TIDMICGT

28 April 2020

ICG ENTERPRISE TRUST PLC

Preliminary Results

For the 12 months ended 31 January 2020

STRONG PORTFOLIO PERFORMANCE DELIVERS DOUBLE DIGIT GROWTH FOR THE YEAR

Continued short, medium and long-term outperformance of public markets

Performance to 31 January 2020 1 year 3 year 5 year 10* year

----------------------------------------- ------ ------ ------ --------

Net asset value per share (total return) 11.2% 40.6% 85.0% 190.5%

Share price (total return) 20.5% 49.1% 92.6% 286.1%

FTSE All-Share Total Return 10.7% 18.4% 35.6% 111.2%

*As the Company changed its year end in 2010, the ten-year figures are

for the 121-month period to 31 January 2020.

Highlights:

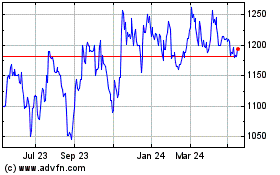

-- NAV per share of 1,152p - total return of 11.2%1 in the year

-- Growth driven by strong EBITDA growth and realisation uplifts

-- 11th consecutive year of double-digit underlying Portfolio growth

-- 16.6%1 constant currency return from the investment Portfolio;

14.6%1 return in sterling

-- 17% average LTM earnings growth from Top 30 Companies; 46% of the

Portfolio

--Strong period for realisations with selective new investment

-- GBP149m of proceeds received, equivalent to 20% of opening portfolio

value

-- Realisations at 37%1 uplift to carrying value; 2.4x1 multiple to cost;

consistent with five-year average

-- GBP159m of new investment; 39% into high conviction investments

-- Four co-investments completed; one alongside ICG and three alongside

third party managers

-- GBP156m committed to 12 primary funds; five new relationships

--Portfolio well diversified - weighted towards larger companies and

more resilient sectors

-- Focus on defensive growth means Portfolio is weighted towards more

resilient sectors, such as healthcare, consumer staples, business

services and technology

-- Portfolio is invested in larger companies in Europe and the US; bias to

managers who have strong operational focus and demonstrable experience of

successfully managing investments through economic cycles

-- ICG managed investments now represents 22% of the Portfolio; invested

across the capital structure in companies with resilient business models

--Impact of COVID-19 on Portfolio companies

-- Situation is continually evolving, and we are working closely with our

underlying managers, who have moved decisively to address immediate risks

and implement plans to protect and preserve value

-- We believe the diversified and resilient nature of the Portfolio is well

placed to navigate the challenges ahead

-- Performance and speed of recovery will vary between geographies, sectors

and companies and will be dependent on business models, end markets and

government policy

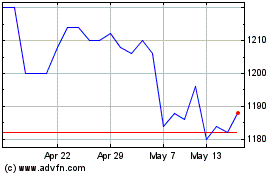

--Sharp decline in public markets and economic fall-out from COVID-19

likely to impact Net Asset Value in the short term

-- The Net Asset Value at January 2020 is based on valuations which preceded

the current crisis

-- We expect recent falls in public markets and the broader consequences of

COVID-19 to impact valuations in the coming months and we anticipate the

rate of realisations from the Portfolio to slow

-- We will provide shareholders with an update in the announcement of our

NAV as at 30 April 2020 in June

--Balance sheet and liquidity

-- Closing net asset value of GBP794m; investment portfolio represents 102%

of net asset value

-- GBP162m total liquidity (including GBP14m of cash and GBP148m undrawn

bank facility); uncalled commitments of GBP459m of which GBP82m are to

funds outside their investment periods

-- New EUR176m (GBP148m) bank facility signed during the year

-- To provide increased flexibility, GBP40m was drawn from our bank facility

in March, taking total gross cash balances to GBP56m at 23 April 2020

--Annual dividend of 23p and buybacks

-- Final dividend of 8p, taking total dividends for the year to 23p

-- 4.5% increase on previous year and 2.4% yield on year end share price

-- GBP3m of shares bought back in year; a further GBP1m purchased since the

year end

Oliver Gardey, Head of Private Equity Fund Investments, ICG, commented:

"The portfolio delivered strong underlying returns in the year,

extending the record of double-digit growth to 11 consecutive years. We

continued to deploy capital selectively into companies with strong

defensive characteristics in sectors with non-cyclical growth drivers

and build new relationships with leading managers both in the US and

Europe. We are especially pleased with the progress made in increasing

our portfolio weighting to the US in line with our long-term strategic

objectives.

"While the current economic conditions are uncertain, our portfolio is

weighted towards more resilient and defensive companies. We invest with

leading managers in the US and Europe, focused on mid-market and larger

buyouts, with a bias towards those with strong in-house operating teams

and capital markets specialists. In the weeks since the COVID-19 crisis

unfolded, we have seen some of the benefits of the private equity model,

with managers acting quickly and decisively to preserve and protect

value. We believe the private equity model is well suited to dealing

with current market conditions and are confident that our managers will

adapt to future events and continue to grow value.

"Our flexible mandate, and in particular our high conviction approach,

allows us to be nimble and adapt the mix of new investment to evolving

market conditions. While in the short term, we do not expect to see

significant new investment activity, when markets stabilise we are well

placed to benefit from more favourable entry valuations and take

advantage of the opportunities as they arise.

"Finally, it goes without saying that a key priority for us is the

wellbeing and safety of our staff; they are the most important part of

our business and we have taken the necessary actions to protect our

employees, as well as maintaining business continuity."

Enquiries

Analyst / Investor enquiries: +44 (0) 20 3201 7700

Oliver Gardey, Head of Private Equity Fund Investments, ICG

Colm Walsh, Managing Director, Private Equity Fund Investments, ICG

Ian Stanlake, Investor Relations, ICG

Media:

Alicia Wyllie, Co-Head of Corporate Communications, ICG

+44 (0) 20 3201 7994

Ed Gascoigne Pees, Eddie Livingstone-Learmonth, Camarco

+44 (0) 20 3757 4993

Website:

www.icg-enterprise.co.uk

Comparison to prior year

31 Jan 2020 31 Jan 2019

NAV per share 1,152p 1,057p

Realisations in the 12 months GBP149m GBP163m

Realisations -- uplift to carrying value 37% 35%

Realisations -- multiple to cost 2.4x 2.4x

Capital deployed GBP159m GBP158m

% of Capital deployed into high conviction

investments 39% 50%

New primary fund commitments GBP156m GBP162m

Notes

Included in this document are Alternative Performance Measures ("APMs").

APMs have been used if considered by the Board and the Manager to be the

most relevant basis for shareholders in assessing the overall

performance of the Company, and for comparing the performance of the

Company to its peers and its previously reported results. The Glossary

includes further details of APMs and reconciliations to IFRS measures,

where appropriate. The rationale for the APMs is discussed in detail in

the Manager's Review.

In the Chairman's Statement, Manager's Review and Supplementary

Information, reference is made to the "Portfolio". This is an APM. The

Portfolio is defined as the aggregate of the investment portfolios of

the Company and of its subsidiary limited partnerships. The rationale

for this APM is discussed in detail in the Manager's Review. The

Glossary includes a reconciliation of the Portfolio to the most relevant

IFRS measure. In the Chairman's Statement, Manager's Review and

Supplementary Information, all performance figures are stated on a total

return basis (i.e. including the effect of re-invested dividends). ICG

Alternative Investment Limited, a regulated subsidiary of Intermediate

Capital Group plc, acts as the Manager of the Company.

