TIDMRST

RNS Number : 8936E

Restore PLC

16 March 2022

16 March 2022

Restore plc

("Restore" or the "Group" or "Company")

Full Year 2021 Audited Results - Exceeding expectations

Strategic M&A and organic growth driving Restore

Restore plc (AIM: RST), the UK's leading provider of digital and

information management and secure lifecycle services, is pleased to

provide its audited results for the year ended 31 December

2021.

Restore reached a record financial performance in 2021 through

the successful delivery of its strategy centred on strong organic

growth, margin expansion and eight acquisitions across four

business units.

SUMMARY OF RESULTS

Continuing operations 2021 2020 Change

------------------------------- --------- --------- -------

Revenue GBP234.3m GBP182.7m +28%

Statutory profit before tax GBP23.0m GBP4.0m +475%

Adjusted profit before tax(1) GBP38.1m GBP23.2m +64%

EBITDA(2) GBP74.2m GBP57.4m +29%

Net debt GBP100.8m GBP66.1m (52%)

Adjusted earnings per share(3) 23.2p 15.0p +55%

Earnings per share 8.7p 0.2p +4,250%

Dividend per share 7.2p - (n/a)

-------------------------------- --------- --------- -------

BUSINESS AND STRATEGIC HIGHLIGHTS

-- Good performance across all business units contributing to

growth, with strong underlying organic growth and eight successful

acquisitions driving increased scale and capability across the

Group

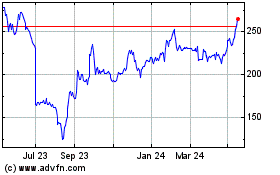

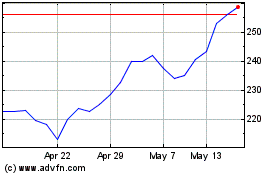

-- Exit run rate revenue of GBP260 million based on Q4, 21% higher than pre pandemic levels

-- Restore Digital's transformative acquisition of EDM in April

2021 doubles exit run rate revenue to GBP46 million, enhances

capability (Cloud, BPO, Software) and delivers scale margin

benefit

-- Restore Technology completed three strategic acquisitions

doubling exit run rate revenue to GBP34 million with strong demand

and margin momentum building through the year

-- Restore Records Management gained further market share with

strong organic revenue growth of 5.6%, alongside acquisition

revenue growth of 5.9% and COVID-19 repair of 4.2%

o Positive net box growth momentum in line with expectations at

1.3% (2020: 0.9%)

o Property consolidation strategy progressed with new high

density storage facilities in Heywood and Sittingbourne

-- Restore Datashred continued steady recovery to 84% of

pre-pandemic activity levels by Q4, with significant progress in

underlying productivity although profit behind 2019 levels

-- Restore Harrow Green activity levels strong throughout the UK

with a new site in Cambridge addressing the life sciences sector

and delivering record profitability

-- Development of significant pipeline of further acquisition

opportunities across the Group to support the ambitious growth

plans

-- The Group announced its new ESG strategy, 'Restoring our

World' with ambitious targets including our Net Zero commitment by

2035

FINANCIAL HIGHLIGHTS

-- Revenue up +28% to GBP234.3 million (2020: GBP182.7 million) driven by:

o Organic growth +5.0%

o COVID19 repair +5.6%

o In year acquisitions +16.4% plus full year effect of prior

year acquisitions +1.2%

-- Adjusted profit before taxation up +64% to GBP38.1 million

(2020: GBP23.2 million) and operating margin increasing from 18.5%

in H1 to 20.7% in H2

-- Statutory profit before tax up 475% to GBP23.0 million

-- Strategic acquisitions successfully completed totalling

GBP86.3 million during 2021, delivering a post synergy ROIC(4) of

13.0%

-- Strong Cash conversion(5) at 85% with closing net debt at

GBP100.8 million and leverage(6) of 1.8x

-- New increased debt facility agreed post year end at enhanced

terms, providing further capacity for continued investment

-- Proposed final dividend of 4.7 pence, taking total dividend

for 2021 to 7.2 pence (2020: nil pence)

CURRENT TRADING AND OUTLOOK

2021 saw delivery of record revenues and profit demonstrating

strong strategic progress and the resilience of our revenue and

markets despite a challenging economic backdrop.

The new financial year has started well, in line with our

expectations, and we are expecting further financial and strategic

progress in 2022, which will benefit from:

-- Further underlying organic growth, market share gains and new

customer wins from a significant commercial pipeline;

-- Ongoing cost reduction and productivity programmes which,

together with effective pricing discussions, should help mitigate

further inflationary cost pressures;

-- The contribution from accretive acquisitions completed in

2021, with additional synergies realised during 2022; and

-- A substantial and high-quality strategic acquisition pipeline

with several transactions already in exclusivity or with verbal

commitments and over 10 deals strongly progressed with more in the

pipeline.

Strong activity and momentum has continued into the new

financial year with underlying demand for our mission critical

services continuing to build and we will continue to further extend

our capability and offering in line with the long term structural

growth trends that underpin our markets. Against this backdrop, we

have an ambitious but achievable medium-term target to grow annual

revenue to GBP450-500 million and double EBITDA to more than GBP150

million (2021: GBP74.2 million).

Charles Bligh, CEO, commenting on the results and outlook,

said:

"Our strong organic growth and eight successful strategic

acquisitions have delivered an outstanding performance with record

results for 2021. The new businesses we have acquired are improving

margins and there is no doubt the quality of Restore's services is

reflected in our sector leading positions in all of our

markets.

With excellent sales momentum, activity levels further

increasing across all our markets and a well progressed pipeline of

acquisitions, I am confident our success will build further in 2022

and beyond."

1) Adjusted profit before tax is stated before amortisation,

impairment, and exceptional items and after the effects of IFRS

16

2) EBITDA is earnings before interest, taxation, depreciation,

amortisation, impairment, and exceptional items

3) Adjusted earnings per share is calculated using adjusted

profit before tax and a standard tax rate of 19%

4) Calculated using pre-IFRS16 EBITDA adjusted for management's

expectations of post-acquisition synergies, and consideration net

of cash acquired plus exceptional costs

5) Calculated using net cash generated from operating activities

after capital expenditure and lease payments, but before

exceptional items, divided by adjusted operating profit with a

standard tax rate of 19%, with an amendment to exclude the impact

of the VAT deferral from 2020 to 2021

6) Calculated using pre-IFRS16 EBITDA adjusted for share-based

payments, including a pro-forma adjustment for acquisitions in line

with financial covenants

Restore plc www.restoreplc.com

Charles Bligh, CEO 020 7409 2420

Neil Ritchie, CFO

Peel Hunt LLP www.peelhunt.com

Mike Bell 020 7418 8900

Ed Allsopp

Buchanan Communications www.buchanan.uk.com

Charles Ryland 020 7466 5000

Stephanie Whitmore

Tilly Abraham

Chair's Introduction

I am pleased to report that Restore achieved an excellent

all-round performance for 2021 with significant financial growth,

substantial strategic progress made and further enhancement on the

quality of the business overall.

The business is performing well, and I was delighted that the

Board invited me to take on the role of Chair from Martin Towers on

his retirement from the Board during October 2021. I would like to

thank Martin on behalf of the Board and shareholders for his

significant contribution to the substantial growth of the business

during his tenure.

As I look ahead, I am highly confident in Restore's prospects

and that our team will continue to transform and evolve the Group

and the critical services it provides to the organisations we

serve.

