TIDMEQT

RNS Number : 4892Y

EQTEC PLC

05 May 2023

5 May 2023

EQTEC plc

("EQTEC", the "Company" or the "Group")

Audited results for the year ended 31 December 2022

EQTEC plc (AIM: EQT), a global technology innovator powering

distributed, decarbonised, new energy infrastructure through its

waste-to-value solutions for hydrogen, biofuels and energy

generation announces its audited results for the year ended 31

December 2022, with post-period progress.

Financial highlights

-- Revenue and other operating income: EUR8.0 million (2021: EUR9.2 million)

-- EBITDA loss before significant and non-recurring items:

EUR4.9 million (2021: EUR3.8 million)

-- Net assets: EUR37.1 million (31 December 2021: EUR43.4 million)

-- Capital raise of GBP3.7 million (EUR4.2 million) through the placing of new shares

-- Two loan facilities secured: one for up to GBP10 million

(EUR11.3 million) and the other for GBP2 million (EUR2.3

million)

The net loss including significant and non-recurring items was

EUR10.5 million (2021: EUR4.7 million), which included an

investment impairment of EUR4.7 million in relation to the North

Fork project in California.

Commercial and operational highlights

-- Strong progress with Market Development Centres ("MDCs"):

-- Italy MDC construction completed, and commissioning commenced.

-- Croatia MDC funding identified for final construction and recommissioning.

-- France MDC acquired, and project buyer identified for sale of the project.

-- EQTEC France launched as wholly owned subsidiary, with strong

pipeline of projects particularly focused on renewable natural gas

("RNG") and advanced biofuels.

-- Contaminated plastics added to EQTEC feedstock library after

testing success, followed by collaboration agreement with French

waste management company toward future plants.

-- EQTEC R&D facility at Université de Lorraine ("UL")

upgraded to support steam-oxygen gasification capabilities for

testing of advanced biofuel solutions.

-- Deeside project (UK) completed initial FEED, Livadia project (Greece) achieved 80% funding.

-- North Fork project (USA) refinanced, and construction

restarted; Southport and Billingham projects (UK) restructured to

reduce EQTEC liabilities whilst maintaining rights to development

fees due.

David Palumbo, CEO of EQTEC, commented:

"EQTEC in 2022 reaffirmed its business strategy, strengthened

its growth platform and toughened its resolve. Based on having one

of the few technologies of its kind with a proven track record, we

focused our energies on ensuring we can truly make our technology

available, reliably and consistently, for the several business

models we support in the world of new energy infrastructure.

We delivered focused, formative progress in three key areas of

our business strategy. First, we pushed ahead with three MDCs, as

demonstration of EQTEC's versatile syngas solutions in live,

reference plants that deliver attractive returns through a variety

of business models. Second, we took further steps in retaining our

technology leadership, deploying upgraded R&D capability for

regular testing of solutions for advanced biofuels such as RNG,

hydrogen, liquid fuels such as sustainable aviation fuel (SAF) and

for chemicals such as ethanol or methanol. Third, we released the

Company from untenable liabilities in major projects and turned our

attention to the Tier 1 and 2 leaders that will help us deploy our

solutions through the world's best funded, best managed

projects.

Our target remains making EQTEC a leading licensor and innovator

of technology that delivers clean, baseload energy and biofuels

solutions to the world's leading Industrial and Utility companies

and to Municipalities and Agroindustry around the globe. To become

that, we must be more than simply the leading innovator for

waste-to-value solutions; we must also be known for deploying our

technology through projects that consistently deliver on time, to

budget and for plants that deliver healthy returns on investment,

sustainably over their lifetimes."

Current trading and outlook

-- France and Italy leading execution of EQTEC business

strategy, combining advanced capabilities, demonstration of EQTEC

technology and collaboration with top-tier partners:

-- Mechanical and electrical completion of Italy MDC in 2022,

followed by achievement of full operations in March 2023 with

handover to the operating company expected imminently.

-- Visits by prospective customers throughout 2022 and early

2023 to Movialsa plant in Spain and now also to Italy MDC in

Tuscany, with a full slate of visits planned to Italy MDC in

2023.

