TIDMRNWH

RNS Number : 6745G

Renew Holdings PLC

24 November 2015

24 November 2015

Renew Holdings plc

("Renew" or the "Group")

Preliminary results

Renew (AIM: RNWH), the Engineering Services Group supporting

critical UK infrastructure, announces record preliminary results

for the year ended 30 September 2015. The Company continues to

demonstrate strong cash generation and has increased the full year

dividend by 40%.

Financial Highlights

2015 2014

Revenue GBP519.6m GBP464.5m +12%

Adjusted operating profit GBP20.4m GBP16.4m +24%

Adjusted operating margin 3.9% 3.5% +11%

Adjusted profit before

tax GBP19.6m GBP16.1m +22%

Adjusted earnings per

share 26.03p 20.80p +25%

Basic earnings per share 21.34p 16.83p +27%

Dividend per share 7.0p 5.0p +40%

Adjusted results are shown prior to exceptional items,

amortisation and discontinued operations.

Operational Highlights

-- Engineering Services revenue up 15% to GBP440.5m (2014: GBP382.5m)

-- 22% underlying organic growth excluding the effect of

acquisitions and non-recurring revenue

-- Engineering Services adjusted operating profit up 23% to GBP20.1m (2014: GBP16.3m)

-- Engineering Services operating margin now 4.6% (2014:

4.3%)

-- Order book up 14% to GBP502m (2014: GBP439m)

-- Substantial reduction in net debt to GBP4.8m (2014: GBP16.1m)

-- Expected net cash position by the end of 2015/16 financial

year

R J Harrison OBE, Chairman said: "These results highlight

another record year for Renew as a leading provider of engineering

services supporting critical infrastructure within the UK.

In 2014 we set our 2017 targets of total revenues of over

GBP500m, a Group operating margin of 4.5% and growth in adjusted

earnings per share of at least 40% from the 20.8p reported last

year. We have achieved our revenue target ahead of schedule. With

an 11% improvement in adjusted Group operating margin to 3.9% and a

25% increase in adjusted EPS in these results, the Board is

confident that Renew is on track to deliver these strategic targets

by 2017."

Renew Holdings plc Tel: 0113 281 4200

Brian May, Chief Executive

John Samuel, Group Finance Director

Numis Securities Limited Tel: 020 7260 1000

Stuart Skinner (Nominated Adviser)

James Serjeant (Corporate Broker)

Walbrook PR Tel: 020 7933 8780 or renew@walbrookpr.com

Paul McManus Mob: 07980 541 893

Lianne Cawthorne Mob: 07584 391 303

About Renew Holdings plc

Engineering Services, which accounts for 85% of Group revenue

and 90% of operating profit, focuses on the key markets of Energy

(including Nuclear), Environmental and Infrastructure, which are

largely governed by regulation and benefit from non-discretionary

spend with long-term visibility of committed funding.

Specialist Building focuses on the High Quality Residential

market in London and the Home Counties.

For more information please visit the Renew Holdings plc

website: www.renewholdings.com

Chairman's Statement

Results

Record results for the year ended 30 September 2015 demonstrate

that the Group continues to progress as a leading provider of

engineering services, supporting critical UK infrastructure.

Group revenue increased by 12% to GBP519.6m (2014: GBP464.5m)

with operating profit prior to exceptional items and amortisation

increasing by 24% to GBP20.4m (2014: GBP16.4m). Earnings per share

on this basis increased by 25% to 26.03p (2014: 20.80p) with basic

earnings per share on continuing activities up 27% to 21.34p (2014:

16.83p).

The Engineering Services business has seen growth of 15% across

its Energy, Environmental and Infrastructure markets with revenue

of GBP440.5m (2014: GBP382.5m). When the effect of acquisitions and

non-recurring Rail revenue is eliminated, the underlying organic

growth in Engineering Services is 22%.

Engineering Services now accounts for 85% of Group revenue

(2014: 82%). Engineering Services operating profit was up 23% to

GBP20.1m (2014: GBP16.3m) with a margin of 4.6% (2014: 4.3%).

Specialist Building remains focused on the High Quality

Residential market in London and the Home Counties. Revenue was

GBP79.5m (2014: GBP82.1m) with an operating profit of GBP2.3m

(2014: GBP2.2m) resulting in an improved margin of 2.9% (2014:

2.6%).

