RNS Number:4930C

International Nuclear Solutions PLC

20 August 2007

International Nuclear Solutions plc

Interim Results for the six months ended 30 June 2007

International Nuclear Solutions plc (INS), a company supplying engineering

support services to the nuclear industry for over 25 years, announces a 25%

increase in turnover with operating profits before exceptional items at a

similar level to the comparable period in 2006.

Financial Highlights

6 months ended 6 months ended 12 months ended

30/6/07 30/6/06 31/12/06

#'000 #'000 #'000

Turnover 15,675 12,577 31,745

Operating Profit* 1,027 1,008 2,501

Profit before taxation 812 179 1,708

Basic Earnings per share 0.78p 0.06p 1.68p

Adjusted Earnings per share* 1.22p 1.40p 3.01p

Net Cash Inflow 352 458 2,370

Net cash and cash equivalents 3,086 822 2,734

* Before exceptional items relating to costs of the demerger from Robotic

Technology Systems PLC (RTS) and admission to AIM in 2006, and before

exceptional items relating to the offer for INS by Babcock International Group

PLC (Babcock) in 2007.

KEY POINTS

Turnover in the period increased by 25% from #12.6m to #15.7m.

Offer from Babcock provides an excellent return for shareholders.

Changing market place bringing uncertainty for INS in a market with increasing

penetration from larger corporations.

Retention and recruitment remains difficult and there are significant labour

cost pressures.

Reconstitution of the Board with the appointment to the Board of two Babcock

representatives and the move of the current executive directors to a full time

management committee role.

Chris Brown, Chairman of INS, said today:

"INS has successfully completed its first year of trading as a listed company

following the demerger from RTS. The offer from Babcock so soon after demerger

was unexpected but the Directors believe that it provides an excellent return to

shareholders. In the light of the rapidly changing UK market place shareholders

can crystallize their investment while the company gains a stronger position

from which to address these new challenges."

20 August 2007

Enquiries

International Nuclear Solutions plc Tel: 0161 777 2043

Chris Brown, Chairman

Collins Stewart Europe Limited Tel: 020 7523 8350

Chris Wells, Mark Connelly, Stewart Wallace

College Hill Tel: 020 7457 2020

Matthew Smallwood, Matthew Gregorowski

International Nuclear Solutions plc

Interim results for the six months ended 30 June 2007

Chairman's Statement

Overview

International Nuclear Solutions plc ("INS") successfully completed its first

year of trading as a listed company following the demerger from Robotic

Technology Systems PLC ("RTS") on 31st May 2006.

In the six months to 30 June 2007, turnover was #15.7m (2006: #12.6m), which is

broadly in line with our expectations. The order book at the end of June was

#6.4m (2006: #11.4m) which is behind forecast and reflects contracts being

placed at a slower rate than anticipated, particularly at our major operating

site at Sellafield.

Nearly 40% of revenues came from Tier 2 prime contractors or consortia where INS

was either a subcontractor or a teaming member but not the lead organisation.

This is further evidence of the changing nature of the nuclear sector - fewer

but larger contracts and framework agreements - which we have forecast

previously.

The net cash inflow over the period was #0.4m (2006: #0.5m) and the closing cash

balance stood at #3.1m as compared to #0.8m at the half year in 2006.

Operating profit before exceptional charges over the first 6 months remained at

a similar level at #1m (2006: #1m). Escalating labour costs are the primary

cause of the lower profit margin achieved. Labour costs have been running ahead

of national average earnings as a result of a shortage of skilled personnel and

an increasing demand from industry in general.

The basic earnings per share after exceptional costs was 0.78p (2006: 0.06p).

The adjusted basic earnings per share before exceptional costs is 1.22p (2006:

1.40p).

An exceptional charge of #0.28m relates to the costs arising in the period from

the offer by Babcock International Group PLC (Babcock). The total cost of this

in the full year is anticipated to be in excess of #0.5m.

On 2 August 2007 Babcock announced that it had acquired or had received valid

acceptances for 58.5% of the existing share capital of INS. The fact that

Babcock now owns more than 50% of the shares means that INS will now be

considered as a subsidiary of Babcock while remaining a separately listed

company.

INS will be publishing its first annual financial statements prepared in

accordance with International Financial Reporting Standards (IFRS) as adopted by

the European Union (EU) for the year ended 31 December 2007. In accordance with

the AIM Rules for Companies, INS's interim report for the six months ended 30

June 2007 has been prepared on the basis of the accounting policies which will

be applied in those financial statements.

Operational Review

Whilst revenues in the first six months of the year were at the highest level

ever recorded, the order book was significantly lower than anticipated. This was

a result of a slowdown in tendering and contract placement for projects both at

Sellafield and the Magnox sites.

Even where contracts have been placed with INS, either directly or as part of a

consortium, projects have been slow to mobilise or have received only partial

funding as part of a phased funding approach.

INS, as part of the ACCORD Alliance (a consortium of AMEC, INS and DGP

International - now part of the Scott Wilson Group), has been successful in

winning the next stage of design for the B41 Silo project at Sellafield, one of

the highest hazard rated facilities on the Sellafield site.

