TIDMMTL

RNS Number : 5072B

Metals Exploration PLC

14 February 2022

METALS EXPLORATION PLC

Updated Mineral Resource and Ore Reserve Estimate

Metals Exploration plc (AIM: MTL) ("Metals Exploration", the

"Company" or the "Group"), a gold producer in the Philippines,

today provides an updated Mineral Resource Estimate and Ore

Reserves Statement at its Runruno gold project ("Runruno" or the

"Project") in the Philippines.

Summary of Report

In association with the Company's review of its mining plan for

the remaining life of mine ("LOM"), the Company commissioned Robin

Rankin of GeoRes Consulting to verify the Company's updated JORC

compliant Mineral Resource Estimate (the "MRE") for the Runruno

project. The last MRE was independently compiled in 2011 by Mining

Associates.

At present, mining rates estimated in the new MRE indicates a

mine life of at least five years with possible extensions through

further drilling.

Orebody domains and wireframes have been updated using

information obtained from 49 new diamond drill holes and the

compilation of a new structural geology model. Using updated

univariate statistics and variography, a new Ordinary Kriged

estimate was used to generate a 10 metres x 10 metres x 5 metres

Block Model of the Mineral Resource. Table 1 below shows the

breakdown of the 2021 MRE by resource category.

Table 1: Updated 2021 Total Mineral Resource Estimate

Main Runruno Ore Gold Sulphur

Resource Category Mt g/t Moz % Mt

----- ----- ----- ----- -----

Measured 12.1 1.66 0.65 1.48 0.18

----- ----- ----- ----- -----

Indicated 9.3 1.44 0.43 1.16 0.11

Inferred 5.1 1.14 0.19 1.03 0.05

----- ----- ----- ----- -----

Total 26.5 1.48 1.27 1.29 0.34

----- ----- ----- ----- -----

The new drilling generally intercepted lower grades on the

Western extensions of the Runruno ore body, which is in line with

the actual mining outcomes experienced. Shorter ranges were used in

the variograms which better reflect the style of mineralisation.

The block size used in this model was reduced to 10 metres x 10

metres x 5 metres in order to better define the thinner lode

structures and reduce waste dilution within the model.

Table 2 below compares the 2021 MRE to the previous official MRE

release in 2011.

Table 2 - Comparison of the 2011 and 2021 Mineral Resource

Estimates

Main Runruno Ore Gold

Resource Category Mt g/t Moz

----- ----- -----

2011 Resource Measured 11.2 1.88 0.68

----------- ----- ----- -----

Indicated 7 1.64 0.37

--------------------------- ----- ----- -----

Inferred 7.5 1.44 0.35

--------------------------- ----- ----- -----

Total 25.7 1.69 1.39

--------------------------- ----- ----- -----

2021 Resource Measured 12.1 1.66 0.65

----------- ----- ----- -----

Indicated 9.3 1.44 0.43

--------------------------- ----- ----- -----

Inferred 5.1 1.14 0.19

--------------------------- ----- ----- -----

Total 26.5 1.48 1.27

--------------------------- ----- ----- -----

Variance Measured 8% -12% -4%

----------- ----- ----- -----

Indicated 33% -12% 16%

--------------------------- ----- ----- -----

Inferred -32% -21% -46%

--------------------------- ----- ----- -----

Total 3% -12% -9%

--------------------------- ----- ----- -----

The new resource model shows an increase in tonnage but at a

lower grade. The net result is an overall increase of 30,000

Measured and Indicated Resource ounces.

Updated Ore Reserve Estimate

The updated 2021 MRE was used by the Company to re-optimize the

open pit and calculate a new Ore Reserves Estimate for its Runruno

project. This work was carried out in-house and independently

verified by Xenith Consulting, compilers of the 2020 Ore Reserve

estimate. Set out below are several matters that should be

considered in conjunction with the Updated Ore Reserve

Estimate:

-- Updated structural geology and geotechnical models were used in the pit optimisation;

-- Pit optimisation was based on an average 80% recovery and US$1,750/oz gold price;

-- The higher gold price drove a lower economic cut-off grade of

0.53 g/t gold vs 0.56 g/t in 2020;

-- Pit designs were updated based on the optimisation results to

include ramps and other accesses;

-- Both in-pit and ex-pit waste dumps were redesigned and optimised;

-- A new life of mine schedule was developed based on the updated pit designs;

-- Updated mine economics were based on the Company's internal

budgets and economic models; and

-- A substantial amount of mineral resource remains uneconomic

due to grade, depth and/or terrain restrictions, or a combination

of these factors.

