TIDMDLN

RNS Number : 8420Y

Derwent London PLC

28 February 2013

28 February 2013

Derwent London plc ("Derwent London" / "the Group")

Results for the year ended 31 December 2012

Confident outlook underpinned by strong performance

Financial highlights

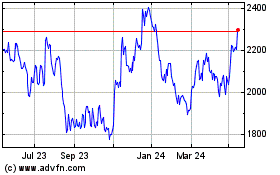

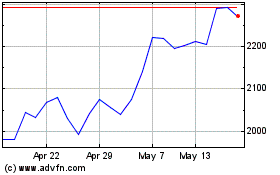

-- EPRA net asset value per share increased by 11% to 1,886p from 1,701p at 31 December 2011

-- EPRA profit before tax of GBP52.5m (2011: GBP52.3m) despite

increase in development activity

-- EPRA earnings per share of 50.36p (2011: 51.59p)

-- Increase in EPRA like-for-like net rental income of 8.2%

-- Final dividend increased by 8.4% to 23.75p per share (2011: 21.90p)

-- Loan-to-value ratio of 30% (2011: 32%)

Performance

-- GBP13.3m of lettings concluded on 340,300 sq ft (31,610m(2))

at a 7.6% premium to December 2011 ERV

-- Vacancy rate low at 1.6% (31 December 2011: 1.3%) reflecting

strong demand particularly from the TMT sector

-- Underlying valuation increase of 7.3% in 2012 (2011: 7.6%)

-- Underlying estimated rental values rose 6.7% (2011: 6.3%)

-- EPRA net initial yield 4.3% (31 December 2011: 4.4%) and true

equivalent yield 5.55% (31 December 2011: 5.61%)

-- Developments and major refurbishments rose 14.1% in value

Projects

-- Six major planning consents obtained during the year totalling 655,000 sq ft (60,850m(2))

-- 495,000 sq ft (46,000m(2)) of major projects underway at year end of which 37% pre-let

-- Further 422,000 sq ft (39,200m(2)) to start in 2013

-- 2.7 million sq ft (250,000m(2)) pipeline, two thirds of which has planning consent

-- Construction of White Collar Factory, City Road EC1 being

brought forward on a speculative basis

-- Unlocked redevelopment opportunity at 55-65 North Wharf Road,

Paddington W2 allowing construction of 240,000 sq ft (22,300m(2))

of offices from 2014

Acquisitions and disposals

-- Acquisitions totalled GBP101m

-- Disposals raised GBP161m after costs, giving a 4.5% surplus over 31 December 2011 values

Robert Rayne, Chairman, commented:

"Derwent London has delivered another strong set of results in

2012. The Group achieved a double digit percentage increase in net

asset value driven by increasing rents in our markets, management

activity and progress in our development pipeline.

We are continuing to see new tenants attracted to the space we

provide and consider that rents in our markets will continue to

rise. This gives us the confidence both to accelerate our

development pipeline and increase the dividend for the year by

7.5%."

John Burns, Chief Executive Officer, commented:

"Last year was an excellent one for Derwent London. Our

signature mid-market central London office space remains in demand

and we expect our rental values to rise between 4% and 6% in

2013.

At Derwent London we look to create tomorrow's space today. We

will complete 260,000 sq ft of projects in 2013 and by the year end

we intend to have over 650,000 sq ft under construction, including

80 Charlotte Street, our largest regeneration project to date. We

believe our prospects are good and look forward to the future with

confidence."

For further information, please contact:

Derwent London Tel: 020 7659 3000

John Burns, Chief Executive Officer

Damian Wisniewski, Finance Director

Louise Rich, Head of Investor Relations

Brunswick Group LLP Tel: 020 7404 5959

Kate Holgate/Elizabeth Adams

There will be a webcast of the results at 10:00am today which

can be accessed at www.derwentlondon.com

CHAIRMAN'S STATEMENT

Last year was both a significant year for London and another

strong one for Derwent London. The Group's hallmark mid-market

office product was in demand, there was excellent progress in the

development pipeline, a string of successful planning decisions and

the unlocking of value through restructuring of leasehold

interests. We added to the portfolio in our core markets, recycled

capital and achieved our refinancing targets. This activity added

value and we saw an 11% increase in EPRA net asset value per share

to 1,886p with the portfolio generating an overall revaluation

surplus of GBP175.3m. All this was achieved whilst broadly

maintaining profits and further strengthening our balance

sheet.

Highlights

Progress was made across all the Group's business areas:

-- 340,300 sq ft (31,610m(2)) of space was let, securing

GBP13.3m of rental income at an average premium of 7.6% to 31

December 2011 ERV, of which 55% related to pre-lettings of

developments. The EPRA vacancy rate of available space at the year

end was 1.6%.

-- Six planning consents were secured totalling 655,000 sq ft (60,850m(2)).

-- 4 & 10 Pentonville Road N1 was completed (55,000 sq ft/ 5,110m(2)) and is 87% let.

-- Asset management initiatives were completed on 580,000 sq ft

(53,900m(2)) providing greater longevity of income and inbuilt

rental growth.

-- Principal acquisitions were five properties totalling 247,500

sq ft (23,000m(2)) bought for GBP90.3m after costs (GBP365 per sq

ft/ GBP3,930 per m(2)) at an average net initial yield of 4.7%.

-- Disposals raised GBP161m after costs, generating a profit of

GBP6.9m. These included the 50% interest in 1-5 Grosvenor Place SW1

to facilitate future development. The remainder were non-core

assets.

-- Our financing retains strength and flexibility. During the

year we signed an GBP83m 3.99% 12-year secured loan, further

diversifying our sources of finance and increasing our weighted

average length of unexpired debt to 6.1 years at the year end.

The EPRA net initial yield of the portfolio was 4.3% at 31

December 2012. The EPRA like-for-like net rental income increased

over the year by 8.2%. In addition at the year end reversionary

income stood at GBP55.4m pa, 38% of which is contracted through the

expiry of rent free periods, stepped rents and fixed uplifts.

Our market

In 2012, the eyes of the world were on London, which hosted

memorable celebrations for the Queen's Diamond Jubilee, the

Olympics and the Paralympics. The capital excelled in its time in

the spotlight, demonstrating just what an attractive, welcoming and

exciting place it is. It has an effective and improving

infrastructure, a diverse and vibrant mix of cultural events and

the London economy stands apart from the country as a whole. London

is a desirable place in which to live, work and operate businesses.

Consequently the property investment market in central London

continues to flourish with yields remaining firm supported by high

levels of activity.

Derwent London is an innovator in the regeneration of London's

offices, investing in improving areas in the West End and City

borders and offering tenants great space. This requires

well-designed buildings at reasonable rents in the appealing

locations of the future - such as those close to the Crossrail

routes or within "London's Tech Belt", an arc stretching between

Kings Cross and Whitechapel. Our mid-market offices continue to

attract tenants with Unilever recently taking 21,100 sq ft

(1,960m(2)) at the Buckley Building EC1. We said at the beginning

of 2012 that rents would rise, and were pleased to see stronger

growth than the 4-5% we had envisaged, with a 6.7% underlying

increase in the estimated rental value (ERV) and new lettings

signed at rents on average 7.6% ahead of December 2011 ERV.

Capturing value

The strength of the occupational market and our robust financing

give us the confidence to press ahead with our development

pipeline. We completed 4 & 10 Pentonville Road N1 in August

2012, but still had six major projects underway at the year end

totalling 495,000 sq ft (46,000m(2)). During 2013 we are starting

work on three additional schemes totalling 422,000 sq ft

(39,200m(2)) including our largest project to date, the 385,000 sq

ft (35,800m(2)) regeneration of 80 Charlotte Street, Fitzrovia

W1.

Looking further to the future, we have over 1.8 million sq ft

(169,000m(2)) of exciting projects to start in 2014 and beyond of

which 0.9 million sq ft (86,000m(2)) has planning permission.

