TIDMDOTD

RNS Number : 4626D

dotDigital Group plc

03 March 2022

3 March 2022

Dotdigital Group plc

("Dotdigital" or the "Group")

Interim results for the six months ended 31 December 2021

Dotdigital Group plc (AIM: DOTD), the leading 'SaaS' provider of

an omnichannel marketing automation and customer engagement platform,

announces its unaudited interim results for the six months ended

31 December 2021 ("H1 2022").

Financial Highlights -- Organic revenue up by 10% to GBP30.9m (H1 2021: GBP28.2m) driven by growth in

sales from both

new and existing customers

* Recurring revenue as a percentage of total revenue

increased to 94% ( 30 June 2021: 93%)

* Monthly ARPC(1) up by 19% to GBP1,422 per month (H1

2021: GBP1,196 per month)

-- Adjusted EBITDA(2) grew 17% to GBP12.2m (H1 2021: GBP10.5m) and adjusted

operating profit(3)

grew 17% to GBP8.9m (H1 2021: GBP7.6m)

-- R&D continues to underpin Dotdigital's growth strategy, with recurring

revenues from enhanced

product functionality growing by 22% to GBP10.8m (H1 2021: GBP8.9m)

-- Strong net cash balance as of 31 December 2021 of GBP40.0m (30 June 2021:

GBP32.0m)

Operational Highlights -- International revenue increased by 4% to GBP9.7m (H1 2021: GBP9.3m), with

international sales

representing 31% to total revenue (H1 2021: 33%)

-- Strengthening of strategic partnerships in both ecommerce and CRM, with sales

through connectors

increasing by 9% to GBP13.9m (H1 2021: GBP12.8m)

-- Significant enhancements, such as single customer view and program analytics

and reporting,

to the Dotdigital platform, driving new growth opportunities and deepen

existing customer

relationships

Current Trading and Outlook -- Unwinding of customer buying behaviour in post-lockdown environment, with

reduced growth in

demand for SMS, and macro headwinds affecting international activities as

previously highlighted.

The Board now expects full year revenue growth to be slower than previous

expectations during

the current and future financial years

-- The Group is committed to investing in its people and its culture, in an

increasingly competitive

global labour market, in order to continue to achieve year on year revenue

growth

Milan Patel, CEO of Dotdigital, commented:

"The Group delivered a first half performance of strong growth and

profitability driven by new customer wins and expanded use of the

platform across the existing customer base. Our consistent strategy

continues to support our growth ambition in what is a significant

market opportunity.

"Although we appear to be moving away from the worst of the pandemic,

it triggered a dramatic acceleration in organisations' adoption

of digital marketing that is set to endure, and the strength of

our platform puts us in an ideal position to benefit from that trend.

Whilst we continue to navigate through market challenges, particularly

related to hiring, and adjust to a post-lockdown environment, the

Board is committed to investing in our teams in line with the growth

opportunity available, supported by a strong financial position

and recurring SaaS business model."

Investor Presentation : https://www.dotdigitalgroup.com/events-presentations/

Live presentation to investors: Management will host a live presentation

to investors via the Investor Meet Company platform on 4 March at

4pm UK time. Investors who already follow Dotdigital on the platform

will automatically be invited, others are invited to register in

advance via the following link: https://www.investormeetcompany.com/dotdigital-group-plc/register-investor

.

Notes

1. ARPC means Average Revenue Per Customer (including new customers

added in period and existing customers)

(2. EBITDA is earnings before interest, tax, depreciation and amortization

and adjusted for acquisition costs and share-based payments)

(3. Operating profit is adjusted for acquisition costs and share-based

payments)

For further information please contact:

Dotdigital Group plc Tel: 020 3953 3072

Milan Patel, CEO InvestorRelations@dotdigital.co

m

Alma PR (Financial PR) Tel: 020 3405 0210

Hilary Buchanan dotdigital@almapr.co.uk

David Ison

Kieran Breheny

Canaccord Genuity (Nominated Advisor Tel: 020 7523 8000

and Joint Broker)

Bobbie Hilliam

Georgina McCooke

Jonathan Barr, Sales

finnCap (Joint Broker) Tel: 020 7220 0500

Stuart Andrews, Corporate Finance

Alice Lane, ECM

Rhys Williams, Sales

Singer Capital Markets (Joint Broker) Tel: 020 7496 3000

Shaun Dobson, Head of Corporate Finance

Alex Bond, Corporate Finance

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED TO

CONSTITUTE INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF THE

MARKET ABUSE REGULATION (EU) NO. 596/2014. UPON THE PUBLICATION

OF THIS ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED

TO BE IN THE PUBLIC DOMAIN.

OPERATIONAL REVIEW

Introduction

For the first half period the Group delivered solid growth in a

more normalised trading environment against a strong comparative

period in the prior year. The marketing industry's march towards

digital continues at pace, and while the mix of channel usage ebbs

and flows, our omnichannel offering positions us well to capture

the full range of opportunities it presents.

The focus in the first half of 2022 has been on cementing our position

as one of the leading marketing automation platforms through enhancing

the functionality of our Engagement Cloud, deepening our strategic

partnerships and hiring exciting talent to build demand across our

territories among both new and existing customers.

We continue to be trusted by household names to help them engage

with and get closer to their audiences. In the period, we signed

Warner Bros, Sunderland Football Club, and the British Dental Association

as new customers, and the pipeline for the second half remains healthy.

We continue to invest in product innovation, geographic expansion

and strategic partnerships - the three components of our growth

strategy - to grow our share of the market while protecting our

strong margins. Demand for our platform is growing globally, underpinned

by a robust, pureplay SaaS model, which provides high-quality and

highly visible recurring revenues.

Current Trading and Outlook

Trading in the first half of the year, which delivered 10% growth

and strong profitability, reflects a period of more normalised trading

following a spike in one-off pandemic related SMS activity in the

prior year. This trend has continued with the emergence from lockdown

in EMEA accelerating post period end, and while our core offering

has made an encouraging start to the second half, we have seen a

further softening of transactional based SMS of which we will see

the full impact next financial year.

In addition, we are seeing a lag in US growth due to the impact

of a challenging labour market on our pace of recruitment and retention.

In the US we have put in place a new management structure and team

to support the region, which will start contributing through the

second half of the year.