The remaining estimated ore Reserves as verified by Xenith

Consulting as at February 2022 are set out in Table 3 below:

Table 3: 2022 Ore Reserve Estimate

Reserve Ore Gold

Category Mt g/t M Oz

----- ----- -----

Proved - - -

----- ----- -----

Probable 9.94 1.35 0.43

----- ----- -----

Total 9.94 1.35 0.43

----- ----- -----

Inferred included in LOM model pit

Inferred material 0.69 1.11 0.02

----- ----- -----

-- Mining grade dilution reduced to 20% based on model reconciliations.

-- Unchanged mining recovery of 85% inclusive of a 5% mining loss.

-- Measured and Indicated Resource - converted to 9.94Mt of Probable Reserve.

-- 0.69Mt of Inferred resource represents 6% of the total reserve.

-- LOM pit design remains economic with Inferred material included at zero grade.

Reconciliation to 2020 Ore Reserve estimate

The 2020 Ore Reserves estimate, prepared by Xenith Consulting in

April 2020, is shown in Table 4 below.

Table 4: 2020 Ore Reserve Estimate

Reserve Ore Gold

Category Mt g/t M Oz

----- ----- -----

Proved Nil nil nil

----- ----- -----

Probable 11.7 1.38 0.50

----- ----- -----

Total 11.7 1.38 0.50

----- ----- -----

Inferred included in LOM model pit

Inferred material 2.7 1.21 0.10

----- ----- -----

While overall tonnes of ore have been depleted at a rate

consistent with the available tonnes as estimated in the 2020 Ore

Reserve Estimate, the updated estimated grade is lower reflecting

both new drill results and mining history.

The Company has an ongoing resource drilling programme that will

provide the basis for the next updated project Ore Reserve Estimate

and an exploration program to develop extensions to the existing

pit and available Ore Reserves.

Darren Bowden, CEO of Metals Exploration commented:

"The results released today demonstrate a life of mine of at

least five years which, given the work that we have carried out and

are undertaking we are confident can be extended.

This report shows we have an excellent project and that we have

built a solid foundation from which to grow."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014, which forms part of United

Kingdom domestic law by virtue of the European (Withdrawal) Act

2018. Upon the publication of this announcement, this inside

information is now considered to be in the public domain.

- -

Glossary of Key Terms

Cut-off grade the lowest grade value that is included in a resource

statement

g/t grams per tonne, equivalent to parts per million

--------------------------------------------------------------

grade relative quantity or the percentage of ore mineral

or metal content in an ore body

--------------------------------------------------------------

Indicated resource that part of a Mineral Resource for which tonnage,

densities, shape, physical characteristics, grade

and mineral content can be estimated with a reasonable

level of confidence

--------------------------------------------------------------

Inferred resource that part of a Mineral Resource for which tonnage,

grade and mineral content can be estimated with

a low level of confidence

--------------------------------------------------------------

JORC The Australasian Joint Ore Reserves Committee Code

for Reporting of Exploration Results, Mineral Resources

and Ore Reserves 2012 (the "JORC Code" or "the

Code"). The Code sets out minimum standards, recommendations

and guidelines for Public Reporting in Australasia

of Exploration Results, Mineral Resources and Ore

Reserves

--------------------------------------------------------------

Kriging A method of interpolation which predicts unknown

values from data observed at known locations. It

uses the variogram to express spatial variation,

and minimises the error of predicted values that

are estimated by spatial distribution of the predicted

values

--------------------------------------------------------------

Measured Resource that part of a Mineral Resource for which tonnage,

densities, shape, physical characteristics, grade

and mineral content can be estimated with a high

level of confidence. It is based on detailed and

reliable exploration, sampling and testing information

gathered through appropriate techniques from locations

such as outcrops, trenches, pits, workings and

drill holes.

--------------------------------------------------------------

Mineral Resource a concentration or occurrence of material of intrinsic

economic interest in or on the Earth's crust in

such form, quality and quantity that there are

reasonable prospects for eventual economic extraction.

The location, quantity, grade, geological characteristics

and continuity of a Mineral Resource are known,

estimated or interpreted from specific geological

evidence and knowledge. Mineral Resources are sub-divided,

in order of increasing geological confidence, into

Inferred, Indicated and Measured categories

--------------------------------------------------------------

Mt million tonnes

--------------------------------------------------------------

oz troy ounce (= 31.103477 grams)

--------------------------------------------------------------

Probable Reserve the economically mineable part of an indicated,

and in some circumstances, a Measured Mineral Resource

. The confidence in the Modifying Factors applying

to a Probable Mineral Reserve is lower than that

applying to a Proven Mineral Reserve

--------------------------------------------------------------

Proven Reserve is the highest confidence level of the economically

mineable part of a Measured Mineral Resource

--------------------------------------------------------------

Reserve the economically mineable part of a Measured and/or

Indicated Mineral Resource

--------------------------------------------------------------

For further information please visit or contact:

