TIDMKED

RNS Number : 0877U

Kedco PLC

21 December 2012

Press release 21 December 2012

Kedco plc

("Kedco" or the "Company")

Completion of acquisition of Reforce Energy Limited

Kedco plc, (AIM:KED) the renewable energy group focusing on the

production of clean energy in the UK and Ireland, announces that it

has completed the acquisition of Reforce Energy Limited ("Reforce")

(the "Acquisition"). Consideration for the Acquisition will

initially be satisfied via the issue of 139,386,678 ordinary shares

in Kedco (the "Ordinary Shares") to Reforce. A further issue of

59,737,148 Ordinary Shares to Reforce will take place when Reforce

obtains eight planning permissions for renewable energy projects

from its project pipeline. The shareholders of Reforce have agreed

to an orderly market arrangement in relation to the Ordinary

Shares, which they will acquire for a period of twelve months from

the date of issue.

Reforce shareholders will be issued with 19,912,383 warrants

(the "Reforce Warrants") to subscribe for Ordinary Shares. The

Reforce Warrants will entitle holders to subscribe for new Ordinary

Shares at a price of GBP0.016 and are exercisable at any time prior

to the third anniversary of their issue.

Reforce is a renewable energy development company focused on

small-scale renewable projects across various technologies.

Reforce's key markets are the UK, Ireland and Northern Ireland,

where it already has an active pipeline of over 60 projects, with a

potential capacity of in excess of 40MW, at various stages of

development. Reforce was founded by Steve Dalton and Tim O'Keeffe

in 2011.

In the period from 18 February 2011 (the date of incorporation

of Reforce) to 31 December 2011, Reforce incurred a loss before tax

of EUR48,260. As at 31 December 2011, Reforce's net assets, which

are recorded at their net book value for accounting purposes,

totalled EUR400,343.

Kedco's consolidated financial statements for the year ending 30

June 2013 will include Reforce's financial performance from the

date of completion of the Acquisition.

Steve Dalton, a director of Reforce will today join the Board of

Kedco as an Executive Director. Mr Dalton was previously head of

RBS Ulster Bank's project finance business in Ireland with specific

responsibility for the financing of renewable energy projects. For

over six years he led the financing of 35 renewable energy projects

with a combined capacity in excess of 500MWs. He was a founder

director of Reforce Energy Limited and Mexican Renewable Energy

Limited, both renewable energy development companies.

As a result of the acquisition of Reforce Energy by Kedco, Mr

Dalton will have an interest in 24,146,213 Ordinary Shares and

3,449,459 Reforce Warrants.

Further information on Mr Dalton is provided below.

Gerry Madden, CEO of Kedco, commented:

"We are very pleased to announce the completion of the

acquisition of Reforce. The acquisition increases our pipeline of

projects under development and adds depth to our management team.

We are delighted to welcome Steve Dalton to the Board as an

Executive Director. With his considerable experience in the

renewable energy sector, he brings invaluable knowledge and

expertise to assist with the Company's future growth and

development. We feel strongly that bringing together both

companies' experience in the renewable energy sector is an ideal

match and enhances our aim of becoming one of the UK and Ireland's

largest independent renewable energy companies."

Exercise of FBD Warrants

As detailed in Kedco's announcement of 27 November 2012, the

Company's major shareholder, Farmer Business Developments plc

("FBD"), currently has 32,352,620 warrants (the "FBD Warrants"). As

a result of the Acquisition, FBD will convert all of its FBD

Warrants into Ordinary Shares on a one-for-one basis (the

"Conversion").

Issue of Management Warrants

On 20 December 2012 the Board of Kedco agreed to grant warrants

to Gerry Madden CEO of the Company, over a total of 30,000,000

Ordinary Shares (the "Management Warrants"). The purpose of the

Management Warrants is to incentivise the CEO during a key phase in

the development of the company. The Management Warrants are

exercisable by Mr Madden at a price of GBP0.016 per ordinary share

and are exercisable at any time prior to the third anniversary of

their issue.

Interests in Kedco shares

Following the Acquisition and the Conversion, the following

Kedco shareholders will have an interest in excess of 3 per cent.

in the Ordinary Shares:

Number of shares Percentage of issued

held share capital following

the Acquisition and

the Conversion

FBD 299,696,768 26.79

Edward Barrett 86,194,592 7.71

Ronan Barrett 65,207,621 5.83

John Barrett 53,092,933 4.75

Johnny Barrett 34,189,491 3.06

Pursuant to the Acquisition and the Conversion, an application

will be made for the admission of 171,739,298 new Ordinary Shares

in the Company to trading on AIM. The new Ordinary Shares, which

will be issued, fully paid, will rank pari passu in all respects

with the existing ordinary shares of the Company. Admission of the

new Ordinary Shares to trading on AIM is expected to occur on 28

December 2012.

As a result of the Acquisition and the Conversion, the total

number of voting rights as at 28 December 2012 will increase to

1,118,502,058. Shareholders should use this figure as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in the Company, under the FSA's Disclosure and

Transparency Rules.

Additional information on Mr Steve Dalton

Mr Steven Dalton, aged 34, is currently a director of Reforce

Energy Limited, Reforce Energy (West) Limited, Mexican Renewable

Energy Limited, SAAI Limited and Pluckanes Windfarm Limited. In the

last five years he has held no other directorships.

There is no other information that is required to be disclosed

under paragraph (g) of Schedule Two to the AIM Rules for Companies

of the London Stock Exchange

- Ends -

For further information:

+353 (0)21 483

Kedco plc 9104

Gerry Madden, CEO and Interim Finance Director

+44 (0)20 7936

Deloitte Corporate Finance - Nomad 3000

David Smith / Byron Griffin

+44 (0)20 7638

SVS Securities plc - Broker 5600

Ian Callaway / Alex Mattey

+44 (0)20 7398

Abchurch Communications 7714

Joanne Shears / Ashleigh Lezard

About Kedco plc

Kedco plc's business strategy is to identify, develop, build,

own and operate renewable energy electricity and heat generation

plants in the UK and Ireland. These plants will contribute to the

need for sustainable energy from renewable sources.

The Company possesses significant knowledge of renewable energy

markets, clean technologies, fuel sources, project development,

project finance and project delivery.

Kedco has a strong pipeline of renewable energy projects at

varying stages of operation and development, including a 4MW plant

in Newry in Northern Ireland whose initial phase has commenced

operation and a site in North London with full Planning and

Environmental Permission for the conversion of 60,000 tonnes of

waste timber per annum into up to 12MW of electricity and heat. The

Company is also currently engaged in the planning process for

proposed renewable energy projects in Rutland, East Anglia and Clay

Cross, Derbyshire.

Kedco was admitted to trading on AIM, a market operated by the

London Stock Exchange, in October 2008 (AIM:KED).

www.kedco.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCBRBDDDUDBGDG

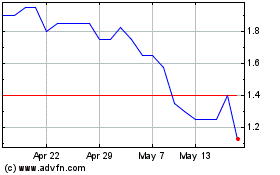

Eqtec (LSE:EQT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eqtec (LSE:EQT)

Historical Stock Chart

From Jul 2023 to Jul 2024