TIDMSHI

RNS Number : 9420Z

SIG PLC

24 September 2020

24 September 2020

SIG plc

Results for the six months ended 30 June 2020

Successful recapitalisation provides foundation for new growth

strategy

SIG plc ("SIG", "the Group" or "the Company") is a leading

supplier of specialist building solutions to trade customers across

Europe, with strong positions in its core markets as a market

leading supplier of insulation and interiors solutions to the

construction industry, and a specialist merchant of roofing

materials for small to medium sized construction businesses. The

Group today announces its half year results for the six months

ended 30 June 2020 ("H1 2020" or "the period").

Strategic and operational highlights

-- New leadership team appointed

-- Successful restructuring of the Group's financing facilities

and capital raise of GBP165m, concluded in July, including GBP83m

equity investment by Clayton, Dubilier & Rice LLC

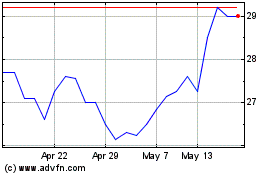

-- Post capital raise, substantial liquidity headroom provides

security against ongoing market uncertainty and confidence to

invest in new growth strategy, with a net cash position at 31

August of GBP29m, pre IFRS 16

-- Branch and customer-centric restructuring in the UK

progressing to plan; Germany and Benelux also refocusing under new

combined team

-- The Group has been able to trade safely, working closely and

flexibly with our employees, customers and suppliers to adapt to

new Covid-19 norms

Financial results

-- Like-for-like H1 sales down 23.9% on prior year, impacted by Covid -19

-- Gross margin down 50bps due to lower volumes. Group

underlying operating loss of GBP43.2m (H1 2019: GBP29.1m

profit)

-- Underlying LBT of GBP53.7m (H1 2019: GBP17.4m profit) and

underlying loss per share of 9.1p (H1 2019: 2.1p earning per

share)

-- Statutory loss before tax from continuing operations of

GBP125.4m (H1 2019: profit before tax of GBP2.2m) reflecting

GBP71.7m of Other items, including GBP42.8m of impairment of

goodwill in the UK businesses, mainly reflecting the impact of

Covid-19

-- Net debt, pre IFRS 16, down to GBP90.0m (H1 2019: GBP158.2m),

helped by sale of Air Handling division in January

Current trading and outlook

-- Market fundamentals remain sound and near-term order books

give an element of encouragement, but there remains significant

economic uncertainty

-- Trading following initial estimates of immediate H1 Covid-19

impact was better than anticipated, and the Board now expects full

year sales to be moderately higher than guided in May

-- H2 expected to remain loss-making, but at a lower rate than H1

-- Net cash outflow expected in H2 due to unwind of tax

deferrals (government supported Covid-19 schemes) and cessation of

some historical year-end and half-year working capital

practices

Underlying operations(1) H1 2020 H1 2019 Change

------------ ------------ -----------

Revenue GBP817.7m GBP1,071.5m (23.7)%

LFL (2) sales (23.9)% (3.8)% n/a

Gross margin 24.8% 25.3% (50)bps

Underlying(3) operating

(loss)/profit (GBP43.2m) GBP29.1m (GBP72.3m)

Underlying(3) (loss)/profit

before tax (GBP53.7m) GBP17.4m (GBP71.1m)

Underlying(3) (loss)/earnings

per share (9.1p) 2.1p (11.2p)

Operating margin (5.3)% 2.7% (800)bps

Net debt GBP341.8m GBP449.0m 23.9%

Net debt (pre IFRS 16) GBP90.0m GBP158.2m 43.1%

------------ -----------

Statutory results H1 2020 H1 2019

------------------------------- ------------ ------------

Revenue(4) GBP840.1m GBP1,113.3m

Operating (loss)/profit(4) (GBP102.9m) GBP14.2m

(Loss)/profit before tax(4) (GBP125.4m) GBP2.2m

Basic (loss)/earnings

per share(4) (9.1p) 0.2p

Total (loss)/profit after

tax (5) (GBP53.8m) GBP1.3m

Dividend per share - 1.25p

------------------------------- ------------ ------------

1. Underlying operations excludes businesses divested or closed,

or which the Board has resolved to divest or close by 23 September

2020.

2. Like-for-like (LFL) is defined as sales per working day in

constant currency excluding acquisitions and disposals completed or

agreed in the prior year, or before announcement of the Group's

results for the relevant period. Sales are not adjusted for branch

openings or closures. LFL sales differ from the previous trading

statement primarily as a result of the reclassification of non-core

businesses.

3. Underlying represents the results before Other items. Other

items relate to the amortisation of acquired intangibles,

impairment charges, profits and losses on agreed sale or closure of

non-core businesses and associated impairment charges, net

operating profits and losses attributable to businesses identified

as non-core, net restructuring costs, investment in omnichannel

retailing, other specific items, fair value gains and losses on

derivative financial instruments, the taxation effect of Other

items and the effect of changes in taxation rates. Other items have

been disclosed separately in order to give an indication of the

underlying earnings of the Group.

4. Statutory results of Continuing operations only.

5. Statutory results including both Continuing and Discontinued

operations.

Commenting, Steve Francis, Chief Executive Officer, said:

"I would like to thank all our people for their resilience and

commitment in the face of the very challenging circumstances of

recent months, the effects of which clearly impacted our first half

results. Providing a safe environment and instilling an even

greater focus on good health and safety behaviours have been a

major focus of the new management team.

"In mid-summer, we concluded the successful restructure of our

financing facilities and a GBP165m capital raise. These, along with

our careful management of working capital and cash in recent

months, have created a sound financial base on which we can rebuild

the business.

"The new management team has started to execute its strategy and

implement its organisational model, which focuses on our local

branch teams, enabling growth and returning to active industry

leadership. As previously stated, the essence of our new strategy

is re-connection with our people - employees, customers, suppliers

and the communities in which we do business. We are a local, sales

and service-driven business. We firmly believe that our new

strategy for growth will provide the basis, not only for the

restoration of profit and strong cash conversion, but also serve as

a foundation to play a leading role in our industry in the years to

come.

"Long term fundamentals remain sound in the Group's markets

across Europe. In the short term, significant economic uncertainty

remains in all of our markets, although government stimulus for the

construction sector, notably in the UK, is welcome.

"Trading was better than anticipated during the peak lockdown

months of March to May, compared to our initial estimates of the

possible Covid-19 impact, and the Board now expects full year sales

to be moderately higher than guided in May. Group sales in July and

August were encouraging although down year on year, and market

share losses during 2019, particularly in the UK distribution

business, will take time to recover. The second half of 2020 is

expected to remain loss making, but at a lower rate than the first

despite some increased pressure on gross margin in the UK.

"I am extremely encouraged by the energy and excitement with

which our people have embraced the new strategy and by the initial

progress made in a short space of time.

"The Group demonstrated agility and resilience in the first half

of the year, dealing with an unprecedented external challenge, and

significant internal change and activity. Coupled with a

strengthened balance sheet, the foundations are now in place for

the business to grow."

Investor and Analyst presentation (9am today)

A webcast of the Group's briefing for analysts and investors

will take place today at 9am, a recording of which will also be

available later in the day on the investor page of the company's

website, www.sigplc.com .

Please click this URL to join.

https://storm-virtual-uk.zoom.us/j/81232011672

Or join by phone:

United Kingdom: +44 203 481 5240 / +44 203 901 7895 / +44 131

460 1196 / +44 203 051 2874 / +44 203 481 5237

Webinar ID: 812 3201 1672

International numbers available:

https://storm-virtual-uk.zoom.us/u/kbsO8Tkr7C

LEI: 213800VDC1BKJEZ8PV53

Enquiries

SIG plc

Steve Francis, Chief Executive Officer +44 (0) 114 285 6300

Ian Ashton, Chief Financial Officer +44 (0) 114 285 6300

Jefferies International Limited -

Joint Broker

Ed Matthews / Will Soutar +44 (0) 20 7029 8000

Peel Hunt LLP - Joint Broker

Charles Batten / Nicholas How +44 (0) 20 7418 8900

FTI Consulting

Richard Mountain / Susanne Yule +44 ( 0) 20 3727 1340

OPERATIONAL REVIEW

The first half has been a transformational period for the Group.

