TIDMKED

RNS Number : 7376U

Kedco PLC

21 October 2010 Kedco plc ("Kedco" or the "Company") Preliminary

Results for the year ended 30 June 2010 Kedco plc (LSE: KED

21 October 2010

Kedco plc

("Kedco" or the "Company")

Preliminary Results for the year ended 30 June 2010

Kedco plc (LSE: KED.L), the cleantech group focusing on clean

energy production in the UK, Ireland and Eastern Europe, announces

today its preliminary results for the year ended 30 June 2010.

Key Operational Highlights

-- Site secured on 20 year lease for a biomass wood gasification

plant located in Newry, Northern Ireland, which has full permitting

approval and will be capable of generating 4 megawatt ("MW") of

electricity and 3MW of heat.The plant has an estimated capital cost

of GBP15 million and is expected to generate EBITDA of

approximately GBP2 million per year once complete. In excess of

GBP6 million has been invested in the Newry project to date and

site construction is almost complete.Completed factory acceptance

of 2MW gasifier and produced gas of sufficient quantity and quality

to meet the engine specifications for power generation. The

gasifier is on site in Newry. The project can be completed in two

stages of 2MW each. In order to complete the first 2MW a further

GBP2.0 million needs to be invested in the project. The second

stage to bring the project to 4MW would require a further GBP6.5

million of investment.

-- Received planning permission to build a biomass wood

gasification plant in Enfield, North London capable of generating

12MW of electricity and 10 MW of heat. Plant has an estimated

capital cost of GBP45 million and is expected to generate EBITDA of

approximately GBP9 million per year once complete. Site secured on

20 year lease and 10 year feedstock supply agreement signed with

local waste operator.

-- Generating electricity for sale to national grid from 75KW

containerised biomass wood gasification plant located in Cork,

Ireland.

-- Signed a joint venture agreement with AgriKomp GmbH, a

leading German supplier of biogas plants, with the aim of building

and selling anaerobic digestion plants to convert primarily

agricultural wastes into clean energy in the United Kingdom and

Ireland.

-- Group can now take advantage of UK Government decision to

"grandfather" biomass plants effectively guaranteeing Renewable

Obligation Certificates ("ROCs") levels for 20 years.

-- Successfully completed capacity and efficiency increases at

group's biomass wood processing plant in Vudlande in Latvia which

resulted in an increase in sales to EUR8 million from EUR4 million

in the year. Vudlande reported EBITDA of EUR1.5m in the year.

Key Financial Highlights

-- Revenue of EUR9.0 million, in line with revised expectations

(FY 2009: EUR5.9 million).

-- Gross profit of EUR2.0 million, a substantial increase on the

prior year (FY 2009: EUR0.8 million)

-- Loss for the period of EUR3.2 million, a significant decrease

on the prior year (FY 2009: EUR6.2 million).

-- Additional capital of EUR3.5 million raised during the

financial year.

-- Post-period end loan capital of EUR3.2 million sourced from a

variety of private and institutional investors.

Donal Buckley, Chief Executive Officer of Kedco, commented:

"Kedco continues to progress its strategy of identifying,

developing, owning and building biomass electricity and heat

generating plants in the UK and Ireland. Our current focus is in UK

and Ireland and we have been very successful in progressing our

projects through the various stages from procuring sites and

securing planning and permitting to actual construction.

As projects progress through the various stages their value

increases. By achieving financial closure on projects we

significantly increase their value. We are currently working

through five projects where full planning permissions have been

granted either to Kedco or to Kedco and its partners.

The current economic climate is challenging. Preserving cash and

securing additional finance remain a priority. However the decision

of the UK government to grandfather biomass plants has removed some

of the uncertainty from the sector. This is a time of opportunity

for biomass and in our view this sector now has the best risk

return profile in the renewable energy space. Our model of taking

"best of breed" technology, which exceeds all current environmental

regulations ensures that we can rapidly maximise any opportunities

presented to the Company.

