TIDMDPEU

RNS Number : 0834B

DP Eurasia N.V

31 May 2023

31 May 2023

DP Eurasia N.V.

("DP Eurasia" or the "Company", and together with its

subsidiaries, the " Group ")

Trading Update for the four months ended 30 April 2023 (the

"Period") (1) (2)

(millions of TRY, unless otherwise indicated)

For the period ended

30 April

-----------------------

2023 2022 Change

Number of stores 856 828 28

Turkey (Domino's) 658* 617 41

Turkey (COFFY) 40 12 28

Azerbaijan 10 10 -

Georgia 6 5 1

Russia 142 184 -42

Number of stores (excluding

Russia) 714 644 70

Change

Group system sales (after (pre-IAS

IAS 29) (3) 2023 2022 Change 29)

Turkey 1,385.5 1,148.0 20.7% 83.9%

Azerbaijan 25.6 28.1 -8.8% 38.5%

Georgia 18.9 13.2 43.2% 117.4%

COFFY 50.1 10.5 378.4% 612.5%

Total continuing operations 1,480.2 1,199.8 23.4% 87.9%

Russia (discontinued operations) 291.1 283.0 2.8% 2.8%

Grand Total 1,771.2 1,482.8 19.5% 64.8%

---------------------------------- ----------- ---------- ------- ----------

System sales LfL growth(4) (after IAS 29) (pre-IAS 29)

2023 2022 2023 2022

Turkey 17.5% -6.6% 78.9% 47.6%

Azerbaijan (based on AZN) 3.2% -3.5% 3.2% -3.5%

Georgia (based on GEL) 5.0% 45.9% 5.0% 45.9%

Total continuing operations 17.1% -6.2% 76.9% 46.8%

Russia (discontinued operations,

based on RUB) -23.9% -1.5% -23.9% -1.5%

*Including temporarily closed 10 stores due to earthquake

Highlights

-- Strong Period with Group system sales for continuing

operations up 23.4% (pre-IAS 29: 87.9%) or 17.1% on a LfL

basis.

-- Growth reflects ongoing focus on network expansion, strategic

pricing, product and service innovation, and sustained demand for

COFFY.

-- 17.5% LfL growth in Turkey achieved amid sustained

inflationary environment. Swift reaction to devastating earthquake

in February means its impact not expected to be material to

2023.

-- Of the 12 stores not operational because of the earthquake as

reported within our Preliminary Results announcement, two are up

and running. We have been working on several options for the

temporarily closed 10 stores, including moving some to other cities

and opening prefabricated stores in the affected regions.

-- Azerbaijan and Georgian operations delivered a positive LfL

performance in local currencies with growth of 3.2% and 5.0%

respectively.

-- Online delivery system sales in Turkey increased to 83.3%

(2022: 81.2%) as a share of delivery system sales(6) , reflecting

our robust positioning for the online ordering channel. Turkish

online system sales growth was a strong 18.2% (pre-IAS 29:

80.1%).

-- New store opening momentum was maintained across the Group.

o 41 Domino's Pizza net new store openings in Turkey

year-on-year, reflecting strong demand profile.

o One new store in Georgia increases the total number in the

country to six.

o COFFY network increased by 28 stores year-on-year to reach 40.

Expect new COFFY store openings to accelerate during the rest of

the year.

-- COFFY delivered TRY 50.1 million to Group system sales, up

378.4%, and continues to represent an excellent growth

opportunity.

-- The Group continues to evaluate its presence in Russia and,

as previously announced is considering various options which may

include a divestment of its Russian operations. Whilst work on a

potential transaction is ongoing, there can be no certainty as to

the outcome. In the meantime, the Group continues to limit

investment in Russia and remains focused on optimising the existing

store coverage. Total number of stores stood at 142 at Period-end,

compared to 184 year-on-year. All corporate stores were franchised

by the end of May as a result of the optimisation process, while

the total store count in Russia remains unchanged from Period-end.

Cash proceeds from the conversion of corporate stores to franchised

stores have been retained within the Russian business to maintain

the flexibility whilst the Group continues to progress a potential

exit from the country.

-- Liquidity position as of 30 April 2023: TRY 293 million cash

and an undrawn bank facility of TRY 290 million.

-- Guidance is being maintained, though we are mindful of

sustained macro-economic volatility and inflation. Continue to

believe that inflation can be appropriately managed, and management

has an excellent track record of mitigating its impact, but the

risk it poses to overall growth levels remains.

-- Full year guidance is as follows:

LfL growth rate High single digit

(pre IAS 29: 60-70%)

Domino's Pizza net store

openings 35 - 40

COFFY net store openings 50 - 60

Capital expenditure TRY 160 millon

------------------------- ---------------------

Commenting on the update, Chief Executive Officer, Aslan Saranga

said:

"We have started the year well and successfully implemented our

targeted action plan despite the ongoing macro challenges.