In order to return to profitable growth and win back market share,

a new management team has been appointed to develop a new,

customer-centric strategy that reprioritises sales and

re-establishes SIG's traditional strengths of being an experienced,

technically strong and service-focused local sales business. In

July, the Group concluded the successful renegotiation of its debt

arrangements and capital raise. These actions, along with careful

management of working capital and cash in recent months, have

created a sound financial base on which to rebuild the

business.

Covid-19

We acted quickly to develop a coordinated and decisive response

to Covid-19 to support our operating companies , to ensure the

health and safety of our people, customers, suppliers and local

communities within which we operate and to minimise the adverse

impacts on our businesses. Collective actions across all central

support and operations functions at branch, regional and Group

management levels were implemented, under demanding circumstances,

in accordance with local government guidelines.

In response to the challenges posed by the pandemic, we acted

swiftly to reduce costs, optimise cash flow, protect the Group's

liquidity and, where necessary, change our ways of operation and

how we interacted with both suppliers and customers.

The furloughing of employees for a limited period, combined with

other wage saving initiatives and, where available, accessing

various government support schemes in all of its countries of

operation, enabled the Group to support its cash position in the

period. From 1 April to 30 June 2020, the Board of Directors and

the Group Executive Leadership Team took pay reductions.

Additionally, the majority of the UK and Ireland employees took

lower pay during April, the period when those businesses were,

effectively, closed.

The Board also took the decision not to declare a full year 2019

dividend.

The ability of the Group to respond effectively to the Covid-19

pandemic and to maintain its liquidity position during this

unprecedented period of extreme uncertainty reflects the

effectiveness of the mitigating actions initiated by the Board, and

the agility and resilience of the organisation, and points towards

the successful adoption of the new strategy as the Group emerges

from this period of business disruption.

H1 Trading

Overall, the Group performed better than initial internal

estimates made at the beginning of the pandemic. Nevertheless,

trading in the first half was significantly impacted by Covid-19,

particularly in March and April during the most severe lockdown

period in the majority of markets. With the easing of lockdown

restrictions in May and June, the Group saw a gradual improvement

in trading performance, accompanied by a corresponding improvement

in profitability.

January to February

The Group's underlying revenue for the two months ended 29

February 2020 was GBP296.0m, down by GBP36.9m from the prior year

(two months ended 28 February 2019: GBP332.9m), a like-for-like

decline of 11.1%. Trading in the UK and Germany saw a continuation

of the challenging trends seen in the last quarter of 2019, whilst

trading activity in the rest of Europe was relatively stable.

Due to reduced sales volumes in key markets, the gross profit

margin fell compared to the prior year period (two months ended 28

February 2019).

March to April

As announced on 29 May 2020, the Group's underlying revenue for

the two months ended 30 April 2020 was GBP235.0m, down by GBP138.8m

from the prior year (two months ended 30 April 2019: GBP373.8m).

Revenues in the period were significantly impacted by the Covid-19

outbreak, particularly in the UK, Ireland and France, with the

Group's underlying like-for-like revenues down 37.7% over the two

months.

On 30 March 2020, the Group announced that large parts of its UK

market had seen sales fall away rapidly, in common with the broader

construction industry. It was concluded that it was necessary and

appropriate to temporarily close UK operations. Trading sites in

Ireland were also temporarily closed due to restrictions

implemented by the Irish Government. The UK and Ireland businesses

remained open to service critical and emergency projects only, such

as for the NHS, energy and food sectors.

Trading activity in France was affected by the short-term

closure of all branches for three days in mid-March, which was

followed by a staged reopening throughout April. Like-for-like

revenues in France during this two-month period were down

39.0%.

The Group's operating companies in Germany, Poland and Benelux

were also impacted by government measures, albeit to a lesser

extent.

Similar to the first two months, the Group's gross profit margin

in March and April was negatively impacted by the decline in

overall sales, combined with a shift in mix away from the more

profitable roofing merchanting businesses in the UK and France.

During this period, the Group took a number of decisive cost

saving actions and also accessed government-supported job retention

schemes, resulting in a reduction in its operating costs year on

year.

May to June

The Group witnessed a gradual improvement in trading performance

throughout May and June 2020, particularly in the UK and Ireland

where branches continued to reopen during May as lockdown

restrictions were eased. The Group's underlying like-for-like sales

over May and June were down 21.7%, with May 35.7% down and June

improving to just 8.0% down on 2019.

In the UK and Ireland, average daily sales began to recover in

May, at which point all but two of the UK and Ireland sites had

reopened. This positive revenue trend continued throughout June

with combined like-for-like revenues in May and June down

40.9%.

France also demonstrated a strong recovery during May, despite

the fact that parts of the French construction market were not

fully open, reflecting the release of pent-up demand during the

lockdown period, and signalling optimism for the early summer

trading period when sales are seasonally strongest. Average daily

sales continued to improve in June.

Sales in Germany, Poland and Benelux remained stable during May,

with further improvement during June. On a combined basis,

like-for-like sales were 10.0% behind prior year over the two-month

period.

Profitability across the Group also improved materially during

May and June, albeit the Group was still loss making overall. The

improvements were driven by a combination of the improved trading

performance, particularly in the UK and Ireland, the decisive cost

actions by management, and continued governmental support.

Liquidity and balance sheet strengthening

The successful renegotiation of the Group's debt facilities in

the summer resulted in a resetting of its covenant requirements,

with consolidated net debt and liquidity covenants to be tested

monthly through to February 2022. From March 2022, covenants over

the Group's liquidity, leverage and interest cover will be tested

on a quarterly basis. Consolidated net worth will also be tested,

throughout the above periods.

The significant loss of revenues in 2020 impacted profitability,

cash generation and therefore debt levels, though the immediate and

comprehensive set of actions enacted across the business around

cash conservation, coupled with the receipt of the sale proceeds of

the Air Handling division, meant that the Group was able to

preserve its liquidity throughout the period.

In the announcement of its full year 2019 results on 29 May

2020, the Group reported that it had cash resources of GBP155.3m as

at 30 April, with a net debt position, pre IFRS 16, of GBP114.1m.

As at 30 June, the cash position had improved to GBP197.3m with net

debt, pre IFRS 16, of GBP90.0m. This improvement reflects improved

levels of profitability, a continuation of cost control actions and

utilisation of government support schemes, as well as an ongoing

rigorous, though careful, management of working capital.

In mid-July, the Group completed a successful capital raise, as

previously announced, raising gross proceeds of GBP165m (GBP153m

net of related costs). In addition, approximately GBP13m costs were

paid in relation to the debt refinancing.

As at 31 August, the Group had cash resources of GBP267.5m, with

a net cash position, pre IFRS 16, of GBP29.2m. Approximately GBP13m

of deferred payments relating to government support schemes will

unwind over the coming months, the majority doing so in H2 2020.

The settlement of these deferrals, the cessation of some historical

year-end working capital practices, as well as a carefully managed

increase in stock levels in parts of the business to improve the

service to customers and to support the Group's sales growth, will

result in working capital levels increasing over H2 . This increase

in working capital will be funded from the Group's available

resources.

Strategy update: re-connect, re-energise and re-set

On 29 May, the Group launched its new strategy for growth. The

restructuring of its debt facilities and the successful capital

raise provide firm and stable foundations for this strategy to be

delivered. Fundamental to the new strategy is the recognition that

SIG is a sales-led organisation, where the ability to grow its

customer base through the provision of high levels of customer

service and disciplined pricing are critical. The establishment of

strong customer relationships, by empowering and energising key

account and branch teams, and promoting an entrepreneurial spirit

throughout the company's extensive branch network, is key to this

objective.

With a strong executive team in position, and the strengthening

of the senior management teams across a number of areas of the

business over the past few months, particularly in the UK and

Germany, the Board is confident that the Group will deliver a

significant improvement in its operational and financial

performance over the medium term and achieve its vision of being

the leading B2B distributor of specialist construction products in

the markets in which it operates.