INS has also been successful in winning our first framework agreement for

engineering services for The United Kingdom Atomic Energy Authority (UKAEA) at

Dounreay, the second largest site in the Nuclear Decommissioning Authority (NDA)

portfolio.

An order has been received for the continued evaluation of the INS Encapsulation

process - a technology that has been developed by INS for the encapsulation of

nuclear waste materials for which it has applied for a patent. INS is one of

only three companies selected to continue to the next stage of evaluation.

The UK's nuclear support services market is going through a period of

consolidation and re-structuring as demonstrated by the recent sale of Nukem and

the acquisition of BNFL's Magnox Reactor sites management company by large

overseas conglomerates. There will be further consolidation following the

decision by the UK Government to sell the nuclear decommissioning division of

the UKAEA, which employs over 2,000 people. The Directors of INS believe that

the larger nuclear-focused companies and consortia will become more dominant in

the industry and that INS, as a smaller independent organisation, will become

more reliant on these larger organisations as they increase their penetration

into the UK nuclear sector.

Retention and recruitment remains difficult and there are significant labour

cost pressures reflecting the capacity constraints arising from a buoyant market

place for skilled engineering personnel and the competition for this labour by

the larger multi-national corporations.

We will continue to concentrate on staff retention and recruitment, which is one

of the biggest challenges currently facing the business.

INS was a finalist in the North West Business Awards for Innovation and has also

won two RoSPA (Royal Society for the Prevention of Accidents) awards, one being

a prestigious sector award.

The Executive Directors (Tony Moore, Steve McGowan and Geoff Mellor) will step

down from the Board with effect from today to full time roles as part of a

management committee, under the supervision of a non-executive Board, to allow

them to concentrate on the day to day operation of the business. I, along with

my fellow independent Non Executive Director, John Ridings will remain on the

Board. We have invited Archie Bethel (54) and Kevin Thomas (53), both senior

Babcock executives, with extensive experience of the nuclear business to join

the Board as Non Executive Directors. The new directors' appointment will take

effect from today. A list of the new Directors' current and past directorships

is attached at the end of this announcement. Other than as disclosed in the

list, there are no disclosures to be made under Schedule Two, para G of the AIM

Rules for Companies.

Outlook

Whilst order intake has been slow in the first half of the year, quotation

activity has increased significantly at the start of the second half of the year

reflecting increased activity on a number of significant projects. The delay in

some major projects is likely to affect overall revenues for 2007. However, we

remain optimistic about the outlook for 2008 particularly since the level of

annual spend at the Aldermaston Weapons Establishment (AWE) is expected to

increase over the next few years and there are a significant number of

opportunities there that are of interest to INS.

Chris Brown, Chairman

20 August 2007

Consolidated Income Statement for the six months ended 30 June 2007 (IFRS)

6 months 6 months 12 months

ended ended ended

30/06/07 30/06/06 31/12/06

(Unaudited) (Unaudited*) (Unaudited*)

Continuing operations Notes #'000 #'000 #'000

Revenue 15,675 12,577 31,745

Cost of sales (12,771) (10,165) (26,006)

Gross profit 2,904 2,412

5,739

Distribution costs (157) (168) (364)

Administrative expenses (1,995) (2,072) (3,706)

Operating profit before exceptional charges 1,027 1,008 2,501

Exceptional administrative expenses included in

administrative expenses above 4 (275) (836) (832)

Operating profit 752 172 1,669

Finance income 60 8 41

Finance costs - (1) (2)

60 7 39

Profit before taxation 812 179 1,708

Taxation 5 (327) (140) (663)

Profit for the year attributable to equity

shareholders

485 39 1,045

Earnings per share deriving from both total and

continuing operations

Basic 6 0.78p 0.06p 1.68p

Diluted 6 0.77p 0.06p 1.67p

* Comparative information for the six months ended 30 June 2006 and the year

ended 31 December 2006 was previously reported under UK GAAP and has been

restated under IFRS as adopted by the EU. The reconciliations from UK GAAP to

IFRS for each period are shown in note 8.

Consolidated Statement of Changes in Shareholders' Equity for the six months

ended 30 June 2007 (IFRS)

6 months ended 6 months ended 12 months ended

30/06/07 30/06/06 31/12/06

(Unaudited) (Unaudited*) (Unaudited*)

Note #'000 #'000 #'000

At 1 January 1,527 2,420 2,420

Profit for the financial period 485 39 1,045

Equity shares issued - 623 623

Preference shares issued - 50 50

Preference shares redeemed - (50) (50)

Reserve arising on demerger - 23,064 23,064

Reverse acquisition reserve - (23,687) (23,687)

Dividend paid - (1,964) (1,964)

Movement on other reserves relating to share options 23 2 26

At end of period 9 2,035 497 1,527

Group Balance Sheet at 30 June 2007 (IFRS)

30/06/07 30/06/06 31/12/06

(Unaudited) (Unaudited*) (Unaudited*)

