Embargoed Release: 07:00hrs Monday 13 June 2005

Matrix Communications Group plc

("Matrix" or the "Group")

INTERIM RESULTS FOR THE SIX MONTHS ENDED 30 APRIL 2005

Matrix Communications Group Plc, the supplier of high performance IT network

solutions to the public and private sectors in the UK, is pleased to present

its unaudited results for the six month period ended 30 April 2005.

Highlights

* Turnover up over 500% to �22.5m (2004 - �3.7m)

* Gross Profit up 400% to �8.0m (2004 - �1.6m)

* Operating profit, excluding an amortisation charge of �0.6m for the period,

up 210% to �1.9m (2004 - �0.6m)

* EBITDA up over 200% to �2.2m (2004 - �0.7m)

* Secured a significant global contract for the provision of the Groups'

unique leading edge content filtering software with a global mobile

wireless operator

* Raised �7.5m before expenses from the issue of new equity

* Successfully completed a further 3 acquisitions

* Benefited from the implementation of a new divisional structure and

corporate branding

Ian Smith, CEO, commented:

"I am very pleased to report on what has been yet another period of significant

progress for the Group. As well as completing three more key and value

enhancing acquisitions we have been successful in completing the final stages

of our initial goal to create the UK's leading integrated high performance

technology Group. In doing so we have established ourselves as the defacto

route to market for leading edge technologies - whether that be as a

distributor through our partner sales division or as an end user facing

integrator. The key to this is that having implemented our divisional structure

and having made further progress on the integration of our acquisitions we

believe that we have overcome the initial hurdles we faced as a new entrant

into our market space. Looking forward we can now expect to reap the rewards of

the achievements we have made over the past year and a half as we capture the

additional cost savings available to us and begin the next stage of our

development which will be focussed on aggressive organic growth both here in

the UK and on a wider basis as we begin to penetrate overseas markets. Looking

towards our intended overseas expansion I am particularly excited about the

prospects for our newly formed mobile division, Fujin Technology, and very much

looking forward to reporting on our progress in the future."

Further Information:

Ian Smith, CEO

Matrix Communications Group Plc: 0870 737 5000

Andrew Tan

Hansard Communications Plc: 020 7245 1100

CHAIRMAN'S STATEMENT

Introduction

During the six months to 30 April 2005, the Group focussed its efforts on

finalising its divisional structure and has begun to leverage its established

position as a provider of leading edge high performance IT network solutions.

Results and Financial Review

It is with great pleasure that we present our unaudited interim results for the

six months ended 30 April 2005. This period is the fourth reporting period

since Matrix joined the Group as a start-up in March 2003. In line with our

previous reports we have continued to make substantial progress through the

period.

Group turnover increased to �22.5m (2004 - �3.7m) and the profit before tax to

�1.15m (2004 - �0.63m). The profit before tax includes a charge of �0.59m for

amortisation of goodwill arising from acquisitions (2004 - �0.03m). Earnings

per share increased from 1.47p per share in 2004 to 2.03p per share in this

period, representing an increase of 38%.

The results are absolutely in line with the Group's expectations for the first

half of the year. As the effect of cost savings already implemented, coupled

with additional cost savings realised through the consolidation of our offices

from 8 to 4, plus a substantial contribution from Fujin in the second half is

seen, we can all look forward to a greater level of profitability.

Many new customers were added across the Group during the period and we are

beginning to see the real benefit of having multiple disciplines within the

Group as the uptake in cross selling is increased. While there have been many

customer wins the Group has adopted a position of officially now only

announcing wins that are in excess of �1m due to the number of customer wins

below this level. Of course we will still make the lesser value customer wins

available via short releases and case studies on our website.

While it seems all of our peers are suffering with margin pressure we are very

pleased with the continued level of GP across our distribution and integration

divisions at 32% and 47% respectively. As Fujin commences its contribution to

the Group our expectation is that the GP from this division will be between 35%

and 40%.