The implementation of the strategy is now underway. In the UK

and Germany, where the Group's operational and financial

performance has seen greater deterioration, the new strategy is

initially focusing on repairing the operational foundations of

these businesses so as to provide the appropriate platform from

which market share can be recaptured and profitable growth

restored. In France, Benelux, Poland and Ireland, where the Group's

operational and financial performance has been more stable, the new

strategy is empowering the Group's operating companies to move onto

a growth footing.

The Group's new strategy for growth is shaped around seven key

pillars which have been developed over the past few months and can

be summarised as follows:

o Sustainable behaviours: establishing a sustainable and wholly

recognisable set of behaviours across the Group's workforce so that

our people feel safe, valued and proud to be SIG employees

o Branch focus: developing our branch-based employees to create

an entrepreneurial and well-trained workforce

o Sales and customer focus: driving a sales-led culture by

strengthening sales capacity and productivity, with the key focus

being one of customer service

o Superior expertise: re-establishing specialist focus and

expertise across all customer-facing functions of the

organisation

o Closer to suppliers and markets: gaining market share through

enhanced customer proximity and service, and re-partnering with

suppliers

o High productivity: investing in consistent and highly

productive support functions, with a strong governance framework

and robust financial disciplines

o Expansive vision: recognising and building on the company's

core strengths as a platform for acquisitive growth

Through the implementation of these strategic pillars, supported

by the strengthened balance sheet and strong leadership teams

across the organisation, the Board is confident that SIG will

return to sustainable and long term profitable growth, recognising

that the primary short term focus for the Group is to recapture the

market share that it has lost over recent years.

Market share recapture plan

The Group's market share recapture plan, particularly for SIG's

UK businesses, Distribution and Exteriors, as well as for its

Germany and Benelux businesses, is built upon five key

enablers.

Merger of leadership of UK Distribution and Exteriors

The UK's Distribution and Exteriors businesses have now been

merged to create a single UK division, with a combined leadership

team replicating the model already deployed in SIG France, which

will leverage potential synergies in support functions whilst

maintaining separate commercial organisations and footprints

(primarily branches). The new regional structure of the combined

business will focus on promoting local entrepreneurship,

accountability and P&L account responsibility.

Combined Germany and Benelux businesses

A similar combined management approach to that now deployed in

the UK and France is close to finalisation across the German and

Benelux businesses. Due to their geographic positions, the cost

synergies are expected to be less than those in the UK.

A clearer understanding of "core" business

In light of the new strategy for growth, the Group has now

commenced a review to refine the definitions of its marketplace and

thereby revise and expand the definition of "core" business. This

is designed to facilitate the development of a more expansive

growth strategy in each of the Group's countries of operation. The

Company expects this review to highlight opportunities, consistent

with the Group's USPs (Expertise, Proximity, Service), to widen its

product offering and expand its geographic coverage.

Energise sales and market share recovery and growth efforts

The Group plans to improve proximity to its customers by

identifying and filling gaps in its geographical coverage. Sales

forces are being expanded and up-skilled by restoring their

historic industry-leading, bench-strength of specialist local

expertise in areas such as fire protection, energy efficiency and

sustainable materials. Salesforce productivity will also be

increased through enhanced sales management and training, supported

by salesforce management tools, disciplines and aligned incentives,

with customer reconnection a top priority.

Facilitate growth through better operations

A number of actions are underway in the Group's operations to

increase efficiency and service levels to boost the sales effort,

including:

o pricing tools and training for key account and branch

managers, providing enhanced visibility and autonomy to set pricing

quickly and competitively;

o improved product availability through the use of enhanced

systems and more accurate operational key performance indicators,

such as stock availability;

o enhanced on time and in full delivery; and

o additional training, which is being provided to the Group's

workforce in order to promote operational excellence and customer

service.

Portfolio management

As announced on 3 February 2020, the Company completed the sale

of its Air Handling division to France Air Management SA for an

enterprise value of EUR222.7m (c.GBP187.0m) on a cash free, debt

free basis on 31 January 2020. The net proceeds received by SIG

were EUR180.9m (c.GBP151.9m), exclusive of the repayment of debt

owed to SIG by the Air Handling division of EUR40.9m (c.GBP34.3m).

The results from this business have been excluded from the reported

underlying results and are shown as a discontinued operation in

order to provide a better understanding of the Group's underlying

performance in the continuing businesses.

The Building Solutions business was classified as held for sale

at 31 December 2019, as a sale to Kingspan had been agreed and was

due to complete in first half of 2020 subject to approval from the

UK Competition & Markets Authority (CMA). On 21 May 2020, the

Group announced that the parties had agreed to terminate the sales

agreement as terms could not be agreed for the extension of the

agreement to enable the completion of the CMA phase 2

investigation. The business continues to be classified as non-core

but does not meet the criteria to be presented as held for sale at

30 June 2020.

Dividend

The Board took the decision not to declare and pay a final

dividend for the 2019 financial year, in the interest of preserving

the Group's liquidity position. No interim dividend for the current

year will be paid (2019: 1.25p) under the terms of the Group's

amended debt arrangements and nor will a final dividend be

declared.

People

The Board would like to thank all employees of SIG for their

continued commitment and resilience in what has been a challenging

six months, particularly in relation to the ongoing Covid-19

pandemic. The key priority for the Group continues to be ensuring

that all necessary measures are taken in line with government

safety guidelines to protect the health and safety of employees,

suppliers, customers and other partners. The Board is pleased to

report that of the c.2,000 Group employees who were put on furlough

(principally in the UK, Ireland and France), the vast majority are

now back at work.

Current trading and outlook

Long term fundamentals remain sound in the Group's markets

across Europe. In the short term, significant economic uncertainty

remains in all of our markets, although government stimulus for the

construction sector, notably in the UK, is welcome.

Trading was better than anticipated during the peak lockdown

months of March to May, compared to our initial estimates of the

possible Covid-19 impact, and the Board now expects full year sales

to be moderately higher than guided in May. Group sales in July and

August were encouraging although down year on year, and market

share losses during 2019, particularly in the UK distribution

business, will take time to recover.

The second half of 2020 is expected to remain loss making, but

at a lower rate than the first despite some increased pressure on

gross margin in the UK.

As at 31 August, the Group had cash resources of GBP267.5m, with

a net cash position, pre IFRS 16, of GBP29.2m. Approximately GBP13m

of deferred payments relating to government support schemes will

unwind over the coming months, the majority doing so in H2 2020,

and in aggregate H2 is expected to generate a cash outflow, as

previously outlined above.

The Group demonstrated agility and resilience in the first half

of the year, dealing with an unprecedented external challenge, and

significant internal change and activity. Coupled with a

strengthened balance sheet, the foundations are now in place for

the business to grow.

FINANCIAL REVIEW

Revenue and gross margin

The Group saw a 23.9% decline in its like-for-like (LFL) revenue

over the period, including a favourable 0.1% currency movement and

an adverse 0.3% impact from fewer working days . Group underlying

revenue was down 23.7% to GBP817.7m (H1 2019: GBP1,071.5m),

impacted by Covid-19.

Underlying results exclude the results from the businesses that

are classified as non-core in order to provide a better

understanding of the underlying performance of the Group. These

businesses reported sales of GBP22.4m (H1 2019: GBP41.8m). On a

statutory basis, Group revenue was GBP840.1m (H1 2019:

GBP1,113.3m).

The Group's underlying gross margin decreased by 50bps to 24.8%

(H1 2019: 25.3%) and underlying gross profit reduced by GBP68.2m to

GBP203.0m (H1 2019: GBP271.2m), reflecting lower rebate receipts

due to decreased revenue volumes. On a statutory basis, the Group's

gross margin decreased by 40bps to 24.9% (H1 2019: 25.3%) and

statutory gross profit fell from GBP282.1m to GBP209.5m.

Operating costs and profit

The Group's underlying operating costs were GBP246.2m (H1 2019:

GBP242.1m). The increase is primarily due to the release of a

number of one-off accruals and provisions in H1 2019, which reduced

the comparator, some temporary costs related to the UK and broader

Group reorganisations, additions to bad debt reserves in response

to Covid-19 uncertainty, and cost inflation. These increases were

partially offset by c.GBP10m benefit from furlough schemes and wage

saving initiatives. The Group's underlying operating loss was

GBP43.2m (H1 2019: GBP29.1m profit) and at a statutory level the

Group's operating loss was GBP102.9m (H1 2019: GBP14.2m profit)

after non-underlying items of GBP59.7m (H1 2019: GBP14.9m),

including GBP42.8m impairment charges relating to impairment of

goodwill in the UK businesses following the reassessment of trading

expectations to reflect the impact of Covid-19, GBP6.9m costs

associated with refinancing, and GBP4.1m costs relating to

investment in omnichannel retailing.