#'000 #'000 #'000

Assets

Non-current assets

Property, plant and equipment 993 908 1,038

Other intangible assets 197 170 193

1,190 1,078 1,231

Current assets

Trade and other receivables 4,077 3,898 5,238

Amounts due from customers for contract work 1,734 3,488 2,117

Cash and cash equivalents 3,086 822 2,734

8,897 8,208 10,089

Liabilities

Current liabilities

Trade and other payables (6,065) (5,804) (7,970)

Amounts due to customers for contract work (1,668) (2,851) (1,376)

Current tax liabilities (319) (134) (447)

(8,052) (8,789) (9,793)

Net current assets/(liabilities) 845 (581) 296

Net assets 2,035 497 1,527

Equity shareholders' funds

Called up share capital 623 623 623

Merger reserve 23,064 23,064 23,064

Capital redemption reserve 50 50 50

Reverse acquisition reserve (23,687) (23,687) (23,687)

Other reserves 49 2 26

Retained earnings 1,936 445 1,451

Total equity attributable to equity holders of the

parent 2,035 497 1,527

Group Cash Flow Statement for the six months ended 30 June 2007 (IFRS)

6 months 6 months 12 months

ended ended ended

30/06/07 30/06/06 31/12/06

(Unaudited) (Unaudited*) (Unaudited*)

Note #'000 #'000 #'000

Net cash inflow from operating activities 7 849 3,508 5,908

Cash flows from investing activities

Purchase of property, plant and equipment (54) (903) (1,161)

Purchase of intangible assets (41) (190) (244)

Interest received 60 8 41

Net cash used in investing activities (35) (1,085) (1,364)

Cash flows from financing activities

Interest paid - (1) (2)

Taxation paid (462) - (208)

Dividend paid - (1,964) (1,964)

Net cash used in financing activities (462) (1,965) (2,174)

Net increase in cash and cash equivalents in the

period

352 458 2,370

Opening cash and cash equivalents 2,734 364 364

Closing cash and cash equivalents 3,086 822 2,734

Notes to the Financial Information

General information and basis of preparation

The consolidated interim financial statements have been prepared in accordance

with the AIM Rules for Companies and on a basis consistent with the accounting

policies set out in note 2, which will be applied when the Group prepares its

first set of annual financial statements in accordance with IFRS as adopted by

the EU for the financial year ending 31 December 2007.

These are the Group's first interim financial statements prepared under IFRS as

adopted by the EU, with the exception of IAS 34 (Interim Financial Reporting),

which is not mandatory for UK groups, and therefore IFRS 1 "First-time Adoption

of International Financial Reporting Standards" has been applied. The

disclosures required by IFRS 1 concerning the transition from UK GAAP to IFRS as

adopted by the EU are given in note 8.

The interim financial statements are unaudited and do not constitute statutory

accounts within the meaning of Section 240 of the Companies Act 1985. The

financial information for the year ended 31 December 2006 has been derived from

the published statutory accounts as restated by the IFRS adjustments set out in

note 8. A copy of the full accounts for that period, on which the auditors

issued an unqualified report that did not contain statements under Section 237

(2) or (3) of the Companies Act 1985, has been delivered to the Registrar of

Companies.

The preparation of financial statements in conformity with IFRS as adopted by

the EU requires the use of certain critical accounting estimates. It also

requires management to exercise its judgment in the process of applying the

Group's accounting policies. The areas involving a higher degree of judgment or

complexity, or areas where assumptions and estimates are significant to the

consolidated financial statements, are disclosed in Note 3.

Accounting policies

The financial statements have been prepared under the historical cost convention

and are in accordance with the Companies Act 1985 and applicable accounting

standards.

The accounting policies adopted during the period have been reviewed as part of

the conversion to IFRS and are largely consistent with those adopted previously

under UK GAAP. As these are the first set of accounts prepared under IFRS as

adopted by the EU, the accounting policies are set out in full below:

First time adoption of IFRS

The year ended 31 December 2007 will be the Group's first financial statements

prepared in accordance with IFRS. Accordingly, IFRS 1 "First time adoption of

International Financial Reporting Standards" has been applied in the interim

consolidated financial statements. The Group's transition date to IFRS is 1

January 2006, and the Group prepared its opening balance sheet at that date in

accordance with IFRS effective at 30 June 2007.

Comparative information for the six months ended 30 June 2006 and the year ended

31 December 2006 was previously reported under UK GAAP and has been restated

under IFRS as adopted by the EU. The reconciliations from UK GAAP to IFRS for

each period are shown in note 8. In addition, there is a reconciliation of

equity at the transition date for the Group, being 1 January 2006.

The Group has not taken advantage of any of the exemptions to IFRS 1.

Basis of consolidation

In preparing the consolidated financial statements, INS Innovation Limited has

been deemed to be the acquirer and the Company, the legal parent, has been

deemed to be the acquiree. Under IFRS 3 "Business Combinations", the acquisition

of INS Innovation Limited by the Company has been accounted for as a reverse

acquisition and the consolidated IFRS financial information of the Company is

therefore a continuation of the financial information of INS Innovation Limited.

