AGM Statement

April 26 2006 - 8:00AM

UK Regulatory

RNS Number:0189C

FBD Holdings PLC

26 April 2006

FBD HOLDINGS PLC

ANNUAL GENERAL MEETING

Wednesday, April 26th 2006

HIGHLIGHTS OF CHAIRMAN'S STATEMENT TO AGM

UNDERWRITING

*Insurance underwriting the main driver of performance

*Measures to reduce the incidence of claims and to reform the over-costly

claims regime have been key to the underwriting turnaround of recent years

*Reforms yet to be implemented can bring further significant benefits

*Change of mindset by motorists and adequate enforcement needed

NON-UNDERWRITING

*Political and economic factors dampen performance of Leisure-Property

interests

*Intrinsic value of property and leisure assets evidenced by recent

conditional agreement for property sale at La Cala

*Intention to distribute net proceeds of sale by way of two special

dividends

CAPITAL ALLOCATION

*Appraised on an ongoing basis

CURRENT YEAR

*Overall business targets being achieved in year to date

*Urban and city markets key elements in growth strategy

Speaking on road safety and reforms yet to be implemented at the AGM, the

Chairman, Michael Berkery, said:

"I welcome recent moves by the government on this front but caution that

introducing penalty points, per se, will not deliver the desired improvement in

road accident statistics. What needs to be brought about is a change in mindset

by all motorists, especially younger drivers, underpinned by adequate

enforcement of the new and the old traffic laws. Sufficient resources must be

deployed by Government to achieve this. I would suggest that the 2% Government

Levy on insurance premiums, which amounted to approximately Euro80m. in 2005, be

applied specifically in support of this objective".

CHAIRMAN'S ADDRESS

As I have stated in our Annual Report, 2005 was another highly successful year

for the FBD Group. It was a year in which we surpassed all previous

performances, with

*Operating profit up by 30.3% to Euro162.6m.

*Operating earnings per share, up by 41.9% to Euro3.64

*Net assets per share up by 29% to Euro12.51

In view of the excellent results, the Board is recommending a final dividend of

37.5c, which brings the total dividend for the year to 57.5c. This represents an

increase of 43.75% on the 2004 figure and is a further indication of the Board's

commitment to increase dividend payout relative to the earnings achieved by the

Group.

As you are aware, INSURANCE UNDERWRITING is the core activity of the Group. It

has been the main driver of our excellent overall performance. Shareholders and

policyholders alike have benefited from the favourable turnaround in our

underwriting experience which has been a feature of FBD's and other Irish

insurers' performance in recent times. As a result, FBD shareholders have

enjoyed higher returns whilst policyholders have benefited from significant

reductions in premiums.

As most people are aware, the critical catalyst in delivering the turnaround in

underwriting performance was the concerted effort made by all interested parties

to introduce measures to reduce the incidence of claims and to reform the

over-costly claims regime which hitherto had operated in Ireland. It is widely

accepted that reforms yet to be implemented have the potential to deliver

further significant benefits. One immediately thinks of the savings, not only in

broad economic terms but in human trauma also, that would emerge from an

improvement in road safety throughout the country. I add my voice, once again,

to the ongoing calls that are being made on Government to attend to this matter

as a critical national priority and to resolve all of the issues that have

impeded delivery. I welcome recent moves by the Government on this front but

caution that introducing penalty points, per se, will not deliver the desired

improvement in road accident statistics. What needs to be brought about is a

change of mindset by all motorists, especially younger drivers, underpinned by

adequate enforcement of the new and the old traffic laws. Sufficient resources

must be deployed by Government to achieve this. I would suggest that the 2%

Government Levy on insurance premiums, which amounted to approximately Euro80m. in

2005, be applied specifically in support of this objective.

In relation to the Group's LEISURE and LEISURE-PROPERTY businesses, we all know

that global and domestic political and economic factors impact particularly on

them. In 2005, these pressures continued to feature adversely and dampened the

performance of our interests both in Spain and in Ireland. Given these

circumstances, a key consideration for the Board is the intrinsic value of these

property and leisure assets. In this regard, shareholders will have been pleased

to learn that post year end, the conditional sale of the major portion of our

building land at La Cala in Spain was agreed at a significant premium to

carrying value. The Board has also informed shareholders of its intention to

distribute the net proceeds of this sale, which would be up to Euro120m, by way of

two special dividends.