-- Acquisition of France MDC in July 2022, followed by

engagement of prospective buyer, confirmation of planning,

feedstock and offtake arrangements; project sale expected in H1

2023.

-- Launch into the contaminated plastic waste treatment business

in France with French partner SEPS in March 2022, following

completion of successful contaminated plastic waste trials.

-- Following a competitive tender win, EQTEC and French utility

partner Idex awarded in March 2023 a waste-to-RNG project built on

demonstrated R&D capabilities.

-- Collaboration agreement in April 2023 between EQTEC and

Poseidon LNG Hub, a sister company of Belleli Group and consortium

including Linde, Wood, Alfa Laval and Chemprod.

-- Built on collaboration agreement with major players, pipeline

in Italy for at least four waste-to-RNG and waste-to-hydrogen

solutions, also building on global partnership with Wood.

-- Major UK, France and Ireland projects demonstrate EQTEC scale

capability with target business models and top-tier customers:

-- Reconfiguration of near-premise Industrial business model at

Deeside, Flintshire, UK for a more cost-effective, dual-technology

facility deploying Anaergia, Inc. anaerobic digestion technology

and EQTEC syngas technology for power offtake by neighbouring

Toyota Motor Company engine production plant; initial FEED

completed by global EPC Black & Veatch.

-- Updated financial modelling and development strategy for

Billingham project, for an advanced facility that can support

surrounding, large-scale Industrial offtakers in Teesside, with

Petrofac appointed as the FEED partner and prospective EPC;

engagement with neighbouring CF Fertilisers and other local players

for purchase of advanced biofuels.

-- Progress toward acquisition of project at decommissioned,

large-scale coal-fired power station at Gardanne, France, secured

in Q1 2023; EQTEC leading feasibility work for an early-stage

design of a clean, syngas-based production of RNG or other,

advanced biofuels in support of Industrial and/or Municipal offtake

customers.

-- Engagement underway toward Ireland-based projects in support

of power, RNG or ethanol production to support Ireland's IT

services industry, de-carbonise the national grid and create

autonomous, sustainable alternatives to traditional energy

solutions.

-- Appointed top-tier investment bank to approach large

corporates in the growing market for large-scale, new energy

infrastructure such as RNG, hydrogen and liquid fuels with a

mandate to identify strategic investors at individual project,

project portfolio and/or Group levels.

-- Continued commitment to innovation and applied R&D:

-- Expansion of variable feedstock capabilities, including

successful tests of plastics and polymers contaminated with fossil

fuels and other chemicals that cannot be burned or put into

landfill, and successful testing of high-humidity RDF

(refuse-derived fuel).

-- Expansion of R&D capabilities for advanced offtake

applications such as RNG, hydrogen, liquid biofuels, ethanol,

methanol and other chemicals, through upgrade of R&D facility

at the University of Lorraine to accommodate steam-oxygen

gasification technology.

-- Active engagement of Wood VESTA technology for hydrogen or

for RNG at multiple project opportunities, starting with Southport

project in UK, with other opportunities in France, Italy.

-- Collaboration agreement with CompactGTL for development of

liquid biofuels through EQTEC syngas technology and CompactGTL

gas-to-liquids technology, at UK pilot plant.

-- Ireland project opportunity for development of integrated

syngas-to-ethanol capability with new technology partner to be

announced.

-- Focus Plan in response to tighter market conditions, for prioritised, strategic execution:

-- Portfolio prioritisation with focus on completion and live

operation of MDCs in Italy, Croatia and France, followed by

development of scale capabilities at large facilities in UK, France

and Italy.

-- Exited liabilities of EUR18 million+ through renegotiation of

agreements at all three UK projects: Deeside, Billingham,

Southport.

-- Focus on core capabilities, bringing on top-tier development,

project management, FEED and EPC partners to support EQTEC's

design, engineering and technology integration.