The effect of this transaction is that the net assets of INS Innovation Limited

at the date of the transaction are presented at book value and those of the

legal parent are shown at fair value. However, two large and opposing reserves

are created which are shown gross on the face of the balance sheet. The net of

these two reserves is the difference between the share capital of the legal

parent (INS plc) and the substantive parent (INS Innovation Ltd).

Subsidiaries are all entities over which the Group has the power to govern the

financial and operating policies generally accompanying a shareholding of more

than one half of the voting rights. Subsidiaries are fully consolidated from the

date on which control is transferred to the Group.

Inter-company transactions, balances and unrealised gains on transactions

between Group companies are eliminated. Unrealised losses are also eliminated

subject to impairment in relation to the asset transferred. Accounting policies

of subsidiaries have been changed where necessary to ensure consistency with the

policies adopted by the Group.

Employee share option schemes

The Group operates an equity-settled share-based compensation plan. The fair

value of the employee services received in exchange for the grant of share

options is measured by reference to the fair value of the share options at the

date of grant, and is recognised in the income statement on a straight line

basis over the vesting period, based on the Company's estimate of shares that

will eventually vest. The associated credit is recognised in other reserves.

Fair value is determined by reference to the Binomial option pricing model in

respect of the EMI scheme and the Black Scholes option pricing model in respect

of the SAYE scheme.

If dividends are paid on the underlying shares during the period between vesting

date and the end of the option's life an early exercise is more likely. In these

circumstances the Binomial model is the most appropriate option pricing model to

estimate the fair value of the options. This is because the Binomial model can

compare the benefit of option exercise with its time value at each step of the

option's life where exercise is possible.

SAYE options have term to expiration equal to the vesting period and an option

of an early exercise is not applicable. Therefore, the Black-Scholes model is

the most appropriate and accurate method to evaluate these options.

At each balance sheet date, the Company revises its estimate of the number of

options that are expected to become exercisable.

When share options are exercised, the proceeds received, net of any transaction

costs, are credited to share capital (nominal value) and share premium.

Investment in subsidiary undertakings

The investment in INS Innovation Ltd in the Company balance sheet is recorded at

the cost, which is based on the fair value of shares issued. This is calculated

by multiplying the share price on flotation by the number of shares issued at

acquisition.

In these consolidated interim accounts, the investment is cancelled out against

the shares issued on acquisition, which gives rise to the creation of the

reverse acquisition reserve in the consolidated balance sheet.

Property, plant and equipment

Property, plant and equipment is stated at cost less accumulated depreciation

and any impairment losses. Cost comprises the purchase price together with any

directly attributable costs.

Depreciation commences when an asset is available for use. Depreciation is

provided to write-off the depreciable amount of assets to their residual values

on a straight line basis, over their expected useful economic lives. Where there

is evidence of impairment, assets are written down to their recoverable amounts.

Depreciation is calculated at the following annual rates:

Leasehold buildings - Over length of the lease

Fixtures, fittings and equipment - 20%

Plant and machinery - 20%

Residual values are assessed each year and where material are restated to their

current values.

Intangible assets

Purchased computer software is carried at cost less accumulated amortisation,

plus any impairment losses. Amortisation is calculated on a straight line basis

over 5 years.

Impairment of tangible and intangible assets

At each balance sheet date, the Group assesses whether there is any indication

that its assets have been impaired. If any such indication exists, the

recoverable amount of the asset is estimated in order to determine the extent of

the impairment, if any.

The recoverable amount of an asset is the higher of its fair value less costs to

sell and its value in use. The value in use is the present value of the future

cash flows expected to be derived from an asset.

If the recoverable amount of an asset is less than its carrying amount, the

carrying amount of the asset is reduced to its recoverable amount. That

reduction is recognised as an impairment loss and is recognised immediately in

the income statement.

If an impairment loss subsequently reverses, the carrying amount of the asset is

increased to the revised estimate of its recoverable amount. A reversal of an

impairment loss is recognised in the income statement.

Revenue

Revenue is derived from the design and installation of equipment and systems and

the provision of design services. Such services are provided under one of four

contract types:

Reimbursable contracts are generally for services under which initial design

ideas and concepts are produced. Under these contracts, INS is reimbursed in

full for work done with an agreed percentage uplift. Costs incurred and

associated revenue is recognised as incurred.

Target price contracts. Target total costs and profit percentage uplift are

agreed with the customer at the start of the contract. Any cost savings or

overruns are shared 50% with the customer up to an agreed maximum payable

contract price. Costs are recognised as incurred, along with revenue equalling

costs incurred and a percentage profit uplift based on total expected profits.

Incentivised contracts. Costs are recharged to the customer as incurred, plus a

variable percentage profit uplift. The amount of uplift varies in accordance

with an agreed formula based on the performance of INS against an agreed set of

KPI's. Performance against KPI's is reviewed on a monthly basis. Costs are

recognised as incurred and revenue is calculated in accordance with the results

of the monthly reviews.

Fixed price contracts are entered into when a detailed specification of the

final design is known. Costs are recognised as incurred, along with revenue

equalling costs incurred and a percentage profit uplift based on total expected

profits.

In the case of all types of contract, any anticipated losses are provided

immediately in full.

