TIDMICGT

ICG Enterprise Trust plc

1 February 2022

Q3 Update for the three months ended 31 October 2021

NAV per Share Total Return of 33.2% in the last 12 months,

strong momentum continuing

Highlights

-- NAV per Share of 1,628p (31 July 2021: 1,523p), NAV

per Share Total Return of 7.3%1 during the quarter;

33.2% during the last twelve months

-- Portfolio Return on a Local Currency Basis during the

quarter of 8.3%1 (Sterling return: 8.5%); 44.7%

during the last twelve months. Portfolio valued at

GBP1,090m on 31 October 2021

-- Realisation Proceeds of GBP90.0m during the quarter,

including 27 Full Exits at a weighted-average of 40%1

Uplift to Carrying Value and 4.2x1 Multiple to Cost

-- GBP75.2m of investments during the quarter, 40.1%

into High Conviction Investments including GBP16.9m

into two Direct Investments

-- Third quarter dividend of 6p per share, taking total

for the nine months to 31 October 2021 to 18p.

Intention reaffirmed to declare total dividends of at

least 27p per share in respect of the financial year

ending 31 January 2022, which would represent an

increase of 12.5% per share compared to the previous

financial year

-- Actively managed Portfolio well positioned to

navigate dynamic market conditions

Oliver Gardey

Head of Private Equity Fund Investments, ICG

This has been another very strong quarter for ICG

Enterprise Trust, delivering NAV per share Total Return

of 33.2% over the last twelve months. All parts of

the business have produced good results, building

on the continued positive momentum we reported for

the first half of our financial year.

The Portfolio return was broad-based, with our High

Conviction investments generating an enhanced return

on top of our diversified Third Party fund investments.

This composition of growth underlines the benefits

our shareholders receive from our active portfolio

construction.

Our LP secondaries programme is progressing well.

The investment we made during the first half of this

financial year is performing above expectations and

we signed a second transaction after the end of the

quarter covered in this report.

Realisation and investment levels remain high. As

we continue to benefit from realisations within the

Portfolio, we are finding attractive opportunities

to deploy our shareholders' capital, particularly

into new High Conviction investments.

Looking ahead, we have an attractive and actively

managed portfolio focussed on defensive growth and

invested in high quality companies. The portfolio

is well positioned to navigate dynamic market conditions,

with balanced exposures across different vintages,

sectors and countries. Activity remains robust and

we have a healthy pipeline of both investments and

realisations as we look to the fourth quarter of our

financial year and beyond.

PERFORMANCE OVERVIEW

Three months to: Nine months to: 12 months to:

------------------ ------------------- --------------------

31 Oct. 31 Oct. 31 Oct. 31 Oct. 31 Oct. 31 Oct.

2021 2020 2021 2020 2021 2020

------------ -------- -------- -------- --------- --------- ---------

Portfolio

Return on a

Local

Currency

Basis 8.3% 12.1% 23.8% 7.9% 44.7% 11.9%

NAV per Share

Total

Return 7.3% 10.7% 19.1% 9.6% 33.2% 11.1%

Realisation GBP90m GBP72m GBP265m GBP94m GBP308m GBP127m

Proceeds

Total New GBP75m GBP30m GBP209m GBP82m GBP266m GBP131m

Investment

Annualised

--------------------------

3 months 9 months 1 year 3 years 5 years 10 years

---------------------- -------- -------- ------ ------- ------- --------

Performance to 31

October 2021

NAV per Share Total

Return 7.3% 19.1% 33.2% 18.1% 17.1% 13.2%

Share Price Total

Return 15.7% 31.6% 56.3% 17.7% 16.8% 15.4%

FTSE All-Share Index

Total Return 3.5% 16.6% 35.4% 5.6% 5.6% 7.5%

ENQUIRIES

Investor / Analyst enquiries:

