TIDMNGHT

RNS Number : 5850E

Nightcap PLC

14 March 2022

NIGHTCAP

14 March 2022

Nightcap plc

("Nightcap", the "Company" or the "Group")

Interim results for the 26-week period ended 26 December

2021

"Strong trading results and the successful acquisition of Barrio

Familia - Nightcap continues to execute its strategy"

Key Highlights for unaudited results for the 26-week period

ended 26 December 2021:

26 weeks ended 26 weeks ended 52 weeks ended

26 December 2021 27 December 2020 27 June 2021

(Unaudited) (Unaudited) (Audited)

----------------------------------------- ----------------- ----------------- --------------

Revenue (GBPm) 15.8 2.0 6.0

Adjusted EBITDA (GBPm) 2.5 0.6 1.0

Adjusted EBITDA (IAS17) (GBPm) 1.6 0.5 0.2

Loss from operations (GBPm) (0.0) (0.0) (4.9)

Loss before tax (GBPm) (0.5) (0.3) (5.3)

Basic and diluted loss per share (pence) (0.39) (0.46) (5.55)

Cash generated from operations (GBPm) 1.1 0.2 2.4

----------------------------------------- ----------------- ----------------- --------------

-- Reported revenues for the period increased by more than 700%

and IAS17 Adjusted EBITDA increased by more than 200%, despite

Government "Plan B" guidelines in the final two weeks of the

period

-- Acquisition of Barrio Familia on 21 November 2021 brought

four Latin American-inspired, Tequila-led, cocktail bars and

Disrepute, a luxurious high-end Soho cocktail bar into the

Group

-- Bars continue to trade strongly, with like for like* revenue

growth of 24.8% for the nine weeks ended 27 February 2022 when

compared to the same period in 2020 and 24.6% when compared to the

same period in 2019

-- 19 bars traded throughout the period, with 27 bars being

operated at the end of the period, reflecting the acquisition of

Barrio Familia and the opening of three TCC venues during November

2021, all of which traded for only the last five weeks of the

period

-- Additions to the estate provide a significant increase in

expected run rate revenues for the second half of this financial

year and the subsequent year

-- Organic growth progressing well, with three new openings,

four refurbishments and one additional new lease completed in the

period

-- Excellent opportunities in the property market with over 24

sites in legal negotiations or under offer across several Group

brands

-- Investment in people to add key operational management to

facilitate roll out plans, plus welcomed key management from Barrio

Familia

-- As at 26 December 2021, the Group had unaudited cash

resources of approximately GBP9.4m and had total legacy bank

borrowings of approximately GBP6.0m giving a net cash position of

GBP3.4m (excluding lease liabilities)

-- Nightcap has GBP4.7m of legacy bank borrowings from its

acquisitions in previous periods, and in the period assumed a

further GBP1.3m of debt from the acquisition of Barrio Familia on

long-term favourable terms

-- Completed additional two leases for TCC in Cardiff and Exeter

in 2022, which together with the three new TCC openings and the

Tonight Josephine Cardiff lease signed during the period, takes the

total new sites to six for the year so far

Sarah Willingham, CEO of Nightcap, commented:

"Nightcap has had a fantastic half year. We have taken the first

steps in significantly growing our family of bars, both by adding

the Barrio Familia Group in November 2021 and by opening three more

The Cocktail Clubs in Bristol, Reading and London. We finished the

calendar year with 27 top quality, late night bars."

"This half year has been spent focusing on getting the team and

the Group ready for the fast and sustainable growth that we have

planned for 2022 and beyond. With the team now in place to execute

Nightcap's strategy, we see continued excellent opportunities in

the property market with over 24 sites in legal negotiations or

under offer across several of our brands, in addition to the three

new bars we have already announced for Cardiff and Exeter.

Importantly, out of this portfolio of sites not a single property

premium has been paid or offered to date. We can look forward to

the growth of our brilliant brands across the United Kingdom with

confidence during the 2022 calendar year."

"At the same time we have delivered incredible numbers

throughout the core estate with reported revenue increasing by more

than 700% compared to last year (H1 2020) (primarily due to the

acquisition of The Adventure Bar Group) and a 300% increase

compared to the same period in 2019. The like for like* revenue

growth of 22.4% (compared to H1 2019) demonstrates that through

excellent management and motivated, happy teams we have been able

to respond to the pent up demand from our wonderful customers,

while significantly growing the underlying businesses."

"It is worth noting that out of our 27 bars only 19 bars (70%)

traded for the whole 26 week period. Five sites were added through

the acquisition of the Barrio Familia Group on 21 November 2021

(19%) and a further three sites (11%) opened under The Cocktail

Club brand also in November 2021."

"All of this was despite the Government's "Plan B" Guidelines

introduced in December 2021 that impacted the final few weeks of

the 26 week period. Up until the two weeks before Christmas, for

the 24 weeks ended 12 December 2021, we achieved a 28.3% increase

on a like for like* basis against the same period in 2019."

"Our amazing team were able to reschedule over 70% of the

initially cancelled Christmas bookings into our Q3 (January 2022 -

March 2022), and because of their flexibility and customer care, we

are already seeing bookings and re-bookings for Christmas

2022!"

"This performance shows that we can trade strongly with or

without COVID restrictions, and our guests and their demographics

are resilient and keen to get out and socialise."

Sarah Willingham, Michael Toxvaerd and Toby Rolph will provide a

live presentation relating to the Interim Results for the 26 weeks

ended 26 December 2021 via the Investor Meet Company platform on 16

March 2022 at 3:00 pm GMT.

The presentation is open to all existing and potential

shareholders. Investors can sign up to Investor Meet Company for

free and add to meet Nightcap via:

https://www.investormeetcompany.com/nightcap-plc/register-investor

Investors who already follow Nightcap on the Investor Meet

Company platform will automatically be invited.

