Final Results

March 03 2005 - 2:02AM

UK Regulatory

RNS Number:2800J

Infast Group PLC

03 March 2005

PRELIMINARY STATEMENT 2004

Infast Group plc, the inventory management services group, announces its

preliminary statement for the year ended 31 December 2004.

KEY POINTS

* Exit from manufacturing completed:

- At a cost which was lower than anticipated

- Earlier than previously expected

* The Group fully focused on value added Inventory Management Services

businesses

* Merging of two Industrial Divisions providing a single channel to market

FINANCIALS

* Turnover on continuing operations at #157.1m (2003: #171.4m)

* Operating profit before goodwill amortisation and exceptional items of

#3.5m (2003: #3.2m)

* Final dividend of 0.6p (2003: 1.2p)

* Net debt of #13.9m (2003: #12.3m) expected to fall considerably in 2005

Graham Titcombe, Chairman of Infast, said: "2004 was a year of significant

change for Infast. The Board believes that the Group now has the requisite

structure and management resources in place to develop its business. We are

confident about the prospects for the re-shaped Infast businesses in 2005."

For further information, please contact:

Infast Group plc Tel: 01452 880 500

Robert Sternick, Chief Executive

John Kimber, Finance Director

Rawlings Financial PR Limited Tel: 01756 770 376

John Rawlings

Catriona Valentine

CHAIRMAN'S STATEMENT

The year ended 31 December 2004 has been one of significant change for the

Group.

In July 2004, the Board announced its decision to exit from its manufacturing

operations in order to focus entirely on Inventory Management Services. This

process has been successfully completed with the sale of GKS Centrepiece and

Philidas and the closure and asset disposals at Arnold Wragg. These actions have

streamlined the Group's activities, relieved us of mounting losses and created

new commercial opportunities for our retained businesses.

This has been achieved at a lower than anticipated cost. We expect the total

exceptional charge before goodwill realisation to be #6.5m rather than the

original estimate of #8m. Of this sum, a cost of #7.2m is reflected in our 2004

results but we expect to gain #0.7m in the current year, following the sale of

the two related properties. In addition, we expect the cash flow generated from

the exit process to have a #2m positive effect on the 2005 balance sheet even

though net cash costs of #1.5m were absorbed in the year under review.

During the year we also sought to improve the efficiency and focus of our

Inventory Management Services operations. In April we initiated a cost reduction

plan in our Premier Automotive division, which is on target to deliver annual

savings of #0.7m. In July we merged the Infast Industrial and Infast Direct

divisions, creating a strong single source service channel to the industrial

market, which should give rise to further cost savings of #0.7m in 2005. The

#0.4m costs arising from these actions have been shown as an operating

exceptional item in the accounts.

Increased raw material prices, particularly steel, provided a major challenge in

2004. The actions taken to pass on these price increases to our customers and to

reduce operating costs should alleviate the continued pressure on margins.

Financial Results

Turnover for the year was #163.8m (2003: #178.4m) of which #157.1m (2003:

#171.4m) was contributed by our continuing Inventory Management Services

operations. This reduction in turnover was attributable to the expiry of an

automotive contract at the end of 2003 and the exit from an unprofitable

industrial contract in mid 2004. The year on year impact of these two events was

a fall in turnover of over #21m, more than offsetting the growth achieved

elsewhere.

Operating Profit before goodwill amortisation and exceptional items was #3.5m

(2003: #3.2m). This figure includes a #0.8m loss (2003: #1.2m loss) from the

discontinued manufacturing operations.

Net debt levels increased to #13.9m in the year (2003: #12.2m) primarily as a

result of the costs incurred during the exit from manufacturing. Stock levels

were also increased during this period to ensure continuity of supplies, whilst

some parts were resourced from overseas manufacturers. We expect net debt to

fall considerably in 2005.

Dividend

The Board recommends the payment of a final dividend of 0.6p (2003: 1.2p)

bringing the total dividend for the year to 1.0p (2.0p). At this level, the

dividend is covered more than two times by the adjusted Earnings per Share

figure of 2.1p (2003: 2.8p).

