TRIVEST VCT PLC

Interim Results for the six months ended 31 March 2006

Chairman's Statement

I am pleased to present the Company's Interim results for the six months ended

31 March 2006.

Portfolio

During the six-month period ended 31 March 2006 the FTSE100 index rose 10.72%,

the FTSE All-Share index rose 12.71%, and the FTSE AIM index rose 9.98%,

reflecting continuing high institutional liquidity.

On the investment side there has been no shortage of equity and debt providers

looking for good propositions. The competition to finance such situations

remains strong. The Chancellor's recent budget and the proposed legislation in

respect of VCTs ensured that demand, before 6 April 2006, for investment in

these vehicles was at an all time high. This will mean that over the next

couple of years our Investment Managers will face even stiffer competition for

good investments which could result in price/earnings ratios rising. The

converse of this position could be that realisation levels may also rise.

Subscriptions into new VCTs are likely to be lower in the light of the new

taxation legislation in respect of VCTs.

The last six months have largely been a period of consolidation for the

portfolio with the slight decline in the Net Asset Value (NAV) per share being

mainly attributable to the fall in share price of several of our quoted

technology stocks. Whilst the portfolio during this period has not seen the

sharp increase in the NAV per share enjoyed in the previous period, the Board

and Investment Managers are pleased with the continuing progress of the

portfolio and the possibility of a number of profitable realisations during the

next period. At 31 March 2006, the Company's NAV per share was 117.06 pence (30

September 2005: 122.53 pence as restated).

Within the Foresight portfolio, in January 2006 Blue Curve Limited was sold to

Mondas plc for an initial consideration of �925,000 with up to �2,075,000 to

follow through based on an earnout of revenues. During October and November

2005 TriVest purchased a total of a further 150,000 shares in Sarantel plc. In

February 2006, Oxonica plc, our largest single investment, continued to make

progress and completed the acquisitions of US based Nanoplex Technologies Inc

for a total consideration of up to 7,538,440 fully paid ordinary shares in

Oxonica which is equivalent to approximately 17% of the equity.

Overall, the MPEP portfolio has performed well with strong profit growth being

shown by Image Source, Original Additions and Secure Mail Services, the last of

which has consolidated the turnaround in its trading seen over the previous

year. The past six months has seen three companies added to the portfolio. We

invested �1 million in October 2005 to support the MBO of Youngman Group, a

leading manufacturer of ladders and access towers. This was followed by two

further investments in January 2006; first �215,914 was invested in Vectair

Holdings, a Basingstoke-based producer of air-care and sanitary products used

primarily in office and commercial washrooms, and secondly, �334,880 was

invested in Campden Media, a London-based publisher of magazines and yearbooks

and arranger of conferences aimed at the healthcare and private wealth

management markets. Shortly after the period end a new investment of �388,842

was made into VSI, a Group of associated businesses that specialises in

developing and marketing 3D software. Two further new investments of �360,969

into Blaze Signs Holdings, a designer, manufacturer and installer of shop front

and internal signage for major multiple retailers; and of an additional �

126,229 into BBI Holdings were completed after the period end. Also during this

period, BG Consulting Group carried out a reconstruction as a result of which

TriVest now also holds an equity stake and loan stock in a new company called

Duncary 4. The valuation of our interest remains largely unchanged.

Disappointingly, since the period end, The Hunter Rubber Company has been

placed into administration after incurring continuing losses. This has had no

effect on the current NAV as TriVest had already made a full provision against

this investment.

Within the Nova portfolio, in January 2006 a further investment of �100,000 was

made into NexxtDrive Limited (formerly DriveTec (UK) Ltd) as it moves towards a

flotation.

Revenue Account

At 31 March 2006, revenue reserves available for distribution to shareholders

were �199,160 (31 March 2005; �118,309 as restated). As in previous years, the

Board does not propose to declare an interim dividend but expects to be able to

propose a final dividend for the year ended 30 September 2006. The net asset

value per share as at 31 March 2006 was 117.06 pence (122.53 pence as at 31

March 2005 as restated) and the total loss per share was 2.50 pence (23.25

pence earnings per share as at 31 March 2005 as restated).

Investment company status

The Company revoked its investment company status on 30 November 2005. This

will enable the Company to make distributions out of capital gains that have

started to be realised as the portfolio matures. The first dividend out of

capital gains of 2.5 pence per share was paid to Shareholders on 14 February

2006.