Oliver Gardey, Head of Private Equity Fund Investment, ICG: +44

(0) 20 3545 2000

Colm Walsh, Managing Director, Private Equity Fund Investments,

ICG

Chris Hunt, Head of Shareholder Relations, ICG

Media enquiries:

Clare Glynn, Corporate Communications, ICG: +44 (0) 20 3545

1395

Ed Gascoigne Pees, Georgina Whittle, Camarco: +44 (0) 20 3757

4987

Website:

www.icg-enterprise.co.uk

Company timetable

Ex-dividend date: 10 February 2022

Record date: 11 February 2022

Payment of dividend: 4 March 2022

ABOUT ICG ENTERPRISE TRUST

ICG Enterprise Trust is a leading listed private equity investor

focused on creating long-term growth by delivering consistently

strong returns through selectively investing in profitable private

companies, primarily in Europe and the US.

As a listed private equity investor, our purpose is to provide

shareholders with access to the attractive long-term returns

generated by investing in private companies, with the added benefit

of daily liquidity.

We invest in companies directly via co-investments and through

funds managed by ICG and other leading private equity managers who

focus on creating long-term value and building sustainable growth

through active management and strategic change.

We have a long track record of delivering strong returns through

a flexible mandate and highly selective approach that strikes the

right balance between concentration and diversification, risk and

reward.

NOTES

Included in this document are Alternative Performance Measures

("APMs"). APMs have been used if considered by the Board and the

Manager to be the most relevant basis for shareholders in assessing

the overall performance of the Company, and for comparing the

performance of the Company to its peers and its previously reported

results. The Glossary in the Company's H1 results includes further

details of APMs and reconciliations to International Financial

Reporting Standards ("IFRS") measures, where appropriate.

In the Manager's Review and Supplementary Information, all

performance figures are stated on a Total Return basis (i.e.

including the effect of re-invested dividends). ICG Alternative

Investment Limited, a regulated subsidiary of Intermediate Capital

Group plc, acts as the Manager of the Company.

DISCLAIMER

This report may contain forward looking statements. These

statements have been made by the directors in good faith based on

the information available to them up to the time of their approval

of this report and should be treated with caution due to the

inherent uncertainties, including both economic and business risk

factors, underlying such forward-looking information. These written

materials are not an offer of securities for sale in the United

States. Securities may not be offered or sold in the United States

absent registration under the US Securities Act of 1933, as

amended, or an exemption therefrom. The issuer has not and does not

intend to register any securities under the US Securities Act of

1933, as amended, and does not intend to offer any securities to

the public in the United States. No money, securities or other

consideration from any person inside the United States is being

solicited and, if sent in response to the information contained in

these written materials, will not be accepted.

BUSINESS REVIEW

Portfolio performance

-- Portfolio valued at GBP1,090m on 31 October 2021

-- Portfolio Return on a Local Currency Basis of 8.3% during the quarter and

23.8% during the nine months to 31 October 2021

-- High Conviction Investments (48.9% of the Portfolio) generated local

currency returns of 9.3% during the quarter

-- Third Party Funds (51.1% of the Portfolio) generated local currency

returns of 7.3% during the quarter

-- Gains were broad-based, including a number of successful Full Exits and

Partial Realisations within the Portfolio

-- Our portfolio of secondary investments performed particularly strongly

during the quarter, and at 31 October 2021 secondary investments

represented 17.0% of our Portfolio (31 July 2021: 12.0%)

Three months Nine months

Movement in the Portfolio to 31 October 2021 GBPm GBPm

--------------------------------------------- ------------ -----------

Opening Portfolio 1,019.0 949.2

------------ -----------

Total New Investments 75.2 208.5

Total Proceeds (90.0) (274.7)

------------ -----------

Net cash (inflow)/outflow (14.8) (66.2)

Valuation movement* 84.2 225.8

Currency movement 1.9 (18.5)

--------------------------------------------- ------------ -----------

Closing Portfolio 1,090.3 1,090.3

% Portfolio growth (local currency) 8.3% 23.8%

--------------------------------------------- ------------ -----------

% currency movement 0.2% (2.0)%

------------ -----------

% Portfolio growth (Sterling) 8.5% 21.8%

Expenses and other (1.2)% (2.7)%

--------------------------------------------- ------------ -----------

NAV per share Total Return 7.3% 19.1%

--------------------------------------------- ------------ -----------

* 91% of the Portfolio is valued using 30 September

2021 (or later) valuations.