For further enquiries:

Nightcap plc

Sarah Willingham / Toby Rolph / Gareth Edwards email@nightcapplc.com

Allenby Capital Limited (Nominated Adviser and

Broker) +44 (0) 20 3328 5656

Nick Naylor / Alex Brearley / Piers Shimwell (Corporate www.allenbycapital.com

Finance)

Matt Butlin / Amrit Nahal / Tony Quirke (Sales

and Corporate Broking)

Bright Star Digital (PR) https://www.brightstardigital.co.uk/

Pam Lyddon +44 (0) 7534 500 829

pamlyddon@brightstardigital.co.uk

* Like for like revenue is a measure of the period over period

change in revenue for the same site base. We define the same site

base to include sites that have been open for a full 52 week

period. The Board believes this measure highlights the performance

of existing sites, while excluding the impact of new site openings

and site closures due to refurbishments. The Board considers this

to be a widely used indicator in the hospitality sector to measure

current trading performance.

Within the context of this announcement, the Group's trading

over the 26-week period ended 26 December 2021 has been compared

with the 26 week period ended 29 December 2019. The trading over

the 24-week period ended 12 December 2021 has been compared with

the 24 week period ended 15 December 2019. For the post half year

end trading period, the trading over the nine-week period ended 27

February 2022 has been compared with the nine week period ended 1

March 2020 for the 2020 comparison and has been compared with the

nine week period ended 3 March 2019 for the 2019 comparison.

For all periods presented the same site base includes ten TCC

sites, seven Adventure Bar Group sites and five Barrio Familia

sites. The Board believes this gives a more meaningful comparison

to highlight trading performance in the Group following the

acquisitions of Adventure Bar Group in May 2021 and Barrio Familia

in November 2021'.

CHIEF EXECUTIVE OFFICER'S STATEMENT

I am pleased to present Nightcap's unaudited interim results for

the 26-week period from 28 June 2021 to 26 December 2021.

TRADING

For the 26 weeks ended 26 December 2021, the Group's reported

revenues increased by more than 700% to GBP15.8m, with a 22.4% like

for like* increase compared to the same period in 2019. Excluding

the 'Plan B' period, Group revenue increased by 28.3% on a like for

like* basis for the 24 weeks ended 12 December 2021 compared to the

same period in 2019.

As well as fast, sustainable growth, we continue to focus on our

conversion, and in this respect, we are delighted to report a

strong Adjusted EBITDA of GBP2.5m (IAS17 Adjusted EBITDA: GBP1.6m)

for the half year. This is an increase of over 300% and 200%

respectively on the comparable period in 2020.

As at 26 December 2021, the Group had unaudited cash resources

of approximately GBP9.4m and had total legacy bank borrowings

assumed from its acquisitions of approximately GBP6.0m giving a net

cash position of GBP3.4m (excluding lease liabilities). With the

legacy debt from our acquisitions having attractive terms (both in

tenure and interest rate) Nightcap is well placed to execute its

roll out strategy.

BRANDS

Since the inception of Nightcap in January 2021, we have

delivered on our strategy to acquire strong brands, aimed at the

resilient millennial market, with simple, replicable business

models and nationwide appeal.

In November 2021, we welcomed the Barrio Familia group into the

Nightcap family, comprising four Latin American- inspired,

Tequila-led, cocktail bars under the Barrio brand and the famous

Disrepute bar in Kingly Court, Soho, which recently won a well

deserved 12th place in William Reed's UK Top 50 Cocktail Bars. The

total consideration paid for the Barrio Familia group was GBP5.6m,

comprising cash and shares. As part of the acquisition, the Group

acquired net cash of GBP1.4m (comprising cash of GBP3.2m and bank

loans and borrowings of GBP1.8m) resulting in a net cash

consideration of GBP3.2m (excluding the consideration shares issued

of GBP1.1m).

When Nightcap was founded and after the acquisition of The

Cocktail Club (TCC), one of our goals was to acquire a bar group

that has the potential to maximise on the winning combination of

margaritas and tacos. Over the past year, we have closely observed

the significant growth of the Tequila market with great interest,

and believe that this acquisition has significant potential for

UK-wide expansion and we have already begun sourcing potential

sites across the country. The entire team at Barrio has hit the

ground running and has integrated well, sharing offices and

resources with the other brands and teams. They have already

prepared an ambitious roll-out plan for the brand and are now fully

embedded into the property pipeline as described.

In addition to The Cocktail Club and Barrio brands, during 2022

we will focus on the roll out of Tonight Josephine and Blame Gloria

across the UK.

Tonight Josephine has now grown to four venues, with the most

recent venture being the opening of their new site in Clapham High

Street (replacing an Adventure Bar site). Seeing a significant

uplift in sales since its re-brand, the site has become a go-to

hotspot for on-trend 20-somethings in South-West London. Fuelled by

wild themed brunches and late-night party antics, the site

continues to go from strength to strength.

In the pipeline for Tonight Josephine is the imminent launch of

a new bar in Cardiff in early April 2022, which will be the first

of their bars to boast a brand-new look and feel. Noticing a gap in

the market, Tonight Josephine is on a mission to disrupt the

Millennial-focused landscape and fulfil the surge in demand from

Generation Z for stand out places to enjoy a night out. Tapping

into popular culture and piggybacking off the 'TikTok' era - this

design refresh is planned to be, as always, right on trend and is

set to put Tonight Josephine on the map as the trailblazers of this

new wave of hospitality.

Much like Tonight Josephine, Blame Gloria is also going through

exciting developments. Having successfully opened their second bar

in Clapham Junction (also replacing an original Adventure Bar

site), they are set to swing the doors open to their first regional

site in the first half of 2022. Part of Blame Gloria's ongoing

strategy is to bring the same sell-out brunches and late night

socialising from Covent Garden, to all corners of the UK.

Fuelled by their dreamy interiors, outstanding cocktail menus

and electric vibes; Tonight Josephine, Blame Gloria and The

Cocktail Club have recently undertaken a partnership with hot new

dating app, Thursday .Selling out in minutes and surpassing midweek

sales targets, this ongoing partnership has solidified these bars

as the place to be for singles across London.