As a result of the above, the Board anticipates revenue for the

full year to show growth in the range of 7 - 8%, slightly below

current expectations. Whilst our operating margin at the half year

is higher than normal levels, we expect this to be in the region

of 20 - 22% margin by the end of the year as we accelerate our investment

in our teams due to wage inflation and strengthen our international

operations. This investment in talent and the actions taken as described

above, positions us well for continued revenue growth in the next

financial year and beyond.

We appear to be moving away from the worst of the pandemic, yet

the acceleration in organisations' adoption of digital marketing

triggered is set to endure, and the strength of our platform puts

us in an ideal position to benefit from that trend. There remain

industry-wide pressures to overcome, but they don't detract from

the confidence we have in continuing to make significant strides

forward with each period that passes. We continue to grow our presence

in key territories around the world, developing a product that meets

the changing needs of marketeers while strengthening the organisational

infrastructure that underpins it.

Market

The shift from traditional to digital marketing is a long-term trend,

dramatically accelerated by the pandemic as organisations quickly

grew to rely on digital channels from both a customer retention

and acquisition perspective. At the same time, we have seen a marked

increase in demand for a more sophisticated approach, as marketeers

recognise the step change in ROI possible from developing more targeted

and personalised campaigns based on increasingly rich data sets.

This is evident in the continued adoption of channels in addition

to email, which remains the most widely used means of engagement,

and strong growth in functionality recurring revenue seen in the

period.

As a result of the pandemic and the increased frequency and depth

of engagement, organisations have grown their contact bases, and

the audiences now expect a personalised end-to-end experience; a

trend that will persist long after Covid-related restrictions ease.

We have developed Dotdigital's platform to provide marketeers with

everything they need to meet these expectations and more, from highly

customisable user experiences to the most advanced analytics on

the market, ensuring every campaign and touchpoint is memorable

and feeds back data to drive continuous ROI enhancements.

We continue to see digital marketing grow as a percentage of overall

revenue spend and expect to see organisations in those industries

worst affected by the pandemic such as travel continue to increase

their budgets as they ramp back up.

As the world moves towards a point where there is acceptance of

Covid as part and parcel of normal life, organisations will adapt

their strategies accordingly, but their reliance on marketing automation

will continue to grow apace and the strength of our offering puts

us in a strong position to capitalise.

Strategy

The Group's strategy has organic growth at its core, centred around

three strategic pillars: international diversification, expanded

market reach through partnership relationships, and continuous product

innovation.

Geographic expansion

Organic international revenue increased by 4% to GBP9.7m (H1 2021:

GBP9.3m) in the period, with international sales contributing 31%

to total revenue (H1 2021: 33%).

EMEA

EMEA showed solid revenue growth of c.10% in the period to GBP23.6m

(H1 2021: GBP21.5m).

The Group continues to see growing demand in the region for its

omnichannel capability, as marketeers increase their focus on relevancy

and personalisation to provide the best possible customer experience.

As international travel is now opening, our teams have started to

meet customers face to face and build further pipeline through the

partner and sales teams.

People was a major focus in EMEA across the period. We continued

to: invest in our customer success team, which is already having

a tangible, positive impact on retention; strengthen our partnership

team to deepen relationships and drive greater reach into their

respective customer bases; and broaden our agency and technology

partner ecosystem, helping to build 'top of funnel' lead generation

demand.

North America

Revenues from North America grew organically by c.3% to $6.5m (H1

2021: $6.3m).

The recruitment of talent and expanding the employee base is key

to improving growth rates within the region. In a challenging labour

market with high levels of wage inflation, the Directors continue

to focus on strengthening the management team in the region, most

recently with the hire of a new VP of Growth and VP of Customer

Success. Whilst investment in management bandwidth will take time

to flow through to the financial results, this provides us with

the right structure to support future growth. With the addition

of more customer success specialists to support growth and consultants

to help drive increased uptake of our platform from upper-tier mid-market

companies and larger enterprises, and plans to further strengthen

our senior team, our prospects for the territory remain strong.

APAC

APAC revenue grew organically by c.27% to AUS$4.4m (H1 2021: AUS$3.5m).

The Group's Japan office is now operational and uptake of the platform

in Singapore has been encouraging. The Group has continued to develop

its presence in Australia despite the challenges posed by lockdowns.

As our newest region, the focus in APAC continues to be building

our teams on the ground, deepening relationships with strategic

partners, and driving brand awareness.

The Group continues to navigate various cost pressures, particularly

regarding hiring, across all regions but is confident of actions

being taken by management to support the Group's geographic expansion

strategy in the second half and beyond.

Strategic partnerships

The Group continues to broaden and deepen its partnership relationships,

amplifying the Group's market reach beyond its direct sales channel.

A strategic technology partner for the Group is defined as a partner

where our customer using that technology integration has the potential

to represent or accounts for 10% of Group revenue. This strategic

partnership model is complemented by a broader general partner referral

network which includes over 200 active global partners. A core focus

of the strategic partnership network is forging connectors into

both ecommerce and CRM platforms, with the aim of building brand

awareness as we push out into international markets.

Sales through connectors into our strategic partners increased by

9% to GBP13.9m (H1 2021: GBP12.8m). Magento connector revenue grew

6%, Shopify connector revenue grew by 47% and MS Dynamics connector

revenue grew by 3% compared to the same period in the previous year.

While the Group works through pressures in the US, it continues

to build on its work with its strategic partners, both in the ecommerce

and CRM platform space, to drive brand awareness across their customer

bases through joint go to market plans. In H1, the Group increased

its investment in adding new channel managers into its international

operations, building on the strong relationships it has with its

agency and technology partners that operate within the ecosystem.

The pipeline continues to build as we move through the second half,

with the Group now also exploring opportunities to expand its strategic

partner base and further diversify its revenues into areas such

as service clouds, as is evident with the recent Zendesk Sell integration.

Product innovation

The Group's growth is supported by a focussed R&D investment programme

which continues to drive value for both our new and existing customers.

Recurring revenue from enhanced product functionality and upgrades

increased 22% to GBP10.8m. The key areas of investment for the Group

remain: enhancing our customer data and experience platform capabilities;

data visualisations through reporting and analytics; deeper integrations

with new and existing technology partners; and our user experience

of the platform.

