TIDMPPS

RNS Number : 8992A

Proton Motor Power Systems PLC

28 September 2022

28 September 2022

Proton Motor Power Systems plc

("Proton Motor" or the "Company")

Unaudited Interim Results for the six months to 30 June 2022

Proton Motor Power Systems plc (AIM: PPS), the designer,

developer and producer of fuel cells and fuel cell electric hybrid

systems with a zero-carbon footprint, announces its unaudited

interim results for the six months ended to 30 June 2022 (the

"Period" or "H1 2022").

Operational Highlights

- Successful installation of two marine HyShip(R)71 Fuel Cell systems for Fincantieri

- Successful Factory Acceptance Test (FAT) of a HyFrame(R) S36

Fuel Cell system with long-standing client Deutsche Bahnbau Group

GmbH (German Rail)

- In line with order intake for a series of standard products,

production labour has been restructured to include groups

specifically dedicated to the various standard product groupings,

thereby increasing production efficiency

- After the period end, launch of large power generator pack (90kW)

Financial Highlights

- Order intake of GBP1.5m (H1 2021: GBP1.8m) for a total order

book at the period end of GBP2.3m to be delivered by 2023,

including repeat orders from existing customers and income from

maintenance agreements

- Sales of GBP980k in H1 2022 (H1 2021: GBP922k)

- Generating a positive gross margin

- Increased existing loan facilities with principal shareholders by approximately EUR12.5m

Dr. Nahab, CEO of Proton, commented : "Although faced with

highly challenging trading conditions in 2022, the Company has made

further progress. In the year ahead, we are focused on further

progressing the maturity of the Group's technology offer, ramping

up production capacity and exploiting the current potential order

intake and sales pipeline.

"Furthermore, it is anticipated that the significant

strengthening of political commitment to hydrogen, continuing to be

evident in 2022, will contribute to further accentuating the demand

for hydrogen related products, such as the fuel cell."

For further information:

Proton Motor Power Systems Plc

Dr Faiz Nahab, CEO

Helmut Gierse, Chairman

Roman Kotlarzewski, CFO +49 (0) 173 189 0923

Antonio Bossi, Non-Executive Director

Investor relations: www.protonpowersystems.com

investor-relations@proton-motor.de

Allenby Capital Limited

Nominated Adviser & Broker +44 (0) 20 3328 5656

James Reeve / Vivek Bhardwaj

About Proton Motor Fuel Cell GmbH

Proton Motor has more than 20 years of experience in Power

Solutions using CleanTech technologies such as hydrogen fuel cells,

fuel cell and hybrid systems with a zero carbon footprint. Based in

Puchheim near Munich, Proton Motor offers complete fuel cell and

hybrid systems from a single source - from the development and

production through the implementation of customized solutions. The

focus of Proton Motor is on back-to-base, for example, for mobile,

marine and stationary solutions applications. The product portfolio

consists of base-fuel cell systems, standard complete systems, as

well as customized systems.

Proton Motor serves IT, Telecoms, public infrastructure and

healthcare customers in Germany, Europe and Middle East with power

supply solutions for DC and AC power demand. In addition to power

supply, SPower also offers solutions for Solar Systems as well as a

new product line for Solar Energy Storage.

Proton Motor Fuel Cell GmbH is a wholly owned subsidiary of

Proton Motor Power Systems plc. The Company has been quoted on the

AIM market of the London Stock Exchange since October 2006 (code:

PPS).

CHAIRMAN'S REPORT

We are pleased to report our unaudited results for the six

months ended 30 June 2022.

Overview

Proton Motor has strengthened its organisation in order to

continue to deliver complete zero emission power supply solutions

through the addition of new staff in the production and product

development teams.

Finance

Proton Motor received orders for GBP1.5m in the first half year

of the year including a number of repeat orders from existing

customers. Repeat orders allow better planning of production

material purchases on more favourable terms, which management

expects will lead to an improvement in margins.

Sales in H1 2022 were GBP980k (H1 2020: GBP922k), arising from

the 2021 and H1 2022 order intake. These sales were generated in

the stationary and maritime sectors, together with service and

engineering income. GBP1.5m was invested in the development

programme and our workforce has increased to 108 (H1 2021: 99) full

time employees. In line with demand, we added staff resources

predominantly in the areas of production and product

development.

During the Period, we generated a Gross Profit of GBP265k (H1

2021: GBP97k) representing a 173 per cent increase.

Excluding the impact of exchange losses, the operating loss in

the first half of 2022 was GBP4.9m (H1 2021: GBP3.9m). This was in

line with our budgeted expectations and resulted from further

investments in product development, production and staff in

addition to manufacturing infrastructure.