2021 has been an important year for the Group with strategic

development and expansion of the Technology and Digital businesses,

continued growth in Records Management, solid performance in Harrow

Green and stabilisation in Datashred as we exit the pandemic. With

a clear strategy for growth, set out at our Capital Markets Day

event in November 2021, shareholders should be assured that the

Group is in good health and well positioned for future

expansion.

Over the last two years, the pandemic has required an

extraordinary response from the nation and the team at Restore. Our

people have shown tremendous resilience and relentless commitment

to our customers and to one another, maintaining full service

throughout the disruption of the past two years. I feel incredibly

proud of the positive response from our front-line teams, the

supporting functions, and our leadership group as they navigated

the uncertain events of the past two years. I would like to thank

them for their outstanding contribution on behalf of the Board,

shareholders, and our customers.

2021 Performance

Restore has delivered strong revenue and profit growth in 2021

with a 28% increase in revenues to GBP234.3 million and a 64%

increase in adjusted profit before tax to GBP38.1 million compared

with 2020. This growth is from the restoration of revenues impacted

in 2020 by extensive disruption, through acquisition and from

underlying organic revenue growth. With a strong exit rate from

2021 and an annualised GBP260 million exit run rate revenue, the

business is 21% larger when compared to the pre-pandemic revenue of

GBP215.6 million in 2019.

Whilst 2021 was subject to further restrictions, particularly in

the first quarter and at the end of the year with the emergence of

the Omicron variant, the underlying business environment for

Restore has been more predictable with the embedding of adapted

working patterns across the organisations we serve. As a result of

this high confidence in the performance of the business, the Board

approved investment in eight acquisitions during the course of the

year. These acquisitions continued to build the Records Management

business and have transformed the Digital and Technology

businesses, more than doubling their scale and significantly

enhancing our product capability.

To support this investment, the Group raised GBP40 million

through an equity raise in May and the Board thanks shareholders

for their support in this over-subscribed offer.

As a result of the improved profits of the Group and reflecting

the increase in shares issued, adjusted earnings per share

increased to 23.2 pence for the year, an increase of 55% compared

to 15.0 pence achieved for 2020.

The Group continues to demonstrate its strong cash generative

nature and despite the substantial level of investments during

2021, the closing leverage of 1.8x EBITDA provides plenty of

capacity to continue to invest in 2022.

Strategic progress

In addition to the strong financial performance for the year,

Restore has made strategic progress across a number of commercial

and operational areas adding further depth and capability to the

Group.

Records Management continues to grow in scale and is providing

an excellent platform for extension of the Group's digital and

information management services. Over the course of the last year

the business has won, and is executing, a number of substantial

client service contracts supporting the increasing requirement to

extract value from existing and newly created data in both hard

copy and digital formats.

The investment in Restore Digital, and its subsequent expansion

of scale and product lines, is a significant step in the

development of the business. It is well on its evolutionary journey

from high volume processor of scanning and digitisation to become a

value-add digital services partner, focussed on business process

outsourcing, digital storage, digital data management and enhanced

software capabilities.

The Board and I are also pleased to report on the successful

steps in executing on the substantial opportunity Charles and the

team have previously presented in relation to the IT and Technology

asset lifecycle support sector. Restore Technology reached number 1

status in this sector during the year with 6% market share and the

team are successfully driving a fast growth acquisition and organic

growth strategy.

Management have also been very active in deepening the quality

of the business. In addition to the continued digitisation of the

business and internal operational enhancements, the Board was

pleased to formally launch the Group's Environmental, Social and

Governance ('ESG') strategy in November 2021.

The 'Restoring Our World' strategy can be found on the Group's

recently updated website at www.restoreplc.com. Our management team

and the Board is fully committed to the balanced objectives set out

in the strategy and in achieving the headline target to become a

Net Zero organisation by 2035.

The Board received an unsolicited, non-binding and equity-based

offer from Marlowe plc during the year. Whilst the Board took time

to seek external guidance and invested significant resources to

properly assess the offer, the bid was unanimously rejected by the

Board. We considered that it fundamentally undervalued the Group,

lacked strategic rationale or logic and the financial consideration

proposed, in the form of Marlowe shares, would have been a very

poor outcome for shareholders. The Board would like to thank our

shareholders for their overwhelming support of the Board in their

rejection of this offer.

Health and Safety

During the last quarter of the year, the Board engaged a third

party to perform an independent audit of the Group's health and

safety environment and to assess progress since the last external

audit performed in 2019.

The audit highlighted significant progress in Restore's Health

and Safety operating framework and recognised the high priority

given to Health and Safety matters across the Group's management.

The report also highlighted additional areas to focus on, in

particular more advanced skills training and reporting, and these

will be taken forward and actioned.

In addition to the development of the Health and Safety

structure I would extend my gratitude to the health and safety and

management team for their excellent navigation of the COVID-19

period and for guiding us in the constant evolution of our safe

working practices through the whole period.

Finally, I would like to mention the investment we have made in

our deep-storage mine facilities which I visited with the Board in

October. Over the course of the last two years the Group has made

significant investment into enhancing the environmental quality of

our deep-storage facilities and in 2021 successfully installed

extensive networking within the mines, creating a safer and more

productive work environment.

Dividends

Your Board is recommending a final dividend of 4.7 pence,

payable on 8 July 2022. This brings the total dividend for the year

to 7.2 pence (2020: nil pence due to pandemic risk mitigation).

The restoration of the dividend during 2021 is consistent with

the Board's high degree of confidence in the business and a return

to its previous progressive dividend policy.

CEO's Statement

I am delighted to report that 2021 was a transformational year

for the company with record adjusted profit before tax of GBP38.1

million (+64% vs 2020 and +7% vs 2019) and a significant expansion

of the services we provide to customers which will continue in 2022

as we make progress on our ambitious growth strategy. We completed

eight acquisitions in the year across Records Management, Digital,

Datashred and Technology which has increased both the scale and the

capability of these business units in what continue to be high

growth, mission critical services.

I reported last year that the business showed great resilience

in the face of the pandemic and that during the second half of 2020

the business rebounded, quickly regaining momentum after the

initial impact of the pandemic in Q2. This recovery continued to

build through 2021, with both underlying growth and bounce back

effects, despite the significant lockdowns that were imposed in Q1

of 2021. The strong bounce back beyond pre-pandemic levels

demonstrates the resilience of the business and the critical nature

of the services we provide to our customers despite any social or

business restrictions posed by COVID-19.

Health and Safety (H&S) is the number one priority in the

Group for our employees, suppliers and customers. I am delighted to

report improving results in all business units throughout the year.

With the increasing activity in the business a key focus was around

new employees and their correct H&S induction. We increased the

number of surveillance audits with encouraging results because our

focus is to continue to improve our operations and to invest

strongly in H&S, training, education and drive a culture of

H&S first in all that we do.

During the year all business units started to deliver on

investments in technology and organisational changes which will

yield benefits in 2022 and beyond. These changes and further

investments in 2022 will transform the digital experience for

customers and also create significant productivity benefits. In

most of the business units our portals and customer digital

experience are very good, but our goal is to have an industry

leading experience from initial engagement, through the sales

process to the day-to-day operational management.