Metals Exploration PLC

Via Tavistock Communications

Limited +44 (0) 207 920 3150

-------------------------

Nominated & Financial STRAND HANSON LIMITED

Adviser:

-------------------------

James Spinney, James

Dance, Rob Patrick +44 (0) 207 409 3494

-------------------------

Financial Adviser & Broker: HANNAM & PARTNERS

-------------------------

Matt Hasson, Franck Nganou +44 (0) 207 907 8500

-------------------------

Public Relations: TAVISTOCK COMMUNICATIONS

LIMITED

-------------------------

Jos Simson, Nick Elwes,

Oliver Lamb +44 (0) 207 920 3150

-------------------------

Web: www.metalsexploration.com

Twitter: @MTLexploration

LinkedIn: Metals Exploration

Competent Person's Statement

The information contained in this release that relates to the

2021 gold Mineral Resource Estimate is based on information

compiled by Mr Vyron Leal of Metals Exploration and reviewed by Mr

Robin Rankin, who is a Member of The Australasian Institute of

Mining and Metallurgy and the Australian Institute of

Geoscientists. Mr Rankin is a full-time employee of GeoRes

Consulting. Mr Rankin has sufficient experience that is relevant to

the style of mineralisation and type of deposit described in the

release to qualify as a Competent Person as defined by the JORC

Code, 2012 Edition. Mr Rankin consents to the inclusion of this

information in the form and context in which it appears in this

release.

The Ore Reserve Statement was compiled by Paola Tuyor of Metals

Exploration and reviewed and verified by Grant Walker of Xenith

Consulting. Mr Walker is a Member of The Australasian Institute of

Mining and Metallurgy and is a Competent Person as defined by the

JORC Code, 2012 Edition, having five years' experience that is

relevant to the style of mineralisation and type of deposit

described in the Report.

Mr Darren Bowden, a director of the Company, a Member of the

Australasian Institute of Mining and Metallurgy and who has been

involved in the mining industry for more than 25 years, has

compiled, read and approved the technical disclosure in this

regulatory announcement in accordance with the AIM Rules - Note for

Mining and Oil & Gas Companies.

Forward Looking Statements

Certain statements relating to the estimated or expected future

production, operating results, cash flows and costs and financial

condition of Metals Explorations, planned work at the Company's

projects and the expected results of such work contained herein are

forward-looking statements which are based on current expectations,

estimates and projections about the potential returns of the Group,

industry and markets in which the Group operates in, the Directors'

beliefs and assumptions made by the Directors . Forward-looking

statements are statements that are not historical facts and are

generally, but not always, identified by words such as the

following: "expects", "plans", "anticipates", "forecasts",

"believes", "intends", "estimates", "projects", "assumes",

"potential" or variations of such words and similar expressions.

Forward-looking statements also include reference to events or

conditions that will, would, may, could or should occur.

Information concerning exploration results and mineral reserve and

resource estimates may also be deemed to be forward-looking

statements, as it constitutes a prediction of what might be found

to be present when and if a project is actually developed.

These statements are not guarantees of future performance or the

ability to identify and consummate investments and involve certain

risks, uncertainties and assumptions that are difficult to predict,

qualify or quantify. Among the factors that could cause actual

results or projections to differ materially include, without

limitation: uncertainties related to raising sufficient financing

to fund the planned work in a timely manner and on acceptable

terms; changes in planned work resulting from logistical, technical

or other factors; the possibility that results of work will not

fulfil projections/expectations and realize the perceived potential

of the Company's projects; uncertainties involved in the

interpretation of drilling results and other tests and the

estimation of gold reserves and resources; risk of accidents,

equipment breakdowns and labour disputes or other unanticipated

difficulties or interruptions; the possibility of environmental

issues at the Company's projects; the possibility of cost overruns

or unanticipated expenses in work programs; the need to obtain

permits and comply with environmental laws and regulations and

other government requirements; fluctuations in the price of gold

and other risks and uncertainties.

The Company expressly disclaims any obligation or undertaking to

disseminate any updates or revisions to any forward looking

statements contained herein to reflect any change in the Group's

expectations with regard thereto or any change in events,

conditions or circumstances on which any such statements are based

unless required to do so by applicable law or the AIM Rules.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLFZGMZKFLGZZM

(END) Dow Jones Newswires

February 14, 2022 02:00 ET (07:00 GMT)

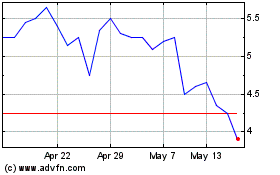

Metals Exploration (LSE:MTL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Metals Exploration (LSE:MTL)

Historical Stock Chart

From Jul 2023 to Jul 2024