One of our largest schemes with planning permission is the White

Collar Factory at City Road EC1 where we are about to finish a

working prototype. Marketing presentations begin in April before we

move into full scale construction of this office development in the

heart of "London's Tech Belt" on a speculative basis.

We have recently signed an option agreement with the freeholder

and head leaseholder that provides for a regear of our leasehold

interest at 55-65 North Wharf Road W2. This will enable us to

proceed with the development of 240,000 sq ft (22,300m(2)) of

office space under a 999-year lease at this important site in

Paddington where we hold a planning consent.

Results and dividend

Derwent London's property portfolio increased in value to

GBP2.86bn as at 31 December 2012, showing an overall revaluation

surplus of GBP175.3m and an underlying valuation increase of 7.3%

during the year, which compares to annual capital growth of 4.1%

produced by the IPD Central London Offices Index. Of our valuation

increase, 4.1% came in the second half of 2012. The portfolio's

total property return for the year was 11.6% against 8.8% for IPD.

This strong property return contributed to EPRA net asset value per

share rising to 1,886p at the year end compared with 1,701p at 31

December 2011 and 1,770p at 30 June 2012. After adding back

dividends, the Group's total return for the year was 12.7%.

Despite a significant acceleration in development activity

during the year, income levels have been broadly maintained, with

EPRA profit before tax of GBP52.5m against GBP52.3m in the previous

year. Given dividend cover of 1.5 times and our current outlook, we

are recommending a final dividend for the year of 23.75p, an

increase of 8.4%, to be paid on 14 June 2013 to shareholders on the

register on 10 May 2013. Of this, 18.75p will be paid as a PID

under the UK REIT regime and there will be a scrip alternative. The

total dividend for the year is therefore 33.70p, an increase of

7.5% on that in 2011.

The Group's overall debt position was broadly unchanged with net

debt up by only 1.2% over the year to GBP874.8m. The overall

loan-to-value ratio at the end of 2012 fell to 30.0% from 32.0% in

2011 and gross interest cover over 2012 has increased to 351% from

307% last year. Following the arrangement of a new GBP83m 12-year

loan in August, around 50% of our current financing is with

non-bank sources and we have increased the weighted average

unexpired duration of debt to 6.1 years. We had substantial undrawn

facilities totalling GBP333m and uncharged properties totalling

GBP624m at the year end giving us the headroom to meet our

committed capital expenditure requirements.

We do not achieve these results without considerable commitment,

skill and hard work. I would like to thank the Derwent London team,

and congratulate them for winning Management Today's 'Britain's

Most Admired Property Company' award for the third successive

year.

The Board

We welcomed Simon Fraser to the Board on 1 September 2012 and

believe that his extensive corporate broking and financial services

experience will benefit the Group. Simon Neathercoat retired from

the Board on 31 December 2012 after giving 13 years of valuable

advice.

Outlook

London is a desirable place in which to operate and invest and

this currently shows no signs of changing. Our office brand appeals

to a wide range of tenants from both a design and a price

perspective, in particular those from the broad-based TMT world.

The increase in rents in our markets in 2012 exceeded our

expectations. We believe we shall see rental growth in these

markets of 4-6% in 2013 with yields remaining stable.

We have an extensive and deliverable pipeline of value-creating

developments, both for the near term and extending into the future.

These are well-located in our core areas and in many cases will

benefit substantially from the arrival of Crossrail.

In 2013 we aim to make progress in the following areas:

-- Complete 212,000 sq ft (19,700m(2)) at Buckley Building EC1

and 1 Page Street SW1 which are 70% pre-let overall.

-- Progress construction of 256,000 sq ft (23,790m(2)) at 1-2

Stephen Street W1, 40 Chancery Lane WC2 and Turnmill EC1.

-- Commence construction of 422,000 sq ft (39,200m(2)) in three

developments including 80 Charlotte Street W1. Of this space around

20% will be residential, which will enable Derwent London to take

advantage of the current high demand for central London residential

property.

-- Progress a number of major consented projects including White

Collar Factory EC1, 55-65 North Wharf Road W2 and a retail scheme

at 18-30 Tottenham Court Road W1 (together 570,000 sq ft/

52,910m(2)).

-- Advance the planning of our future value-creating

opportunities, including 1-5 Grosvenor Place SW1.

Our increased development programme, significant reversionary

potential and asset management activities provide a strong

foundation for the delivery of future value. Low leverage and our

focus on interest cover create the financial strength to undertake

this development pipeline and to take advantage of new

opportunities. These components give us a powerful platform for

growth thereby continuing to provide attractive returns to

shareholders.

Robert A. Rayne

28 February 2013

OUR MARKET

See Appendix 1 for supporting graphs

http://www.rns-pdf.londonstockexchange.com/rns/8420Y_-2013-2-27.pdf

London's economy is predominantly service-based and accounts for

approximately 20% of national output. It remained resilient in 2012

despite the weakness in the UK economy as a whole. In central

London, Derwent London's core market, office take-up was lower than

average but the supply of space was constrained, thereby keeping

vacancy rates below trend and providing the conditions for further

rental growth. In addition London continued to be seen by investors

as offering an attractive investment destination. Transaction

volumes were at their highest level for five years according to

leading surveyors, CBRE.

Economic backdrop

The lack of growth in the UK economy, with continued austerity

measures and uncertainties within the Eurozone, provided the main

economic backdrop to 2012. UK GDP was flat over 2012, compared with

a rise of 0.9% in 2011. The UK base rate remained unchanged at

0.5%, whilst total employment reached an all-time high, rising 1.6%

over the year and CPI inflation fell from 4.2% to 2.7%. London's

economy proved more resilient than that of the country as a whole

with its GDP growing 0.3% over the year according to Oxford

Economics.

Looking forward, the outlook for UK growth remains subdued. The

Bank of England forecast that the economy is likely to see a

gradual recovery over the next three years with GDP growth of

around 1% predicted for 2013, well below its historical average. In

London the economy is expected to continue to outperform the

country as a whole, notwithstanding some of the enduring banking

issues, with GDP growth of 1.3% forecast for 2013 and 2.5% for

2014.

Central London office occupier market

The central London office market, where 97% of Derwent London's

portfolio is located, plays a key role in the success of the

capital by providing a home to a wide range of national and

international companies. At the year end, the capital's office

stock totalled approximately 221 million sq ft (20.5 million m(2))

- 49% located in the City, 42% in the West End and 9% in

Docklands.

CBRE reported that central London office take-up in 2012

totalled 9.8 million sq ft (0.91 million m(2)), 7% lower than the

previous year and 17% below the 10-year average. In the West End

take-up was 16% below the average at 3.5 million sq ft (0.33

million m(2)) with the TMT sector comprising 23% of transactions.

During 2012, West End active demand increased 15% with the TMT

sector accounting for over 50% of year end requirements, suggesting

that the low take-up at least in part reflects the low level of

completions. Overall City activity was 12% below the 10-year

average at 4.1 million sq ft (0.38 million m(2)).

On the delivery side, West End development completions were

fractionally below the 10-year average at 0.95 million sq ft

(88,300m(2)) whilst City completions were just 0.51 million sq ft

(47,400m(2)), 73% below the 10-year average. These relatively low

levels of supply helped moderate the central London vacancy rate

which was 5.3% at the year end. The West End vacancy rate declined

slightly from 4.3% to 4.2% whilst the City rate decreased from 7.0%

to 6.8% over the same period. With supply for both locations still

below 10-year averages, the CBRE prime rent index showed further

rental uplift with growth of 3.7% in the West End and 0.8% in the

City over the year.

The level of West End completions is expected to rise

considerably during 2013, but we expect that this space will be

absorbed by the market given current levels of demand and the level

of pre-lets already agreed on these properties.