Disclaimer

This report may contain forward looking statements. These statements

have been made by the Directors in good faith based on the information

available to them up to the time of their approval of this report and

should be treated with caution due to the inherent uncertainties,

including both economic and business risk factors, underlying such

forward-looking information. These written materials are not an offer of

securities for sale in the United States. Securities may not be offered

or sold in the United States absent registration under the US Securities

Act of 1933, as amended, or an exemption therefrom. The issuer has not

and does not intend to register any securities under the US Securities

Act of 1933, as amended, and does not intend to offer any securities to

the public in the United States. No money, securities or other

consideration from any person inside the United States is being

solicited and, if sent in response to the information contained in these

written materials, will not be accepted.

CHAIRMAN'S STATEMENT

The year to 31 January 2020 was another strong period of double-digit

growth for ICG Enterprise Trust, with NAV per share increasing from

1,057p to 1,152p, an 11.2% total return, ahead of the FTSE All-Share

Total Return of 10.7%. Performance was again driven by strong underlying

trading and realisations at significant uplifts to carrying value and

cost.

Since our year end, the spread of COVID-19 has dramatically altered the

economic and investment landscape. We cover the potential short to

medium term impact of this global pandemic on the Portfolio later in my

statement and in the Manager's Review.

Delivering on our strategic goals

We made further progress towards our strategic goals of becoming more

fully invested, increasing our weighting towards high conviction

investments and extending our geographical diversification.

Over the last three years, we have reduced the impact of cash drag on

performance by becoming more fully invested without compromising the

quality of the Portfolio(2) . This has been achieved without being any

less selective and with a focus on investing responsibly, leveraging

ICG's strong Environmental, Social and Governance ("ESG") credentials.

Our flexible mandate has meant that we have been able to increase the

capital deployed into our high conviction portfolio, which remains a

significant driver of growth. These are investments the team has

proactively decided to increase exposure to, either by individual

co-investments alongside third party managers, proprietary investments

managed by ICG or secondary fund holdings.

Our high conviction portfolio has generated a return of 19% p.a.(3) in

local currencies over the last five years. We expect these investments

to continue to enhance the strong returns generated from our third-party

funds portfolio, which underpins our strategy, and has returned 14% p.a.

in local currency over the last five years. During the year, 39% of

total capital deployed was into high conviction investments, which

represent 41% of the Portfolio.

In addition, we continue to diversify geographically with our US

investments now representing 30% of the Portfolio, overtaking our

exposure to the UK market for the first time. The US is the largest

private equity market in the world, with a deep pool of leading private

equity managers who have long track records of outperformance. We expect

our weighting to the US market to continue to grow.

The importance of investing responsibly

Responsible investing remains a key focus for our investment team, who

continue to work closely with ICG's ESG team to ensure that our

investment programme is compatible with our ESG framework. The Board

believes that the long-term success of the Company requires the

effective management of both financial and non-financial measures, and

fully endorses the increasing emphasis on responsible investment. We

believe that companies that are successful in managing ESG risks, while

embracing opportunities, will outperform over the long term.

Continued investment in the ICG Enterprise team

ICG has continued to invest in the development of the team, and we now

have 14 people managing the Portfolio and overseeing the finance, legal

and investor relations functions of the Company. In September Oliver

Gardey joined ICG and the Investment Committee to lead the investment

team, succeeding Emma Osborne. Emma remains on the investment committee

as a Senior Adviser. Oliver has over 25 years' experience in the private

equity industry, joining ICG from Pomona Capital, where he was a partner

for 10 years and a member of its global investment committee. The

strength of Oliver's experience, alongside that of our existing team,

will be of great value to the Company and to our focus on delivering

consistently strong returns. We are delighted with the smooth transition

and the leadership that he has demonstrated since his appointment. Colm

Walsh, who has been a key team member for 10 years, also joined the

investment committee during the year.

Board evolution

Jane Tufnell and Gerhard Fusenig joined the Board in the year. The Board

currently comprises six independent non-executive Directors, with a

diverse range of skills and expertise, and an equal ratio of men and

women. We expect to appoint one new Director during this year, and we

will continue to evolve the Board and make further appointments, as

appropriate. Further details of the Board are set out in our Annual

Report.

This is my last year as your Chairman as I will step down from the Board

at the AGM, having been a director since 2008. The Nominations Committee,

led by the Senior Independent Director, undertook a rigorous search for

my successor and recommended Jane Tufnell becomes your new Chair. Jane

has a wealth of experience working in financial services, asset

management and with listed companies and we are delighted that she has

agreed to accept this appointment. It has been a privilege to serve as

your Chairman and I know I am leaving the Company in extremely capable

hands.

Dividend

The Company reported another strong set of results for the 12 months to

31 January 2020, and while there is limited visibility on the impact of

COVID-19 on the Portfolio's performance this financial year, the Board

is proposing a final dividend of 8p, which, together with the three

interim dividends of 5p each, will take total dividends for the year to

23p. This is a 4.5% increase on the prior year dividend of 22p and a

2.4% yield on the year-end share price. The Board recognises the

importance of a reliable source of income for our shareholders.

Annual General Meeting

The Annual General Meeting will be held on 17 June 2020. The Board is

mindful of the current travel and social gathering restrictions arising

from the COVID-19 pandemic and will be communicating with shareholders

outlining the format of the meeting, with the Notice of Meeting, in the

coming weeks.

Impact of COVID-19 pandemic on the Portfolio and performance

The economic impact of COVID-19 is likely to become more apparent over

the coming months and it is impossible to gauge the long term impact on

the Portfolio accurately at this stage. What we know today is that

companies across the globe are being impacted by the significant

reduction in economic activity, and while it is too early to assess the

depth and duration of this impact, we expect major economies to

experience large-scale economic contractions in the first half of 2020.

Performance and the speed of any recovery will vary between geographies,

sectors and companies and will be dependent on business models, end

markets and government policy. In the short term, we expect the sharp

fall in public markets and broader immediate consequences of COVID-19 to

impact valuations and slow the rate of realisations from the Portfolio.

Beyond the short term, we have a well-diversified global Portfolio that

is invested in developed economies and weighted towards more resilient

sectors, such as healthcare, consumer staples, business services and

technology. Our Portfolio also has a bias to managers who have a strong

operational focus and demonstrable experience of successfully managing

investments through periods of economic stress. Our managers have moved

decisively to address immediate risks and are implementing plans to

protect and preserve long term value.

Well placed to navigate the current challenging environment

I joined the Board in 2008, just prior to the financial crisis. At the

time, the Company's net assets stood at GBP327m, invested in a

predominantly UK and European portfolio. Since then we have grown our

net assets to GBP794m and returned GBP127m to shareholders, a 166% total

return over the 12 years, well ahead of the 93% total return from the

FTSE All-Share. Over the same period our share price total return has

been 157%.

We are again facing an incredibly challenging environment. With 11

consecutive years of double-digit growth, we do this from a base of

consistently strong returns. We have a diversified global portfolio of

market leading companies, led by expert management teams and supported

by some of the world's best private equity managers. We have significant

financial resources available to us and substantial expertise within our

investment team and, more broadly, ICG has a long track record of

managing private companies through multiple financial and economic

cycles. Just as we did in the financial crisis, I am confident that we

will manage and protect shareholder value through the current

challenging environment and are well placed to continue to generate

value for our shareholders over the longer term.

Jeremy Tigue

27 April 2020

MANAGER'S REVIEW

Performance overview

The potential for COVID-19 to cause widespread disruption was not

evident at our year end date. The valuation of the Portfolio at 31

January 2020 was therefore not negatively impacted by COVID-19 and does

not reflect the subsequent stock market falls in late February and early

March.

