TIDMPODP

RNS Number : 3387R

Merrill Lynch International

04 November 2021

NOT FOR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN OR ANY JURISDICTION IN

WHICH SUCH DISTRIBUTION WOULD BE UNLAWFUL

4 November 2021

Pod Point Group Holdings plc Pre-Stabilisation Period Notice

Merrill Lynch International hereby gives notice that it, and its

affiliates, may stabilise the offer of the following securities in

accordance with the relevant provisions of Regulation (EU) No

596/2014 (Market Abuse Regulation) and Commission Delegated

Regulation (EU) 2016/1052, in each case as it forms part of

retained EU law by virtue of the European Union (Withdrawal) Act

2018. Stabilisation transactions aim at supporting the market price

of the Securities during the Stabilisation Period. Stabilisation

may not necessarily occur and it may cease at any time.

Securities:

Issuer: Pod Point Group Holdings plc (the "Issuer")

==========================================================

Securities Ordinary shares of GBP0.001 each in the capital of

to be stabilised: the Issuer (ISIN: GB00BNDRD100) (the "Shares")

==========================================================

Offering 44,315,828 Shares (excluding the over-allotment option)

size:

==========================================================

Offer price: 225 pence per Share

==========================================================

Stabilisation:

Stabilisation Merrill Lynch International, 2 King Edward Street,

London, EC1A 1HQ

Manager: Contact: Andrew Briscoe; Telephone: +44 207 995 3700

==================================================================

Stabilisation 4 November 2021

Period expected

to start

on:

==================================================================

Stabilisation 3 December 2021

Period expected

to end no

later than:

==================================================================

Stabilisation London Stock Exchange - Main Market

trading venue:

==================================================================

Maximum size The Stabilising Manager may over-allot the securities

and conditions to the extent permitted in accordance with applicable

of use of law, up to the maximum size of 4,431,583 Shares

over--allotment

facility:

==================================================================

Over-allotment Option:

Terms: In connection with the offering (the "Offer"), Merrill

Lynch International (as Stabilising Manager), or any

of its agents, may (but will be under no obligation

to), to the extent permitted by applicable law and

for stabilisation purposes, over-allot Shares up to

a total of 10% of the total number of Shares included

in the Offer or effect other transactions with a view

to supporting the market price of the Shares or any

options, warrants or rights with respect thereto,

or other interest in the Shares or other securities

of the Company, in each case at a higher level than

that which might otherwise prevail in the open market.

The Stabilising Manager is not required to enter into

such transactions and such transactions may be effected

on any securities market, over-the-counter market,

stock exchange or otherwise and may be undertaken

at any time during the period commencing on the date

of the conditional dealings in the Shares on the London

Stock Exchange and ending no later than 30 calendar

days thereafter. Stabilisation transactions aim at

supporting the market price of the securities during

the stabilisation period. Such stabilisation, if commenced,

may be discontinued at any time without prior notice.

If such stabilisation occurs, it will be undertaken

at the London Stock Exchange. However, there will

be no obligation on the Stabilising Manager or any

of its agents to effect stabilising transactions and

there is no assurance that stabilising transactions

will be undertaken. In no event will measures be taken

to stabilise the market price of the Shares above

the Offer Price. Except as required by law or regulation,

neither the Stabilising Manager nor any of its agents

intends to disclose the extent of any over-allotments

made and/or stabilising transactions conducted in

relation to the Offer.

For the purposes of allowing the Stabilising Manager

to cover short positions resulting from any such over-allotment

and/or from sales of Shares effected by it

during the stabilisation period, the Stabilising Manager

has been granted an over- allotment option (the "Over-allotment

Option"), pursuant to which it may purchase, or procure

purchasers for, Shares (representing up to 10%) of

the total number of Shares included in the Offer)

at the Offer Price (the "Over-allotment Shares").

The Over-allotment Option may be exercised in whole

or in part upon notice by the Stabilising Manager

at any time on or before the 30th calendar day after

the commencement of conditional dealings in the Shares

on the London Stock Exchange. Any Over-allotment Shares

made available pursuant to the Over- allotment Option

will be made available on the same terms and conditions

as Shares being offered or sold pursuant to the Offer,

will rank pari passu in all respects with all other

Shares (including with respect to pre-emption rights)

and will form a single class with all other Shares

for all purposes, including with respect to voting

and for all dividends and distributions thereafter

declared, made or paid on the ordinary share capital

of the Company.