Central London office investment market

According to CBRE, central London office investment transactions

totalled GBP14.0bn in 2012, 55% greater than 2011 and 28% above the

10-year average. London's status as an international safe haven

persisted with the property market offering both rental growth and

liquidity. Overseas investors accounted for 67% of

acquisitions.

Prime yields were static throughout the year at 4.0% in the West

End and 5.0% in the City.

The progress in the Crossrail project gained visibility during

2012. There was a flurry of acquisition and development activity

around future Crossrail hubs such as Tottenham Court Road and

Farringdon stations, where we have a large concentration of our

portfolio, whilst Shoreditch, with its new High Street station,

benefited from the completion of the London Overground orbital.

We note with interest the Government's plans to include

conversion of offices to residential units within permitted

development rights for three years, but do not believe that this

will have a significant impact on our business.

VALUATION

See Appendix 2 for supporting graphs and tables

http://www.rns-pdf.londonstockexchange.com/rns/8420Y_1-2013-2-27.pdf

The strong levels of investment in London's commercial property

market, together with good demand for space and improving central

London office rents, presented a positive backdrop to the

valuation. The Group's investment portfolio was valued at GBP2.86bn

at 31 December 2012. Over the year, there was a valuation surplus

of GBP183.3m, before deducting lease incentive adjustments of

GBP8.0m, giving a total movement of GBP175.3m. The underlying

valuation increased by 7.3%, a similar level to the 7.6% in 2011,

and outperformed both the IPD Index for central London offices in

2012, which increased by 4.1%, and the wider market, the IPD All UK

Property Index, which declined by 3.1%.

Within the investment portfolio, seven principal projects were

on site during 2012, comprising five developments and two major

phased refurbishments. These progressed well, not only on the

construction and delivery side, but also through lettings to

companies including Burberry, Ticketmaster and Unilever. They are

detailed further under the Portfolio Management section. Reflecting

this activity, the developments increased in value by 20.6% during

the year to GBP185.3m, and the refurbishments by 8.7% to GBP202.3m,

giving a total increase in value of 14.1% to GBP387.6m. They

represented about 14% of the investment portfolio at the year end

and delivered around a quarter of the portfolio's valuation

surplus. Excluding projects, the balance of the portfolio increased

by 6.3% on an underlying basis.

In addition to the strong performance from our projects, the ERV

of the portfolio increased steadily over the year and we were

active on the asset management front. Both were also important

contributors to the valuation uplift. Our ERVs rose by 6.7% and

followed a 6.3% increase in 2011. Examples of our asset management

accomplishments were lease management and letting activity at 1

Oliver's Yard EC2 and the Tea Building E1. This gave rise to

valuation increases over the year at these buildings of 17% and 10%

respectively.

Our central London properties, which comprise 97% of the

portfolio, increased by 7.8%, with those in the West End rising by

7.2% and the City border assets by 10.2%. The balance of the

portfolio at 3% is our non-core Scottish holdings. These

principally comprise a retail warehouse park and agricultural land

and saw a 5.3% valuation decline in 2012, reflecting the general

outward movement of yields in provincial markets.

The portfolio's net initial yield, on an EPRA basis, was 4.3%,

which rises to 4.8% on a 'topped-up' basis, following contractual

uplifts and expiry of rent free periods. The true equivalent yield

was 5.55% and compares with 5.61% at the end of 2011. This reflects

the general stabilisation of yields for London assets.

The portfolio remains highly reversionary. At 31 December 2012

the Group's net annualised rental income was GBP119.6m, with the

portfolio's ERV at GBP175.0m, representing GBP55.4m of reversion.

Of this, GBP21.0m is contractual, from our scheme pre-lets, such as

1 Page Street SW1 at GBP5.3m, fixed rental uplifts from the expiry

of rent free periods and contracted stepped rentals. A further

GBP21.1m is from available space at year end and our projects where

we are on site. The balance of the reversion of GBP13.3m was from

future rent reviews and lease renewals.

On a total property return basis the portfolio delivered 11.6%

compared with 13.4% in 2011. The IPD Total Return Index was 8.8%

for Central London Offices and 2.7% for All UK Property.

PORTFOLIO MANAGMENT

See Appendix 3 for supporting graphs and tables

http://www.rns-pdf.londonstockexchange.com/rns/8420Y_2-2013-2-27.pdf

Letting activity

Our mid-market offices in the West End and City borders continue

to prove attractive to tenants, as evidenced by another excellent

year for lettings in 2012. We let 340,300 sq ft (31,610m(2)) at an

annual rent of GBP13.3m and an average premium of 7.6% to the

December 2011 ERV. For comparison, in 2011, when we had more space

available, we concluded 495,700 sq ft (46,050m(2)) of lettings at

an annual rent of GBP16.7m.

Excluding short-term lettings where we want to retain

flexibility for future projects, and which constituted 8% by income

and 11% by floorspace, open market lettings were at an average

premium of 9.2% to the December 2011 ERV.

Annual income from lettings in the first half of the year

totalled GBP8.9m, and GBP4.4m in the second half. Overall lettings

in the second half were settled at an average premium of 10.3% to

the June 2012 ERV and for open market lettings at a 12.3% premium.

On the basis of our most recent activity and ongoing tenant

interest we see no slowdown in the rental market for our

properties.

During 2012 we maintained a low vacancy rate, and 55% of our

transactions by income were pre-lets, including most of our large

transactions: Burberry at 1 Page Street SW1, Unilever at Buckley

Building EC1 and BrandOpus at 1 Stephen Street W1. We also saw, and

continue to see, strong interest in our available space from the

TMT sector with 27% of our lettings in 2012 from this sector and

68% if wider creative industries are included.

The principal transactions in 2012 were as follows:

-- 1 Page Street SW1

This 127,000 sq ft (11,800m(2)) building was pre-let to Burberry

for 20 years with a break in year ten at a rent of GBP5.3m pa,

rising to a minimum of GBP5.7m pa after five years. The initial

rent equates to GBP50 per sq ft (GBP540 per m(2)) on the best

space, which compares with GBP38 per sq ft (GBP410 per m(2)) on

similar space that Burberry currently occupies in our adjacent

162,700 sq ft (15,110m(2)) Horseferry House.

-- 4 & 10 Pentonville Road N1

Within two months of practical completion, 47,700 sq ft

(4,430m(2)) of this 55,000 sq ft (5,110m(2) ) building was let for

12 years to Ticketmaster at GBP45 per sq ft (GBP484 per m(2)) on

the top floor and GBP42.50 per sq ft (GBP457 per m(2)) on a typical

mid-level floor, giving a total rent of GBP1.9m pa. The completion

of this development, opposite our Angel Building where rents of

GBP42 per sq ft (GBP452 per m(2)) were achieved in 2011, continues

the regeneration of this increasingly vibrant part of

Islington.

-- Buckley Building EC1

Unilever has pre-let 21,100 sq ft (1,960m(2)) of office space

paying GBP45 per sq ft (GBP484 per m(2)) on the ground floor and

GBP40 per sq ft (GBP431 per m(2)) on the lower ground to give a

total rent of GBP0.9m pa, 27% above the 30 June 2012 ERV of this

space. The lease is for 12 years with a tenant's break at year six

on payment of a 12 month rent penalty. A rent free period

equivalent to 12 months was granted, with an additional six months

if the break is not exercised.

We are formally launching the marketing of the remaining 64,000

sq ft (5,900 m(2)) in this building in April 2013, following

completion of the project.

-- 1-2 Stephen Street W1

BrandOpus is more than tripling its occupation in our portfolio

and will relocate to 18,300 sq ft (1,700m(2)) in Phase 1 of the 1-2

Stephen Street refurbishment from 5,000 sq ft (460m(2)) at the

nearby Charlotte Building W1. It took 15,400 sq ft (1,430m(2)) in

2012 and an additional 2,900 sq ft (270m(2)) in February 2013. It

will occupy ground and lower ground floor offices under a 10-year

lease, paying a rent of GBP0.8m pa, representing GBP52.50 per sq ft

(GBP565 per m(2)) on the prime space.