We will continue to progress our pipeline of large scale biomass

projects and to advance our strategy of deploying smaller anaerobic

digestion and gasification plants to the marketplace through our

joint venture with AgriKomp.

For additional information please contact:

Kedco plc +353 (0)21

Donal Buckley, Chief Executive 467 0427

/ Gerry Madden, Finance Director

Deloitte Corporate Finance - +44 (0)20

Nomad 7936 3000

Jonathan Hinton / David Smith

Chairman's Statement

I am pleased to report that the year ended 30 June 2010 proved

to be an important and successful one in the progression of Kedco

plc.

Kedco's business strategy is to identify, develop, own, build

and operate biomass electricity and heat generation plants in the

UK and Ireland using two tried and tested technologies:

gasification of wood and wood waste; and anaerobic digestion of

either food or agricultural waste.

Value is created as we move from one stage of a biomass power

project to the next. When we secure a site, value is created; when

we secure planning and permitting further value is created. Moving

to financial close on projects and actual construction and

operation in our view increases value substantially.

Biomass is a renewable energy source and is made from living or

recently living organisms such as wood and waste. Kedco use

anaerobic digestion and gasification conversion technologies to

convert wood and waste into electricity and heat. Both technologies

qualify for two Renewable Obligation Credits ("ROCs") under the UK

renewable energy regime. It has been confirmed that the Renewable

Obligation Order will continue until 2037.

There has been some uncertainty surrounding continuing ROC

support for biomass and this has led to difficulties for lending

instiutions. However in late July of this year the UK government

made the decision to "grandfather" biomass plants effectively

guaranteeing ROC levels from the plants for 20 years. We welcome

this decision and the degree of certainty it brings.

Having achieved planning and securing a 20 year lease for a

GBP15 million, 4MW biomass wood gasification plant in Newry, Co.

Down Northern Ireland and having spent approximately GBP6 million

in constructing and equipping the plant we believe that the removal

of the uncertainty in relation to ROCs will enable us to achieve

financial close and complete the construction of the plant.

Our success in obtaining planning for a 12MW biomass wood

gasification plant in Enfield in North London has also added value

to the Company and points to the successful execution of the

Company's strategy.

The UK has a significant requirement for new sources of

renewable energy; biomass generation as a proven technology is well

placed to satisfy that need. We expect Kedco to be able to

capitalise on the significant growth in the market for biomass

generation. Our experienced management team has demonstrated that

it can create value by developing biomass projects to the

satisfaction of the town and environmental planners as shown by the

granting of full planning to the site in London.

I would like to thank all my fellow directors and all company

employees, stakeholders and shareholders whose combined efforts and

support have positioned the Company to avail itself of what we

continue to believe, more than ever, to be an exciting and

rewarding opportunity.

William Kingston

Non-Executive Chairman

Chief Executive's Report

Operational Review

I am pleased to be able to report the progress we have made

during the financial year ended 30 June 2010.

Kedco continues to progress its strategy of indentifying,

developing, owning and building biomass electricity and heat

generating plants in the UK and Ireland. We continue to progress

our projects through the various stages from securing sites to

securing planning and permitting to actual construction.

As projects progress through the various stages their value

increases. By achieving financial closure on projects we

significantly increase their value. We are currently working

through five projects where full planning permissions have been

granted either to Kedco or to Kedco and its partners.

We identify seven stages in the development of a biomass power

generation project. These are; initial evaluation, sign letter of

intent secure site, obtain planning and permitting, secure

financial closure, construction and finally operation.

