TIDMTAM

RNS Number : 7739D

Titanium Asset Management Corp

01 May 2013

Titanium Asset Management Corp.

Reports 2013 First Quarter Results

Milwaukee, WI, May 1, 2013 - Titanium Asset Management Corp.

(AIM - TAM) today reported results for the first quarter ended

March 31, 2013.

Highlights are as follows:

-- Assets under management (AUM) increased 1.3% during the first

quarter of 2013 to $8,966.8 million reflecting both net inflows and

positive market returns.

-- Average AUM of $8,910.7 million for the first quarter of 2013

were 5.4% higher relative to the average AUM of $8,452.3 million

for the same period last year. Investment management fee revenues

were $5,883,000 for the first quarter of 2013, an 11.9% increase

from investment management fee revenues of $5,259,000 for the same

period last year, primarily due to the higher average AUM levels

and a higher average fee rate.

-- Adjusted EBITDA(1) continued to improve during the first

quarter of 2013. Adjusted EBITDA was $652,000 for the first quarter

of 2013, compared to Adjusted EBITDA of $264,000 for the same

period last year. The improvement primarily reflects the increased

investment management fee revenues.

-- Net investment income of $119,000 for the first quarter of

2013 compared to net investment income of $236,000 for the same

period last year.

-- Net income of $491,000, or $0.02 per diluted common share,

for the first quarter of 2013 compared to a net loss of $1,932,000,

or $0.09 per diluted common share, for the first quarter of

2012.

(1) See the table below for a definition of Adjusted EBITDA, a

non-GAAP financial measure. The table provides a description of

this non-GAAP financial measure and a reconciliation to the most

directly comparable GAAP measure.

For further information please contact:

Titanium Asset Management Corp.

Robert Brooks, Chairman 312-335-8300

Titanium Asset Management Corp.

Brian Gevry, Chief Executive Officer 216-771-3450

Cantor Fitzgerald Europe

David Foreman / Rishi Zaveri +44 20 7894 7000

Forward-looking Statements

Statements in this press release which are not historical facts

may be "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements

are subject to a number of assumptions, risks, and uncertainties,

many of which are beyond our control.

Any forward-looking statements made in this press release speak

as of the date made and are not guarantees of future performance.

Actual results or developments may differ materially from the

expectations expressed or implied in the forward-looking

statements, and we undertake no obligation to update any such

statements. Results may differ significantly due to market

fluctuations that alter our assets under management; a further

decline in our distributed assets; termination of investment

advisory agreements; impairment of goodwill and other intangible

assets; our inability to compete; market pressure on investment

advisory fees; ineffective management of risk; changes in interest

rates, equity prices, liquidity of global markets and international

and regional political conditions; or actions taken by TAMCO

Holdings, LLC, as our significant stockholder. Additional factors

that could influence our financial results are included in our

Securities and Exchange Commission filings, including our Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K.

Our Quarterly Report on Form 10-Q for the quarter ended March

31, 2013, is expected to be filed with the Securities and Exchange

Commission on or about May 3, 2013. The report will be available on

the SEC's website at www.sec.gov and on our website at

www.ti-am.com.

Assets Under Management

Assets under management of $9.0 billion at March 31, 2013 were

1% higher than the $8.9 billion reported at December 31, 2012 due

to net inflows and positive investment returns. The following table

presents summary activity for 2013 and 2012 periods.

Three Months Ended

March 31,

--------------------------

(in millions) 2013 2012

------------ ------------

Annual Activity:

Beginning balance $ 8,854.6 $ 8,316.8

Inflows 432.1 496.0

Outflows (397.3) (382.6)

------------ ------------

Net flows 34.8 113.4

------------ ------------

Market value change 77.4 157.6

------------ ------------

Ending balance $ 8,966.8 $ 8,587.8

============ ============

Average Assets Under Management (1) $ 8,910.7 $ 8,452.3

Average Fee Rate (basis points) 26.4 24.9

(1) Average assets under management are calculated based on the quarter end balances.

The principle factors affecting our net flows during the periods

ended March 31, 2013 and 2012 include the following:

-- Multiemployer pension and welfare plans represent

approximately 38% of our client base, and these plans have been

faced with a challenging economic environment over the last several

years. The current economic environment has generally led to

reduced employer contributions and increased withdrawals. For the

three months ended March 31, 2013, net inflows from multiemployer

pension and welfare plans were approximately $13 million compared

to net inflows of approximately $112 million for the prior year

period.

-- Inflows and outflows are also significantly affected by the

timing of tax receipts and disbursements for several public entity

accounts that we manage. Net inflows related to these accounts were

$41 million for the three months ended March 31, 2013 compared to

net inflows of $62 million for the prior year period. While these

flows can fluctuate significantly from period to period, they do

not have a significant impact on our overall fees due to low or

fixed fee rates.

Market value changes reflect our investment performance. Fixed

income assets comprised approximately 89% of our total assets under

management at March 31, 2013. The overall market value change

related to fixed income assets was approximately $20.5 million, or

0.3%, for the three months ended March 31, 2013 ($93.5 million, or

1.3% for the comparable 2012 period). Fixed income returns as

measured by the Barclay's Aggregate Index were -0.1% for the three

months ended March 31, 2013 (0.3% for the comparable 2012 period).