Annual report

The full, 2022 annual report, which addresses all the points

above and which details full, financial results and other

performance outcomes for the Company, may be found on the Company's

website at https://eqtec.com/investing-in-eqtec/

Additionally, the full2022 annual report for the Company is

available at the following hyperlink:

http://www.rns-pdf.londonstockexchange.com/rns/4892Y_1-2023-5-4.pdf

The principal financial tables, extracted from the Annual

Report, are set out below:

Consolidated statement of profit or loss for the financial year

ended 31 December 2022

Notes 2022 2021

EUR EUR

Revenue 8 7,970,072 9,171,764

Cost of sales (7,002,314) (7,541,354)

Gross profit 967,758 1,630,410

Operating income/(expenses)

Administrative expenses (5,742,563) (4,190,592)

Other income 9 33,645 -

Impairment costs 14 (2,752) (5,498)

Other (gains)/losses 12 10,088 (1,418,860)

Employee share-based compensation 10 (340,257) (205,648)

Foreign currency gains 156,835 348,885

Operating loss (4,917,246) (3,841,303)

Share of results from equity accounted

investments 21 (52,059) (24,188)

Gains from sales to equity accounted

investments deferred 21 (28,378) (211,478)

Loss/(gain) arising from loss

of control of subsidiaries (489) 9,957

Change in fair value of financial

investments 23 (326,501) (250,378)

Finance income 11 316,805 134,069

Finance costs 11 (589,618) (517,108)

Significant and non-recurring

transactions:

Impairment of equity-accounted

investment 15 (4,712,490) -

Loss on disposal of tangible asset 15 (154,205) -

Loss before taxation 14 (10,464,181) (4,700,429)

Income tax 16 (60,934) -

LOSS FOR THE FINANCIAL YEAR (10,525,115) (4,700,429)

Loss attributable to:

Owners of the Company (10,525,104) (4,700,497)

Non-controlling interest (11) 68

(10,525,115) (4,700,429)

2022 2021

EUR per share EUR per share

Basic loss per share:

From continuing operations 17 (0.001) (0.001)

From continuing and discontinued

operations 17 (0.001) (0.001)

Diluted loss per share:

From continuing operations 17 (0.001) (0.001)

From continuing and discontinued

operations 17 (0.001) (0.001)

Consolidated statement of comprehensive income for the financial

year ended 31 December 2022

2022 2021

EUR EUR

Loss for the financial year (10,525,115) (4,700,429)

Other comprehensive (loss)/income

Items that may be reclassified

subsequently to profit or loss

Exchange differences arising on

re-translation

of foreign operations (478,066) 238,715

Other comprehensive (loss)/income

for the year (478,066) 238,715

Total comprehensive loss for

the financial year (11,003,181) (4,461,714)

Attributable to:

Owners of the company (11,128,847) (4,301,511)

Non-controlling interests 125,666 (160,203)

(11,003,181) (4,461,714)

Consolidated statement of financial position at 31 December

2022

Notes 2022 2021

ASSETS EUR EUR

Non-current assets

Property, plant and equipment 18 133,053 446,861

Intangible assets 19 17,578,231 17,702,833

Investments accounted for using

the equity method 21 7,619,514 8,074,184

Financial assets 22 3,728,434 4,050,030

Other financial investments 23 171,186 506,976

Total non-current assets 29,230,418 30,780,884

Current assets

Development assets 25 6,033,543 3,455,496

Loan receivable from project development

undertakings 25 5,446,087 3,000,469

Trade and other receivables 26 7,221,046 6,876,747

Cash and cash equivalents 27 1,693,116 6,446,217

Total current assets 20,393,792 19,778,929

Total assets 49,624,210 50,559,813

EQUITY AND LIABILITIES EUR EUR

Equity

Share capital 28 26,799,584 25,977,130

Share premium 28 87,203,372 83,610,562

Other reserves 28 2,694,125 2,353,868

Accumulated deficit (77,305,919) (66,177,072)

Equity attributable to the owners

of the company 39,391,162 45,764,488

Non-controlling interests 29 (2,258,523) (2,384,189)

Total equity 37,132,639 43,380,299

Non-current liabilities

Borrowings 30 1,064,598 -

Lease liabilities 31 - 56,855

Total non-current liabilities 1,064,598 56,855

Current liabilities

Trade and other payables 32 6,264,404 6,921,806

Borrowings 30 5,106,038 -

Lease liabilities 31 56,531 200,853

Total current liabilities 11,426,973 7,122,659

Total equity and liabilities 49,624,210 50,559,813

The financial statements were approved by the Board of Directors

on 5 May 2023 and signed on its behalf by:

Ian Pearson

David Palumbo

Non-Executive Chairman Chief Executive Officer

05 May 2023

05 May 2023

Consolidated statement of changes in equity for the financial

year ended 31 December 2022

Equity

attributable

to owners

Share Accumulated of the Non-controlling

Capital Share premium Other reserves deficit company interests Total

EUR EUR EUR EUR EUR EUR EUR

Balance at 1

January 2021 24,355,545 62,896,521 2,148,220 (61,875,561) 27,524,725 (2,223,986) 25,300,739

Issue of

ordinary

shares in

EQTEC plc

(Note 28) 1,402.324 18,206,268 - - 19,608,592 - 19,608,592

Conversion of

debt into

equity

(Notes 28) 167,728 3,285,013 - - 3,452,741 - 3,452,741

Issued in

acquisition

of financial

asset (Note

28) 51,533 693,628 - - 745,161 - 745,161

Share issue

costs (Note

28) - (1,470,868) - - (1,470,868) - (1,470,868)

Employee

share-based

compensation

(Notes 10) - - 205,648 - 205,648 - 205,648

Transactions

with owners 1,621,585 20,714,041 205,648 - 22,541,274 - 22,541,274

Loss for the

financial

year - - - (4,700,497) (4,700,497) 68 (4,700,429)

Unrealised

foreign

exchange

losses - - - 398,986 398,986 (160,271) 238,715

Total

comprehensive

loss

for the

financial

year - - - (4,301,511) (4,301,511) (160,203) (4,461,714)

Balance at 31

December 2021 25,977,130 83,610,562 2,353,868 (66,177,072) 45,764,488 (2,384,189) 43,380,299

Issue of

ordinary

shares in

EQTEC plc

(Note 28) 769,697 3,717,379 - - 4,487,076 - 4,487,076

Conversion of

debt into

equity

(Note 28) 52,757 237,672 - - 290,429 - 290,429

Share issue

costs (Note

28) - (362,241) - - (362,241) - (362,241)

Employee

share-based

compensation

(Note 10) - - 340,257 - 340,257 - 340,257

Transactions

with owners 822,454 3,592,810 340,257 - 4,755,521 - 4,755,521

Loss for the

financial

year - - - (10,525,104) (10,525,104) (11) (10,525,115)

Unrealised

foreign

exchange

losses - - - (603,743) (603,743) 125,677 (478,066)

Total

comprehensive

loss

for the

financial

year - - - (11,128,847) (11,128,847) 125,666 (11,003,181)

Balance at 31

December 2022 26,799,584 87,203,372 2,694,125 (77,305,919) 39,391,162 (2,258,523) 37,132,639

Consolidated statement of cash flows for the financial year

ended 31 December 2022

Notes 2022 2021

EUR EUR

Cash flows from operating activities

Loss for the financial year before

income tax (10,464,181) (4,700,429)

Adjustments for:

Depreciation of property, plant

and equipment 18 239,233 156,520

Amortisation of intangible assets 19 124,602 72,685

Loss on disposal of tangible assets 15 154,205 -

Impairment of equity-accounted

investments 15 4,712,490 -

Employee share-based compensation 10 340,257 205,648

Impairment of development assets 25 2,752 -

Share of loss of equity accounted

investments 21 52,059 24,188

Gains from sales to equity accounted

investments deferred 21 28,378 211,478

Loss/(gain) on loss of control

of subsidiary 20 489 (9,957)

Change in fair value of financial

investments 23 326,501 250,378

(Gain)/loss on debt for equity

swap 12 (10,088) 1,418,860

Unrealised foreign exchange movements (319,440) 103,234

Operating cash flows before working

capital changes (4,812,743) (2,267,395)

Increase in:

Development assets (2,578,047) (3,144,600)

Trade and other receivables (2,837,708) (5,946,010)

(Decrease)/increase in Trade and

other payables (274,938) 3,432,256

Net cash used in operating activities

- continuing operations (10,503,436) (7,925,749)

Finance income 11 (316,805) (134,069)