Profit growth and realisations drive the 11(th) consecutive year of

double-digit underlying growth

Continued strong operating performance and realisations at significant

uplifts to carrying value generated a return of 16.6% in local

currencies, or 14.6% in sterling. These results represent the 11(th)

consecutive year of double-digit underlying portfolio growth, over which

time period the Portfolio return has averaged 16% p.a. in local

currencies.

All parts of the Portfolio performed well and contributed to growth in

the year, with particularly strong performance from our US,

co-investment and ICG portfolios, with growth driven by a combination of

strong trading performance, realisations, IPOs and movements in quoted

share prices.

Within our high conviction portfolio, notable contributors include three

US co-investments: PetSmart (a leading US pet retailer), which

successfully listed its online business, Chewy; Abode Healthcare (a

provider of at-home hospice care), which was sold during the year at

2.0x cost and a gross IRR of 69%; and Ceridian (a human capital

management software provider), which was listed in 2018 and whose share

price increased by almost 80% in the year taking the return to 4.6x

cost. In addition, three of our recent co-investments alongside ICG's

flagship European strategy (Domus, Minimax and Visma) all outperformed

the wider portfolio following strong underlying growth.

Outside of our high conviction portfolio, Gridiron III, a US mid-market

fund which is currently our second largest fund holding by value,

reported significant gains in the year, with one of its portfolio

companies, Leaf Home Solutions, driving a significant proportion of the

gain. This follows exceptionally strong trading performance. The

business, which provides gutter protection solutions that reduce the

requirement for homeowners to clear gutters, is considered one of the

fastest growing home maintenance companies in the US.

Year Year

ended ended

Movement in the portfolio 31 Jan 31 Jan

GBPm 2020 2019

----------------------------------------------------- -------- --------

Opening Portfolio* 694.8 600.7

Third party funds portfolio drawdowns 97.4 79.2

High conviction investments -- ICG funds, secondary

investments and co-investments 61.2 78.4

-------- --------

Total new investment 158.6 157.6

Realisation Proceeds (148.8) (163.0)

-------- --------

Net cash outflow/(inflow) 9.8 (5.4)

Underlying Valuation Movement** 115.4 90.4

Currency movement (13.6) 9.1

Closing Portfolio* 806.4 694.8

-------- --------

% underlying Portfolio growth (local currency) 16.6% 15.0%

% currency movement (2.0%) 1.6%

-------- --------

% underlying Portfolio growth (Sterling) 14.6% 16.6%

-------- --------

* Refer to the Glossary for reconciliation to the

portfolio balance presented in the preliminary results.

** 95% of the Portfolio is valued using 31 December

2019 (or later) valuations (Jan 19: 91%).

Portfolio overview

High conviction investments underpinned by a portfolio of leading funds

Our strategy is focused on investing in larger companies, those with

leading market positions and strong management teams as we believe they

will generate the most consistently strong returns through the cycle.

Our Portfolio combines investments managed by ICG and those managed by

third parties, in both cases directly and through funds, and at 31

January 2020 the Portfolio was valued at GBP806m (31 Jan 19: GBP695m).

Third party funds were valued at GBP477m (31 Jan 19: GBP407m) providing

the Portfolio with a base of strong diversified returns and also deal

flow for our high conviction portfolio. The underlying funds are managed

by leading mid-market and large-cap European and US private equity firms,

with a bias to managers who have a strong defensive growth and

operational focus. Over the last five years this portfolio has generated

a net return of 14% p.a. in local currencies.

High conviction investments were valued at GBP329m (31 Jan 19: GBP288m).

The common characteristic of our high conviction investments is that ICG

selects the underlying companies, in contrast to a conventional fund of

funds in which third party managers make all the underlying investment

decisions.

Our high conviction portfolio allows us to proactively increase exposure

to companies that benefit from long term structural trends, those which

we believe would be more resilient in an economic downturn. We are able

to enhance returns and increase visibility on underlying performance

drivers, and we mitigate the more concentrated risk through a highly

selective approach and our focus on defensive growth companies. Over the

last five years, high conviction investments have generated a net return

of 19% p.a. in local currencies and we have a strategic goal to increase

the weighting to these investments towards 50% - 60% of the overall

Portfolio.

31 Jan

2020 31 Jan 2019

% of

Investment category Portfolio % of portfolio

------------------------------------ ---------- --------------

High conviction investments

ICG managed investments 22 20

Third party co-investments 14 16

Third party secondary investments 5 5

Total High conviction investments 41 41

Third party funds' portfolio

Third party primary funds 59 59

Total diversified fund investments 59 59

------------------------------------ ---------- --------------

Total 100 100

------------------------------------- ---------- --------------

Top 30 companies performed well in the year, dominated by high

conviction investments and defensive growth companies

Our largest 30 companies ("Top 30 Companies") represent 46% of the

Portfolio by value (31 Jan 19: 46%), and are weighted towards our high

conviction investments, which make up 71% of the Top 30 Companies by

value (31 Jan 19: 70%).

During the year, the Top 30 Companies performed well, reporting average

LTM earnings growth of 17% and revenue growth of 12%. It is particularly

encouraging that a quarter of these companies generated LTM earnings

growth in excess of 20% in the year, driven by both organic growth and

M&A activity. The valuation multiples of the Top 30 Companies increased

from 10.9x to 11.7x, a reflection of the change of mix and weightings,

rather than an increase in aggregate multiples overall. The net

debt/EBITDA ratio remained relatively unchanged at 4.1x, although mix

and weightings also had an impact with the majority of companies

de-levering in the year on a like-for-like basis. As we look across the

Portfolio, the growth and valuation trends are similar

Since the year end the economic landscape has altered dramatically. In

the 71% of the Top 30 Companies portfolio which are high conviction

investments, there is a strong bias towards investments in sectors which

have defensive characteristics. This includes a number of recent

co-investments in sub-sectors such as software and packaging which

continue to perform well even in the current climate. We also believe

that our investments alongside ICG will, in addition to having defensive

business models, benefit from being structured to provide downside

protection. This makes these investments less sensitive to short term

earnings or valuation pressure compared to a conventional buyout deal

structure.

Performance in the current environment will vary between sector and

company, and, while our underlying portfolio companies are not immune to

the impact of a global pandemic, we believe that the vast majority of

our Top 30 Companies are well placed to weather the current uncertainty

and take advantage of any recovery. Three of our Top 30 Companies are

quoted, and it is worth noting that two of these have increased in value

since 31 January 2020 with Chewy and TeamViewer's share price increasing

by 64%, and 29% respectively(4) . The third, Ceridian, has declined

since the onset of the crisis, however, more than a third of our January

holding was sold at a premium to the January valuation in February 2020.

Realisations(5)

Continued strong realisation activity at significant uplifts to carrying

value and cost

Realisations continued at a healthy level during the year with

GBP141m(6) of cash being generated from the Portfolio. Although lower

than the historical highs of the two previous years, at 20% of the

opening Portfolio it is in line with our 10 year average.

The realisation of 48 companies completed at an average uplift of 37%(7)

to the previous carrying value, which is consistent with the long-term

trend of significant uplifts being generated when companies are sold.

The average return multiple of 2.4x cost was also strong, reflecting a

number of highly successful investments realised in the year, with 40%

by number being sold for at least 2.5x cost. Over the last five years

exits have averaged 33% uplift to carrying value and a multiple of 2.3x

cost.

The largest realisation in the year came from our co-investment in

Froneri and its associated fund PAI V which together generated GBP18m of

proceeds. This fund, which has performed extremely well, had two assets

remaining with strong prospects but was coming to the end of its term.

PAI therefore offered investors the opportunity to realise their

holdings in these companies or reinvest into a new vehicle, PAI

Strategic Partnerships, giving more time to maximise the potential from

these companies. Given the continued strong performance of Froneri and

its future prospects, we decided to re-invest the majority of the

proceeds into the new transaction ensuring the company remains in our

Top 30 Companies.