With the increasing activity across the Group, we end the year

with record number of employees in the business to further expand

in 2022. The end of year employee numbers are 2,760 permanent

employees with a further 300-400 agency workers which is overall an

increase of over 25% on pre-pandemic levels. I have been

particularly delighted with the improvement in the leadership

talent across the group as we invest in leadership cognisant of

delivering improving profit in the year but also investing heavily

in talent for the next stage in the scaling of the business. In the

top 62 leaders over 75% are new in role or new to the company

through hiring or acquisition of businesses and in the Executive

Committee there have been two new appointments in the year.

We made good progress on our high growth strategy and we have

further announced ambitious but achievable medium-term goals to

increase our exit run rate revenues from c.GBP260 million towards

GBP450- 500 million with EBITDA doubling to over GBP150 million.

This will deliver significant shareholder value creation.

Results

I am delighted to report record revenues of GBP234.3 million

which is 28% up on 2020 and 9% above pre-pandemic levels. Our

profit performance is strong with a record adjusted profit before

tax of GBP38.1 million, strong operating margin performance across

the businesses and EBITDA of GBP74.2 million for the year (+29%).

We continue to show a disciplined approach to cash management with

debtor days and aged debt in line with our expectation, net debt

finishing the year at GBP100.8 million and a leverage ratio of

1.8x. From the Group's continued high cash generation and with

increased capacity from our newly expanded bank facility, the

Restore Group has substantial capacity for further investment

growth.

As well as driving earnings accretive acquisitions our

disciplined approach demands a strong Return On Invested Capital

(ROIC) from our investments. With GBP86.3 million invested in 2021,

delivering a post-synergy ROIC of 13.0%, the returns from our

investments are proving to be very strong and well above our cost

of finance. As the business expands and matures, the scale benefit

of the investments we are making will substantially enhance the

ROIC from the business.

Organic revenue growth continues to compound and was 5.0% for

2021, which is a very good result considering 3-4 months of the

year were significantly disrupted with lockdowns delaying sales

decisions. We can see momentum in each of our sectors and

strengthening levels of cross selling and up-selling opportunity

across the Group with over 1,200 referrals from one business unit

to another.

We continue our focus on cost management and productivity across

the teams. I am delighted the business units have continued to

improve operational performance metrics while delivering

productivity and cost management initiatives.

The strong financial performance for 2021, and our confidence to

invest GBP86.3 million in acquisitions during the year,

demonstrates the team's successful progress in delivering our

strategy and confirms our strong conviction in our potential for

substantial growth in the future.

Customers and our Markets

The business has transformed over the last 3 years and this

change is reflected in the divisional structure and our evolution

from Document Management and Relocation to Digital and Information

Management and Secure Lifecycle Services.

We currently participate in markets with total size of at least

GBP1.9 billion with an overall market share of c.13%. We have

either a number one or number two position in each market and even

with these leading positions we have ample room to grow to a 25%+

share and towards our initial goal of GBP450-500 million in

revenues. The market forces which dominate the rate of change and

growth are 1) Digitisation, 2) Security of Data, 3) Flexible

working, and 4) Sustainable working. The pandemic is likely to

further accelerate momentum to these changes which as we have said

over the last three years (even before the pandemic) are very good

trends for the growth of Restore. We have embraced and are driving

these trends and actively evolving our offerings and creating new

ones with large public and private sector organisations to provide

commercial benefit, manage risk, address their ESG obligation and

expand their productivity.

One other key change in the markets we could see in the medium

term as a result of COVID-19 is customer evaluation of the

providers with whom they deal.

We prioritised customer responsiveness and experience during the

last 18 months and in a number of cases invested significant extra

effort to service those customers. We have also worked hard to

moderate price rises with cost management; the end result being

extremely favourable customer feedback and low customer churn

levels. The same cannot be said for our competitors in various

business units who either closed offices/service provision or

responded with, in our view aggressive pricing tactics.

In the first month of the pandemic, we said very clearly we

would prioritise 1) Health & Safety, 2) customer experience,

and 3) the bounce back of the business. Those decisions taken early

in 2020 are very evident in the performance of the business in

2021. I firmly believe that with our very strong customer

experience, value of our services, investment in continual

transformation and investment in new services we will be the net

beneficiary of customers looking to establish new long-term

relationships with our business.

ESG

We announced our new ESG Strategy in Q4 2021 called 'Restoring

our World'. We have taken the time to understand what matters to

all stakeholders in the business when developing this strategy from

shareholders, employees, customers, suppliers, and the wider

community. We have also worked hard to ensure we have specific

targets, actions, and timing for this first strategic plan with the

aim of delivering on these and also looking to improve the timing

and impact. At Restore we pride ourselves on being extremely

customer centric and pragmatic with the way we run our business for

the long term but also brave in transforming the business and using

the strong financial position of the company to deliver against the

plans.

We have set out a bold target to become a Net Zero organisation

by 2035 which requires real and sustained focus along with

technology based investments and we are endeavouring to work

towards even more ambitious achievements. We are also working on

the next version of the strategy to include more specific plans on

Waste, Scope 3 emissions and other areas that matter to our

stakeholders based on feedback from the inaugural strategy and

plans we have announced.

I can say with absolute certainty that the whole team at Restore

is motivated and energised by our commitment to do the best for our

environment and the communities we live in. We are committed to

deliver with the highest levels of integrity and governance you

would expect from a company entrusted with such critical services

to customers and the broader society in the UK.

Digital and Information Management

Our Digital and Information Management division comprises

Restore Records Management and Restore Digital. For 2021 revenue

was GBP138.3 million, up GBP32.2 million on 2020 with operating

profit of GBP42.5 million, an increase of GBP8.5 million on

2020.

Restore Records Management

Restore Records Management growth was substantial during 2021

with organic revenue growth of 5.6% and total revenue growth up

16%. Pricing was increased at ordinary inflation rates with total

box storage volumes up 11.6%, including organic growth at an

impressive 1.3% (vs 0.9% in 2020 and 1.9% in 2019). This

demonstrates that even with various lockdowns and interrupted

business activity in the wider economy we can grow strongly. Three

acquisitions in the year of 1BDM, EDM and The Document Warehouse

('TDW') contributed to this overall excellent result. Our total box

storage volume at the end of 2021 is now 22 million boxes which

means over the last three years we have increased our storage by

2.6 million boxes or 13.3%.

Storage revenue grew by 5.4% during the year and including

activity-based revenues the total revenue for the year was GBP101.4

million and we end the year with exit run rate revenue of GBP110

million. Although we experienced a strong recovery in activity

levels, we still have a number of customers in the private and

public sector that are yet to fully recover their delivery and

retrievals which will provide a positive further tailwind for the

business in 2022.

Occupancy rates closed the year at 89% (2020: 94%) with the

addition of capacity at our new Heywood site of c.1 million boxes

and capacity in the recently acquired TDW business in

Sittingbourne. We exited one large site at Transfessa, Paddock Wood

with a further 4-5 sites planned for consolidation in 2022. Over

the next 8 years we have a clear plan to reduce the number of

buildings in the estate by 50% while at the same time ensuring

increased capacity for the organic and acquisitive growth of the

business. We will invest in larger and higher density sites as we

have done in 2021 to drive down our property cost in the region of

c.25%. We will do this while staying close to our customers to

ensure excellent service levels with deliveries of records.

New customer wins included Department for Work & Pensions

('DWP'), a document services project of approximately GBP10 million

over 20 months which commenced in June 2021.

As part of the service, 95 employees transferred across to us

from the previous provider. We had several other significant wins

across the public sector, including NHS Hospitals, local councils,

and Clinical Commissioning Groups (CCG's). These entities are a new

opportunity for us, driven by funding by NHS commissioners to move

patient notes off site.