Strategy and Outlook

The Board believes that, following these significant changes, the Group now has

the requisite structures and management resources in place to develop and expand

its Inventory Management Services business.

The Group has been particularly active in expanding its products and service

capabilities both in the United Kingdom and internationally. Despite static

markets, we are increasing sales to new and existing customers. These higher

sales are expected to offset an anticipated reduction in demand from the rail

carriage building industry in the United Kingdom in 2005.

Turnover for the first two months of 2005 in our continuing operations is

marginally higher than for the same period of 2004. Although too early to

predict a clear trend, we are confident about the prospects for the re-shaped

Infast businesses in 2005.

Graham Titcombe

Chairman 3 March 2005

CHIEF EXECUTIVE'S STATEMENT

The exit from all three manufacturing facilities announced last July has

successfully been completed, ahead of schedule and below the projected #8.0

million exceptional charge, excluding goodwill realisation. We expect the

current charge of #7.2 million will be reduced further to #6.5m with profits

realised on the sale of property in 2005.

Protecting the supply of products to our customers was of fundamental importance

during this process, which was made more difficult by sizeable steel price

increases and availability. Substantial work was conducted to re-source many of

the components to lower cost countries and to secure new supply agreements. We

established safety stocks to ensure a smooth transition to the new supply,

temporarily impacting our working capital, with no effect to service levels.

In the early part of the year, we restructured our Premier Automotive division,

improving our productivity and ensuring our costs were commensurate with the

level of the business. This gave rise to a one-off cost of #0.2m. Annual cost

savings are expected to be in the region of #0.7m.

In July we announced the merger of two divisions, Infast Direct and Infast

Industrial, into a single division, Infast Industrial, serving the Industrial

markets with the whole range of our products and services through one channel.

This has been accomplished smoothly and is being well received by our customers.

The newly streamlined division has already generated some good opportunities and

new orders from existing customers.

The merger resulted in a re-organisation cost of #0.2m. Annual cost savings are

expected to be in the region of #0.7m.

The restructuring of Premier Automotive and Infast Industrial was made possible

through a series of stepped changes in the business, consolidating structures,

system implementation, closing DSCs while increasing our capabilities. We

believe that the newly streamlined divisions add to our services capabilities

and will enable us to take on new business in the UK, mainland Europe and

America.

Expansion of Services

Additional services were developed during the year, including the Infast

Technical Centre (ITC), providing technical and application engineering support,

and the iQLab, which achieved United Kingdom Accreditation Service ('UKAS')

approval on its first audit. The iQLab, as a business, is already receiving

orders and is capable of performing failure analysis, chemical analysis,

metallography, mechanical testing and product finish testing. The iQLab

replenishes our technical capabilities, following our exit from manufacturing,

and adds to our services.

There was an acceleration in demand for our kitting services in 2004, as we

started to take orders for sub-assembly work. We expect to see continued growth

in this area of our business.

Export growth has been a key objective for the Group and, in the year under

review, our exports grew by 35%. Part of this growth was achieved by servicing

the French and Belgian operations of some of our existing UK customers. We have

also secured new contracts for inventory management services from new and

existing customers in Germany and Spain. We expect to expand our reach into

these and other countries.

2004 Markets

We witnessed a change in the mix of business in 2004. Demand for the Jaguar

models reduced, whilst our volumes increased for the successful new Land Rover

models - Freelander, Range Rover and Discovery 3.

The agricultural market in the UK and US also reduced, as a result of delays to

new model introductions. This affected the results of Premier Automotive and

Infast USA. We are confident, however, that this was a temporary slow down.

In contrast, demand for construction-related equipment was good with the timely

introduction of new, higher specification vehicles fuelling demand.

Orders for rail products also remained strong throughout the year, as we

completed a major rail contract. Although that contract has now ended, due to

lower demand for carriages in the UK, further orders will continue at reduced

levels. Significant new contract wins, replacing the rail business, have been

received from a number of existing and new customers both in the UK and

internationally.

Infast USA, which was impacted by lower agriculture business and industrial

action at a customer site, received a major new order, which included a customer

plant transfer and facility start up. This project was completed in November

2004 and the full benefits of the contract are now flowing in 2005.