Long-term contracts

Amounts recoverable on each long term contract are stated at cost plus

attributable profits, less provision for any known or anticipated losses and

payments on account, and are included in trade and other receivables. Payments

on account in excess of amounts recoverable on each long term contract are

included in payables.

Pre-contract costs

Where pre-contract costs can be separately identified and measured reliably and

it is probable that the contract will be obtained, they are included as part of

the contract costs and taken to cost of sales as incurred.

Where it is not possible to identify or measure them reliably, or where the

probability of obtaining the contract is uncertain, pre-contract costs are

recognised as expenses as incurred and charged to the income statement.

Taxation

The tax expense represents the sum of the tax currently payable and deferred

tax.

The tax currently payable is based on the taxable profit for the year. Taxable

profit differs from net profit as reported in the income statement because it

excludes items of income or expense that are taxable or deductible in other

years, and it further excludes items that are never taxable or deductible. The

Group's liability for current tax is calculated using tax rates that have been

enacted or substantively enacted by the balance sheet date.

Deferred tax liabilities are recognised for all taxable temporary differences

and deferred tax assets to the extent that it is probable that taxable profit

will be available against which the deductible temporary difference can be

utilised, except for goodwill and differences arising through business

combinations.

Deferred tax is calculated at the tax rates that are expected to apply in the

period when the liability is settled, or the asset is realised. Deferred tax is

charged or credited in the income statement, except when it relates to items

charged or credited directly to equity, in which case the deferred tax is also

dealt with in equity.

Leases

Leases are classified as finance leases wherever the terms of the lease transfer

substantially all the risks and rewards of ownership to the lessee. All other

leases are classified as operating leases.

Assets held under finance leases are recognised as assets in the balance sheet

at their fair values or, if lower, at the present value of the minimum lease

payments, both determined at the inception of the lease. The corresponding

obligation is recorded as finance lease obligations and presented within

payables. Lease payments are apportioned between finance charges and a

reduction of the lease obligation. The finance charge is allocated to each

period during the lease term so as to produce a constant periodic rate of

interest on the remaining balance of the liability.

Rentals due under operating leases are charged to the income statement on a

straight line basis over the term of the lease.

Pension costs

Contributions to defined contribution pension schemes are charged to the income

statement in the year in which they become payable.

Research and development

Expenditure on research is recognised as an expense when incurred. Development

costs are capitalised only when it is probable that future economic benefit will

result from the project and the following criteria are met:

The technical feasibility of the product has been ascertained;

Adequate technical, financial and other resources are available to complete and

sell or use the intangible asset;

The Group can demonstrate how the intangible asset will generate future economic

benefits and the ability to use or sell the intangible asset can be

demonstrated;

It is the intention of management to complete the intangible asset and use it or

sell it; and

The development costs can be measured reliably.

Currency exposure

These consolidated interim financial statements are presented in pounds

sterling, which represents the functional currency of the Group

Monetary assets and liabilities denominated in foreign currencies are translated

to Sterling at the rates of exchange at the balance sheet date. Transactions in

foreign currencies are recorded at the rate ruling at the date of the

transaction. All differences are recognised in the income statement.

Financial instruments

Financial assets and financial liabilities are recognised on the Group's balance

sheet when the Group becomes a party to the contractual provisions of the

instrument.

Trade and other receivables

Trade and other receivables do not carry any interest and are stated at their

fair values reduced by appropriate allowances of estimated irrecoverable

amounts.

Cash and cash equivalents

Cash and cash equivalents include cash in hand, deposits on call with banks and

bank overdrafts. Bank overdrafts are disclosed as current borrowings on the

balance sheet.

Trade and other payables

Trade and other payables are not interest bearing and are stated at their

settlement amount.

Financial risk management

Price risk

The Company has no significant exposure to securities price risk, as it holds no

listed equity investments.

Credit risk

The Group's principal financial assets are bank balances, cash, and trade

receivables, which represent the Group's maximum exposure to credit risk in

relation to financial assets.

The Group's credit risk is primarily attributable to its trade receivables.

Credit risk is managed by monitoring the aggregate amount and duration of

exposure to any one customer depending upon their credit rating. The amounts

presented in the balance sheet are net of allowances for doubtful debts,

estimated by the Group's management based on prior experience and their

assessment of the current economic environment.

The credit risk on liquid funds is limited because the counterparties are banks

with high credit-ratings assigned by international credit-rating agencies. The

Group has no significant concentration of credit risk, with exposure spread over

a large number of counterparties and customers.

Financial risk management (continued)

Cash flow interest rate risk

Interest bearing assets comprise cash and bank deposits, all of which earn

interest at a fixed rate. The interest rate on the bank overdraft is at market

rate and the Group's policy is to keep the overdraft within defined limits such

that the risk that could arise from a significant change in interest rates would

not have a material impact on cash flows. The Group's policy is to maintain

other borrowings at fixed rates to fix the amount of future interest cash flows.

The directors monitor the overall level of borrowings and interest costs to

limit any adverse effects on financial performance of the Group.

Undrawn bank facilities

The Group has an undrawn committed floating rate bank borrowing facility of

#4million. The facility is for the purpose of providing flexibility in the

management of liquidity and is subject to annual review and confirmation.

