TIDMRGL

RNS Number : 3998Y

Regional REIT Limited

05 December 2017

THIS ANNOUNCEMENT IS NOT FOR PUBLICATION, RELEASE OR

DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR

INTO THE UNITED STATES OF AMERICA, AUSTRALIA, NEW ZEALAND, CANADA,

THE REPUBLIC OF SOUTH AFRICA, JAPAN OR ANY OTHER JURISDICTION IN

WHICH IT WOULD BE UNLAWFUL TO DO SO.

This announcement is not an offer of securities for sale, or an

offer to buy or subscribe for, directly or indirectly, securities

to any person in the United States of America or any other

jurisdiction, including in or into Australia, New Zealand, Canada,

the Republic of South Africa and Japan or any other jurisdiction in

which such offer or solicitation is unlawful. This announcement is

an advertisement and not a prospectus (or prospectus equivalent

document). A prospectus in connection with the proposed firm

placing, placing, open offer and offer for subscription (together,

the "Capital Raising") (the "Prospectus") and the admission of new

ordinary shares of no par value ("New Ordinary Shares") in Regional

REIT Limited ("Regional REIT" or the "Company" and, together with

its subsidiaries, the "Group") to be issued pursuant to the Capital

Raising to listing on the premium listing segment of the Official

List of the Financial Conduct Authority ("FCA") and to trading on

the Main Market for listed securities of London Stock Exchange plc

(together, "Admission") is expected to be published by the Company

later today. A copy of the Prospectus will, following publication,

be available on the Company's website (www.regionalreit.com) and be

available for viewing at the National Storage Mechanism at

https://www.morningstar.co.uk/uk/NSM.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

5 December 2017

Regional REIT Limited

("Regional REIT" or the "Company")

Results of Firm Placing

Firm Placing of GBP50 million and Placing, Open Offer and Offer

for Subscription to raise up to GBP50 million at 101 pence per New

Ordinary Share

Further to the announcement on 4 December 2017, Regional REIT

Limited (LSE: RGL), is pleased to announce the results of its

accelerated bookbuild having conditionally raised GBP50 million

under the Firm Placing. The Company is now seeking to raise up to a

further GBP50 million through the Placing, Open Offer and Offer for

Subscription.

Subject to, inter alia, the Resolutions being passed at the

Extraordinary General Meeting which is expected to be convened to

be held on 19 December 2017, in aggregate, 49,504,950 New Ordinary

Shares are to be issued pursuant to the Firm Placing, with up to

49,504,950 New Ordinary Shares to be issued pursuant to the

Placing, Open Offer and Offer for Subscription, at an Offer Price

of 101 pence per New Ordinary Share, seeking to raise, in

aggregate, gross proceeds of up to approximately GBP100 million

(approximately GBP97 million net of expenses) from the Capital

Raising. The Board will have the ability to increase the size of

the Issue by up to 25 per cent. should there be sufficient

demand.

The 49,504,950 New Ordinary Shares to be issued pursuant to the

Firm Placing represent 16.5 per cent. of the Existing Ordinary

Shares and the 49,504,950 New Ordinary Shares to be issued pursuant

to the Placing, Open Offer and Offer for Subscription represent up

to 16.5 per cent. of the Existing Ordinary Shares.

The New Ordinary Shares to be issued pursuant to the Capital

Raising will rank pari passu in all respects with the Ordinary

Shares currently in issue and will have the right to receive all

dividends and distributions declared in respect of issued Ordinary

Share Capital of the Company after Admission, including the final

top-up dividend, which is expected to be 2.45 pence per Ordinary

Share, in respect of the financial year ended 31 December 2017.

Firm Placing

The Company is proposing to raise gross proceeds of GBP50

million through the Firm Placing of 49,504,950 New Ordinary Shares

which will represent approximately 50.0 per cent. of the New

Ordinary Shares and approximately 12.4 per cent. of the Enlarged

Share Capital.

Peel Hunt and Cenkos, as agents of the Company, have

conditionally placed the Firm Placing Shares with institutional and

other investors at the Offer Price. The Firm Placing Shares are not

subject to clawback and are not part of the Placing, Open Offer and

Offer for Subscription. The Firm Placing is subject to the same

conditions as the Placing. The terms and conditions of the Firm

Placing are as set out in the Company's announcement dated 4

December 2017.