-- Johnson Building EC1

Existing media tenant Grey took an additional 11,100 sq ft

(1,030m(2)) on a 9-year lease at GBP45 per sq ft (GBP485 per m(2))

or GBP0.50m pa, taking its total presence in the building to 61,100

sq ft (5,680m(2)).

We maintain the appeal of the space that we offer by

anticipating and reflecting the evolving needs of occupiers. Many

tenants now tend to occupy their space in a more open-plan way than

in a traditional office design, with informal meeting spaces and

coffee bars worked into the fit-out. In May 2012, a Derwent London

team visited San Francisco and Silicon Valley to meet tenants who

may look to expand into the UK as well as to see the occupational

requirements of creative industries there. By following and

understanding such trends, we are able to create tomorrow's space

today and we were pleased to see three Derwent London tenants

(Innocent Drinks, Mind Candy and Mother) featured in the Daily

Telegraph's list of 'Top 10 coolest offices in UK'.

Asset management

We continued to see strong tenant retention in 2012. During the

year GBP14.7m pa of rental income was subject to lease expiries and

breaks. After excluding space taken back for identified projects

and disposals, representing GBP4.2m pa, 81% of this income was

retained and 5% relet during 2012.

The Group concluded 65 rent reviews, lease renewals and regears

in the year on 580,000 sq ft (53,900m(2)) at a combined rent of

over GBP21m pa, at an uplift of 7.7% on the previous income.

In several cases these asset management initiatives built in

longer leases and/ or future rental uplifts, underpinning certainty

of income for Derwent London. The most significant of these

were:

-- 1 Oliver's Yard EC2

o Sage Publications

Four leases covering 40,300 sq ft (3,740m(2)) were extended from

two to seven years. Annual stepped rental increases were

introduced, taking the rent from GBP1.0m pa to GBP1.4m pa over the

term, equating to between GBP25 per sq ft (GBP270 per m(2)) and

GBP36 per sq ft (GBP390 per m(2)) and comparing favourably with a

December 2011 ERV of GBP28.50 per sq ft (GBP305 per m(2)). Lease

incentives equated to a four month rent free period.

o Telecity

Leases on 68,700 sq ft (6,380m(2)) were extended from five to 25

years, with rent increases from GBP1.8m pa in 2012 to GBP2.3m pa in

2017 which equates to GBP45 per sq ft (GBP485 per m(2)) on the best

space. Thereafter the rent increases by 2.5% pa compounded every

five years. Lease incentives equated to a 12 month rent free

period.

-- 8 Fitzroy Street W1

This 148,000 sq ft (13,750m(2)) building is let to Arup until

2033. We replaced five-yearly upward-only rent reviews with an

annual stepped increase taking the rent from GBP6.2m pa (GBP45 per

sq ft/ GBP485 per m(2) on a typical floor) to GBP8.4m pa (GBP60 per

sq ft/ GBP645 per m(2)) in 2021. There is then an upward-only,

open-market rent review with the income increasing 2.5% pa

thereafter.

Reversionary potential

There remains a wide variety of additional opportunities for

asset management initiatives. Our central London average passing

office rent remains modest at GBP26.04 per sq ft (GBP280 per m(2))

and offers an excellent platform for income growth. Allowing for

contracted increases, the average 'topped-up' rent is GBP31.18 per

sq ft (GBP336 per m(2)). This compares with an ERV as at 31

December 2012 of GBP35.64 per sq ft (GBP384 per m(2)).

Rent collection

Rent collection remains prompt, with 97% of rent collected on

average within 14 days of the due date for the year and 98% for the

fourth quarter.

Vacancy rate

With strong tenant demand and retention, the vacancy rate in the

portfolio remained low throughout 2012, even following the

completion of 4 & 10 Pentonville Road N1. At the end of

December 2012 the vacancy rate was 1.6% on an EPRA basis by rental

value, measured as space immediately available for occupation, or

GBP2.1m pa (31 December 2011: 1.3% or GBP1.9m pa). Since the year

end half of this has either been let or is under offer. By

available floorspace, the year end vacancy rate was 1.7% (31

December 2011: 1.3%). This compares favourably with the CBRE

central London rate that stood at 5.3% at the end of 2012.

Our six projects where we are on site have an estimated net

rental value of about GBP22m pa and upon completion, after

adjusting for pre-lets, would increase the Group's vacancy rate of

available space to around 11% measured by rental value. Much of

this space will not be ready for occupation until towards the end

of 2014.

Activity in 2013 to date

In 2013 to date a further 241,900 sq ft (22,470m(2)) has been

let or placed under offer generating income of GBP2.3m pa. This

includes:

-- 132-142 Hampstead Road NW1

The property, which under current plans is expected to be

compulsorily purchased as part of the construction of HS2, is

undergoing a 'light touch' refurbishment. UCL (University College

London) has taken a pre-let of all 217,000 sq ft (20,160m(2)) at a

total rent of GBP1.6m pa with 3% pa uplifts fixed in March 2016 and

September 2018. The lease is for a 10-year term with mutual rolling

breaks from September 2018 and has a rent free period equivalent to

15 months. This letting bolsters net income whilst retaining

flexibility for development if circumstances change.

INVESTMENT ACTIVITY

Acquisitions

During 2012 we added to the portfolio and recycled capital in

specific situations. Our purchases, totalling GBP101.5m including

costs, reflect our strategy of buying income-producing assets off

low capital values with medium-term refurbishment opportunities

and, in most cases, adjacent or very close to existing assets.

The main acquisitions in 2012 were:

Francis House, 9 and 16 Prescot 25 and 29 Berners

11 Francis Street Street E1 Street W1

SW1

------------------- -------------------------- ------------------ -------------------------

Total cost GBP30.6m GBP23.2m GBP36.5m

------------------- -------------------------- ------------------ -------------------------

Tenure Freehold Freehold Leasehold expiring

in 2080

------------------- -------------------------- ------------------ -------------------------

Size 57,000 sq ft (5,300m(2)) 111,000 sq ft 79,500 sq ft (7,390m(2))

(10,310m(2))

------------------- -------------------------- ------------------ -------------------------

Annual passing GBP1.6m rising GBP1.3m GBP1.4m

rent to GBP1.7m from

2015

------------------- -------------------------- ------------------ -------------------------

5.1% rising to

Net initial yield 5.4% 5.5% 3.8%

------------------- -------------------------- ------------------ -------------------------

Tenant Channel Four Television Co-operative Bank PRS for Music

plc (9 Prescot

Street)

------------------- -------------------------- ------------------ -------------------------

Lease expiry 2020 2015 (9 Prescot 2016

Street)

------------------- -------------------------- ------------------ -------------------------

Opportunity Synergy with our Refurbishment Refurbishment

adjacent ownership and extension and redevelopment

at Greencoat & potential in an potential at these

Gordon House and improving area Fitzrovia properties

6-8 Greencoat of Whitechapel. when the tenant

Place in Victoria. vacates.

------------------- -------------------------- ------------------ -------------------------

Disposals

1-5 Grosvenor Riverwalk House Triangle Centre,

Place SW1 and 232-242 Vauxhall Bishopbriggs,

Bridge Road SW1 Scotland

-------------------- ------------------------- ---------------------- -------------------------

Net proceeds GBP66.9m GBP76.6m GBP16.6m

-------------------- ------------------------- ---------------------- -------------------------

Tenure 50% of 150-year Freehold Freehold

lease

-------------------- ------------------------- ---------------------- -------------------------

Annual net passing GBP3.1m (50% share GBP0.2m GBP1.3m

rent of total rent

on the building)

-------------------- ------------------------- ---------------------- -------------------------

Net disposal yield 4.5 % Mostly vacant 8.1%

-------------------- ------------------------- ---------------------- -------------------------

Comment Interest sold Sold for residential 75,500 sq ft (7,010m(2))

as part of the development. shopping centre

regear onto a Profit overage north of Glasgow.

new 150-year headlease, retained. Combined

unlocking potential valuation increased

redevelopment. by 75% over the

last three years.