The public market listing of technology investments was a strong source

of underlying valuation gains and proceeds with 15% of amounts received

arising from sales of listed shareholdings. The partial sell down of

human capital management software provider Ceridian by Thomas H Lee was

the largest contributor with GBP11m being returned in the year, mainly

from our co-investment. Permira's successful listing of remote support

software provider TeamViewer was also a significant contributor both in

terms of proceeds (GBP2m) and gain in the year, with the investment

being written up to 13.6x cost as at 31 January 2020, based on the

closing share price at this date. Both of these companies are in our Top

30 Companies at the year-end.

In addition to sales by our underlying managers, we completed a

secondary sale of one of our third party fund holdings at a premium to

the GP's valuation, which generated a further GBP8m of proceeds. We also

completed the sale of two more holdings, at premiums to the most recent

valuation, shortly after the year-end generating another GBP5m. These

transactions highlight our active approach to managing the Portfolio and

we will continue to pursue further sales opportunistically, taking

advantage of our in-house secondary market expertise.

From our largest 30 underlying companies at the start of the year, two

were fully realised: Atlas for Men from the third party funds portfolio

and Abode Healthcare from the co-investment portfolio, both of which

generated strong returns. In addition, our investment in Visma was

partially realised, with our co-investment managed by Cinven realised,

generating a 2.5x return. We still retain an interest in this company

via an ICG fund holding and co-investment from a later transaction.

New investments

Selective new investment

We invested GBP159m in the year, broadly in line with the GBP158m of new

investment in the year to January 2019. 39% of new investment was into

our high conviction portfolio, down from 50% in the year to January

2019. While we had a similar volume of opportunities compared to the

prior year, we executed fewer co-investments, given our cautious stance

on valuation multiples being paid for acquisitions. We completed three

US co-investments and the Froneri secondary transaction, totalling

GBP35m and one co-investment alongside ICG (GBP10m).

Co-investments have always been a feature of our strategy and have

outperformed both primary and secondary investments over the short and

long term, generating a local currency return of 21% p.a. over the last

five years. Our focus remains on defensive growth businesses with high

cash flow conversion which have demonstrated resilience to economic

cycles. The co-investments made in the year were:

-- DOC Generici is a leading independent generic pharmaceutical company and

the third largest company in the Italian pharmaceutical market. It is

active in the supply of drugs for the treatment of all the common medical

conditions with a strong presence in areas including cardiovascular,

gastrointestinal, metabolism and neurological treatments. We invested

GBP12m in this company.

-- Berlin Packaging, provider of global packaging services with a focus on

the food and healthcare industries in which we invested GBP9m alongside

Oak Hill Capital Partners. The company provides its clients with a fully

integrated service to design, finance and commission packaging. It is the

number one distributor of rigid packaging in North America operating in a

$7bn core addressable market. It has a strong financial track record and

a highly cash generative business model with demand that has proved

resilient through the cycle.

-- VitalSmarts, a US provider of on-line and in-person leadership training,

our second co-investment alongside Leeds Equity Partners, in which we

invested GBP8m. Both the manager and company have an excellent track

record in corporate education and the deal dynamics at entry were

attractive in terms of both entry multiple and the company's capital

structure. The company has worked with over 300 of the Fortune 500

companies and has a highly diversified income base.

-- RegEd is a leading provider of regulatory compliance software services,

primarily to broker-dealers, insurance companies and banks in the United

States. The company's customers include over 200 blue-chip customers

including 80% of the top 25 financial services firms in the US. We

invested GBP5m in RegEd alongside a new US manager, Gryphon Investors. We

expect RegEd to benefit from a number of favourable trends as its clients

transition towards greater automation and less reliance on manual

processes.

All of these companies have defensive business models. Additionally, DOC

Generici features a combination of subordinated debt and equity

investments giving an element of structural downside protection, a

consistent feature of many of our investments with ICG.

12 new fund commitments to both existing and new manager relationships

We completed 12 new primary fund commitments in the year totalling

GBP156m. 11 of these were to third party managers. Of these third party

fund commitments, six were raised by managers we have backed

successfully before: two European funds (IK and Cinven), two global

funds (Advent and Permira), and two US funds (Oak Hill and Gridiron). We

also made a commitment to ICG Europe Mid-Market Fund, ICG's latest

European fund. The managers we back tend to raise funds that are

oversubscribed and therefore difficult to access, and the calibre of

these managers speaks to the relationships that we have built with these

firms over many years. A key area of focus in our selection and due

diligence process relates to the performance of managers during periods

of significant financial stress.

We also added five new manager relationships, of which three are focused

on the US mid-market (AEA, Gryphon Investors and Charlesbank) and two

are focused on the European market (Carlyle Europe and

Investindustrial). Since the move to ICG we have built many new

relationships with US managers and they have been a key source of

co-investment and secondary deal flow in addition to the in-house deal

flow that ICG has given the Company access to. As a result, the

Portfolio is increasingly geographically diverse; of our 29 core manager

relationships, 12 are US managers and we have successfully increased our

US exposure to 30% of the portfolio. Over the medium term we expect our

weighting to the US market to further increase to up to approximately

40% of the Portfolio.

Portfolio analysis(8)

Focus on mid-market and large cap companies

The Portfolio is biased towards mid-market (42%) and large deals (46%)

which we view as more defensive than smaller deals, benefiting from

stronger management teams and often market leading positions.

Portfolio increasingly focused on international markets

The Portfolio is focused on developed private equity markets, primarily

continental Europe (37%), the US (30%) and the UK (27%). Investments in

the Asia Pacific region represent 6% of value, which is primarily in

developed Asian markets such as South Korea and Singapore through ICG's

Asia Pacific subordinated debt and equity team. We have minimal emerging

markets exposure. In line with one of our strategic objectives, our

weighting to the US has increased from 14% at the time of the move to

ICG in 2016. Over the same period, the UK bias has reduced from 45%.

Portfolio bias towards sectors with defensive growth characteristics

The Portfolio is weighted towards more resilient sectors, such as

healthcare, technology and business services. 23% of the Portfolio is

invested in healthcare (17%) and education (6%), with the remainder of

the portfolio broadly spread across the industrial (16%) business

services (15%), consumer goods and services (15%) and technology (14%)

sectors. The company has a lower exposure to the leisure (8%) and

financial (5%) sectors. Within our exposure to the consumer and

industrial sectors, we have a bias to companies with more defensive

business models with non-cyclical growth drivers and high recurring

revenue streams.

Well-balanced vintage year exposure

Our vintage year exposure is balanced with 44% of the Portfolio invested

in transactions completed in 2016 or earlier, and 56% of the value in

investments made in 2017 or later.

Balance sheet and financing

Efficient balance sheet with good liquidity

There was net investment of GBP10m into the Portfolio during the period,

and, after allowing for dividends and expenses, the outstanding cash

balance fell to GBP14m (2019: GBP61m). At the year end the Portfolio

represented 102% of net assets, an increase from 95% at 31 January 2019.

GBPm 31 Jan 2020 31 Jan 2019

-------------------------------- ------------ ------------

Portfolio* 806 695

Cash 14 61

Net obligations (26) (25)

-------------------------------- ------------ ------------

Net assets 794 731

-------------------------------- ------------ ------------

Portfolio as % of net assets 101.6% 95.0%

* Refer to the Glossary for reconciliation to the

portfolio balance presented in the preliminary results

and definition of net obligations.

At 31 January 2020, we had uncalled commitments of GBP459m, against

which we had available liquidity of GBP162m (including GBP148m of

undrawn bank line). Of these uncalled commitments, GBP82m were to funds

outside their investment period.

