Tender Offer and Annual Redemption Facility

February 18 2009 - 3:54AM

UK Regulatory

TIDMFCAP

RNS Number : 4999N

FRM Credit Alpha Limited

18 February 2009

FRM Credit Alpha Limited (the "Company")

18 February 2009

Tender Offer and Introduction of Annual Redemption Facility

THIS COMMUNICATION IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO

THE UNITED STATES, CANADA, JAPAN OR AUSTRALIA.

THIS ANNOUNCEMENT IS AN ADVERTISEMENT AND NOT A PROSPECTUS AND IS NOT AN OFFER

TO SELL OR A SOLLICITATION OF ANY OFFER TO BUY ANY SECURITIES IN THE UNITED

STATES OR IN ANY OTHER JURISDICTION.

In common with many other UK listed fund of hedge funds, the Company's shares

have now traded at a substantial discount to net asset value ("NAV") per share

for several months.

Under the terms of the Company's prospectus dated 1 September 2008 (the

"Prospectus"), the Board has absolute discretion to implement a tender offer of

up to 25 per cent. of a class of shares where such class of shares has, in any

12 months preceding the last NAV calculation date, traded at an average discount

in excess of 5 per cent. of the NAV of that share class.

The Board has resolved, having considered a range of proposals with its advisers

and taken account of the Company's current level of cash and the liquidity of

its underlying holdings, to take the following actions (together the

"Proposals"):

1. The Board proposes to make a tender offer of up to 20 per cent. of the

Company's shares based on the 30 June 2009 NAV, with payment expected by 30

September 2009. The tender is expected to be at the 30 June 2009 NAV less costs.

The size of the tender offer will be dependent on preserving sufficient cash

reserves to meet the Company's foreign currency hedging requirements as well as

sufficient cash being available from the redemption of the Company's underlying

portfolio.

The terms and conditions for the proposed tender offer will be set out in a

circular to be published within the next three months.

2. Following the completion of the tender offer, the Board proposes to replace

the existing tender offer provisions with an annual redemption facility, to be

offered at the absolute discretion of the Directors. The Manager, the

Investment Adviser and the Board all believe that it is preferable for the

Company to have a definitive liquidity event that can be planned for, rather

than the current tender offer arrangements triggered by a rolling discount.

The Board therefore proposes to allow up to 20% of the Company's shares to be

redeemed on an annual basis, at the absolute discretion of the Board.

Redemptions would be made at the relevant NAV less costs. Redemptions would be

required to be submitted by 30 June in any year, commencing June 2010. It is

expected that redemption value would be calculated based on the following

December NAV and payment would be made six weeks after the calculation date.

Depending on the liquidity within the portfolio at the time redemption requests

close, the redemption proceeds may be paid in two tranches. The first tranche

would be based on the December NAV, as set out above. The second tranche, if

required, would be based on the March NAV of the following year. It is expected

that payment in respect of the second tranche would be made within six weeks of

the March calculation date.

An announcement would be made by 31 October in each year setting out whether the

annual redemption would be made through one or two tranches.

3. At the Company's annual general meeting to be held in November 2011,

shareholders will have the opportunity to vote on the Company's continuation.

The Proposals would not affect the existing Distribution Facility, described in

the Prospectus.

The Proposals described above will be set out in a circular to be sent to

shareholders within the next 3 months.

The Board believes the Proposals will bring the Company onto a more flexible

capital basis, are a positive step to address some of the structural issues

facing certain closed-ended funds, particularly funds of hedge funds, and should

narrow the discount at which the Company's shares trade.

The Proposals described above are subject to shareholder approval and all

applicable laws and regulations.

Additional information on the Company is available at www.frmcredit.com.

Enquiries:

Greg Taylor/Luke Burdess, Financial Risk Management 020 7968 6000

Darren Willis, Winterflood Investment Trusts 020 3100 0258

Unless otherwise defined, terms used in this announcement have the same meaning

as in the prospectus relating to FRM Credit Alpha Limited dated 1 September

2008.

This announcement is an advertisement and not a prospectus and is not an offer

to sell or a solicitation of any offer to buy any securities in the United

States or in any other jurisdiction.

The issuer has not been and will not be registered under the US Investment

Company Act of 1940, as amended (the "Investment Company Act"). In addition, the

shares have not been and will not be registered under the US Securities Act of

1933, as amended (the "Securities Act"). Consequently, the shares may not be

offered, sold or otherwise transferred within the United States or to, or for

the account or benefit of, US persons except in accordance with the Securities

Act or an exemption therefrom and under circumstances which will not require the

issuer to register under the Investment Company Act. No offering of the shares

will be made in the United States.

Neither this document nor anything contained herein shall form the basis of, or

be relied upon in connection with, any offer or commitment whatsoever in any

jurisdiction.

This communication is issued in the UK by Financial Risk Management Limited

which is authorised and regulated by the Financial Services Authority and whose

office is at 15 Adam Street, London WC2N 6AH.

This communication is directed only at (i) persons outside the United Kingdom,

or (ii) persons having professional experience in matters relating to

investments who fall within the definition of "investment professionals" in

Article 19(5) of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (the "Order") or (iii) high net worth companies,

unincorporated associations and partnerships and trustees of high value trusts

as described in Article 49(2) (a) to (d) of the Order. Persons within the United

Kingdom who receive this communication (other than persons falling within (ii)

and (iii) above) should not rely on or act upon this communication.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TENSFESAASUSEIE

Finncap (LSE:FCAP)

Historical Stock Chart

From Jun 2024 to Jul 2024

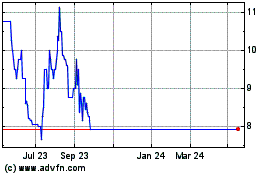

Finncap (LSE:FCAP)

Historical Stock Chart

From Jul 2023 to Jul 2024