During the period we invested GBP3.4m in R&D, underpinning management's

commitment to continuous product innovation. Our focus for product

innovation centres around the key areas of:

* Data and intelligence - joining all data together to

create a single customer view and help our customers

better personalise their campaigns and be relevant

* Marketing automation - harnessing artificial

intelligence (AI) and machine learning across

targeted parts of the platform's architecture,

informed by our customers' needs and requirements to

give efficiencies to time-poor marketeers

* Building out further omni-channel functionality to

Engagement Cloud to assist businesses through the

full customer journey at every touch point they have

with their customers

During the period we introduced single customer view, giving marketeers

and merchants a holistic, real-time view of their customer data

and interactions. We also released new program analytics and reporting,

empowering marketeers to optimise their customer journeys. New segment

analytics provide our customers additional insight into marketing

and commerce audiences, and we were the first to market with a toolkit

to help customers mitigate the impact of iOS 15 and mail privacy

protections. We also, developed new data integrations with Zoom

Webinar, Zendesk Sell, Oracle Netsuite and Shopware 6, expanding

our addressable market and providing customers with greater functionality.

M&A

To support the Group's organic growth strategy, the Board continues

to evaluate the market for complementary acquisitions, backed by

the Group's robust financial position. The Board's acquisition strategy

is focused on set criteria, being: synergy technology for new revenue

streams; bolt-on functionality to accelerate platform development,

new talent acquisition and the expansion of expertise, and extension

of the customer base in strategic territories.

People

Our success to date is solely down to the highly talented team we

have built at Dotdigital. We have built a special culture around

empowering colleagues to make decisions, recognising that everyone

plays an important role in helping us reach our growth ambitions

and giving them the freedom to express themselves. The togetherness

this creates has again paid dividends in the first half, as we continued

to meet challenges head on while driving the business forwards.

On behalf of myself and the Board I would like to thank everyone

at Dotdigital for their continued hard work and dedication.

As announced on 25 February 2022, Chief Financial Officer Paraag

Amin has informed the Board of his intention to step down as an

Executive Director of the Company, effective as of 31 March 2022.

The Company has appointed Spencer Stuart to conduct a formal search

process will update shareholders in due course. We thank Paraag

for his valuable contribution and wish him well in his future endeavours.

To continue to grow and increase our presence around the world,

we need to continue to hire and retain exceptional individuals and

invest in our talent. We have continued to bolster our product development

teams and sales teams while bringing in highly experienced customer

success professionals and continue to work hard to attract more

senior talent to help us realise our vision.

FINANCIAL REVIEW

Revenue

Revenue during the period grew 10% to GBP30.9m from GBP28.2m in

H1 2021. This performance was driven primarily by new customer wins

and existing customer growth.

Recurring revenue represents c.94% of revenues, improving visibility

on future revenues. Enhanced functionality revenue (which includes

licence fees and bolt-on functionality) grew 22% to GBP10.8m from

GBP8.9m in H1 2021.

International revenue was 31% of total sales in the period, from

33% in H1 2021. Of that, revenues were up 3% in the US to $6.5m

(H1 2021: $6.3m), and up 27% in APAC to AUS$4.4m (H1 2021: AUS$3.5m).

EMEA revenues grew 10% in the period to GBP23.6m (H1 2021: GBP21.5m).

During the period ARPC(3) increased by 19% to GBP1422 per month

(H1 2021: GBP1196 per month).

EBITDA

We achieved an adjusted EBITDA(1) margin of 40% and an adjusted

operating profit margin of 29% in the first half, which was in line

with management expectations. The adjustments include a share-based

payment charge of GBP0.22m and exceptional costs of GBP0.06m.

Balance Sheet & Cash Position

Dotdigital continues to generate strong cash flow from its Engagement

Cloud operations with an interim period end net cash balance of

GBP40.0m.

The Group continues to prioritise product development and during

the period spent GBP3.4m on development (compared to GBP3.1m in

H1 2021).

Dividend Policy

A dividend of 0.86p per ordinary share (2021: 0.83p) was proposed

by the Company at the time of its Final Results in November last

year, demonstrating a commitment from the Board to deliver value

by focusing on total shareholder return. This dividend was approved

by shareholders at the Annual General Meeting on 22 December 2021

and paid on 31 January 2022.

The Group will continue to conduct a full dividend review at year

end; therefore, in line with previous years the Board is not proposing

an interim dividend.

Dotdigital Group Plc

Consolidated Income Statement

For the six months ended 31 December 2021

------------------------------------------------------------------------------------

Restated*

6 months 6 months 12 months

to 31 Dec to 31 Dec to 30 June

2021 2020 2021

Unaudited Unaudited Audited

Note GBP'000s GBP'000s GBP'000s

Continuing operations

Revenue from contracts with

customers 4 30,911 28,226 58,124

Cost of sales (5,541) (5,067) (10,356)

---------- ---------- -----------

Gross profit 4 25,370 23,159 47,768

Administrative expenses (16,470) (15,583) (34,089)

Share based payments (222) (344) (625)

Exceptional costs** (60) (68) (188)

---------- ---------- -----------

Operating profit from continuing

operations 8,618 7,164 12,866

Finance income 16 16 20

Finance costs (30) (41) (74)

---------- ---------- -----------

Profit before income tax from

continuing operations 8,604 7,139 12,812

Income tax expense (1,825) (815) (1,322)

---------- ---------- -----------

Profit for the period from

continuing operations 6,779 6,324 11,490

---------- ---------- -----------

Discontinuing operations

Loss for the period from discontinued

operations - (424) (899)

Profit for the period attributable

to the owners of the Company 6,779 5,900 10,591

========== ========== ===========

Earnings per share from all operations (pence per share)

Basic 6 2.27 1.98 3.55

Diluted 6 2.23 1.95 3.50

Adjusted basic 6 2.36 2.11 3.82

Adjusted diluted 6 2.32 2.08 3.76

* Restated see note 11

** The exceptional costs relate to amortisation of technology

and in the prior year to amortisation of technology and acquisition

costs of Comapi.

