TIDMDPEU

RNS Number : 2133T

DP Eurasia N.V

21 July 2022

For Immediate Release 21 July 2022

DP Eurasia N.V.

("DP Eurasia" or the "Company", and together with its

subsidiaries, the " Group ")

Trading Update for the six months ended 30 June 2022

Strong trading momentum maintained & FY 2022 guidance

reinstated

For the period ended

30 June

(excl. impact of hyperinflationary

accounting (1) )

---------------------------------------- -------

2022 2021 Change

----------------- --------------------- -------

(in millions of TRY,

unless otherwise indicated)

Number of stores (2) 827 789 38

Group system sales (3)

Turkey 1,201.0 755.7 58.9%

Russia 492.7 278.6 76.8%

Azerbaijan & Georgia 43.0 19.4 121.6%

Total 1,736.7 1,053.7 64.8%

Group system sales LfL growth(4) (excl. impact

of hyperinflationary accounting (1) )

Group(5) 38.6% 52.9%

Turkey 51.0% 64.9%

Russia (based on RUB) -2.6% 18.2%

Highlights

-- Strong growth achieved at the Group level while set against

very strong comparatives, with increased visibility enabling

guidance to be re-instated for the full year ending 31 December

2022.

-- Group system sales increased 64.8% with a like-for-like

("LfL") growth of 38.6%, mainly driven by price adjustments.

-- Adjusting for inflation and last year's VAT reduction of

7ppts to 1% (which lasted until end of July), LfL growth in Turkey

would be flat in 1H 2022 with a low single digit growth in

volumes.

-- Group online system sales (6) growth of 69.7%

o Turkish online system sales growth of 66%

o Russian online system sales growth of 77.5% (-6.8% based on

RUB)

-- Online delivery system sales further increased to 83.2% (June

2021: 77.5%) as a share of delivery system sales (7) , reflecting

DP Eurasia's robust positioning for the online ordering

channel.

-- 21 net store openings in Turkey during the first half of the

year maintains our momentum and is on top of record level of

openings in 2021.

-- Good liquidity position at Period-end with TRY 262.2 million

cash and an undrawn bank facility of TRY 107 million.

-- The new COFFY concept has performed very well with robust

volume growth and accelerating expansion in store network. Having

opened seven new stores in the first half of the year, COFFY traded

from 15 stores at period-end, 10 of which are franchised.

-- Following the appointment of independent non-executive

director (INED), Mr Burak Ertas, at the Annual General Meeting

(AGM) in June 2022, an additional INED will be appointed at the

Extraordinary General Meeting (EGM) which will be held in September

2022.

Outlook

-- The Group is mindful of operating in a volatile environment

with the potential for further macro-economic and geopolitical

challenges, but as a result of increased full year visibility

management is reinstating guidance for 2022.

-- The strong store openings momentum in Turkey is anticipated

to continue in the second half, driven by solid franchisee

demand.

-- The Group continues to limit investment into its Russian

operations given the sustained conflict in the region and is

focused on optimising its existing store network. Management is

monitoring the situation in the region closely.

-- COFFY remains in the early stages of its development, having

launched in 2021, but management believes it represents an

outstanding growth opportunity. More store openings are expected in

the second half

-- Guidance for store openings, LfL growth rates and capital

expenditure for 2022 is as follows:

Turkey Russia

------------------------- ------------------------- ---------------------------

LfL growth rate 55 - 65%* 0% (based on RUB)

Domino's Pizza net store

openings 30 - 40 0

COFFY net store openings 20 - 30 -

Capital expenditure TRY 90 million* RUB 190 million

------------------------- ------------------------- ---------------------------

* excl. impact of hyperinflationary accounting (1)

Commenting on the update, Chief Executive Officer, Aslan Saranga

said:

"In first half of 2022, we continued our strong business

momentum despite the unprecedented challenges in the regions we

operate. This was thanks to our experienced team as we navigated

the operating environment very carefully. Even in these difficult

times, with our innovative and customer-centric mindset, we managed

to grow in a healthy manner. Group system sales grew by 65% with a

39% LfL performance versus a year ago.

"System sales in Turkey grew by 59%, corresponding to 51% LfL

growth. This was achieved against a strong comparative period of

72% system sales growth and 65% LfL growth. In the first half 2022,

with our diligent price adjustments and sustained volume

performance, we broadly caught up with the rapid pace of inflation.

While increasing prices, we remain committed to providing the best

value for money proposition and ensuring our franchisees remain

profitable. We believe that we are well positioned to succeed in

this environment and deliver long-term sustainable growth.

"Our online channel continues to be the main driver behind our

solid growth rates. In Turkey, LfL growth for online system sales

was 59.4% (on top of an almost 100% increase last year) and the

share of online sales in the Turkish delivery system reached 81.2%.

This corresponded to a near seven percentage point increase over

the last twelve months.

