TIDMREAC

RNS Number : 6769S

React Energy PLC

23 December 2016

23 December 2016

REACT Energy plc

("REACT" or the "Company")

Final Results and Notice of AGM

REACT, the renewable energy developer and operator focusing on

the production of clean energy in the UK and Ireland, today

announces its audited final results for the year ended 30 June

2016.

The Annual Report is available for viewing on the Company's

website www.reactenergyplc.com.

REACT also announces that the Annual General Meeting of the

Company will be held at the Cork International Airport Hotel, Cork,

on 31 January, 2017 at 11.00 a.m.

The Notice of the AGM is being posted to shareholders today and

copies are available on the Company's website

www.reactenergyplc.com.

For further information:

+353 (0) 21

REACT Energy plc 2409 056

Gerry Madden / Brendan Halpin

Strand Hanson Limited - Nomad +44 (0) 20

& Broker 7409 3494

James Harris / Richard Tulloch

/ Ritchie Balmer

About REACT:

REACT Energy plc is committed to operating clean electricity and

heat generation plants in the UK and Ireland. The Company seeks to

identify, build, own and operate renewable projects and possesses

significant knowledge of energy markets, clean technologies, fuel

sources, project development, project finance and project delivery.

REACT currently has four operational clean energy plants generating

revenue from the sale of electricity and heat. The generation of

clean electricity and heat from sustainable sources has the

potential to address the key energy challenges of energy security

and carbon commitment and provide strong returns on capital

employed.

The Company is quoted on AIM and trades as REAC. Further

information on the Company can be found at

www.reactenergyplc.com.

REACT Energy plc

Chairman and Chief Executive's Report

The Company presents the 2016 Annual Report, which gives an

update on the activities of the Company over the 2016 financial

period as well as updating on recent activities, including, as

announced on 12 December 2016, an increase in amount and extension

of an existing loan facility with EBIOSS to cover working capital

requirements of the Company.

EBIOSS is an industrial engineering group and is involved in the

engineering, construction, project development and operation of

waste-to-synthesis gas plants. It operates at an international

level and owns a state of the art technology and differential

positioning in designing and construction of waste gasification

power plants with power capacity from 500 kilowatts ("kWs") to 10

megawatts ("MWs"). EBIOSS has developed its own technology, the

EQTEC Gasifier Technology (EGT) by which different types of waste

are transformed into synthesis gas. This leading technology on

waste gasification has made possible the design construction and/or

operation of waste gasification plants in Spain, France, Germany,

India, Italy and Bulgaria among other countries, for third party

international energy groups and for use by EBIOSS itself. EBIOSS is

quoted on Mercado Alternativo Bursátil ("MAB"), the alternative

market of the Spanish Stock Exchanges.

Whilst the Company continues to execute on its strategy, general

market conditions continue to impact investment sentiment. As a

result of this ongoing uncertainty, and to ensure that the Company

continues to have in place the necessary resources to meet this

dynamic business environment, the Board continuously reviews the

Company's strategy, cost base and financing structures to ensure it

is well positioned and appropriately capitalised to take advantage

of opportunities that present in the sector in which it

operates.

During the financial year in question the Company also:

-- Exited the Examinership process in July 2015

-- Recommenced trading of the Company's shares on AIM

-- Secured a EUR750,000 loan facility in January from EBIOSS

which the Company has now fully utilised.

-- Secured GBP1m in funding by way of a Secured Loan facility

with EcoFinance (GLI) Limited which included a refinancing of a

number of existing debt facilities with Altair Group Investment

Limited.

-- Entered into an agreement in December with EBIOSS to purchase

its EGT technology with a power output of 4MW, which NBL will use

in the repowering of the Newry Biomass gasification project

-- The gasification equipment purchased from EBIOSS cost

EUR4.963 million (subsequently increased to EUR5.150 million and

will form part of an Engineer, Procure and Construct ("EPC")

contract to be signed between NBL and EQTEC Iberia ("EQTEC"), a

subsidiary of EBIOSS, in respect of the Newry Project. REACT has

granted EQTEC exclusivity to provide gasification technology as

part of EPC contracts for its biomass gasification project pipeline

in the UK

-- NBL applied and received confirmation from The Office of Gas

and Electricity Markets ("Ofgem") that they have been granted an

extension to 31 March 2018 for the Renewables Obligation ("RO")

registration of the Newry Project

-- Gained planning approval for the construction and operation

of an energy recovery facility using EGT at Clay Cross in

Derbyshire by Clay Cross Biomass Limited a company in which REACT

has a 90% interest, subject to finalising a Section 106 agreement

pursuant to the conditions set out in the report by the planning

authorities

-- Continued to operate its wind turbine at Pluckanes and three biomass heat projects in the UK