-------------------- ------------------------- ---------------------- -------------------------

In 2012, Derwent London recycled properties for net proceeds of

GBP160.9m at a profit of GBP6.9m. This included the sale of three

buildings, as well as the disposal of a 50% interest in 1-5

Grosvenor Place SW1.

Since the year end we have exchanged contracts for the sale of

our holdings in Commercial Road E1, where we have secured planning

permission for a 417-room student accommodation block together with

26,500 sq ft (2,460m(2)) of offices, for GBP17.0m before costs.

PROJECTS

See Appendix 4 for supporting graphs and tables.

http://www.rns-pdf.londonstockexchange.com/rns/8420Y_3-2013-2-27.pdf

As at 31 December 2012 the Group was on site at six major

projects totalling 495,000 sq ft (46,000m(2)). These projects had

capital expenditure to complete at that date of GBP91m, and a total

estimated rental value of about GBP22m. Of this space, 37% has been

pre-let. In 2013 a further three projects totalling 422,000 sq ft

(39,200m(2)) and with capital expenditure to complete of GBP168m

will commence.

Planning success in 2012

We saw continued planning success in 2012, with six schemes

totalling 655,000 sq ft (60,850m(2)) granted planning permission.

The schemes that received permission are:

Size Nature of Project status Comment

development

-------------------- --------------------- --------------- ---------------------------------------

1 Oxford Street W1

-----------------------------------------------------------------------------------------------------

275,000 Offices, Start from The Group holds an option to

sq ft (25,500m(2)) retail and 2017 repurchase this site which

theatre is above Tottenham Court Road

station, following the completion

of Crossrail work.

-------------------- --------------------- --------------- ---------------------------------------

1 Page Street SW1

-----------------------------------------------------------------------------------------------------

127,000 Office refurbishment Underway 100% pre-let to Burberry.

sq ft (11,800m(2)) and extension

-------------------- --------------------- --------------- ---------------------------------------

Riverwalk House and 232-242 Vauxhall Bridge Road SW1

-----------------------------------------------------------------------------------------------------

175,000 Residential Underway Sold in 2012. Group retains

sq ft (16,300m(2)) a profit overage in this development.

-------------------- --------------------- --------------- ---------------------------------------

Queens, 96-98 Bishop's Bridge Road W2

-----------------------------------------------------------------------------------------------------

21,400 sq Residential Started in 16 residential units and ground

ft (1,990m(2)) 2013 floor retail space to be built

on the corner of Bishop's Bridge

Road and Queensway. Completion

is due in Q4 2014.

-------------------- --------------------- --------------- ---------------------------------------

18-30 Tottenham Court Road W1

-----------------------------------------------------------------------------------------------------

41,000 sq Retail extension Start 2014 New and improved double-height

ft (3,810m(2)) frontage, providing modern

units. Area being transformed

through the Crossrail project.

-------------------- --------------------- --------------- ---------------------------------------

73 Charlotte Street W1

-----------------------------------------------------------------------------------------------------

15,500 sq Residential Start 2013 11 units, two of which are

ft (1,440m(2)) affordable, and 1,900 sq ft

(180m(2)) of offices.

-------------------- --------------------- --------------- ---------------------------------------

Project completed in 2012

4 & 10 Pentonville Road N1 was completed in Q3 2012 and 87%

of this 55,000 sq ft (5,110m(2)) office refurbishment was let to

Ticketmaster (see 'Letting activity').

Projects under construction

The following projects were under construction at the end of

2012:

Size of project Capital Completion Pre-let

expenditure date

to complete

---------------------- ------------------------------- ------------- ----------- -----------------

sq ft m(2) GBPm

---------------------- ----------------- ------------ ------------- ----------- -----------------

Developments

------------------------------------------------------------------------------------------------------

Buckley Building,

49 Clerkenwell

Green EC1 85,000 7,900 3 Q1 2013 25% to Unilever

---------------------- ----------------- ------------ ------------- ----------- -----------------

1 Page Street 100% to

SW1 127,000 11,800 15 Q2 2013 Burberry

---------------------- ----------------- ------------ ------------- ----------- -----------------

Turnmill, 63

Clerkenwell Road

EC1 70,000 6,500 19 Q3 2014

---------------------- ----------------- ------------ ------------- ----------- -----------------

40 Chancery Lane

WC2 100,000 9,300 34 Q4 2014

---------------------- ----------------- ------------ ------------- ----------- -----------------

Phased refurbishments

------------------------------------------------------------------------------------------------------

Morelands Buildings,

5-27 Old Street

EC1 27,000 2,510 2 Q1 2013 66% to AHMM

---------------------- ----------------- ------------ ------------- ----------- -----------------

1-2 Stephen Street

W1 86,000 7,990 18 2013/14 21% to BrandOpus

---------------------- ----------------- ------------ ------------- ----------- -----------------

Total 495,000 46,000 91

---------------------- ----------------- ------------ ------------- ----------- -----------------

Other projects

As at 31 December 2012, 282,600 sq ft (26,250m(2)) of minor

refurbishments were underway, including at 3-4 Hardwick Street EC1

and 132-142 Hampstead Road NW1. These had an ERV of GBP4.0m pa and

capital expenditure to complete of GBP8m.

Projects starting in 2013

During 2013 the Group will be increasing the proportion of

development in the portfolio by commencing the following projects,

totalling 422,000 sq ft (39,200m(2)):

-- 80 Charlotte Street W1

At 385,000 sq ft (35,800m(2)), this is the largest regeneration

that Derwent London has undertaken and will be one of the biggest

schemes in the West End when construction starts towards the end of

2013. The main development occupies a 1.4 acre (0.6 hectare) site

that will provide 320,000 sq ft (29,730m(2)) of offices and retail

with 17,000 sq ft (1,580m(2)) of private residential units and

retail adjacent at 67 Whitfield Street W1. Two other nearby

properties will deliver a further 12,000 sq ft (1,110m(2)) of

offices and 36,000 sq ft (3,340m(2)) of residential space, 42% of

which will be affordable housing.

We are currently undertaking implementation works on site and

expect to sign the main construction contract in the summer. A deed

to obtain vacant possession of 80 Charlotte Street from Saatchi

& Saatchi in the second half of 2013 has been signed. Overall

capital expenditure is estimated at around GBP150m and the project

is due for delivery in 2016.

-- Queens, 96-98 Bishop's Bridge Road W2

This 21,400 sq ft (1,990m(2)) residential scheme in Westbourne

Grove comprises 16 units and 2,700 sq ft (250m(2)) of retail space.

Having received planning permission in 2012, work has now

started.

-- 73 Charlotte Street W1

This is another medium-sized residential-led development of

15,500 sq ft (1,440m(2)) to provide 11 units, two of which are

affordable, together with 1,900 sq ft (180m(2)) of offices. Work is

expected to start at this site after the receipt of vacant

possession in the second half of 2013.

Projects for 2014 and beyond

The Group has five further projects with planning permission

with a total proposed net lettable area of 0.9 million sq ft

(86,000m(2)) and a similar level of projects under appraisal,

providing additional opportunities to grow the business. We have

made important progress on the following projects:

-- White Collar Factory, City Road EC1

We have constructed a 3,000 sq ft (280m(2)) working prototype or

'live suite' to showcase the White Collar Factory principles of the

16-storey office building that forms the core of this proposed

development. Marketing presentations begin here in April and we

intend to move into full scale construction of the exciting 289,000

sq ft (26,800m(2)) regeneration at this major corner site at Old

Street which we now expect to build on a speculative basis.