Having successfully opened three new sites in November 2021, The

Cocktail Club is well on its way to its fast national roll out with

two more sites announced in Exeter and Cardiff both opening their

doors in April, with many more planned over the coming months. All

three Cocktail Club bars have opened ahead of budget and are

already exceeding management's expectations.

With their Mansion House site in a prime location for after-work

partygoers, it has seen midweek trade build significantly week on

week, proving that a cocktail with your colleagues is no longer a

thing of the past. Bristol and Reading are re--affirming the

Board's views that there is strong demand for quality cocktails and

late night socialising in the regions outside of London.

MARKET OUTLOOK

The challenges facing the economy and hospitality industry

cannot go without mention.

We continue to receive unprecedented demand, in a typically

quiet time of year, across the entire Nightcap portfolio; The

Adventure Bar Group, The Cocktail Club and our newest acquisition,

Barrio Familia. This is largely due to the distinct and immersive

concepts that they continue to offer, and the growing popularity of

the premium brands they represent. With Covid cases being a

fraction of what was seen at Christmas, and life drawing ever

closer to normal, we have seen an immediate bounce-back across the

estate and pre-Covid socialising habits resurging, leading to the

steep incline in growth. Effectively entering our delayed

"Christmas period", with a wealth of rearranged Christmas parties,

we are seeing a promising uplift in late-night footfall and the

return of late-night partying both in the Capital and the

regions.

Having put all the wheels in motion to ensure that we are well

positioned, should further restrictions be put in place, and

equipped to tackle the everchanging Covid landscape, whilst

remaining profitable at a site level - the Board is confident that

the end of the pandemic is near and even more confident that we are

in a fantastic position to continue thriving in this new and

exciting climate.

The staff across all three of our bar groups are proof that we

are building one of the best hospitality businesses in the UK.

Faced with unexpected adversity across the Christmas period, with

cancelled Christmas parties, working from home orders coming into

effect and livelihoods put on hold, they have remained resilient,

persistent and most importantly, filled with buckets of energy. We

were pleased that our staff were not disheartened by the unexpected

turn of events at Christmas, and rather were optimistic about what

lay on the other side.

Aside from our in-house teams, we have also seen continued

support from suppliers, stakeholders, landlords and investors, who

have all remained flexible and been willing to adapt with us, going

above and beyond to find solutions in an undeniably difficult

time.

Finally, we owe a huge thank you to our guests, who have handled

cancelled plans, missed celebrations and lost time with unrivalled

patience and understanding. When all is said and done, our guests

are the people who allow us to continue to put on great parties and

ultimately thrive as a business. We cannot wait to play host to

hundreds of belated Christmas parties and deliver our biggest year

of summer parties to date.

PIPELINE/ROLL OUT

With a business model that seeks an ROI** above 75% per site per

year across the Group we are capitalised and ready to ramp up our

fast sustainable growth in 2022.

Our team have been travelling all over the country making sure

that we are able to take advantage of the significant opportunity

that we currently see in the property landscape. Competition for

sites is lower than management has seen in 20 years as many

businesses are forced to focus on balance sheet challenges, having

taken on significant debt over the course of the last two years.

Landlords are looking for strong covenants and long term tenants.

The end of the moratorium for commercial rent in March 2022 will

likely see a further influx of property onto the market.

With a varied portfolio of brands we are able to look at most

sites on the market from 2,000 - 10,000 square feet that have the

relevant planning and licensing. We have already demonstrated that

we can have multiple brands successfully operating alongside each

other in both Clapham and Shoreditch and by the end of the year we

will see a number of Nightcap brands in other cities operating

close to each other, helping to revive city centres and enhance

quality late night socialising in key urban areas, where demand is

high.

In all of the more than 30 new sites that we have opened,

announced as completed, currently have under offer or in legal

negotiations, we have not offered or paid a single property premium

and yet we continue to find top tier sites in all of our

prioritised cities nationwide.

**ROI is a ratio where the mature normalised site EBITDA is

divided by the site's total capital expenditure. This ratio is

considered by the Board to be an important indicator of the group's

capital efficiency.

PEOPLE

We have continued to put power behind our hiring strategy to

secure only the most skilled people in the hospitality sector, to

ensure that we nurture an industry-leading management team that

trickles down to all levels of staff. The end goal is to improve

company culture, promote growth across all departments and to act

with an 'aces in places' mentality to ensure that opportunity

unites with skill.

With the acquisition of Barrio Familia in November 2021, new

additions to the management team included hospitality entrepreneur

and founder of the Barrio bar group, Ferdie Ahmed, and Jim

Robertson, Barrio's Managing Director, who has over 15 years of

experience within the hospitality sector. Together they have

successfully opened multiple sites and along with the existing team

represent the best-in-class of the premium bars world in the

UK.

In addition, we have appointed Nick Moule, formerly of

Stonegate, as Operations Director at The Adventure Bar Group, who

we consider to be an exciting hire with a track-record of

delivering fantastic guest experiences across an extensive number

of sites, whilst managing a fast growing group. Also joining The

Adventure Bar Group, is newly appointed Head of People, Chantelle

Christy. Chantelle has a wealth of knowledge across both the

restaurant and cocktail bar sector and is well equipped to

spearhead the new HR function within the Adventure Bar Group.

SYSTEMS

Although the changing hospitality landscape has presented us

with the opportunity and reason to expand at a rapid pace, we are

dedicated to retaining our authenticity across all of our brands

throughout our expansion. A huge part of why the bars in our

portfolio are viewed as pioneers, is down to the independence,

culture and ultimately, the magic and experiences that they provide

for guests when visiting their much loved venues - this is

something we will never take away. By acting as a group, it allows

us to share our pools of knowledge, align our back of house

systems, benefit from group purchasing and generally elevate our

internal processes, offering up the foundations for fruitful

business by utilising the best skill sets across the individual

operating groups.

We expect to continue to invest further in both people and

systems to enhance and improve our online and offline customer

journeys, app and web interfaces and experience, point of sale

systems, data management and utilisation, plus several other areas.