Post period end:

-- In October 2016, signed conditional heads of agreement with

several parties to potentially fund, through a combination of

equity and debt, the circa GBP11.2 million repowering of the NBL

4MW biomass gasification project using EGT

-- It was announced on 12 December 2016 that the terms of the

working capital facility with EBIOSS had been amended by agreement

between that parties such that the amount of the facility was

increased by EUR600,000 to EUR1,350,000 and the repayment date of

the increased facility was extended to 7 January 2018. The

increased facility is to cover the working capital requirements of

the Company.

REACT Energy plc

Chairman and Chief Executive's Report - continued

Current Trading and Prospects

The Company is a clean energy project developer and operator.

The Company seeks to take projects from "Greenfield" (greenfield

land) stage to "Shovel Ready" stage (projects where planning and

development is advanced enough that, given sufficient funding,

construction can begin within a very short time frame) with turnkey

construction contracts and financial packages in place. Debt and

equity partners are then sought to fund the construction phase in

return for a share of the project equity.

The Company develops and builds projects currently using wood

and waste wood as the sustainable fuel source. The core focus has

been on converting biomass or wood into clean electricity and heat.

This was based primarily on the technology available to convert the

fuel into power and the level of government subsidies available

specifically for biomass fuel and the relevant conversion

technology.

In reporting its interim results for the six months to 31

December 2015, the Company stated that the political and regulatory

environment within the UK continued to be challenging, with a lack

of direction and continued changes to the long-term support

mechanisms available for renewable energy projects developed under

the Electricity Market Review (EMR), with the introduction of

Contracts for Difference (CfD) in place of the Renewables

Obligation (RO) regime. As part of its ongoing cooperation and

collaboration with EBIOSS Energy, the Company has reviewed its

strategy for developing and operating clean energy power plants in

the UK.

Overview of the UK Renewable Energy Market

The UK developed its renewable energy sector based on the

Renewables Obligation (RO), a quota scheme that led to the only

publicly subsidised electricity investments in the UK after the

1989 privatisation era. In 2010, the UK government also introduced

the Feed in Tariff (FIT) scheme for supporting small scale

low-carbon installations up to a maximum capacity of 5MW.

Post 2014, the UK's electricity sector is governed by the

Electricity Market Reform (EMR). Based on the EMR, all electricity

investments are publicly subsidised with the fossil-fuel sectors

receiving subsidies by way of the capacity market and the renewable

energy sector by way of the Contracts for Difference (CfDs) scheme.

Having announced the closing of the RO Scheme, the last projects

under the RO Scheme, which needed confirmation of a "grace period"

from Ofgem, must be completed before 31 March 2018. The UK

Government published, in November 2016, a draft of the Budget

Notice ahead of the CfD allocation round opening in April 2017.

This set an overall budget for total support payments for projects

delivered in the two years from the middle of 2021 to 2023 and also

set out strike prices for the various less well established

technologies including advance conversion technologies, such as

advanced gasification.

Overview of the UK Energy from Waste Market

The UK has, over the past ten years, seen a transformation in

its management of household waste. This has been most marked within

local authorities as they make the transition from landfill to

recycling / composting and energy recovery. The waste market is now

moving towards what is termed 'merchant' projects. These are

projects which utilise private, specialist fuel supply such as

refuse derived fuel (RDF), municipal solid waste (MSW), commercial

and industrial waste and waste wood. RDF or solid recovered fuel /

specified recovered fuel (SRF) is a fuel produced by shredding and

dehydrating municipal solid waste (MSW) with a waste converter

technology. In addition, these merchant projects tend to utilise

new advanced conversion technologies and include specialist sub

sectors, like advanced gasification.

REACT Energy plc

Chairman and Chief Executive's Report - continued

Gasification is a process that converts organic or fossil based

carbonaceous materials at elevated temperatures with controlled

amounts of oxygen into carbon monoxide, hydrogen, carbon dioxide

and methane. It is a well-known technology, and its advanced use

with mixed waste feedstock is continually evolving. By its nature

"energy from waste" bridges two sectors both of which are evolving.