Key estimates and judgements

The key area of accounting requiring the exercise of judgment by the Group is

recognition of revenue and profit for target price, incentivised and fixed price

contracts as detailed in the revenue accounting policy on page 12. All

contracts are the subject of monthly management review.

Exceptional items

The profit before taxation is stated after charging the following exceptional

items:

6 months ended 6 months ended 12 months ended

30/06/07 30/06/06 31/12/06

(Unaudited) (Unaudited*) (Unaudited*)

#'000 #'000 #'000

Costs in connection with demerger from RTS and admission to

AIM

- 836 832

Costs in connection with the offer for INS by Babcock. 275 - -

275 836 832

The above items have been highlighted as operating exceptional costs on the

basis that they are considered as one-off items that do not relate to the

underlying performance of the Group.

Taxation

The taxation charge for the period ended 30 June 2007 is significantly higher

than the standard rate of UK corporation tax due to the tax treatment of certain

costs in respect of the offer for the Company by Babcock.

The taxation charge for the period ended 30 June 2006 is significantly higher

than the standard rate of UK corporation tax due to the demerger from RTS and

the tax treatment of certain costs in respect of the subsequent flotation of the

Company.

Earnings per Share

Earnings per ordinary share has been calculated using the weighted average

number of shares in issue during the relevant period. The calculation of basic

earnings per share for the six months ended 30 June 2007 is based upon a profit

after tax of #485,000 (30 June 2006: #39,000; 31 December 2006: #1,045,000). The

weighted average number of shares used in the calculation of basic earnings per

share for the current and comparative periods is 62,335,374.

6 months ended 6 months ended 12 months ended

30/06/07 30/06/06 31/12/06

(Unaudited) (Unaudited*) (Unaudited*)

Pence Pence Pence

Basic earnings per share 0.78 0.06 1.68

Diluted earnings per share (see below) 0.77 0.06 1.67

Adjusted basic earnings per share (see below) 1.22 1.40 3.01

The weighted average number of shares used in the dilution calculation is as

shown below.

6 months ended 6 months ended 12 months ended

30/06/07 30/06/06 31/12/06

(Unaudited) (Unaudited*) (Unaudited*)

Number Number Number

Weighted average number of ordinary shares for the purposes

of basic earnings per share 62,335,374 62,335,374 62,335,374

Effect of dilutive potential ordinary shares in respect of

share options 474,343 49,701 94,766

Weighted average number of ordinary shares for the purposes

of diluted earnings per share 62,809,717 62,385,075 62,430,140

Earnings per share before the exceptional items has been calculated using the

adjusted profit after tax as follows:

6 months ended 6 months ended 12 months ended

30/06/07 30/06/06 31/12/06

(Unaudited) (Unaudited*) (Unaudited*)

#'000 #'000 #'000

Profit after taxation 485 39 1,045

Exceptional item in administrative expenses (note 4) 275 836 832

Adjusted profit after tax 760 875 1,877

Reconciliation of Profit before Taxation to Net Cash Inflow from Operating

Activities

6 months 6 months 12 months

ended ended ended

30/06/07 30/06/06 31/12/06

(Unaudited) (Unaudited*) (Unaudited*)

#'000 #'000 #'000

Profit before taxation 812 179 1,708

Adjustments for:

Depreciation 137 81 240

Finance income (60) (8) (41)

Finance expense - 1 2

Share option charge 23 2 26

Changes in working capital:

Decrease in trade and other receivables 1,551 3,493 3,213

(Decrease)/increase in payables (1,614) (240) 760

Net cash inflow from operating activities 849 3,508 5,908

Reconciliation of equity and profit under UK GAAP to IFRS

International Nuclear Solutions plc reported under UK GAAP in its previously

published financial statements for the year ended 31 December 2006 and interim

report for the six months ended 30 June 2006. The analysis below shows a

reconciliation of equity and profit as reported under UK GAAP as at 31 December

2006 and 30 June 2006 to the revised equity and profit under IFRS. In addition,

there is a reconciliation of equity under UK GAAP to IFRS at the transition date

for the Group, being 1 January 2006.

Reconciliation of consolidated profit for the year ended 31 December 2006

(a)

IAS 19

Employee

UK GAAP benefits IFRS

#'000 #'000 #'000

Revenue 31,745 - 31,745

Cost of sales (26,007) 1 (26,006)

Gross profit 5,738 1 5,739

Distribution costs (364) - (364)

Administration expenses (2,871) (3) (2,874)

Exceptional administrative expenses (832) - (832)

Operating profit 1,671 (2) 1,669

Finance income 41 - 41

Finance costs (2) - (2)

Profit before taxation 1,710 (2) 1,708

Taxation (663) - (663)

Profit attributable to equity shareholders 1,047 (2) 1,045

Reconciliation of consolidated profit for the six months ended 30 June 2006

(a)

IAS 19

Employee

UK GAAP benefits IFRS

#'000 #'000 #'000

Revenue 12,577 - 12,577

Cost of sales (10,126) (39) (10,165)

Gross profit 2,451 (39) 2,412

Distribution costs (163) (5) (168)

Administration expenses (1,217) (19) (1,236)

Exceptional administrative expenses (836) - (836)

Operating profit 235 (63) 172

Finance income 8 - 8

Finance costs (1) - (1)

Profit before taxation 242 (63) 179

Taxation (159) 19 (140)

Profit attributable to equity shareholders 83 (44) 39

The consolidated profit for the period ended 30 June 2006 and the consolidated

equity shareholders' funds at 1 January 2006 disclosed in the unaudited 2006

interim results have been increased/reduced by #50,000 respectively. The

adjustments were reflected in the audited financial statements for the year

ended 31 December 2006.