Dotdigital Group Plc

Consolidated Statement of Comprehensive Income

For the six months ended 31 December 2021

---------------------------------------------------------------------------------------------------------

Restated*

6 months 6 months 12 months

to 31 Dec to 31 Dec to 30 June

2021 2020 2021

Unaudited Unaudited Audited

Note GBP'000s GBP'000s GBP'000s

Earnings per share from continuing operations (pence per share)

Basic 6 2.27 2.12 3.85

Diluted 6 2.23 2.09 3.79

Adjusted basic 6 2.36 2.26 4.12

Adjusted diluted 6 2.32 2.22 4.06

Earnings per share from discontinued operations (pence per share)

Basic 6 - (0.14) (0.30)

Diluted 6 - (0.14) (0.30)

Adjusted basic 6 - (0.14) (0.30)

Adjusted diluted 6 - (0.14) (0.30)

Dotdigital Group Plc

Consolidated Statement of Comprehensive Income

For the six months ended 31 December 2021

---------------------------------------------------------------------------------------------

Restated*

6 months 6 months 12 months

to 31 Dec to 31 to 30 June

2021 Dec 2020 2021

Unaudited Unaudited Audited

note GBP'000s GBP'000s GBP'000s

Profit for the period 6,779 5,900 10,591

Other comprehensive income

Items that may be subsequently

reclassified to

profit and loss:

Exchange differences on translating

foreign operations 29 (79) (87)

---------- ---------- -----------

Total comprehensive income attributable

to:

Owners of the parent 4 6,808 5,821 10,504

Total comprehensive income for

the year

Comprehensive income from continuing

operations 6,808 6,245 11,403

Comprehensive income from discontinued

operations - (424) (899)

========== ========== ===========

Dotdigital Group Plc

Consolidated Statement of Financial Position

For the six months ended 31 December 2021

-------------------------------------------------------------------

Restated*

Note As at As at As at

31 Dec 31 Dec 30 June

2021 2020 2021

Unaudited Unaudited Audited

GBP'000s GBP'000s GBP'000s

Assets

Non-current assets

Goodwill 9,680 9,680 9,680

Intangible assets 16,749 14,893 16,134

Property, plant and equipment 639 722 649

Right-of-use asset 2,983 3,805 3,323

---------- -------------- ---------

30,051 29,100 29,786

---------- -------------- ---------

Current assets

Trade and other receivables 12,838 13,253 13,350

Cash and cash equivalents 40,035 27,556 31,951

---------- -------------- ---------

52,873 40,809 45,301

---------- -------------- ---------

Total assets 4 82,924 69,909 75,087

========== ============== =========

Equity attributable to the owners of the

parent

Called up share capital 8 1,494 1,493 1,494

Share premium 7,124 6,967 7,124

Reverse acquisition reserve (4,695) (4,695) (4,695)

Other reserves 3,829 2,087 3,066

Retranslation reserve (8) (29) (37)

Retained earnings 60,863 50,883 54,081

---------- -------------- ---------

Total equity 68,607 56,706 61,033

========== ============== =========

Dotdigital Group Plc

Consolidated Statement of Financial Position

For the six months ended 31 December 2021

------------------------------------------------------------------

Restated*

As at As at As at

31 Dec 31 Dec 30 June

2021 2020 2021

Unaudited Unaudited Audited

GBP'000s GBP'000s GBP'000s

Liabilities

Non-current liabilities

Lease liabilities 2,174 2,885 2,489

Deferred tax 1,451 1,365 1,207

---------- ---------- ---------

3,625 4,250 3,696

---------- ---------- ---------

Current liabilities

Trade and other payables 9,739 7,830 9,334

Lease liabilities 902 1,031 934

Current tax payable 51 92 90

---------- ---------- ---------

10,692 8,953 10,358

---------- ---------- ---------

Total liabilities 14,317 13,203 14,054

========== ========== =========

Total equity and liabilities 82,924 69,909 75,087

========== ========== =========

Dotdigital Group Plc

Consolidated Statement of Changes in Equity

For the six months ended 31 December 2021

-----------------------------------------------------------------------------------------------------------------------------------------------------------

Share Share Retained Other Reverse Re-translation Total

capital premium Earnings reserves acquisition Reserve

reserve

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

As at 1 July

2020 as

previously

stated 1,493 6,967 45,514 1,372 (4,695) 50 50,701

---------------- ------------ ------------------ ------------------- ---------------- --------------------- ---------------------------- ---------

Impact of

correction

of errors

(note

11) - - 141 228 - - 369

---------------- ------------ ------------------ ------------------- ---------------- --------------------- ---------------------------- ---------

Restated as

at 1 July 2020 1,493 6,967 45,655 1,600 (4,695) 50 51,070

---------------- ------------ ------------------ ------------------- ---------------- --------------------- ---------------------------- ---------

Profit for the

period - - 5,900 - - - 5,900

Retranslation

reserve - - - - - (79) (79)

Dividends - - (950) - - - (950)

Reserve

Transfer - - 278 (278) - - -

Deferred tax

on share

options - - - 421 - - 421

Share based

payments - - - 344 - - 344

------------ ------------------ ------------------- ---------------- --------------------- ---------------------------- ---------

As at 31

December

2020 1,493 6,967 50,883 2,087 (4,695) (29) 56,706

------------ ------------------ ------------------- ---------------- --------------------- ---------------------------- ---------

As at 1 January

2021 1,493 6,967 50,883 2,087 (4,695) (29) 56,706

Profit for the

period - - 4,691 - - - 4,691

Dividends - - (1,522) - - - (1,522)

Retranslation

reserve - - - - - (8) (8)

Issue of share

capital 1 157 - - - - 158

Reserve

Transfer - - 29 (29) - - -

Deferred tax

on share

options - - - 727 - - 727

Share based

payments - - - 281 - - 281

------------ ------------------ ------------------- ---------------- --------------------- ---------------------------- ---------

As at 30 June

2021 1,494 7,124 54,081 3,066 (4,695) (37) 61,033

------------ ------------------ ------------------- ---------------- --------------------- ---------------------------- ---------

As at 1 July

2021 1,494 7,124 54,081 3,066 (4,695) (37) 61,033

Profit for the

period - - 6,779 - - - 6,779

Dividends - - - - - - -

Retranslation

reserve - - - - - 29 29

Reserve

transfer - - 3 (3) - - -

Deferred tax

on share

options - - - 544 - - 544

Share based

payments - - - 222 - - 222

------------ ------------------ ------------------- ---------------- --------------------- ---------------------------- ---------

As at 31

December

2021 1,494 7,124 60,863 3,829 (4,695) (8) 68,607

============ ================== =================== ================ ===================== ============================ =========

Dotdigital Group Plc

Consolidated Statement of Changes in Equity

For the six months ended 31 December 2021

---------------------------------------------

- Share capital is the amount subscribed for shares at nominal

value.