The White Collar Factory will be a 21st century interpretation

of the industrial buildings of the past. It will be of concrete

frame construction with exposed thermal-mass, a generous 3.5 metre

floor to ceiling height, and well-insulated façades that are

tailored to deal with solar gain. With openable windows, cooling

will also be provided by chilled water pipes embedded in the

concrete slabs with air ventilation and simple lighting suspended

underneath. Our engineers estimate that, as a result of its design,

the building will use 25% less carbon and save up to 25% in

operating costs compared with that of a traditional office

building.

The existing buildings are currently occupied on flexible lease

terms allowing vacant possession from the end of 2013. The capital

expenditure to complete this project will be around GBP100m.

-- 55-65 North Wharf Road W2

Having recently entered into an option agreement with the

freeholder and long leaseholder to restructure our headlease, this

redevelopment has moved a step closer. On exercise of the option,

the freeholder will grant Derwent London a 999-year lease over the

240,000 sq ft (22,300m(2)) office element of the site and grant the

long leaseholder a similar lease over the 73,000 sq ft (6,800m(2))

of residential and retail space. Derwent London will pay a modest

ground rent of 2.5% of income and will undertake to build the

basement of both buildings. The long leaseholder will contribute

GBP5m towards the construction cost of the basement.

This site represents one of the best locations within Paddington

Basin yet to be developed and will provide a striking architectural

addition to the regeneration of the wider area. It is directly

opposite one of the entrances to the National Rail, Crossrail and

London Underground services at Paddington.

Current letting terms allow for possession from 2014 onwards and

Derwent London's capital expenditure to undertake this project

would be around GBP100m.

-- 1 -5 Grosvenor Place SW1

In March 2012, Derwent London and Grosvenor announced a joint

venture and headlease regear at 1-5 Grosvenor Place. This

collaboration unlocks a major prime redevelopment opportunity of

over 260,000 sq ft (24,000m(2) ) at this unique 1.5 acre (0.6

hectare) site. Working with Grosvenor a professional advisory team

has been assembled, with the expectation of submitting a planning

application for this mixed-use redevelopment including a hotel,

residential and offices within the next year. The joint venture

partners are working towards choosing an operator for the hotel

element from the current shortlist over the next few months. In the

meantime the property is almost fully let on flexible leases.

We have started studies on our recent acquisitions at Prescot

Street and Berners Street to formulate our longer term plans for

these buildings.

FINANCE REVIEW

See Appendix 5 for supporting graphs and tables

http://www.rns-pdf.londonstockexchange.com/rns/8420Y_4-2013-2-27.pdf

Over many years, Derwent London's business model has been to add

value through refurbishment, redevelopment and asset management

while also maintaining a secure recurring income stream, modest

leverage and strong interest cover. The strength of our balance

sheet plus the confidence that comes from robust five-year

financial projections supports the business and enables us to plan

to take account of anticipated market cycles. This allows

decision-taking that fuels growth backed by a careful assessment of

the risks.

The calendar year 2012 was, in many respects, a significant one

for London. Sterling was seen as a relative safe haven while many

of the other European economies were under extreme pressure.

Notwithstanding the lack of overall economic growth in the UK and

the domestic tension caused by a deficit reduction programme,

policies exercised by Government and the Bank of England helped to

encourage capital flows into London. This strengthened sterling and

forced interest rates down to exceptionally low levels though there

has been some correction in both measures in the first few weeks of

2013.

Another notable feature of the year for our sector was the

continued and substantial disparity between availability and cost

of capital for those seen as strong borrowers and the rest. In

particular, investors associated with London continued to defy the

gloom which was felt in much of the rest of the UK.

All these factors meant that this was a good environment for

stronger companies within our sector to refinance. In January 2012,

we completed GBP300m of bank facilities signed in December 2011. In

addition, Derwent London secured GBP83m of inexpensive long-term

debt in August 2012, tapping a source which we had not previously

utilised.

We also continued our policy of recycling capital through asset

sales, improved our overall interest cover and drove rental growth

in the portfolio with like-for-like net rental growth up by 8.2% on

the year. With low voids and much of the existing development

pipeline de-risked through pre-lets, we have been able to push

ahead with important new projects such as Turnmill EC1 and 40

Chancery Lane WC2 and to commit to our largest scheme to date at 80

Charlotte Street W1. In addition, we have now agreed to accelerate

the development of the White Collar Factory at City Road EC1.

Net asset value

EPRA net asset value per share increased to 1,886p per share as

at 31 December 2012 from 1,701p a year earlier, an increase of

10.9%. This was largely due to another pronounced rise in value of

the property portfolio which showed an increase of 170p per share

after allowing for capital expenditure and lease incentives.

The main components of the rise in NAV per share were as

follows:

2011 2012

p p

Revaluation surplus 170 169

EPRA profit after tax 50 51

Dividends paid (net

of scrip) (30) (25)

Profit on disposals 7 36

Interest rate swap (7) -

termination cost

Minority interests

on revaluation (5) (4)

185 227

The Group's net asset value rose to GBP1.92bn at 31 December

2012 from GBP1.71bn in 2011 and the value of the property portfolio

increased to GBP2.86bn.

The mark-to-market cost of derivatives rose by 2p per share to

53p, offset by a fall in deferred tax liabilities of 5p as certain

historical tax issues were successfully resolved. The fair value of

fixed rate liabilities increased by a net 20p per share as

medium-term interest rates fell significantly. These combined to

bring the Group's EPRA triple net asset value per share to 1,775p

at 31 December 2012, an increase of 10.5% over the year.

Income statement

Derwent London's development activity increased significantly

through 2012. We invested GBP77.5m in the portfolio and capitalised

GBP4.9m of interest against figures of GBP41.0m and GBP2.2m,

respectively, in 2011. This rebalancing of activity away from the

income-producing part of the portfolio inevitably has an impact

upon rental income. However, through strong lettings and asset

management together with careful financial planning, we have sought

to ensure that earnings are broadly flat year on year.

EPRA recurring profit before tax increased slightly to GBP52.5m

for the year ended 31 December 2012 compared with GBP52.3m in 2011.

The prior year benefitted from the write-back of GBP1.8m of current

tax provisions and this is the main reason why EPRA earnings per

share fell back a little to 50.4p from 51.6p in 2011.

Although we have extended our development programme and recycled

capital through property disposals, gross rental income increased

slightly during the year by GBP0.6m to GBP124.7m. New lettings in

2012 added GBP3.7m of income in the year while rent reviews, mainly

in relation to the settlement of the 2011 review at 8 Fitzroy

Street W1, added a further GBP3.5m. Lettings and reviews from the

previous year also contributed GBP4.6m. Properties acquired in 2012

increased 2012 rent by GBP1.6m while the loss of income from

properties sold was GBP6.1m. Lease breaks, expiries and voids

reduced rent by a further GBP6.7m. Premiums received from lease

surrenders vary from year to year and, on a net basis, were only

GBP0.1m in 2012 against GBP1.4m in 2011.

Property outgoings overall were GBP10.3m, a 5.1% increase from

the previous year, part of which is due to the higher ground rent

paid at 1-5 Grosvenor Place SW1 following the regear. The prior

year also benefitted from GBP1.6m of rates credits; in 2012 the

recovery of overpaid rates was GBP0.3m. Surrender premiums paid to

tenants fell to GBP0.2m in 2012 compared to GBP1.9m in 2011.

The real progress in rental income levels across the portfolio

can be demonstrated by the strong increase in like-for-like

property income where the effects of acquisitions, disposals and

developments are taken out; EPRA net rental income increased by

8.2% during the year. A full analysis is shown in the attached

table.