Dividend

The Board is proposing a final dividend of 4.75p per share,

increasing the full year dividend by 40% to 7.0p (2014: 5.0p). The

dividend will be paid on 1 March 2016 to shareholders on the

register as at 29 January 2016. The Board continues to grow

dividends progressively.

Order Book

The Group's contracted order book at 30 September 2015 stood at

GBP502m (2014: GBP439m), a 14% increase, with the Engineering

Services order book up 11% to GBP400m (2014: GBP361m). The order

book reflects our established position in attractive markets with

long-term visibility of revenue.

Cash

Cash generation has been good with a year-end cash position of

GBP10.7m (2014: GBP5.6m) giving a net debt of GBP4.8m (2014:

GBP16.1m). The Board expects the Group to report a net cash

position by the end of the 2015/16 financial year.

People

We are pleased to report our commitment to providing a safe

working environment which has seen the Group continue to record an

Accident Incidence Rate substantially lower than the industry

average. These results and the success of the Group demonstrate the

skills and commitment of all our employees for which the Board

would like to extend its gratitude.

Strategy

In Specialist Building, the Group concentrates on the High

Quality Residential market in London and the Home Counties. Our

expertise is in refurbishment of prestigious private residential

projects where we specialise in engineering solutions for major

structural alterations.

In Engineering Services, the Group continues to develop its

position as a leading provider of engineering services to support

critical UK assets in the Energy, Environmental and Infrastructure

markets. The markets we operate in are mainly governed by

regulation. Our operations focus on the long-term programmes of

essential maintenance spending in these markets, which provide good

visibility of future opportunities and more sustainable earnings

streams.

It remains the Board's strategy to continue the growth of its

Engineering Services business, both organically and through

selective acquisitions. Over the last nine years, Renew has

completed six major acquisitions without recourse to shareholders

for funding. Substantial, profitable growth has been generated from

this strategy which, complemented by organic growth, has enabled

the Board to deliver a six fold increase in market capitalisation

since 2006. In recent weeks, the Board has seen a number of good

quality, potential acquisitions across all market sectors of our

Engineering Services business and we continue to pursue appropriate

earnings enhancing additions to the Group.

Outlook

The Group enters the 2015/16 financial year in a strong

position.

The Board previously published targets for 2017 of Group revenue

in excess of GBP500m, Group operating profit margin prior to

exceptional items and amortisation of 4.5% and growth in EPS on

that basis of at least 40% from the reported level of 20.8p in

2014. The Group revenue target has been achieved with these

results. The Group has also delivered an 11% improvement in Group

operating margin to 3.9% and a 25% increase in EPS giving the Board

confidence that the Group is on track to deliver on these strategic

targets.

R J Harrison OBE

Chairman

24 November 2015

Chief Executive's Review

Renew delivers engineering support services to the UK's critical

infrastructure assets. The Group has strong, long-term

relationships built on responsiveness with a range of clients in

the Energy, Environmental and Infrastructure markets. The Group

operates in mainly regulated markets which have high barriers to

entry. Integrated engineering services are delivered through our

strong, independently branded UK subsidiary businesses which

directly employ a highly skilled workforce. Our operations support

the day-to-day running of key operational assets including nuclear

and traditional power generation sites, water and gas pipes along

with the rail and wireless telecoms networks. The Group also has a

Specialist Building operation focusing on the High Quality

Residential market in London and the Home Counties.

Engineering Services

Revenue in Engineering Services increased by 15% to GBP440.5m

(2014: GBP382.5m) and accounted for 85% (2014: 82%) of Group

revenue and 90% (2014: 88%) of Group operating profit prior to

exceptional items, amortisation and central activities. This

generated an improved margin of 4.6% (2014: 4.3%). The Engineering

Services order book has grown 11% to GBP400m (2014: GBP361m).

Energy

In Energy, the Group provides integrated engineering support to

assets in the nuclear, traditional and renewable energy markets and

in the gas infrastructure market.

(MORE TO FOLLOW) Dow Jones Newswires

November 24, 2015 02:00 ET (07:00 GMT)

During the year, we were appointed by the UK's largest nuclear

decommissioning company, Magnox, as the sole provider on the GBP30m

Electrical, Controls & Instrumentation framework, which runs to

2019, across 10 UK sites. The Group now delivers multidisciplinary

engineering services at 15 nuclear licenced sites, where we support

operational plant associated with long-term waste treatment and

processing, decommissioning and the clean-up of redundant

facilities. The Nuclear Decommissioning Authority's expenditure

continues at approximately GBP3bn per year, of which 67% is

allocated to the Sellafield site in Cumbria where the majority of

our work is undertaken. The Group has operated at Sellafield for

over 70 years and remains the largest mechanical, electrical and

instrumentation employer on site.

