Interim Management Statement

May 13 2010 - 2:00AM

UK Regulatory

TIDMICGC

INTERIM MANAGEMENT STATEMENT

Highlights

Volumes (Year to date, 8 May 2010)

Cars 92,500 -5.6%

Passengers 431,500 +10.4%

RoRo Freight 63,000 -15.1%

Container Freight (teu) 147,000 +10.5%

Terminal Lifts 57,700 +5.6%

Financial (January - April 2010)

Revenue EUR75.7m -0.7%

EBITDA EUR8.0m 0.0%

Net Debt (May 2010) EUR16.0m (EUR21.7m 31 Dec 2009)

Irish Continental Group plc (ICG) issues this Interim Management Statement in

accordance with the reporting requirements of the Transparency Regulations

2007. The statement covers the period from 1 January 2010 to date. It should be

noted that ICG's business is significantly weighted towards the second half of

the year when normally a higher proportion of the Group's operating profit is

generated than in the first six months.

Current Trading

In the first four months of the year Group revenue was EUR75.7 million, compared

with EUR76.2 in the same period last year. Higher passenger and car revenue was

offset by lower freight revenue. Operating costs (before depreciation &

amortisation) were EUR67.7.million versus EUR68.2 million the previous year

including an increase of EUR4.1 million in fuel costs to EUR12.4 million. Earnings

before interest tax and depreciation (EBITDA) were EUR8.0 million compared with EUR

8.0 million in the same period in 2009.

In the period up to 8 May 2010, we carried 92,500 cars, a 5.6% reduction on the

same period last year (3.7% lower on the Irish Sea and 21.7% lower on the

Ireland France route due to a two month later start of the service following

winter vessel refit). The lower volumes were compensated for by higher yields.

Our total passenger numbers were up by 40,500 (10.4 %) at 431,500. The

substantial increase in passenger numbers was influenced by a 49% increase in

foot and coach passengers due partly, but not exclusively, to the disruption to

air travel to and from Ireland during the closure of European airspace from

15th to 21st April. (Prior to the airspace closure foot passenger numbers were

already up 18% versus 2009).

In the Roll on Roll off freight market, while the overall market is showing

signs of modest growth (low single digits) for the first time in approximately

18 months, excess Ro Ro freight capacity continues. Irish Ferries carried

60,300 Ro Ro units compared with 71,000 in the same period in 2009, a reduction

of 15.1 %. Our carryings have been adversely influenced by the additional

capacity put in place in 2009 by competitors on both the Dublin to Holyhead and

Dublin to Liverpool routes despite market demand being at substantially lower

levels than in 2007/ 8. The comparative capacity on Dublin to Holyhead will be

on a like for like basis from early April onwards. In the last 4 weeks our

RoRo carryings were down 4 % on the same period in 2009, a substantial

improvement in trend.

Container freight has returned to growth and our volumes shipped rose by 10.5%

to 147,000 teu (twenty foot equivalent units) in the period to 8 May 2010

compared with the same period last year although rate levels are lower than last

year. Units handled at our terminals in Dublin and Belfast increased by 5.6 %

year on year, over the same period

The Group's balance sheet and cash flow characteristics remain strong. Current

net debt is approximately EUR16 million, down from EUR21.7 million at 31 December

2009. Liquidity remains strong with gross cash balances of EUR25 million.

Outlook

The recent closures of Irish airspace have reinforced the strategic importance

of sea access to the island of Ireland for both passengers and freight.

Forward bookings for Irish Ferries have improved during recent weeks as

uncertainty about the effects of volcanic ash on air travel continues. The

reaction from customers who used our services during the recent disruption has

been universally positive and we are hopeful that this will lead to repeat

business, particularly for summer car traffic.

The decline in the RoRo market has halted after almost eighteen months of

overall decline with small growth in the first quarter of 2010. The base effects

of the increase in competitor capacity, introduced in 2009, will start to be

reflected in the comparative figures from now although the full impact from the

long sea routes will not be comparable until later in the year. The trend in

Irish Ferries RoRo volumes has been improving in recent weeks relative to last

year. The container freight market is also recovering although some freight rate

levels being offered are unsustainably low. Finally, the recent weakening of

the Euro against Sterling is a positive development for both inbound tourism to

Ireland and also Irish exports to the UK, both of which are core business flows

for ICG.

Dublin

13 May 2010

Enquiries

Eamonn Rothwell, CEO, +353 1 6075628

Garry O'Dea, Finance Director, +353 1 6075628

[HUG#1415454]

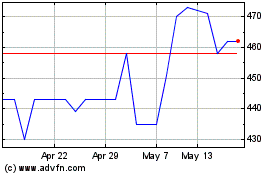

Irish Continental (LSE:ICGC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Irish Continental (LSE:ICGC)

Historical Stock Chart

From Jul 2023 to Jul 2024