Total administrative expenses increased to GBP25.1m from

GBP22.7m in 2011. Development activity and a greater emphasis on

areas such as sustainability has increased headcount again in 2012.

If the provision for cash-settled share options is excluded, the

underlying increase in administrative expenses was 7.5%, due mainly

to increased staff costs. The Group's consistently strong

performance over recent years has contributed to an increase in the

provision for long-term management incentives of GBP0.7m compared

to 2011.

Net finance costs fell to GBP40.8m from GBP43.2m in the prior

year due partly to a higher amount capitalised on projects, GBP4.9m

against GBP2.2m last year. Interest costs have fallen by GBP2.3m

compared to the previous year, offset by an increase of GBP2.5m in

charges for arrangement and non-utilisation fees.

The overall profit before taxation for the year was GBP228.1m,

only marginally lower than the equivalent figure of GBP233.0m in

2011. Overall revaluation gains in 2012 were GBP175.3m of which

GBP174.4m passed through the income statement and property

disposals, principally of Riverwalk House SW1 and half of 1-5

Grosvenor Place, also yielded a profit of GBP6.9m. The profit on

disposal of investment of GBP3.9m related to the realisation of

exchange gains on the liquidation of our last remaining US

subsidiary. The company had been inactive for several years and, as

an equal and opposite amount passed through the statement of

comprehensive income, this has no impact upon EPRA net asset value

or recurring earnings.

In addition to the previously reported GBP6.3m cost of breaking

GBP130m of interest rate swaps in January 2012, a further GBP0.6m

of breakage costs were incurred in August when the other GBP65m

swap associated with the old GBP375m loan facility was also closed

out. The original loan and swap expiry dates were all in March

2013. The cost of 'fair valuing' our other interest rate swaps was

GBP2.4m for the year.

Taxation

As a REIT, we do not generally pay corporation tax as much of

our business activity is tax-exempt. However, part of the business,

principally the unelected share in our joint venture with the

Portman Estate, is outside the REIT; the 2012 tax charge relating

to this non-REIT part of the business was GBP0.8m comprising a tax

charge of GBP0.6m and a prior year tax charge of GBP0.2m. Following

successful discussions with HMRC bringing much of our Scottish land

holdings within the REIT structure, we have been able to write back

GBP4.4m of the Group's deferred tax liability during the year. In

addition, an increase in available tax losses enabled a further

GBP1.3m to be released. The rate of UK corporation tax falls again

to 23% on 1 April 2013 reducing our year end deferred tax balance

by GBP0.4m, though this has been offset by the increased deferred

tax liability on the year's revaluation gains.

Financing

By the start of 2012, we had already refinanced the majority of

the bank facilities falling due for repayment in 2013. As noted in

last year's report, this had been accomplished with the issue of

GBP175m of convertible bonds and GBP425m of new or enlarged

revolving credit facilities signed with relationship lenders.

During the year, we have completed the remaining refinancing

requirement while also continuing with our strategic aims of

diversifying sources of debt, lengthening average debt maturities

and managing the cost and risk profile associated with our debt

facilities.

In January 2012, the new bank facilities documented in December

2011 were drawn. These consisted of a GBP150m fully revolving five

year facility provided equally by RBS and Barclays and a new

GBP150m fully revolving five year facility provided by Lloyds Bank

to replace and extend their existing GBP100m bilateral

facility.

In January 2012, we also broke two interest rate swaps with a

principal amount of GBP130m and a weighted average rate of about

5.0% which were due to expire in March 2013. The cost of breaking

these swaps was GBP6.3m, a small discount to the additional

interest charge that we would have incurred through the remaining

life of the swaps. At the same time, we swapped a total of GBP70m

to April 2019 at just under 2.0%.

Following the repayment in January 2012 of the last loan notes

associated with the London Merchant Securities PLC ("LMS")

transaction, the GBP32.5m unsecured 'loan note' facility due to

expire in June 2012 was also cancelled. In addition, the Group's

overdraft facility was reduced to GBP2.5m from GBP10.0m in July

2012.

Refinancing of the 2013 debt maturities was completed in August

with a new GBP83m fixed rate loan from Cornerstone, part of the

Mass Mutual Financial Group. The new loan was the first transaction

entered into by Cornerstone in the UK. It is fixed at 3.99% until

October 2024, 210 basis points above the reference gilt, and is

secured on two properties in Fitzrovia. The initial loan-to-value

("LTV") ratio was 48.3%, the LTV covenant is set at 70% and there

is no amortisation to expiry. At the same time, the remaining

GBP95m of drawn debt from the GBP375m facility arranged by LMS in

2006 was prepaid and the residual GBP150m facility was cancelled. A

termination cost of GBP0.6m was incurred on a GBP65m interest rate

swap running to March 2013 leaving a forward start swap of GBP65m

at just under 2.0% from March 2013 to April 2019. Overall, these

actions reduced the level of swaps at the balance sheet date by

GBP125m compared to a year earlier, while the amount of fixed rate

debt increased by GBP83m. This overall reduction of GBP42m moved

the proportion at fixed rates or swapped to 92% from 98% at the end

of 2011 and provided a weighted average cost of debt of 4.88% on an

IFRS basis, or 4.63% using the cash cost of the convertible bonds.

This is slightly lower than a year earlier when it was 4.91% and

4.65%, respectively. With the high cost of breaking swaps, the

proportion at fixed rates continues to be slightly higher than our

target range of 60% to 85%.

Available undrawn facilities totalled GBP333m at 31 December

2012 in addition to which there was GBP624m of uncharged property.

The equivalent figures at 31 December 2011 were GBP469m and

GBP589m, respectively.

Maturity profiles of financing facilities and interest rate

hedges as at 31 December 2012 are provided below. The Group's new

long-dated loan has increased the weighted average length of

unexpired debt to 6.1 years at 31 December 2012 compared to 5.3

years in 2011.

Net debt and cash flow

Notwithstanding further significant investment in the pipeline

and GBP101.5m of new properties acquired in the year, property

disposals ensured that net debt only increased by GBP10.3m during

the year to GBP874.8m. The principal properties disposed of were

Riverwalk House, 232-242 Vauxhall Bridge Road, the Triangle Centre

in Scotland and a half share in 1-5 Grosvenor Place which together

provided a cash inflow of GBP161.0m after costs.

Combined with this small increase in debt, the strong rise in

property values meant that the Group's overall LTV ratio fell to

30.0% from 32.0% in 2011. Balance sheet gearing fell

correspondingly from 50.4% to 45.6%. We focus more on interest

cover than absolute levels of leverage and are pleased to report

that gross interest cover rose to 351% for the year compared to

307% in 2011. Net interest cover, after property and administrative

expenses and treating interest capitalised as an expense, increased

to 223% in 2012 from 214% in the previous year.

Dividend

Our approach is to manage dividend distribution in a way that

maintains sufficient dividend cover out of recurring earnings but

which also reflects a progressive and sustainable level of growth

for our shareholders. The Board has been able to recommend an 8.4%

increase in the proposed final dividend to 23.75p per share of

which 18.75p will be paid as a PID with the balance of 5.00p as a

conventional dividend. This will bring the total dividend for the

year to 33.70p per share, an increase of 2.35p or 7.5% over 2011. A

scrip dividend alternative will continue to be offered.

Directors' responsibilities

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company, for safeguarding the assets of

the Company, for taking reasonable steps for the prevention and

detection of fraud and other irregularities and for the preparation

of a Directors' report and the report of the Remuneration Committee

which comply with the requirements of the Companies Act 2006.

The Directors are responsible for preparing the annual report

and the financial statements in accordance with the Companies Act

2006. The Directors are also required to prepare financial

statements for the Group in accordance with International Financial

Reporting Standards, as adopted by the European Union (IFRS) and

Article 4 of the IAS Regulation. The Directors have chosen to

prepare financial statements for the Company in accordance with

IFRSs.