Finance costs 11 589,618 517,108

Taxes paid (108,311) -

Net cash used in operating activities (10,338,934) (7,542,710)

Cash flows from investing activities

Addition to tangible assets 18 (79,199) -

Additions to intangible assets 19 - (1,000,000)

Payments on deposit on land 26 (586,421) -

Cash inflow from disposal of subsidiary 33 170,000 -

Loans advanced to project development

undertakings 25 (773,034) (2,430,137)

Loans repaid by project development

undertakings 25 100,000 -

Investment in equity accounted

undertakings 21 (6,790) (978,825)

Loans advanced to equity accounted

undertakings 21 (2,852,699) (3,746,984)

Loans repaid by equity accounted

undertakings 21 40,018 -

Investment in related undertakings 22 (351,853) (697,635)

Other advances to equity accounted

undertakings (2,000) (27,508)

Net cash used in investing activities (4,341,978) (8,881,089)

Cash flows from financing activities

Proceeds from borrowings and lease

liabilities 30 7,236,850 1,391,174

Repayment of borrowings and lease

liabilities 30 (1,126,483) (3,031,724)

Loan issue costs 30 (334,557) -

Proceeds from issue of ordinary

shares 28 4,430,069 19,420,222

Share issue costs 28 (274,784) (1,180,217)

Interest paid (3,284) (20)

Net cash generated from financing

activities 9,927,811 16,599,435

Net (decrease)/increase in cash

and cash equivalents (4,753,101) 175,636

Cash and cash equivalents at the

beginning of the financial year 6,446,217 6,270,581

Cash and cash equivalents at

the end of the financial year 27 1,693,116 6,446,217

ENQUIRIES

EQTEC plc

David Palumbo / Nauman Babar +44 20 3883 7009

Strand Hanson - Nomad & Financial

Adviser

James Harris / Richard Johnson +44 20 7409 3494

Panmure Gordon - Broker

John Prior / Hugh Rich +44 20 7886 2500

Instinctif - Media & investor relations EQTEC@instinctif.com

enquiries +44 791 717 8920 / +44 788

Guy Scarborough / Tim Field 788 4794

About EQTEC plc

As one of the world's most experienced gasification technology

and engineering companies, with a growing track record of

delivering operational and commercial success for transforming

waste-to-energy through best-in-class technology innovation,

engineering and project development, EQTEC brings together design

innovation, project delivery discipline and solid commercial

experience to add momentum to the global energy transition. EQTEC's

proven, proprietary and patented technology is at the centre of

clean energy projects, sourcing local waste, championing local

businesses, creating local jobs and supporting the transition to

localised, decentralised and resilient energy systems.

EQTEC designs, supplies and builds advanced gasification

facilities in the UK, EU and US, with highly efficient equipment

that is modular and scalable from 1MW to 30MW. EQTEC's versatile

solutions process over 50 varieties of feedstock, including

forestry wood waste, vegetation and other agricultural waste from

farmers, industrial waste and sludge from factories and municipal

waste, all with no hazardous or toxic emissions. EQTEC's solutions

produce a pure, high-quality synthesis gas ("syngas") that can be

used for the widest range of applications, including the generation

of electricity and heat, production of synthetic natural gas

(through methanation) or biofuels (through Fischer-Tropsch,

gas-to-liquid processing) and reforming of hydrogen.

EQTEC's technology integration capabilities enable the Group to

lead collaborative ecosystems of qualified partners and to build

sustainable waste reduction and green energy infrastructure around

the world.

The Company is quoted on AIM (ticker: EQT) and the London Stock

Exchange has awarded EQTEC the Green Economy Mark, which recognises

listed companies with 50% or more of revenues from

environmental/green solutions.

Further information on the Company can be found at

www.eqtec.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR NKQBBABKDAPK

(END) Dow Jones Newswires

May 05, 2023 02:00 ET (06:00 GMT)

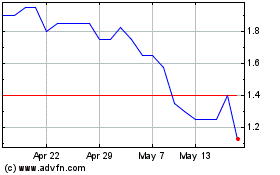

Eqtec (LSE:EQT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eqtec (LSE:EQT)

Historical Stock Chart

From Jul 2023 to Jul 2024