Across the private sector we had a 27% increase in new customer

wins compared to 2020 and our pipeline at the end of 2021 is 7%

bigger compared to the previous year. We have almost half of our

2022 new box target already confirmed.

The market trends are very positive for our Records Management

business. Organisations have been slow to adopt digital workflows

in the last 20 years and although some companies have rushed to

implement new digital experiences for customers in the last 12

months, we are still seeing significant growth in physical

documents for storage. If customers decide to invest in further

digitisation of their business (which we encourage) then we are

well placed to win this business because we can deliver both the

physical and digital service for customers. Flexible working also

drives more demand for those 'unvended boxes' held in customers'

premises. When customers move, whether it be downsizing,

rightsizing or upsizing their business it makes no sense to move

boxes to expensive new office facilities when we can offer a fast

turn around and cheaper service compared to inhouse provision with

additional benefits of inventory and asset tracking to provide

peace of mind. We estimate this un-vended market to be c. GBP50-100

million of revenues per year and we

experienced 185 new customers in 2021 with unvended boxes

demonstrating this growth opportunity. A significant customer trend

is towards sustainability in the Records Management market, this

means a focus on energy costs associated with storage of boxes. We

provide the lowest carbon offering to customers to reduce their

Scope 3 emissions. It is these trends coupled with our excellent

customer experience as shown by over 140 Trustpilot reviews (4.7

out of 5) that means we win against competition to drive an

increase in organic market share.

As demonstrated over the last few years (including during the

COVID-19 pandemic) our overall strategy in Records Management is to

drive capacity growth which will deliver significant revenue and

profit growth. We are delivering consistent organic growth with the

market drivers described while also focusing on the customer

experience and reduction in costs. There are substantial

acquisition opportunities in the market, supported by active

discussions with over 20 companies of a total number of 110 with

whom we have continual dialogue.

Restore Digital

Restore Digital helps customers in their digital journey with

services from Digitisation, Cloud, Consulting, Digital Mailroom and

Business Process Outsourcing ('BPO'). Restore Digital revenues

increased substantially from GBP18.5 million in 2021 to GBP36.9

million for 2021 with an exit run rate of GBP46 million. It was a

transformational year for the business with strong organic growth

coupled with two acquisitions, the largest being EDM which was

completed in April 2021 for GBP62.4 million (24% of the revenues

fall in the Restore Records Management business with 76% of the

revenues in Restore Digital). Importantly the capabilities of the

business have been transformed with the addition of EDM which

enhanced our position in the all-important Digital Mailroom space

to be the market leader, and enhanced our Cloud, BPO and software

assets and capabilities which have been outlined as strategic areas

of growth over the last 2 years. We operate nationally from 11

sites with over 800 employees and provide cloud hosting services of

c.GBP6 million in revenues and growing with c. 500 million cloud

hosted images.

With this increase in higher margin services and additional

scale driving efficiencies alongside operational improvement the

net margin of Restore Digital has improved materially in line with

our expectations and the strategy that we have outlined over the

last 2 years.

We are winning in the market with long term contracts

demonstrating the critical nature of the services we provide. In

addition, the sales pipeline at the end of 2021 was significantly

higher than 2020 (increase of 28%).

We have a 10 year contract in partnership with Canon; an awarded

tender through TCS (Tata Consultancy Services) in the DigiGOV

Framework where we will provide Digital Mailroom and Payment

Processing services commencing in September 2022. These services

are vital to support the delivery of a new smart mobility system

that will reimagine the administration of taxi and private hire

vehicles in London.

We were awarded a 3 year contract directly with Monzo bank, one

of the first online-only challenger banks in the UK. We have

successfully rolled out a digital inbound and outbound omnichannel

mailroom, and together we are looking to develop this further,

including cheque processing and wider electronic banking

services.

We signed a contract for 3 years with Dashly, the only 24/7

Mortgage Evaluation Platform. Restore Digital delivers intelligent

Capture and Data Perfection services that enable Dashly's own

revolutionary technology to evaluate individuals' mortgages against

the entire market 24/7 to find the right deal for every customer.

These services enable mortgage advisers to effortlessly onboard

their clients and are then alerted whenever Dashly identifies an

opportunity for them to save money, taking into account all fees

and early repayment charges.

Over the last 12 months we have made extensive preparations for

the upcoming delivery of critical elements of the Scottish Census

on behalf of National Records Scotland and in partnership with APS

Group we look forward to the start of service delivery at the end

of February 2022. The services provided illustrate the breadth of

Restore Digital's capability, from document digitisation, through

complex data capture and interpretation and including provision of

supporting systems.

The long term trends for Restore Digital are very positive with

customers looking to unlock the information in physical records to

support a digital transformation. We can help customers with both

of these challenges and so provide a one stop shop for customers

who want to simplify what are difficult changes for them. Changes

in the workplace are favourable with services like Digital Mailroom

which remove the need for customers to have onsite mailroom

employees and this also enhances their ability to change their

property portfolios. Hybrid working increases the need to be more

digital and we offer a complete physical to digital service and

with our consulting, cloud and software assets we help customers in

this journey. The services we provide come with attractive

financial profiles for Restore comprising a mixture of project and

multi-year subscriptions revenues.

Our strategy is to continue to grow aggressively with a mix of

organic growth and acquisitions for additional capability and

scale. The market size is at least GBP320 million and growing at a

minimum of 4% and with 15% market share we have significant room to

grow. After integrating EDM in 2021 and delivering strong organic

growth the business is ready for an even bigger year in 2022.

Secure Lifecycle Services

Our Secure Lifecycle Services Division comprises Restore

Technology, Restore Datashred and Restore Harrow Green. For 2021

revenue was GBP96.0 million, up GBP19.4 million on 2020 with

operating profit of GBP11.7 million, an increase of GBP8.5 million

on 2020.

Restore Technology

Restore Technology had a transformational year and exits 2021

with exit run rate revenues of GBP34 million. This means the

revenue from this business unit has trebled in size over the last

three years. Size and scale expansion has also resulted in

significantly improved margins, with further opportunities still to

pursue through operational efficiency. Scaling from GBP15.3 million

to GBP28.1 million, this business unit now operates across seven

sites, provides truly national coverage, employs almost 400 people,

serves 18,000 clients, handles over 1.4 million assets, and enjoys

the market leading position and is the largest UK owned IT

Lifecycle Services business.

Three new businesses were acquired in the year. Starting in

January 2021 we purchased Computer Disposals Limited, a scale IT

Asset Disposals ('ITAD') company with national coverage and

operational strength. We acquired a small business, The Bookyard

which increased our capability with Apple technologies, and in

August we acquired PRM Green Technology, another ITAD company with

operational strength, with significant penetration in the education

sector. I am delighted with the acquisitions in Restore Technology

this year. The inorganic growth from these businesses, combined

with the sales growth delivered by the team has contributed to both

a strengthening of performance and capability. Our pipeline of

future acquisitions is exciting and promises continued success in

this vein, particularly as we consider how expanding capability

throughout the technology lifecycle will offer yet more value to

our clients and differentiation of our portfolio.

In line with our overall growth, 2021 has been a year of success

with our clients. Organic and inorganic growth combined saw this

business welcome GBP9 million of new client opportunities, which is

a several fold increase YoY, incorporating many prestigious logos.