Share buy-backs

During the six months ended 31 March 2006, the Company bought back 600,000

Ordinary Shares (representing 1.47% of the shares in issue at the period end)

at a total cost of �581,100 (net of expenses). These shares were subsequently

cancelled by the Company.

Dividend Investment Scheme

170 Shareholders, who between them held a total of 1,895,589 Ordinary Shares

representing 4.77% of the Company, have joined the Dividend Investment Scheme

Valuation Policy

Quoted stocks are now valued at bid prices, rather than mid-market prices in

accordance with new accounting standards. It is worth commenting that the Fund

does hold a number of relatively early stage AIM listed stocks with limited

marketability. In such cases, the price at which a sizeable block of shares

could be traded, if at all, may vary significantly from the market price used.

TriVest Website

May I remind you that the Company now has its own website which is available at

www.trivestvct.co.uk.

Colin Hook,

Chairman

Investment Portfolio Summary

as at 31 March 2006

Valuation at Additional Valuation

Total cost 30 September investments at

at 2005 in the 31 March

31 March (restated) period 2006

2006 (unaudited)

� � � �

Foresight Venture Partners

Oxonica plc 2,136,763 8,780,297 - 8,012,905

Specialist in the design,

manipulation and

engineering of properties

of materials at the

nano-scale

Camwood Limited 1,028,181 1,780,937 - 2,843,331

Provider of software

repackaging services

SmartFOCUS Group plc 700,000 1,899,292 - 2,110,908

Provider of analytic

software to support

targeting and execution of

marketing campaigns

Aquasium Technology 700,000 2,067,997 - 1,850,780

Limited

Design, manufacture and

marketing of bespoke

electron beam welding and

vacuum furnace equipment

Sarantel Group plc 1,670,252 3,729,170 58,500 1,644,219

Antennae for mobile phones

and other wireless devices

Alaric Systems Limited 595,802 595,762 - 595,762

Software development,

implementation and support

in the credit/debit card

authorisation and payments

market

ANT plc 462,816 472,749 - 512,145

Provider of embedded

browser/email software for

consumer electronics and

Internet appliances

Aigis Blast Protection 272,120 333,320 - 333,320

Limited

Specialist blast

containment materials

company

DCG Datapoint Group 312,074 312,074 - 311,853

Limited

Design, supply and

interrogation of data

storage solutions

Wire-e Limited 500,000 250,000 - 200,000

Provider of mobile data

communication services

Mondas plc (investment 600,000 450,183 33,000 142,953

formerly in

Blue Curve Limited)

Specialist provider of

software solutions To

the banking & securities

and Education markets

Monactive Limited 339,285 160,667 - 23,909

Provider of software

asset management tools

that monitor usage of

software versus licences

held

Broadreach Networks - 15,000 - -

Limited

Public access WLAN and

fixed line Internet

Service Provider

Other investments in the 250,000 - - -

portfolio*

---------- ---------- ---------- ----------

9,567,293 20,847,448 91,500 18,582,085

Matrix Private Equity

Partners Limited

HWA Limited (trading as 69,105 3,219,023 - 3,352,810

Holloway

White Allom)

Specialist contractor in

the high- value

residential and heritage

property refurbishment

market

Secure Mail Services 1,230,256 2,590,494 - 3,165,388

Limited

(formerly Special Mail

Services Limited)

Specialist, secure

credit card delivery

business

Image Source Group 1,000,000 2,618,253 - 2,877,372

Limited

Royalty free picture

library

Original Additions 1,000,000 2,301,687 - 2,540,863

(Beauty Products)

