Duke Royalty Limited Trading Update (8533U)

August 04 2022 - 2:00AM

UK Regulatory

TIDMDUKE

RNS Number : 8533U

Duke Royalty Limited

04 August 2022

4 August 2022

Duke Royalty Limited

("Duke Royalty", "Duke" or the "Company")

Trading Update

Duke Royalty, a provider of alternative capital solutions to a

diversified range of profitable and long-established businesses in

Europe and North America, is pleased to provide the following

trading update for its first financial quarter ended 30 June 2022

("Q1 FY23"), and to provide guidance on trading for the second

quarter of the Company's 2023 financial year, ending 30 September

2022 ("Q2 FY23").

Financial Highlights:

-- Normalised cash revenue* for Q1 FY23 reached a new record of

GBP5.1 million, an increase of 9% on the previous quarter and an

78% increase over Q1 FY22, exceeding the Company's expectations of

GBP5.0 million

-- Q1 FY23 total cash revenue** also totalled GBP5.1 million,

reflecting the fact that no buyouts or equity sales occurred during

the quarter

Normalised Cash Revenue* Total Cash Revenue**

Q1 FY22 GBP2.9 million GBP2.9 million

------------------------- ---------------------

Q2 FY22 GBP3.3 million GBP4.9 million

------------------------- ---------------------

Q3 FY22 GBP3.9 million GBP3.9 million

------------------------- ---------------------

Q4 FY22 GBP4.7 million GBP6.7 million

------------------------- ---------------------

Q1 FY23 GBP5.1 million GBP5.1 million

------------------------- ---------------------

* Normalised cash revenue excludes redemption premium receipts

and cash gains from equity sales

** Total cash revenue is monthly cash distributions from Duke's

royalty partners plus cash gains received from the sales of equity

assets and redemption premiums

-- Based on current trading, Duke expects Q2 FY23 normalised

cash revenue to increase to GBP5.2 million

Operational Highlights:

-- Completed a GBP2.3m follow-on investment into specialist

residential and domiciliary care provider Tristone Healthcare

Limited to fund the acquisition of Beyond Limits (Plymouth)

Limited, a profitable operator of specialist care homes

predominantly in the Southwest of England. The financing increases

Duke's total investment into Tristone to GBP14.4 million.

-- Completed a GBP3.1m follow-on investment into the IT managed

services provider, InTec Business Solutions Limited to fund the

acquisition of Astec Computing (UK), a profitable I.T. managed

services business with a 30 year trading history. The financing

increases Duke's total investment into InTec to GBP17.1

million.

-- GBP20m equity fundraising completed in May 2022. The proceeds

of the equity raise enable the temporary pay down of existing debt,

reducing interest costs and cash drag, in turn increasing total

liquidity available to the Company for additional investments into

existing Royalty Partners deploying a buy and build acquisition

strategy, and new opportunities.

-- Paid a dividend of 0.70p per share paid for the quarter,

representing an annualised yield of over 8% at the current share

price with the dividend well covered by operating cashflow.

Neil Johnson, CEO of Duke Royalty, said:

"Despite the headwinds prevalent in the world economy and the

volatility seen in global stock markets, it was business as usual

for Duke in the quarter. I am pleased to report that the Company

produced another record of normalised cash revenue in Q1 FY23 and I

expect this growth trend to continue into Q2 FY23 by virtue of

Duke's annual yield adjustments linked to underlying companies'

revenue performance in this inflationary macro-environment. Duke's

secured position and exposure to 48 different underlying operating

companies provides investors with exposure to a diverse portfolio

of profitable, long-established businesses in low-risk sectors

which are well managed to navigate through challenging

environments.

The Company's flexible model continues to be attractive to SMEs

operating 'buy and build' acquisition strategies and management

buy-out opportunities, as such we continue to review a healthy

number of new investment opportunities. While we have increased

total liquidity available, we will continue to deploy capital

prudently through our rigorous due diligence and evaluation process

in light of the changing macro-economic conditions. We look forward

to updating our shareholders on our progress in the near

future."

***ENDS***

For further information, please visit www.dukeroyalty.com or

contact:

Neil Johnson / Charles

Cannon Brookes / Hugo

Duke Royalty Limited Evans +44 (0) 1481 730 613

Cenkos Securities

plc

(Nominated Adviser Stephen Keys / Callum

and Joint Broker) Davidson / Michael Johnson +44 (0) 207 397 8900

Canaccord Genuity Adam James / Georgina

(Joint Broker) McCooke +44 (0) 207 523 8000

SEC Newgate (PR) Elisabeth Cowell / Richard +44 (0) 20 3757 6882

Bicknell / Max Richardson dukeroyalty@secnewgate.co.uk

About Duke Royalty

Duke Royalty Limited provides alternative capital solutions to a

diversified range of profitable and long-established businesses in

Europe and abroad. Duke Royalty's experienced team provide

financing solutions to private companies that are in need of

capital but whose owners wish to maintain equity control of their

business. Duke Royalty's royalty investments are intended to

provide robust, stable, long term returns to its shareholders. Duke

Royalty is listed on the AIM market under the ticker DUKE and is

headquartered in Guernsey.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFFFLITIIVIIF

(END) Dow Jones Newswires

August 04, 2022 02:00 ET (06:00 GMT)

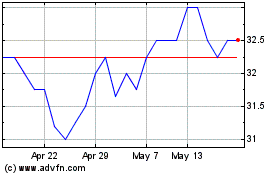

Duke Capital (LSE:DUKE)

Historical Stock Chart

From Jun 2024 to Jul 2024

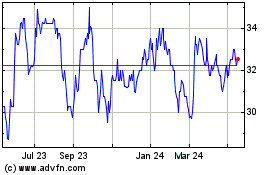

Duke Capital (LSE:DUKE)

Historical Stock Chart

From Jul 2023 to Jul 2024