The Board considers that this is key to enhancing the customer

experience of our individual brands as well as giving our managers

and leadership across the Group the best possible tools to optimise

the existing estate whilst also continuing our nationwide

expansion.

FINANCIAL STATEMENTS / CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

FOR THE 26 WEEKSED 26 DECEMBER 2021

26 weeks ended 26 weeks ended 52 weeks ended

---------------------

26 December 2021 27 December 2020 27 June 2021

---------------------

(Unaudited) (Unaudited) (Audited)

Note GBP GBP GBP

--------------------- ---- ---------------- ---------------- --------------

Revenue 15,786,106 1,968,681 5,968,667

Cost of sales (3,294,057) (454,642) (1,414,419)

--------------------- ---- ---------------- ---------------- --------------

Gross profit 12,492,049 1,514,039 4,554,248

Administrative

expenses (12,521,263) (1,588,163) (10,008,896)

Other income 12,000 25,000 565,748

--------------------- ---- ---------------- ---------------- --------------

Adjusted EBITDA 2,526,887 626,995 958,076

Share based payments (198,140) - (3,823,642)

Depreciation (1,654,486) (524,805) (1,258,637)

Amortisation of

intangible assets (207,169) (732) (51,099)

Exceptional items 3 (352,984) (150,582) (713,598)

Pre opening costs (131,322) - -

--------------------- ---- ---------------- ---------------- --------------

Loss from operations (17,214) (49,124) (4,888,900)

Finance expense (472,644) (206,435) (407,537)

--------------------- ---- ---------------- ---------------- --------------

Loss before taxation (489,858) (255,559) (5,296,437)

Tax credit on

loss 4 33,104 - 32,098

--------------------- ---- ---------------- ---------------- --------------

Loss and total

comprehensive

loss for the period (456,754) (255,559) (5,264,339)

--------------------- ---- ---------------- ---------------- --------------

Loss for the period

attributable to:

- Owners of the

parent (736,865) (255,559) (5,373,111)

- Non-controlling

interest 280,111 - 108,772

--------------------- ---- ---------------- ---------------- --------------

(456,754) (255,559) (5,264,339)

--------------------- ---- ---------------- ---------------- --------------

26 weeks ended 26 weeks ended 52 weeks ended

26 December 27 December

2021 2020 27 June 2021

(Unaudited) (Unaudited) (Audited)

Note pence pence pence

-------------------------------- ---- -------------- -------------- --------------

Earnings per share attributable

to the ordinary equity holders

of the parent

Loss per share 5

- Basic and diluted (0.39) (0.46) (5.55)

-------------------------------- ---- -------------- -------------- --------------

FINANCIAL STATEMENTS / CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

AS AT 26 DECEMBER 2021

26 December 27 December

2021 2020 27 June 2021

(Unaudited) (Unaudited) (Audited)

Note GBP GBP GBP

-------------------------------- ---- ------------ ------------ ------------

Non-current assets

Goodwill 9,279,942 - 6,572,920

Intangible assets 4,927,790 6,586 3,084,034

Property, plant and equipment 6,806,280 2,011,225 3,547,573

Right of use assets 21,064,846 4,540,133 13,446,863

Other receivable 417,270 257,620 271,150

-------------------------------- ---- ------------ ------------ ------------

Total non-current assets 42,496,128 6,815,564 26,922,540

-------------------------------- ---- ------------ ------------ ------------

Current assets

Inventories 611,413 130,312 329,350

Trade and other receivables 1,674,535 322,111 804,411

Cash and cash equivalents 9,448,673 127,943 13,187,479

-------------------------------- ---- ------------ ------------ ------------

Total current assets 11,734,621 580,366 14,321,240

-------------------------------- ---- ------------ ------------ ------------

Total assets 54,230,749 7,395,930 41,243,780

-------------------------------- ---- ------------ ------------ ------------

Current liabilities

Loans and borrowings (1,604,373) (1,076,027) (1,458,652)

Trade and other payables 6 (10,108,618) (1,098,459) (8,628,163)

Lease liabilities due less than

one year (1,968,145) (691,117) (1,440,525)

-------------------------------- ---- ------------ ------------ ------------

Total current liabilities (13,681,136) (2,865,603) (11,527,340)

-------------------------------- ---- ------------ ------------ ------------

Non-current liabilities

Borrowings (4,408,181) (402,287) (3,255,620)

Lease liabilities due more than

one year (20,684,179) (4,483,150) (12,462,624)

Provisions (150,054) - (150,054)

Deferred tax provision (1,263,393) (92,240) (666,662)

-------------------------------- ---- ------------ ------------ ------------

Total non-current liabilities (26,505,807) (4,977,677) (16,534,960)

-------------------------------- ---- ------------ ------------ ------------

Total liabilities (40,186,943) (7,843,280) (28,062,300)

-------------------------------- ---- ------------ ------------ ------------

Net assets / (liabilities) 14,043,806 (447,350) 13,181,480

-------------------------------- ---- ------------ ------------ ------------

Called up share capital 7 1,911,578 55,379 1,854,752

Share premium 20,318,766 178,017 19,267,483

Share based payment reserve 427,201 92,429 216,230

Reverse acquisition reserve (2,512,590) (45,131) (2,512,590)

Retained earnings (6,490,032) (728,044) (5,753,167)

-------------------------------- ---- ------------ ------------ ------------

13,654,923 (447,350) 13,072,708

-------------------------------- ---- ------------ ------------ ------------

Non-controlling interest 388,883 - 108,772

-------------------------------- ---- ------------ ------------ ------------

Total equity 14,043,806 (447,350) 13,181,480

-------------------------------- ---- ------------ ------------ ------------

FINANCIAL STATEMENTS / CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY

FOR THE 26 WEEKSED 26 DECEMBER 2021

Total

attributable

Share to equity

Called based Reverse holders Non-

up share Share payment acquisition Retained of controlling Total

capital premium reserve reserve earnings parent interest equity

GBP GBP GBP GBP GBP GBP GBP GBP

---------------- --------- ---------- -------- ------------ ----------- ------------- ------------ -----------

