Completion of Placing

October 08 2009 - 2:00AM

UK Regulatory

TIDMKED

RNS Number : 4438A

Kedco PLC

08 October 2009

8 October 2009

Kedco plc

("Kedco" or the "Company")

Completion of placing

Kedco, the Irish-based energy group focusing on green-energy production in the

UK and Ireland, is pleased to announce that it has secured EUR2.6 million from a

placing with a variety of investors including the Kedco directors (the

"Placing"). The proceeds from the Placing will be used by Kedco to develop

identified opportunities for joint ventures and working capital purposes.

Placees for each of the new ordinary shares (the "Placing Shares") will also

receive one half of one warrant to subscribe for one new ordinary share at a

price of 25 cents exercisable at any time during the two year period of issue.

Pursuant to the Placing, an application will be made for the admission of

17,360,013 Placing Shares to trading on AIM. The Placing Shares, which will be

issued fully paid, will rank pari passu in all respects with the existing

ordinary shares of the Company. Admission of the Placing Shares to trading on

AIM is expected to occur on 14 October 2009.

In addition to the Placing, the Company has been informed that the Investment

Committee of Enterprise Ireland, the Irish government agency responsible for the

global expansion of Irish companies, has approved a proposed subscription of

EUR0.5 million for cumulative redeemable convertible preference shares in Kedco

Power Limited, a wholly-owned subsidiary of Kedco. This investment is subject to

the finalisation of a share subscription and shareholders' agreement which the

Board hopes to conclude shortly. A further announcement will be made in this

respect in due course.

As part of the Placing, the following directors of Kedco will subscribe for new

ordinary shares in the Company:

+----------------------+---------------+---------------------+-------------------+

| Director | Placing | Resultant total | Resultant |

| | Shares | holding of ordinary | percentage of |

| | subscribed | shares | issued ordinary |

| | for | | share capital |

+----------------------+---------------+---------------------+-------------------+

| Diarmuid Sean Lynch | 1,166,666 | 21,294,186 | 9.47 |

+----------------------+---------------+---------------------+-------------------+

| William Paul | 133,334 | 16,559,734 | 7.37 |

| Kingston | | | |

+----------------------+---------------+---------------------+-------------------+

| Donal James Buckley* | 466,667 | 16,550,627 | 7.36 |

+----------------------+---------------+---------------------+-------------------+

| Edward Barrett | 1,166,666 | 13,486,666 | 6.00 |

+----------------------+---------------+---------------------+-------------------+

| Michael Gerard | 66,667 | 76,667 | 0.03 |

| Madden | | | |

+----------------------+---------------+---------------------+-------------------+

| Donal O'Sullivan | 66,667 | 66,667 | 0.03 |

+----------------------+---------------+---------------------+-------------------+

| Alf Smiddy | 66,668 | 66,668 | 0.03 |

+----------------------+---------------+---------------------+-------------------+

The resultant total holding of ordinary shares in the Company and the resultant

percentage of issued ordinary share capital are based on the aggregate holding

of Donal James Buckley and his wife, Mrs Sinead Buckley. Donal Buckley's

individual holding is 481,667 ordinary shares which is equivalent to 0.21 per

cent. of the issued ordinary share capital of the Company.

As a result of the Placing, the total number of voting rights as at

14 October 2009 will increase to 224,822,627. This figure should be used by

shareholders as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a change to their

interest in the Company, under the FSA's Disclosure and Transparency Rules.

Donal Buckley, Chief Executive said:

"We are very pleased to announce this successful fundraising. The funds were

raised from a number of new and existing investors and we are very encouraged by

the support given to our business and strategy.

"The money will be used to develop and progress previously identified joint

venture opportunities in power generation from waste and for working capital

purposes. We look forward to updating the market as to the progress of our

projects in the coming financial period."

- Ends -

For additional information please contact:

Financial Dynamics - London +44 (0)20 7831 3113

Matt Dixon / Edward Westropp / Alex Beagley

Deloitte Corporate Finance - Nomad +44 (0)20 7936 3000

Jonathan Hinton / David Smith

Beaufort International Associates Limited +44 (0)20 7930 8222

Tanvier Malik

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCMPBATMMIMMBL

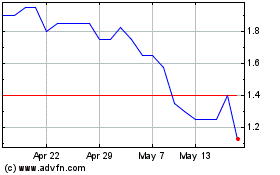

Eqtec (LSE:EQT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eqtec (LSE:EQT)

Historical Stock Chart

From Jul 2023 to Jul 2024