Placing, Open Offer and Offer for Subscription

The Company is proposing to raise gross proceeds of up to

approximately GBP50 million through issuance of 49,504,950 New

Ordinary Shares pursuant to the Placing, Open Offer and Offer for

Subscription. The New Ordinary Shares to be issued under the

Placing, Open Offer and Offer for Subscription will represent up to

approximately 50.0 per cent. of the New Ordinary Shares and

approximately 12.4 per cent. of the Enlarged Share Capital.

Peel Hunt and Cenkos, as agents of the Company, have agreed to

use their reasonable endeavours to place the Placing Shares with

institutional and other investors at the Offer Price. The Placing

Shares will be subject to clawback to satisfy valid applications by

Qualifying Shareholders under the Open Offer. Subject to the

satisfaction or, where applicable, waiver of the conditions and the

Placing Agreement not having been terminated in accordance with its

terms, any Open Offer Shares not subscribed for under the Open

Offer may be issued to Placing Placees, with the net proceeds of

the Placing being retained by Regional REIT. The terms and

conditions of the Placing are as set out in the Company's

announcement dated 4 December 2017.

Open Offer Entitlements

Qualifying Shareholders will have the opportunity under the Open

Offer to subscribe for New Ordinary Shares at the Offer Price,

payable in full on application and free of expenses, pro rata to

their existing shareholdings, on the following basis:

1 New Ordinary Share for every 8 Existing Ordinary Shares

held by them and registered in their names at the Record Time.

Fractions of New Ordinary Shares will not be allotted and each

Qualifying Shareholder's entitlement under the Open Offer will be

rounded down to the nearest whole number. Fractional entitlements

to New Ordinary Shares will be aggregated and will ultimately

accrue for the benefit of the Company.

Qualifying Shareholders are also being offered the opportunity

to subscribe for New Ordinary Shares in excess of their Open Offer

entitlements pursuant to an Excess Application Facility.

Further details of the Firm Placing and the Placing, Open Offer

and Offer for Subscription will be contained in the Prospectus to

be sent to shareholders today.

Financial effects of the Capital Raising

Upon Admission, assuming the gross proceeds of the Capital

Raising are approximately GBP100 million, the Enlarged Share

Capital of the Company will be up to 399,553,808 Ordinary Shares.

This includes 300,543,908 Existing Ordinary Shares, 49,504,950 New

Ordinary Shares to be issued pursuant to the Firm Placing and up to

49,504,950 New Ordinary Shares to be issued pursuant to the

Placing, Open Offer and Offer for Subscription. On this basis, the

Firm Placing Shares will represent approximately 12.4 per cent. of

the Enlarged Share Capital and the Open Offer Shares will represent

approximately 9.4 per cent. of the Enlarged Share Capital.

Following the issue of the New Ordinary Shares to be allotted

pursuant to the Capital Raising:

-- Qualifying Shareholders who take up their full Open Offer

Entitlements will suffer a dilution of 15.4 per cent. to their

interests in the Company; and

-- Qualifying Shareholders who do not take up any of their Open

Offer Entitlements will suffer a dilution of 24.8 per cent. to

their interests in the Company.

Extraordinary General Meeting

The Capital Raising will be conditional upon, amongst other

things, the Resolutions being passed at the Extraordinary General

Meeting of the Company which is expected to take place on 19

December 2017.

A further announcement will be made in due course confirming the

publication of the Prospectus relating to the Capital Raising,

which will include notice of the Extraordinary General Meeting.

Regional REIT Shareholders who hold their Existing Ordinary Shares

in certificated form will also receive forms of proxy for voting on

the Resolutions and application forms in respect of their Open

Offer Entitlements.

Directors' Participations

The Directors are interested in an aggregate of 1,352,549

Existing Ordinary Shares (representing approximately 0.45 per cent.

of the Existing Ordinary Shares). Kevin McGrath intends to

participate in the Firm Placing and has (in aggregate) agreed to

subscribe for 297,029 New Ordinary Shares pursuant to the Firm

Placing.