Our increasing scale and client base presented an opportunity to

evolve our sales strategy and coverage model. We increased our

focus on clients, new and existing, enterprise and SME, direct and

in partnership with our channel. We intensified our efforts around

client experience, eCommerce and digital transformation. Our

resilience and agility enabled our clients to rely on us as their

businesses evolved through 2021, despite the changing landscape of

COVID-19 restrictions.

Our brand's association with trust further strengthened

throughout 2021. Our clients already associate us with the highest

levels of accreditation and certification, giving them confidence

to trust us with the responsibility of handling their data

ethically and securely. Our PlanetMark certification achieved in

2021 underscores our commitment to environmental sustainability, a

core value of our technology business. Trusting Restore Technology

with the processing of technology ensures assets are always handled

securely, ethically and sustainably, whether that be for services

early in the lifecycle such as asset and imaging, services through

the lifecycle such as upgrading or moving, and services at the end

of the lifecycle such as reuse, remarketing, or destruction. The

Restore Technology business is now 'the' secure and sustainable

choice for technology lifecycle services.

As market dynamics continue to elevate the importance of these

values, the technology lifecycle market will only continue to grow

and our opportunity likewise. Technology spend is growing at least

6% pa. which in turn drives demand for the need to recycle

technology assets in a secure and sustainable way. Our ambition for

growth in this area reflects this growing demand and will see us

outpace the market. Our exciting medium-term goals are to build a

business with GBP80-100 million annual revenues with a services

portfolio designed to serve both our clients and our channel alike,

across all phases of the technology lifecycle. 2022 promises to be

another exciting year for this part of our business.

Restore Datashred

Restore Datashred our secure shredding and paper recycling

business was impacted in the H1 2021 with the UK wide lockdowns and

in H2 showed significant improvement in activity levels with

customers. Revenue increased to GBP30.2 million (2020: GBP28.0

million) with a 9% increase in service visits for the year.

Recycled paper prices increased during the year. Entering the year,

the average price per tonne was c GBP158 and the average for the

whole year was c.GBP185, with overall paper volumes on par with

2020 levels; we expect this volume to materially increase in

2022.

We carefully maintained our position as one of the top online

search choices for shredding services in the UK. This maximised the

inbound opportunity and delivered a consistent level of ad-hoc

destruction requirements across the UK. There were a number of key

wins across the year with a sizeable new national pharmacy

customer, operating over 1,400 sites across the UK. This

opportunity was successfully transitioned, on-boarded and

operations began servicing at the end of 2021. In addition, the

sales team on-boarded over 2,200 new customers into the Group. As a

result of cross selling the team supported some major new contracts

in Records Management and Digital, where having the capability to

destroy documents inhouse, formed a major part of the decision

criteria.

We have a clear plan to improve operational efficiency whilst

also improving our customer experience. Our 5-year operational

strategy is focused on delivering transformation aligned to the

Group ESG targets: optimising the number of customers we service

per route per vehicle, ensuring we utilise the right vehicles so we

match capacity with customers, reviewing our depot footprint to

make sure we are aligned to our customer density and have the

optimum destruction capability to service our customer needs. In

addition, over the last 2 years the team has focused on optimising

our fleet with a mix of different vehicles from vans to small and

large trucks to fit the profile of the work we do (onsite shredding

vs offsite) to drive more visits per day and overall utilisation.

We have also improved the routing of vehicles and the operations of

our 9 destruction sites and 3 collection sites across the UK. With

a focus on transformation whilst managing the complexities of the

pandemic, the team have improved the overall structural

productivity of the business. With the expected increase in volumes

across this year, this will generate improved returns from this

business.

Customer satisfaction was excellent throughout the year with

positive feedback and a continued strong Trustpilot score of 4.6/5.

We improved our market leading NPS score from an average across

FY20 of 70 to 72.5. Service levels into our customer base were also

maintained above 95%, which in a COVID impacted environment is

testament to our robust processes and professionalism across our

operations teams.

Our digital transformation drive continues, with a focus on

automation to streamline our processes, enhancing our customer

experience. We launched a new online service, Homeshred for

consumer home collections during the pandemic and expanded the

service to now the most comprehensive range in the market. We also

launched a pilot demonstrating our new automated customer reports,

to which feedback has been excellent, and it is now part of our

mainstream business.

We completed one small acquisition in Q4 2021 which is now fully

integrated, and we are in early stage discussions with a number of

companies. We expect over the next 12 months to see increasing

activity which will help us scale up the business on the stronger

foundations we have created over the last 18 months.

The paramount concern of our customers is the security of data

with their shredding service but increasingly the environmental

impact of the service including carbon emission, waste management

and the recycling of material is becoming a key buying criterium,

which is a positive trend for our business.

Our strategy is to grow the business substantially both

organically and through acquisitions which increases our scale and

investment in new technologies to deliver a Net Zero service. I am

delighted with the progress of the team in the last 2 years. They

have weathered the uncertainties presented by COVID-19 and

continued to transform the business such that we are ready for the

bounce back with significantly improved sales and operational

performance and a lower cost base to generate good returns for the

business as activity and scale returns.

Restore Harrow Green

Restore Harrow Green delivered a very strong year despite the

volatility posed by COVID-19 with customer decision cycles changing

more than normal. Harrow Green achieved an increase in revenues to

GBP37.7 million (2020: GBP33.3 million) and also delivered record

profits with very strong cost control across the business.

In 2021 we saw a sharp increase in activity levels for quoting

of work which was up 24% vs 2020 but still lower than 2019 volumes

as we expected. The increase in opportunities did bring some very

significant wins throughout the year, with the following projects

secured: University of Exeter >GBP800k, University of Glasgow

>GBP190k, City of London Police >GBP350k and Victoria &

Albert Museum >GBP200k. Overall the larger scale corporate

projects have significantly reduced in terms of volume and size

however we expect this to come back in 2022 and beyond with pent up

demand.

We made significant progress in 2021 around our strategic goal

in increasing our presence in the Life Science market. We opened

our Cambridge site in Q1 of 2021 with its increased capability

supporting the pharmaceutical market. We have significant

capability already and on the back of this investment we have seen

very encouraging new wins for major office and laboratory moves

along with storage, delivery and installations of equipment for

OEMs supplying these customers. The additional storage capability

with this new site has meant we have achieved storage revenues of

GBP4.1 million across our 9 facilities which is 26.5% ahead of 2020

and 36% on 2019. We have seen strong long-term demand for this

value added service which also drives improvement in the margin. We

intend to invest further in new facilities in 2022 to increase our

storage capacity. In 2021 we were unsuccessful in renewing the DAS

contract (Defence Accommodation Service) of which we are a

sub-contractor (our portion is <15% of the overall contract)

through Amey. We will have at least 3 months of the contract in

2022 and will TUPE the affected employees at the end of the

contract.

The strong financial result was underpinned with excellent 'on

the day' execution by the team and continued cost control

throughout the year. Activity levels in the regions increased

strongly which offset a more subdued London market which we expect

to equalise during 2022.

Over the next 12-24 months our expectation is that there will be

pent up demand for office relocation and reconfiguration. A number

of companies and public sector organisations delayed lease breaks

and office changes that had been planned and this demand plus the

new demand posed by organisations needing to move offices with

lease breaks will mean a significant wave of activity. We have seen

in the last two months of 2021 increased proposal and quoting

activity, although we have seen a slower return to activity in

January following the latest restrictions. We are being cautious

with the addition of labour to meet this demand and we can flex

with our agency workforce as required.