As part of the high hazard risk reduction programme at

Sellafield, work on the Evaporator D project has again grown

materially ahead of expectation. During the year, the Group

increased its resources to complete critical milestones as the

project moves towards commissioning. This increased scope is now

expected to deliver up to GBP100m of work over the duration of the

project.

Work on the Multi Discipline Site Works ("MDSW") framework

continues and our operations remain focused on the largest scope of

work, Production Operations Support. The MDSW framework, where we

operate as one of three participants, has been extended for two

years to early 2017 and is advertised to deliver GBP70m annually.

Other framework extensions during the year include the Bundling

Spares, Site Remediation & Decommissioning Project and Bulk

Sludge Retrievals Facility frameworks.

The Group also operates in the traditional and renewable energy

markets for clients including E.ON, SSE, Scottish Water and Dwr

Cymru Welsh Water ("DCWW") where work includes long-term

maintenance and asset renewal services. Achievements in the year

include good progress on the hydroelectric scheme at Tyn Y Waun

Water Treatment Works for DCWW, reappointment to the maintenance

framework at Deucheran Hill Wind Farm by E.ON and the refurbishment

of the Cuaich Aqueduct on the Tummel hydroelectric scheme for

SSE.

In the gas infrastructure market work continues for National

Grid and Southern Gas Networks on the 30/30 Iron Mains Replacement

programme as well as on the London Medium Pressure Strategic Gas

Mains Replacement programme. New frameworks for the delivery of

these programmes have been slow to gain momentum and as a result

this business has not performed to our expectations, however the

addressable market is both substantial and visible with the

national programme for iron mains replacement running to 2032 with

an estimated value of GBP1bn per annum.

Environmental

The Group provides operational support to the water industry

where the focus remains on maintaining and renewing infrastructure

assets as well as the flood alleviation and river and coastal

defence programmes.

In the year, we continued our long-standing relationships with

our clients Northumbrian Water, Wessex Water and Welsh Water.

Awards included Northumbrian Water's AMP6 Sewerage Repairs and

Maintenance Framework where we operate as one of two suppliers; the

framework has an advertised value of over GBP14m per annum to

2024.

Work for Wessex Water continued on the Workstream framework

during the year with new awards including the AMP6 Minor Civils

framework. Major projects completed included the Taunton Grid

Scheme.

Revenue for the Environment Agency has doubled in the year where

our relationship was extended with the award of a GBP10m MEICA

framework in 2014. This exclusive framework, which runs to March

2018, covers flood and water management sites throughout the

Northern region. The appointment follows our success on the

existing four Minor Works frameworks which were extended for a

further two years.

In Land Remediation, we operate for National Grid on a number of

frameworks nationally. Other frameworks include the Land Quality

Services framework with Magnox to remediate the sites of former

nuclear power generation across the UK and a new Landfill

Engineering framework with Viridor for the North of England and

Scotland regions.

Infrastructure

The Group delivers nationally a wide range of off-track asset

renewal and maintenance engineering services as well as providing a

24/7 emergency service to the rail network. These services are

provided through Infrastructure Projects and Asset Management

support for Network Rail where we are a top four supplier.

Following the award in 2014 of a number of infrastructure

renewal frameworks for Network Rail, which run to 2019, we have

good visibility of future workflow. During the year, works were

undertaken to enhance the Dawlish lower sea wall following our

successful operation in 2014 to reinstate the wall after severe

storms. Further to our work at Dawlish we have been appointed to

undertake another coastal line protection scheme at Saltcoats in

Scotland. We are now established as the major structures renewals

& maintenance contractor in Scotland.

In Asset Management our frameworks have been extended by two

years to 2017. We carry out infrastructure maintenance works to

bridges, viaducts, tunnels, culverts, embankments, level crossings

and line side structures. During the year, we have delivered over

5,000 individual schemes ranging from minor brickwork repairs to

major sea defence works and our responsiveness was recognised at

the National Rail Awards where we were presented with "Maintenance

Team of the Year".

