Regional REIT Limited 2017 Properties Valuation and Q4 2017 Dividend (5804F)

February 22 2018 - 2:00AM

UK Regulatory

TIDMRGL

RNS Number : 5804F

Regional REIT Limited

22 February 2018

22 February 2018

Regional REIT Limited

Full Year 2017 Properties Valuation and Q4 2017 Dividend

The Board of Regional REIT Limited (LSE: RGL) ("Regional REIT",

"the Group" or "the Company") today announces its Full Year 2017

Gross Investment Properties Valuation and Q4 2017 Dividend.

Full Year 2017 Gross Investment Properties Valuation

The Group's gross investment valuation of its property portfolio

as at 31 December 2017 was GBP737.3m (31 December 2016: GBP502.4m).

There was an increase of 2.6% on a like-for-like basis from the 31

December 2016 value, adjusting for capital expenditure and

disposals during the period. During 2017 the Group completed

property acquisitions totalling GBP228.1m (before costs), disposals

of GBP17.4m (before costs) and a GBP1.2m gain on disposals.

The Group's net loan-to-value ratio was c.45.0% as at 31

December 2017.

Fourth Quarter 2017 Dividend Declaration

The Company will pay a dividend of 2.45 pence per share ("pps")

for the period 1 October 2017 to 31 December 2017. The dividend

payment will be made on 12 April 2018 to shareholders on the

register as at 2 March 2018. The ex-dividend date will be 1 March

2018. The dividend will be paid as 2.205 pps as a REIT property

income distribution ("PID") and 0.245 pps as an ordinary dividend

("non-PID").

The fourth quarter dividend manages the Company's compliance

with at least the REIT minimum distribution requirement, having

paid a dividend of 1.80pps for each of the first three quarters of

2017.

In respect of the financial year 2017 Regional REIT has declared

dividends amounting to 7.85pps. The increased dividend from 2016

full year dividend of 7.65pps is in accordance with the Company's

intention to pursue a progressive dividend policy.

The level of future payment of dividends will be determined by

the Board having regard to, among other things, the financial

position and performance of the Group at the relevant time, UK REIT

requirements and the interests of Shareholders.

Stephen Inglis, Chief Executive Officer of London & Scottish

Investments, the Asset Manager, commented:

"In the course of another challenging year for the UK commercial

property market I am extremely pleased that we have delivered

steady progress with the portfolio. This performance has

underpinned our confidence in the robustness of the UK's regional

office and light industrial property markets, and in our active

asset management, which continues to deliver for our

shareholders."

- ENDS -

Enquiries:

Regional REIT Limited

Press enquiries through Headland

Toscafund Asset Management Tel: +44 (0) 20 7845 6100

Investment Manager to the Group

Adam Dickinson, Investor Relations, Regional REIT Limited

London & Scottish Investments Tel: +44 (0) 141 248 4155

Asset Manager to the Group

Stephen Inglis

Headland Tel: +44 (0) 20 3805 4222

Financial PR

Francesca Tuckett, Bryony Sym, Jack Gault

About Regional REIT

Regional REIT Limited (LSE: RGL) ("Regional REIT", "the Group"

or "the Company") is a London Stock Exchange Main Market traded

specialist real estate investment trust focused on office and

industrial property interests in the principal regional locations

of the United Kingdom outside of the M25 motorway.

Regional REIT is managed by London & Scottish Investments,

the Asset Manager, and Toscafund Asset Management, the Investment

Manager, and was formed by the Managers as a differentiated play on

the expected recovery in UK regional property, to deliver an

attractive total return to Shareholders and with a strong focus on

income.

The Group's investment portfolio, as at 30 June 2017, was spread

across 150 regional properties, 1,093 units and 823 tenants. As at

30 June 2017, the investment portfolio had a value of GBP640.4m and

a net initial yield of 6.7%. The weighted average unexpired lease

term to first break was 3.5 years.

The Company's shares were admitted to the Official List of the

UK's Financial Conduct Authority and to trading on the London Stock

Exchange on 6 November 2015. For more information, please visit the

Group's website at www.regionalreit.com.

www.regionalreit.com

LEI: 549300D8G4NKLRIKBX73

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCSEFFWFFASELE

(END) Dow Jones Newswires

February 22, 2018 02:00 ET (07:00 GMT)

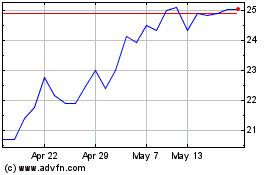

Regional Reit (LSE:RGL)

Historical Stock Chart

From Jun 2024 to Jul 2024

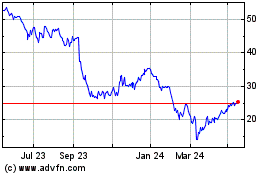

Regional Reit (LSE:RGL)

Historical Stock Chart

From Jul 2023 to Jul 2024