During the financial year we secured a site on a 20 year lease

for a biomass wood gasification plant located in Newry, Northern

Ireland which has full permitting approval and is capable of

generating 4MW of electricity and 3MW of heat. In excess of GBP6

million has been invested in the Newry project to date and site

construction is almost complete. We have completed factory

acceptance of one 2MW gasifier and produced gas of sufficient

quantity and quality to meet the engine specifications for power

generation. We also took delivery of the 2MW gasifier on site in

Newry. In order to complete the project to its full capacity we

need to achieve financial close. The project can be completed in

two stages of 2MW each. In order to complete the first 2MW a

further GBP2.0 million needs to be invested in the project. The

second stage to bring the project to 4MW would require a further

GBP6.5 million of investment.

We are extremely pleased to have received planning permission to

build a biomass wood gasification plant in Enfield, North London

capable of generating 12MW of electricity and 10MW of heat. The

plant has an estimated capital cost of GBP45 million and is

expected to generate EBITDA of approximately GBP9 million per year

once complete. The site has been secured on a 20 year lease and a

10 year feedstock supply agreement has been signed with a local

waste operator.

We also commenced operations on a 75KW containerised biomass

wood gasification plant located in Cork, Ireland and are currently

generating electricity for sale to the national grid.

We continue to invest capital in developing customer and partner

relationships and in furthering projects in our pipeline. Excluding

Newry and London we have four projects at full planning and

permitting stage. Our next objective is to progress these to

financial closure. We have a further five projects at letter of

intent stage and we are currently working to secure the sites and

move towards the planning and permitting stage.

A significant milestone during the year was the signing of a

joint venture agreement with AgriKomp GmbH, a leading German

supplier of biogas plants, with the aim of building and selling

anaerobic digestion plants to convert primarily agricultural wastes

into clean energy in the United Kingdom and Ireland. Our

partnership with one of the leaders in Europe in this area is an

exciting prospect for the Company and we are already working

closely with AgriKomp in the marketplace.

We are very happy with the progress made in our biomass wood

processing facility at the group's Vudlande plant in Latvia. As

well as being a profitable business in its own right we consider

the waste wood from the plant to be a potential backup biomass

feedstock source for generating plants. We successfully completed

capacity and efficiency increases which resulted in an increase in

sales to EUR8 million from EUR4 million in the year.

Financial Review

Revenue in the period amounted to EUR9 million, in line with

revised expectations (FY 2009: EUR5.9m). The Company increased its

reported gross profit to EUR2.0 million from EUR0.8 million in FY

2009. The Company reported a loss for the period of EUR3.2 million:

a decrease on the prior year figure of EUR6.2 million for FY

2009.

During the year the Company has continued to exercise tight

control over costs whilst, at the same time strengthening its

balance sheet. During the year the Company raised total additional

capital of EUR3.5 million. Following the year-end, the Company has

sourced a further EUR3.2 million in loan capital from a variety of

private, and institutional investors.

On 27 July 2010, the UK government published "Government

Response to the Grandfathering Policy of Support for Dedicated

Biomass, Anaerobic Digestion and Energy from Waste under the

Renewable Obligation". This announced the UK government's decision

to "grandfather" biomass plants, effectively guaranteeing ROC

levels for 20 years. The uncertainty that existed prior to this

decision led many financial and investment entities to give pause.

The removal of this uncertainty in our view opens up the market for

financing biomass plants.

At 30 June 2010, the Company had net debt of EUR9.1 million (30

June 2009: EUR7.8 million) including cash balances of EUR116,753

(30 June 2009: EUR340,242).

Outlook

The current economic climate is challenging. Preserving cash and

securing additional finance remain a priority. However the decision

of the UK Government to grandfather biomass plants has removed a

degree of uncertainty from the sector.

We will continue to progress our pipeline of large-scale biomass

projects and to advance our strategy of deploying smaller anaerobic

digestion and gasification plants to the marketplace through our

joint venture with AgriKomp.

Whilst our strategy is to build own and operate biomass power

generating plants, once the site has been secured and planning and

permitting has been obtained we would be in a position, if we so

chose, to monetise the value of the project.