In the wireless telecoms infrastructure delivery market, the

Group works for the major cellular network operators and original

equipment manufacturers. This market has seen major corporate

M&A activity during the year which has caused volatility and a

performance below our expectations. The attraction of this market

remains as demand for 4G mobile internet access and communications

is outstripping current capacity, requiring additional

infrastructure, upgrading of existing networks and decommissioning

of redundant assets.

Specialist Building

In Specialist Building revenue of GBP79.5m (2014: GBP82.1m) and

an operating profit of GBP2.3m (2014: GBP2.2m) generated an

improved margin of 2.9% (2014: 2.6%). Our Specialist Building order

book stands at GBP102m (2014: GBP78m). In the High Quality

Residential market in London and the Home Counties our subsidiary,

Walter Lilly, is a market leading luxury brand. It focuses on major

structural engineering works including extending properties below

ground. In excess of GBP85m of new projects has been secured in the

period.

Discontinued Operation

On 31 October 2014, the Board reached an agreement to sell

Allenbuild Ltd to Places for People Group Ltd ("PFP") for a total

consideration of GBP2.75m payable in cash. PFP paid the initial 50%

of the consideration on 31 October 2014 and will pay the balance on

31 January 2016. Allenbuild Ltd is a business focused on the new

build affordable housing market and as such was not core to the

Group's strategy to develop its Engineering Services business. In

accordance with IFRS 5, the results of Allenbuild Ltd have been

treated as a discontinued business. During the transition period,

Renew retains the cost and benefit of certain contracts. These were

secured during the recession and subsequently supply chain prices

have risen markedly resulting in post-tax losses of GBP7.3m in the

discontinued business.

Summary

In Specialist Building, our business operates in the

consistently robust High Quality Residential market and continues

to improve its quality of earnings with an emphasis on risk

mitigation.

In Engineering Services, we have strengthened our position in

our chosen, mainly regulated markets, undertaking essential work on

critical assets where funding is derived from clients' operational

expenditure budgets. Our key markets' characteristics combined with

the Group's integrated engineering support services model will

continue to provide opportunities for further profitable

growth.

B W May

Chief Executive

24 November 2015

Group income statement

For the year ended 30 September 2015

Before

exceptional

items and Amortisation

amortisation of

intangible

of assets

intangible

Note assets (see Note Total Total

3)

2015 2015 2015 2014

GBP000 GBP000 GBP000 GBP000

Group revenue from

continuing

activities 2 519,645 - 519,645 464,474

Cost of sales (462,154) - (462,154) (411,413)

------------- ------------- ----------- -----------

Gross profit 57,491 - 57,491 53,061

Administrative

expenses (37,121) (3,536) (40,657) (39,678)

------------- ------------- ----------- -----------

Operating profit 2 20,370 (3,536) 16,834 13,383

(MORE TO FOLLOW) Dow Jones Newswires

November 24, 2015 02:00 ET (07:00 GMT)

Finance income 27 - 27 182

Finance costs (939) - (939) (427)

Other finance income/(expense) - defined

benefit pension schemes 189 - 189 (87)

------------- ------------- ----------- -----------

Profit before income

tax 19,647 (3,536) 16,111 13,051

Income tax

expense 4 (3,579) 636 (2,943) (2,714)

------------- ------------- ----------- -----------

Profit for the year from continuing activities 16,068 (2,900) 13,168 10,337

------------- -------------

Loss for the year from discontinued operation

3 (7,263) (5,155)

----------- -----------

Profit for the year attributable to equity

holders of the parent company 5,905 5,182

----------- -----------

Basic earnings per share from continuing

activities 6 21.3p 16.8p

Diluted earnings per share from

continuing operations 6 21.0p 16.6p

----------- -----------

Basic earnings per share 6 9.6p 8.4p

Diluted earnings per share 6 9.4p 8.3p

----------- -----------

Prior year operating profit of GBP13.4m is stated after charging GBP3.1m

of exceptional items and amortisation (See Note 3).