It has its roots firmly in waste management but is becoming of

increasing importance to energy generation.

Waste management is changing to be much less about how society

get rid of things it no longer wants and more about managing

discarded resources back into the economy. Likewise, energy

generation is evolving to make best use of renewables, novel fuels

and different energy outputs always with an eye to energy security.

The need to meet 2020 landfill diversion targets for biodegradable

waste has been a major driver for waste policy and infrastructure

development in the UK over the last ten years. The landfill tax is

a key instrument to meeting the target along with other policies

and initiatives. There are wider societal and environmental

benefits associated with energy generation and use that will drive

energy policy and impact on energy from waste. Energy from waste in

particular has the potential to deliver low carbon energy in a

cost-effective way and as a non-intermittent source helps provide

energy security.

The term 'energy from waste' (commonly abbreviated to EfW)

covers a range of different processes and technologies and

describes a number of treatment processes and technologies used to

generate a usable form of energy and which also reduce the solid

volume of residual waste. This energy can be in the form of

electricity, heating and/or cooling or a combination of these

forms. Conversion treatments are processes which convert residual

waste or RDF/SRF into a more useable form of energy such as heat or

electricity. These processes include gasification such as the

EGT.

By choosing the right location, the right technology and the

right processing, energy from waste can help to deliver much needed

long-term affordable, low carbon and secure energy.

The EGT can operate economically over a wider range of scales

and is therefore potentially more flexible and has the potential to

generate much greater efficiencies through a range of outputs.

The UK faces a potential energy gap, with the margin of supply

over demand expected to diminish to very-thin levels from 2015

onwards. The scheduled closure of old nuclear facilities has not

been matched by the construction of replacement new-build nuclear

sites and/or other power station facilities.

Local Authority managed waste going for combustion with energy

recovery rose 13% to 5.5 million tonnes in 2012/13 and has more

than doubled in the last ten years. A 2010 survey found only 2% of

commercial and industrial waste was combusted with energy recovery

in England. In 2012, 24 Energy from Waste plants operating in

England were treating almost 4 million tonnes of residual MSW and

SRF. In 2010, the combustion of the biodegradable component of MSW

provided 6.2% of the UK's total renewable electricity generation

and 4.7% of total combined renewable heat and electricity

generation. Waste derived renewable electricity from thermal

combustion in England is forecast to grow from the current 1.2

terrawatt hours ("TWh") to between 3.1TWh and 3.6TWh by 2020.

REACT and EBIOSS Energy have entered into mutually beneficial

business arrangements over the last year with the objective of

working closer together to avail of opportunities initially in the

UK EfW market.

REACT Energy plc

Chairman and Chief Executive's Report - continued

Current project portfolio

Newry

As noted above, NBL entered into an agreement with EBIOSS Energy

to purchase its EGT, with a power output of 4MW, which NBL will use

in the repowering of the Newry biomass plant. The equipment has

been delivered and is currently on site in Newry.

Once financial close on the repowering of the Newry biomass

plant is achieved, the Company expects that the plant will be able

to again export electricity to the grid within 15 months (i.e. pre

31 March 2018).

NBL applied and received confirmation from Ofgem that they have

granted an extension to 31 March 2018 for the RO registration of

the Newry biomass plant, at which point the plant will need to have

been repowered and commissioned, which the Company intends it will

have been.

The Company announced on 11 October 2016 that it has signed

conditional heads of agreement with several parties to potentially

fund, through a combination of equity and debt, the repowering of

the plant. The heads of agreement envisage a total investment of up

to GBP11.2 million to be made both directly, and indirectly through

REACT, into NBL.

The terms of the heads of agreement between the parties are

legally binding, however, are subject to the completion of, inter

alia, legal, financial and technical due diligence, which has

commenced and is expected to be completed shortly. The terms

therefore may change from that set out in the heads of agreement.

There can be no guarantee that definitive agreements will be

concluded on the terms currently envisaged or at all, or on the

timetable envisaged.

If it was not possible to reach agreement with the parties, the

Company, in partnership with EBIOSS Energy and its subsidiary

EQTEC, using their combined resources, would commission the project

to a basic level to ensure that the ROCs are registered for the

plant by 31 March 2018. In this scenario, the plant having been

commissioned to basic standards, would be refinanced with third

party funders and completed in full.