Limited

Manufacturer and

distributor of beauty

products

Youngman Group Limited 1,000,000 - 1,000,000 1,000,000

Manufacture of ladders

and access towers

Tottel Publishing 514,800 514,800 - 867,229

Limited

Specialist law and tax

imprint

Ministry of Cake Limited 721,280 721,280 - 721,280

Manufacturer of desserts

and cakes for the food

service industry

BBI Holdings plc 369,890 731,910 - 731,910

Manufacturer of gold

conjugate for the

medical diagnostics

industry

Letraset Limited 1,000,000 487,737 - 719,878

Manufacturer and

distributor of graphic

art products

Brookerpaks Limited 500,000 1,033,058 - 676,570

Importer and distributor

of garlic and

vacuum-packed vegetables

Campden Media Limited 334,880 - 334,880 334,880

Magazine publisher and

conference organiser

F H Ingredients Limited 403,303 403,303 - 317,602

Processor of fresh herbs

to produce a frozen

product used by food

processing companies in

the production of ready

meals

Vectair Holdings Limited 215,914 - 215,914 215,914

Provider of air care and

sanitary Washroom

products

Inca Interiors Limited 350,000 300,562 - 200,000

Supplier of quality

kitchens to house

developers

SectorGuard plc 150,00 128,571 - 160,714

Provision of manned

guarding, mobile

Patrolling and alarm

response services

B G Consulting Group 1,153,976 125,000 153,976 114,828

Limited/

Duncarry 4 Limited

Technical training

business and

outplacement careers

consultancy

Other investments in the 1,316,482 - - -

portfolio*

---------- ---------- ---------- ----------

11,329,886 15,175,678 1,704,770 17,997,238

Nova Capital Management

Limited

Tikit Group plc 517,624 882,607 - 869,564

Provider of consultancy

services and software

solutions for law firms

IDOX plc 737,625 668,500 - 859,500

Developer of products

for document, content

and information

management

Biomer Technology 137,170 753,837 - 753,837

Limited

Developer of

biomaterials for medical

devices

NexxtDrive Limited 600,000 412,500 100,000 512,500

Developer of patented

transmission technology

Other investments in the 698,999 - - -

portfolio*

---------- ---------- ---------- ----------

2,691,418 2,717,444 100,000 2,995,401

---------- ---------- ---------- ----------

Total 23,588,597 38,740,570 1,896,270 39,574,274

---------- ---------- ---------- ----------

* Other investments in the portfolio comprises those investments that have

been valued at nil and from which the Directors only expect to receive small

recoveries; iDesk plc in the Foresight portfolio; The Hunter Rubber Company

Limited, in administration and Stortext-FM in the MPEP portfolio and Trident

Publishing Limited (dissolved 24 April 2006) in the Nova portfolio.

Investment Managers' Review

Foresight Venture Partners

The last six month period has been one of mixed fortunes for the portfolio

investments. On the one hand a number of the portfolio companies have been

benefiting from improved market conditions. For example, SmartFOCUS has made

good progress since we increased our investment in the company at the time of

its AIM flotation in October 2004. During 2005 the company achieved a 112%

growth in revenues to �6.0 million, a maiden profit and made its first

acquisition. Aquasium benefited from capital investment programmes,

particularly in China, and achieved another year of increased sales and

profits. On the other hand, there was considerable downward pressure on the

prices of certain of the AIM listed investments, in particular Sarantel and

ANT, and these are described in more detail below.

Oxonica, which engineers the properties of materials at the nano-scale level

for application in fuel additives, UV protection and other products, has seen

encouraging demand for its products and Stagecoach is now using its fuel

additive product throughout its UK and New Zealand bus fleets. Furthermore,

Boots plc has incorporated Oxonica's UV protection additive into a sunscreen

product, which is currently available throughout its stores. Oxonica's shares

placed on AIM at 95.8p per share and were trading at �1.55 at 31 March 2006,

representing an uplift of �5.8 million on the fund's investment cost. Oxonica

announced an agreement to acquire US based Nanoplex Technologies Inc. in

December 2005 and completed the transaction in February 2006.

Sarantel, which manufactures miniature antennas used in mobile phones and

personal digital systems offering location based services through navigation

satellites, announced a sales increase to �2.8 million in the year to 30

September 2005 from �0.8 million in 2004 but a series of contract delays

resulted in negative trading updates and the price fell sharply to 35p per

share at the end of March (from a float price of 82p). Your Investment Manager

remains confident, however, that the company's strategy will produce more

positive results over the next twelve to eighteen months.

Similarly ANT, which listed on the AIM market on 16 March 2005 raising �11

million, has, as a result of a negative trading update, fallen from a float

price of 126p to 78p per share at 31 March 2006. The company has more recently

experienced increased demand for its software products and reported an

encouraging pipeline for new business prospects in 2006.

Camwood has continued to enjoy improved trading conditions, which has resulted

in increased profitability and a significant upward movement in its valuation.

On the negative side, Broadreach Networks went into administration in the final

quarter of 2005 and the valuation was reduced accordingly.