Earnouts

During the period, two of the earlier acquisitions, namely Bedrock and Decorum

successfully completed their earnouts with the former exceeding sales and

profit targets by over 50% and 150% respectively and the latter by over 20% and

40% respectively. Completion of the earnouts has allowed the changes necessary

to achieve full and effective integration within the division to be made

providing the Group with the opportunity to capture further operational cost

savings.

The overperformance of the subsidiaries in the achievement of their earnouts

has also given the Board comfort in the carrying value of goodwill in the

balance sheet.

Trading divisions

Following the award of a global contract from a wireless operator to provide a

content filtering service across its UK and overseas subsidiaries, it was

decided to establish a third division to the existing integration and partner

sales divisions, namely Fujin Technology. Under the direction of Peter

Drinkwater, this division will seek to exploit further the many opportunities

both at home and overseas in the mobile market for security services. David

Grant will now manage the Integration Division.

Acquisitions

On 31 January 2005, �7.5m less expenses was raised from the placing of

3,750,000 new ordinary 10p shares at 200p per share with institutional

investors for planned acquisitions.

During the six month period three further acquisitions were completed, namely

Network Partners Ltd, Equip Technology Ltd and the operating subsidiaries of

Harrier Group Plc.

Since acquisition, Network Partners, Equip Technology and Norwood Adam Systems,

have performed above the levels required to achieve the deferred consideration

payable to them and the Board has therefore decided to release the vendors from

the specific performance targets in order to allow full integration (and the

resultant cost savings) to be achieved in the following months.

Customer views

In a period when a number of our peers have reported challenging IT service

environments, we have delivered exceptional year on year organic growth. This

growth can be seen at a turnover level and is also reflected in our retained

profits. Indeed the profit growth has enabled us to substantially invest into

our sales and engineering teams with the belief that this will further

accelerate our position over the next 12 months.

The company believes that this growth is the best testament of the Group's

differentiated product strategy and the real value that we bring to our

customer base. By focussing on leading edge technologies we have been able to

retain our differentiated position and thereby avoid the margin pressure

identified elsewhere. Equally this field of specialisation is the area of our

industry that is demonstrating the highest growth potential, with Cisco's own

advanced technology group showing 66% year on year growth. This area of Cisco's

product portfolio is identical to the areas of expertise that we bring to our

customers. Clear areas of growth for the Group will come from additional VoIP

and Network security sales with perhaps the greatest opportunity deriving from

the work conducted within the newly created Fujin Technology business division.

Indeed this division now has a clear objective of taking its own unique skills

into the International arena and establishing sales opportunities overseas.

Summary and Outlook

Our first half of FY05 has seen much activity not least of all;

� 3 acquisitions

� Implementation of divisional structure and branding

� Cost saving initiatives

� Emphasis on sales with the creation of a number of new sales and engineering

roles

� Identification and planned launch of exciting new technologies in H2 FY05

Our view is that the market place will continue to see consolidation and the

Group intends to continue its participation in the appropriate circumstances.

The recent deals with Xpert/Redstone, Kingston/Omnetica and Prime/2E2 are

evidence of such. The traditional Cisco partners are seeing ever increasing

pressure on their margins and in an attempt to deal with this margin pressure

these entities will have to regard merger/acquisition as the only way to

financially engineer their way to sustainability and profit. We also expect

that Telecom companies will seek to recoup their sunk cost in network

infrastructure by exploiting value added services in Local Area Networks, as

evidenced in the recent deal between BT and Skynet. Consequently we expect that

further consolidation activity will become more expensive in the short term.

In the meantime the Board is confident that the payback for the effort invested

in the first 6 months will be delivered in the second half when all

acquisitions will be contributing for the full period and we look forward to

reporting positively for our fifth period as the enlarged Matrix Group.