Group statement of comprehensive

income

For the year ended 30 September 2015 2014

2015

GBP000 GBP000

Profit for the year attributable to equity

holders of the parent company 5,905 5,182

----------- -----------

Items that will not be reclassified to profit

or loss:

Movement in actuarial valuation of the defined

benefit pension schemes 8,880 1,068

Movement on deferred tax relating to the

defined benefit pension schemes (1,570) (214)

----------- -----------

Total items that will not be reclassified

to profit or loss 7,310 854

----------- -----------

Items that are or may be reclassified subsequently

to profit or loss:

Exchange movements in reserves 304 1

----------- -----------

Total items that are or may be reclassified

subsequently to profit or loss 304 1

----------- -----------

Total comprehensive income for the year attributable

to equity holders of the parent company 13,519 6,037

----------- -----------

Group statement of changes in equity

Called Share Capital Cumulative Share Retained Total

up based

share premium redemption translation payments earnings equity

capital account reserve adjustment reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 October 2013 6,140 5,893 3,896 751 390 (6,735) 10,335

Transfer from

income

statement for the

year 5,182 5,182

Dividends paid (2,461) (2,461)

New shares issued 12 49 61

Recognition of

share

based payments (98) (98)

Exchange

differences 1 1

Actuarial gains

recognised

in pension

schemes 1,068 1,068

Movement on

deferred

tax relating to

the

pension schemes (214) (214)

------------ ------------ ----------- ------------- ------------- ----------- -----------

At 30 September

2014 6,152 5,942 3,896 752 292 (3,160) 13,874

Transfer from

income

statement for the

year 5,905 5,905

Dividends paid (3,546) (3,546)

New shares issued 40 1,047 1,087

Recognition of

share

based payments 35 35

Exchange

differences 304 304

Actuarial gains

recognised

in pension

schemes 8,880 8,880

Movement on

deferred

tax relating to

the

pension schemes (1,570) (1,570)

------------ ------------ ----------- ------------- ------------- ----------- -----------

At 30 September

2015 6,192 6,989 3,896 1,056 327 6,509 24,969

------------ ------------ ----------- ------------- ------------- ----------- -----------

Group balance sheet

At 30 September 2015

2014

2015 (restated*)

GBP000 GBP000

Non-current assets

Intangible assets - goodwill 56,060 56,060

- other 4,234 7,770

Property, plant and equipment 13,101 14,143

Retirement benefit assets 15,154 1,456

Deferred tax assets 1,718 2,741

90,267 82,170

---------- ------------

Current assets

Inventories 4,864 4,068

Trade and other receivables 96,960 85,319

Assets held for resale - 1,250

Current tax assets 2,187 -

Cash and cash equivalents 10,662 5,586

---------- ------------

114,673 96,223

---------- ------------

Total assets 204,940 178,393

---------- ------------

Non-current liabilities

Borrowings (9,300) (15,500)

Obligations under finance leases (2,514) (3,575)

Retirement benefit obligations (599) -

Deferred tax liabilities (3,537) (1,056)

Provisions (1,232) (1,232)

---------- ------------

(17,182) (21,363)

(MORE TO FOLLOW) Dow Jones Newswires

November 24, 2015 02:00 ET (07:00 GMT)

---------- ------------

Current liabilities

Borrowings (6,200) (6,200)

Trade and other payables (153,612) (133,130)

Obligations under finance leases (2,609) (2,764)

Current tax liabilities - (694)

Provisions (368) (368)

---------- ------------

(162,789) (143,156)

---------- ------------

Total liabilities (179,971) (164,519)

---------- ------------

Net assets 24,969 13,874

---------- ------------

Share capital 6,192 6,152

Share premium account 6,989 5,942

Capital redemption reserve 3,896 3,896

Cumulative translation reserve 1,056 752

Share based payments reserve 327 292

Retained earnings 6,509 (3,160)

---------- ------------

Total equity 24,969 13,874

---------- ------------

*See Note 7

Group cash flow statement

For the year ended 30 September

2015 2014

GBP000 GBP000

Profit for the year from continuing

activities 13,168 10,337

Amortisation of intangible assets 3,536 2,231

Depreciation 3,927 2,893

Profit on sale of property, plant and equipment (278) (435)

Expense in respect of share 1,087 -

option exercise

(Increase) in inventories (586) (323)

(Increase)/decrease in receivables (14,191) 1,324

Increase in payables 18,741 9,630

Current and past service cost in respect of defined

benefit pension scheme 248 59

Cash contribution to defined benefit pension

schemes (4,279) (3,117)

Expense/(credit) in respect of share

options 35 (98)

Finance income (27) (182)

Finance expenses 750 514

Interest paid (939) (427)

Income taxes paid (3,066) (1,926)