IBS2

The implementation of the J D Edwards system rollout achieved its objectives in

2004 in both the UK and USA, completing the roll-out at Premier Automotive

Division and planned sites for the US. The focus is now on completing the

roll-out for Industrial Division and the remaining US sites.

Human Resources development

Training and development programmes, linked to succession planning and the

recruitment of new skills to service the business and International markets,

continued throughout the year.

I would like to congratulate our high achievers in 2004 and give a special

mention to our Divisional winners Donna Wheatley, Richard Jursons, Bill Vajda

and Karen Eve, as well as this year's Group winner Erica Kirk of our Industrial

Division. I also wish to thank all the Infast Employees for their contributions,

high degree of motivation and success in improving the business.

Management Priorities for 2005

* Increase profitability through sourcing, continuous productivity

improvements and new products and services.

* Continue growth in cash generation thereby reducing debt.

* Expansion of our products and services internationally and through

single channels.

* Continuous development of our people and I.T. systems through

empowerment and knowledge.

* Growth in shareholder value.

Moving Forward with Inventory Management Services

Market demand for our products and services is very encouraging in the UK, US

and now Europe. The European expansion of our services started in 2004 into four

countries and will continue to accelerate as we increase our customer base in

these and other territories while remaining vigilant on overheads.

We believe Infast to be well positioned for providing more products and services

to current and new customers in the UK and abroad in addition we will continue

to develop the level of our services and are confident in achieving good growth.

Robert Sternick

Chief Executive Officer 3 March 2005

FINANCE DIRECTOR'S REVIEW

Operating Results

Group turnover decreased by 8% in the year to #163.8m (2003: #178.4m). This

decrease was in line with expectations in our main continuing operations and was

further added to by our phased exit from manufacturing.

The exit from manufacturing started in May 2004 and was completed in February

2005. Consequently, the results of these operations have been included in these

accounts as discontinued.

Group operating profit (pre goodwill amortisation and exceptional items) was

#3.5m (2003: #3.2m), after deducting operating losses of #0.8m (2003: #1.2m)

from the discontinued operations. Operating profit from continuing operations as

a percentage of sales (pre goodwill amortisation and exceptional items) rose

marginally to 2.7% (2003: 2.6%). Overall operating profit increased to #1.9m

(2003: #1.5m) largely due to the action taken to exit from manufacturing.

Loss on sale and closure on businesses

A total charge of #14.7m has been made in these accounts to reflect our exit

from manufacturing. Of this charge #7.5m relates to goodwill previously written

off to reserves. This item, therefore, is a presentational issue which has no

impact on the reserves. The remainder of the charge, #7.2m, relates to the costs

of exit and asset write-downs arising from the sale and closure of the

businesses. Provisions have been included in this figure for the expected costs

and asset write-downs on the sale of Philidas completed in 2005.

Following the exit from manufacturing, the Group has two surplus freehold

properties both of which are under negotiation for sale. It is expected that

these properties will realise approximately #2.3m in cash and a surplus of #0.7m

to book value which will then be reflected in the profit and loss account.

Financing

The Group's net debt position at the end of the year was #13.9m (2003: #12.3m),

giving rise to gearing of 32% (2003: 25%).

Capital expenditure in the year was #3.2m (2003: #4.0m), whilst asset disposals

(excluding those associated with the manufacturing exit) raised #0.4m (2003:

#0.1m). The depreciation charge was #3.0m (2003: #3.1m). Capital expenditure was

lower in the year, principally due to a lower spend in manufacturing operations.

Main areas of spend continue to be in IT projects and materials handling

equipment. The major item of expenditure in the year was a robotic warehouse

management system for the Industrial division

Free cash flow (operating cash flow adjusted for interest, taxation and fixed

asset acquisitions and disposals) was #2.2m (2003: #4.4m) after deducting a net

spend of #1.5m (2003: Nil) resulting from the sale and closure of businesses.