Related Party Transaction

Martin Hughes is a related party of the Company for the purposes

of Chapter 11 of the Listing Rules as a result of him having been

entitled, during the 12 month period prior to the date of this

announcement, to exercise, or to control the exercise of over, 10

per cent. of the votes able to be cast at an extraordinary general

meeting of the Company. Martin Hughes, through Toscafund

Investments Limited, a private company controlled by Martin Hughes,

has agreed to subscribe for up to 6,435,643 New Ordinary Shares

under, and on the terms and conditions of, the Firm Placing, which

is classified as a smaller related party transaction for the

purposes of Chapter 11.1.10R of the Listing Rules.

Unless otherwise defined, capitalised terms used in this

announcement shall have the same meanings as set out in the

announcement made by the Company on 4 December 2017.

Expected timetable of principal events

Each of the times and dates in the table below is indicative

only and may be subject to change.

Record Time for entitlements 6.00 p.m. on 1 December

under the Open Offer 2017

Ex-Entitlements date for the 8.00 a.m. on 5 December

Open Offer 2017

Publication and despatch of 5 December 2017

Prospectus, Form of Proxy,

Subscription Forms and, to

Qualifying non-CREST Shareholders,

Open Offer Application Form

Open Offer Entitlements and As soon as possible

Excess Open Offer Entitlements on 6 December 2017

credited to stock accounts

of Qualifying CREST Shareholders

in CREST

Recommended latest time for 4.30 p.m. on 13

requesting withdrawal of Open December 2017

Offer Entitlements and Excess

Open Offer Entitlements from

CREST (i.e. if your Open Offer

Entitlements and Excess Open

Offer Entitlements are in

CREST and you wish to convert

them to certificated form)

Latest time and date for depositing 3.00 p.m. on 14

Open Offer Entitlements into December 2017

CREST

Latest time and date for receipt 11.00 a.m. on 15

of Forms of Proxy and receipt December 2017

of electronic proxy appointments

via CREST

Latest time and date for splitting 3.00 p.m. on 15

of Open Offer Application December 2017

Forms (to satisfy bona fide

market claims only)

Latest time and date for receipt 11.00 a.m. on 19

of completed Open Offer Application December 2017

Forms and payment in full

under the Open Offer or settlement

of relevant CREST instruction

(as appropriate). Open Offer

Entitlements and Excess Open

Offer Entitlements disabled

in CREST

Latest time and date for receipt 11.00 a.m. on 19

of Placing commitments December 2017

Latest time and date for receipt 11.00 a.m. on 19

of completed Subscription December 2017

Forms in respect of the Offer

for Subscription

Extraordinary General Meeting 11.00 a.m. on 19

December 2017

Announcement of results of by 7.00 a.m. on

Extraordinary General Meeting 20 December 2017

Results of the Placing and by 7.00 a.m. on

Capital Raising announced 20 December 2017

through a Regulatory Information

Service

Admission and commencement 8.00 a.m. on 21

of dealings in New Ordinary December 2017

Shares

Expected date of despatch within 5 Business

of definitive share certificates Days

for Open Offer Shares (to

Qualifying non-CREST Shareholders)

and new Ordinary Shares under

the Offer for Subscription

Notes:

(i) CREST Shareholders should inform themselves of CREST's

requirements in relation to electronic proxy appointments.

(ii) Subject to certain restrictions relating to Shareholders

with a registered address outside the United Kingdom

The times and dates set out in the expected timetable of

principal events above and mentioned throughout this document are

indicative only and subject to change. If any of the times and/or

dates change, the revised time and/or date will be notified to the

London Stock Exchange, the UKLA and through a Regulatory

Information Service.

Different deadlines and procedures may apply in certain cases.

For example, Shareholders who hold their Existing Ordinary Shares

through a CREST member or other nominee may be set earlier

deadlines by the CREST member or other nominee than the times and

dates noted above.