GBP213k was invested in equipment and infrastructure during the

period (H1 2021: GBP197k).

The "Fair value movements" in the H1 2021 financial results

related to the embedded derivative, which was a non-operating,

non-cash item, required by IFRS financial reporting, which was

based on gauging the potential effects of partial convertible

interest on loan financing. Due to the waiver of convertible

interest on loan financing at the end of 2021, there is no fair

value movement in H1 2022, as the embedded derivative associated

with the convertible interest has been eliminated. The

non-operating result in the first half of 2022 was negatively

affected by the movement of exchange rates between Pound Sterling

and the Euro.

Cash burn from operating activities increased during the Period

to GBP4.8m (H1 2021: GBP4.4m), reflecting the increased level of

activity to deliver our sales pipeline and from further investment.

Cash flow is our key financial performance target and our objective

is to achieve a positive cash flow in the shortest time possible.

Current contracts are quoted with up-front payments, reducing

reliance on working capital as we continue to invest in our

manufacturing capability. The cash position as at 30 June 2022 was

GBP2.2m (30 June 2021: GBP2.7m).

We were very pleased with the continued support of our principal

shareholders with whom we agreed to increase the existing financing

facilities by EUR12.5 million to ensure operational financing for

the Company into 2023. The principal and interest on these

additional facilities is not convertible and interest is charged at

EURIBOR+3%.

I personally would like to thank all our customers who believe

in us, our committed employees and our shareholders who have the

vision to invest in our mission.

Current trading and outlook

We are confident of our medium term prospects and are planning

to increase our production capacity to up to 30,000 stacks per

annum; this will also involve moving to new larger premises; the

Board and I look forward to updating you on our progress over the

next 12 months and further in the future.

Helmut Gierse

Non-Executive Chairman

STATEMENT OF COMPREHENSIVE INCOME

Unaudited Unaudited Audited

Six months Six months Year ended

Note to 30 June to 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Revenue 980 922 2,771

Cost of sales (715) (825) (2,346)

--------------- ---------------- -------------

Gross profit 265 97 425

Other operating income 211 234 501

Administrative expenses (5,454) (4,232) (10,047)

--------------- ---------------- -------------

Operating loss (4,978) (3,901) (9,121)

Finance income 1 1 3

Finance costs incl. exchange

(losses)/gains (3,064) 2,735 3,222

(Loss) for the period before

embedded derivatives (8,042) (1,165) (5,896)

--------------- ---------------- -------------

Fair value gain on embedded

derivatives - 212,739 609,201

--------------- ---------------- -------------

(Loss)/Gain for the period

attributable to shareholders (8,042) 211,574 603,305

--------------- ---------------- -------------

Gain/(Loss) / Profit per share

(expressed as pence per share)

Restated

Basic 7 (0.5) 27.3 77.5

Restated

Diluted 7 (0.5) 13.2 77.5

(Loss) / Profit per share (expressed

as pence per share) excluding

embedded derivative

Basic 7 (0.5) (0.2) (0.8)

Diluted 7 (0.5) (0.1) (0.8)

OTHER COMPREHENSIVE INCOME

Unaudited Unaudited Audited

Six months Six months Year ended

to 30 June to 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

------------ ------------ -------------

(Loss)/ Profit for the period (8,042) 211,574 603,305

------------ ------------ -------------

Other comprehensive (expense)

/ income

------------ ------------ -------------

Items that may not be reclassified

to profit and loss

Exchange differences on translating

foreign operations (97) 186 (586)

------------ ------------ -------------

Total other comprehensive income

/ (expense) (97) 186 (586)

------------ ------------ -------------

Total comprehensive (expense)

for the period (8,139) 211,760 602,719

============ ============ =============

STATEMENT OF FINANCIAL POSITION

Unaudited Unaudited Audited

At 30 At 30 June At 31 December

June 2021 2021

2022

GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Intangible assets 107 97 78

Property, plant and equipment 1,589 1,434 1,619

Right-of-use assets 13 210 111

Fixed asset investments 11 11 11

---------- ------------ ----------------

Total non-current assets 1,720 1,752 1,819

Current assets

Inventories 2,408 2,842 1,835

Trade and other receivables 1,242 699 1,624

Cash and cash equivalents 2,183 2,702 2,152

---------- ------------ ----------------

Total current assets 5,833 6,243 5,611

---------- ------------ ----------------

Total Assets 7,553 7,995 7,430

========== ============ ================

Current Liabilities

Trade and other payables (4,831) (5,019) (4,498)

Lease debt (14) (206) (111)

Borrowings (410) (615) (517)