"In Russia, we faced into a strong comparable period while

operating in a difficult geo-political and economic environment. As

a result, we had a negative LfL by the end of first half. The

online system sales share increased to 93.5% delivering around one

and a half percentage points of increase. As previously announced,

the Group continues to limit investment into the territory and is

focused on optimising the existing store coverage in Russia,

resulting in the closure of four stores during the first half of

the year. We continue to monitor the situation in the region

closely while the safety and welfare of all the Group's employees

and customers remains our primary priority.

"The strong performance in Turkey continues to generate a very

robust franchisee demand. We opened 21 net stores in Turkey during

the first half of the year. Given our strong pipeline, we remain

confident that 2022 will be another solid year for store

growth.

"Our new and own-branded COFFY concept has performed extremely

well. We achieved robust volume expansion also supported by the

enriched product range, which is well received by the Turkish

public. Our network reached 15 by the end of June with the addition

of new store concepts that serve different consumer profiles. I am

personally very excited for the future growth prospects for COFFY

and believe it has the ability to make a considerable contribution

to our investment story in years to come."

"Whilst the Board is conscious of the ongoing uncertainty,

current trends suggest that our adjusted EBITDA(8) for 2022 is

likely to be above the current market expectations."

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018.

Enquiries

DP Eurasia N.V.

İlknur Kocaer, CFA - Investor Relations

Director +90 212 280 9636

Buchanan (Financial Communications)

Richard Oldworth / Toto Berger / Verity +44 20 7466 5000

Parker dp@buchanan.uk.com

A conference call for investors and analysts will be held at

9.00am this morning, which will be accessible using the following

details:

Conference call: Dial-in: +44 (0)330 165 3641

PIN code: 212745

For international dial-in numbers or any further

details, please contact Buchanan on +44 20 7466

5000 / dp@buchanan.uk.com .

A recording of the conference call will subsequently be

available at www.dpeurasia.com .

Notes to Editors

DP Eurasia N.V. is the exclusive master franchisee of the

Domino's Pizza brand in Turkey, Russia, Azerbaijan and Georgia. The

Company was admitted to the premium listing segment of the Official

List of the Financial Conduct Authority and to trading on the main

market for listed securities of the London Stock Exchange plc on 3

July 2017. The Company (together with its subsidiaries, the " Group

" ) is the largest pizza delivery company in Turkey and the third

largest in Russia. The Group offers pizza delivery and takeaway/

eat-in facilities at its 827 stores (628 in Turkey, 184 in Russia,

10 in Azerbaijan and five in Georgia as of 30 June 2022) and

operates through its owned corporate stores (22%) and franchised

stores (78%). The Group maintains a strategic balance between

corporate and franchised stores, establishing networks of corporate

stores in its most densely populated areas to provide a development

platform upon which to promote best practice and maximise

profitability. The Group has adapted the Domino's Pizza

globally proven business model to its local markets.

Performance Review

Store As at 30 June

count

------------------------------------------------------------------------------

2022 2021

Corporate Franchised Total Corporate Franchised Total

Turkey 94 534 628 103 481 584

Russia 92 92 184 116 76 192

Azerbaijan - 10 10 - 9 9

Georgia - 5 5 - 4 4

Total 186 641 827 218 571 789

Delivery channel mix and online LfL growth

The following table shows the Group's delivery system sales ( 8)

, broken down by ordering channel and by the Group's two largest

countries in which it operates, as a percentage of delivery system

sales for the periods ended 30 June 2022 and 2021:

For the period ended 30 June

--------------------------------------------------

2022 2021

------------------------ ------------------------

Turkey Russia Total Turkey Russia Total

18.3 6.5 16.4 25.6 7.7 22.2

Store % % % % % %

Group's online 25.1 72.2 38.2 25.9 69.5 36.5

Online platform % % % % % %

56.1 21.3 45.0 48.1 22.9 41.0

Aggregator % % % % % %

81.2 93.5 83.2 74.0 92.3 77.5

Total online % % % % % %

Call 0.5 0.4 0.4 0.3

centre % - % % - %

Total 100% 100% 100% 100% 100% 100%

The following table shows the Group's online LfL growth (2) ,

broken down by the Group's two largest countries in which it

operates, for the periods ended 30 June 2022 and 2021:

For the period ended

30 June

(excl. impact of hyperinflationary

accounting (1) )

------------------------------------------

2022 2021

----------------------- -----------------

Group online system sales LfL

growth(4)

Group(5) 45.1% 77.6%

Turkey 59.4% 98.0%

Russia (based on RUB) -2.5% 19.2%

Liquidity

The Group continues to have a strong liquidity position with TRY

262.2 million of cash and access to an additional banking facility

of TRY 107 million.