The Group's underlying net finance costs decreased to GBP10.5m

(H1 2019: GBP11.7m), resulting in underlying loss before tax of

GBP53.7m (H1 2019: GBP17.4m profit). On a statutory basis, the

Group saw a loss before tax of GBP125.4m (H1 2019: GBP2.2m profit)

after non-underlying items of GBP71.7m (H1 2019: GBP15.2m),

including a GBP11.3m loss on modification recognised in relation to

the private placement notes.

The Group's underlying tax credit for the period was GBP0.1m (H1

2019: GBP4.7m charge), representing an underlying effective tax

rate credit of 0.2% (H1 2019: 26.7%). After Other items, the total

tax credit was GBP0.8m (H1 2019: GBP1.5m charge).

Segmental analysis

As a result of recent organisational changes, we have reassessed

our operating segments to ensure they are appropriate. In 2019, the

reportable operating segments were grouped on a line of business

basis with subtotals for Specialist Distribution and Roofing

Merchanting. There is no change to the reported operating segments

from those reported in the 2019 Annual Report and Accounts, but the

segments are now grouped on a geographical basis instead of on a

line of business basis. This reflects the way in which information

is reported and reviewed by the Chief Operating Decision Maker

(CODM) following the change in management and strategy during

2020.

Underlying Underlying

Underlying Underlying

operating operating

revenue revenue (loss)/profit profit

H1 2020 H1 2019 H1 2020 H1 2019

(GBPm) (GBPm) LFL sales (GBPm) (GBPm)

----------- ----------- ---------- --------------- -----------

UK Distribution 154.9 295.2 (47.5)% (27.4) 6.8

UK Exteriors 104.1 143.5 (27.5)% (8.9) 5.1

UK before

non-core 259.0 438.7 (41.0)% (36.3) 11.9

----------- ----------- ---------- --------------- -----------

Non-core businesses 21.2 29.6 - 0.3 1.1

--------------------- ----------- ----------- ---------- --------------- -----------

UK 280.2 468.3 (41.0)% (36.0) 13.0

--------------------- ----------- ----------- ---------- --------------- -----------

UK

Underlying revenue in UK Distribution, a market leading

specialist insulation and interiors distribution business, was down

47.5% to GBP154.9m (H1 2019: GBP295.2m). Underlying gross margin

dropped to 22.9% (H1 2019: 24.9%). The lockdown during March and

April severely impacted UK trading and as a result, combined with

some continued underlying weakness in performance, underlying

operating loss for the half year was GBP27.4m (H1 2019: GBP6.8m

profit). On a statutory basis, after taking into account Other

items, notably an impairment charge of GBP31.0m due primarily to

the Covid-19 impact, UK Distribution reported an operating loss of

GBP61.0m (H1 2019: GBP2.6m profit).

UK Exteriors, a market leading and national specialist roofing

merchant, saw underlying revenue fall by 27.6% to GBP104.1m (H1

2019: GBP143.5m). Gross margin decreased 170bps to 27.2% (H1 2019:

28.9%). As a result of the trading impact of Covid-19, the business

saw an underlying operating loss of GBP8.9m (H1 2019: GBP5.1m

profit). On a statutory basis, after taking into account Other

items, notably an impairment charge of GBP11.8m due primarily to

the Covid-19 impact, UK Exteriors reported an operating loss of

GBP23.4m (H1 2019: GBP2.0m profit).

France

Underlying Underlying

Underlying Underlying

operating Operating

revenue revenue profit/(loss) Profit/(Loss)

H1 2020 H1 2019 H1 2020 H1 2019

(GBPm) (GBPm) LFL sales (GBPm) (GBPm)

----------- ----------- ---------- --------------- ---------------

France Distribution 73.8 93.0 (20.2)% 1.3 6.6

France Exteriors 154.4 172.4 (11.4)% 1.6 4.2

France before

non-core 228.2 265.4 (14.5)% 2.9 10.8

----------- ----------- ---------- --------------- ---------------

Non-core businesses 1.2 0.9 - (0.2) (0.3)

--------------------- ----------- ----------- ---------- --------------- ---------------

France 229.4 266.3 (14.5)% 2.7 10.5

--------------------- ----------- ----------- ---------- --------------- ---------------

Trading activity suffered a temporary setback in France

following the short term closure of all branches for three days in

mid-March. The businesses then commenced a staged reopening through

into May.

In France Distribution, trading as LiTT, a leading structural

insulation and interior business, underlying revenue decreased by

20.6% to GBP73.8m (H1 2019: GBP93.0m), impacted by the

aforementioned temporary lockdown. However, underlying gross margin

increased 280bps to 26.4% (H1 2019: 23.6%), largely enabled by the

introduction of a new pricing framework during the latter stages of

2019. The reduction in revenue, offset by improved margin, resulted

in a GBP5.3m decrease in underlying operating profit to GBP1.3m (H1

2019: GBP6.6m). On a statutory basis, after taking into account

Other items, France Distribution reported an operating profit of

GBP1.3m (H1 2019: GBP6.6m).

Underlying revenue in France Exteriors, trading as Larivière, a

market leading specialist roofing business, decreased by 10.4% to

GBP154.4m (H1 2019: GBP172.4m), also impacted by the lockdown.

Underlying gross margin remained relatively stable at 23.6% (H1

2019: 23.3%). This resulted in a GBP2.6m decrease in underlying

operating profit to GBP1.6m (H1 2019: GBP4.2m). On a statutory

basis, after taking into account Other items, France Exteriors

reported an operating profit of GBP1.1m (H1 2019: GBP2.8m).

Germany and Benelux

Underlying Underlying

Underlying Underlying

operating operating

revenue revenue (loss)/profit profit

H1 2020 H1 2019 H1 2020 H1 2019

(GBPm) (GBPm) LFL sales (GBPm) (GBPm)

----------- ----------- ---------- --------------- -----------

Germany 177.1 191.5 (7.8)% (1.3) 3.3

Benelux 47.7 53.7 (10.7)% 1.8 2.9

Germany and

Benelux before

non-core 224.8 245.2 (8.5)% 0.5 6.2

----------- ----------- ---------- --------------- -----------

Non-core businesses - 11.3 - - 0.6

--------------------- ----------- ----------- ---------- --------------- -----------

Germany and

Benelux 224.8 256.5 (8.5)% 0.5 6.8

--------------------- ----------- ----------- ---------- --------------- -----------

The Group's operating companies in Germany and Benelux were

impacted by government measures due to Covid-19 but to a lesser

extent than in the UK, Ireland and France, and trading continued

from all sites throughout the period.

Underlying revenue in a specialist insulation and interiors

distribution business in Germany, trading as WeGo/VTi, fell by 7.5%

to GBP177.1m (H1 2019: GBP191.5m). In addition to Covid-19, trading

in Germany saw a continuation of the challenging trends seen in the

last quarter of 2019. However, underlying gross margin increased

60bps to 28.2% (H1 2019: 27.6%) assisted by further enhancements

around pricing controls. As a result, underlying operating loss for

the period was GBP1.3m (H1 2019: GBP3.3m profit). On a statutory

basis, after taking into account Other items, Germany reported a

loss of GBP1.1m (H1 2019: GBP1.9m loss).

Underlying revenue from the Group's distributor of insulation

and interiors in the Benelux region fell by 11.3% to GBP47.7m (H1

2019: GBP53.7m). Underlying gross margin decreased slightly to

24.5% (H1 2019: 24.8%). As a result, operating profit decreased to

GBP1.8m (H1 2019: GBP2.9m). On a statutory basis, after taking into

account Other items, Benelux reported an operating profit of

GBP1.4m (H1 2019: GBP2.7m).