---------- ------------ ----------------

Total current liabilities (5,255) (5,840) (5,126)

Non-current liabilities

Borrowings (91,859) (80,023) (83,956)

Lease debt (4) (15) (8)

Embedded derivatives on convertible - (396,462) -

interest

---------- ------------ ----------------

Total non-current liabilities (91,863) (476,500) (83,964)

---------- ------------ ----------------

Total Liabilities (97,118) (482,340) (89,090)

---------- ------------ ----------------

Net liabilities (89,565) (474,345) (81,660)

========== ============ ================

Equity

Capital and reserves attributable

to equity shareholders

Share capital 11,025 11,022 11,023

Share premium account 20,416 20,254 20,390

Merger reserve 15,656 15,656 15,656

Reverse acquisition reserve (13,861) (13,861) (13,861)

Share option reserve 2,393 961 2,187

Foreign translation reserve (10,682) 9,448 11,745

Capital contributions 1,171 1,215 1,143

Accumulated losses (115,683) (519,040) (129,943)

---------- ------------ ----------------

Total equity (89,565) (474,345) (81,660)

========== ============ ================

STATEMENT OF CHANGES IN EQUITY

Reverse Share Foreign Capital

Share Share Merger Acquisition Option Translation Contribution Accumulated Total

Capital Premium Reserve Reserve Reserve Reserve Reserves Losses Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2021 10,598 19,574 15,656 (13,861) 949 11,038 1,215 (732,390) (687,221)

Share based

payments - - - - 12 - - - 12

Proceeds from

share issues 424 680 - - - - - - 1,104

Currency

translation

differences - - - - - - - -

Transactions

with owners 424 680 - - 12 - - - 1,116

Profit for the

period - - - - - - - 211,574 211,574

Other

comprehensive

income:

Currency

translation

differences - - - - - (1,590) - 1,776 186

Total

comprehensive

income for

the

year - - - - - (1.590) - 213,350 211,760

Balance at 30

June 2021 11,022 20,254 15,656 (13,861) 961 9,448 1,215 (519,040) (474,345)

Balance at 1

July 2021 11,022 20,254 15,656 (13,861) 961 9,448 1,215 (519,040) (474,345)

Share based

payments 4 284 - - 1,226 - - (272) 1,242

Proceeds from

share issues (3) (148) - - - - - - (151)

Currency

translation

differences - - - - - - - -

Transactions

with owners 1 136 - - 1,226 - - (272) 1,091

Profit for the

period - - - - - - - 391,731 391,731

Other

comprehensive

income:

Currency

translation

differences - - - - - 2,297 (72) (2,362) (137)

Total

comprehensive

income for

the

year - - - - - 2,297 (72) 389,369 391,594

Balance at 31

December 2021 11,023 20,390 15,656 (13,861) 2,187 11,745 1,143 (129,943) (81,660)

Balance at 1

January 2022 11,023 20,390 15,656 (13,861) 2,187 11,745 1,143 (129,943) (81,660)

Share based payments - - - - 206 - - - 206

Proceeds from

share issues 2 26 - - - - - - 28

Currency translation

differences - - - - - - - -

Transactions

with owners 2 26 - - 206 - - 234

Loss for the

period - - - - - - - (8,042) (8,042)

Other comprehensive

income:

Currency translation

differences - - - - - (22,427) 28 22,302 (97)

Total comprehensive

income for the

year - - - - - (22,427) 28 14,260 (8,139)

------ ------ ------ -------- ----- -------- ----- --------- --------

Balance at 30

June 2022 11,025 20,416 15,656 (13,861) 2,393 (10,682) 1,171 (115,683) (89,565)

====== ====== ====== ======== ===== ======== ===== ========= ========

Share premium account

Costs directly associated with the issue of the new shares have

been set off against the premium generated on issue of new

shares.

Merger reserve

The merger reserve of GBP15,656,000 arose as a result of the

acquisition of Proton Motor Fuel Cell GmbH during 2006. The merger

reserve represents the difference between the nominal value of the

share capital issued by the Company and their fair value at 31

October 2006, the date of the acquisition.

Reverse acquisition reserve

The reverse acquisition reserve arose as a result of the method

of accounting for the acquisition of Proton Motor Fuel Cell GmbH by

the Company. In accordance with IFRS 3 the acquisition has been

accounted for as a reverse acquisition.

Share option reserve

The Group operates an equity settled share-based compensation

scheme. The fair value of the employee services received for the

grant of the options is recognised as an expense. The total amount

to be expensed over the vesting period is determined by reference

to the fair value of the options granted. At each balance sheet

date the Company revises its estimate of the number of options that

are expected to vest. The original expense and revisions of the

original estimates are reflected in the income statement with a

corresponding adjustment to equity. The share option reserve

represents the balance of that equity.