New investment and commitment activity

-- GBP75.2m of Total New Investment in the quarter; 40.0% (GBP30.1m)

invested into High Conviction Investments with the remaining 60.0%

(GBP45.1m) being drawdowns on commitments to Third Party Funds

-- This brings the Total New Investment in the nine months to 31 October to

GBP208.5m, of which 63.1% (GBP131.6m) was into High Conviction

Investments and 36.9% (GBP76.9m) was in the form of drawdowns from

commitments to Third Party Funds

-- Within the GBP30.1m of High Conviction Investments made during the

quarter, we invested a total of GBP16.9m in two new Direct Investments:

Company Manager Company Description Investment

sector

------- -------- ---------- ---------------------------------------------------------- ----------

Davies BC TMT Provider of business outsourcing services to the insurance GBP8.7m

Group Partners sector

------- -------- ---------- ---------------------------------------------------------- ----------

Planet Eurazeo Financials Provider of integrated payments services focused on GBP8.2m

/ hospitality and luxury retail

Advent

------- -------- ---------- ---------------------------------------------------------- ----------

-- The remaining GBP13.2m of High Conviction Investments made in the quarter

were through ICG funds (GBP10.3m) and add-on investments for existing

portfolio companies (GBP2.9m)

-- We made no new commitments to Third Party Funds during the quarter

Realisation activity

-- Realisation proceeds of GBP90.0m received during the quarter, of which

GBP61.5m was generated from 27 Full Exits executed at an average of 40%

Uplift to Carrying Value and 4.2x Multiple to Cost. This includes

proceeds from the sale of U-POL that was announced in our H1 results

-- For the nine months to 31 October 2021, Full Exits have been executed at

an average of 30% Uplift to Carrying Value and 3.1x Multiple to Cost

Quoted Companies

-- We do not invest directly in publicly quoted companies, but gain listed

investment exposure when IPOs are used to exit an investment

-- At 31 October 2021, we had 54 investments in quoted companies,

representing 13.5% of the Portfolio (31 July 2021; 14.2%)

-- There were five quoted investments that individually accounted for 0.5%

or more of the Portfolio value:

Company Ticker % value of Portfolio

---------------- ----------------------------- ------- --------------------

Chewy (part of PetSmart

1 holding)(1) CHWY-US 6.2%

---------------- ----------------------------- ------- --------------------

2 Olaplex OLPX 0.9%

---------------- ----------------------------- ------- --------------------

3 Allegro ALE-WA 0.6%

---------------- ----------------------------- ------- --------------------

4 Synlab SYAB-F 0.6%

---------------- ----------------------------- ------- --------------------

5 Autostore AUTO.OL 0.5%

---------------- ----------------------------- ------- --------------------

Other 4.7%

---------------- ----------------------------- ------- --------------------

Total 13.5%

---------------- ----------------------------- ------- --------------------

(1) % value of Portfolio includes entire holding of

PetSmart and Chewy. Majority of value is within Chewy

Balance sheet and financing

-- Total liquidity of GBP246.9m, comprising GBP76.2m cash and GBP170.7m

undrawn bank facility

GBPm

---------------------------------------------------- ------

Cash at 31 July 2021 69.5

Realisation Proceeds 90.0

Third Party Fund drawdowns (45.1)

High Conviction Investments (30.1)

Shareholder returns (4.1)

FX and other (4.0)

