and has established a strong brand

reputation in its market sector. Since it was established in 1994, the Company

has shown profitable growth in each financial year to date and increased

turnover from #6.5m to #9.3m in 2000. Tikit has been innovative in developing

the market for specific applications in the legal sector, establishing

commercial relationships with a number of software vendors for specific

applications relevant to that sector. It combines these with its own software

enhancement modules and integration capabilities to provide solutions tailored

principally for major law firms.

An investment of #500,000 was made by TriVest in June 2001, in Tikit Group

plc. Tikit has been listed on the Alternative Investments Market since June

2001 and the value of TriVest's investment as at 30 September 2001 was #

478,260. Information provided in the latest audited accounts for the period to

31 December 2000 is as follows: Turnover #1,866,351; Loss before Tax #848,332,

Net Assets #317,667. TriVest owns 3.0% of the total equity of Tikit which

comprises 100% ordinary shares. No income was received from the investment

during the period.

VCF Partners

ANT Limited

ANT Ltd is a software company that develops embedded browsers to improve

users' interactive communication with digital television sets and other

consumer electronic devices.

TriVest made an investment of #1,000,000 in ANT Limited in July 2001.

Information provided in the latest audited accounts for the period to 31

December 2000 is as follows: Turnover #1,866,351; Loss before Tax #848,332,

Net Assets #317,667. TriVest owns 5.3% of the total equity of the Company

which comprises 100% ordinary shares. #518 was receivable as income from loan

stock during the period.

Heritage Image Partnership Limited

Heritage Image Partnership Limited is building an online library of

high-resolution images from exclusive access to the content of heritage

institutions, principally museums and libraries, and sells directly to

business customers.

The company launched its service in April 2001 and is generating a good level

of interest.

TriVest invested #300,000 in Heritage Image Partnership Ltd in March 2001.

Information provided in the latest audited accounts for the 11 months to 31

December 2000 is as follows: Turnover Nil; Loss before Tax #1,376,794, Net

liabilities #1,375,795. TriVest owns 5.9% of the total equity of the Company

which comprises 100% ordinary shares. No income was received from the

investment during the period.

Monactive Limited (formerly Xpert Client Systems Limited)

Monactive Limited is a leading provider of Software Asset Management (SAM)

tools with over 100 customers. The Company's software monitors software usage

on PC networks providing corporates with data for cost reduction and

compliance. Its customers are able to reduce their software licensing costs

whilst demonstrating legal compliance.

TriVest invested #250,000 in Monactive Ltd in March 2001. Information provided

in the latest audited accounts for the period to 31 July 2000 is as follows:

Turnover #261,753; Loss before Tax #320,800; Net Liabilities #287,249. TriVest

owns 5.9% of the total equity of the Company which comprises 100% ordinary

shares. #2,521 was receivable as income from loan stock during the period.

iDesk plc

IDesk provides telcos, ISPs and other blue chip customers with outsourced

technical help desks, operated from a call centre in London. iDesk also sells

its proprietary and licensed CRM software and provides electronic billing

services. The Board believes it is prudent to write down the investment by 50%

due to difficult trading conditions in the company's market. TriVest made an

investment in iDesk plc of #250,000 in November 2000. Information provided in

the latest audited accounts for the 17 month period to 31 December 2000 is as

follows: Turnover #8,303,186; Loss before Tax #1,398,464, Net Liabilities #

989,723. TriVest owns 0.83% of the total equity of the Company which comprises

100% ordinary shares. No income was received from the investment during the

period.

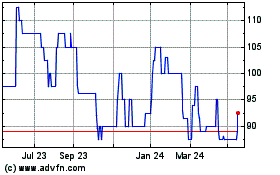

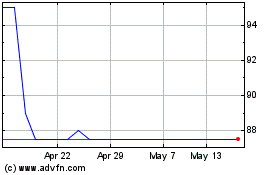

Touchstar (LSE:TST)

Historical Stock Chart

From Jun 2024 to Jul 2024

Touchstar (LSE:TST)

Historical Stock Chart

From Jul 2023 to Jul 2024