During December 2005, Blue Curve agreed terms for a takeover by Mondas plc for

an initial consideration of �925,000 with up to �2.1 million to follow from a

revenue based earn-out. The transaction was share based and recent falls in the

Mondas share price have resulted in a provision against the previous valuation

of Blue Curve. However, the enlarged business has had recent contract successes

and early indications suggest that Mondas' increased product offerings have

appealed to their enlarged customer base.

Matrix Private Equity Partners Limited

The past six months has seen three companies added to the MPEP portfolio, all

of which were Management Buy Outs ("MBOs"). TriVest invested �1 million in

October 2005 to support the MBO of Youngman Group, a leading manufacturer of

ladders and access towers. This was followed by two further investments in

January 2006; first �215,914 was invested in Vectair Holdings, a

Basingstoke-based producer of air-care and sanitary products used primarily in

office and commercial washrooms, and secondly �334,880 was invested in Campden

Media, a London-based publisher of magazines and yearbooks and arranger of

conferences aimed at the healthcare and private wealth management markets.

Overall the portfolio has again performed well, with particularly strong profit

growth being shown by Image Source, Original Additions and Secure Mail

Services, the last of which has consolidated the turnaround in its trading seen

over the previous year. During the period, BG Consulting Group carried out a

reconstruction as a result of which TriVest now also holds an equity stake and

loan stock in Duncary 4; the valuation of TriVest's interest has remained

largely unchanged. Disappointingly, since the period end, The Hunter Rubber

Company was placed in administration after incurring continuing losses despite

rapid expansion and diversification. Other investments have shown solid

progress and the portfolio continued to generate yield from MPEP's geared

investment structuring.

The MPEP portfolio now comprises 19 investments, over three quarters of which

are MBOs. The value of the portfolio has increased by a further �1.2 million

over cost since the year end and now stands at just under �18 million, or 167%

of current cost (31 March 2005: 166%).

Nova Capital Management Limited

There are four investments in the portfolio as at 31 March 2006. No investments

were made into any new companies in the period under review. The emphasis of

Nova's work has been on value improvement within the existing financial

resources of each company unless there is clear evidence that new investment

will make a significant difference.

Tikit, an AIM quoted company, specialising in providing consultancy services

and software solutions to law firms, had a small decline in its market value

over the last six months, while it consolidated its operations from the

acquisition of three smaller companies but we remain optimistic about its long

term prospects.

IDOX, an AIM quoted company providing knowledge management software and

solutions to the public sector had an increase of 18% in its share price over

the period.

Biomer is a company concerned with the development of novel polymers for

product applications in cardiovascular and other interventional medical

devices. Development work with a leading American medical devices corporation

appears to be making good progress.

NexxtDrive is developing technology which will increase fuel efficiency and

performance of conventional and hybrid vehicles. During the period TriVest made

a further investment of �100,000 in NexxtDrive as part of a �550,000 funding

round. At the period end, TriVest's total holding was valued at �512,500 which

includes �325,000 of convertible loan notes. NexxtDrive is considering an IPO

on the AIM market.

Unaudited Profit and Loss Account

for the six months ended 31 March 2006

Six months to 31 March 2006

(unaudited)

Revenue Capital Total

� � �

Unrealised (losses)/gains on - (893,173) (893,173)

investments

(Losses)/gains on realisation of - (1,498) (1,498)

investments

Cost of investment transactions - (17,524) (17,524)

Income 596,717 - 596,717

Investment management fees (119,952) (359,854) (479,806)

Other expenses (216,430) - (216,430)

---------- ---------- ----------

Profit/(loss) before income tax 260,335 (1,272,049) (1,011,714)

Tax on ordinary activities (61,175) 61,175 -

---------- ---------- ----------

Profit/(loss) for the financial 199,160 (1,210,874) (1,011,714)

period

---------- ---------- ----------

Earnings per share (2.50)p

Six months to 31 March 2005

(Unaudited and restated)

Revenue Capital Total

� � �

Unrealised (losses)/gains on - 9,306,029 9,306,029

investments

(Losses)/gains on realisation of - 355,867 355,867

investments

Cost of investment transactions - - -

Income 553,515 - 553,515

Investment management fees (87,446) (262,337) (349,783)

Other expenses (305,892) - (305,892)

---------- ---------- ----------

Profit/(loss) before income tax 160,177 9,399,559 9,559,736

Tax on ordinary activities (41,868) 41,868 -

---------- ---------- ----------

Profit/(loss) for the financial 118,309 9,441,427 9,559,736

period

---------- ---------- ----------

Earnings per share 23.25p

Year to 30 September 2005

(restated)

