Adamas Finance Asia Limited Open Offer and Placing Update and Portfolio Update (7739A)

October 01 2020 - 2:00AM

UK Regulatory

TIDMADAM

RNS Number : 7739A

Adamas Finance Asia Limited

01 October 2020

1 October 2020

ADAMAS FINANCE ASIA LIMITED

(" ADAM " or the " Company ")

Open Offer and Placing Update

And

Portfolio Update

Further to the announcement on 18th September 2020, the Company

has received confirmation that remaining subscription monies due

under the Placing have now been transferred with funds expected to

be credited to its bank account shortly. The Company remains

confident that it can proceed with the admission of the Placing,

Open Offer and Placing Commission Shares (a total of 13,165,782 New

Ordinary Shares) to trading on AIM on 7th October 2020

("Admission"). Dispatch of share certificates in respect of the New

Ordinary Shares in certificated form (certificated holders only) is

expected to occur by approximately 14(th) October 2020.

Upon Admission the Company's issued share capital (excluding

2,647,804 shares held in Treasury by the Company) will then consist

of 115,590,204 Ordinary Shares. All of the shares, excluding those

in Treasury, have equal voting rights. The Company's total issued

share capital (including those now held in Treasury) comprises

118,238,008 Ordinary Shares. This figure of 115,590,204 Ordinary

Shares may be used by shareholders in the Company as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change in their

interest in, the share capital of the Company under the Financial

Conduct Authority's Disclosure Guidance and Transparency Rules.

With reference to the Company's 2020 Interim Report, financial

guidance for Future Metal Holdings Limited for the 2020 year was to

be provided in September 2020. The Company will now provide an

update of this asset within its Quarterly Portfolio Update for the

period ending 30 September 2020. This update should be released by

the end of October or early November.

Also with reference to the Company's 2020 Interim report,

Infinity TNP's asset, Tellus Niseko, has opened for online bookings

for the 2020/2021 Winter period.

For further information on ADAM, please visit the Company's

website at http://adamasfinance.com and follow the Company on

Twitter (@ AdamasFinance ).

FOR FURTHER INFORMATION, PLEASE CONTACT:

Adamas Finance Asia Limited +44 (0) 778 531 5588

John Croft

---------------------

WH Ireland Limited - Nominated Adviser +44 (0) 20 7220 1666

---------------------

James Joyce

---------------------

James Sinclair Ford

---------------------

Pello Capital Limited - Corporate Broker +44 (0) 20 3700 2500

---------------------

Mark Treharne

---------------------

Maitland/AMO - Communications Advisor +44 (0) 20 7379 5151

---------------------

James Benjamin

---------------------

Peter Hamid

---------------------

About Adamas Finance Asia

Adamas Finance Asia Limited (ADAM) is quoted on the AIM Market

of the London Stock Exchange and is committed to providing

shareholders with attractive uncorrelated, risk adjusted long-term

returns from a combination of realising sustainable capital growth

and delivering dividend income.

The Company is focused on providing growth capital and financing

to emerging and established Small and Medium Enterprises (SME)

sector throughout Asia, well diversified by national geographies,

instruments and asset classes. This vital segment of the economy is

underserved by the traditional banking industry for regulatory and

structural reasons.

The Company's investment manager, Harmony Capital, seeks to

capitalise on its team's established investment expertise and broad

networks across Asia. Through rigorous diligence and disciplined

risk management, Harmony Capital is dedicated to delivering

attractive income and capital growth for shareholders with

significant downside protection through selectively investing in

assets and proactively managing them.

Harmony Capital is predominately sourcing private opportunities

and continues to create a strong pipeline of attractive income

generating assets from potential investments in growth sectors

across Asia, including healthcare, fintech, hospitality, IT and

property.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEASEFELNEFEA

(END) Dow Jones Newswires

October 01, 2020 02:00 ET (06:00 GMT)

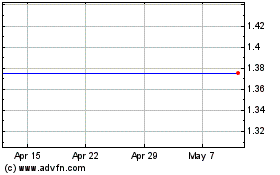

Jade Road Investments (LSE:JADE)

Historical Stock Chart

From Jun 2024 to Jul 2024

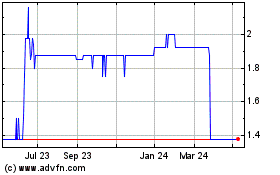

Jade Road Investments (LSE:JADE)

Historical Stock Chart

From Jul 2023 to Jul 2024