Restore Harrow Green's strategy is to grow organically and

expand into new customer segments that value certainty of delivery

as demonstrated with our Life Sciences investment in Cambridge.

Although the strategy is focused on organic growth, we will look at

acquisition opportunities that may present themselves as we emerge

from COVID-19 to strengthen our regional footprint and also key

customer segments.

Outlook

Looking ahead we are seeing increasing demand for our mission

critical services and coupled with strong cost control and

acquisitions we expect to deliver further increases in EPS in-line

with our high growth strategy.

Despite macro uncertainty, we are well positioned for further

organic growth in 2022 and have an active pipeline of strategic

acquisitions to further build scale and capability. Inflation is a

headwind but with strong productivity gains and pricing, we are

confident in our ability to contain this risk.

In Records Management, we delivered 1.3% organic growth in boxes

in 2021 and we are determined to improve on this result in 2022 in

line with our guidance of between 1-2% organic volume growth, and

with price increases on the storage revenue increase in 2021.

Our margin expansion strategy over the medium term is very

clear, and, in the shorter term with continued scaling of the

business, higher margin services and tight cost control, we see a

good margin expansion opportunity on a business which is much

larger.

The financial strength stemming from strong recurring revenues

and long-term contracts coupled with high customer satisfaction

levels mean we can invest heavily for long term growth while

delivering in year increases in EPS. We operate in attractive

markets that are growing and also largely fragmented and so we have

significant organic and acquisition growth opportunity.

Our medium-term goal to increase run rate revenues from GBP260

million to between GBP450-500 million and double EBITDA of GBP74.2

million today to over GBP150 million is on track.

Trading since the start of the year has been in line with the

Board's expectations.

CFO's Statement

Restore has delivered a strong financial performance for 2021

with record levels of revenue and profit, positive organic growth

momentum and successful execution of a number of transformative

acquisitions.

The Group has delivered clear underlying business expansion and

successfully completed eight strategically aligned, high quality

business acquisitions at an investment cost of GBP86.3 million, net

of cash acquired, during the year to 31 December 2021. With

combined annualised revenues of c.GBP44 million and EBITDA of

c.GBP16 million after synergies, these investments are providing

strong returns and a post synergy ROIC of over 13.0%. These

investments have increased the number of boxes under management in

Records Management from 20 to 22 million boxes, more than doubled

the size of both Restore Digital and Restore Technology and further

enhanced the Group's scale, capability, and breadth of

products.

Reflecting this strong financial performance and confidence in

the Group's prospects, a final dividend of 4.7 pence per share is

proposed. Together with the interim dividend of 2.5 pence per

share, previously declared and paid, the total dividend for the

year to 31 December 2021 will be 7.2 pence per share (2020: nil

pence).

With revenues of GBP234.3 million for 2021, and an exit run rate

of GBP260 million, Restore has substantially increased in scale.

With a track record of strong cash generation, substantial balance

sheet capacity and significant opportunity for organic and

acquisition expansion, the Group is well placed for further growth

in 2022.

H1 H2 2021

Revenue GBPm GBPm GBPm

2021 106.1 128.2 234.3

2020 89.5 93.2 182.7

2019 106.2 109.4 215.6

2021 v 2020 119% 138% 128%

2021 v 2019 100% 117% 109%

------------- ------ ------ ------

Income Statement and profit performance

The Group's revenue for the year ended 31 December 2021 was

GBP234.3 million, an increase of 28% over 2020. This strong growth

reflects a return to largely normal activity levels during 2021

following the impact of COVID-19 on 2020 performance, underlying

organic expansion and the benefit of strategic acquisitions during

2021.

Revenue bridge GBPm

2020 Revenue 182.7

COVID-19 repair 10.2

Organic growth 9.2

Acquisitions in year 30.0

Full year effect of prior year acquisitions 2.2

2021 Revenue 234.3

--------------------------------------------- ------

As anticipated, 2021 saw a strong recovery from the impact of

COVID-19 restrictions on 2020 performance with revenues back to 95%

of pre-pandemic levels by the end of Q1 2021. The business

experienced a steady return of activity and underlying organic

expansion throughout the year although Restore Datashred was slower

to recover than other businesses repairing from 62% of pre-pandemic

revenue levels in Q1 2021 to 84% by Q4 2021.

Organic growth in the year, is estimated at GBP9.2 million with

identifiable, organic only effects derived from net box growth,

normal price increase and net contract wins. This represents an

organic growth rate of 5% and is in line with strategic objectives

as set out at the Capital Markets Day in November 2021.

Whilst COVID-19 recovery and organic expansion has been strong,

a number of headwinds remained in the year with potential to repair

further in the future. Notably, compared to the pre-pandemic

period, Restore Datashred revenues were down c.GBP10 million;

Restore Digital once again absorbed the cancellation of GCSE and A

level digital exam scanning at a revenue impact of c.GBP3 million;

and certain service income activities were lower in Harrow Green

(c.GBP4 million); and Records Management (c.GBP4 million).

Acquisitions in the year benefitted revenue by GBP30 million.

This annualises to GBP44 million and has driven a substantial

increase in the scale of the business from revenues of GBP215.6

million in 2019 to an exit run rate of GBP260 million by Q4 2021.

The returns on these investments have been excellent, achieving a

post synergy return in capital invested of 13.0%.

The business continued to focus on cost and margin improvement

during the year with a number of strategic cost initiatives

underway. Of note, the Group completed fuel supplier consolidation

in H1, entered into a strategic long-term lease in Heywood and

acquired a freehold in Sittingbourne to support Records Management

growth and reduce cost per box through increased storage density.

In Q4, the business commenced a strategic review of fleet

suppliers, in light of future ESG goals, and started to assess the

potential consolidation of security and facilities services across

the Group.

Using 2019 as a clean comparative, the key cost ratios have

remained flat through to 2021 with people costs at 43% of revenue

in 2021 and 2019, and with property lease payments at 8% of revenue

across the two periods.

As a result of the revenue expansion and productivity

improvements, the Group's adjusted profit before tax increased to

GBP38.1 million for the year to 31 December 2021 from GBP23.2

million for 2020, an increase of 64%. The operating margins also

showed positive momentum during 2021, growing from 18.5% in H1 to

20.7% for H2 to give a full year margin of 19.7% (2020: 17.4%).

The statutory profit before tax for the year to 31 December 2021

was GBP23.0 million (2020: GBP4.0 million). This increase results

from the positive trading reasons stated previously and the impact

of non-cash impairments in the prior year totalling GBP8.6

million.

Adjusted profit items

Due to the one-off nature of exceptional costs and the noncash

element of certain charges, the Directors believe that the

alternative performance measure of an adjusted profit before tax

and earnings per share provides shareholders and other stakeholders

with a useful representation of the Group's underling earnings and

performance. The adjusting items in arriving at the underlying

adjusted profit before tax are as follows:

2021 2020

GBPm GBPm

Statutory profit before tax 23.0 4.0

Adjustments

- Amortisation 10.7 8.3

- Impairment - 8.6

- Exceptional costs 4.4 2.3

Adjusted profit before tax 38.1 14.6

----------------------------- ----- -----

Amortisation has increased as a result of acquisition

investment. Details of exceptional cost movements are set out

below.

Exceptional costs

Restore's strategy is to grow through organic expansion,

strategic acquisition and margin enhancement through efficiency and

scale. To deliver these objectives, costs of a one-off or unusual

nature may occur and in order to give a suitable representation of

the underlying earnings of the Group, these costs are shown

separately.