- Share premium represents the excess of the amount subscribed

for Share Capital over the nominal value net of the share issue

expenses.

- Retained earnings represents the cumulative earnings of the

Group attributable to equity shareholders.

- The reverse acquisition reserve relates to the adjustment

required to account the reverse acquisition in accordance with

International Financial Reporting Standards.

- Other reserves relate to the charge for the share-based

payments in accordance with International Financial Reporting

Standard 2. The reserve transfer in the period relates to lapsed

share options.

- Retranslation reserve relates to the retranslation of a

foreign subsidiary into the functional currency of the Group.

Dotdigital Group Plc

Consolidated Statement of Cash Flows

For the six months ended 31 December 2021

----------------------------------------------------------------------------------------------------

6 months 6 months 12 months

to 31 Dec to 31 Dec to 30 June

2021 2020 2021

Unaudited Unaudited Audited

note GBP'000s GBP'000s GBP'000s

Cash flow from operating activities 7 13,258 7,944 17,969

Tax paid (1,075) (982) (975)

------------ ---------- ------------------

Net cash generated from operating activities 12,183 6,962 16,994

------------ ---------- ------------------

Net cash used in continuing operating

activities 12,183 7,534 20,710

Net cash used in discontinuing operating

activities - (572) (3,716)

Cash flow from investing activities

Purchase of intangible fixed assets (3,439) (3,147) (6,870)

Purchase of property, plant and equipment (162) (57) (169)

Proceeds from sale of property, plant

and equipment - - 2

Interest received 16 16 20

------------ ---------- ------------------

Net cash used in investing activities (3,585) (3,188) (7,017)

------------ ---------- ------------------

Net cash used in continuing investing

activities (3,585) (3,188) (7,017)

Net cash used in discontinuing investing

activities - - -

Cash flows from financing activities

Equity dividends paid - (950) (2,472)

Payment of leasing liabilities (543) (572) (1,182)

Proceeds from share issues - - 158

------------ ---------- ------------------

Net cash used in financing activities (543) (1,522) (3,496)

------------ ---------- ------------------

Net cash used in continuing financing

activities (543) (1,492) (3,446)

Net cash used in discontinuing financing

activities - (30) (50)

Increase in cash and cash equivalents 8,055 2,252 6,481

============ ========== ==================

Cash and cash equivalents at beginning

of period 31,951 25,383 25,383

Effect of foreign exchange rate changes 29 (79) 87

Cash and cash equivalents at end of

period. 40,035 27,556 31,951

============ ========== ==================

Dotdigital Group Plc

Notes to interim financial statements

For the six months ended 31 December 2021

------------------------------------------------------------------------------------------------------------------------------------------------------------------

1. GENERAL INFORMATION

Dotdigital Group Plc is a company incorporated in England and Wales and

quoted on the AIM market.

2. BASIS OF INFORMATION

These consolidated interim financial statements have been prepared in

accordance with International Financial Reporting Standards ("IFRS") as

adopted by the UK and on a historical basis, using the accounting policies

which are consistent with those set out in the Group's annual report and

accounts for the year ended 30 June 2021. The interim financial information

for the six months to 31 December 2021, which complies with IAS 34 'Interim

Financial Reporting' has been approved by the Board of Directors on 3

March 2022.

The unaudited interim financial information for the period ended 31 December

2021 does not constitute statutory accounts within the meaning of Section

435 of the Companies Act 2006. The comparative figures for the year ended

30 June 2021 are extracted from the statutory financial statements which

have been filed with the Registrar of Companies and contain an unqualified

audit report and did not contain statements under Section 498 to 502 of

the Companies Act 2006.

3. SIGNIFICANT ACCOUNTING POLICIES

The accounting policies applied are consistent with those of the annual

financial statements for the year ended 30 June 2021, as described in

those financial statements.

Dotdigital Group Plc

Notes to interim financial statements

For the six months ended 31 December 2021

----------------------------------------------------------------------------------------------------------------------------------------------------------------------

4. SEGMENTAL REPORTING

The Group's single line of business is the provision of data-driven omnichannel

marketing automation. The chief operating decision maker considers the

Group's reportable segments to be by geographical location this being

EMEA, US and APAC operations and by business activity, this being core

Dotdigital and CPaaS as shown below:

Geographical revenue and results (from all

operations) 6 months to 31 December 2021

------------------------------------------------

EMEA US APAC

Operations Operations Operations Total

GBP'000s GBP'000s GBP'000s GBP'000s

Income statement

Revenue 23,644 4,885 2,382 30,911

Gross profit 18,927 4,367 2,076 25,370

Profit/(Loss) before

income tax 8,774 96 (266) 8,604

----------- ----------- ----------- ---------

Total comprehensive income

attributable to the owners

of the parent 7,046 13 (251) 6,808

=========== =========== =========== =========

Financial position

Total assets 75,743 4,670 2,511 82,924

Net current assets 36,957 3,727 1,497 42,181

=========== =========== =========== =========

Restated 6 months to 31 December 2020

------------------------------------------------

EMEA US APAC

Operations Operations Operations Total

GBP'000s GBP'000s GBP'000s GBP'000s

Income statement

Revenue 22,973 4,842 1,933 29,748

Gross profit (restated

see note 11) 17,251 4,354 1,775 23,380

Profit before income

tax 6,386 425 (96) 6,715

----------- ----------- ----------- ---------

Total comprehensive

income attributable to

the owners of the parent

(restated see note 11) 5,576 362 (117) 5,821

=========== =========== =========== =========

Financial position

Total assets 63,279 4,629 2,001 69,909

Net current assets (restated

see note 11) 26,757 3,623 1,476 31,856

=========== =========== =========== =========

Dotdigital Group Plc

Notes to interim financial statements

For the six months ended 31 December 2021

--------------------------------------------------------------------------------------------------------------------------------------------------------------------