At 28 June 2020 55,379 178,017 92,429 (45,131) (472,485) (191,791) - (191,791)

Total

comprehensive

expense for the

26 week period - - - - (255,559) (255,559) - (255,559)

---------------- --------- ---------- -------- ------------ ----------- ------------- ------------ -----------

At 27 December

2020 55,379 178,017 92,429 (45,131) (728,044) (447,350) - (447,350)

---------------- --------- ---------- -------- ------------ ----------- ------------- ------------ -----------

Issue of share

capital 300 50,700 (92,429) - 92,429 51,000 - 51,000

Transfer to

reverse

acquisition

reserve (55,679) (228,717) - 284,396 - - - -

Recognition of

Nightcap

plc equity at

reverse

acquisition 398,800 845,200 - (2,751,855) - (1,507,855) - (1,507,855)

Issue of shares

- IPO 400,000 3,600,000 - - - 4,000,000 - 4,000,000

Transaction fees

related to

issue

of shares - (628,588) - - - (628,588) - (628,588)

Issue of shares

on acquisition

-

The Cocktail

Club 553,788 4,984,095 - - - 5,537,884 - 5,537,884

Issue of shares

on acquisition

-

Adventure Bar

Group 47,619 1,142,857 - - - 1,190,476 - 1,190,476

Issue of shares

- placing

shares 434,783 9,565,217 - - - 10,000,000 - 10,000,000

Transaction fees

related to

placing

shares - (636,537) - - - (636,537) - (636,537)

Issue of shares

- debt

conversion 19,762 395,238 - - - 415,000 - 415,000

Share based

payments

and related

deferred

tax recognised

directly

in equity - - 216,230 - - 216,230 - 216,230

---------------- --------- ---------- -------- ------------ ----------- ------------- ------------ -----------

Total

transactions

with owners

recognised

directly in

equity 1,854,752 19,267,483 216,230 (2,512,590) (635,615) 18,190,260 - 18,190,260

---------------- --------- ---------- -------- ------------ ----------- ------------- ------------ -----------

Total

comprehensive

expense for the

26 week period - - - - (5,117,552) (5,117,552) 108,772 (5,008,780)

---------------- --------- ---------- -------- ------------ ----------- ------------- ------------ -----------

At 27 June 2021 1,854,752 19,267,483 216,230 (2,512,590) (5,753,167) 13,072,708 108,772 13,181,480

---------------- --------- ---------- -------- ------------ ----------- ------------- ------------ -----------

Issue of shares

on acquisition

-

Barrio Bar

Group 56,826 1,051,283 - - - 1,108,109 - 1,108,109

Share based

payments

and related

deferred

tax recognised

directly

in equity - - 210,971 - - 210,971 - 210,971

---------------- --------- ---------- -------- ------------ ----------- ------------- ------------ -----------

Total

transactions

with owners

recognised

directly in

equity 1,911,578 20,318,766 427,201 (2,512,590) (5,753,167) 14,391,788 108,772 14,500,560

---------------- --------- ---------- -------- ------------ ----------- ------------- ------------ -----------

Total

comprehensive

expense for the

26 week period - - - - (736,865) (736,865) 280,111 (456,754)

---------------- --------- ---------- -------- ------------ ----------- ------------- ------------ -----------

At 26 December

2021 1,911,578 20,318,766 427,201 (2,512,590) (6,490,032) 13,654,923 388,883 14,043,806

---------------- --------- ---------- -------- ------------ ----------- ------------- ------------ -----------

FINANCIAL STATEMENTS / CONSOLIDATED STATEMENT OF CASH FLOW

FOR THE 26 WEEKSED 26 DECEMBER 2021

26 weeks ended 26 weeks ended 52 weeks ended

26 December 27 December 27 June 2021

2021 2020

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

----------------------------------------------- -------------- -------------- --------------

Cash flows from operating activities

Loss for the period (456,754) (255,559) (5,264,339)

Adjustments for:

Depreciation 1,654,486 524,805 1,258,637

Amortisation 207,169 732 51,099

Lease concessions - (177,448) -

Revaluation of right of use assets - (108,697) -

Share based payments 198,140 - 3,823,642

Interest on lease liabilities 370,754 128,809 297,215

Interest on borrowings 101,890 77,626 110,322

Tax expense (33,104) - (32,098)

(Increase)/decrease in trade and other

receivables (256,147) 121,648 19,436

(Decrease)/increase in trade and other

payables (518,215) (129,004) 2,112,687

(Increase)/decrease in inventories (170,322) 9,414 42,744

----------------------------------------------- -------------- -------------- --------------

Cash generated from operations 1,097,897 192,326 2,419,345

Corporation taxes (paid)/repaid (59,091) 30,899 30,901

----------------------------------------------- -------------- -------------- --------------

Net cash flows from operating activities 1,038,806 223,225 2,450,246

----------------------------------------------- -------------- -------------- --------------

Investing activities

Acquisition of Adventure Bar Group, net

of cash - - 657,088

Acquisition of The Cocktail Club - transaction

costs and pre IPO expenses - - (902,401)

Acquisition of Barrio Bar Group, net of

cash (461,800) - -

Purchase of property, plant and equipment (2,728,869) (36,977) (508,865)

Purchase of intangible assets (30,025) - (9,275)

----------------------------------------------- -------------- -------------- --------------

Net cash used in investing activities (3,220,694) (36,977) (763,453)

----------------------------------------------- -------------- -------------- --------------

Financing activities

Issue of ordinary shares - - 15,295,000

Share issue costs - - (1,265,125)

Repayment of loans and borrowings (525,996) (10,618) (1,418,023)

Principal paid on lease liabilities (569,853) (4,687) (744,081)

Interest paid on lease liabilities (370,754) - (297,215)

Interest paid on loans and borrowings (90,315) (77,625) (104,495)

Shareholder loan repayments - (229,863) (229,863)

----------------------------------------------- -------------- -------------- --------------

Net cashflow from financing activities (1,556,918) (322,793) 11,236,198

----------------------------------------------- -------------- -------------- --------------

Net (decrease)/increase in cash and cash

equivalents (3,738,806) (136,545) 12,922,991

Cash and cash equivalents at beginning

of the period 13,187,479 264,488 264,488

----------------------------------------------- -------------- -------------- --------------

Cash and cash equivalents at end of the

period 9,448,673 127,943 13,187,479

----------------------------------------------- -------------- -------------- --------------

FINANCIAL STATEMENTS / NOTES TO THE CONSOLIDATED FINANCIAL

STATEMENTS

1. GENERAL INFORMATION

The Directors of Nightcap plc (the "Company") and its

subsidiaries (the "Group") present their interim report and the

unaudited condensed consolidated financial statements for the 26

weeks ended 26 December 2021 ("Interim Financial Statements").

