-- 30MW Co-development Agreement: Reforce Energy signed a

co-development agreement in January 2013 with a private landowner

for three windfarm projects located in the North west of Ireland

with a minimum capacity of 10MWs each. The planning process for

these projects has already started and a formal submission will be

made in October 2013.

-- Other wind projects: The Group intends to finance groups of

small-scale projects together, thereby creating a small-scale wind

portfolio. Pluckanes, Altilow and Moneygorm will be the first of

such portfolios into which further projects can be added.

In addition to the above, the Group has made advances in other

areas, including:

-- Small-scale solar projects: Two projects are already planning

approved, with a plan to install and commission these during 2013.

There are further opportunities for solar projects within the

existing pipeline.

-- Anaerobic Digestion ("AD"): Planning has been approved with

waste permits in place Cork and Kerry AD 500kW projects. The Board

will review these projects pending the review of government support

scheme and project economies. At least two UK AD projects will be

brought forward in 2013.

Outlook

Against the positive backdrop of the successful balance sheet

restructuring, the sale of electricity from the Newry Biomass plant

and the progress made with the Group's portfolio of development

projects, the Company will continue to develop and review its

project pipeline and focus on its funding requirements including

raising additional project debt and project equity in 2013 and

securing additional funds to continue with its activities and its

planned development program.

The Board believes that the outlook for the Company is positive

and that Kedco has the right strategy, the right management team

and the right project portfolio to deliver sustained shareholder

value into the future.

Dermot O'Connell Gerry Madden

Non-Executive Chairman Chief Executive Officer

Kedco plc

Condensed Consolidated Income Statement

for the six months ended 31 December 2012

(Restated)

6 months ended 6 months ended

Notes 31 Dec 2012 31 Dec 2011

Continuing operations: EUR EUR

Revenue 5 1,764,791 7,380,542

Cost of sales (1,764,791) (7,258,735)

--------------- ---------------

Gross profit - 121,807

Operating expenses

Administrative expenses (760,313) (698,822)

(Losses)/gains on foreign exchange (144,728) 343,689

Revision of accounting estimates - 250,297

Other operating income 9,000 2,100

--------------- ---------------

Operating (loss)/profit (896,041) 19,071

Finance costs (125,933) (521,946)

Share of losses on joint ventures

after tax 9 (20,208) (190,437)

Finance income - 236

--------------- ---------------

Loss before taxation 5 (1,042,182) (693,076)

Income tax expense 6 - -

--------------- ---------------

Loss for the period from continuing

operations (1,042,182) (693,076)

--------------- ---------------

Discontinued operations

Profit for the period from discontinued

operations 13 164,322 326,380

Loss recognised on disposal

of subsidiary 13 (8,866) -

--------------- ---------------

155,456 326,380

--------------- ---------------

Loss for the period (886,726) (366,696)

=============== ===============

(Loss)/Profit attributable to:

Owners of the Company (919,591) (431,972)

Non-controlling interest 32,865 65,276

--------------- ---------------

(886,726) (366,696)

=============== ===============

6 months 6 months ended

ended

31 Dec 2012 31 Dec 2011

EUR EUR

Euro per Euro per share

share

Basic loss per share:

From continuing and discontinued

operations 7 (0.002) (0.001)

From continuing operations 7 (0.002) (0.003)

Diluted loss per share:

From continuing and discontinued

operations 7 (0.001) (0.001)

From continuing operations 7 (0.002) (0.002)

Kedco plc

Condensed Consolidated Statement of Comprehensive Income

for the six months ended 31 December 2012

(Restated)

6 months ended 6 months ended

31 Dec 2012 31 Dec 2011

EUR EUR

Loss for the financial period (886,726) (366,696)

Other comprehensive income

and expense

Elimination of profit recognised

in prior year from jointly

controlled entity that was (256,358) -

acquired as a subsidiary in

current period

Exchange differences arising

on retranslation

of foreign operations 51,185 (194,261)

--------------- ---------------

Total comprehensive income

and expense

for the period (1,091,899) (560,957)

=============== ===============

Attributable to:

Owners of the company (1,124,764) (626,233)

Non-controlling interests 32,865 65,276

--------------- ---------------

(1,091,899) (560,957)

=============== ===============

Kedco plc

Condensed Consolidated Statement of Financial Position

As at 31 December 2012

As at As at

Notes 31 Dec 2012 30 June

2012

ASSETS EUR EUR

Non-current assets

Goodwill 10 2,342,501 -

Property, plant and equipment 757,739 757,329

Share of net assets of jointly controlled

entities 9 246,539 -

Financial assets 8 6,517,534 7,608,687

Total non-current assets 9,864,313 8,366,016

------------- -------------

Current assets

Inventories - 50,000

Amounts due from customers under construction

contracts 790,267 1,355,212

Trade and other receivables 714,014 1,605,518

Cash and cash equivalents 433,843 144,764

------------- -------------

1,938,124 3,155,494

Assets classified as held for resale - 6,584,239

------------- -------------

Total current assets 1,938,124 9,739,733

------------- -------------

Total assets 11,802,437 18,105,749

============= =============

EQUITY AND LIABILITIES

Equity

Share capital 11 12,176,200 4,106,808

Share premium 19,097,472 19,375,525

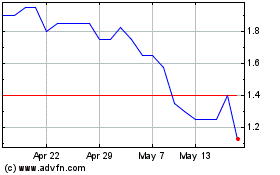

Eqtec (LSE:EQT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eqtec (LSE:EQT)

Historical Stock Chart

From Jul 2023 to Jul 2024