2021 2020

GBPm GBPm

Acquisition transaction costs 1.2 0.1

Acquisition related restructuring costs 2.4 0.1

Restructuring and redundancy - 1.3

Other exceptional items 0.8 0.8

Total exceptional costs 4.4 2.3

----------------------------------------- ----- -----

Acquisition related transaction costs and restructuring costs

have increased from GBP0.2 million in 2020 to GBP3.6 million in

2021. This increase is as a result of the Group's eight

acquisitions during the year and represents 4% of the acquisition

investment during the year, in line with management

expectations.

Other exceptional costs in 2021 include legal and advisory costs

in respect of the unsolicited, non-binding, highly conditional

approach to the Group by Marlowe plc during the year (GBP0.5

million), and final adjustments to the penalty relating to an

incident at the Crayford site in 2018 (GBP0.3 million), with the

total fine finalised at GBP0.6 million.

Earnings Per Share (EPS)

Basic adjusted earnings per share are calculated by reference to

the adjusted profit for the year, less a standard tax charge, to

the weighted average number of shares in issue during the year.

The fully diluted adjusted earnings per share are calculated by

reference of the adjusted profit for the year, less a standard tax

charge, to the weighted average number of shares in issue and

options granted over the shares of the Group during the year.

2021 2020

Basic adjusted earnings per share from continuing

operations 23.2p 15.0p

Fully diluted adjusted earnings per share from

continuing operations 22.4p 14.6p

Basic earnings per share from continuing operations 8.7p 0.2p

----------------------------------------------------- ------ ------

The 55% year on year increase adjusted EPS reflects the 64%

increase in the Group's earnings in excess of the 6% increase in

the weighted average number of shares following the issue of equity

in support of acquisition activity in May 2021.

Interest cost 2021 2020

GBPm GBPm

Interest on bank loans and overdrafts 2.6 2.8

Interest on lease liabilities 5.2 5.4

Amortisation of deferred finance costs 0.3 0.3

Total 8.1 8.5

---------------------------------------- ----- -----

The bank interest cost for 2021 is slightly reduced compared to

2020 with the average debt balance broadly similar, although

generally increasing, through 2021.

Non-cash interest cost on the lease liability reflects the

application of IFRS16 and is slightly reduced from GBP5.4 million

in 2020 to GBP5.2 million for 2021 as the liability reduced during

the year from GBP120.7 million at 31 December 2020 to GBP117.0

million at 31 December 2021.

Taxation

The current tax charge for the period is GBP11.5 million.

Following the announcement on 3 March 2021 of a change to the UK

corporate rate to 25% in 2023, which has now been substantively

enacted, we have re-assessed the deferred tax position of the Group

which has resulted in an additional non-cash tax charge of GBP6.2

million being recognised in the income statement.

Cash generation and financing

The Group's cashflow continues to benefit from a high quality,

reliable customer base with very low levels of bad debt or late

payment. The free cashflow generation of GBP24.5 million for 2021

(2020: GBP29.6 million), reflects the continued high profit to cash

conversion characteristic of the Group and is after a working

capital outflow of GBP12.1 million primarily due to absorbing the

effect of the expansion of working capital in support of the

business growth of c.GBP2 million, working capital requirements

associated with acquisitions and full repayment of c.GBP8 million

of VAT deferred from 2020.

During the year, the Group substantially increased the pace of

business acquisitions and invested GBP86.3 million, net of cash

acquired, including deferred consideration. Whilst primarily funded

from the Group's debt facilities, the business also raised

additional capital of GBP38.1 million, net of issue costs, through

an equity placing in May 2021.

The Group continues to have significant headroom within its

borrowing facilities with the current Revolving Credit Facility

(RCF), which runs to April 2025, providing borrowing capacity of up

to GBP200 million plus a further uncommitted accordion of GBP50

million, leaving the Group with flexibility to invest as

opportunities arise.

Statement of Financial Position

The Group's balance sheet continues to be in good health with

key working capital ratios in line with previous years and further

expansion of the net assets of the business due to the profitable

nature of the Group's activities whilst balancing with returns to

shareholders.

2021 2020

GBPm GBPm

------------------------- ------ ------

Working capital* 12.8 3.3

Total Equity/Net Assets 265.2 218.6

Net Debt (post IFRS16) 217.8 186.8

Net Debt (pre IFRS16) 100.8 66.1

------------------------- ------ ------

*Trade and other receivables plus inventory less trade and other

payables

Working capital management remains a strength of the business

with debt ageing consistent at 51 days and the current asset to

current liability ratio improving from 1.2x to 1.4x. Total equity

has increased to GBP265.2 million (2020: GBP218.6 million) as a

result of the annual profit and the equity raise in May 2021.

The strength of the Statement of Financial Position is

indicative of the overall good health of the business and provides

substantial capacity to support future growth and investment

requirements.

Consolidated statement of comprehensive income

For the year ended 31 December 2021

Year ended Year ended

31 December 31 December

2021 2020

Note GBP'm GBP'm

=================================== ==== ============ ============

Revenue 2 234.3 182.7

Cost of sales (127.1) (105.9)

=================================== ==== ============ ============

Gross profit 107.2 76.8

Administrative expenses (61.1) (45.2)

Amortisation of intangible assets (10.7) (8.3)

Exceptional items 3 (4.4) (2.3)

Movement in trade receivables loss

allowance 0.1 0.1

Impairment of intangible assets - (7.0)

Impairment of investment - (1.6)

----------------------------------- ---- ------------ ------------

Operating profit 31.1 12.5

=================================== ==== ============ ============

Finance costs (8.1) (8.5)

=================================== ==== ============ ============

Profit before tax 23.0 4.0

=================================== ==== ============ ============

Taxation 4 (11.5) (3.8)

=================================== ==== ============ ============

Profit after tax 11.5 0.2

=================================== ==== ============ ============

Other comprehensive income - -

=================================== ==== ============ ============

Total comprehensive income for

the year and

profit attributable to owners of

the parent 11.5 0.2

=================================== ==== ============ ============

Earnings per share attributable

to owners

of the parent (pence)

=================================== ==== ============ ============

Total - basic 5 8.7p 0.2p

Total - diluted 5 8.4p 0.2p

=================================== ==== ============ ============

All the Group's results are from continuing operations.