Ireland

Underlying Underlying

Underlying Underlying

operating operating

revenue revenue (loss)/profit profit

H1 2020 H1 2019 H1 2020 H1 2019

(GBPm) (GBPm) LFL sales (GBPm) (GBPm)

----------- ----------- ---------- --------------- -----------

Ireland 33.4 47.5 (29.4)% (1.4) 2.9

--------- ----------- ----------- ---------- --------------- -----------

In Ireland, a specialist distributor of interiors, insulation

and construction accessories, revenues in March to April were

significantly impacted by the Covid-19 pandemic, with a gradual

improvement in performance in May to June as branches began to

reopen. Underlying revenue declined by 29.7% to GBP33.4m (H1 2019:

GBP47.5m). Underlying gross margin dropped to 21.9% (H1 2019:

24.9%). Underlying operating loss was GBP1.4m (H1 2019: GBP2.9m

profit) and on a statutory basis, after taking into account Other

items, Ireland reported an operating loss of GBP1.4m (H1 2019:

GBP2.1m profit).

Poland

Underlying Underlying

Underlying Underlying

operating operating

revenue revenue profit profit

H1 2020 H1 2019 H1 2020 H1 2019

(GBPm) (GBPm) LFL sales (GBPm) (GBPm)

----------- ----------- ---------- ----------- -----------

Poland 72.3 74.7 (6.0)% 0.6 1.3

-------- ----------- ----------- ---------- ----------- -----------

In Poland, a market leading distributor of insulation and

interiors, underlying revenue fell to GBP72.3m (H1 2019: GBP74.7m).

Whilst also impacted by government measures, trading continued from

all sites throughout the period. However, underlying gross margin

increased slightly to 20.6% (H1 2019: 20.3%), reflecting a change

in customer sales mix during the period, with greater volumes

coming from its sole trader and small company customer base, where

margins are usually higher. The business delivered an underlying

and statutory operating profit of GBP0.6m (H1 2019: GBP1.3m).

Air Handling disposal complete

The Group completed the sale of its Air Handling division on 31

January 2020. The Air Handling division delivered revenue for the

period of GBP25.4m (H1 2019: GBP159.3m) and underlying operating

profit of GBP1.1m (H1 2019: GBP9.2m). The results from this

business are shown as a discontinued operation.

Other items

Other items, being items excluded from underlying results,

during the period amounted to GBP71.7m (H1 2019: GBP15.2m) on a

pre-tax basis, and comprised:

-- Amortisation of acquired intangibles of GBP2.8m (H1 2019: GBP3.1m);

-- Impairment charges of GBP42.8m (H1 2019: GBPnil), relating to

impairment of goodwill in the UK businesses following the

reassessment of trading expectations to reflect the impact of

Covid-19;

-- Profits and losses on the sale or closure of non-core

businesses and associated impairment charges of GBP1.4m profit (H1

2019: GBP0.9m loss), together with net operating profit from those

businesses of GBP0.1m (H1 2010: GBP1.4m);

-- Net restructuring costs of GBP3.5m comprising property

closure costs of GBP0.7m (H1 2019: GBP0.5m), redundancy and staff

related costs of GBP0.8m (H1 2019: GBP6.1m), impairment of

non-current and current assets due to restructuring of GBP0.1m (H1

2019: GBP0.5m), restructuring consultancy costs of GBP1.7m (H1

2019: GBP5.1m) and GBP0.2m other (H1 2019: GBPnil), primarily

incurred in connection with the fundamental restructuring of the

target operating model of the major operating companies in the UK,

Germany and France;

-- Costs relating to investment in omnichannel retailing of GBP4.1m (H1 2019: GBPnil);

-- Costs associated with refinancing GBP6.9m (H1 2019: GBPnil);

-- Other specific items of GBP1.1m (H1 2019: GBP0.1m), including

GBP1.7m of fees in relation to a PwC independent review offset by

GBP0.6m gain in forward currency options;

-- Non underlying finance costs GBP12.0m (H1 2019: GBP0.3m),

including GBP11.3m loss on modification recognised in relation to

the private placement notes.

Impact of non-core businesses

H1 2019 has been restated to reflect the business divestments

classified as non-underlying subsequent to the 2019 interim

announcement (Building Solutions and Maury) and the presentation of

the Air Handling division as discontinued. Please refer to the

table below.

Underlying Underlying

revenue PBT

(GBPm) (GBPm)

----------- -----------

As reported at H1 2019 results 1,260.1 27.3

-------------------------------- ----------- -----------

Air Handling (159.3) (8.6)

Building Solutions (National)

Ltd (28.4) (1.6)

Maury (0.9) 0.3

-------------------------------- ----------- -----------

Restated at H1 2020 results 1,071.5 17.4

-------------------------------- ----------- -----------

Responsibility Statement

We confirm to the best of our knowledge that:

(a) the condensed interim set of financial statements has been

prepared in accordance with IAS 34 "Interim Financial Reporting" as

adopted by the European Union;

(b) the Interim Report includes a fair review of the information

required by DTR 4.2.7R (indication of important events during the

first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

(c) the Interim Report includes a fair review of the information

required by DTR 4.2.8R (disclosure of related parties' transactions

and changes therein).

By order of the Board

Steve Francis Ian Ashton

Director Director

24 September 2020 24 September 2020

Cautionary Statement

This Interim Report is prepared for and addressed only to the

Company's Shareholders as a whole and to no other person. The

Company, its Directors, employees, agents or advisors do not accept

or assume responsibility to any other person to whom this Interim

Report is shown or into whose hands it may come and such

responsibility or liability is expressly disclaimed.

This Interim Report contains forward-looking statements that are

subject to risk factors including the economic and business

circumstances occurring from time to time in countries and markets

in which the Group operates and risk factors associated with the

building and construction sectors. By their nature, forward-looking

statements involve a number of risks, uncertainties and assumptions

because they relate to events and/or depend on circumstances that

may or may not occur in the future and could cause actual results

and outcomes to differ materially from those expressed in or

implied by the forward-looking statements. No assurance can be

given that the forward-looking statements in this Interim Report

will be realised. Statements about the Directors' expectations,

beliefs, hopes, plans, intentions and strategies are inherently

subject to change and they are based on expectations and

assumptions as to future events, circumstances and other factors

which are in some cases outside the Group's control. Actual results

could differ materially from the Group's current expectations.

It is believed that the expectations set out in these

forward-looking statements are reasonable but they may be affected

by a wide range of variables which could cause actual results or

trends to differ materially, including but not limited to, market

conditions, competitors and margin management, commercial

relationships, fluctuations in product pricing, changes in foreign

exchange and interest rates, government legislation, availability

of funding, working capital and cash management, IT infrastructure

and cyber security and availability and quality of key

resources.

The Company's Shareholders are cautioned not to place undue

reliance on the forward-looking statements. This Interim Report has

not been audited or otherwise independently verified. The

information contained in this Interim Report has been prepared on

the basis of the knowledge and information available to Directors

at the date of its preparation and the Company does not undertake

any obligation to update or revise this Interim Report during the

financial year ahead.

Condensed Consolidated Income Statement

for the six months ended 30 June 2020 (unaudited)

Six months ended 30 June Six months ended 30 June Year ended 31 December

2020 2019 2019

Other

Other Underlying* items** Total Other

Underlying* items** Total Restated^ Restated^ Restated^ Underlying* items** Total

Note GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

Revenue 2 817.7 22.4 840.1 1,071.5 41.8 1,113.3 2,084.7 75.9 2,160.6

Cost of sales (614.7) (15.9) (630.6) (800.3) (30.9) (831.2) (1,545.5) (56.0) (1,601.5)

------------------ ----- ------------ -------- -------- ------------ ---------- ---------- ------------ -------- ----------

Gross profit 203.0 6.5 209.5 271.2 10.9 282.1 539.2 19.9 559.1

Other operating

expenses (246.2) (66.2) (312.4) (242.1) (25.8) (267.9) (499.6) (147.4) (647.0)

------------------ ----- ------------ -------- -------- ------------ ---------- ---------- ------------ -------- ----------

Operating

profit/(loss) 3 (43.2) (59.7) (102.9) 29.1 (14.9) 14.2 39.6 (127.5) (87.9)