CASH FLOW STATEMENT

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 ended 30 31 December

June June 2021

2022 2021

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Profit / (Loss) for the period (8,042) 211,574 603,305

------------ ------------ -------------------------

Adjustments for:

Depreciation and amortisation 214 201 641

Loss on disposal of property, - - -

plant and equipment

Impairment of investment - - -

Interest income (1) (1) (3)

Interest expense 986 721 1,498

Share based payments (206) (12) 966

Movement in inventories (572) (1,052) (45)

Movement in trade and other

receivables 381 (351) (1,276)

Movement in trade and other

payables 333 630 109

Movement in fair value of embedded

derivatives - (212,739) (609,201)

Exchange rate movements 2,079 (3,456) (4,720)

------------ ------------ -------------------------

Net cash used in operations (4,827) (4,485) (8,726)

------------ ------------ -------------------------

Cash flows from investing

activities

Purchase of intangible assets (45) (45) (44)

Purchase of property, plant

and equipment (169) (152) (633)

Purchase value of leased assets - (21) -

Investment in associate company - - -

Interest received 1 2 3

------------ ------------ -------------------------

Net cash used in investing

activities (213) (216) (674)

------------ ------------ -------------------------

Cash flows from financing

activities

Proceeds from issue of loan

instruments 4,823 4,423 7,962

Proceeds from issue of new

shares 234 30 1,241

New obligations of lease debt - 21 (297)

Repayment of obligations under

lease debt (105) (106) 21

Repayment of short term borrowings (84) (175) (202)

------------ ------------ -------------------------

Net cash generated from financing

activities 4,868 4,193 8,725

------------ ------------ -------------------------

Net increase in cash and cash

equivalents (171) (508) (675)

Effect of foreign exchange

rates 203 471 88

Opening cash and cash equivalents 2,152 2,739 2,739

------------ ------------ -------------------------

Closing cash and cash equivalents 2,183 2,702 2,152

============ ============ =========================

Notes to the interim report

1. Basis of preparation

These interim consolidated financial statements of Proton Power

Systems plc were prepared in accordance with International

Financial Reporting Standards (IFRS) as issued by the International

Accounting Standards Board (IASB) as adopted by the European Union

and with those parts of the Companies Act 2006 applicable to those

companies under IFRS. They were also prepared under the historical

cost convention and in accordance with IFRS interpretations

(IFRICS) except for embedded derivatives which are carried at fair

value through the income statement and on the basis that the Group

continues to be a going concern. The condensed consolidated interim

financial statements have been prepared in accordance with the

accounting policies adopted in the 31 December 2021 statutory

audited financial statements. No new accounting standards have been

adopted by the group since preparing its last annual report.

The Group has chosen not to adopt IAS 34 (Interim Financial

Statements) in preparing these financial statements therefore the

interim financial information is not in full compliance with

IFRS.

The financial information for the half year ended 30 June 2022

set out in this interim report is unaudited and does not constitute

statutory accounts as defined in Section 434 of the Companies Act

2006. The Group's audited statutory financial statements for the

year ended 31 December 2020 have been filed with the Registrar of

Companies. The independent auditor's report on those financial

statements was unqualified and did not contain statements under

Section 498(2) or (3) of the Companies Act 2006.

Until such time as the Group achieves operational cash inflows

through becoming a volume producer of its products to a receptive

market it will remain dependent on its ability to raise cash to

fund its operations from existing and potential shareholders and

the debt market.

In preparing the consolidated financial information, Proton

Motor Fuel Cell GmbH has been deemed to be the acquirer and the

Company, the legal parent, has been deemed to be the acquiree.

Under IFRS 3 "Business Combinations", the acquisition of Proton

Motor Fuel Cell GmbH by the Company has been accounted for as a

reverse acquisition and the consolidated IFRS financial information

of the Company is therefore a continuation of the financial

information of Proton Motor Fuel Cell GmbH.

Goodwill arising on consolidation represents the excess of the

cost of acquisition over the Group's interest in the fair value of

the identifiable assets and liabilities of a subsidiary, associate

or jointly controlled entity at the date of acquisition. The cost

of an acquisition is measured as the fair value of the assets

given, equity instruments issued and liabilities incurred or

assumed at the date of exchange. Goodwill is initially recognised

as an asset at cost and is subsequently measured at cost less any

accumulated impairment losses. Goodwill is reviewed for impairment

at least annually, or more frequently where circumstances suggest

an impairment may have occurred. Any impairment is recognised

immediately in income statement and is not subsequently

reversed.