Net interest costs in the year were #0.6m (2003: #0.5m). Interest payable fell

to #0.7m (2003: #0.8m) benefiting from lower average interest rates paid and the

weaker US Dollar, which affected the translation of the interest paid in US

Dollars. Interest receivable consisted primarily of an interest payment received

on the Haden International Group loan.

A significant proportion of the Group's core debt needs continue to be

denominated in US dollars. This US Dollar debt is in part provided by a Private

Placement loan. The balance outstanding on this loan at the end of the year was

$7.1m and is being repaid by equal instalments in February 2005 and February

2006.

The balance of the Group's debt was made up of #1.6m of finance leases and

short-term bank debt of #8.6m both of which attract a variable rate of interest.

The Group's short-term bank facilities totalled #13.5m at the year-end and have

subsequently been renewed at this level for a further 12 months.

The Group's liquidity and interest rate risk are managed centrally following

guidelines laid down by the Board. The Group's objective is to maintain a

balance of continuity of funding and flexibility through the use of borrowings

with a range of maturities attracting both fixed and variable interest rates.

Currency Hedging

The Group aims to minimise the risk associated with foreign currency

fluctuations by using a combination of foreign currency borrowings to hedge

foreign currency denominated assets and forward contracts to hedge known trading

exposures. Forward contracts are used only to manage risk and speculation is not

permitted.

The US Dollar debt largely hedges our US dollar net assets and the interest on

these loans also provide an effective hedge against US earnings.

Taxation

The overall tax credit for the year was #1.3m (2003: charge of #0.2m), which

represents an effective rate of 28% on losses pre goodwill amortisation and

realisation. This net credit reflected a charge of #1.1m on profit before

exceptional items and a credit of #2.4m on the exceptional items.

Net corporation tax receivable at the end of the year was #0.1m (2003: #Nil) the

balance sheet also reflects a deferred tax asset of #0.3m (2003: Nil).

Pensions

The Group continues to adopt the transitional arrangements for reporting under

FRS17.

The Group's defined benefit scheme, which was closed to new members in 1992, had

a deficit after tax at the end of the year calculated in accordance with FRS17

of #2.1m (2003: #1.9m deficit).

Dividend

A final dividend of 0.6p is proposed, bringing the year's total to 1.0p (2003:

2.0p). This will have a total cash cost of #1.1m. Although the payment of this

is not covered by the profit on ordinary activities after taxation, it is

covered by adjusted earnings and is also covered by free cash flow.

Implementation of International Financial Reporting Standards

The European Union is seeking to harmonise standards of financial reporting

across its member states and is therefore requiring the adoption of

International Financial Reporting Standards (IFRS). The adoption timetable

requires that the Company's 2005 Interim Statement and Report and Accounts be

prepared in accordance with the new rules.

It is currently too early to quantify the impact of adopting IFRS on the Group's

results and financial position. We have undertaken an exercise to identify the

key areas that will be affected by preparing the Group results under IFRS, which

are in the areas of accounting for pensions, goodwill, deferred taxation and

share-based payments. In addition the presentation and disclosure in the

financial statements will be noticeably different.

John Kimber

Finance Director 3 March 2005

CONSOLIDATED PROFIT AND LOSS ACCOUNT

For the year ended 31st December 2004

Before Before

exceptional Exceptional exceptional Exceptional

items items Audited items items Audited

2004 2004 2004 2003 2003 2003

Notes #m #m #m #m #m #m

Turnover

Continuing operations 157.1 - 157.1 171.4 - 171.4

Discontinued operations 6.7 - 6.7 7.0 - 7.0

-------- -------- -------- -------- -------- --------

2 163.8 - 163.8 178.4 - 178.4

-------- -------- -------- -------- -------- --------

Operating costs

Goodwill amortisation (1.2) - (1.2) (1.3) - (1.3)

Other operating costs (161.3) (0.4) (161.7) (175.2) (0.4) (175.6)

Release of provision for closure

costs 1.0 - 1.0 - - -

-------- -------- -------- -------- -------- --------

3 (161.5) (0.4) (161.9) (176.5) (0.4) (176.9)

Operating profit/(loss)