In our view biomass plants have much greater potential for

higher returns than other renewable sources because they operate

more effectively as a base load power source in comparison to

intermittent technologies such as wind and solar. This is a time of

opportunity for biomass and in our view this sector now has the

best risk return profile in the renewable energy space.

We are a development company. Economic conditions remain

uncertain and the tight credit markets could continue to have an

impact on the availability of finance. We have continued to raise

finance successfully during the period and we expect to continue to

be successful in the coming period.

Donal Buckley

Chief Executive Officer

Kedco plc

Consolidated income statement

for the year ended 30 June 2010

2010 2009

EUR EUR

Revenue 9,023,979 5,914,077

Cost of sales (7,069,165) (5,106,316)

------------ ------------

Gross profit 1,954,814 807,761

Operating expenses

Administrative expenses (4,310,925) (5,525,791)

Once off listing costs - (946,024)

------------ ------------

Operating loss (2,356,111) (5,664,054)

Finance costs (758,567) (690,597)

Share of losses on joint

ventures (113,536) -

Finance income 32,411 114,113

------------ ------------

Loss before taxation (3,195,803) (6,240,538)

Income tax expense (47,098) -

------------ ------------

Loss for the year from

continuing operations (3,242,901) (6,240,538)

============ ============

(Loss)/Profit attributable

to:

Owners of the company (3,388,284) (6,132,743)

Non-controlling interest 145,383 (107,795)

------------ ------------

(3,242,901) (6,240,538)

============ ============

2010 2009

EUR EUR

Euro per Euro per

share share

Basic loss per share:

From continuing operations (0.02) (0.03)

Diluted loss per share:

From continuing operations (0.01) (0.03)

Consolidated statement of comprehensive income and expense

for the year ended 30 June 2010

2010 2009

EUR EUR

Loss for the financial

year (3,242,901) (6,240,538)

Other comprehensive

income

Exchange differences

arising on translation

of foreign operations 880 15,568

------------ ------------

Total comprehensive

income and expense

for the year (3,242,021) (6,224,970)

============ ============

Attributable to:

Owners of the company (3,387,404) (6,118,786)

Non-controlling interests 145,383 (106,184)

------------ ------------

(3,242,021) (6,224,970)

============ ============

Consolidated balance sheet

At 30 June 2010

2010 2009

ASSETS EUR EUR

Non-current assets

Goodwill 549,451 549,451

Intangible assets 71,995 157,309

Property, plant and equipment 5,570,812 6,138,936

Financial assets 990,000 990,000

Share of gross assets of

jointly controlled entities 207,109 10,593

------------- -------------

Total non-current assets 7,389,367 7,846,289

Current assets

Inventories 1,610,015 1,327,324

Amounts due from customers

under

construction contracts 9,291,911 7,065,467

Trade and other receivables 2,511,302 2,330,315

Cash and cash equivalents 116,753 340,242

------------- -------------

Total current assets 13,529,981 11,063,348

Total assets 20,919,348 18,909,637

============= =============

EQUITY AND LIABILITIES

Equity

Share capital 3,239,407 3,065,807

Share premium 17,410,077 15,096,219

Shared based payment reserves 328,383 164,188

Retained earnings - deficit (17,639,511) (14,252,107)

------------- -------------

Equity attributable to equity

holders of the parent 3,338,356 4,074,107

Minority interest 635,850 490,467

------------- -------------

Total equity 3,974,206 4,564,574

Non-current liabilities

Borrowings 6,749,672 6,746,220

Deferred income - government

grants 50,653 56,662

Finance lease liabilities 4,693 50,324

Deferred tax liability 128,176 81,078

Total non-current liabilities 6,933,194 6,934,284

Current liabilities

Amounts due to customers

under construction contracts 1,302,357 1,000,000

Trade and other payables 6,221,514 4,915,895

Borrowings 2,445,265 1,371,176

Deferred income - government

grants 6,009 15,033

Finance lease liabilities 36,803 108,675

------------- -------------

Total current liabilities 10,011,948 7,410,779

Total equity and liabilities 20,919,348 18,909,637

============= =============

Consolidated cashflow statement

for the year ended 30 June 2010

2010 2009

EUR EUR

Cash flows from operating

activities

Loss before taxation (3,195,803) (6,240,538)