4. SEGMENTAL REPORTING (CONTINUED...)

12 months to 30 June 2021

------------------------------------------------

EMEA US APAC

Operations Operations Operations Total

GBP'000s GBP'000s GBP'000s GBP'000s

Income statement

Revenue 47,024 9,264 4,262 60,550

Gross profit 36,878 8,241 3,864 48,983

Profit/(Loss) before

income tax 11,699 609 (294) 12,014

----------- ----------- ----------- ---------

Total comprehensive income

attributable to the

owners of the parent 10,436 379 (311) 10,504

=========== =========== =========== =========

Financial position

Total assets 71,566 3,098 423 75,087

Net current assets/(liabilities) 33,942 1,387 (386) 34,943

=========== =========== =========== =========

Business activity revenue and results from all operations

6 months to 31 December 2021

---------------------------------

Core CPaaS Total

GBP'000s GBP'000s GBP'000s

Income statement

Revenue 30,911 - 30,911

Gross profit 25,370 - 25,370

Profit/(Loss) before income tax 8,604 - 8,604

---------- ---------- ---------

Total comprehensive income attributable

to the owners of the parent 6,808 - 6,808

========== ========== =========

Financial position

Total assets 82,882 42 82,924

Net current assets/(liabilities) 42,213 (32) 42,181

========== ========== =========

Dotdigital Group Plc

Notes to interim financial statements

For the six months ended 31 December 2021

--------------------------------------------

4. SEGMENTAL REPORTING (CONTINUED...)

Restated 6 months to 31 December

2020

-------------------------------------

Core CPaaS Total

GBP'000s GBP'000s GBP'000s

Income statement

Revenue 28,226 1,522 29,748

Gross profit (restated see note

11) 23,159 221 23,380

Profit/(Loss) before income tax 7,139 (424) 6,715

----------- ----------- -----------

Total comprehensive income attributable

to the owners of the parent (restated

see note 11) 6,245 (424) 5,821

=========== =========== ===========

Financial position

Total assets 67,069 2,840 69,909

Net current assets (restated

see note 11) 31,088 768 31,856

=========== =========== ===========

12 months to 30 June 2021

-------------------------------

Core CPaaS Total

GBP'000s GBP'000s GBP'000s

Income statement

Revenue 58,124 2,426 60,550

Gross profit 47,768 1,215 48,983

Profit/(Loss) before income

tax 12,812 (798) 12,014

--------- --------- ---------

Total comprehensive income attributable

to the owners of the parent 11,403 (899) 10,504

========= ========= =========

Financial position

Total assets 74,976 111 75,087

Net current assets 34,974 (31) 34,943

========= ========= =========

5. DIVIDS

The proposed final dividend of GBP2,563,819 for the year ended

30 June 2021 of 0.86p per share was paid on the 31 January

2022.

Dotdigital Group Plc

Notes to interim financial statements

For the six months ended 31 December 2021

--------------------------------------------

6. EARNINGS PER SHARE

Earnings per share data is based on the consolidated profit

using the weighted average number of shares in issue of the parent

Company. Basic earnings per share are calculated by dividing the

earnings attributable to ordinary shareholders by the weighted

average number of ordinary shares outstanding during the

period.

Diluted earnings per share is calculated using the weighted

average number of shares adjusted to assume the conversion of all

dilutive potential ordinary shares. Adjusted earnings per share is

based on the consolidated profit deducting the acquisition related

exceptional costs and share-based payment.

A number of non-IFRS adjusted profit measures are used in the

annual report and financial statements and in these interim

financial statements. Adjusting items are excluded from our

headline performance measures by virtue of their size and nature,

in order to reflect management's view of the performance of the

Group. Summarised below is a reconciliation between statutory

results to adjusted results. The Group believes that alternative

performance measures such as adjusted EBITDA are commonly reported

by companies in the markets in which it competes and are widely

used by investors in comparing performance on a consistent basis

without regard to factors such as depreciation and amortisation,

which can vary significantly depending upon accounting methods

(particularly when acquisitions have occurred) or based on factors

which do not reflect the underlying performance of the business.

The adjusted profit after tax earnings measure is also used for the

purpose of calculating adjusted earnings per share.

Reconciliations to earnings figures 6 months 6 months 12 months

used in arriving at adjusted earnings to 31 December to 31 December to 30 June

per share are as follows: 2021 2020 2021

From all operations GBP'000s GBP'000s GBP'000s

Profit for the year attributable to

the owners of the parent 6,779 5,900 10,591

Amortisation of acquisition-related

intangible fixed asset 60 60 120

Other exceptional costs - 8 68

Share-based payment 222 344 625

---------------- ---------------- ----------------

Adjusted profit for the year attributable

to the owners of the parent 7,061 6,312 11,404

---------------- ---------------- ----------------

Adjusted profit for the year attributable to the owners of the parent

from:

Continuing operations: 7,061 6,736 12,303

Discontinuing operations: - (424) (899)

---------------- ---------------- ------------

7,061 6,312 11,404

Management does not consider the above adjustments to reflect

the underlying business performance.

Dotdigital Group Plc

Notes to interim financial statements

For the six months ended 31 December 2021

--------------------------------------------------------------------------------------------------

6. EARNINGS PER SHARE (CONTINUED...)

6 months 6 months 12 months

to 31 Dec to 31 Dec to 30 June

2021 2020 2021

Unaudited Unaudited Audited

All operations

Earnings per Ordinary share:

Basic (pence) 2.27 1.98 3.55

Diluted (pence) 2.23 1.95 3.50

Adjusted basic (pence) 2.36 2.11 3.82

Adjusted diluted (pence) 2.32 2.08 3.76

=========== ================ ==============

Continuing operations

Earnings per Ordinary share:

Basic (pence) 2.27 2.12 3.85

Diluted (pence) 2.23 2.09 3.79

Adjusted basic (pence) 2.36 2.26 4.12

Adjusted diluted (pence) 2.32 2.22 4.06

=========== ================ ==============

Discontinued operations

Earnings per Ordinary share:

Basic (pence) - (0.14) (0.30)

Diluted (pence) - (0.14) (0.30)

Adjusted basic (pence) - (0.14) (0.30)

Adjusted diluted (pence) - (0.14) (0.30)

Dotdigital Group Plc

Notes to interim financial statements

For the six months ended 31 December 2021

---------------------------------------------------------------------------------------------

