TIDMGFTU

RNS Number : 3788Z

Grafton Group PLC

11 January 2024

Grafton Group plc

Trading Update

Full Year Operating Profit to Slightly Exceed Top End of

Analysts' Forecasts

Grafton Group plc ("Grafton" or "the Group"), the international

building materials distributor and DIY retailer, issues this

trading update for the period from 1 November 2023 to 31 December

2023.

Highlights

-- Resilient performance in subdued markets

-- Adjusted operating profit(1) to be slightly ahead of top end of Analysts' forecasts(2)

-- Fourth share buyback programme increased in December from GBP50 million to GBP100 million

-- Group ended year in strong financial position

Trading and Performance

Grafton delivered a resilient performance in this latest trading

period despite a continuation of the softer market conditions

experienced in September and October. Group revenue for the year

was up by 0.8 per cent to GBP2.32 billion (2022: GBP2.30 billion).

The geographic spread of our operations and exposure to multiple

end-markets are core strengths with 60 per cent of Group revenue

for the year generated outside the UK from operations in Ireland,

the Netherlands and Finland.

Full year adjusted operating profit(1) is expected to be

slightly ahead of the top end of Analysts' forecasts(2) supported

by stronger trading by our businesses in Ireland alongside the

timely implementation of previously announced cost reduction

measures and ongoing Group-wide cost discipline.

Overall activity in the Group's businesses remained subdued in

November and December with average daily like-for-like revenue down

by 2.9 per cent which was slightly less than the outturn for

September and October. The decline was partly driven by modest

product price deflation experienced in the distribution businesses

in Ireland and the UK.

In Ireland, Chadwicks performed well in the run up to the year

end and continued to benefit from an improving trend in daily

like-for-like revenue. Demand was firmer in the residential repair,

maintenance and improvement ("RMI") and new build markets and in

segments served by Chadwicks specialist brands. Our UK markets

remained weak and RMI volumes continued to be under pressure due to

lower discretionary spending by households on their homes, the

decline in housing transactions and a fall-off in larger home

improvement projects.

In the Netherlands, the rate of materials price inflation eased

considerably in the period. Lower revenue from smaller customers

and timber factories was mainly offset by growth from customers

engaged on large commercial construction projects. In our Finnish

business, the slowdown in economic and construction activity

continued to weigh on volumes in IKH.

In Retailing, the Woodie's DIY, Home and Garden business in

Ireland delivered a strong performance in the final months of the

year. In Manufacturing, CPI Mortars experienced a sharp decline in

volumes as its house building customer base reduced output in

response to lower demand from buyers. Volumes were also lower in

the StairBox staircase manufacturing business that supplies the RMI

market.

Segmental Trading

The table below shows the year-on-year changes in average daily

like-for-like revenue and in total revenue.

Segment Average Daily Like-for-Like Total Revenue Growth

Revenue Growth

in Constant Currency

Constant Sterling

Currency

Ten Months Two Months Year to Year to Year to

to 31 to 31 December 31 December 31 December 31 December

October 2023 2023 2023 2023

2023

Merchanting

- Ireland (1.7%) 1.5% (1.2%) 0.1% 2.1%

- UK (2.8%) (5.2%) (3.2%) (2.4%) (2.4%)

- Netherlands 2.9% (0.2%) 2.3% 2.3% 4.4%

- Finland (3.8%) (13.0%) (5.6%) (4.2%) (2.4%)

Retailing 4.2% 2.4% 3.8% 3.9% 5.8%

Manufacturing 1.9% (16.2%) (0.8%) (0.1%) 0.0%

----------- ---------------- ------------- -------------

Group (0.8%) (2.9%) (1.1%) (0.4%) 0.8%

----------- ---------------- ------------- -------------

Share Buybacks

As previously announced, the fourth share buyback programme

launched on 31 August 2023 was extended to 31 May 2024 and the

maximum aggregate consideration increased from GBP50 million to

GBP100 million. The Group had completed GBP47.5 million of the

buyback programme by 31 December 2023.

A total of GBP290.8 million was returned to shareholders through

share buybacks between 9 May 2022 and 31 December 2023 reflecting

confidence in the Group's trading prospects and its strong balance

sheet and cash generative operations while also retaining

significant capacity to invest in strategic growth

opportunities.

Eric Born, Chief Executive Officer of Grafton Group plc

commented:

"While the trading environment in the final months of the year

continued to be subdued across most of our markets, we are pleased

that adjusted operating profit for 2023 is now expected to be

slightly ahead of the top end of analysts' forecasts. We made good

progress during the year developing and executing our strategy and

in starting to build a deeper pool of acquisition opportunities in

targeted European markets . We remain confident in the medium-term

drivers of demand in our markets and, underpinned by a strong

balance sheet, Grafton is well positioned for growth as trading

conditions improve ."

(1) Operating profit is defined as profit before amortisation of

intangible assets arising on acquisitions,

acquisition related items, exceptional items, net finance

expense and income tax charge.

(2) Grafton compiled consensus Analysts' forecasts for 2023 show

operating profit(1) of circa GBP197.3 million and a range of

GBP194.0 million to GBP201.0 million.

Ends

For further information please contact:

Investors Media

Grafton +353 1 216 Murrays +353 1 498 0300

Group plc 0600 Pat Walsh +353 (0) 87 226 9345

Eric Born Chief Executive

Officer

David Arnold Chief Financial Buchanan GraftonGroup@buchanancomms.co.uk

Officer Helen Tarbet +44 (0) 7872 604 453

Toto Berger +44 (0) 7880 680 403

About Grafton

Grafton Group plc is an international distributor of building

materials to trade customers and has leading regional or national

positions in the distribution markets in the UK, Ireland, the

Netherlands and Finland. Grafton is also the market leader in the

DIY, Home and Garden retailing market in Ireland and is the largest

manufacturer of dry mortar and bespoke timber staircases in the

UK.

Grafton trades from circa 360 branches and has circa 9,000

colleagues. The Group's portfolio of brands includes Selco Builders

Warehouse, Leyland SDM, MacBlair, TG Lynes, EuroMix and StairBox in

the UK; Chadwicks and Woodie's in Ireland; Isero and Polvo in the

Netherlands; and IKH in Finland.

For further information visit www.graftonplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUASNRSBUAARR

(END) Dow Jones Newswires

January 11, 2024 02:00 ET (07:00 GMT)

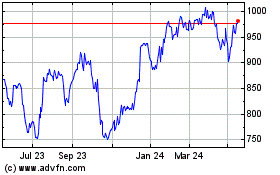

Grafton Grp.uts (LSE:GFTU)

Historical Stock Chart

From Jun 2024 to Jul 2024

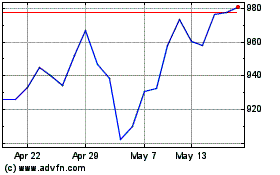

Grafton Grp.uts (LSE:GFTU)

Historical Stock Chart

From Jul 2023 to Jul 2024