In managing the Company's balance sheet our objective is to be broadly

fully invested through the cycle. We do not intend to be geared for long

periods of time. Outstanding commitments tend to be substantially drawn

down over a four to six-year period with approximately 10%--15% retained

at the end of the investment period to fund follow-on investments and

expenses. If outstanding commitments were to follow a linear drawdown

rate to the end of their respective remaining investment periods, we

estimate that approximately GBP85m would be called over the next 12

months. However, it is important to note that in previous periods of

economic and financial market distress, drawdown rates from underlying

funds slowed materially.

During the year we strengthened the Company's financial position by

agreeing a new bank facility of EUR176m (GBP148m), which matures in two

equal tranches in April 2021 and April 2022. Our anticipation is that

economic impact from COVID-19 will result in the rate of realisations

from the Portfolio slowing and this enlarged facility gives us greater

flexibility.

Since the year end, we have drawn GBP40m from our facility, taking our

gross cash balances to GBP56m at 23 April 2020. We have sufficient

headroom within our facility's covenants and are well placed to manage

the Portfolio cash flows. As demonstrated by the secondary sales

completed in the year, we also have a Portfolio that attracts strong

demand in the secondary market and continue to be active in this market.

GBPm 31 Jan 2020 31 Jan 2019

----------------------------------------------- ----------- -----------

Outstanding commitments 459 411

Total available liquidity (including facility) (162) (164)

----------- -----------

Overcommitment (including facility) 297 247

----------------------------------------------- ----------- -----------

Overcommitment % of net asset value 37% 34%

----------------------------------------------- ----------- -----------

Activity since the year-end

Since the year-end, the Portfolio has continued to generate cash

proceeds. In total GBP25m of distributions have been received in the two

months to 31 March 2020 and we have paid GBP19m of capital calls. We

committed EUR10m to Apax X, a global buyout fund, focused on the

Technology & Telecoms, Services, Healthcare, and Consumer sectors. We

also committed $5m to Hg Saturn 2, a new strategy with an existing

European mid-market manager.

Outlook

We are working closely with our managers to understand both the

immediate and potential future impact of the COVID-19 pandemic, and its

economic fallout, on the performance of our portfolio companies. We

expect the decline in public markets seen after the year-end and the

broader consequences of COVID-19 on global economies to have an impact

on portfolio valuations in the months ahead and for the rate of

realisations to slow. The speed of any recovery, in the medium term,

will depend on business models, end markets and government policy, and

will also vary by geography, by sector and by company.

ICG Enterprise has a well-diversified Portfolio, invested primarily in

companies with strong defensive characteristics and weighted towards

more resilient sectors. We invest with leading managers in the US and

Europe focused on mid-market and larger buyouts, with a bias towards

those with strong in-house operating teams and capital markets

specialists. The managers that we invest with have access to capital to

support portfolio companies and significant experience in managing

companies through periods of economic stress. In the weeks since the

crisis unfolded, we have begun to see some of the benefits of the

private equity model, with managers acting quickly and decisively to

preserve and protect value. We believe private equity is well suited to

dealing with current market conditions and have confidence that our

managers will be able to adapt to future events.

Our flexible mandate, and in particular our high conviction approach,

allows us to be nimble and adapt the mix of new investment to evolving

market conditions. While we do not expect significant new investment

activity until markets stabilise, we are well placed to benefit from

more favourable entry valuations and take advantage of the opportunities

as they arise.

ICG Private Equity Fund Investments Team

27 April 2020

Supplementary information (unaudited)

This section presents supplementary information regarding the Portfolio

(see Manager's Review and the Glossary for further details and

definitions).

The 30 largest underlying companies

The table below presents the 30 companies in which ICG Enterprise had

the largest investments by value at 31 January 2020. These investments

may be held directly or through funds, or in some cases in both ways.

The valuations are gross and are shown as a percentage of the total

investment Portfolio.

Value as

Year of a % of

Company Manager investment Country Portfolio

------------------------------------------------------------ --------- ----------- ------------ ---------

1 DomusVi +

Operator of retirement homes ICG 2017 France 3.6%

2 City & County Healthcare Group

Graphite

Provider of home care services Capital 2013 UK 2.9%

3 Minimax +

Supplier of fire protection systems and services ICG 2018 Germany 2.9%

4 Roompot +

PAI

Operator and developer of holiday parks Partners 2016 Netherlands 2.5%

5 PetSmart +

BC

Retailer of pet products and services Partners 2015 USA 2.4%

6 Leaf Home Solutions

Provider of gutter protection solutions Gridiron 2016 USA 2.1%

7 Visma +

Provider of accounting software and accounting outsourcing

services ICG 2017 Norway 1.8%

8 Yudo +

Manufacturer of components for injection moulding ICG 2018 South Korea 1.8%

9 Doc Generici +

Retailer of pharmaceutical products ICG 2019 Italy 1.8%

10 System One +

Thomas H

Lee

Provider of specialty workforce solutions Partners 2016 USA 1.7%

11 Supporting Education Group +^

Provider of temporary staff for the education sector ICG 2014 UK 1.7%

12 Gerflor^

Manufacturer of vinyl flooring ICG 2017 France 1.7%

13 Froneri^

PAI

Manufacturer and distributor of ice cream products Partners 2019 UK 1.6%

14 nGAGE

Graphite

Provider of recruitment services Capital 2014 UK 1.5%

15 Beck & Pollitzer

Provider of industrial machinery installation and Graphite

relocation Capital 2016 UK 1.5%

16 IRI +

Provider of data and predictive analytics to consumer New

goods manufacturers Mountain 2018 USA 1.4%

17 Endeavor Schools +

Leeds

Equity

Operator of schools Partners 2018 USA 1.4%

18 YSC

Provider of leadership consulting and management assessment Graphite

services Capital 2017 UK 1.4%

19 ICR Group

Provider of repair and maintenance services to the Graphite

energy industry Capital 2014 UK 1.3%

20 Compass Community

Provider of fostering services and children residential Graphite

care Capital 2017 UK 1.1%

21 Berlin Packaging +

Oak Hill

Capital

Provider of global packaging services and supplies Partners 2019 USA 1.1%

22 VitalSmarts +

Leeds

Provider of corporate training courses focused on Equity

communication skills and leadership development Partners 2019 USA 1.0%

23 PSB Academy +

Provider of private tertiary education ICG 2018 Singapore 1.0%

24 U-POL^

Manufacturer and distributor of automotive refinishing Graphite

products Capital 2010 UK 0.9%

25 Ceridian +

Thomas H

Lee

Provider of payroll and human capital software Partners 2007 USA 0.9%

26 David Lloyd Leisure +

TDR

Operator of premium health clubs Capital 2013 UK 0.8%

27 Cognito +^

Graphite

Supplier of communications equipment, software & services Capital 2002 / 2014 UK 0.7%

28 Random42

Graphite

Provider of medical animation and digital media services Capital 2017 UK 0.6%

29 EG Group

TDR

Operator of petrol station forecourts Capital 2014 UK 0.6%

30 TeamViewer

Provider of secure remote support and online meeting

software Permira 2014 Germany 0.6%

------------------------------------------------------------ --------- ----------------- ---------

Total of the 30 largest underlying investments 46.3%

-------------------------------------------------------------------------------------------------- ---------

All or part of this investment is held directly as

a co-investment or other direct investment.

^ All or part of this investment was acquired as part

of a secondary purchase.