6. EARNINGS PER SHARE (CONTINUED...)

6 months 6 months 12 months

to 31 Dec to 31 Dec to 30 June

2021 2020 2021

Unaudited Unaudited Audited

GBP'000s GBP'000s GBP'000s

Profit for the period from all

operations for the purpose of earnings

per share:

Basic 6,779 5,900 10,591

Adjusted 7,061 6,312 11,404

=========== ================ ==============

Profit for the period from

continuing

operations for the purpose

of earnings

per share:

Basic 6,779 6,324 11,490

Adjusted 7,061 6,736 12,303

=========== ================ ==============

Profit for the period from

discontinued

operations for the purpose

of earnings

per share:

Basic - (424) (899)

Adjusted - (424) (899)

=========== ================ ==============

Weighted average number of shares in issue

as follows:

6 months 6 months 12 months

to 31 Dec to 31 Dec to 30 June

2021 2020 2021

Unaudited Unaudited Audited

Weighted average number

Basic 298,778,630 298,547,645 298,598,459

Diluted 304,006,513 303,231,752 302,921,327

================ ================ ============

The adjusted profit for the period, adjusted basic earnings per

ordinary share and adjusted diluted earnings per ordinary share

exclude exceptional costs relating to share based payments GBP221,767

(2020: GBP343,920, 2021: GBP624,881), ongoing acquisition costs

of Comapi GBPnil (2020: GBP7,857, 2021: GBP68,095) and amortisation

of acquired intangibles GBP60,000 (2020: GBP60,000, 2021: GBP120,000).

Dotdigital Group Plc

Notes to interim financial statements

For the six months ended 31 December 2021

7. RECONCILIATION OF PROFIT BEFORE CORPORATION TAX TO NET CASH

GENERATED FROM OPERATIONS

6 months 6 months 12 months

to 31 Dec to 31 Dec to 30 June

2021 2020 2021

Unaudited Unaudited Audited

GBP'000s GBP'000s GBP'000s

Profit before income tax

from all operations 8,604 6,715 12,014

Adjustments for:

Depreciation 565 651 1,267

Amortisation 2,824 2,314 4,795

Exceptional costs - 8 68

Gain on disposal of fixed

assets - - (2)

Share-based payments 222 344 625

Finance lease non-cash movement 96 140 (48)

Finance expense 30 41 75

Decrease/ (increase) in trade

and other receivables 512 (266) (363)

Increase/(decrease) in trade

and other payables 405 (2,003) (462)

-------------- -------------- -----------

Net cash from operations 13,258 7,944 17,969

============== ============== ===========

8. CALLED UP SHARE CAPITAL

During the period no shares were issued.

Dotdigital Group Plc

Notes to interim financial statements

For the six months ended 31 December 2021

----------------------------------------------------------------------------------------

9. RELATED PARTY NOTE

Transactions between the company and its subsidiaries, who are related

parties, have been eliminated on

consolidation and are not disclosed

in this note.

Key management remuneration:

Key management include Directors and non-executive

Directors

The remuneration paid for key management for employee services are

as follows:

12 months

6 months 6 months

to 31 Dec to 31 Dec to 30 June

2021 2020 2021

Unaudited Unaudited Audited

GBP'000s GBP'000s GBP'000s

Aggregate emoluments 312 285 1,136

Share-based payments

on the LTIP options

granted 133 220 347

Company contributions

to money purchase

pension scheme 13 13 26

----------- ------------------ ----------------

458 518 1,509

=========== ================== ================

The end-to-end awards granted to Milan Patel and to Paraag Amin

can only be exercised at the end of a 3-year vesting period, based

on challenging absolute total shareholder return performance

targets. Under IFRS 2 Share-based payments, the Group must provide

an estimate for the costs based on a Black Scholes model valuation

each year, as if they fully paid out at the end of the performance

period in December 2020 to Milan Patel and October 2021 for Paraag

Amin. To fully vest, the Group must achieve an annual compounded

TSR of 35% over a c.3 year period. In the period, part of the

end-to-end share options awarded to Milan vested and the remainder

lapsed. A new grant was made by the remuneration committee under

the long-term incentive program with performance measures that are

based on the company's total shareholder return and earnings per

share in 2024.

Dotdigital Group Plc

Notes to interim financial statements

For the six months ended 31 December 2021

--------------------------------------------

9.RELATED PARTY NOTE (CONTINUED...)

6 months 6 months 12 months

to 31 Dec to 31 Dec to 30 June

2021 2020 2021

Unaudited Unaudited Audited

GBP'000s GBP'000s GBP'000s

The following transactions were carried out

with related parties

Sale of services

Entities controlled by non - executive director

of the Group:

Ipswich Town Football Club 5 - 4

Epwin Group Plc - Email marketing

services 3 3 6

Cadence Performance Ltd - Email 1

marketing services - -

---------- --------------------- ---------------

8 4 10

========== ===================== ===============

Year end balances arising from

the sale of services

Entities controlled by non-executive directors

of the Group:

Ipswich Town Football Club - - 1

Epwin Group Plc - Email marketing

services - 1 1

---------- --------------------- ---------------

- 1 2

========== ===================== ===============

10. SUBSEQUENT EVENTS TO 31 DECEMBER

2021

As at the date of these statements and the date they were approved

by the Board of Directors there were no such events to report.

Copies of this interim statement are available form the Company

at its registered office at, No 1 London Bridge London, SE1 9BG.

The interim financial information document will also be available

on the Company's website www.dotdigitalgroup.com.

Dotdigital Group Plc

Notes to interim financial statements

For the six months ended 31 December 2021

--------------------------------------------

11. PRIOR YEAR RESTATEMENT NOTE

During the year ended 30 June 2021, the Group made the decision

to modify the classification of direct marketing from cost of sales

to administrative expenses and tech infrastructure from under

administrative expenses to cost of sales, to reflect more

appropriately gross profit and gross profit margin plus also

administrative expenses under continuing operations. Comparative

amounts in the 6 months ended 31 December 2020 in the Consolidated

Income Statement have been reclassified for consistency. As a

result, GBP66,111 was reclassified from administrative expenses to

cost of sales. There has been no impact on the profit for the 6

months ended 31 December 2020 however gross profit has decreased

from GBP23,225,000 to GBP23,159,000 and administrative expenses

decreased from GBP15,649,000 to GBP15,583,000.