Enfield, London

The Enfield Biomass project is a 12MW biomass gasification

project located in Enfield, London. The project has secured full

planning and permitting approval and is ready to construct. The

Company obtained an updated planning permission for converting

60,000 tonnes per annum of Grade C wood waste in January 2014. An

environmental permit was received April 2012.

As part of the Examinership process, the Company ceased to

pursue the legal action, which was announced on the 3 June 2015, in

relation to the Enfield Biomass Limited property lease agreement

and has agreed to the revocation of the existing lease on that

site. The site has currently been put up for sale by the existing

landlord. The Company intends to open discussions with a new owner

in relation to the future of this site and further updates will be

made as and when appropriate.

REACT Energy plc

Chairman and Chief Executive's Report - continued

Clay Cross

On 12 April 2016, the Company announced that the Regulatory

Planning Committee of Derbyshire County Council (the "Committee")

voted in favour, on 11 April 2016, to approve the construction and

operation of an energy recovery facility at Clay Cross Facility in

Derbyshire (the "Clay Cross Facility") by Clay Cross Biomass

Limited ("Clay Cross Biomass"), a company in which REACT has a 90%

interest, subject to finalising an agreement under Section 106 of

the Town and Country Planning Act 1990 pursuant to the conditions

set out in the report to the Committee.

Clay Cross Biomass anticipates utilising the EGT, the same

technology that the Company is installing at Newry Biomass, to

power the plant as part of the EPC contract for the construction of

the Clay Cross Facility. Once commissioned, the Clay Cross Facility

is expected to convert approximately 80,000 tonnes per annum of

construction and demolition (C&D) waste wood, which is

currently sent to landfill, to generate up to 12MW of electrical

energy, sufficient to provide electricity for over 18,000 homes,

and up to 14MW of thermal energy per annum.

The Company is currently in preliminary discussions to secure

finance for the construction of the Clay Cross Facility and

estimates that it will take approximately 18 months from obtaining

finance to the final commissioning of the plant. The expected cost

to develop the Clay Cross Facility is approximately GBP50

million.

Biomass Heat

The Company owns 30% of a special purpose vehicle ("SPV") set up

with Equitix ESI Finance Limited ("Equitix") and receives

development and on-going management fees from it. The SPV currently

operates three biomass heat projects in the UK.

Renewable Heat Incentive (RHI) is the primary incentive scheme

in operation for these projects. The digression in RHI tariffs for

boilers below 200kw range is impeding progress on projects within

the pipeline and represents a continuing challenge to completion of

project financing.

Wind Electricity Generation

In Ireland, the Company is currently operating a cash generating

800kW Enercon wind turbine in Pluckanes, County Cork. This plant

was financed by company equity and bank debt provided by AIB Bank

plc and has a 15-year Power Purchase Agreement with Viridian Energy

Limited.

The Company is advancing the project pipeline with the intention

to finance a number of small-scale projects together via company

equity and bank financing, thereby creating a small-scale wind

portfolio. The return on capital employed for each project will be

assessed to ensure an adequate return. The Company is also working

on creating a master supply agreement with a turbine manufacturer

arising from wind measurement and site analysis.

Future strategy

The overall business strategy of the Group is to focus on taking

advantage of the significant opportunities in the Energy from Waste

Market in the UK.

REACT Energy plc

Chairman and Chief Executive's Report - continued

Financial position

FY 2016 Financials

-- Loss of EUR1.540 million versus a profit of EUR5.319 million

in 2015 (EUR0.091 million loss related to continuing operations in

2015)

-- Loss for the year includes net foreign exchange losses of

EUR0.164 million and interest costs of EUR0.603 million

-- Loss per share of 0.015 cents versus a profit of 0.173 cents in 2015

-- At 30 June 2016, total cash and cash equivalents were

EUR0.324 million versus EUR0.211 million in 2015

Post FY 2016 Financials

-- Further drawdown of EUR175,000 on loan facility from EBIOSS

together with an increase in facility size from EUR750,00 to

EUR1,350,000 and extension of the term to 7 January 2018

Outlook

After what has been a very tough 18 months for everyone, thanks

to the major support of the Company's existing stakeholders and new

investor EBIOSS, the Company now has the potential to take

advantage of the opportunities presenting themselves in the UK

Energy from Waste market and in turn advance its pipeline of

projects throughout the UK.