On disposal of a subsidiary, the attributable amount of goodwill

is included in the determination of the profit or loss on

disposal.

2. Critical accounting estimates and judgements

The Group makes estimates and assumptions concerning the future.

The resulting accounting estimates will, by definition, seldom

equal the related actual results. Estimates and judgements are

continually evaluated and are based on historical experience and

other factors, including expectations of future events that are

believed to be reasonable under the circumstances. The estimates

and assumptions that have a significant risk of causing a material

adjustment to the carrying amounts of assets and liabilities within

the next financial period are discussed below.

Recognition of development costs

Self developed intangible assets are recognised where the Group

can estimate that it is probable that future economic benefits will

flow to the entity.

Impairment of goodwill

The carrying value of goodwill must be assessed for impairment

annually, or more frequently if there are indications that goodwill

might be impaired. This requires an estimation of the value in use

of the cash generating units to which goodwill is allocated. Value

in use is dependent on estimations of future cash flows from the

cash generating unit and the use of an appropriate discount rate to

discount those cash flows to their present value.

3. Segmental information

An operating segment is a group of assets and operations engaged

in providing products or services that are subject to risks and

returns that are different from those of other operating segments

for which discreet financial information is available and is

regularly reviewed by the Chief Operating Decision Maker

("CODM").

Based on an analysis of risks and returns, the Directors

consider that the Group has only one identifiable operating

segment, green energy.

All non-current assets are located in Germany.

4. Share based payments

The Group has incurred an expense in respect of share options

and shares issued to directors as follows:

Unaudited Unaudited Audited

Six months Six months Year ended

ended ended 30 31 December

30 June June 2021

2022 2021

GBP'000 GBP'000 GBP'000

Share options - 10 (64)

Share awards 206 - 1,318

Shares 28 65 65

------------ ------------ -------------

234 75 1,319

============ ============ =============

5. Finance costs including exchange differences

Unaudited Unaudited

Six months Six months Audited

ended 30 ended 30 Year ended

June June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Interest 985 721 1,498

Exchange (gain) on shareholder loans - (3,456) (4,720)

Exchange loss on shareholder loans 2,079 - -

----------- ----------- ------------

Net finance cost (gain)/loss 3,064 (2,735) (3,222)

=========== =========== ============

6. Taxation

Due to losses within the Group, no expenses for tax on income

were required in either the current or prior periods.

7. Profit / (Loss) per share

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Basic Diluted Basic Diluted Basic Diluted

(Loss) before

embedded derivative (8,042) (8,042) (1,165) (1,165) (5,896) (5,896)

Fair value gain

Embedded derivative - - 212,739 212,739 609,201 609,201

------------ ------------ ------------ ------------ ------------- ------------

(Loss) / Profit

attributable

to equity holders

of the company (8,042) (8,042) 211,574 211,574 603,305 603,305

------------ ------------ ------------ ------------ ------------- ------------

Weighted average

number of ordinary

shares (thousands) 1,549,553 1,549,553 774,285 1,597,816 778,571 778,571

------------ ------------ ------------ ------------ ------------- ------------

(Restated year

ended 31 December Pence Pence Pence Pence

2021) per share per share Pence Pence per share per share

per share per share

(Loss) / Profit

per share (pence

per share) (Restated (0.5) (0.5) 27.3 13.2 77.5 77.5

Year ended 31

December 2021)

(Loss) / Profit

per share (pence

per share) excluding

embedded derivative (0.5) (0.5) (0.2) (0.1) (0.8) (0.8)

Basic loss per share is calculated by dividing the loss

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the period.

Diluted loss per share is calculated by adjusting the weighted

average number of ordinary shares outstanding to assume conversion

of all dilutive potential ordinary shares. The Company one category

of dilutive potential ordinary shares: share options, which have

not been included in the calculation of loss per share because they

are anti-dilutive for these periods. No interim dividend has been

proposed or paid in relation to the current or prior interim

period.

A copy of the interim report and the information required by AIM

Rule 26 is available from the Company's website at

www.protonmotor-powersystems.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR QDLFLLKLFBBK

(END) Dow Jones Newswires

September 28, 2022 02:00 ET (06:00 GMT)

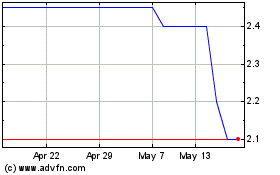

Proton Motor Power Systems (LSE:PPS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Proton Motor Power Systems (LSE:PPS)

Historical Stock Chart

From Jul 2023 to Jul 2024