Adjustments for:

Share based payments 164,195 164,188

Depreciation of property,

plant and equipment 658,599 533,587

Amortisation of intangible

assets 85,314 84,657

(Profit)/Loss on disposal

of property, plant and equipment (13,478) 30,619

Impairment of property, plant

and equipment - 571,710

Unrealised foreign exchange

loss - 2,866

Share of losses of jointly

controlled entities 113,536 -

Interest expense 758,567 690,597

Interest income (32,411) (114,113)

------------ ------------

Operating cash flows before

working capital changes (1,461,481) (4,276,427)

(Increase)/decrease in:

Amounts due from customers

under construction contracts (2,226,444) (7,065,467)

Trade and other receivables (184,785) (458,423)

Inventories (282,691) 297,992

Increase in:

Amounts due to customers

under construction contracts 302,357 1,000,000

Trade and other payables 1,318,622 3,576,830

------------ ------------

(2,534,422) (6,925,495)

Income taxes paid 12,545 -

------------ ------------

Net cash used in operating

activities (2,521,877) (6,925,495)

------------ ------------

Cash flows from investing

activities

Additions to property, plant

and equipment (185,068) (770,552)

Proceeds from sale of property,

plant and equipment 19,051 135,010

Additions to investments

in jointly controlled entities (309,172) (1,000,593)

Additions to intangibles - (7,665)

Interest received 35,950 110,573

------------ ------------

Net cash used in investing

activities (439,239) (1,533,227)

------------ ------------

Cash flows from financing

activities

Proceeds from borrowings 2,584,154 593,027

Repayments of borrowings (1,839,889) (109,670)

Proceeds from issuance of

ordinary shares 2,487,458 8,776,792

Payments of finance leases (117,503) (213,214)

Interest paid (709,869) (694,178)

------------ ------------

Net cash from financing activities 2,404,351 8,352,757

------------ ------------

Net decrease in cash and

cash equivalents (556,765) (105,965)

Cash and cash equivalents

at the beginning of the financial

year (252) 105,713

------------ ------------

Cash and cash equivalents

at the end of the financial

year (557,017) (252)

============ ============

Notes to the consolidated financial statements

for the year ended 30 June 2010

1. Basis of preparation

The Group's consolidated financial statements have been prepared

in accordance with International Financial Reporting Standards

(IFRS) effective at 30 June 2010 for all periods presented as

issued by the International Accounting Standards Board. The

consolidated financial statements are also prepared in accordance

with IFRS as adopted by the European Union ('EU').

The consolidated financial statements are prepared under the

historical cost convention. The principal accounting policies set

out below have been applied consistently by the parent company and

by all of the Company's subsidiaries to all periods presented in

these consolidated financial statements.

The financial statements of the parent company, Kedco plc have

been prepared in accordance with accounting standards generally

accepted in Ireland and Irish statute comprising the Companies Acts

1963 to 2009.

As described in the Chief Executive's Report, the Company

continues to invest capital in developing customer and partner

relationships in the UK and Ireland. The Company has also continued

to develop and expand its pipeline of projects. These activities

together with the current challenging economic environment have

resulted in the Company continuing to report losses for the year to

30 June 2010.

The Company secured additional finance of EUR3.2 million in July

2010. The Directors have instituted a number of measures to

preserve cash and also to secure additional finance. The board is

currently engaged in advanced discussions with a number of

different parties around the potential investment of equity and/or

debt finance into the Company and in the meantime continues to

manage its working capital position tightly. The board remains

confident that suitable investment will be secured.