Alan Watkins

Chairman

Matrix Communications Group Plc

Consolidated Profit and Loss Account for six months ended 30 April 2005

Six months Six months Year to 31

to 30 April to 30 April October

2005 2004 2004

(unaudited) (unaudited) (audited)

� � �

Turnover 22,527,049 3,696,999 11,134,827

Cost of sales (14,520,328) (2,056,548) (6,322,870)

Gross profit 8,006,721 1,640,451 4,811,957

Administrative expenses (6,717,011) (1,024,760) (3,590,594)

Operating profit 1,289,710 615,691 1,221,363

Profit on disposal of subsidiary - 19,684 -

Profit before interest and 1,289,710 635,375 1,221,363

taxation

Interest receivable 29,037 - 13,084

Interest payable (169,413) (1,397) (22,024)

Profit on ordinary activities 1,149,334 633,978 1,212,423

before taxation

Corporation tax (482,082) (190,194) (153,414)

Profit after taxation 667,252 443,784 1,059,009

Minority interest 0 (84,398) 85,910

Profit for the financial period 667,252 359,386 1,144,919

Earnings per share (pence) 2.03 1.47 3.94

Matrix Communications Group Plc

Consolidated Balance Sheet as at 30April 2005

As at As at As at 31

October

30 April 200 30 April 2004

5 2004

(audited)

(unaudited) (unaudited)

� � �

Fixed Assets

Tangible assets 1,610,625 35,749 689,047

Intangible assets 33,263,750 2,282,779 10,857,547

34,874,375 2,318,528 11,546,594

Current assets

Stocks 1,956,137 324,417 464,785

Debtors 15,953,829 2,851,047 4,399,867

Cash at bank and in hand 1,034,573 1,897,578 312,680

18,944,539 5,073,042 5,177,332

Creditors: amounts falling due (28,547,619) (2,854,254) (6,994,884)

within one year

Net current (liabilities) / assets (9,603,080) 2,218,788 (1,817,552)

Total assets less current 25,271,295 4,537,316 9,729,042

liabilities

Creditors: amounts falling due (6,000,000) - -

after one year

Minority interest - (64,485) -

Net assets 19,271,295 4,472,831 9,729,042

Capital and reserves

Called up equity share capital 3,539,720 2,759,274 2,855,068

Share premium account 12,824,915 3,727,190 4,752,074

Shares to be issued 3,467,508 - 3,350,000

Profit and loss account (560,848) (2,013,633) (1,228,100)

19,271,295 4,472,831 9,729,042

Matrix Communications Group Plc

Group Cash Flow Statement for the period ended 30 April 2005

Six months Six months Year to 31

to 30 April to 30 April October

2005 2004 2004

(unaudited) (unaudited) (audited)

� � �

Net cash (outflow) / inflow from (563,917) 40,001 (696,564)

operating activities

Returns on investments and

servicing of finance

Interest paid (169,413) (1,397) (16,007)

Interest received 29,037 - 13,083

Interest element of finance leases - - (8,543)

Net cash outflow from returns on (140,376) (1,397) (11,467)

investments and servicing of

finance

Taxation 5,392 - (33,538)

Capital expenditure and financial

investment

Payments to acquire tangible fixed (515,447) (33,230) (182,527)

assets

Receipts from sale of fixed assets 49,270 - -

Net cash outflow from capital (466,177) (33,230) (182,527)

expenditure

Acquisitions and disposals

Payments to acquire investments in (11,797,447) (741,274) (2,703,433)

subsidiary undertakings

Cash in subsidiaries at 3,400,604 147,413 887,300

acquisition

Receipts from sale of business - - 7,500

Net cash outflow from acquisitions (8,396,843) (593,861) (1,808,633)

and disposals

Net cash outflow before financing (9,561,921) (588,487) (2,732,729)

Financing

Bank loans advanced 7,000,000 - -

Other loans repaid (3,753,099) - -

Issue of equity share capital 375,000 267,857 267,857

Share premium on issue of equity 7,125,000 2,057,143 1,939,471

shares

Capital element of finance leases (32,000) - (33,695)

Net cash inflow from financing 10,714,901 2,325,000 2,173,633

Increase/ (decrease) in cash 1,152,980 1,736,513 (559,096)