The 30 largest fund investments

The table below presents the 30 largest funds by value at 31 January

2020. The valuations are net of any carried interest provision.

Outstanding

Value commitment

Fund Year of commitment Country/ region GBPm GBPm

---------------------- ------------------ --------------------- ------ -----------

Graphite Capital

1 Partners VIII *

Mid-market buyouts 2013 UK 90.1 14.9

Gridiron Capital Fund

2 III

Mid-market buyouts 2016 North America 24.3 4.1

3 ICG Europe VI **

Mezzanine and equity

in mid-market

buyouts 2015 Europe 20.0 3.3

CVC European Equity

4 Partners VI

Large buyouts 2013 Europe/USA 18.0 2.9

Thomas H Lee Equity

5 Fund VII

Mid-market and large

buyouts 2015 USA 17.9 1.6

BC European Capital IX

6 **

Large buyouts 2011 Europe/USA 15.7 2.1

7 PAI Europe VI

Mid-market and large

buyouts 2013 Europe 14.7 1.5

Advent Global Private

8 Equity VIII

Large buyouts 2016 Europe/USA 14.6 1.4

9 Permira V

Large buyouts 2013 Europe/USA 14.4 0.8

PAI Strategic

10 Partnerships **

Mid-market and large

buyouts 2019 Europe 14.4 1.5

11 Sixth Cinven Fund

Large buyouts 2016 Europe 13.7 5.3

Graphite Capital

12 Partners VII * / **

Mid-market buyouts 2007 UK 13.7 2.8

13 ICG Europe VII

Mezzanine and equity

in mid-market

buyouts 2018 Europe 13.6 22.6

14 BC European Capital X

Large buyouts 2016 Europe 12.4 1.9

ICG Strategic

15 Secondaries Fund II

Secondary fund

restructurings 2016 Europe/USA 12.3 14.4

16 One Equity Partners VI

Mid-market buyouts 2016 Europe/USA 11.8 0.8

17 Silverfleet II

Mid-market buyouts 2014 Europe 11.5 2.0

ICG Asia Pacific Fund

18 III

Mezzanine and equity

in midmarket buyouts 2016 Asia Pacific 11.3 2.7

CVC European Equity

19 Partners VII

Large buyouts 2017 Europe/North America 10.9 10.0

20 TDR Capital III

Mid-market and large

buyouts 2013 Europe 10.3 2.1

21 Resolute II **

Mid-market buyouts 2018 USA 10.3 2.3

Oak Hill Capital

22 Partners IV

Mid-market buyouts 2017 USA 8.9 2.7

23 Permira VI

Large buyouts 2016 Europe 8.9 1.8

Activa Capital Fund

24 III

Mid-market buyouts 2013 France 8.7 1.9

Nordic Capital

25 Partners VIII

Mid-market and large

buyouts 2013 Europe 8.6 1.3

Hollyport Secondary

26 Opportunities VI

Tail-end secondary

portfolios 2017 Global 8.3 2.3

27 IK VIII

Mid-market buyouts 2016 Europe 8.1 1.5

28 Gryphon V

Mid-market buyouts 2019 North America 8.0 3.9

29 IK VII

Mid-market buyouts 2013 Europe 8.0 0.4

30 Bain Capital Europe IV

Mid-market buyouts 2014 Europe 8.0 0.8

Total of the largest 30 fund investments 451.4 117.6

Percentage of total investment Portfolio 56.0%

----------------------------------------------------------------- ------ -----------

* Includes the associated Top Up funds.

** All or part of an interest acquired through a secondary

fund purchase.

Portfolio analysis

Closing Portfolio by value

% of value of % of value of

underlying underlying

investments investments

Portfolio by investment type 31 January 2020 31 January 2019

----------------------------- ---------------- ----------------

Large buyouts 46.4% 44.7%

Mid-market buyouts 42.2% 47.2%

Small buyouts 8.7% 4.6%

Other 2.7% 3.5%

----------------------------- ---------------- ----------------

Total 100.0% 100.0%

----------------------------- ---------------- ----------------

Portfolio by calendar year of % of value of underlying investments

investment 31 January 2020

----------------------------------- ------------------------------------

2020 0.1%

2019 17.2%

2018 19.7%

2017 19.2%

2016 16.2%

2015 7.7%

2014 8.5%

2013 5.5%

2012 1.4%

2011 0.9%

2010 1.3%

2009 0.6%

2008 0.1%

2007 1.3%

2006 and before 0.3%

------------------------------------ ------------------------------------

Total 100.0%

------------------------------------ ------------------------------------

Portfolio by % of value of underlying investments % of value of underlying investments

sector 31 January 2020 31 January 2019*

------------ ------------------------------------ ------------------------------------

Healthcare

and

education 23.2% 20.8%

Industrials 15.5% 16.4%

Business

services 15.4% 17.8%

Consumer

goods and

services 15.1% 14.2%

TMT 13.6% 11.8%

Leisure 7.7% 8.7%

Financials 5.3% 5.5%

Other 4.2% 4.8%

------------ ------------------------------------ ------------------------------------

Total 100.0% 100.0%

------------ ------------------------------------ ------------------------------------

* Restated following the reclassification of four

underlying investments in the current year

% of value of % of value of

underlying underlying

Portfolio by geographic distribution based on location investments investments

of company headquarters 31 January 2020 31 January 2019

Europe 36.7% 38.8%

UK 27.1% 30.9%

North America 29.9% 25.9%

Rest of world 6.3% 4.4%

------------------------------------------------------- ---------------- ----------------

Total 100.0% 100.0%

------------------------------------------------------- ---------------- ----------------

Commitments analysis

The following tables analyse commitments at 31 January 2020. Original

commitments are translated at 31 January 2020 exchange rates.

Total undrawn commitments

Original Outstanding Average

commitment commitment drawdown % of

GBP'000 GBP'000 percentage commitments

------------------------- ----------- ----------- ----------- ------------

Investment period not

commenced 16,801 16,801 0.0% 3.7%

Funds in investment

period 543,836 360,044 33.8% 78.5%

Funds post investment

period 804,907 81,793 89.8% 17.8%

------------------------- ----------- ----------- ----------- ------------

Total 1,365,544 458,639 66.4% 100.0%

------------------------- ----------- ----------- ----------- ------------

Movement in outstanding commitments in year ended

31 January 2020 GBPm

--------------------------------------------------------- -------

As at 1 February 2019 411.2

New primary commitments 156.3

New commitments relating to co-investments and secondary

purchases 2.0

Drawdowns (113.3)

Secondary disposals (1.5)

Currency and other movements 3.9

--------------------------------------------------------- -------

As at 31 January 2020 458.6

--------------------------------------------------------- -------

New commitments during the year to 31 January 2020

Fund Strategy Geography GBPm

------------------------- ------------------------ ---------------- -----

Primary commitments

ICG Europe Mid-Market Mezzanine and equity in

Fund mid-market buyouts Europe 17.9

Seventh Cinven Large buyouts Europe 17.3

Oak Hill V Mid-market buyouts USA 15.8

AEA VII Mid-market buyouts North America 15.3

Investindustrial VII Mid-market buyouts Southern Europe 13.6

IK IX Mid-market buyouts Europe 13.5

Permira VII Large buyouts Global 13.4

Advent IX Large buyouts Europe/USA 13.2

Gridiron IV Mid-market buyouts North America 12.4

Gryphon V Mid-market buyouts North America 11.5

Carlyle Europe V Mid-market buyouts Europe 8.6

CB Technology Lower middle-market

Opportunities Fund buyouts North America 3.8

Total primary commitments 156.3

Commitments relating to co-investments and secondary

investments 2.0

--------------------------------------------------------------------- -----

Total new commitments 158.3

------------------------- ----------------------------------------- -----

Currency exposure

31 January 31 January 31 January 31 January

2020 2020 2019 2019

Portfolio(1) GBPm % GBPm %

--------------- ---------- ---------- ---------- ----------

Sterling 246.0 30.5 241.9 34.8

Euro 226.6 28.1 190.8 27.5

US Dollar 224.2 27.8 173.3 25.0

Other European 59.6 6.2 53.8 7.7

Other 50.0 7.4 35.0 5.0

--------------- ---------- ---------- ---------- ----------

Total 806.4 100.0 694.8 100.0

--------------- ---------- ---------- ---------- ----------

(1) Currency exposure is calculated by reference to

the location of the underlying Portfolio companies'

headquarters.