Continuing operations 3.1 (0.4) 2.7 3.1 (0.2) 2.9

Discontinued operations (1.8) - (1.8) (1.2) (0.2) (1.4)

Release of provision for closure

costs 1.0 - 1.0 - - -

-------- -------- -------- -------- -------- --------

2.3 (0.4) 1.9 1.9 (0.4) 1.5

Loss on sale and closure of businesses

- discontinued operations - (14.7) (14.7) - - -

-------- -------- -------- -------- -------- --------

Profit/(loss) on ordinary activities

before interest 2.3 (15.1) (12.8) 1.9 (0.4) 1.5

Net interest (0.6) - (0.6) (0.5) - (0.5)

-------- -------- -------- -------- -------- --------

Profit/(loss) on ordinary activities

before taxation 1.7 (15.1) (13.4) 1.4 (0.4) 1.0

Taxation on (loss)/profit on

ordinary activities 4 (1.1) 2.4 1.3 (0.3) 0.1 (0.2)

-------- -------- -------- -------- -------- --------

Profit/(loss) on ordinary activities

after taxation 0.6 (12.7) (12.1) 1.1 (0.3) 0.8

Dividends 6 (1.1) (2.3)

-------- --------

Retained loss for the financial year (13.2) (1.5)

======== ========

Basic and diluted (loss)/earnings

per share (p) 7 (10.6) 0.7

Adjusted basic earnings per

share (p) 7 2.1 2.8

CONSOLIDATED STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

For the year ended 31 December 2004

2004 2003

Audited Audited

#m #m

(Loss)/profit for the financial year (12.1) 0.8

Exchange adjustments (0.2) (0.3)

-------- --------

Total recognised gains and losses in the year (12.3) 0.5

======== ========

CONSOLIDATED BALANCE SHEET

As at 31 December 2004

2004 2003

Audited Audited

#m #m

Fixed assets

Intangible assets 16.6 18.1

Tangible assets 13.3 16.2

Investments 0.7 0.8

-------- --------

30.6 35.1

Current assets

Stocks 25.7 28.4

Debtors 32.8 34.0

-------- --------

58.5 62.4

Creditors:

Amounts falling due within one year (41.5) (42.7)

-------- --------

Net current assets 17.0 19.7

-------- --------

Total assets less current liabilities 47.6 54.8

Creditors:

Amounts falling due after more than one year (2.9) (4.2)

Provisions for liabilities and charges (0.7) (0.7)

-------- --------

44.0 49.9

======== ========

Capital and reserves

Called up share capital 22.9 22.9

Share premium account 9.8 9.8

Other reserves 4.0 4.0

Profit and loss account 7.0 12.9

-------- --------

Equity shareholders' funds 43.7 49.6

Equity minority interest 0.3 0.3

-------- --------

44.0 49.9

======== ========

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 31 December 2004

Notes 2004 2003

Audited Audited

#m #m

Net cash inflow from operating activities* 9 2.6 8.6

Returns on investments and servicing of finance

Interest received 0.1 0.3

Interest paid (0.7) (0.7)

Interest element of finance lease rentals (0.1) (0.1)

-------- --------

Net cash outflow from returns on investments

and servicing of finance (0.7) (0.5)

Tax refunded/(paid) 0.3 (0.2)

Capital expenditure and financial investment

Payments to acquire tangible fixed assets (1.5) (3.6)

Receipts from the disposal of tangible fixed 0.8 0.1

assets -------- --------

Net cash outflow from capital expenditure and

financial investment (0.7) (3.5)

Acquisitions and disposals

Deferred consideration from sale of subsidiary - 1.8

Equity dividends paid (1.9) (2.3)

-------- --------

Net cash (outflow)/inflow before financing (0.4) 3.9

-------- --------

Financing

Repayment of finance lease obligations (0.8) (0.7)

Repayment of medium term loans (2.0) (2.2)

-------- --------

Net cash outflow from financing (2.8) (2.9)

-------- --------

(Decrease)/increase in cash** (3.2) 1.0

======== ========

* Included within net cash outflow from operating activities are costs amounting

to #1.9m (2003: Nil) that have resulted from the sale and closure of businesses.