The financial statements have been prepared on a going concern

basis. The Directors have given careful consideration to the

appropriateness of the going concern concept in the preparation of

the financial statements. The validity of the going concern concept

is dependent upon finance being available for the Company's working

capital requirements and for the continued investment in the

Company's strategy of identifying, developing, building and

operating power generating plants so that the Group can continue to

realise its assets and discharge its liabilities in the normal

course ofbusiness. Whilst the strategy is to build, own and operate

plants, once a site has been secured and planning and permitting

obtainedthe Company would be in a position, if it so chose, to

monetise the value of the project. The financial statements do not

include any adjustments that would result should the above

conditions not be met.

After making enquiries and considering the items referred to

above, the Directors believe that solid progress towards securing

finance is being made and that, whilst there is no guarantee that

such investment will be forthcoming, the Directors have a

reasonable expectation that the Company has adequate resources to

continue in operational existence for the foreseeable future. For

these reasons the Directors continue to adopt the going concern

basis of accounting in preparing the financial statements.

2. Loss per share 2010 2009

EUR EUR

Euro per Euro per

share share

Basic loss per share

From continuing operations (0.02) (0.03)

Diluted loss per share

From continuing operations (0.01) (0.03)

Basic loss per share

The loss and weighted average number of ordinary shares used in

the calculation of the basic loss per share are as follows:

2010 2009

EUR EUR

Loss for year attributable to

equity holders of the parent (3,388,284) (6,132,743)

Weighted average number of ordinary

shares for

the purposes of basic loss per

share 220,482,654 192,591,780

Diluted loss per share

The loss used in the calculation of all diluted earnings per

share measures is the same as those for the equivalent basic

earnings per share measures, as outlined above.

The weighted average number of ordinary shares for the purposes

of diluted loss per share reconciles to the weighted average number

of ordinary shares used in the calculation of basic loss per share

as follows:

2010 2009

Weighted average number of ordinary

shares used

in the calculation of basic

loss per share 220,482,654 192,591,780

Shares deemed to be issued in

respect of

long term incentive plan 49,256,332 32,837,555

Weighted average number of ordinary

shares used in the

calculation of diluted earnings

per share 269,738,986 225,429,335

Share warrants which could potentially dilute basic earnings per

share in the future have not been included in the calculation of

diluted earnings per share as they are anti-dilutive for the

periods presented. The dilutive effect as a result of share

warrants in issue as at 30 June 2010 would be to increase the

weighted average number of shares by 8,075 766 (2009: 130,480).

Convertible preference shares which could potentially dilute

basic earnings per share in the future have not been included in

the calculation of diluted earnings per share as they are

anti-dilutive for the periods presented. The dilutive effect as a

result of preference shares in issue as at 30 June 2010 would be to

increase the weighted average number of shares by 1,562,500 (2009:

nil).

2. Loss per share (continued)

Convertible loans which could potentially dilute basic earnings

per share have not been included in the calculation of diluted

earnings per share as they are anti-dilutive for the periods

presented. The dilutive effect as a result of loans in issue as at

30 June 2010 would be to increase the weighted average of shares by

1,208,333.

3. Events after the balance sheet date

During July 2010, the Company raised EUR3.2 million from a loan

note placing with a variety of investors including Kedco directors.

The proceeds from the placing will be used to develop identified

opportunities for joint ventures and working capital purposes.

The annual report and financial statements for the year ended 30

June 2010 will be posted to shareholders shortly. The annual report

and financial statements will also be available on the Company's

website - www.kedco.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR KKKDKABDDBKB

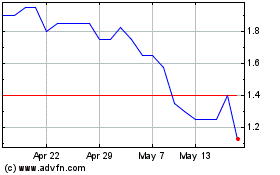

Eqtec (LSE:EQT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eqtec (LSE:EQT)

Historical Stock Chart

From Jul 2023 to Jul 2024