For the twelve months ended March 31, 2013, approximately 93% of

our fixed income assets with defined performance benchmarks

outperformed their respective benchmarks.

Equity assets comprised approximately 7% of our total assets

under management at March 31, 2013. The overall market value change

related to equity assets was approximately $59.5 million, or 9.8%,

for the three months ended March 31, 2013 ($64.0 million, or 10.3%

for the comparable 2012 period). Equity returns as measured by the

S&P 500 Index were up 10.6% for the three months ended March

31, 2013 (compared to an increase of 12.6% for the comparable 2012

period). Approximately 15% of our equity assets outperformed their

respective benchmarks for the twelve months ended March 31,

2013.

The following table presents summary breakdowns for our assets

under management at March 31, 2013 and December 31, 2012.

(in millions) March 31, % of December % of

total 31, 2012 total

2013

------------ ------- ------------ -------

By investment strategy:

Fixed income $ 7,983.0 89% $ 7,914.9 89%

Equity 647.6 7% 595.6 7%

Real estate 336.2 4% 344.1 4%

------------ ------- ------------ -------

Total $ 8,966.8 100% $ 8,854.6 100%

============ ======= ============ =======

By client type:

Institutional $ 7,938.0 89% $ 7,748.7 88%

Retail 1,028.8 11% 1,105.9 12%

------------ ------- ------------ -------

Total $ 8,966.8 100% $ 8,854.6 100%

============ ======= ============ =======

By investment vehicle:

Separate accounts $ 8,103.4 90% $ 8,009.1 90%

Private funds 863.4 10% 845.5 10%

------------ ------- ------------ -------

Total $ 8,966.8 100% $ 8,854.6 100%

============ ======= ============ =======

Our mix of assets under management by investment strategy was

unchanged as fixed income assets comprised 89% of total assets

under management at March 31, 2013 and December 31, 2012.

Our mix of assets under management by client type was relatively

unchanged as institutional accounts comprised 89% of total assets

under management at March 31, 2013 compared to 88% at December 31,

2012.

Our mix of assets under management by investment vehicle was

unchanged as separate accounts comprised 90% of total assets under

management at March 31, 2013 and December 31, 2012.

Operating Results

Three Months Ended

March 31,

----------------------------

2013 2012

------------- -------------

Average assets under management (in millions) $ 8,910.7 $ 8,452.3

Average fee rate (basis points) 26.4 24.9

Investment management fees $ 5,883,000 $ 5,259,000

Incentive fees 32,000 -

Referral fees - 125,000

------------- -------------

Total operating revenue 5,915,000 5,384,000

Adjusted EBITDA(1) 652,000 264,000

Amortization of intangible assets 243,000 2,401,000

Operating income (loss) 372,000 (2,168,000)

Net investment income 119,000 236,000

Net income (loss) 491,000 (1,932,000)

Earnings (loss) per share:

Basic and diluted $ 0.02 $ (0.09)

(1) See the table below for a definition of Adjusted EBITDA, a

non-GAAP financial measure. The table provides a description of

this non-GAAP financial measure and a reconciliation to the most

directly comparable GAAP measure.

For the three month period, our investment management fees

increased by $624,000, or 12%, due to a 5% increase in our average

assets under management and a 6% increase in our average fee

rate.

We also receive incentive fees on an annual basis from the

management of certain of our private funds, including one that

invests in preferred stocks. Because investment returns on

preferred stocks can be volatile, the level of incentive fees

earned can vary significantly from year to year. These fees

generally are based on a calendar year performance period and we

recognize the fees at the conclusion of the performance period. In

2012, we earned incentive fees of $1,165,000, which were recognized

in December 2012. Based on performance through March 31, 2013, we

would have earned incentive fees of approximately $350,000 (of

which $32,000 was recognized due to withdrawals). Because these

fees are primarily earned on a calendar year performance, the

results for the first three months are not necessarily indicative

of the fees to be expected for the full year.

Our Adjusted EBITDA for the three months ended March 31, 2013

was $652,000, an increase of $388,000, over the comparable amount

for the 2012 period. The improvement to Adjusted EBITDA primarily

reflects the increases in investment management fees.

Amortization of intangible assets

Amortization of intangible assets decreased by $2,158,000 for

the three months ended March 31, 2013. The reduction reflects the

elimination of amortization expense related to the NIS referral

relationship intangible asset in 2013 as the asset was fully

amortized as of December 31, 2012.

Titanium Asset Management Corp.