31 January 31 January 31 January 31 January

2020 2020 2019 2019

Outstanding commitments GBPm % GBPm %

------------------------ ---------- ---------- ---------- ----------

-- Sterling 65.3 14.2 83.3 20.3

-- Euro 213.0 46.5 172.2 41.9

-- US Dollar 178.5 38.9 153.9 37.4

-- Other European 1.8 0.4 1.8 0.4

------------------------ ---------- ---------- ---------- ----------

Total 458.6 100.0 411.2 100.0

------------------------ ---------- ---------- ---------- ----------

Realisation activity

Year of Proceeds

Investment Manager investment Realisation type GBPm

-------------- ------------- ------------- ------------------ ------------

Froneri PAI Partners 2013 Restructuring(1) 17.8

Abode Tailwind

Healthcare Capital 2018 Financial buyer 10.8

Thomas H Lee

Ceridian Partners 2007 Sell down post IPO 10.7

Visma Cinven 2014 Financial buyer 8.3

Atlas for Men Activa 2016 Financial buyer 4.6

Stella ICG 2015 Financial buyer 3.7

SK:N Limited Graphite

(Lasercare) Capital 2006 Financial buyer 3.6

Aston Scott Bowmark 2015 Financial buyer 3.5

Parex CVC 2014 Trade 2.9

Integer ICG 2018 Financial buyer 2.9

-------------- ------------- ------------- ------------------ ------------

Total of 10 largest

underlying realisations 68.9

----------------------------- -------------------------------- ------------

Total realisations 148.8

---------------------------------------------------------------- ------------

(1) Majority of proceeds from current year sale re-invested

into a rollover vehicle managed by PAI Partners.

Investment activity

Cost(1)

Investment Description Manager Country GBPm

------------ ------------------------------------------------------------ ---------- ---------- -------

PAI

Froneri(2) Manufacturer and distributor of ice cream products Partners UK 13.1

Doc Generici Retailer of pharmaceutical products ICG Italy 12.4

Leeds

Provider of corporate training courses focused on Equity

VitalSmarts communication skills and leadership development Partners USA 8.3

Oak Hill

Berlin Capital

Packaging Provider of global packaging services and supplies Partners USA 8.1

Provider of regulatory compliance and management software Gryphon

RegEd products Investors USA 4.6

NRS Provider of community products and services which Graphite

Healthcare are used to help elderly and disabled live independently. Capital UK 2.9

Organiser of B2B conferences for pharmaceutical and Graphite

Hanson Wade biotech industries. Capital UK 2.8

Horizon Care

and Graphite

Education Provider of specialist care for children and adolescents. Capital UK 2.6

Tat Hong Operator of crane rental company ICG Singapore 2.5

Provider of consulting and managed services for telecom/DSP

Prodapt ecosystems ICG India 2.4

------------ ------------------------------------------------------------ ---------- ---------- -------

Total of 10 largest underlying new investments 59.7

-------------------------------------------------------------------------------------------------- -------

Total new investment 158.6

-------------------------------------------------------------------------------------------------- -------

(1) Represents ICG's indirect exposure (share of fund

cost) plus any amounts paid for co-investments in

the period.

(2) Majority of proceeds from current year sale re-invested

into a rollover vehicle managed by PAI Partners.

PRINCIPAL RISKS AND UNCERTAINTIES

Risk management

The Board is responsible for risk management and determining the

Company's overall risk appetite. The Audit Committee assesses and

monitors the risk management framework and specifically reviews the

controls and assurance programmes in place.

Principal risks and uncertainties

The execution of the Company's investment strategy is subject to risk

and uncertainty and the Board and Manager have identified a number of

principal risks to the Company's business. As part of this process, the

Board have carried out a robust assessment of the principal risks facing

the entity, including those that would threaten its business model,

future performance, solvency or liquidity.

The Company considers its principal risks (as well as a number of

underlying risks comprising each principal risk) in four categories:

Investment Risks -- the risk to performance resulting from ineffective

or inappropriate investment selection, execution, monitoring.

External Risks -- the risk of failing to deliver the Company's strategic

objectives due to external factors beyond the Company's control.

Operational Risks -- the risk of loss or missed opportunity resulting

from a regulatory failure or the failure of people, processes or

systems.

Financial Risks -- the risks of adverse impact on the Company due to

having insufficient resources to meet its obligations or counterparty

failure and the impact any material movement in foreign exchange rates

may have on underlying valuations.

Emerging risks are regularly considered to assess any potential impact

on the Company and to determine whether any actions are required.

Emerging risks include those related to regulatory/legislative change

and macro-economic and political change, which in the current year have

included the impact of ESG on the Company and the UK's trade

negotiations with the EU.

Following the year end, there have been significant developments in

relation to the COVID-19 outbreak. These developments are unprecedented

and likely to have a material impact on a number of our principal risks,

in particular on investment performance risk and valuation risk. The

Manager and the Board are working closely to understand and mitigate the

immediate and potential future impact of the COVID-19 pandemic, and its

economic fallout, on the Company. The Manager is in regular contact with

the underlying managers, who have a strong operational focus, to

understand the impact on their portfolios and mitigating actions that

they may take. In addition, the Company has drawn GBP40m on its bank

facility since the year end to further strengthen its liquidity

position. Given the rapid escalation of the crisis, we currently have

limited visibility on the short and longer-term impact of COVID-19 on

the global economy. It is difficult to fully assess the impact on the

Company at this stage, but clearly a number of risks are heightened

currently.

Other risks, including reputational risk, are seen as potential outcomes

of the core principal risks materialising. These risks are managed as

part of the overall risk management of the Company.

A comprehensive risk assessment process is undertaken regularly to

re-evaluate the impact and probability of each risk materialising and

the nancial or strategic impact of the risk. Where the residual risk is

determined to be outside of appetite, appropriate action is taken.

Further information on risk factors is set out within the financial

statements.

Risk appetite and tolerance

The Board acknowledges and recognises that in the normal course of

business the Company is exposed to risk and that it is willing to accept

a certain level of risk in managing the business to achieve its targeted

returns.

As part of its risk management framework, the Board considers its risk

appetite in relation to each principal risk and monitors this on an

ongoing basis. Where a risk is approaching or is outside the tolerance

set, the Board will consider the appropriateness of actions being taken

to manage the risk.

In particular, the Board has a very low tolerance for financing risk

with the aim to ensure that even under the most severe stress scenario,

the Company is likely to meet its funding requirements and financial

obligations. Similarly, the Board has a low-risk tolerance concerning

operational risks including legal, taxation, regulatory and business

process and continuity risk.