Management is extremely experienced in navigating volatility, and

Group system sales remained strong overall with LfL growth.

"The impact of the earthquake in February was devastating, and

our thoughts and condolences remain with all of those who have been

impacted. The Board is proud of the Group's rapid reaction to

support affected colleagues and restore operations where possible.

We continue to stand in solidarity with our employees, business

partners and the wider community.

"Since the beginning of 2022, we have implemented and operated a

targeted strategy that focuses on three areas - strategic pricing

and product innovation, continued digital innovation, and

operational efficiencies to generate sustainable profitability.

This approach has enabled us to combat the high levels of

volatility in the regions in which we operate, and the impact of

our efforts continues to be visible through volume generation and

customer acquisition.

"Our focus on product innovation remains integral. We continue

to broaden our entry price product range and launched a new

mushroom pizza in January which has already reached good volumes.

Following the successful Pizzetta launch last year, we added new

varieties to further enhance the potential of this product line. In

addition, our new 'snacks from the oven' range was launched in

February presenting a broad choice of attractively priced products

to customers who increasingly seek value and affordability. The

latest addition to our product range has been Pizza XL which will

contribute to average ticket price and size mix.

"We continue to improve the online proportion of our sales, and

digital innovation remains an important enabler for us to enhance

the customer experience and further solidify our robust positioning

for the online ordering channel.

"We retain a fundamental commitment to ensuring franchisees

remain profitable. As a result, franchisee demand for both Domino's

Pizza and COFFY continues to be very healthy. We have a strong

pipeline and remain confident that 2023 will be another solid year

for network expansion.

"Consumer demand for COFFY stands very strong owing to its

already proven sales performance. This demand, alongside our

ambitious targets for 2023, will enable us to add further scale to

the business.

"Overall, we are pleased with the good start to the year and

will continue to deliver on our targeted strategy in order to make

the most of what continues to be a significant growth

opportunity."

Enquiries

DP Eurasia N.V.

İlknur Kocaer, CFA - Investor Relations

Director +90 212 280 9636

Buchanan (Financial Communications)

Richard Oldworth / Toto Berger / Verity +44 20 7466 5000

Parker dp@buchanan.uk.com

A conference call for investors and analysts will be held at

9.00am this morning, which will be accessible using the following

details:

Conference call dial-in: 08006522435

For further details, please contact Buchanan on +44 20 7466 5000

/ dp@buchanan.uk.com .

Notes to Editors

DP Eurasia N.V. is the exclusive master franchisee of the

Domino's Pizza brand in Turkey, Russia, Azerbaijan, and Georgia.

The Company was admitted to the premium listing segment of the

Official List of the Financial Conduct Authority and to trading on

the main market for listed securities of the London Stock Exchange

plc on 3 July 2017. The Company (together with its subsidiaries,

the " Group " ) is the largest pizza delivery company in Turkey and

the third largest in Russia. The Group offers pizza delivery and

takeaway/ eat-in facilities at its 856 stores (658 in Turkey, 142

in Russia, 10 in Azerbaijan and 6 in Georgia) as of 30 April 2023

and operates through its owned corporate stores (14%) and

franchised stores (86%). In addition to its pizza delivery

business, the Group also has its own coffee brand, COFFY, which

trades from 40 stores at period-end, 29 of which are franchised.

The Group maintains a strategic balance between corporate and

franchised stores, establishing networks of corporate stores in its

most densely populated areas to provide a development platform upon

which to promote best practice and maximise profitability.

Performance Review

Store count As of 30 April

----------------------------------------------------------------------------

2023 2022

Corporate Franchised Total Corporate Franchised Total

Turkey (Domino's) 87 571 658 100 517 617

Azerbaijan - 10 10 - 10 10

Georgia - 6 6 - 5 5

COFFY 11 29 40 5 7 12

Total 98 616 714 105 539 644

Russia 23 119 142 92 92 184

Grand Total 121 735 856 197 631 828

Delivery channel mix and online LfL growth

The following table shows the Group's delivery system sales (7)

, broken down by ordering channel and by the Group's two largest

countries in which it operates, as a percentage of delivery system

sales for the periods ended 30 April 2023 and 2022:

For the period ended 30 April

--------------------------------------------------

2023 2022

------------------------ ------------------------

Turkey Russia Total Turkey Russia Total

16.1 5.4 16.1 18.3 17.7

Store % % % % 6.3 % %

Group's online 22.3 72.2 30.0 24.8 72.9 33.9

Online platform % % % % % %

61.0 22.4 53.5 56.4 20.8 48.1

Aggregator % % % % % %

83.3 94.6 83.4 81.2 93.7 82.0

Total online % % % % % %

0.5

Call centre 0.6 % - % 0.4 % - 0.3 %

Total 100% 100% 100% 100% 100% 100%

The following table shows the Group's online LfL growth (4) ,

broken down by the Group's two largest countries in which it

operates, for the periods ended 30 April 2023 and 2022:

Group online system sales (after IAS 29) (pre-IAS 29)

LfL growth

2023 2022 2023 2022

Group(5) 7.6% 0.2% 55.4% 44.8%

Turkey 15.9% 0.4% 76.5% 58.6%

Russia (based on RUB) -23.6% -0.4% -23.6% -0.4%

--------------------------- ------------ ---------- ------- ------

Notes

(1) COFFY numbers are included in all Turkey and Group figures,

unless presented separately. Like-for-like figures exclude COFFY.

These numbers are not audited.

(2) IAS 29 'Financial Reporting in Hyperinflationary Economies'

is currently applicable in Turkey. Company's preliminary results

for the year ended 31 December 2022, published on 12 April, was

adjusted accordingly.

(3) System sales are sales generated by the Group's corporate

and franchised stores to external customers and do not represent

revenue of the Group.

(4) Like-for-like growth is a comparison of sales between two

periods that compares system sales of existing system stores. The

Group's system stores that are included in like-for-like system

sales comparisons are those the Group considers to be mature

operations. The Group considers mature stores to be those stores

that have operated for at least 52 weeks preceding the beginning of

the first month of the period used in the like-for-like comparisons

for a certain reporting period, assuming the relevant system store

has not subsequently closed or been "split" (which involves the

Group opening an additional store within the same map of an

existing store or in an overlapping area). This is a non-IFRS

measure and non-IFRS measures are not audited.

(5) Group like-for-like growth is a weighted average of the

country like-for-like growths based on store numbers as described

in Note (4). This is a non-IFRS measure and non-IFRS measures are

not audited.

(6) Online system sales are system sales of the Group generated

through its online ordering channel.

(7) Delivery system sales are system sales of the Group

generated through the Group's delivery distribution channel.

(8) EBITDA, adjusted EBITDA and non-recurring and non-trade

income/expenses are not defined by IFRS. These items are determined

by the principles defined by the Group management and comprise

income/expenses which are assumed by the Group management to not be

part of the normal course of business and are non-trading items.

These items which are not defined by IFRS are disclosed by the

Group management separately for a better understanding and

measurement of the sustainable performance of the Group.

Appendices

Exchange Rates

For the period ended 30 April

----------------------------------------------------------

2023 2022

---------------------------- ----------------------------

Currency Period End Period Average Period End Period Average

----------- --------------- ----------- ---------------

EUR/TRY 21.440 20.457 15.545 15.698

RUB/TRY 0.237 0.252 0.202 0.167

EUR/RUB 88.371 81.241 74.559 93.460

Delivery - Take away / Eat in mix

For the period ended 30 April

--------------------------------------------------

2023 2022

------------------------ ------------------------

Turkey Russia Total Turkey Russia Total

Delivery 73.8% 74.3% 73.7% 76.6% 77.9% 76.5%

Take away / Eat in 26.2% 25.7% 26.3% 23.4% 22.1% 23.5%

Total 100% 100% 100% 100% 100% 100%

Forward looking statements

This press release includes forward-looking statements which

involve known and unknown risks and uncertainties, many of which

are beyond the Group's control and all of which are based on the

Directors' current beliefs and expectations about future events.

They appear in a number of places throughout this press release and

include all matters that are not historical facts and include

predictions, statements regarding the intentions, beliefs or

current expectations of the Directors or the Group concerning,

among other things, the results of operations, financial condition,

prospects, growth and strategies of the Group and the industry in

which it operates.

No assurance can be given that such future results will be

achieved; actual events or results may differ materially as a

result of risks and uncertainties facing the Group. Such risks and

uncertainties could cause actual results to vary materially from

the future results indicated, expressed, or implied in such

forward-looking statements.

Forward-looking statements contained in this press release speak

only as of the date of this press release. The Company and the

Directors expressly disclaim any obligation or undertaking to

update these forward-looking statements contained in this press

release to reflect any change in their expectations or any change

in events, conditions, or circumstances on which such statements

are based.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTWPUUGAUPWGMU

(END) Dow Jones Newswires

May 31, 2023 02:00 ET (06:00 GMT)

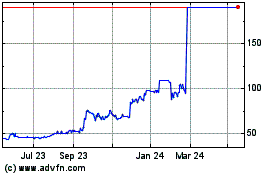

Dp Eurasia N.v (LSE:DPEU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Dp Eurasia N.v (LSE:DPEU)

Historical Stock Chart

From Jul 2023 to Jul 2024