The Group's sufficient liquidity position enables it to pre-pay

its bank borrowings in Russia, despite the recent devaluation of

TRY, if required. The Group obtained a waiver from Sberbank with

respect to its covenants for all four quarters of 2022 and is in

negotiations to reset the covenants or repay the remaining loan.

The principal outstanding amount under the Sberbank loan currently

amounts to RUB 0.7 billion, of which RUB 0.02 billion is supported

by a cash collateral deposit.

Additional disclosure for the period from 1 January 2022 to 31

March 2022

Jubilant Foodworks Limited, a significant shareholder in DPEU

holding approximately 44% of the Company's ordinary share capital,

has certain regulatory disclosure requirements regarding its

investment in DPEU. In connection with this, going forward DPEU

will disclose on a quarterly basis profit after tax and other

comprehensive income.

For the period from 1 January 2022 to 31 March 2022, DPEU

recorded unaudited loss after tax of TRY 29.7 million and unaudited

other comprehensive income of TRY 4.2 million.

Notes

(1) IAS 29 'Financial Reporting in Hyperinflationary Economies'

is currently applicable in Turkey and the Company's interim results

for the period ending 30 June 2022, expected to be published in

September 2022, will be adjusted accordingly. The figures disclosed

in this announcement of 21 July 2022 are unaudited and are not

inflation adjusted unless stated otherwise.

(2) Excluding Coffy stores

(3) System sales are sales generated by the Group's corporate

and franchised stores to external customers and do not represent

revenue of the Group.

(4) Like-for-like growth is a comparison of sales between two

periods that compares system sales of existing system stores. The

Group's system stores that are included in like-for-like system

sales comparisons are those the Group considers to be mature

operations. The Group considers mature stores to be those stores

that have operated for at least 52 weeks preceding the beginning of

the first month of the period used in the like-for-like comparisons

for a certain reporting period, assuming the relevant system store

has not subsequently closed or been "split" (which involves the

Group opening an additional store within the same map of an

existing store or in an overlapping area).

(5) Group like-for-like growth is a weighted average of the

country like-for-like growths based on store numbers as described

in Note (4).

(6) Online system sales are system sales of the Group generated

through its online ordering channel.

(7) Delivery system sales are system sales of the Group

generated through the Group's delivery distribution channel.

(8) EBITDA, adjusted EBITDA and non-recurring and non-trade

income/expenses are not defined by IFRS. These items are determined

by the principles defined by the Group management and comprise

income/expenses which are assumed by the Group management to not be

part of the normal course of business and are non-trading items.

These items which are not defined by IFRS are disclosed by the

Group management separately for a better understanding and

measurement of the sustainable performance of the Group.

Appendices

Exchange Rates

For the period ended 30 June

--------------------------------------

2022 2021

------------------ ------------------

Period Period Period Period

Currency End Average End Average

------- --------- ------- ---------

EUR/TRY 17.522 16.196 10.365 9.485

RUB/TRY 0.321 0.200 0.119 0.105

EUR/RUB 53.858 83.520 86.203 89.547

Delivery - Take away / Eat in mix

For the period ended 30 June

--------------------------------------------------

2022 2021

------------------------ ------------------------

Turkey Russia Total Turkey Russia Total

75.7 75.9 75.4 83.2 77.2 81.4

Delivery % % % % % %

Take away / 24.3 24.1 24.6 16.8 22.8 18.6

Eat in % % % % % %

Total(2) 100% 100% 100% 100% 100% 100%

Forward looking statements

This press release includes forward-looking statements which

involve known and unknown risks and uncertainties, many of which

are beyond the Group's control and all of which are based on the

Directors' current beliefs and expectations about future events.

They appear in a number of places throughout this press release and

include all matters that are not historical facts and include

predictions, statements regarding the intentions, beliefs or

current expectations of the Directors or the Group concerning,

among other things, the results of operations, financial condition,

prospects, growth and strategies of the Group and the industry in

which it operates.

No assurance can be given that such future results will be

achieved; actual events or results may differ materially as a

result of risks and uncertainties facing the Group. Such risks and

uncertainties could cause actual results to vary materially from

the future results indicated, expressed, or implied in such

forward-looking statements.

Forward-looking statements contained in this press release speak

only as of the date of this press release. The Company and the

Directors expressly disclaim any obligation or undertaking to

update these forward-looking statements contained in this press

release to reflect any change in their expectations or any change

in events, conditions, or circumstances on which such statements

are based.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTRMMPTMTITBMT

(END) Dow Jones Newswires

July 21, 2022 02:00 ET (06:00 GMT)

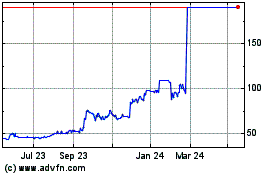

Dp Eurasia N.v (LSE:DPEU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Dp Eurasia N.v (LSE:DPEU)

Historical Stock Chart

From Jul 2023 to Jul 2024