Also within receipts from disposal or tangible fixed assets are proceeds #0.4m

(2003: Nil) resulting from the sale and closure of businesses.

** Under FRS 1 (revised), cash is defined as cash in hand plus deposits less

overdrafts, each of which are repayable on demand. Bank deposits, which are not

repayable on demand are treated as liquid resources, and not cash, in the cash

flow statement but are netted off against bank overdrafts in the balance sheet

where there is right of set-off.

NOTES TO THE ACCOUNTS

1. Basis of Preparation

The accounts have been prepared in accordance with applicable accounting

standards under the historical cost convention and using the accounting policies

as set out on pages 31 and 32 of the Annual Report and Accounts 2003.

The above results and these notes do not constitute statutory accounts (within

the meaning of section 240 of the Companies Act 1985). The statutory accounts

for 2003, on which the auditors gave an unqualified opinion, have been filed

with the Registrar of Companies. The statutory accounts for 2004, on which an

auditors' unqualified report has been made, will be delivered to the Registrar

following the Company's forthcoming Annual General Meeting.

2. Segmental Analysis

Turnover, operating profit and capital employed all relate to the Group's sole

activity of the provision of inventory management services.

3. Exceptional Items

2004 2003

#m #m

Operating exceptional items

Restructuring costs

Continuing operations (0.4) (0.2)

Discontinued operations - (0.2)

------- -------

(0.4) (0.4)

======= =======

There was a cash outflow in respect of the 2004 charge of #0.3m. The 2003 charge

gave rise to a cash outflow of #0.2m in 2003 and #0.2m in 2004.

2004 2003

#m #m

Non-operating exceptional items (discontinued operations):

Loss on termination and sale of businesses

Costs incurred and asset write offs (7.2) -

Goodwill previously written off now realised (7.5) -

------- -------

(14.7) -

======= =======

The above charge relates to the Group's decision to exit from its manufacturing

operations which is now completed, consequently these operations are shown as

discontinued in these accounts. There was a net cash outflow of #1.5m relating t

o this charge in the year.

4. Taxation

2004 2003

(Credit)/charge:

UK Overseas Total UK Overseas Total

#m #m #m #m #m #m

Current tax on profits for

the period (0.1) - (0.1) 0.6 - 0.6

Adjustments in respect of

previous years (0.2) - (0.2) (0.5) - (0.5)

------- ------- ------- ------- ------- -------

(0.3) - (0.3) 0.1 - 0.1

Deferred tax

Originating and reversal of

timing differences (0.6) - (0.6) 0.1 - 0.1

Adjustments in respect of

previous years (0.4) - (0.4) - - -

------- ------- ------- ------- ------- -------

(1.0) - (1.0) 0.1 - 0.1

------- ------- ------- ------- ------- -------

(1.3) - (1.3) 0.2 - 0.2

======= ======= ======= ======= ======= =======

Included within the tax charge

are the following amounts of

tax arising on sale and

closure of businesses:

Current tax (2.0) - (2.0) - - -

Deferred tax (0.3) - (0.3) - - -

------- ------- ------- ------- ------- -------

(2.3) - (2.3) - - -

======= ======= ======= ======= ======= =======

The tax credit of #1.3m (2003: charge #0.2m) includes a tax credit of #0.1m

(2003: #0.1m) relating to operating exceptional costs incurred during the year

of #0.4m (2003: #0.4m).

The effective tax rate, excluding goodwill amortisation and realisation, was 28%

(2003: 9%).

5. Analysis of net debt

As at Other non As at 31

1 January cash Exchange December

2004 Cash flows movements movements 2004

#m #m #m #m #m

Bank overdraft 5.7 3.2 - (0.3) 8.6

Medium term loan 6.0 (2.0) - (0.3) 3.7

Finance leases 0.6 (0.8) 1.8 - 1.6

------ ------ ------ ------ ------

Net debt 12.3 0.4 1.8 (0.6) 13.9

====== ====== ====== ====== ======

The non cash movement represents the inception of finance leases.