Reconciliation of consolidated equity at 31 December 2006

(a) (b) (c)

IAS 19 IAS 38 IFRS 3

Employee Intangible Business

UK GAAP benefits assets combinations IFRS

#'000 #'000 #'000 #'000 #'000

Non-current assets

Property, plant and equipment 1,231 - (193) - 1,038

Other intangible assets - - 193 - 193

1,231 - - - 1,231

Current assets

Trade and other receivables 5,238 - - - 5,238

Amounts due from customers for 2,117 - - - 2,117

contract work

Cash and cash equivalents 2,734 - - - 2,734

10,089 - - - 10,089

Current liabilities

Trade and other payables (7,952) (18) - - (7,970)

Amounts due to customers for (1,376) - - - (1,376)

contract work

Current tax liabilities (452) 5 - - (447)

(9,780) (13) - - (9,793)

Net current assets 309 (13) - - 296

Net assets 1,540 (13) - - 1,527

Shareholders' equity

Called up share capital 623 - - - 623

Merger reserve (623) - - 23,687 23,064

Capital redemption reserve 50 - - - 50

Reverse acquisition reserve - - - (23,687) (23,687)

Other reserves 26 - - - 26

Retained earnings 1,464 (13) - - 1,451

1,540 (13) - - 1,527

Reconciliation of consolidated equity at 30 June 2006

(a) (b) (c)

IAS 19 IAS 38 IFRS 3

Employee Intangible Business

UK GAAP benefits assets combinations IFRS

#'000 #'000 #'000 #'000 #'000

Non-current assets

Property, plant and equipment 1,078 - (170) - 908

Other intangible assets - - 170 - 170

1,078 - - - 1,078

Current assets

Trade and other receivables 3,898 - - - 3,898

Amounts due from customers for 3,488 - - - 3,488

contract work

Cash and cash equivalents 822 - - - 822

8,208 - - - 8,208

Current liabilities

Trade and other payables (5,725) (79) - - (5,804)

Amounts due to customers for (2,851) - - - (2,851)

contract work

Current tax liabilities (158) 24 - - (134)

(8,734) (55) - - (8,789)

Net current liabilities (526) (55) - - (581)

Net assets 552 (55) - - 497

Shareholders' equity

Called up share capital 623 - - - 623

Merger reserve (623) - - 23,687 23,064

Capital redemption reserve 50 - - - 50

Reverse acquisition reserve - - - (23,687) (23,687)

Other reserves 2 - - - 2

Retained earnings 500 (55) - - 445

552 (55) - - 497

Reconciliation of consolidated equity at 1 January 2006 (date of transition to

IFRS)

(a)

IAS 19

UK GAAP Employee benefits IFRS

#'000 #'000 #'000

Non-current assets

Property, plant and equipment 66 - 66

Other intangible assets - - -

66 - 66

Current assets

Trade and other receivables 8,304 - 8,304

Amounts due from customers for contract work 2,568 - 2,568

Cash and cash equivalents 364 - 364

11,236 - 11,236

Current liabilities

Trade and other payables (8,408) (16) (8,424)

Amounts due to customers for contract work (163) - (163)

Current tax liabilities (300) 5 (295)

(8,871) (11) (8,882)

Net current assets 2,365 (11) 2,354

Net assets 2,431 (11) 2,420

Shareholders' equity

Retained earnings 2,431 (11) 2,420

2,431 (11) 2,420

Explanation of reconciling items between UK GAAP and IFRS

The standards and interpretations giving rise to the changes to the previously

reported profit and equity of the Group are:

(a) IAS 19 Employee benefits

Under IAS 19, any unused paid holiday entitlement that has accumulated at the

balance sheet date must be charged to the income statement in the year to which

it relates.

(b) IAS 38 Intangible assets

Under UK GAAP, all capitalised computer software was included within tangible

fixed assets. IAS 38 requires software that is not an integral part of an item

of computer hardware to be classified within intangible assets.

(c) IFRS 3 Business combinations

Under UK GAAP, the demerger of INS Innovation Ltd from Robotic Technology

Systems plc was accounted for by merger accounting in accordance with FRS 6 "

Acquisitions and mergers". IFRS 3 requires that the acquirer be identified as

the party that gains control of the other party. Therefore under IFRS, the

transaction is accounted for as a reverse acquisition.

Cash flows

Income taxes and dividends which were presented as separate categories of cash

flows under UK GAAP have been included in financing cash flows under IFRS.

There are no other significant adjustments to the cash flows presented under

IFRS.