Finance income 0.3 - 0.3 0.2 - 0.2 0.5 - 0.5

Finance costs (10.8) (12.0) (22.8) (11.9) (0.3) (12.2) (24.5) (0.8) (25.3)

------------------ ----- ------------ -------- -------- ------------ ---------- ---------- ------------ -------- ----------

Profit/(loss)

before tax (53.7) (71.7) (125.4) 17.4 (15.2) 2.2 15.6 (128.3) (112.7)

Income tax

(expense)/credit 5 0.1 0.7 0.8 (4.7) 3.2 (1.5) (15.9) 4.5 (11.4)

------------------ ----- ------------ -------- -------- ------------ ---------- ---------- ------------ -------- ----------

Profit/(loss)

after tax

from continuing

operations (53.6) (71.0) (124.6) 12.7 (12.0) 0.7 (0.3) (123.8) (124.1)

------------------ ----- ------------ -------- -------- ------------ ---------- ---------- ------------ -------- ----------

Discontinued

operations

Profit/(loss)

after tax

from

discontinued

operations 8 - 70.8 70.8 - 0.6 0.6 - (0.4) (0.4)

------------------ ----- ------------ -------- -------- ------------ ---------- ---------- ------------ -------- ----------

Profit/(loss)

after tax

for the period (53.6) (0.2) (53.8) 12.7 (11.4) 1.3 (0.3) (124.2) (124.5)

------------------ ----- ------------ -------- -------- ------------ ---------- ---------- ------------ -------- ----------

Attributable to:

Equity holders of

the Company (53.6) (0.2) (53.8) 12.7 (11.4) 1.3 (0.3) (124.2) (124.5)

Earnings per

share

Basic and diluted

earnings/(loss)

per share 6 (9.1)p 0.2p (21.0)p

Basic and diluted

earnings/(loss)

per share from

continuing

operations 6 (21.1)p 0.1p (21.0)p

------------------ ----- ------------ -------- -------- ------------ ---------- ---------- ------------ -------- ----------

* Underlying represents the results before Other items.

** Other items relate to the amortisation of acquired

intangibles, impairment charges, profits and losses on agreed sale

or closure of non-core businesses and associated impairment

charges, net operating profit/(losses) attributable to businesses

identified as non-core, net restructuring costs, investment in

omnichannel retailing, other specific items, fair value gains and

losses on derivative financial instruments, non-underlying finance

costs, the taxation effect of Other items and the effect of changes

in taxation rates. Other items have been disclosed separately in

order to give an indication of the underlying earnings of the

Group. Further details can be found in Note 4.

^ The results for the period to 30 June 2019 have been restated

to present Air Handling as a discontinued operation. See Note 1 and

Note 8 for further details.

Condensed Consolidated Statement of Comprehensive Income

for the six months ended 30 June 2020 (unaudited)

Six months Six months Year ended

ended ended 31 December

30 June 2020 30 June 2019 2019

GBPm GBPm GBPm

Profit/(loss) after tax (53.8) 1.3 (124.5)

Items that will not subsequently

be reclassified to the Consolidated

Income Statement:

Remeasurement of defined benefit

pension liability (Note 13) (9.8) (3.8) (1.8)

Current tax movement associated

with remeasurement of defined

benefit pension liability - - 0.4

Deferred tax movement associated

with remeasurement of defined

benefit pension liability - 0.8 (6.6)

(9.8) (3.0) (8.0)

Items that may subsequently

be reclassified to the Consolidated

Income Statement:

Exchange difference on retranslation

of foreign currency goodwill

and intangibles 4.4 (0.4) (7.4)

Exchange difference on retranslation

of foreign currency net investments

(excluding goodwill and intangibles) 18.0 (0.9) (16.1)

Exchange and fair value movements

associated with borrowings and

derivative financial instruments (12.5) - 10.9

Tax credit on exchange and fair

value movements arising on borrowings

and derivative financial instruments 2.4 - (2.1)

Exchange differences reclassified

to the Consolidated Income Statement

in respect of the disposal of

foreign operations (5.9) - (0.1)

Gains and losses on cash flow

hedges 2.0 0.8 0.4

Transfer to profit and loss

on cash flow hedges (1.6) (0.1) 0.9

---------------------------------------- -------------- -------------- -------------

6.8 (0.6) (13.5)

---------------------------------------- -------------- -------------- -------------

Other comprehensive (expense)/income (3.0) (3.6) (21.5)

---------------------------------------- -------------- -------------- -------------

Total comprehensive (expense)/income (56.8) (2.3) (146.0)

---------------------------------------- -------------- -------------- -------------

Attributable to:

Equity holders of the Company (56.8) (2.3) (146.0)

(56.8) (2.3) (146.0)

---------------------------------------- -------------- -------------- -------------

Condensed Consolidated Balance Sheet

as at 30 June 2020 (unaudited)

30 June 31 December

30 June 2020 2019 2019

Note GBPm GBPm GBPm

Non-current assets

Property, plant and equipment 67.1 81.1 58.6

Right-of-use assets 257.6 304.4 255.2

Goodwill 131.3 293.5 159.0

Intangible assets 43.1 46.7 42.3

Lease receivables 4.0 4.8 4.4

Deferred tax assets 6.9 15.5 4.4

Derivative financial instruments 11 4.5 2.6 1.7

Deferred consideration 11 - 0.3 -

---------------------------------- ----- --------------- --------- -------------

514.5 748.9 525.6

---------------------------------- ----- --------------- --------- -------------

Current assets

Inventories 185.3 219.7 156.5

Lease receivables 0.8 0.8 0.8

Trade and other receivables 293.6 464.8 294.7

Contract assets - 3.1 -

Current tax assets - 5.3 0.9

Derivative financial instruments 11 0.7 - 0.9

Deferred consideration 11 - 0.6 -

Cash at bank and on hand 197.3 153.1 110.0

Assets classified as held

for sale 7 - 9.3 258.4

---------------------------------- ----- --------------- --------- -------------

677.7 856.7 822.2

---------------------------------- ----- --------------- --------- -------------

Total assets 1,192.2 1,605.6 1,347.8

---------------------------------- ----- --------------- --------- -------------

Current liabilities

Trade and other payables 341.8 480.8 327.4

Contract liabilities - 2.3 -

Lease liabilities 54.6 61.2 51.5

Bank overdrafts - 5.6 -

Bank loans - 94.7 99.6

Private placement notes 48.3 - 175.5

Other financial liabilities 0.5 1.2 1.5

Derivative financial instruments 11 0.1 0.1 0.2

Current tax liabilities 3.2 2.7 3.7

Provisions 8.1 7.0 6.7

Liabilities directly associated

with assets classified as

held for sale - 2.2 115.7

---------------------------------- ----- --------------- --------- -------------

456.6 657.8 781.8

---------------------------------- ----- --------------- --------- -------------

Non-current liabilities

Lease liabilities 224.5 258.2 224.1

Bank loans 67.2 - -

Private placement notes 149.4 185.0 -

Derivative financial instruments 11 3.2 4.2 1.9

Other financial liabilities 1.3 - 1.4

Deferred tax liabilities - 1.4 -

Other payables 3.1 3.5 1.0

Retirement benefit obligations 13 33.0 30.7 24.8

Provisions 16.5 19.0 18.6

---------------------------------- ----- --------------- --------- -------------

498.2 502.0 271.8

---------------------------------- ----- --------------- --------- -------------

Total liabilities 954.8 1,159.8 1,053.6

---------------------------------- ----- --------------- --------- -------------

Net assets 237.4 445.8 294.2

---------------------------------- ----- --------------- --------- -------------

Capital and reserves

Called up share capital 12 59.2 59.2 59.2

Share premium account 447.3 447.3 447.3

Capital redemption reserve 0.3 0.3 0.3

Share option reserve 1.8 2.3 1.8

Hedging and translation

reserve 16.8 20.4 10.2

Cost of hedging reserve 0.5 0.4 0.3

Retained losses (288.5) (84.1) (224.9)

---------------------------------- ----- --------------- --------- -------------

Attributable to equity holders

of the Company 237.4 445.8 294.2

---------------------------------- ----- --------------- --------- -------------

Total equity 237.4 445.8 294.2

---------------------------------- ----- --------------- --------- -------------

Condensed Consolidated Cash Flow Statement

for the six months ended 30 June 2020 (unaudited)