The Company looks forward to updating its shareholders in the

future on further developments as the Company further builds its

position in the Energy from Waste market.

Dermot O'Connell Gerry Madden

Chairman Chief Executive

REACT Energy plc

Consolidated statement of profit or loss

for the financial year ended 30 June 2016

Notes 2016 2015

EUR EUR

Revenue 246,864 279,966

Cost of sales - (10,145)

Gross profit 246,864 269,821

Operating expenses

Administrative expenses (712,468) (2,293,489)

Share of fair value of previously

held equity interest in

Newry Biomass Limited - 2,335,810

Impairment of property,

plant and equipment (307,759) (336,532)

Foreign currency losses/(gains) (163,721) 218,518

Operating (loss)/profit (937,084) 194,128

Finance costs (602,975) (285,342)

Finance income 15 -

Loss before taxation (1,540,044) (91,214)

Income tax credit - -

Loss for the year from continuing

operations (1,540,044) (91,214)

Profit arising from the

derecognition of discontinued

operations - 5,307,258

Profit for the year on discontinued

operations - 103,375

Net profit for the year

from discontinued operations - 5,410,633

(Loss)/profit for the year (1,540,044) 5,319,419

(Loss)/profit attributable

to:

Owners of the company (1,041,035) 5,320,045

Non-controlling interest (499,009) (626)

(1,540,044) 5,319,419

2016 2015

EUR per EUR per

share share

Basic (loss)/earnings per

share:

From continuing operations 2 (0.015) (0.003)

From continuing and discontinued

operations 2 (0.015) 0.173

Diluted (loss)/earnings

per share:

From continuing operations 2 (0.015) (0.003)

From continuing and discontinued

operations 2 (0.015) 0.069

REACT Energy plc

Consolidated statement of other comprehensive income

for the financial year ended 30 June 2016

2016 2015

EUR EUR

(Loss)/Profit for the financial

year (1,540,044) 5,319,419

Other comprehensive income

and expense

Items that may be reclassified

subsequently to profit or

loss

Exchange differences arising

on retranslation

of foreign operations (603,466) (683,068)

(603,466) (683,068)

Total comprehensive income

and expense for the year (2,143,510) 4,636,351

Attributable to:

Owners of the company (1,327,723) 4,592,909

Non-controlling interests (815,787) 43,442

(2,143,510) 4,636,351

REACT Energy plc

Consolidated statement of financial position

At 30 June 2016

2016 2015

ASSETS EUR EUR

Non-current assets

Property, plant and equipment 10,799,870 7,201,844

Investments in joint ventures - -

Financial assets - -

Total non-current assets 10,799,870 7,201,844

Current assets

Amounts due under construction

contracts 150,847 150,847

Trade and other receivables 158,029 141,799

Cash and cash equivalents 324,195 211,346

Total current assets 633,071 503,992

Total assets 11,432,941 7,705,836

EQUITY AND LIABILITIES

Equity

Share capital 17,453,246 13,006,149

Share premium 21,863,190 20,713,637

Retained earnings - deficit (40,139,172) (38,811,449)

Deficit attributable to the

owners of the company (822,736) (5,091,663)

Non-controlling interests 1,639,780 2,455,567

Total equity 817,044 (2,636,096)

Non-current liabilities

Borrowings 3,379,621 -

Total non-current liabilities 3,379,621 -

Current liabilities

Trade and other payables 5,425,146 4,440,615

Borrowings 1,811,130 5,901,317

Total current liabilities 7,236,276 10,341,932

Total equity and liabilities 11,432,941 7,705,836

REACT Energy plc

Consolidated statement of cash flows

for the financial year ended 30 June 2016

2016 2015

EUR EUR

Cash flows from operating activities

(Loss)/profit for the financial

year (1,540,044) 5,319,419

Adjustments for:

Depreciation of property, plant

and equipment 73,272 78,607

Profit on disposal of property,

plant and equipment - (5,576)

Share of fair value of previously

held equity interest in Newry

Biomass Limited - (2,335,810)

Impairment of property, plant

and equipment 307,759 336,532

Impairment of amounts due from

customers under construction

contracts (1,246) 26,777

Unrealised foreign exchange movements (583,265) (334,659)

Increase in provision for impairment

of trade and other receivables - 34,423

Gain on de-recognition of subsidiary

undertakings - (5,307,258)

Operating cash flows before working

capital changes (1,743,524) (2,187,545)

Decrease/(Increase) in:

Amounts due from customers under

construction contracts - (55,963)

Trade and other receivables 134,273 (147,189)

(Decrease)/increase in:

Amounts due to customers under

construction contracts - (129,197)

Trade and other payables 155,891 1,479,741

Cash used in operating activities (1,453,360) (1,040,153)

Finance costs 602,975 285,342

Finance income (15) -

Income taxes (paid)/refunded (6) 2,705

Net cash used in operating activities (850,406) (752,106)

Cash flows from investing activities

Additions to property, plant

and equipment (311,490) (425,882)

Proceeds from sale of property,

plant and equipment - 277,707

Interest received 15 -

Net cash inflow from acquisition

of subsidiaries - (1)

Net cash inflow on derecognition

of subsidiaries - 165,991

Net cash (used in)/generated

from investing activities (311,475) 17,815

Cash flows from financing activities

Proceeds from borrowings 2,101,631 444,052

Repayments of borrowings (15,000) (18,750)

Loan issue costs (484,476) -

Share issue costs (128,081) -

Interest paid (199,885) (47,181)

Net cash generated from financing

activities 1,274,189 378,121

Net increase/(decrease) in cash

and cash equivalents 112,308 (356,170)

Cash and cash equivalents at

the beginning of the financial

year 211,341 567,511

Cash and cash equivalents at

the end of the financial year 323,649 211,341

REACT Energy plc

Extract from the notes to the consolidated financial

statements

for the financial year ended 30 June 2016

1. Basis of Preparation and Going Concern

The Group's consolidated financial statements have been prepared

in accordance with International Financial Reporting Standards

(IFRS) as adopted by the European Union ('EU') and effective at 30

June 2016 for all periods presented as issued by the International

Accounting Standards Board.

The consolidated financial statements are prepared under the

historical cost convention except for certain financial assets and

financial liabilities which are measured at fair value. The

principal accounting policies set out below have been applied

consistently by the parent company and by all of the Company's

subsidiaries to all periods presented in these consolidated

financial statements.

The financial statements of the parent company, REACT Energy plc

have been prepared in accordance with International Financial

Reporting Standards (IFRS) as adopted by the European Union ('EU')

effective at 30 June 2016 for all periods presented as issued by

the International Accounting Standards Board and Irish Statute

comprising the Companies Act, 2015.

The Group incurred a loss of EUR1,540,044 (2015: profit of

EUR5,319,419) during the year, and had net current liabilities of

EUR6,603,205 (2015: EUR9,837,940) and net assets of EUR817,044

(2015: net liabilities of EUR2,636,096) at 30 June 2016.

Development of, and revenue generation from, the principal

assets of the Company will require additional financing which is

expected to be sourced in due course.

The Company announced on 12 December 2016 that a EUR750,000 loan

facility secured in January 2016 from EBIOSS has now been fully

utilised. It was also announced that the terms of the facility had

been amended by agreement between that parties such that the amount

of the facility was increased by EUR600,000 to EUR1,350,000 and the

repayment date of the increased facility was extended to 7 January

2018. The increased facility is to cover the working capital

requirements of the Company.

The Directors have given careful consideration to the

appropriateness of the going concern basis in the preparation of

the financial statements. The validity of the going concern basis

is dependent upon additional financing being obtained for the

development of, and revenue generation from, the principal assets

of the Company and to provide ongoing general working capital. As

no definite funding has been received on a number of developments

of the Group, a material uncertainty exists in relation to the

Company and the Group's ability to continue as a going concern.

The Directors believe that progress towards securing finance has

been made. The Directors have a reasonable expectation that the

Company will source this financing and the Group will have adequate

resources to continue in operational existence for the foreseeable

future. For these reasons the Directors continue to adopt the going

concern basis of accounting in preparing the financial statements.

The financial statements do not include any adjustments that would

result if the Group was unable to continue as a going concern.

The Group continues to invest capital in developing and

expanding its portfolio of clean energy projects. The nature of the

Group's development programme means that the timing of funds

generated from developments is difficult to predict. Management

have prepared financial forecasts to estimate the likely

cash requirements of the Group over the next 12 months. The

forecasts include certain assumptions with regard to the costs of

ongoing development projects, overheads and the timing and amount

of any funds generated from developments. The forecasts indicate

that during this period the Group will require additional funds to

continue with its activities and its planned development

program.