---------------------------------------------------- ------

Cash at 31 October 2021 76.2

---------------------------------------------------- ------

Available undrawn debt facilities 170.7

---------------------------------------------------- ------

Cash and undrawn debt facilities (total available

liquidity) 246.9

---------------------------------------------------- ------

-- Portfolio represented 97.7% of net assets

GBPm % of net assets

---------------------- ------- ---------------

Total Portfolio 1,090.3 97.7%

Cash 76.2 6.8%

Current liabilities (50.7) (4.5)%

---------------------- ------- ---------------

Net assets 1,115.8 100%

---------------------- ------- ---------------

-- Undrawn commitments of GBP442.5m, of which 22.7% (GBP100.3m) were to

funds outside of their investment period

DIVID

-- Continued commitment to provide a progressive dividend in line with

current policy

-- Third quarter dividend of 6p per share, taking total for the nine months

to 31 October 2021 to 18p. Intention reaffirmed to declare total

dividends of at least 27p per share in respect of the financial year

ending 31 January 2022, which would represent an increase of 12.5% per

share compared to the previous financial year

ACTIVITY SINCE THE QUARTER (TO 31 DECEMBER 2021)

-- Total Proceeds of GBP61.7m

-- New Investments of GBP47.2m, 36.3% into High Conviction Investments

-- New Fund Commitments

-- ICG Ludgate Hill II: $20.0m (GBP15m) -- secondary portfolio

ICG Private Equity Fund Investments Team

1 February 2022

SUPPLEMENTARY INFORMATION

Top 30 companies

The table below presents the 30 companies in which ICG

Enterprise Trust had the largest investments by value at 31 October

2021.

Year of Value as a %

Company Manager investment Country of Portfolio

----------------------------------------------------------- ------------ ----------- ---------- -------------

1 PetSmart/Chewy+^

Retailer of pet products and services BC Partners 2015 United States 6.2%

2 Minimax+

Supplier of fire protection systems and services ICG 2018 Germany 3.0%

3 IRI+

Provider of mission-critical data and predictive analytics

to consumer goods manufacturers New Mountain 2018 United States 2.9%

4 Leaf Home Solutions

Provider of home maintenance services Gridiron 2016 United States 2.0%

5 Yudo+

Manufacturer of components for injection moulding ICG 2017 Hong Kong 1.9%

6 DOC Generici+

Distributor of pharmaceutical products ICG 2019 Italy 1.8%

7 Berlin Packaging+

Provider of global packaging services and supplies Oak Hill 2018 United States 1.8%

8 Froneri+

Manufacturer and distributor of ice cream products PAI 2019 United Kingdom 1.7%

9 Visma+

Provider of business management software and outsourcing ICG /

services HgCapital 2017 / 2020 Norway 1.6%

10 Endeavor Schools+

Operator of private-pay schools Leeds Equity 2018 United States 1.6%

11 David Lloyd Leisure+

Operator of premium health clubs TDR 2013 / 2020 United Kingdom 1.4%

12 DomusVi+

Operator of retirement homes ICG 2021 France 1.4%

13 AML RightSource+

Provider of compliance and regulatory services and

solutions Gridiron 2020 United States 1.3%

14 Ivanti+

Provider of IT management software solutions Charlesbank 2021 United States 1.2%

15 PSB Academy+

Provider of tertiary education ICG 2018 Singapore 1.0%

Year of Value as a %

Company Manager investment Country of Portfolio

----------------------------------------------------------- ---------- ----------- ------------ -------------

16 Davies Group +

Provider of business outsourcing services to the insurance BC

sector Partners 2021 United Kingdom 0.9%

17 Olaplex

Provider of hair care products Advent 2020 United Kingdom 0.9%

18 DigiCert+

Provider of enterprise security solutions ICG 2021 United States 0.8%

19 Curium Pharma+

Supplier of nuclear medicine diagnostic pharmaceuticals ICG 2020 United Kingdom 0.8%