Debt falls due as shown in the table below:

Within Within one Within two

one year to two years to five years Total

#m #m #m #m

Bank overdraft 8.6 - - 8.6

Medium term loan 1.9 1.8 - 3.7

Finance leases 0.5 0.5 0.6 1.6

------ ------ ------ ------

Net debt at 31 December 2004 11.0 2.3 0.6 13.9

====== ====== ====== ======

Net debt at 31 December 2003 8.1 2.1 2.1 12.3

====== ====== ====== ======

All of the Group's borrowings, excluding hire purchase debt, are on an unsecured

basis.

6. Dividend

The proposed final dividend of 0.6p per Ordinary share is payable on 3 June 2005

to shareholders on the register on 6 May 2005.

7. Loss / earnings per share

The calculation of basic loss per share of 10.6p (2003: basic earnings 0.7p) is

based on the Group loss after tax of #12.1m (2003: profit #0.8m) and on the

weighted average number of 20p ordinary shares in issue during the year of

114.3m (2003: 114.3m).

The calculation of diluted loss per share of 10.6p (2003: earnings of 0.7p) is

based on the Group loss after tax of #12.1m (2003: profit #0.8m) and 114.4m

(2003: 114.6m) ordinary shares as shown below:

2004 2003

Number of Number of

shares shares

Weighted average number of shares 114.3 114.3

Share Options 0.1 0.3

-------- --------

114.4 114.6

======== ========

Adjusted basic earnings per share is calculated as follows:

Earnings Earnings per share

2004 2003 2004 2003

#m #m pence pence

Basic (loss)/earnings and (loss)/earnings

per share (12.1) 0.8 (10.6) 0.7

Basic (loss)/earnings and (loss)/earnings

per share attributable to:

Loss on sale and closure of businesses 14.7 - 12.9 -

Tax on loss on sale and closure of

businesses (2.3) - (2.0) -

Operating exceptional items - continuing

operations 0.4 0.2 0.4 0.2

Tax credit on operating exceptional items (0.1) (0.1) (0.1) (0.1)

Goodwill amortisation 1.2 1.3 1.0 1.1

Discontinued operations (after tax) 0.6 1.0 0.5 0.9

------ ------ ------ ------

Adjusted basic earnings and earnings per 2.4 3.2 2.1 2.8

share ====== ====== ====== ======

The adjusted basic earnings per share is presented so as to show more clearly

the underlying performance of the Group for continuing operations.

8. Reconciliation of net cash flow to movement in net debt

2004 2003

#m #m

(Decrease)/increase in cash as shown in cash flow statement (3.2) 1.0

Adjust for:

Repayment of medium term loan 2.0 2.2

Finance lease repayments 0.8 0.7

------- -------

Change in net debt resulting from cash flow (0.4) 3.9

New finance leases (1.8) (0.4)

Exchange movements 0.6 0.7

------- -------

Movement in net debt in the year (1.6) 4.2

Net debt at as at 1 January 2004 (12.3) (16.5)

------- -------

Net debt as at 31 December 2004 (13.9) (12.3)

======= =======

9. Reconciliation of operating profit to net cash inflow from operating

activities

2004 2003

#m #m

Operating profit before exceptional costs 2.3 1.5

Operating exceptional costs (0.4) -

------- -------

1.9 1.5

Depreciation 3.0 3.1

Amortisation of goodwill 1.2 1.3

Loss/(profit) on sale of tangible fixed assets 0.1 (0.1)

Decrease/(increase) in stocks 0.5 (2.7)

Decrease in debtors 0.9 4.5

(Decrease)/increase in creditors (3.1) 1.7

Movement on provision - (0.6)

Exchange adjustments - (0.1)

------- -------

4.5 8.6

Costs of sale and closure of businesses (1.9) -

------- -------

2.6 8.6

======= =======

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EAEDAEENSEAE

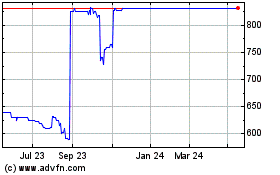

Instem (LSE:INS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Instem (LSE:INS)

Historical Stock Chart

From Jul 2023 to Jul 2024