For further information:

Regional REIT Limited

Press Enquiries through Headland

Toscafund Asset Management Tel: +44 (0)

Investment Manager to the Group 20 7845 6100

Adam Dickinson, Investor Relations

for Regional REIT Limited

London & Scottish Investments Tel: +44 (0)

Limited 141 248 4155

Asset Manager to the Group

Stephen Inglis, Derek McDonald

Peel Hunt Tel: +44 (0)

Sponsor and Sole Bookrunner 20 7418 8900

Corporate: Capel Irwin, Edward

Fox

ECM: Alastair Rae, Sohail Akbar

Cenkos Tel: +44 (0)

Joint Placing Agent 20 7397 8900

Institutional Sales: Bob Morris,

George Fraser

Corporate: Alex Collins, Sapna

Shah

Headland Tel: +44 (0)

Financial PR 20 3805 4822

Francesca Tuckett, Bryony Sym,

Jack Gault

Important Notices

This announcement has been issued by Regional REIT and is the

sole responsibility of Regional REIT. The information in this

announcement is for background purposes only and does not purport

to be full or complete. The material set out herein is for

information purposes only and should not be construed as an offer

of securities for sale in the United States or any other

jurisdiction. The information contained in this announcement is

given at the date of its publication (unless otherwise stated) and

is subject to updating, revision and amendment. In particular, the

proposals referred to herein are tentative and are subject to

verification, material updating, revision and amendment.

This announcement is not an offer of securities for sale, or an

offer to buy or subscribe for, directly or indirectly, securities

to any person in the United States of America or any other

jurisdiction, including in or into Australia, New Zealand, Canada,

the Republic of South Africa and Japan or any other jurisdiction in

which such offer or solicitation is unlawful. This announcement is

an advertisement and not a prospectus (or prospectus equivalent

document). A prospectus in connection with the proposed firm

placing, placing, open offer and offer for subscription (together,

the "Capital Raising") and the admission of the new ordinary shares

of no par value in the Company ("New Ordinary Shares") to be issued

pursuant to the Capital Raising to listing on the premium listing

segment of the Official List of the Financial Conduct Authority

("FCA") and to trading on the Main Market for listed securities of

London Stock Exchange plc (together, "Admission") is expected to be

published by the Company later today. A copy of the Prospectus

will, following publication, be available on the Company's website

(www. regionalreit.co.uk) and be available for viewing at the

National Storage Mechanism at

https://www.morningstar.co.uk/uk/NSM.

The distribution or publication of this announcement, any

related documents, and the offer, sale and/or issue of the New

Ordinary Shares in certain jurisdictions may be restricted by law.

Persons into whose possession any document or other information

referred to herein comes are required to inform themselves about

and to observe any such restrictions. Any failure to comply with

these restrictions may constitute a violation of the securities

laws of such jurisdiction.

No action has been, or will be, taken by Regional REIT or any

other person to permit a public offer or distribution of this

announcement, or any related documents, in any jurisdiction where

action for that purpose may be required, other than in the United

Kingdom.

This announcement is not an offer of securities for sale in the

United States, and is not for publication or distribution, directly

or indirectly, in or into the United States. This announcement is

not an offer of securities for sale into the United States. The New

Ordinary Shares and the Open Offer Entitlements referred to herein

have not been, and will not be, registered under the US Securities

Act or any relevant securities laws of any state or other

jurisdiction of the United States and, subject to limited certain

exceptions, may not be offered, sold, taken up, exercised, resold,

renounced, transferred or delivered, directly or indirectly, within

the United States. No public offering of securities is being made

in the United States and the New Ordinary Shares are being offered

or sold outside the United States in reliance on Regulation S. The

Company has not been, and will not be, registered under the US

Investment Company Act of 1940, as amended (the "US Investment

Company Act"), and investors will not be entitled to the benefits

of that Act. The New Ordinary Shares made available under the Firm

Placing and Placing are being offered and sold (i) in the United

States only to persons reasonably believed to be (a) qualified

institutional buyers (each a "QIB") as defined in Rule 144A under

the US Securities Act who are also qualified purchasers ("QPs") as

defined in section 2(a)(51) of the US Investment Company Act and

(b) accredited investors (each an "Accredited Investor") as defined

in Rule 501 of Regulation D under the US Securities Act who are

also QPs and, in each such case, in reliance on Section 4(a)(2) of,

and Rule 506(b) under, the US Securities Act or pursuant to another

exemption from, or in a transaction not subject to, the

registration requirements of the US Securities Act; and (ii)

outside of the United States to persons who are not US Persons (as

defined in Regulation S) in offshore transactions in reliance on

Regulation S. For a description of these and certain further

restrictions on offers, sales and transfers of the New Ordinary

Shares, see Terms and Conditions of the Firm Placing and the

Placing.