20 Class Valuation+

Provider of residential mortgage appraisal management

services Gridiron 2021 United States 0.8%

21 RegEd+

Provider of Saas-based governance, risk and compliance Gryphon

enterprise software solutions Investors 2018 United States 0.8%

22 Planet+

Provider of integrated payments services focused on Eurazeo /

hospitality and luxury retail Advent 2021 Ireland 0.8%

23 Crucial Learning+ (fka VitalSmarts)

Provider of corporate training courses focused on Leeds

communication skills and leadership development Equity 2019 United States 0.7%

24 AMEOS Group+

Provider of health care services ICG 2021 Switzerland 0.7%

25 Allegro

Operator of an online marketplace and price comparison Cinven /

website Permira 2017 Poland 0.6%

26 Synlab

Operator of medical diagnostic laboratories Cinven 2015 Germany 0.6%

27 HSE24

Home shopping network in Germany ICG 2020 Germany 0.6%

28 AutoStore

Designer and manufacturer of automated storage and

retrieval systems TH Lee 2019 Norway 0.5%

29 proALPHA

Developer and vendor of resource planning software ICG 2017 Germany 0.5%

30 IRIS

Provider of business-critical software ICG 2018 United Kingdom 0.5%

----------------------------------------------------------- ---------- ---------------- -------------

Total of the 30 largest underlying investments 41.3%

-------------------------------------------------------------------------------------------------- -------------

+ All or part of this investment is held directly as a

Co-investment or other Direct Investment

^ All or part of this investment was acquired as part of a

secondary purchase

30 largest fund investments

The table below presents the 30 largest funds by value at 31

October 2021. The valuations are net of underlying managers' fees

and Carried Interest.

Outstanding

Year of Value commitment

Fund commitment Country/ region GBPm GBPm

------------------------------------------- ----------- ---------------------- ----- -------------