The utilisation of capital generated in the Group, which has not been

specifically allocated to one of our existing operating businesses, is a matter

which the Board appraises on an ongoing basis. Shareholders will recall that, in

March 2005, Euro81m. of shareholders' funds was used in a share buyback when KBC

placed their 23% shareholding on the market. The remaining non-allocated capital

and the funds subsequently generated and retained constitute, what the Board

terms, a "capital fund". How best to maximise this capital for the benefit of

shareholders is kept under ongoing review. At this particular juncture, apart

from the dividend payouts already mentioned, the Board has decided to retain

this capital in the Company and to investigate all possible opportunities to

invest some or all of it in the Group's primary business of insurance

underwriting, or in related financial service activities. Whilst it is

investigating such possibilities, the Board does not rule out other options for

use of capital if it deems them to be in the best interests of shareholders.

On the CORPORATE front, the placing in the market by KBC of its entire

shareholding in our Group in March 2005, which I referred to earlier,

constituted a significant change in the shareholding structure of the Company,

with many new institutional shareholders coming on board.

The sale by KBC marked an historic milestone in the life of FBD. KBC had been a

substantial shareholder in FBD since FBD's foundation in the late 1960s. Their

decision to dispose of their stake was undertaken for KBC's own strategic

reasons and with the full knowledge of FBD. I wish to record my personal thanks,

and that of the Board, to KBC for the role they played and the solid

shareholding position they maintained in FBD down through the years. Their

shareholding bridged our Group's pre and post Stock Exchange Listing and I am

pleased that Johan Thijs, KBC's Non-Life General Manager, agreed to remain on

the FBD Board as a Non-Executive Director. As I have alluded to, the departure

of KBC created an opportunity for new investors to acquire stock in the Company.

I wish to take this opportunity to welcome them to FBD and to acknowledge their

confidence in our Group.

In February of this year, Mr. John Dillon resigned as a Director. I wish to

thank John for his valuable contribution to the Board during the four years he

served as a Director. In March of this year, Mr. Padraig Walshe, the recently

elected President of The Irish Farmers' Association, was co-opted onto the

Board. I welcome Padraig and I am sure he will make a valuable contribution as a

Board Member.

In looking to the FUTURE, we draw confidence from the past year, when FBD

expanded its core business base significantly. Customer numbers grew and the

Organisation has strengthened, structurally and resource wise. New markets were

sourced and the momentum for growth was advanced. I am pleased to say that this

progress has continued in the year to date and that we are achieving our overall

business targets. As we have previously signalled, urban and city markets are

key elements in our growth strategy. With clearly defined objectives and

appropriate plans being pursued to achieve them, I am confident that FBD's

success will continue.

In conclusion, I want to sincerely thank the Board, Management and Staff for

their hard work and dedication which have yielded the results I am so pleased to

report on. Their commitment and ability are vital in the success we have

achieved, and in maintaining profitable growth in the future.

For Further Information, please contact:

Mr. Philip Fitzsimons, FBD Tel: +353 1 409 3200

Mr. Joe Murray, Murray Consultants Tel: +353 1 498 0300

Mobile: 086 253 4950

This information is provided by RNS

The company news service from the London Stock Exchange

END

AGMEAFLKALLKEFE

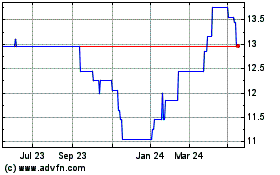

Fbd (LSE:FBH)

Historical Stock Chart

From Jun 2024 to Jul 2024

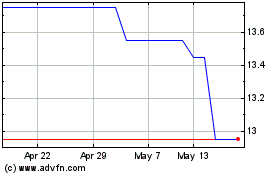

Fbd (LSE:FBH)

Historical Stock Chart

From Jul 2023 to Jul 2024