The reconciliation between the statutory results shown above and

the non-GAAP adjusted measures are shown below:

Year ended Year ended

31 December 31 December

2021 2020

Note GBP'm GBP'm

========================================= ==== ============ ============

Operating profit - continuing

operations 31.1 12.5

Adjustments for:

Amortisation of intangible assets 8 10.7 8.3

Exceptional items 3 4.4 2.3

Impairment of intangible assets - 7.0

Impairment of investment - 1.6

Adjustments 15.1 19.2

========================================= ==== ============ ============

Adjusted operating profit 46.2 31.7

========================================= ==== ============ ============

Depreciation of property, plant,

and equipment and right of use

assets 28.0 25.7

========================================= ==== ============ ============

Earnings before interest, taxation,

depreciation, amortisation, impairment,

and exceptional items (EBITDA) 74.2 57.4

========================================= ==== ============ ============

Profit before tax 23.0 4.0

========================================= ==== ============ ============

Adjustments (as stated above) 15.1 19.2

========================================= ==== ============ ============

Adjusted profit before tax 38.1 23.2

========================================= ==== ============ ============

Consolidated statement of financial position

At 31 December 2021

Company registered no. 05169780

31 December 31 December

2021 2020

Note GBP'm GBP'm

=============================== ===== =========== ===========

ASSETS

Non-current assets

Intangible assets 8 327.2 247.4

Property, plant, and equipment 78.8 70.6

Right of use assets 102.5 107.1

Investments - -

Deferred tax asset 5.9 3.4

=============================== ===== =========== ===========

514.4 428.5

=============================== ===== =========== ===========

Current assets

Inventories 1.4 0.9

Trade and other receivables 56.9 41.2

Corporation tax receivable - 0.3

Cash and cash equivalents 10 32.9 26.4

=============================== ===== =========== ===========

91.2 68.8

=============================== ===== =========== ===========

Total assets 605.6 497.3

=============================== ===== =========== ===========

LIABILITIES

Current liabilities

Trade and other payables (45.5) (38.8)

Financial liabilities - lease

liabilities (18.2) (16.7)

Current tax liabilities (1.5) -

Provisions (0.9) (0.4)

=============================== ===== =========== ===========

(66.1) (55.9)

=============================== ===== =========== ===========

Non-current liabilities

Financial liabilities - borrowings 10 (133.7) (92.5)

Financial liabilities - lease liabilities (98.8) (104.0)

Deferred tax liability (33.9) (19.8)

Provisions (7.9) (6.5)

------------------------------------------ ------- -------

(274.3) (222.8)

------------------------------------------ ------- -------

Total liabilities (340.4) (278.7)

------------------------------------------ ------- -------

Net assets 265.2 218.6

------------------------------------------ ------- -------

EQUITY

Share capital 6.8 6.3

Share premium account 187.9 150.3

Other reserves 7.0 6.0

Retained earnings 63.5 56.0

------------------------------------------ ------- -------

Equity attributable to the owners

of the parent 265.2 218.6

------------------------------------------ ------- -------

Consolidated statement of changes in equity

For the year ended 31 December 2021

Attributable to owners of the parent

------------------------------------------------------

Share Share Other Retained Total

capital premium reserves earnings equity

GBP'm GBP'm GBP'm GBP'm GBP'm

----------------------------- --------- --------- ---------- ---------- --------

Balance at 1 January

2020 6.2 150.3 6.1 55.9 218.5

Profit for the year - - - 0.2 0.2

----------------------------- --------- --------- ---------- ---------- --------

Total comprehensive income

for the year - - - 0.2 0.2

----------------------------- --------- --------- ---------- ---------- --------

Transactions with owners

Issue of shares during

the year 0.1 - - (0.1) -

Current tax on share-based

payments - - 0.8 - 0.8

Deferred tax on share-based

payments - - (1.3) - (1.3)

Share-based payments

charge - - 1.2 - 1.2

Purchase of treasury

shares - - (0.8) - (0.8)

Balance at 31 December

2020 6.3 150.3 6.0 56.0 218.6

----------------------------- --------- --------- ---------- ---------- --------

Balance at 1 January

2020 6.3 150.3 6.0 56.0 218.6

Profit for the year - - - 11.5 11.5

----------------------------- --------- --------- ---------- ---------- --------

Total comprehensive income

for the year - - - 11.5 11.5

----------------------------- --------- --------- ---------- ---------- --------

Transactions with owners

Issue of shares during

the year 0.5 39.5 - - 40.0

Issue costs - (1.9) - - (1.9)

Dividends - - - (3.4) (3.4)

Current tax on share-based

payments - - 0.2 - 0.2

Deferred tax on share-based

payments - - 0.6 - 0.6

Share-based payments

charge - - 2.2 - 2.2

Transfer* - - (0.2) 0.2 -

Purchase of treasury

shares - - (2.6) - (2.6)

Disposal of treasury

shares - - 0.8 (0.8) -

Balance at 31 December

2021 6.8 187.9 7.0 63.5 265.2

----------------------------- --------- --------- ---------- ---------- --------

* In 2021 a net amount of GBP0.2m was reclassified from

share-based payments reserve to retained earnings in respect of

lapsed and exercised options.

Consolidated statement of cash flows

For the year ended 31 December 2021

Year ended Year ended

31 December 31 December

2021 2020

Note GBP'm GBP'm

========================================== ==== ============ ============

Cash generated from operating activities 9 59.9 66.9

Net finance costs (7.0) (8.0)

Income taxes paid (5.2) (7.2)

========================================== ==== ============ ============

Net cash generated from operating

activities 47.7 51.7

Cash flows from investing activities

Purchase of property, plant and

equipment and applications software (8.8) (7.3)

Purchase of subsidiary undertakings,

net of cash acquired (85.8) (3.4)

Purchase of trade and assets (0.9) (0.3)

Cash flows used in investing activities (95.5) (11.0)

Cash flows from financing activities

Net proceeds from share issue 38.1 -

Dividends paid (3.4) -

Purchase of treasury shares (2.6) (0.8)

Repayment of revolving credit facility (65.0) (13.0)

Drawdown of revolving credit facility 106.0 -

Lease principal repayments (18.8) (17.1)

========================================== ==== ============ ============

Net cash used in financing activities 54.3 (30.9)

========================================== ==== ============ ============

Net increase in cash and cash equivalents 6.5 9.8

========================================== ==== ============ ============

Cash and cash equivalents at start

of year 26.4 16.6

========================================== ==== ============ ============

Cash and cash equivalents at end

of year 10 32.9 26.4

========================================== ==== ============ ============

Notes to the preliminary financial information

For the year ended 31 December 2021

1. Basis of Preparation

The financial information in this preliminary announcement has

been extracted from the audited consolidated financial statements

for the year ended 31 December 2021 and does not constitute the

statutory accounts for the Group.

The consolidated financial statements of Restore plc have been

prepared in accordance with UK-adopted International Accounting

Standards in conformity with the requirements of the Companies Act

2006 as applicable to companies reporting under those

standards.

The consolidation financial statements have been prepared on a

historical cost basis, except for certain financial assets and

liabilities which are held at fair value. The accounting policies

have been consistently applied, other than where new accounting

standards have been adopted. The preparation of financial

statements in conformity with IFRS requires the use of certain

accounting estimates. It also requires management to exercise its

judgement in the process of applying the Group's accounting

policies.

The consolidated financial statements are presented in pounds

sterling and, unless stated otherwise, shown in pounds million to

one decimal place.

2. Segmental Analysis

During the year, the Directors have reviewed the Group's

operating segments, which has resulted in the classification of two

new operating segments: Digital & Information Management, and

Secure Lifecycle Services. The prior year comparatives have

therefore been restated in accordance with these new segments.

The vast majority of trading of the Group is undertaken within

the United Kingdom. Segment assets include intangibles, property,

plant, and equipment, right of use assets, inventories,

receivables, and operating cash. Central assets include deferred

tax and head office assets. Segment liabilities comprise operating

liabilities. Central liabilities include income tax and deferred

tax, corporate borrowings and head office liabilities. Capital

expenditure comprises additions to computer software and property,

plant, and equipment. Segment assets and liabilities are allocated

between segments on an actual basis.

Revenue

The revenue from external customers was derived from the Group's

principal activities primarily in the UK (where the Company is

domiciled) as follows:

(Restated)

2021 2020

Revenue - Continuing operations GBP'm GBP'm

================================= === ====== ==========

Restore Records Management 101.4 87.6

Restore Digital 36.9 18.5