=================================================================

Duration: The Over-allotment Option may be exercised in whole

or in part at any time during the Stabilisation Period.

=================================================================

In connection with the offer of the above securities, the

Stabilising Manager, or any of its agents, may over-allot the

securities or effect transactions with a view to supporting the

market price of the securities during the stabilisation period at a

level higher than that which might otherwise prevail. However,

stabilisation may not necessarily occur and any stabilising action,

if begun, may cease at any time. Any stabilising action or

over--allotment shall be conducted in accordance with all

applicable laws and rules.

This announcement is for information purposes only and does not

constitute an invitation or offer to underwrite, subscribe for or

otherwise acquire or dispose of any securities of the Issuer in any

jurisdiction.

This announcement is not for release, publication or

distribution, directly or indirectly, in or into the United States

of America (the "United States"), Australia, Canada, Japan or any

other jurisdiction where such release, publication or distribution

would be unlawful. This announcement does not contain or

constitute, or form part of, an offer to sell, or a solicitation of

an offer to purchase, any securities in the United States,

Australia, Canada, Japan or any other jurisdiction where such an

offer would be unlawful.

The securities discussed herein have not been and will not be

registered under the U.S. Securities Act of 1933, as amended (the

"Securities Act"), or with any securities regulatory authority of

any state or other jurisdiction of the United States. The

securities may not be offered, sold, resold, transferred or

delivered, directly or indirectly, within the United States except

pursuant to an applicable exemption from or in a transaction not

subject to the registration requirements of the Securities Act and

in compliance with any applicable securities laws of any state or

other jurisdiction of the United States. No public offering of the

securities discussed herein is being made in the United States. The

securities referred to herein have not been registered under the

applicable securities laws of Australia, Canada or Japan and,

subject to certain exceptions, may not be offered or sold within

Australia, Canada or Japan or to any national, resident or citizen

of Australia, Canada or Japan. The release, publication or

distribution of this announcement in other jurisdictions may be

restricted by law and persons into whose possession this

announcement comes should inform themselves about, and observe,

such restrictions.

This announcement is only addressed to and directed at specific

addressees who: (A) if in member states of the European Economic

Area (the "EEA"), are persons who are "qualified investors" within

the meaning of Article 2(e) of Regulation (EU) 2017/1129 (as

amended) ("Qualified Investors"); and (B) if in the United Kingdom,

are "qualified investors" within the meaning of Article 2(e) of

Regulation (EU) 2017/1129 (as amended) as it forms part of retained

EU law by virtue of the European Union (Withdrawal) Act 2018 who

are: (i) persons having professional experience in matters relating

to investments who fall within the definition of "investment

professionals" in Article 19(5) of the Financial Services and

Markets Act 2000 (Financial Promotion) Order 2005 (the "Order"); or

(ii) high net worth entities falling within Article 49(2) (a) to

(d) of the Order; or (C) are other persons to whom it may otherwise

lawfully be communicated (all such persons referred to in (B) and

(C) together being "Relevant Persons"). This announcement must not

be acted or relied on (i) in the United Kingdom, by persons who are

not Relevant Persons and (ii) in any member state of the EEA by

persons who are not Qualified Investors. Any investment activity to

which this announcement relates (i) in the United Kingdom is

available only to, and may be engaged in only with, Relevant

Persons; and (ii) in any member state of the EEA is available only

to, and may be engaged only with, Qualified Investors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STAFIFSRLALSIIL

(END) Dow Jones Newswires

November 04, 2021 03:00 ET (07:00 GMT)

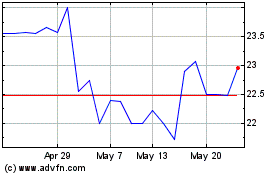

Pod Point (LSE:PODP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Pod Point (LSE:PODP)

Historical Stock Chart

From Jul 2023 to Jul 2024