Six months Six months Year ended

ended 30 June ended 30 31 December

2020 June 2019 2019

Note GBPm GBPm GBPm

Net cash flow from operating

activities

Cash generated from operating

activities 9 (28.5) 86.4 166.0

Income tax paid (3.5) (5.9) (10.8)

--------------------------------- ----- ---------------- ----------- -------------

Net cash generated from

operating activities (32.0) 80.5 155.2

--------------------------------- ----- ---------------- ----------- -------------

Cash flows from investing

activities

Finance income received 0.3 0.3 0.6

Purchase of property, plant

and equipment and computer

software (13.4) (13.1) (34.5)

Proceeds from sale of property,

plant and equipment 4.6 3.9 7.6

Net cash flow arising on

the sale of businesses 7 149.5 0.6 8.4

Net cash (used in)/generated

from investing activities 141.0 (8.3) (17.9)

--------------------------------- ----- ---------------- ----------- -------------

Cash flows from financing

activities

Finance costs paid (10.8) (5.8) (25.1)

Repayment of lease liabilities (27.2) (34.8) (59.9)

Acquisition of non-controlling

interests - (0.9) (0.9)

Repayment of loans/settlement

of derivative financial

instruments 1.0 (3.7) -

Additional drawdown/(repayment)

of revolving credit facility* (30.0) 41.0 42.4

Costs paid in relation to

equity raise 20 (1.3) - -

Dividends paid to equity

holders of the Company 14 - - (22.2)

Net cash used in financing

activities (68.3) (4.2) (65.7)

--------------------------------- ----- ---------------- ----------- -------------

Increase in cash and cash

equivalents in the period 10 40.7 68.0 71.6

--------------------------------- ----- ---------------- ----------- -------------

Cash and cash equivalents

at beginning of the period 145.1 78.8 78.8

Effect of foreign exchange

rate changes 11.5 0.7 (5.3)

--------------------------------- ----- ---------------- ----------- -------------

Cash and cash equivalents

at end of the period** 197.3 147.5 145.1

--------------------------------- ----- ---------------- ----------- -------------

* As part of the changes to the debt facility agreements on 18

June 2020 (see Note 1), GBP70.0m drawn under the existing revolving

credit facility was converted into a GBP70.0m term facility, with

no additional repayment or drawdown made.

** Cash and cash equivalents comprise cash at bank and on hand

of GBP197.3m (30 June 2019: GBP153.1m; 31 December 2019: GBP145.1m)

less bank overdrafts of GBPnil (30 June 2019: GBP5.6m; 31 December

2019: GBPnil)

Condensed

Consolidated

Statement

of Changes in

Equity

for the six

months ended 30

June

2020 (unaudited)

Called Hedging Retained

up Share Capital Share and Cost of (losses)

share premium redemption option translation hedging / Non-controlling Total

capital account reserve reserve reserves reserve profits Total interests equity

For the six

months ended 30

June

2020 GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------ -------- -------- ----------- -------- ------------ -------- --------- ------- ---------------- -------

At 1 January 2020 59.2 447.3 0.3 1.8 10.2 0.3 (224.9) 294.2 - 294.2

Profit/(loss)

after tax - - - - - - (53.8) (53.8) - (53.8)

Other

comprehensive

income/(expense) - - - - 6.6 0.2 (9.8) (3.0) - (3.0)

------------------ -------- -------- ----------- -------- ------------ -------- --------- ------- ---------------- -------

Total

comprehensive

income/(expense) - - - - 6.6 0.2 (63.6) (56.8) - (56.8)

------------------ -------- -------- ----------- -------- ------------ -------- --------- ------- ---------------- -------

At 30 June 2020 59.2 447.3 0.3 1.8 16.8 0.5 (288.5) 237.4 - 237.4

------------------ -------- -------- ----------- -------- ------------ -------- --------- ------- ---------------- -------

Called Hedging Retained

up Share Capital Share and Cost of (losses)

share premium redemption option translation hedging / Non-controlling Total

capital account reserve reserve reserves reserve profits Total interests equity

------------------

For the six

months ended 30

June

2019 GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------ -------- -------- ----------- -------- ------------ -------- --------- ------- ---------------- -------

At 1 January 2019 59.2 447.3 0.3 1.7 21.7 1.0 (68.3) 462.9 - 462.9

Impact of

adoption of IFRS

16 - - - - - - (0.6) (0.6) - (0.6)

Adjusted balance

at 1 January

2019 59.2 447.3 0.3 1.7 21.7 1.0 (68.9) 462.3 - 462.3

Profit after tax - - - - - - 1.3 1.3 - 1.3

Other

comprehensive

income/(expense) - - - - (1.3) (0.6) (1.7) (3.6) - (3.6)

Total

comprehensive

income/(expense) - - - - (1.3) (0.6) (0.4) (2.3) - (2.3)

Credit to share

option reserve - - - 0.6 - - - 0.6 - 0.6

Dividends paid to

equity holders

of the Company - - - - - - (14.8) (14.8) - (14.8)

------------------ -------- -------- ----------- -------- ------------ -------- --------- ------- ---------------- -------

At 30 June 2019 59.2 447.3 0.3 2.3 20.4 0.4 (84.1) 445.8 - 445.8

------------------ -------- -------- ----------- -------- ------------ -------- --------- ------- ---------------- -------

Called Hedging Retained

up Share Capital Share and Cost of (losses)

share premium redemption option translation hedging / Non-controlling Total

capital account reserve reserve reserves reserve profits Total interests equity

------------------

For the year

ended 31 December

2019 GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------ -------- -------- ----------- -------- ------------ -------- --------- -------- ---------------- --------

At 1 January 2019 59.2 447.3 0.3 1.7 21.7 1.0 (68.3) 462.9 - 462.9

Impact of

adoption of IFRS

16 - - - - - - (0.6) (0.6) - (0.6)

Adjusted balance

at 1 January

2019 59.2 447.3 0.3 1.7 21.7 1.0 (68.9) 462.3 - 462.3

Profit/(loss)

after tax - - - - - - (124.5) (124.5) - (124.5)

Other

comprehensive

income/(expense) - - - - (12.8) (0.7) (8.0) (21.5) - (21.5)

------------------ -------- -------- ----------- -------- ------------ -------- --------- -------- ---------------- --------

Total

comprehensive

income/(expense) - - - - (12.8) (0.7) (132.5) (146.0) - (146.0)

Transfer of

reserves - - - - 1.3 - (1.3) - -

Credit to share

option reserve - - - 0.1 - - - 0.1 - 0.1

Dividends paid to

equity holders

of the Company - - - - - - (22.2) (22.2) - (22.2)

------------------ -------- -------- ----------- -------- ------------ -------- --------- -------- ---------------- --------

At 31 December

2019 59.2 447.3 0.3 1.8 10.2 0.3 (224.9) 294.2 - 294.2

------------------ -------- -------- ----------- -------- ------------ -------- --------- -------- ---------------- --------

The share option reserve represents the cumulative

equity-settled share option charge under IFRS 2 "Share-based

payment" less the value of any share options that have been

exercised.

The hedging and translation reserve represent movements in the

Condensed Consolidated Balance Sheet as a result of movements in

exchange rates and movements in the fair value of cash flow hedges

which are taken directly to reserves.

Notes to the Condensed Interim Financial Statements

1. Basis of preparation of Condensed Interim Financial Statements

The Condensed Interim Financial Statements were approved by the

Board of Directors on 24 September 2020.

The Condensed Interim Financial Statements do not constitute

statutory accounts as defined in Section 434 of the Companies Act

2006. The interim results to 30 June 2020 and 30 June 2019 have

been subject to an Interim Review in accordance with ISRE 2410 by

the Company's Auditor. The financial information for the full

preceding year is based on the audited statutory accounts for the

financial year ended 31 December 2019 prepared in accordance with

IFRS as adopted by the European Union. Those accounts have been

delivered to the Registrar of Companies. The Auditor's Report was

(i) unqualified, (ii) contained a number of material uncertainties

in respect of going concern to which the auditor drew attention by

way of emphasis without modifying their report and (iii) did not

contain statements under Section 498(2) or Section 498(3) of the

Companies Act 2006 in relation to the financial statements.