The Company is a public limited company whose shares are

publicly traded on the AIM market of the London Stock Exchange and

is incorporated and registered in England and Wales. The registered

office address of the Company is c/o Locke Lord (UK) LLP, 201

Bishopsgate, London, EC2M 3AB.

The Interim Financial Statements were approved by the Board of

Directors on 11 March 2022.

2. ACCOUNTING POLICIES

2.1. Basis of preparation

The Interim Financial Statements have been prepared in

accordance with IAS34, 'Interim Financial Reporting'. They do not

include all of the information required for a complete set of IFRS

financial statements. However, selected explanatory notes are

included to explain events and transactions that are significant to

an understanding of the changes in the Group's financial position

and performance since the last financial statements.

The Interim Financial Statements are presented in Pounds

Sterling, except where otherwise indicated; and under the

historical cost convention.

In January 2021 the Company acquired the entire share capital of

The Cocktail Club Limited in a share for share exchange. The

introduction of the Company into the Group has been accounted for

as a reverse acquisition. In doing so the comparatives for the 26

weeks ended 27 December 2021 and 52 weeks ended 27 June 2021 have

been presented as if the Group had always existed in its current

form.

The Directors consider that the principal risks and

uncertainties faced by the Group are as set out in the Group's

Annual Report and Financial Statements for the period ended 27 June

2021.

The accounting policies adopted in the preparation of the

Interim Financial Statements are consistent with those applied in

the preparation of the Group's consolidated financial statements

for the period ended 27 June 2021. The Group has not early adopted

any other standard, interpretation or amendment that has been

issued but is not yet effective.

2.2. Going concern

In concluding that it is appropriate to prepare these Interim

Financial Statements on the going concern basis, the Directors have

considered the Group's cash flows, liquidity and business

activities. Particular attention has been paid to the impact of

Covid-19 on the business, both experienced to date and potentially

foreseeable in the future.

As reported in the Group's Annual Report and Financial

Statements for the period ended 27 June 2021, the Group had cash

balances of GBP13.2m at that date. As at 26 December 2021, the

Group had cash balances of GBP9.4m with the reduction primarily

driven by the GBP2.7m the Group has invested in its existing and

new sites during the period, along with net cash outflows of

GBP0.8m associated with the Barrio Familia acquisition.

Based on these assessments the Group forecasts to be in

compliance with its banking covenant obligations, and accordingly

the Directors have concluded that it is appropriate to prepare the

Interim Financial Statements on the going concern basis. If further

lockdowns are mandated there is a risk that a reduction in trade

could potentially cause the Group to breach future EBITDA based

bank covenants. However, given the strong relationship the Group

has with its bankers, the Board anticipates that its bankers would

continue to be supportive.

2.3. Alternative Performance Measures

The Interim Financial Statements include both statutory and

alternative performance measures ("APMs"). Further background to

the use of APMs and reconciliations between statutory measures and

APMs are presented in Note 10.

2.4. Accounting estimates and judgements

In preparing these Interim Financial Statements, management has

made judgements, estimates and assumptions that affect the

application of accounting policies and the reported amounts of

assets and liabilities, income and expense. Actual results may

differ from these estimates.

The significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those applied to the Group's

consolidated financial statements for the period ended 27 June 2021

and are set out in the Group's Annual Report and Financial

Statements for that period.

2.5. Seasonality

The Group has a variety of brands and concepts within its

business. The demand across our sites is well spread throughout the

financial year. Historically the lead up to Christmas has always

been a busy period for hospitality businesses but with our well

diversified range of brands, the seasonal impact of Christmas is

balanced with strong summer periods due to the outdoor venues in

the Group, particularly Luna Springs and Bar Elba which provide

large outdoor bar and event space.

3. EXCEPTIONAL ITEMS

26 weeks ended 26 weeks ended 52 weeks ended

26 December 27 December 27 June 2021

2021 2020

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

---------------------------------------- -------------- -------------- --------------

Included in administrative expenses:

IPO and acquisition related transaction

costs 352,984 150,582 546,068

Corporate finance fees - - 167,530

---------------------------------------- -------------- -------------- --------------

352,984 150,582 713,598

---------------------------------------- -------------- -------------- --------------

The IPO and acquisition related transaction costs in the 26

weeks ended 26 December 2021 relate to costs incurred directly in

connection with the acquisition of Barrio Familia Limited. For the

26 weeks ended 27 December 2020 and 52 weeks ended 27 June 2021

these costs relate to the IPO and reverse acquisition of The

Cocktail Club which completed on 13 January 2021, along with the

acquisition of Adventure Bar Group on 14 May 2021. These costs

include employee bonuses and professional fees.

The corporate finance fees in the 52 weeks ended 27 June 2021

represent legal and advisory costs paid by The Cocktail Club in

2021 in connection with an aborted sale of The Cocktail Club in

2019. These costs had no cash impact on the Group, as they were

borne by the vendors of The Cocktail Club by virtue of being

withheld by the Company from the sale proceeds paid to them.

4. TAX CREDIT ON LOSS

The income tax credit is applicable on the Group's

operations.