The New Ordinary Shares and the Open Offer Entitlements have not

been and will not be registered under the applicable securities

laws of Australia, New Zealand, Canada, the Republic of South

Africa and Japan. Subject to certain exceptions, the New Ordinary

Shares and the Open Offer Entitlements referred to herein may not

be offered or sold in Australia, New Zealand, Canada, the Republic

of South Africa or Japan or to, or for the account or benefit of,

any national, resident or citizen of Australia, New Zealand,

Canada, the Republic of South Africa or Japan. There will be no

public offer of securities in Australia, New Zealand, Canada, the

Republic of South Africa and Japan.

The New Ordinary Shares are only suitable for investors who

understand the potential risk of capital loss, for whom an

investment in the New Ordinary Shares is part of a diversified

investment programme and who fully understand and are willing to

assume the risks involved in such an investment programme. There is

no guarantee that the Capital Raising will proceed and that

Admission will occur and you should not base your financial

decisions on Regional REIT's intention in relation to the Capital

Raising and Admission at this stage. Acquiring New Ordinary Shares

to which this announcement relates may expose an investor to a

significant risk of losing all of the amount invested. When

considering what further action you should take you are recommended

to seek your own financial advice immediately from your

stockbroker, bank manager, solicitor, accountant, fund manager or

other appropriate independent financial adviser duly authorised

under the Financial Services and Markets Act 2000 (as amended)

("FSMA"), if you are resident in the United Kingdom, or, if not,

from another appropriately authorised independent financial

adviser. This announcement does not constitute a recommendation

concerning the Capital Raising. The price and value of the New

Ordinary Shares may decrease as well as increase. Information in

this announcement, past performance and any documents relating to

the Capital Raising or Admission cannot be relied upon as a guide

to future performance. Potential investors should consult a

professional adviser as to the suitability of the Capital Raising

for the person concerned.

This announcement contains statements which are based on the

Directors' current expectations and assumptions and involve known

and unknown risks and uncertainties that could cause actual

results, performance or events to differ materially from those

expressed or implied in such statements. These statements include

forward-looking statements both with respect to the Group and the

markets in which the Group operates. Statements which include the

words "expects", "intends", "plans", "believes", "projects",

"anticipates", "will", "targets", "aims", "may", "would", "could",

"continue" or, in each case, their negative or other variations,

and similar statements of a future or forward-looking nature,

identify forward-looking statements. It is believed that the

expectations reflected in these statements are reasonable, but they

may be affected by a number of variables which could cause actual

results or trends to differ materially, including (but not limited

to) any limitations of Regional REIT's internal financial reporting

controls; an increase in competition; an unexpected decline in

turnover, rental income or the value of all or part of the Group's

property portfolio; legislative, fiscal and regulatory

developments; and currency and interest rate fluctuations. Each

forward-looking statement speaks only as of the date of this

announcement. Except as required by the rules of the FCA (and, in

particular, the Disclosure Guidance and Transparency Rules and the

Market Abuse Regulation), the London Stock Exchange, the Listing

Rules or by law (in particular, FSMA), Regional REIT expressly

disclaims any obligation or undertaking to release publicly any

updates or revisions to any forward-looking statements contained in

this announcement to reflect any change in Regional REIT's

expectations with regard thereto or any change in events,

conditions or circumstances on which any such statement is based.

All subsequent written and oral forward-looking statements

attributable to any person involved in the preparation of this

announcement or to persons acting on Regional REIT's behalf are

expressly qualified in their entirety by the cautionary statements

referred to above and contained elsewhere in this announcement.

By their nature, forward-looking statements involve known and

unknown risks and uncertainties because they relate to events and

depend on circumstances that may or may not occur in the future.

Forward-looking statements are not guarantees of future

performance. The Group's actual results of operations, financial

condition, prospects, growth, strategies and dividend policy, and

the development of the industry in which it operates, may differ

materially from the impression created by the forward-looking

statements contained in this announcement. In addition, even if the

results of operations, financial condition, prospects, growth,

strategies and the dividend policy of Regional REIT, and the

development of the industry in which it operates, are consistent

with the forward-looking statements contained in this announcement,

those results or developments may not be indicative of results or

developments in subsequent periods.

