The Group operates in two principal geographical areas: Republic

of Ireland (country of domicile), and the United Kingdom. The

Group's revenue from continuing operations from external customers

and information about its non-current assets* by geographical

location are detailed below:

Revenue from Jointly Non-current assets*

Controlled Entities

and External Customers

(Restated)

6 Months 6 Months As at As at

to to

31 Dec 2012 31 Dec 2011 31 Dec 2012 30 Jun

2012

EUR EUR EUR EUR

Republic of Ireland - 45,608 2,571,224 757,329

United Kingdom 1,764,791 7,334,934 529,016 -

1,764,791 7,380,542 3,100,240 757,329

* Non-current assets excluding financial instruments and

investment in jointly controlled entities.

The management information provided to the chief operating

decision maker does not include an analysis by reportable segment

of assets and liabilities and accordingly no analysis by reportable

segment of total assets or total liabilities is disclosed.

6 months 6 months

ended ended

6. INCOME TAX EXPENSE 31 Dec 2012 31 Dec

2011

Income tax expense comprises: EUR EUR

Current tax - -

Deferred tax - -

Income tax expense recognised in profit - -

or loss

An income tax charge does not arise for the six months ended 31

December 2012 or 31 December 2011 as the effective tax rate

applicable to expected total annual earnings is Nil as the Group

has sufficient tax losses coming forward to offset against any

taxable profits. A deferred tax asset has not been recognised for

the losses coming forward.

(Restated)

7. LOSS PER SHARE 6 months 6 months

ended ended

31 Dec 2012 31 Dec 2011

EUR EUR

Basic (loss)/earnings per share

From continuing operations (0.002) (0.003)

From discontinued operations - 0.002

Total basic loss per share (0.002) (0.001)

Diluted (loss)/earnings per share

From continuing operations (0.002) (0.002)

From discontinued operations 0.001 0.001

Total diluted loss per share (0.001) (0.001)

Basic (loss)/earnings per share

The loss and weighted average number of ordinary shares used in

the calculation of the basic (loss)/earnings per share are as

follows:

6 months 6 months

ended ended

31 Dec 2012 31 Dec 2011

EUR EUR

Loss for period attributable to equity

holders of the parent (886,726) (366,696)

Profit for period from discontinued operations

used in the calculation of basic earnings

per share from discontinued operations 155,456 326,380

Losses used in the calculation of basic

loss per share from continuing operations (1,042,182) (693,076)

Weighted average number of ordinary shares

for

the purposes of basic loss per share 551,919,336 225,281,916

Diluted (loss)/earnings per share

The loss used in the calculation of all diluted earnings per

share measures is the same as those for the equivalent basic

earnings per share measures, as outlined above.

The weighted average number of ordinary shares for the purposes

of diluted loss per share reconciles to the weighted average number

of ordinary shares used in the calculation of basic loss per share

as follows:

6 months 6 months

ended ended

31 Dec 2012 31 Dec 2011

Weighted average number of ordinary

shares used

in the calculation of basic loss per

share 551,919,336 255,281,916

"A" Shares in issue 99,117,952 99,117,952

Weighted average number of ordinary

shares used in the

calculation of diluted earnings per

share 651,037,288 354,399,868

Share warrants which could potentially dilute basic earnings per

share in the future have not been included in the calculation of

diluted earnings per share as they are anti-dilutive for the

periods presented. The dilutive effect as a result of share

warrants in issue as at 31 December 2012 would be to increase the

weighted average number of shares by 37,511,646 (31 December 2011:

32,592,915).

Convertible preference shares which could potentially dilute

basic earnings per share in the future have not been included in

the calculation of diluted earnings per share as they are

anti-dilutive for the periods presented. The dilutive effect as a

result of preference shares in issue as at 31 December 2012 would

be to increase the weighted average number of shares by 3,125,000

(31 December 2011: 3,125,000).

Convertible loans which could potentially dilute basic earnings

per share have not been included in the calculation of diluted

earnings per share as they are anti-dilutive for the periods

presented. The dilutive effect as a result of loans in issue as at

31 December 2012 would be to increase the weighted average of

shares by Nil (31 December 2010: 21,000,000).

As noted in note 14 below, the Kedco Group will be required to

make a further issue of 59,737,418 ordinary shares in Kedco plc to

the former shareholders of Reforce Energy Limited ("Reforce") when

Reforce obtains eight planning permissions for renewable energy

projects from its project pipeline, as part of the agreement to

purchase Reforce. If this transaction had taken place prior to 31

December 2012, they would have affected the calculation of the

weighted average number of shares in issue for the purposes of

calculating both the basic earnings per share and diluted earnings

per share by 9,956,236 (assuming the shares were issued in December

2012).

8. FINANCIAL ASSETS

31 Dec 2012 30 June

2012

EUR EUR

Loans advanced to Jointly Controlled

Entities

Balance at start of period 7,608,687 7,351,666

Loan eliminated as part of acquisition

of jointly (990,000) -

controlled entity

Foreign currency exchange movement (101,153) 257,021

Balance at end of period 6,517,534 7,608,687

9. INVESTMENT IN JOINTLY CONTROLLED ENTITIES

Details of the Group's interests in jointly controlled entities

at 31 December 2012 are as follows:

Name of jointly Country of Shareholding Principal activity

controlled entity incorporation

Newry Biomass Limited Northern Ireland 50%* Energy utility

company

Asdee Renewables Republic of 50% Energy utility

Limited Ireland company

Bridegreen Energy Republic of 50% Energy utility

Limited Ireland company

* Under the terms of the joint venture agreement for Newry

Biomass Limited, the split of the share of profits in the company

are on the basis of (1) the aggregate amount of called up share

capital in the company and (2) the nominal holdings of loan notes

issued by the company. As a result of the loan notes issued by

Newry Biomass Limited in the period ended 31 December 2011, the

share of the profits/losses to which the Group is entitled to is

92%.

Summarised financial information in respect of the group's

interests in jointly controlled entities is as follows:

31 Dec 30 June

2012 2012

EUR EUR

Non-current assets 13,325,399 11,095,301

Current Assets 99,804 4,863,923

Non-current liabilities (6,787,407) (6,892,749)

Current liabilities (6,090,189) (9,705,017)

Net assets/(liabilities) 547,607 (638,542)

Group's share of net assets/liabilities of

jointly controlled entities 246,539 (509,599)

6 months 6 months

ended ended

31 Dec 2012 31 Dec 2011

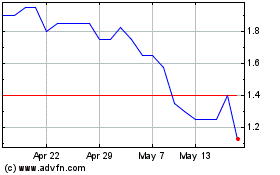

Eqtec (LSE:EQT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eqtec (LSE:EQT)

Historical Stock Chart

From Jul 2023 to Jul 2024