26 weeks 26 weeks 52 weeks

ended ended ended

26 December 27 December 27 June

2021 2020 2021

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

-------------------------------------- ------------- ------------- -----------

Taxation (credit) / charge to

the income statement

Current income taxation - - 18,585

Adjustments for current taxation

of prior periods - - -

Research & development claim - - -

-------------------------------------- ------------- ------------- -----------

Total current income taxation - - 18,585

-------------------------------------- ------------- ------------- -----------

Deferred Taxation

Origination and reversal of temporary

timing differences

Current period 19,122 - (303,947)

Adjustments in respect of prior

periods - - (3,168)

Adjustment in respect of change

of rate of corporation tax (52,226) - 256,432

-------------------------------------- ------------- ------------- -----------

Total deferred tax (33,104) - (50,683)

-------------------------------------- ------------- ------------- -----------

Total taxation credit in the

consolidated income statement (33,104) - (32,098)

-------------------------------------- ------------- ------------- -----------

The taxation credit on loss for the interim period is GBP33,104

(26 weeks ended 27 December 2020 - GBPnil). The effective tax rate

of 6.8% (26 weeks ended 27 December 2020 - 0%) differs from the UK

corporation tax rate (19%) as a result of permanent disallowable

costs (depreciation of non-qualifying fixed assets, exceptional

items, accounting share based payment charge) and the differential

between the rate at which items impact current tax compared with

deferred tax, all reducing the effective tax rate for the year. The

rate reduction is partially offset by the 30% permanent element of

the 130% capital allowances 'super deduction' on new qualifying

plant and machinery additions and the impact of certain brought

forward deferred tax balances being restated from 19% to 25% (to

the extent the temporary differences are expected to unwind after 1

April 2023 when that rate applies).

The full year effective tax rate is expected to be c.5.7%.

5. EARNINGS PER SHARE

Basic (losses)/earnings per share is calculated by dividing the

profit/(loss) attributable to equity shareholders by the weighted

average number of shares outstanding during the year, excluding

unvested share options pursuant to The Nightcap plc Share Option

Plan and contingently issuable shares in connection with the

acquisition of the Adventure Bar Group.

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares. During the 26

weeks ended 26 December 2021 the Group had potentially dilutive

shares in the form of unvested share options pursuant to the above

long-term incentive plan.

26 weeks ended 26 weeks ended 52 weeks ended

26 December 27 December 27 June 2021

2021 2020

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

----------------------------------------------- -------------- -------------- --------------

Loss for the period after tax for the purposes

of basic and diluted earnings per share (736,865) (255,559) (5,373,111)

Non-controlling interest 280,111 - 108,772

Taxation credit (33,104) - (32,098)

Finance cost 472,644 206,435 407,537

Exceptional items 352,984 150,582 713,598

Pre-opening costs 131,322 - -

Share based payment charge 198,140 - 3,823,642

Depreciation and amortisation 1,861,655 525,537 1,309,736

----------------------------------------------- -------------- -------------- --------------

Profit for the period for the purposes of

Adjusted EBITDA (IFRS 16) basic and diluted

earnings per share 2,526,887 626,995 958,076

----------------------------------------------- -------------- -------------- --------------

IAS 17 Rent charge (942,727) (136,928) (777,042)

----------------------------------------------- -------------- -------------- --------------

Profit for the period for the purposes of

Adjusted EBITDA (IAS 17) basic and diluted

earnings per share 1,584,160 490,067 181,034

----------------------------------------------- -------------- -------------- --------------

26 weeks ended 26 weeks ended 52 weeks ended

26 December 27 December 27 June 2021

2021 2020

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

----------------------------------------------- -------------- -------------- --------------

Weighted average number of ordinary shares

in issue for the purposes of basic earnings

per share 186,593,082 55,378,837 96,859,609

Effect of dilutive potential ordinary shares

from share options 6,665,383 - 3,976,038

----------------------------------------------- -------------- -------------- --------------

Weighted average number of ordinary shares

in issue for the purposes of diluted earnings

per share 193,258,465 55,378,837 100,835,647

----------------------------------------------- -------------- -------------- --------------

26 weeks ended 26 weeks ended 52 weeks ended

26 December 27 December

2021 2020 27 June 2021

(Unaudited) (Unaudited) (Audited)

pence pence pence

----------------------------------------------- -------------- -------------- --------------

Earnings per share:

Basic and diluted (0.39) (0.46) (5.55)

----------------------------------------------- -------------- -------------- --------------

Adjusted EBITDA (IFRS 16) basic 1.35 1.13 0.99

----------------------------------------------- -------------- -------------- --------------

Adjusted EBITDA (IAS 17) basic 0.85 0.88 0.19

----------------------------------------------- -------------- -------------- --------------

During a period where the Group or Company makes a loss,

accounting standards require that 'dilutive' shares for the Group

be excluded in the earnings per share calculation, because they

will reduce the reported loss per share; consequently, all

per-share measures in the current period are based on the weighted

number of ordinary shares in issue.

6. TRADE AND OTHER PAYABLES

26 December 27 December 27 June 2021

2021 2020

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

-------------------------------- ------------- ------------- ------------

Trade payables 2,776,797 542,625 2,740,849

Social security and other taxes 1,126,970 60,259 300,549

Corporation tax 359,132 221 343,652

Defined contribution pension 16,796 14,860 15,043

Other payables 3,710,409 200,563 2,974,422

Accruals and deferred income 2,118,514 279,931 2,253,648

-------------------------------- ------------- ------------- ------------

10,108,618 1,098,459 8,628,163

-------------------------------- ------------- ------------- ------------

Included within other payables is GBP2,343,000 relating to the

valuation in connection with the contingent deferred consideration

shares relating to the Adventure Bar Group acquisition in May 2021.

Other payables also includes GBP866,822 in respect of deferred

consideration arising from a completion accounts process in

relation to the acquisition of Barrio Familia Limited in November

2021 - see Note 9. This was paid in January 2022.