The Group's Condensed Interim Financial Statements have been

prepared in accordance with IAS 34 "Interim Financial Reporting" as

adopted by the European Union and the accounting policies included

in the Annual Report and Accounts for the year ended 31 December

2019, which have been applied consistently throughout the current

and preceding periods. In 2019 the reportable operating segments

were grouped on a line of business basis with subtotals for

Specialist Distribution and Roofing Merchanting. There is no change

to the reportable operating segments from those reported in the

2019 Annual Report and Accounts, but the segments are now grouped

on a geographical basis instead of a line of business basis. This

reflects the way in which information is reported and reviewed by

the Chief Operating Decision Maker (CODM) following the change in

management and strategy during 2020.

The areas of critical accounting judgements and key sources of

estimation uncertainty set out on pages 154 to 155 of the 2019

Annual Report and Accounts are considered to continue and be

consistently applied. The impact of Covid-19 on the key sources of

estimation has been considered. The carrying value of non-current

assets has been reviewed, which has resulted in an impairment of

GBP42.8m being recognised at 30 June 2020 in relation to the UK

Distribution and UK Exteriors CGUs. Provisions for expected credit

losses in relation to trade receivables have been considered, but

this has not resulted in any significant increase in the level of

provision required.

The Air Handling business, which has been sold during the

period, was classified as a discontinued operation in the 2019

Annual Report and Accounts and the results for the period to the

date of disposal continue to be classified as discontinued in these

interim financial statements, together with the gain on sale. The

comparatives for the period to 30 June 2019 have been restated to

present the results for Air Handling on a consistent basis. Other

businesses identified as non-core in 2019 did not meet the

disclosure criteria of being discontinued operations as they did

not individually or in aggregate represent a separate major line of

business or geographical area of operation. In order to give an

indication of the underlying earnings of the Group, the results of

these businesses have been included within Other items in the

Condensed Consolidated Income Statement. The comparatives for the

period ending 30 June 2019 have been re-analysed to present net

operating profits of GBP1.6m attributable to businesses identified

as non-core in the second half of 2019 within Other items.

Significant changes in the current reporting period

The Covid-19 pandemic has had a significant impact on the global

and UK economies and on the Group's results for the period ended 30

June 2020, as explained in more detail below and in the operational

and financial review. The Group has completed the sale of the Air

Handling business during the period, with further details of the

impact on the results for the period included in Note 8 to these

interim financial statements. The Group has also amended the terms

of its financing arrangements, as explained below and in Note

4.

As disclosed in the 2019 Annual Report and Accounts, the project

to implement SAP 1Hana in Germany and France has been paused during

the period in light of the Covid-19 situation and to allow new

senior management to fully assess the overall IT strategy. A

decision will be made over the coming months to determine the

future direction and feasibility of the project. Costs of GBP13.6m

are included in intangible assets at 30 June 2020.

Going Concern

The Group closely monitors its funding position throughout the

year, including monitoring compliance with covenants and available

facilities to ensure it has sufficient headroom to fund

operations.

Following a challenging trading period in 2019 and a change in

its Executive Directors in February 2020, the Group undertook an

extensive review of its business and operating strategy together

with potential growth opportunities. During these reviews, it

became clear that revised lower forecasts for future earnings for

2020 to 2022 were likely to leave the Group with higher than

anticipated leverage levels during this period. In turn, these

highlighted that the Group's capital structure needed to be

addressed and, as a result, the Group sought to raise new equity in

order to support its ability to successfully deliver the Group's

new strategy while at the same time managing liquidity.

In July 2020 the Group successfully raised GBP165m of equity

through a firm placing and placing and open offer in order to

reduce net debt and strengthen the Group's balance sheet. Alongside

this, as announced on 19 June 2020, the Group also agreed amended

debt facility agreements in respect of its Revolving Credit

Facility (RCF) and private placement debt.

Following the conclusion of the refinancing in June, the Group

is, or will be, now subject to covenant testing as follows:

-- Leverage (net debt/EBITDA) and interest cover

(EBITA/interest) will not be tested until March 2022, from which

point they will be tested every quarter, the tests being applied to

the prior 12 months.

-- From 31 July 2020 until 28 February 2022 the Group must

ensure that Consolidated Net Debt (CND) does not exceed GBP125m for

each test date in 2020 and GBP225m for each test date thereafter.

As at 30 June 2020, the CND was GBP82.2m. However, following

completion of the equity raise, the Group is currently in a net

cash position.

-- Consolidated Net Worth (CNW) must at all times not be less

than GBP250m. At 30 June 2020 the CNW, under frozen GAAP, as

reported herein, was GBP257.2m. After the equity raise, completed

on 10 July 2020 this rose by approximately GBP152m.

-- The Company must ensure that Liquidity of the Group is not

less than GBP40m from the date of signing the amendments (18 June

2020).

The forecasts which underpin our going concern assessment, and

specifically our ability to meet the CND, CNW and liquidity tests

above, look out to 30 September 2021. These forecasts reflect the

more normal trading levels seen since the worst of the Covid-19

impact, as well as the expected positive impact of the strategic

actions being undertaken to improve future performance, notably in

the UK. Management have continued to manage liquidity, such that

cashflow performance is better than initial expectations for the

current period and continue to monitor the Group's forecast

liquidity position to ensure it does not fall below minimum

required levels. The forecasts indicate that the Group will be able

to operate within the covenants for at least 12 months from the

date of approval of this half-year report. This is also the case

under a plausible downside scenario, which was prepared for the

equity raise and assumed a decline in sales volumes across most of

the Group's end use markets, and specifically assumed an impact

from further potential Covid-19 related restrictions. It also

assumed a slower turnaround in our UK business.

After careful consideration, the Directors therefore believe

that it is appropriate to prepare the financial statements on a

going concern basis.

New standards, interpretations and amendments adopted by the

Group

A number of amended standards became applicable for the current

reporting period. These standards did not have any impact on the

Group's accounting policies and did not require retrospective

adjustments.

2. Revenue from contracts with customers

Set out below is the disaggregation of the Group's revenue from

contracts with customers:

Total

Germany

UK UK Total France France Total and Total

Distribution Exteriors UK Distribution Exteriors France Germany Benelux Benelux Ireland Poland Eliminations Group

Six months

ended 30 June

2020 GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

--------------- ------------- ---------- ------ ------------- ---------- ------- -------- -------- -------- -------- ------- ------------- ------

Type of

product

Interiors 154.9 - 154.9 73.8 - 73.8 177.1 47.7 224.8 19.8 69.2 - 542.5

Exteriors - 104.1 104.1 - 154.4 154.4 - - - 13.6 - - 272.1

Heating,

ventilation

and air

conditioning - - - - - - - - - - 3.1 - 3.1

Inter-segment

revenue^ 1.0 1.0 2.0 0.7 3.1 3.8 - - - - - (5.8) -

---------------

Total

underlying

revenue 155.9 105.1 261.0 74.5 157.5 232.0 177.1 47.7 224.8 33.4 72.3 (5.8) 817.7

--------------- ------------- ---------- ------ ------------- ---------- ------- -------- -------- -------- -------- ------- ------------- ------

Revenue

attributable

to businesses

identified

as non-core - 21.2 21.2 - 1.2 1.2 - - - - - - 22.4

--------------- ------------- ---------- ------ ------------- ---------- ------- -------- -------- -------- -------- ------- ------------- ------

Total 155.9 126.3 282.2 74.5 158.7 233.2 177.1 47.7 224.8 33.4 72.3 (5.8) 840.1

--------------- ------------- ---------- ------ ------------- ---------- ------- -------- -------- -------- -------- ------- ------------- ------

Nature of

revenue

Goods for

resale 155.9 126.3 282.2 74.5 158.7 233.2 177.1 47.7 224.8 31.6 72.3 (5.8) 838.3

Construction

contracts - - - - - - - - - 1.8 - - 1.8

--------------- ------------- ---------- ------ ------------- ---------- ------- -------- -------- -------- -------- ------- ------------- ------

Total 155.9 126.3 282.2 74.5 158.7 233.2 177.1 47.7 224.8 33.4 72.3 (5.8) 840.1