Income tax expense 2,943 2,714

--------- -----------

Net cash inflow from continuing operating activities 21,069 23,194

Net cash outflow from discontinued operating

activities (3,590) (4,691)

--------- -----------

Net cash inflow from operating activities 17,479 18,503

--------- -----------

Investing activities

Interest received 27 182

Proceeds on disposal of property, plant and

equipment 530 647

Purchases of property, plant and equipment (1,454) (1,559)

Disposal/(acquisition) of subsidiaries net

of cash acquired 1,135 (32,132)

--------- -----------

Net cash inflow/(outflow) from continuing investing

activities 238 (32,862)

Net cash inflow/(outflow) from discontinued

investing activities 162 (106)

--------- -----------

Net cash inflow/(outflow) from investing activities 400 (32,968)

--------- -----------

Financing activities

Dividends paid (3,546) (2,461)

Issue of Ordinary Shares - 61

New loan - 24,000

Loan repayments (6,200) (4,800)

Repayments of obligations under finance leases (3,067) (2,096)

--------- -----------

Net cash (outflow)/inflow from financing activities (12,813) 14,704

--------- -----------

Net increase in continuing cash and cash equivalents 8,494 5,036

Net decrease in discontinued cash and cash

equivalents (3,428) (4,797)

--------- -----------

Net increase in cash and cash equivalents 5,066 239

Cash and cash equivalents at beginning of year 5,586 5,348

Effect of foreign exchange rate changes on cash and

cash equivalents 10 (1)

--------- -----------

Cash and cash equivalents at end of year 10,662 5,586

-----------

Bank balances and cash 10,662 5,586

--------- -----------

Notes

1 International Financial Reporting Standards

The consolidated financial statements for the year ended 30

September 2015 have been prepared in accordance with International

Financial Reporting Standards ("IFRS"). These preliminary results

are extracted from those financial statements.

2 Segmental analysis

The Group is organised into two operating business segments plus

central activities which form the basis of the segment information

reported below. These segments are:

Engineering Services, which comprises the Group's engineering

activities which are characterised by the use of the Group's

skilled engineering workforce, supplemented by specialist

subcontractors where appropriate, in a range of civil, mechanical

and electrical engineering applications and:

Specialist Building, which comprises the Group's building

activities which are characterised by the use of a supply chain of

subcontractors to carry out building works under the control of the

Group as principal contractor and;

Central activities, which include the sale of land for

development, the leasing and sub-leasing of some UK properties and

the provision of central services to the operating

subsidiaries.

(MORE TO FOLLOW) Dow Jones Newswires

November 24, 2015 02:00 ET (07:00 GMT)

On 31 October 2014, the Group entered into a contract to dispose

of part of its Specialist Building segment.

The results of that business are shown as a discontinued

operation.

2015 2014

Revenue is analysed as follows: GBP000 GBP000

Engineering Services 440,502 382,467

Specialist Building 79,492 82,112

Inter segment revenue (380) (105)

-------- --------

Segment revenue 519,614 464,474

Central activities 31 -

-------- --------

Group revenue from continuing

activities 519,645 464,474

-------- --------

Before

exceptional Exceptional

items and items and

amortisation amortisation

charges charges 2015 2014

Analysis of operating profit GBP000 GBP000 GBP000 GBP000

from continuing activities

Engineering Services 20,055 (3,536) 16,519 14,049

Specialist Building 2,274 - 2,274 2,157

Segment operating profit 22,329 (3,536) 18,793 16,206

Central activities (1,959) - (1,959) (2,823)

------------- ------------- ------------------------ ----------

Operating profit 20,370 (3,536) 16,834 13,383

Net financing expense (723) - (723) (332)

------------- ------------- ------------------------ ----------

Profit on ordinary activities

before income tax 19,647 (3,536) 16,111 13,051

------------- ------------- ------------------------ ----------

Segment operating profit for the year ended 30 September 2014 is

stated after charging exceptional items and amortisation charges

totaling GBP3,055,000.

3 Exceptional items and amortisation of intangible assets

2015 2014

GBP000 GBP000

Acquisition costs - 824

Total losses arising from exceptional

items - 824

Amortisation of intangible assets 3,536 2,231

------- -------

3,536 3,055

------- -------

The Board has determined that certain charges to the income

statement should be separately identified for better understanding

of the Group's results. In 2014 the Company acquired Forefront

Group Ltd and Clarke Telecom Ltd and incurred GBP824,000 of costs

associated with the acquisitions.