Matrix Communications Group Plc

Group Cash Flow Statement for the period ended 30 April 2005

Reconciliation of operating results to net cash (outflow) / inflow from

operating activities

Six months Six months Year to 31

to 30 April to 30 April October

2005 2004 2004

(unaudited) (unaudited) (audited)

� � �

Operating Profit 1,289,710 635,375 1,221,363

Depreciation & amortisation 897,734 59,008 633,031

Profit / (loss) on disposal of 3,920 - (23,185)

fixed assets

(Increase) / decrease in stocks (344,608) (48,790) 188,320

Increase in debtors (9,299,460) (2,687,730) (1,035,529)

Increase / (decrease) in creditors 6,888,787 2,082,138 (1,680,564)

Net cash (outflow) / inflow from (563,917) 40,001 (696,564)

operating activities

Reconciliation of net cash flow to movement in net debt

Six months Six months Year to 31

to 30 April to 30 April October

2005 2004 2004

(unaudited) (unaudited) (audited)

� � �

Increase / (decrease) in cash in 1,152,980 1,736,513 (559,096)

the period

Loans advanced (7,000,000) - -

Cash outflow in respect of finance 32,000 - 33,695

leases

Change in net debt resulting from (5,815,020) 1,736,513 (525,401)

cashflow

New finance leases - - (91,100)

Change in net debt (5,815,020) 1,736,513 (616,501)

Net funds at the start of the (455,436) 161,065 161,065

period

Net funds at the end of the period (6,270,456) 1,897,578 (455,436)

Analysis of changes in net funds

At 1 Cash flows At 30 April

November 2005

2004

� � �

Cash:

Cash at bank and in hand 312,680 721,893 1,034,573

Bank overdraft (710,711) 431,087 (279,624)

(398,031) 1,152,980 754,949

Debt:

Debt due < 1 year - (1,000,000) (1,000,000)

Debt due > 1 year - (6,000,000) (6,000,000)

Finance leases (57,405) 32,000 (25,405)

(57,405) (6,968,000) (7,025,405)

Total (455,436) (5,815,020) (6,270,456)

1. Major non-cash transactions

During the period 3,096,519 ordinary 10 pence shares were issued to satisfy

deferred consideration payable following the acquisition of certain

subsidiaries

2. Earnings per share have been calculated on the net basis on ordinary

activities after taxation of �667,252 (2004 : �359,386) using the weighted

average number of ordinary shares in issue of 32,833,698 (2004 :

24,483,643).

3. The interim accounts were approved by the Board of Directors on the 10 June

2005.

4. The interim report has been prepared using accounting policies consistent

with those set out in the statutory accounts of the company for the year

ended 31 October 2004 within the group companies.

Additional policies are:

Basis of Consolidation

The consolidated Profit & Loss Account and Balance Sheet include the financial

statements of the Company and it's subsidiaries made up to 30 April 2005. The

results of subsidiaries are included in the Profit & Loss Account from the date

of acquisition.

On acquisition the subsidiaries net assets are recorded at fair value.

Goodwill

Goodwill arising on consolidation represents the excess of fair value of

consideration given over the fair value of identifiable net assets acquired.

Goodwill is capitalised and amortised over its useful economic life.

5. The interim financial information for the two half year periods is

unaudited and does not constitute statutory accounts within the meaning of

Section 240 of the Companies Act 1985. The results for the year ended 31

October 2004 have been extracted from the statutory accounts of the company

on which an unqualified auditors' report has been received and which have

been delivered to the Registrar of Companies.

END

Mgc Pharmaceuticals (LSE:MXC)

Historical Stock Chart

From Jun 2024 to Jul 2024

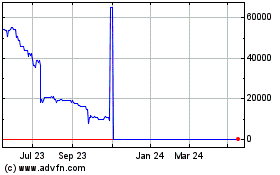

Mgc Pharmaceuticals (LSE:MXC)

Historical Stock Chart

From Jul 2023 to Jul 2024