Revenue Capital Total

� � �

Unrealised (losses)/gains on - 16,221,200 16,221,200

investments

(Losses)/gains on realisation of - 1,080,192 1,080,192

investments

Cost of investment transactions - - -

Income 1,163,788 - 1,163,788

Investment management fees (193,717) (581,150) (774,867)

Other expenses (537,493) - (537,493)

---------- ---------- ----------

Profit/(loss) before income tax 432,578 16,720,242 17,152,820

Tax on ordinary activities (106,870) 106,047 (823)

---------- ---------- ----------

Profit/(loss) for the financial 325,708 16,826,289 17,151,997

period

---------- ---------- ----------

Earnings per share 42.05p

Unaudited Note of Historical Cost Profits and Losses

For the six months ended 31 March 2006

Six months Six months Year to 30

to to September

31 March 31 March 2005

2006 2005

(restated) (restated)

� � �

(Loss)/profit on ordinary activities (1,011,714) 9,559,736 17,152,820

before taxation

Add/(less) unrealised losses/(gains) on 893,173 (9,306,029) (16,221,200)

investments

(Less)/add realisation of revaluation (4,417,530) 130,616 350,156

(losses)/gains of previous

Years

---------- ---------- ----------

Historical cost (loss)/profit on (4,536,071) 384,323 1,281,776

ordinary activities before taxation

---------- ---------- ----------

Historical cost (loss)/profit on (5,779,578) (129,868) 767,585

ordinary activities after taxation

and dividends

---------- ---------- ----------

Unaudited Balance Sheet

as at 31 March 2006

31 March 31 March 30 September

2006 2005 2005

(unaudited) (unaudited (restated)

and restated)

� � �

Non current assets

Investments at fair 39,574,724 30,949,359 38,740,570

value

---------- ---------- ----------

39,574,724 30,949,359 38,740,570

Current assets

Debtors and prepayments 1,235,863 420,799 1,386,381

Current asset 5,601,089 9,716,441 6,345,873

investments

Cash at bank 48,838 1,329,476 2,926,233

---------- ---------- ----------

6,885,790 11,466,716 10,658,487

Creditors: amounts (95,030) (314,252) (194,338)

falling due

within one year

---------- ---------- ----------

Net current assets 6,790,760 11,152,464 10,464,149

---------- ---------- ----------

Net assets 46,365,484 42,101,823 49,204,719

---------- ---------- ----------

Capital and reserves

Called up share capital 396,099 407,347 401,574

Share premium account 60,973 - -

Capital redemption 22,441 10,668 16,441

reserve

Special reserve 26,756,241 38,388,923 32,229,428

Revaluation reserve 16,140,070 5,920,082 12,615,713

Profit and loss account 2,989,660 (2,625,197) 3,941,563

---------- ---------- ----------

Equity shareholders' 46,365,484 42,101,823 49,204,719

funds

---------- ---------- ----------

Net asset value per 117.06p 103.36p 122.53p

share

Unauditied Summarised Cash flow Statement

For the six months ended 31 March 2006

Six months Six months Year to

to to 30

31 March 31 March September

2006 2005 2005

(unaudited) (unaudited)

� � �

Operating activities

Net revenue on activities before taxation 260,335 160,177 432,578

Interest receivable converted into an - (36,506) (36,506)

investment

Capitalised fees (359,854) (262,337) (581,150)

Transaction costs (17,524) - -

(Increase)/decrease in debtors (115,721) 81,008 54,464

(Decrease)/increase in creditors (99,308) 51,772 35,522

---------- ---------- ----------

Net cash outflow from operating (332,072) (5,886) (95,092)

activities

Equity dividends paid (1,243,507) (514,191) (514,191)

Taxation paid - - (25,279)

Acquisitions of investments (1,492,138) (1,778,732) (3,660,979)

Disposals of investments 29,552 1,094,310 2,885,804

Management of liquid resources 744,784 (1,789,500) 581,068

Financing (584,014) (309,744) (878,317)

---------- ---------- ----------

Decrease in cash for the period (2,877,395) (3,303,743) (1,706,986)

---------- ---------- ----------

Reconciliation of net cash flow to

movement in net debt

Decrease in cash for the period (2,877,395) (3,303,743) (1,706,986)