During the year ended 30 June 2021, the Group discovered that

the share-based payment arrangement had been erroneously recognised

in Dotdigital Group PLC instead of being recognised in the

subsidiaries in which the employees are employed. Under IFRS 2

Share-based payments, when a parent grants rights to it's equity

instruments to employees of its subsidiaries this arrangement

should be accounted for as equity-settled in the consolidated

financial statements but results in an investment being created in

the parent's own statement of financial position. Therefore, the

subsidiaries should in their own separate financial statements,

measure the services received from its employees in accordance with

the requirements of IFRS 2 applicable to equity-settled share-based

payment transactions. Thereby resulting in a corresponding increase

recognised in equity as a capital contribution from the parent.

There was no impact on the Group profit for the 6 months ended 31

December 2020.

At the year end, the Group discovered on the calculation of

deferred tax on the share options and the internally generated

development costs that this had been misallocated and miscalculated

respectively. On the misallocation of the deferred tax on the share

option under IFRS 2 Share based payment, where the final deferred

tax calculation exceeds the cumulative amount recognised as a

share-based expense in the Income statement, the maximum amount of

deferred tax income that can be recognised in the Income Statement

can only equal the total share-based payment expense. Any excess

deferred tax is recognised directly in reserves.

As for the miscalculation of deferred tax on the internally

generated development costs this is with respect to the

identification and calculation of the net book value for internally

generated development costs qualifying for research and

development, thereby impacting the deferred tax liability.

Both adjustments have impacted the prior year's profit for the 6

months ended 31 December 2020 where this has decreased from

GBP6,656,000 to GBP6,324,000. Net assets as per the consolidated of

financial position have increased from GBP56,248,000 to

GBP56,706,000.

Dotdigital Group Plc

Notes to interim financial statements

For the six months ended 31 December 2021

--------------------------------------------

11. PRIOR YEAR RESTATEMENT NOTE continued

Consolidated Income Statement for the 6 months ended 31 December

2020

As previously

reported Adjustments As restated

GBP'000s GBP'000s GBP'000s

Continuing operations

Revenue from contracts

with customers 28,226 - 28,226

Cost of sales (5,001) (66) (5,067)

Gross profit 23,225 (66) 23,159

Administrative expenses (15,649) 66 (15,583)

Share based payments (344) - (344)

Exceptional costs (68) - (68)

-------------- ------------ ------------

Operating profit from continuing

operations 7,164 - 7,164

Finance income 16 - 16

Finance costs (41) - (41)

-------------- ------------ ------------

Profit before income tax

from continuing operations 7,139 - 7,139

Income tax expense (483) (332) (815)

-------------- ------------ ------------

Profit for the period from

continuing operations 6,656 (332) 6,324

-------------- ------------ ------------

Discontinuing operations

Loss for the year from

discontinued operations (424) - (424)

Profit for the period attributable

to the owners of the Company 6,232 (332) 5,900

-------------- ------------ ------------

Dotdigital Group Plc

Notes to interim financial statements

For the six months ended 31 December 2021

--------------------------------------------

11. PRIOR YEAR RESTATEMENT NOTE continued

Consolidated Statement of Comprehensive Income for the 6 months

ended 31 December 2020

As previously Adjustments As restated

reported

Unaudited Unaudited Unaudited

GBP'000s GBP'000s GBP'000s

Profit for the period 6,232 (332) 5,900

Other comprehensive income

Items that may be subsequently reclassified

to

profit and loss:

Exchange differences on translating

foreign operations (79) - (79)

----------------------- -------------- ---------------

Total comprehensive income attributable

to:

Owners of the parent 6,153 (332) 5,821

Total comprehensive income for the

year

6,577 (332) 6,245

Comprehensive income from continuing

operations

Comprehensive income from discontinued

operations (424) - (424)

======================= ============== ===============

Dotdigital Group Plc

Notes to interim financial statements

For the six months ended 31 December 2021

--------------------------------------------

11. PRIOR YEAR RESTATEMENT NOTE continued

Consolidated Statement of Financial Position as at 31 December

2020

As previously

reported Adjustments As restated

GBP'000s GBP'000s GBP'000s

Assets

Non-current assets

Goodwill 9,680 - 9,680

Intangible assets 14,893 - 14,893

Property, plant and equipment 4,527 - 4,527

-------------- ------------ ------------

29,100 - 29,100

Current assets

Trade and other receivables 13,253 - 13,253

Cash and cash equivalents 27,556 - 27,556

-------------- ------------ ------------

40,809 - 40,809

-------------- ------------ ------------

Total assets 69,909 - 69,909

============== ============ ============

Equity attributable to the owners

of the parent

Called up share capital 1,493 - 1,493

Share premium 6,967 - 6,967

Reverse acquisition reserve (4,695) - (4,695)

Other reserves 1,438 649 2,087

Retranslation reserve (29) - (29)

Retained earnings 51,074 (191) 50,883

-------------- ------------ ------------

Total equity 56,248 458 56,706

-------------- ------------ ------------

Dotdigital Group Plc

Notes to interim financial statements

For the six months ended 31 December 2021

--------------------------------------------

11. PRIOR YEAR RESTATEMENT NOTE continued

Consolidated Statement of Financial Position as at 31 December

2020

As previously

reported Adjustments As restated

GBP'000s GBP'000s GBP'000s

Liabilities

Non-current liabilities

Lease liabilities 2,885 - 2,885

Deferred tax 1,904 (539) 1,365

-------------- ------------ ------------

4,789 (539) 4,250

-------------- ------------ ------------

Current liabilities

Trade and other payables 7,830 - 7,830

Lease liabilities 1,031 - 1,031

Current tax payable 11 81 92

-------------- ------------ ------------

8,872 81 8,953

-------------- ------------ ------------

Total liabilities 13,661 (458) 13,203

============== ============ ============

Total equity and liabilities 69,909 - 69,909

============== ============ ============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR XLLLBLXLXBBD

(END) Dow Jones Newswires

March 03, 2022 02:00 ET (07:00 GMT)

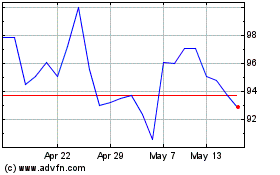

Dotdigital (LSE:DOTD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Dotdigital (LSE:DOTD)

Historical Stock Chart

From Jul 2023 to Jul 2024