1 ICG Ludgate Hill I

Secondary portfolio 2021 Europe/North America 44.2 10.2

BC European Capital IX

2 Mid-market and large buyouts 2011 Europe/North America 38.0 1.7

3 ICG Europe VII

Mezzanine and equity in mid-market buyouts 2018 Europe 34.8 10.5

4 ICG Strategic Equities Fund III

Secondary fund restructurings 2018 Global 33.2 10.1

5 Gridiron Capital Fund III

Mid-market buyouts 2016 North America 26.9 4.0

6 Sixth Cinven Fund

Large buyouts 2016 Europe 24.1 2.0

7 Graphite Capital Partners VIII

Mid-market buyouts 2013 UK 23.7 3.1

8 Thomas H Lee Equity Fund VIII

Mid-market and large buyouts 2017 North America 21.1 4.3

9 CVC European Equity Partners VI

Large buyouts 2013 Europe/North America 20.0 2.6

10 CVC European Equity Partners VII

Large buyouts 2017 Europe/North America 19.8 7.2

11 Advent Global Private Equity IX

Large buyouts 2019 Europe/North America 19.0 5.5

12 Advent Global Private Equity VIII

Large buyouts 2016 Europe/North America 18.0 0.6

13 PAI Strategic Partnerships

Mid-market and large buyouts 2019 Europe 17.7 0.6

14 PAI Europe VI

Mid-market and large buyouts 2013 Europe 17.3 1.4

15 BC European Capital X

Mid-market and large buyouts 2016 Europe 17.3 0.6

16 TDR Capital III

Mid-market and large buyouts 2013 Europe 15.8 1.6

17 PAI Europe VII

Mid-market and large buyouts 2017 Europe 14.3 10.3

18 Gryphon V

Mid-market buyouts 2019 North America 14.0 1.4

Outstanding

Year of Country/ Value commitment

Fund commitment region GBPm GBPm

------------------------ ---------- ------------ ----- ---------------

18 Gryphon V

North

Mid-market buyouts 2019 America 14.0 1.4

19 New Mountain Partners V

North

Mid-market buyouts 2017 America 13.7 1.5

20 Permira V

Europe/North

Large buyouts 2013 America 13.2 0.4

ICG Strategic Equity

21 Fund IV

Secondary fund

restructurings 2021 Global 12.9 19.4

22 Gridiron Capital Fund IV

North

Mid-market buyouts 2019 America 12.9 4.2

23 Permira VI

Large buyouts 2016 Europe 12.8 1.9

24 Resolute IV

North

Mid-market buyouts 2018 America 12.6 2.2

Charterhouse Capital

25 Partners X

Large buyouts 2015 Europe 11.9 3.8

26 Leeds Equity Partners VI

North

Mid-market buyouts 2017 America 10.8 0.8

27 Permira VII

Large buyouts 2019 Global 10.4 3.6

ICG Strategic

28 Secondaries II

Secondary fund Europe/North

restructurings 2016 America 9.9 15.2

One Equity Partners VI Europe/North

29 Mid-market buyouts 2016 America 9.6 0.6

Resolute II Continuation North

30 Mid-market buyouts 2021 America 9.5 -

Total of the largest 30

fund investments 573.4 132.7

Percentage of total

investment Portfolio 52.6%

------------------------ ---------- ------------ ----- ---------------

Portfolio at 31 October 2021

All data is presented on a look-through basis to the investment

portfolio held by the Company, consistent with the commentary in

previous annual and interim reports

Investment category GBPm % of Portfolio

------------------------------------ ------- ---------------

ICG managed investments 289.8 26.6%

Third party Direct Investments 185.2 17.0%

Third party Secondary Investments 58.1 5.3%

------------------------------------ ------- ---------------

High Conviction Investments 533.1 48.9%

------------------------------------ ------- ---------------

Third Party Funds 557.2 51.1%

------------------------------------ ------- ---------------

Total 1,090.3 100%

------------------------------------ ------- ---------------

Portfolio by calendar year of

investment % of value of underlying investments

-------------------------------------- ------------------------------------

2021 19.4%

2020 12.1%

2019 18.9%

2018 19.1%

2017 10.2%

2016 6.9%

2015 8.2%

2014 and older 5.2%

-------------------------------------- ------------------------------------

Total 100.0%

-------------------------------------- ------------------------------------

Portfolio by sector % of value of underlying investments

---------------------------- ------------------------------------

Consumer goods and services 22.9%

TMT 20.2%

Healthcare 17.4%

Business services 13.8%

Industrials 8.9%

Education 5.4%

Financials 3.6%

Leisure 3.4%

Other 4.4%

---------------------------- ------------------------------------

Total 100.0%

---------------------------- ------------------------------------

% of value of

Portfolio by geographic distribution based on location underlying

of company headquarters investments

------------------------------------------------------- ---------------------

North America 40.4%

Europe 31.4%

UK 19.4%

Rest of world 8.8%

------------------------------------------------------- ---------------------

Total 100.0%

------------------------------------------------------- ---------------------

(1) Alternative Performance Measure

Attachment

-- 220201_ICGT 31 October 2021 Result_FINAL

https://ml-eu.globenewswire.com/Resource/Download/c67bb9b9-f928-4565-9015-2064f16c872c

(END) Dow Jones Newswires

February 01, 2022 02:00 ET (07:00 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

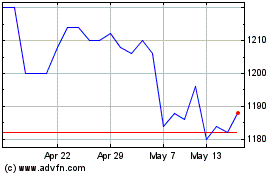

Icg Enterprise (LSE:ICGT)

Historical Stock Chart

From Jun 2024 to Jul 2024

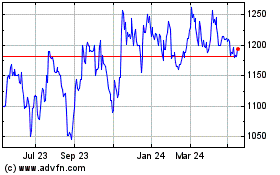

Icg Enterprise (LSE:ICGT)

Historical Stock Chart

From Jul 2023 to Jul 2024