Net funds at the start of the period 2,926,233 4,633,219 4,633,219

---------- ---------- ----------

Net funds at the end of the period 48,838 1,329,476 2,926,233

---------- ---------- ----------

Unaudited reconciliation of Movements in Shareholders' Funds

for the six months ended 31 March 2006

Six months Year to

Six months to 30 September

to 31 March 2005

31 March 2006 (restated)

2006 (restated)

� � �

Opening shareholders' funds 49,386,890 33,031,728 33,031,728

Restated for the application of new (182,171) 413,502 413,502

accounting policies

---------- ---------- ----------

As at 1 October 2005 (restated) 49,204,719 33,445,230 33,445,230

Net share capital (bought back)/ (584,014) (388,952) (878,317)

subscribed for in the year

(Loss)/profit for the period (1,011,714) 9,559,736 17,151,997

Dividends paid in period (1,243,507) (514,191) (514,191)

---------- ---------- ----------

Closing Shareholders' Funds 46,365,484 42,101,823 49,204,719

---------- ---------- ----------

NOTES

1. The accounts have been prepared under the historical cost convention,

modified to include the revaluation of investments, and in accordance with

the Companies Act 1985 and applicable accounting standards in the United

Kingdom.

2. Changes in Accounting Policies

With effect from 1 October 2005, the Company has adopted the following

Financial Reporting Standards (FRS):

FRS 21 (Events after the Balance Sheet Date) - Dividends paid by the Company

are accounted for in the period in which the Company is liable to pay them.

Previously, the Company accrued dividends in the period in which the net

revenue, to which those dividends related, was accounted for.

FRS 25 (Financial Instruments: Disclosure and Presentation) and FRS 26

(Financial Instruments: Measurement) - The Company has designated its

investment assets as being measured at "fair value through profit and loss".

The fair value of quoted investments is deemed to be the bid value of these

investments at the close of business on 31 March 2006.

3. In accordance with the policy statement published under "Management and

Administration" in the Company's prospectus dated 13 October 2000, the

Directors have charged 75% of the investment management expenses to the

capital reserve.

4. All revenue and capital items in the above Profit and Loss account derive

from continuing operations

5. Earnings for the six months to 31 March 2006 should not be taken as a guide

to the results for the full year.

6. Earnings and return per share

Six months Six months Year to

ended ended 30 September

31 March 2006 31 March 2005 2005

Total earning after taxation: �(1,011,714) �9,559,736 �17,151,997

Basic earnings per share (2.50)p 23.25p 42.05p

----------------------------------------------------- ---------- ---------- ----------

Net revenue from ordinary activities before taxation �260,335 �160,177 �432,578

Revenue return per share 0.64p 0.38p 1.06p

----------------------------------------------------- ---------- ---------- ----------

Net realised capital losses �(1,498) �355,867 �1,080,192

Net unrealised capital losses �(893,173) �9,306,029 �16,221,200

Capital income - - -

Capital expenses �(377,378) �(262,337) (581,150)

----------------------------------------------------- ---------- ---------- ----------

Total capital return �(1,272,049) �9,399,559 �16,720,242

Capital return per share (3.14)p 22.87p 40.99p

----------------------------------------------------- ---------- ---------- ----------

Weighted average number of shares in issue in

the period 40,522,780 41,109,734 40,786,094

7. The financial information for the six months ended 31 March 2006 and the

six months ended 31 March 2005 has not been audited. The information for

the year ended 30 September 2005 does not comprise full financial

statements within the meaning of Section 240 of the Companies Act 1985. The

financial statements for the year ended 30 September 2005 have been filed

with the Registrar of Companies. The auditors have reported on these

financial statements and that report was unqualified and did not contain a

statement under Section 237(2) of the Companies Act 1985.

8. Copies of the Interim Report to Shareholders for the six months ended 31

March 2006 will be sent to all Shareholders shortly. Further copies will be

available free of charge from the Company's registered office, One Jermyn

Street, London SW1Y 4UH.

END

END

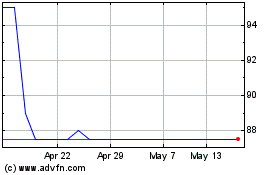

Touchstar (LSE:TST)

Historical Stock Chart

From Jun 2024 to Jul 2024

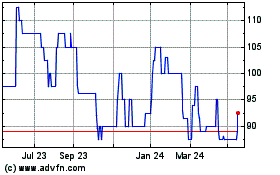

Touchstar (LSE:TST)

Historical Stock Chart

From Jul 2023 to Jul 2024