REACT Energy plc

Extract from the notes to the consolidated financial

statements

for the financial year ended 30 June 2016

1. Basis of Preparation and Going Concern - continued

Whilst the strategy is to build, own and operate plants, once a

site has been secured and planning and permitting obtained the

Group would be in a position, if it so chose, to monetise the value

of the project.

2. (LOSS)/EARNINGS PER SHARE 2016 2015

Basic (loss)/earnings per share EUR per EUR per

share share

From continuing operations (0.015) (0.003)

From discontinued operations - 0.176

Total basic (loss)/earnings

per share (0.015) 0.173

Diluted (loss)/earnings per

share

From continuing operations (0.015) (0.003)

From continuing and discontinued

operations (0.015) 0.069

The loss and weighted average number of ordinary shares used in

the calculation of the basic and diluted (loss)/earnings per share

are as follows:

2016 2015

EUR EUR

(Loss)/profit for year attributable

to equity holders of the parent (1,041,035) 5,320,045

Profit for the year from discontinued

operations used in the calculation

of basic earnings per share

from discontinued operations - 5,410,633

Losses used in the calculation

of basic loss per share from

continuing operations (1,041,035) (90,588)

Weighted average number of ordinary

shares for

the purposes of basic (loss)/earnings

per share 69,684,580 30,669,522

Weighted average number of ordinary

shares for

the purposes of diluted (loss)/earnings

per share 69,684,580 42,990,834

Dilutive and anti-dilutive potential ordinary shares

The following potential ordinary shares were included in the

2015 diluted earnings per share calculation but were excluded in

2016 as they were anti-dilutive.

2016 2015

Share warrants in issue 35,245,833 1,142,248

Convertible loans in issue 9,166,667 11,179,064

Total anti-dilutive shares 44,412,500 12,321,312

REACT Energy plc

Extract from the notes to the consolidated financial

statements

for the financial year ended 30 June 2016

3. EVENTS AFTER THE BALANCE SHEET DATE

Increase and extension of Loan Facility

The Company announced on 12 December 2016 that a EUR750,000 loan

facility secured in January 2016 from EBIOSS has now been fully

utilised. It also announced that the terms of the facility had been

amended by agreement between the parties such that the amount of

the facility was increased by EUR600,000 to EUR1,350,000 and the

repayment date of the increased facility was extended to 7 January

2018. The increased facility is to cover the working capital

requirements of the Company.

Project finance Heads of Agreement

On 11 October 2016, the Company announced that it had signed

conditional heads of agreement with several parties to potentially

fund, through a combination of debt and equity, the repowering of

its 4MW biomass gasification project located in Newry, Co. Down,

Northern Ireland ("Newry Biomass") and owned by its 50.02%

subsidiary, Newry Biomass Limited ("NBL").

The Heads of Agreement envisage a total investment of up to

GBP11.2 million to be made both directly and indirectly through the

Company, into NBL, through a combination of debt and equity. If an

agreement is concluded, the equity component of the investment is

to be provided by a sub fund of the Ethika Fund SICAV Plc, a

Professional Investor Fund ("Ethika"), and Kyotherm SAS, a

France-based equity investor in biomass, geothermal energy and

energy saving projects. Under the terms of the Heads of Agreement,

Ethika is also to procure the debt financing for the

repowering.

The terms of the Heads of Agreement between the parties are

legally binding, however, are subject to the completion of, inter

alia, legal, financial and technical due diligence, which is

currently under way and is expected to be completed before the end

of the calendar year, and therefore may change from that set out in

the Heads of Agreement. There can be no guarantee that definitive

agreement will be concluded on the terms currently envisaged or at

all, or on the timetable envisaged.

There is a possibility that the equity component of the

investment may require, inter alia, shareholder approval; however,

this will not be known until the conclusion of the due diligence

exercise. In the event that shareholder approval is required, the

Company will prepare and send the necessary documentation to the

shareholders to convene a general meeting of the Company to approve

the proposals.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR KMMZZGFDGVZG

(END) Dow Jones Newswires

December 23, 2016 02:00 ET (07:00 GMT)

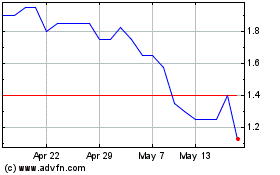

Eqtec (LSE:EQT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eqtec (LSE:EQT)

Historical Stock Chart

From Jul 2023 to Jul 2024