RISK IMPACT MITIGATION CHANGE IN

THE YEAR

Investment Risks

------------------------------------------------------------

Investment performance Poor origination, investment selection and monitoring The Manager has a strong track record of investing Stable(9)

The Manager selects the fund investments and direct by the Manager and/or third party managers could significantly in private equity through multiple economic cycles. The Board reviews the activities and performance of

co-investments for the Company's Portfolio. The underlying affect the performance of the portfolio. The Manager has a highly selective investment approach the Manager on an ongoing basis and reviews the investment

managers of those funds in turn select individual and disciplined process, which is overseen by ICG strategy annually. Following this assessment and other

investee companies. Enterprise's Investment Committee within the Manager, considerations, the Board concluded that there was

The origination, investment selection and management which comprises a balance of skills and perspectives. no material change in investment performance risk

capabilities of both the Manager and the third party Further, the Company's Portfolio is diversified reducing during the year.

managers are key to the performance of the Company. the likelihood of a single investment decision impacting

portfolio performance.

Valuation Incorrect valuations being provided would lead to The Manager carries out a formal valuation process Stable(9)

In valuing its investments in private equity funds an incorrect overall NAV. involving a quarterly review of third party valuations, The Board discussed the valuation process in detail

and unquoted companies and publishing its NAV, the verification of the latest audited reports, as well with the Manager and the external auditors, including

Company relies to a significant extent on the accuracy as a review of any potential adjustments that are the sources of valuation information and methodologies

of financial and other information provided by the required to ensure the valuation of the underlying used. Following this assessment and other considerations,

underlying managers to the Manager. There is the potential investments are in accordance with the fair market the Board concluded that there was no material change

for inconsistency in the valuation methods adopted value principles required under International Financial in valuation risk during the year.

by the managers of these funds and companies and for Reporting Standards ("IFRS").

valuations to be misstated

External

Political and macroeconomic uncertainty Changes in the macro-economic The Manager actively monitors these developments, Stable(9)

Political and macroeconomic uncertainty, including or political environment could significantly affect with the support of a dedicated in-house economist The Board monitors and reviews the potential impact

impacts from the performance of existing investments (and valuations) and professional advisers where appropriate, to ensure on the Company from political and economic developments

the UK's trade negotiations with the EU, uncertainty and prospects for realisations. In addition, it could it is prepared for any potential impacts (to the extent on an ongoing basis, including input and discussions

around US trade negotiations, or similar scenarios, impact the number of credible investment opportunities possible). with the Manager. Incorporating these views and other

could impact the environment in which the Company the Company can originate. considerations, the Board concluded that there was

and its investment portfolio companies operate. no material change in political and macro-economic

uncertainty risk during the year.

Private equity sector A change in sentiment to the sector has the potential Private equity has outperformed public markets over Stable(9)

The private equity sector could fall to damage the Company's reputation and impact the the long term and it has proved to be an attractive The Board receives regular updates from the Company's

out of favour with investors leading to a reduction performance of the Company's share price and widen asset class through various cycles. broker and is kept informed of all material discussions

in demand for the Company's shares. the discount the shares trade at relative to NAV per The Manager is active in marketing the Company's shares with investors and analysts. Incorporating these updates

share, causing shareholder dissatisfaction. to a wide variety of investors to ensure the market and other considerations, the Board concluded that

is informed about the Company's performance and investment there was no material change in private equity sector

proposition. sentiment risk during the year.

The Board monitors the discount to NAV and considers

appropriate solutions to address any ongoing or substantial

discount to NAV, including share buybacks.

Foreign exchange At present, the Company does The Board regularly reviews the Company's exposure Stable(9)

The Company has continued to expand its geographic not hedge its foreign exchange exposure. Therefore, to currency risk and reconsiders possible hedging The Board reviewed the Company's exposure to currency

diversity by making investments in a number of countries. movement strategies on an annual basis. Furthermore, the Company's risk and possible hedging strategies and concluded

Accordingly, a number of investments are denominated in exchange rates between these currencies may have multicurrency bank facility permits the borrowings that there was no material change in foreign exchange

in US dollars, euros and other currencies other than a material effect on the underlying valuations of to be drawn in euros and US dollars, if required. risk during the year and that it remained appropriate

sterling. the investments and performance of the Company. for the Company not to hedge its foreign exchange

exposure.

Operational Risks

------------------------------------------------------------

Regulatory, legislative If applicable law and regulations are not complied The Board is responsible for ensuring the Company's Increased

and taxation compliance with, the Company could face regulatory sanction and compliance with all applicable regulations. Monitoring As a result of the Company entering the FTSE 250 index

Failure by the Manager to comply with relevant regulation penalties as well as a significant damage to its reputation. of this compliance, and regular reporting to the Board during the year, as well as other regulatory and corporate

and legislation could have an adverse impact on the thereon, has been delegated to the Manager. The Manager's governance developments, the financial or reputational

Company, or adherence to such could become onerous. in-house legal counsel, supported by the Compliance impact resulting from potential regulatory or legislative

This includes the Corporate Governance Code, Corporation and Risk functions, provides regular updates to the failings has increased. During the year, both the

Tax Act 2010, the Companies Act 2006, the Companies Board covering relevant changes to legislation and Board and the Manager's risk function have closely

(Miscellaneous Reporting) Regulations 2018, the Alternative regulation. The Manager and the Board ensure compliance monitored and evaluated the risks resulting from these

Investment Fund Managers Directive, accounting standards, with applicable regulation and legislation occurs developments, and the Company has continued to enhance

investment trust regulations and the Listing Rules in an effective manner. its processes and controls in order to remain compliant

and Disclosure Guidance and Transparency Rules. with current and expected legislation.

People If the Manager's investment team The Manager regularly updates the Board on team developments Decreased

Loss of key investment professionals were not able to deliver, investment opportunities and succession planning. Oliver Gardey was appointed as head of the Company's

at the Manager could impair the Company's ability could be missed or misevaluated, while existing investment The Manager places significant focus on developing investment team, succeeding Emma Osborne. As a result

to deliver its investment strategy if replacements performance may suffer. key individuals to ensure that there is a pipeline of the successful transition, the Board believes that

are not found in a timely manner. of potential succession candidates internally. External the risk in respect of People has now reduced.

appointments are also considered if that best satisfies

the business needs at the appropriate time.

The Company's investment team

within the Manager has always taken

a team-based approach to decision-making which helps

to mitigate against key person risk. In addition,

no one investment professional has sole responsibility

for an investment or fund manager relationship and,

to ensure that insights and knowledge are widely spread

across the investment team, the team meets weekly

to discuss all potential new investments and the overall

performance of the portfolio.

The Manager's compensation policy is designed to minimise

turnover of key people. In addition, the senior investment

professionals are required to co-invest alongside

the Company for which they are entitled to a share

of investment profits if performance hurdles are met,

which aids retention.

Information security A significant disruption to these IT systems, including Application of the Manager's and Administrator's information Stable(9)

The Company is dependent on effective information breaches of data confidentiality or cybersecurity, security policies is supported by a governance structure The Board carries out a formal assessment of the Manager's

technology systems at both the Manager and Administrator. could result in, among other things, financial losses, and a risk framework that allows for the identification, internal controls and risk management systems every

These systems support key business functions and are an inability to perform business critical functions, control and mitigation of technology risks. year. Following this review and other considerations,

an important means of safeguarding sensitive information. regulatory censure, legal liability and reputational The adequacy of the systems and controls the Manager the Board concluded that there was no material change

damage. and Administrator have in place to mitigate the technology in information security risk during the year.

risks is continuously monitored and subject to regular

testing. The effectiveness of the framework is periodically

assessed.

The Manager and other A significant failure of or disruption The Audit Committee formally assesses the internal Stable

third party advisers, including business processes to the Manager, Administrator or Depositary's processes controls of the Manager, the Administrator and Depositary The Board carries out a formal assessment of the Manager's

and continuity could result on an annual basis to ensure adequate controls are internal controls and risk management systems every

The Company is dependent on third parties for the in, among other things, financial losses, an inability in place. year. Following this review and other considerations,