The Board has also separately identified the charge of

GBP3,536,000 (2014: GBP2,231,000) for the amortisation of the fair

value ascribed to certain intangible assets other than goodwill

arising from the acquisitions of Amco Group Holdings Ltd, Lewis

Civil Engineering Ltd, Clarke Telecom Ltd and Forefront Group

Ltd.

Discontinued operation analysis

2015 2014

GBP000 GBP000

Revenue 31,947 49,992

Expenses (41,278) (54,124)

Profit on disposal 1,250 -

Loss before income tax (8,081) (4,132)

Income tax credit - benefit of 818 -

tax losses

Income tax expense - deferred

tax - (1,023)

--------- ---------

Loss for the year from discontinued

operation (7,263) (5,155)

--------- ---------

On 31 October 2014, the Board reached an agreement to sell

Allenbuild Ltd to Places for People Group Ltd ("PFP") for a total

consideration of GBP2.75m payable in cash. PFP paid the initial 50%

of the consideration on 31 October 2014 and will pay the balance on

31 January 2016. The trading result for this business has therefore

been included within the loss for the year from discontinued

operations.

Discontinued expenses include the following exceptional

items:

2015 2014

GBP000 GBP000

Provision against amounts recoverable

on old

Building contracts 1,755 2,528

Costs related to exceptional storm

damage on a Building contract 800 1,500

2,555 4,028

-------- --------

The provision of GBP1,755,000 (2014:GBP2,528,000) relates to

settling final accounts and contractual issues on old

contracts.

A further GBP800,000 (2014:GBP1,500,000) of costs have been

recognised following the exceptional storm damage experienced in

2013.

4 Income tax expense

Analysis of expense in year 2015 2014

GBP000 GBP000

Current tax:

UK corporation tax on profits of the year (2,360) (2,265)

Adjustments in respect of previous periods 1,359 (227)

----------------- ---------------

Total current tax (1,001) (2,492)

----------------- ---------------

Deferred tax - defined benefit pension schemes (760) (594)

Deferred tax - other timing differences (1,182) (651)

----------------- ---------------

Total deferred tax (1,942) (1,245)

----------------- ---------------

Income tax expense (2,943) (3,737)

Deferred tax in respect of discontinued operation - 1,023

----------------- ---------------

Income tax expense in respect of continuing

activities (2,943) (2,714)

----------------- ---------------

5 Dividends 2015 2014

Pence/share Pence/share

Interim (related to the year ended 30

September 2015) 2.25 1.50

Final (related to the year ended 30 September

2014) 3.50 2.50

----------------- -------------

Total dividend paid 5.75 4.00

----------------- -------------

GBP000 GBP000

Interim (related to the year ended 30

September 2015) 1,393 923

Final (related to the year ended 30 September

2014) 2,153 1,538

----------------- -------------

Total dividend paid 3,546 2,461

----------------- -------------

Dividends are recorded only when authorised and are shown as a

movement in equity rather than as a charge in the income statement.

The Directors are proposing that a final dividend of 4.75p per

Ordinary Share be paid in respect of the year ended 30 September

2015. This will be accounted for in the 2015/16 financial year.

6 Earnings per share

2015 2014

Earnings EPS DEPS Earnings EPS DEPS

GBP000 Pence Pence GBP000 Pence Pence

Earnings before

exceptional items

& amortisation

charges 16,068 26.03 25.70 12,781 20.80 20.51

Exceptional items

& amortisation

charges (2,900) (4.69) (4.64) (2,444) (3.97) (3.92)

-------------- -------- -------- ----------------- ------- -------

Basic earnings

per share - continuing

activities 13,168 21.34 21.06 10,337 16.83 16.59

Loss for the

year from discontinued

operation (7,263) (11.77) (11.62) (5,155) (8.39) (8.27)

-------------- -------- -------- ----------------- ------- -------

Basic earnings

(MORE TO FOLLOW) Dow Jones Newswires

November 24, 2015 02:00 ET (07:00 GMT)

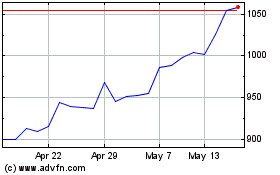

Renew (LSE:RNWH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Renew (LSE:RNWH)

Historical Stock Chart

From Jul 2023 to Jul 2024