Tatton Asset Management PLC Trading Statement (2654W)

April 16 2019 - 2:00AM

UK Regulatory

TIDMTAM

RNS Number : 2654W

Tatton Asset Management PLC

16 April 2019

16 April 2019

Tatton Asset Management plc (the 'Group')

Trading Statement for 12 months ending 31 March 2019

Tatton Asset Management plc (AIM: TAM), the on-platform

discretionary fund management (DFM) and IFA support services

business, is today providing an unaudited update for the 12 months

ended 31 March 2019.

The Group has continued to grow revenue and adjusted operating

profits* against the backdrop of a complex and challenging market

environment and expects to report revenue and operating profits

within the range of analyst estimates.

Highlights

Tatton Investment Management sustained a strong performance in

to the second half of the year. The year ended with assets under

management (AUM) of GBP6.1 billion at 31 March 2019 (31 March 2018:

GBP4.9 billion, 30 September 2018; GBP5.7 billion), an increase of

GBP1.2 billion or 24.5% for the financial year and GBP0.4 billion

or 7.0% for the last six-month period.

Net inflows were GBP1.1 billion over the last 12 months, an

average of GBP92.5 million per month and GBP0.5 billion for the

last six months, an average of GBP87.1 million per month.

Paradigm Mortgage Services continues to grow well, outperforming

the growth of the mortgage market and continuing to gain market

share. Member firms increased to 1,393 at 31 March 2019 (31 March

2018: 1,219), a 14.3% increase year-on-year. Paradigm Consulting

increased its member firms to 390 (31 March 2018: 368) but has seen

downward pressure on revenue from consultancy services and the

impact of reduced flows on the Paradigm wrap platform.

Tatton Asset Management expects to report its results for the

year ending 31 March 2019 on Monday, 3 June 2019.

Paul Hogarth, Founder and CEO of Tatton Asset Management plc,

said:

"I am very pleased with the performance of Tatton Investment

Management which continues to increase AUM and attract net inflows

in difficult markets. The sustained growth in AUM and new firms

using Tatton is confirmation that the service and proposition

continue to resonate with IFAs and their clients by delivering

consistent investment returns at a competitive market price.

"To the extent we are pleased with the Mortgage services

performance we are disappointed with the lack of growth of Paradigm

Consulting though it remains an important component of the Group's

strategic makeup. The Group remains well positioned to achieve

continued growth and deliver against its stated strategy."

*Adjusted for exceptional charges and share based payments

Enquiries:

Tatton Asset Management plc

Paul Hogarth (Chief Executive Officer) +44 (0) 161 486 3441

Paul Edwards (Chief Financial Officer) +44 (0) 161 486 3441

Lothar Mentel (Chief Investment Officer) +44 (0) 161 486

3441

Zeus Capital - Nomad and Broker

Martin Green (Corporate Finance) +44 (0) 20 3829 5000

Pippa Hamnett (Corporate Finance) +44 (0) 20 3829 5000

Dan Bate (Corporate Finance and QE) +44 (0) 20 3829 5000

Media Enquiries

Roddi Vaughan-Thomas +44 (0) 20 7190 2952

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTGMGMDNKFGLZM

(END) Dow Jones Newswires

April 16, 2019 02:00 ET (06:00 GMT)

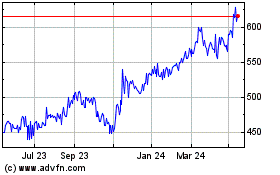

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jun 2024 to Jul 2024

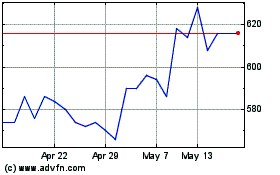

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jul 2023 to Jul 2024