Condensed Consolidated Balance Sheets

March 31, December

31, 2012

2013

-------------- --------------

(unaudited)

Assets

Current assets

Cash and cash equivalents $ 5,222,000 $ 3,092,000

Investments 4,298,000 5,644,000

Accounts receivable 3,982,000 5,015,000

Other current assets 678,000 854,000

-------------- --------------

Total current assets 14,180,000 14,605,000

Investment in equity investee 4,067,000 3,970,000

Property and equipment, net 466,000 483,000

Goodwill 13,264,000 13,264,000

Intangible assets, net 5,066,000 5,309,000

Total assets $ 37,043,000 $ 37,631,000

============== ==============

Liabilities and Stockholders' Equity

Current liabilities

Accounts payable $ 107,000 $ 166,000

Other current liabilities 1,982,000 2,246,000

-------------- --------------

Total current liabilities and total liabilities 2,089,000 2,412,000

Commitments and contingencies

Stockholders' equity

Common stock, $0.0001 par value; 54,000,000

shares authorized; 19,744,824 shares issued

and outstanding at March 31, 2013 and 20,634,232

issued and outstanding at December 31, 2012 2,000 2,000

Restricted common stock, $0.0001 par value;

720,000 shares authorized; none issued - -

Preferred stock, $0.0001 par value; 1,000,000

shares authorized; none issued - -

Additional paid-in capital 100,227,000 100,971,000

Accumulated deficit (65,220,000) (65,711,000)

Other comprehensive loss (55,000) (43,000)

Total stockholders' equity 34,954,000 35,219,000

-------------- --------------

Total liabilities and stockholders' equity $ 37,043,000 $ 37,631,000

============== ==============

Titanium Asset Management Corp.

Condensed Consolidated Statements of Operations

(unaudited)

Three Months Ended

March 31,

-------------------------------

2013 2012

------------- ----------------

Operating revenues $ 5,915,000 $ 5,384,000

Operating expenses:

Administrative 5,300,000 5,151,000

Amortization of intangible assets 243,000 2,401,000

Total operating expenses 5,543,000 7,552,000

Operating income (loss) 372,000 (2,168,000)

Other income

Interest income 1,000 17,000

Net realized gains (losses) on investments 21,000 (1,000)

Income (loss) from equity investees 97,000 220,000

Income (loss) before income taxes 491,000 (1,932,000)

Income tax benefit - -

Net income (loss) $ 491,000 $ (1,932,000)

============= ================

Earnings (loss) per share

Basic $ 0.02 $ (0.09)

Diluted $ 0.02 $ (0.09)

Weighted average number of common shares outstanding:

Basic 20,114,578 20,634,232

Diluted 20,114,578 20,634,232

Titanium Asset Management Corp.

Condensed Consolidated Statements of Cash Flows

(unaudited)

Three Months Ended

March 31,

------------------------------

2013 2012

------------- ---------------

Cash flows from operating activities

Net income (loss) $ 491,000 $ (1,932,000)

Adjustments to reconcile net loss to net cash

used in operating activities:

Amortization of intangible assets 243,000 2,401,000

Depreciation 37,000 31,000

Net realized losses (gains) on investments (21,000) 1,000

Income from equity investees (97,000) (220,000)

Income distributions from equity investees - 92,000

Changes in assets and liabilities:

Decrease in accounts receivable 1,033,000 141,000

Decrease in other current assets 176,000 316,000

Increase (decrease) in accounts payable (59,000) 123,000

Decrease in other current liabilities (264,000) (204,000)

------------- ---------------

Net cash provided by operating activities 1,539,000 749,000

Cash flows from investing activities

Purchases of investments (1,100,000) (1,374,000)

Sales and redemptions of investments 2,455,000 661,000

Purchases of property and equipment (20,000) (34,000)

------------- ---------------

Net cash provided by (used in) investing activities 1,335,000 (747,000)

Cash flows from financing activities

Repurchase of common stock (744,000) -

------------- ---------------

Net cash used for financing activities (744,000) -

Net increase in cash and cash equivalents 2,130,000 2,000

Cash and cash equivalents:

Beginning 3,092,000 2,787,000

------------- ---------------

Ending $ 5,222,000 $ 2,789,000

============= ===============

Titanium Asset Management Corp.

Reconciliation of Adjusted EBITDA

(unaudited)

Three months ended

March 31,

------------------------------

2013 2012

------------ ----------------

Operating income (loss) $ 372,000 $ (2,168,000)

Amortization of intangible assets 243,000 2,401,000

Depreciation expense 37,000 31,000

Adjusted EBITDA $ 652,000 $ 264,000

============ ================

Notes:

(1) Adjusted EBITDA is defined as operating income or loss

before non-cash charges for amortization and impairment of

intangible assets and goodwill, depreciation, and share-based

compensation expense. We believe Adjusted EBITDA is useful as an

indicator of our ongoing performance and our ability to service

debt, make new investments, and meet working capital obligations.

Adjusted EBITDA as we calculate it may not be consistent with

computations made by other companies. We believe that many

investors use this information when analyzing the operating

performance, liquidity, and financial position of companies in the

investment management industry.

This information is provided by RNS

The company news service from the London Stock Exchange

END

QRFNKDDBNBKDKPK

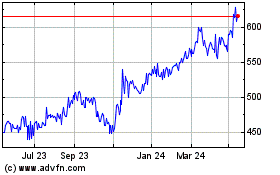

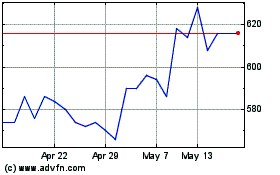

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jul 2023 to Jul 2024