7. CALLED UP SHARE CAPITAL

26 December 27 December 27 June 2021

2021 2020

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

-------------------------------------------- ----------- ----------- ------------

Allotted, called up and fully paid ordinary

shares 1,911,578 55,379 1,854,752

-------------------------------------------- ----------- ----------- ------------

26 December 27 December 27 June 2021

2021 2020

Number Number Number

----------------------------------- ----------- ----------- ------------

A Ordinary shares of GBP0.001 each - 55,378,838 -

Ordinary shares of GBP0.01 each 191,157,801 - 185,475,192

----------------------------------- ----------- ----------- ------------

On 21 November 2021 the Company issued 5,682,609 ordinary shares

in connection with the acquisition of Barrio Familia Limited

accounted for at 19.5 pence - see Note 9.

8. RELATED PARTY TRANSACTIONS

Related parties are considered to be the directors of Nightcap

plc, The Cocktail Club, Adventure Bar Group and Barrio Familia.

Transactions with them are detailed below:

26 weeks ended 26 weeks ended 52 weeks

ended

26 December 27 December 27 June

2021 2020 2021

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

---------------------------------------- -------------- -------------- -----------

Consultancy Fees - 12,000 12,000

---------------------------------------- -------------- -------------- -----------

- 12,000 12,000

---------------------------------------- -------------- -------------- -----------

These transactions are split by related

party as follows:

PAF Ventures Limited - 12,000 12,000

---------------------------------------- -------------- -------------- -----------

- 12,000 12,000

---------------------------------------- -------------- -------------- -----------

9. BUSINESS COMBINATIONS

On 21 November 2021, Nightcap plc acquired 100% of the shares of

Barrio Familia Limited, for the total consideration of GBP5,602,931

comprising cash of GBP3,628,000, 5,682,609 shares issued and

accounted for at a price of 19.5p (GBP1,108,109) and deferred

consideration in relation to the completion accounts process of

GBP866,822. Through the acquisition, Nightcap has become the

operator of an additional five bars, which comprise: i) four Latin

American inspired, Tequila-led, cocktail bars in popular areas of

London which trade under the 'Barrio' brand; and ii) a high end

'60s themed members' cocktail bar which trades under the

'Disrepute' brand in London's Soho area (collectively the "Barrio

Bar Group").

The acquired business contributed revenues of GBP831,000 and

profit before tax of GBP31,000 (in accordance with IFRS) to the

consolidated Group for the period from 21 November 2021 to 26

December 2021.

The values identified in relation to the acquisition are

provisional as at 26 December 2021.

Fair Value

Book Value Adjustments Fair Value

GBP GBP GBP

----------------------------------------- ----------- ------------ -----------

Property, plant and equipment 1,345,503 - 1,345,503

Intangible assets 84,900 1,936,000 2,020,900

Right-of-use assets 5,265,431 - 5,265,431

Inventories 111,741 - 111,741

Receivables 760,097 - 760,097

Cash 3,166,200 - 3,166,200

Payables (2,041,588) - (2,041,588)

Bank loans and borrowings (1,824,278) - (1,824,278)

Lease liabilities (5,265,431) - (5,265,431)

Deferred tax liability (73,874) (568,792) (642,666)

----------------------------------------- ----------- ------------ -----------

Total net assets acquired 1,528,701 1,367,208 2,895,909

----------------------------------------- ----------- ------------ -----------

Fair value of consideration paid GBP

- Cash paid to vendor 3,628,000

- Consideration shares issued 1,108,109

- Deferred consideration 866,822

----------------------------------------- ----------- ------------ -----------

Acquisition date fair value of the total

consideration transferred 5,602,931

----------------------------------------- ----------- ------------ -----------

Goodwill 2,707,022

----------------------------------------- ----------- ------------ -----------

The Group has made certain estimates and judgements in arriving

at the valuation of intangible assets and goodwill.

In accordance with IFRS 3, the identifiable assets acquired and

liabilities and contingent liabilities assumed should be measured

at fair value at the acquisition date in order to determine the

difference between the cost of acquisition and the fair value of

the Group's share of net assets acquired, which should then be

recognised as goodwill on the balance sheet or recognised in the

income statement. In determining the fair value, management has

recognised brand values totalling GBP1.9m in respect of the brands

acquired. Key estimates used in arriving at the brand valuation

include growth rates, discount rate, cashflow assumptions including

working capital estimates, appropriate royalty rates and useful

economic lives.

In addition, the Group has made certain estimates in determining

the deferred consideration payable as part of the completion

accounts process.

10. Reconciliation of Statutory Results to Alternative

Performance Measures

26 weeks ended 26 weeks ended 52 weeks ended

26 December 27 December 27 June 2021

2021 2020

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

------------------------------------------- -------------- -------------- --------------

Loss from operations (17,214) (49,124) (4,888,900)

Exceptional items (Note 3) 352,984 150,582 713,598

Pre-opening costs 131,322 - -

Share based payment charge 198,140 - 3,823,642

------------------------------------------- -------------- -------------- --------------

Adjusted profit / (loss) from operations 665,232 101,458 (351,660)

Depreciation and amortisation (pre IFRS 16

Right of use asset depreciation) 865,633 245,743 618,544

IFRS 16 Right of use asset depreciation 996,022 279,794 691,192

------------------------------------------- -------------- -------------- --------------

Adjusted EBITDA (IFRS 16) 2,526,887 626,995 958,076

IAS 17 Rent charge (942,727) (136,928) (777,042)

------------------------------------------- -------------- -------------- --------------

Adjusted EBITDA (IAS 17) 1,584,160 490,067 181,034

------------------------------------------- -------------- -------------- --------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DZGMFKFGGZZM

(END) Dow Jones Newswires

March 14, 2022 03:00 ET (07:00 GMT)

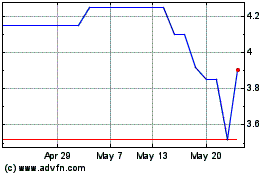

Nightcap (LSE:NGHT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Nightcap (LSE:NGHT)

Historical Stock Chart

From Jul 2023 to Jul 2024