Equity

Analysis of Changes in Consolidated Shareholders' Equity for the six months

ended 30 June 2007

Capital Reverse Profit and

Share redemption Merger acquisition Other loss

capital reserve reserve reserve reserve account Total

#'000 #'000 #'000 #'000 #'000 #'000 #'000

At 1 January 2007 623 50 23,064 (23,687) 26 1,451 1,527

Profit for the period - - - - - 485 485

Share based payments

credit

- - - - 23 - 23

At 30 June 2007 623 50 23,064 (23,687) 49 1,936 2,035

Analysis of Changes in Consolidated Shareholders' Equity for the year ended 31

December 2006

Capital Reverse Profit and

Share redemption Merger acquisition Other loss

capital reserve reserve reserve reserve account Total

#'000 #'000 #'000 #'000 #'000 #'000 #'000

At 1 January 2006 - - - - - 2,420 2,420

Profit for the - - - - - 1,045 1,045

period

Dividend paid - - - - - (1,964) (1,964)

Equity shares issued 623 - - - - - 623

Preference shares 50 - - - - - 50

issued

Preference shares (50) 50 - - - (50) (50)

redeemed

Reserve arising on - - 23,064 - - - 23,064

demerger

Reverse acquisition - - - (23,687) - - (23,687)

reserve

Share based payments - - - - 26 - 26

credit

At 30 June 2006 623 50 23,064 (23,687) 26 1,451 1,527

Analysis of Changes in Consolidated Shareholders' Equity for the six months

ended 30 June 2006

Capital Reverse Profit and

Share redemption Merger acquisition Other loss

capital reserve reserve reserve reserve account Total

#'000 #'000 #'000 #'000 #'000 #'000 #'000

At 1 January 2006 - - - - - 2,420 2,420

Profit for the - - - - - 39 39

period

Dividend paid - - - - - (1,964) (1,964)

Equity shares issued 623 - - - - - 623

Preference shares

issued

50 - - - - - 50

Preference shares

redeemed

(50) 50 - - - (50) (50)

Reserve arising on

demerger

- - 23,064 - - - 23,064

Reverse acquisition

reserve

- - - (23,687) - - (23,687)

Share based payments

credit

- - - - 2 - 2

At 30 June 2006 623 50 23,064 (23,687) 2 445 497

Current and Past Directorships

of Archibald anderson Bethel and Kevin richard Thomas

Archibald anderson Bethel

Current Directorships

Alstec Airports Limited

Alstec Automation Limited

Alstec Defence Limited

Alstec Group Limited

Alstec Limited

Alstec Power Systems Limited

Appledore Shipbuilders (2004) Limited

Armstrong Technology Associates Limited

Babcock Design & Technology Limited

BSN Environmental Services Limited

Defence Supply Chain Solutions Limited

Devonport Management Limited

Devonport Royal Dockyard Limited

FMA Services Limited

FN Consultancy Limited

FNC Group Limited

FNC Limited

Frazer-Nash Consultancy Group Limited

Frazer-Nash Consultancy Limited

Locam Limited

LSC Group Holdings Limited

LSC Group Limited

Marine Engineering & Fabrications (Holdings) Limited

Marine Engineering & Fabrications Limited

Rosyth Royal Dockyard Limited

Past Directorships

Caledonian Compressors Limited

Clayton Walker Limited

MB Aerospace Limited

MB Faber Limited

MB Inspection Limited

MB Material Handling Systems Limited

MB Plastics Limited

MBMHS 3 Limited

Merelake Plastics Limited

Motherwell Bridge Engineering Limited

Motherwell Bridge Fabricators Limited

Motherwell Bridge Holdings Limited(i)

Motherwell Bridge Thermal Limited

Nousenomore 20 Limited

Nowoutofdate 2 Limited

Precision Machining (Edinburgh) Limited

Resin Glass Products Limited

Roberts Brothers Engineering Limited

Sort 4 Limited

Torch Technical Services Limited

KEVIN RICHARD THOMAS

Current Directorships

Alstec Airports Limited

Alstec Automation Limited

Alstec Defence Limited

Alstec Group Limited

Alstec Limited

Alstec Power Systems Limited

Babcock Support Services Limited

FMA Services Limited

X-CMR Consultants Limited

Debut Services (South West) Limited

Past Directorships

Air Power International Limited

Babcock Dyncorp Limited

Debut Services (South West) Limited

Debut Services Limited

Mouchelparkman Babcock Education Ltd

Debut Services Limited

Omnisure Property Management Limited

SGI (Holdings) Limited

The Conservation Practice Architects & Specialist Consultants Ltd

Neither of the newly appointed Non Executive Directors will have a shareholding

in the Company on appointment.

--------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SESFLSSWSEFA

Instem (LSE:INS)

Historical Stock Chart

From Jun 2024 to Jul 2024

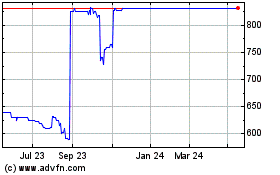

Instem (LSE:INS)

Historical Stock Chart

From Jul 2023 to Jul 2024