Any forward-looking statement contained in this announcement

based on past or current trends and/or activities of the Group

should not be taken as a representation that such trends or

activities will continue in the future. No statement in this

announcement is intended to be a profit forecast or to imply that

the earnings of the Group for the current year or future years will

necessarily match or exceed the historical or published earnings of

the Group.

Each of Peel Hunt and Cenkos and their respective affiliates,

expressly disclaims any obligation or undertaking to update, review

or revise any forward-looking statement contained in this

announcement whether as a result of new information, future

developments or otherwise.

Peel Hunt is authorised and regulated by the FCA in the United

Kingdom. Peel Hunt is acting exclusively for Regional REIT and

no-one else in connection with the Capital Raising, and will not

regard any other person as its client in relation to the Capital

Raising, and will not be responsible for providing the protections

afforded to Peel Hunt clients, nor for giving advice in relation to

the Capital Raising, or any arrangement referred to in, or

information contained in, this announcement.

Cenkos, which is authorised and regulated by the FCA in the

United Kingdom, is acting exclusively for Regional REIT in

connection with the Capital Raising and will not be responsible to

anyone other than Regional REIT for providing the protections

afforded to clients of Cenkos or for providing advice in relation

to the matters described in this announcement.

In connection with the Capital Raising, each of Peel Hunt and

Cenkos, or any of their respective affiliates, may take up a

portion of the New Ordinary Shares and/or related instruments in

connection with the Capital Raising as a principal position and in

that capacity may retain, purchase, sell, offer to sell for their

own account(s) such New Ordinary Shares and/or related instruments

in connection with the Capital Raising or otherwise. Accordingly,

references in the Prospectus, once published, to the New Ordinary

Shares being issued, offered, subscribed, acquired, placed or

otherwise dealt in should be read as including any issue or offer

to, or subscription, acquisition, placing or dealing by Peel Hunt

and Cenkos, or any of their respective affiliates, acting as

investors for their own accounts. Except as required for legal or

regulatory obligations to do so, Peel Hunt and Cenkos do not

propose to make any disclosure in relation to the extent of any

such investments or transactions.

None of Peel Hunt and Cenkos, any of their respective

affiliates, or any of their or their affiliates' respective

directors, officers or employees, advisers or agents accepts any

responsibility or liability whatsoever for the contents of this

announcement, or no representation or warranty, express or implied,

is made as to the accuracy, completeness, correctness or fairness

of the information or opinions contained in, this announcement or

any document referred to in this announcement (or whether any

information has been omitted from this announcement or any document

referred to in this announcement) or any other information relating

to Regional REIT or their respective subsidiaries or affiliates,

whether written, oral or in a visual or electronic form, and

howsoever transmitted or made available or for any loss howsoever

arising from any use of the announcement or its contents or

otherwise arising in connection therewith. Accordingly, each of

Peel Hunt and Cenkos, their respective affiliates, and each of

their and their affiliates' respective directors, officers,

employees and agents, and any other person acting on their behalf,

expressly disclaims any and all liability whatsoever for any loss

howsoever arising from, or in reliance upon, the whole or any part

of the contents of this announcement, whether in tort, contract or

otherwise which they might otherwise have in respect of this

announcement or its contents or otherwise arising in connection

therewith.

The contents of this announcement are not to be construed as

legal, financial or tax advice. Each prospective investor should

consult his own legal adviser, financial adviser or tax adviser for

legal, financial or tax advice, respectively.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCTABPTMBMMMBR

(END) Dow Jones Newswires

December 05, 2017 03:05 ET (08:05 GMT)

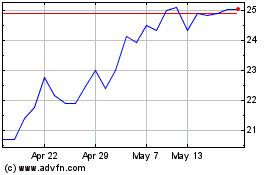

Regional Reit (LSE:RGL)

Historical Stock Chart

From Jun 2024 to Jul 2024

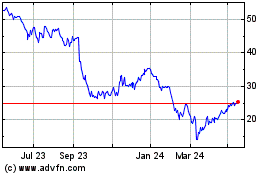

Regional Reit (LSE:RGL)

Historical Stock Chart

From Jul 2023 to Jul 2024