Group financial statements

International Accounting Standard 1 requires that financial

statements present fairly for each financial year the Group's and

Company's financial position, financial performance and cash flows.

This requires the faithful representation of the effects of

transactions, other events and conditions in accordance with the

definitions and recognition criteria for assets, liabilities,

income and expenses set out in the International Accounting

Standards Board's "Framework for the preparation and presentation

of financial statements". In virtually all circumstances, a fair

presentation will be achieved by compliance with all applicable

IFRSs. A fair presentation also requires the Directors to:

-- consistently select and apply appropriate accounting policies;

-- present information, including accounting policies, in a

manner that provides relevant, reliable, comparable and

understandable information; and

-- provide additional disclosures when compliance with the

specific requirements in IFRSs is insufficient to enable users to

understand the impact of particular transactions, other events and

conditions on the entity's financial position and financial

performance.

The Directors confirm to the best of their knowledge:

-- they have complied with the above requirements in preparing

the financial statements which give a true and fair view of the

assets, liabilities, financial position and profit or loss of the

Company and the undertakings included in the consolidation taken as

a whole;

-- the adoption of a going concern basis for the preparation of

the financial statements continues to be appropriate based on the

foregoing and having reviewed the forecast financial position of

the Group; and

-- the business review includes a fair review of the development

and performance of the business and the position of the Company and

the undertakings included in the consolidation taken as whole,

together with a description of the principal risks and

uncertainties that they face.

Financial statements are published on the Group's website in

accordance with legislation in the United Kingdom governing the

preparation and dissemination of financial statements, which may

vary from legislation in other jurisdictions. The maintenance and

integrity of the Group's website is the responsibility of the

Directors. The Directors' responsibility also extends to the

ongoing integrity of the financial statements contained

therein.

On behalf of the board

John D. Burns Damian M.A. Wisniewski

Chief Executive Officer Finance Director

28 February 2013

GROUP INCOME STATEMENT

2012 2011

Note GBPm GBPm

Gross property and other income 5 150.6 150.9

------------------------------------------- ---- ------- -------

Net property and other income 5 117.0 117.7

---- ------- -------

Administrative expenses (24.5) (22.8)

Movement in valuation of cash-settled

share options (0.6) 0.1

---- ------- -------

Total administrative expenses (25.1) (22.7)

Revaluation surplus 13 174.4 170.1

Profit on disposal of investment property 6 6.9 36.1

Profit on disposal of investment 7 3.9 -

Profit from operations 277.1 301.2

Finance income 8 1.0 1.1

Finance costs 8 (41.8) (44.3)

Movement in fair value of derivative

financial instruments (2.4) (26.5)

Financial derivative termination

costs 9 (6.9) -

Share of results of joint ventures 10 1.1 1.5

Profit before tax 228.1 233.0

Tax credit 11 4.6 1.3

Profit for the year 232.7 234.3

Attributable to:

- Equity shareholders 226.9 228.3

- Minority interest 5.8 6.0

232.7 234.3

Earnings per share 12 222.76p 225.20p

Diluted earnings per share 12 211.82p 217.67p

GROUP STATEMENT OF COMPREHENSIVE INCOME

2012 2011

Note GBPm GBPm

Profit for the year 232.7 234.3

Actuarial gains/(losses) on defined

benefit pension scheme 1.2 (3.5)

Revaluation surplus of owner-occupied

property 13 0.9 2.0

Deferred tax on revaluation surplus 15 0.3 0.7

Foreign currency translation 8 (0.3) -

Reclassification of exchange differences

to income statement 7 (3.9) -

------ ------

Other comprehensive expense (1.8) (0.8)

Total comprehensive income relating

to the year 230.9 233.5

Attributable to:

- Equity shareholders 225.1 227.5

- Minority interest 5.8 6.0

230.9 233.5

GROUP BALANCE SHEET

2012 2011

Note GBPm GBPm

Non-current assets

Investment property 13 2,772.6 2,444.9

Property, plant and equipment 14 20.3 19.4

Investments 10.2 9.7

Deferred tax 15 0.5 -

Pension scheme surplus 0.2 -

Other receivables 16 60.9 55.4

2,864.7 2,529.4

Current assets

Trade and other receivables 17 50.8 45.0

Cash and cash equivalents 24 4.4 3.5

55.2 48.5

Non-current assets held for sale 18 16.5 137.5

Total assets 2,936.4 2,715.4

Current liabilities

Bank overdraft and loans 20 - 32.5

Trade and other payables 19 80.5 70.9

Corporation tax liability 1.9 1.3

Provisions 1.7 1.6

84.1 106.3

Non-current liabilities

Borrowings 20 879.2 835.5

Derivative financial instruments 20 54.3 51.9

Provisions 0.8 0.5

Pension scheme deficit - 1.5

Deferred tax 15 - 5.2

934.3 894.6

Total liabilities 1,018.4 1,000.9

Total net assets 1,918.0 1,714.5

Equity

Share capital 5.0 5.0

Share premium 165.3 162.9

Other reserves 934.0 936.6

Retained earnings 756.1 558.2

Equity shareholders' funds 1,860.4 1,662.7

Minority interest 57.6 51.8

Total equity 1,918.0 1,714.5

GROUP STATEMENT OF CHANGES IN EQUITY

Attributable to equity shareholders

Share Share Other Retained Minority Total

capital premium reserves earnings Total interest equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

At 1 January 2012 5.0 162.9 936.6 558.2 1,662.7 51.8 1,714.5

Profit for the year - - - 226.9 226.9 5.8 232.7

Other comprehensive

income - - (3.0) 1.2 (1.8) - (1.8)

Share-based payments - 0.4 0.4 2.3 3.1 - 3.1

Dividends paid - - - (30.5) (30.5) - (30.5)

Scrip dividends - 2.0 - (2.0) - - -

At 31 December 2012 5.0 165.3 934.0 756.1 1,860.4 57.6 1,918.0

Attributable to equity shareholders

Share Share Other Retained Minority Total

capital premium reserves earnings Total interest equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

At 1 January 2011 5.0 158.2 924.0 361.6 1,448.8 45.9 1,494.7

Profit for the year - - - 228.3 228.3 6.0 234.3

Other comprehensive

income - - 2.7 (3.5) (0.8) - (0.8)

Share-based payments - - 0.5 1.9 2.4 - 2.4

Issue of convertible

bonds - - 9.4 - 9.4 - 9.4

Dividends paid - - - (25.4) (25.4) (0.1) (25.5)

Scrip dividends - 4.7 - (4.7) - - -

At 31 December 2011 5.0 162.9 936.6 558.2 1,662.7 51.8 1,714.5

GROUP CASH FLOW STATEMENT

2012 2011

Note GBPm GBPm

Operating activities

Property income 118.1 116.8

Property expenses (9.9) (13.1)

Cash paid to and on behalf of employees (17.8) (14.4)

Other administrative expenses (4.3) (5.2)

Interest received 0.1 -

Interest paid 8 (33.3) (36.5)

Other finance costs (3.4) (1.8)

Other income 2.5 2.1

Tax paid in respect of operating activities (0.2) (0.7)

Net cash from operating activities 51.8 47.2

Investing activities

Acquisition of investment properties (99.8) (91.6)

Capital expenditure on investment properties 8 (78.6) (42.6)

Disposal of investment properties 161.0 131.5

Purchase of property, plant and equipment (0.4) (0.2)

Distributions received from joint ventures 0.7 0.3

Advances to minority interest holder (2.4) (0.8)

Net cash used in investing activities (19.5) (3.4)

Financing activities

Net proceeds of bond issue - 170.2

Repayment of revolving bank loan (123.0) (75.0)

Drawdown of new revolving bank loan 73.0 -

Net movement in other revolving bank

loans 133.5 (179.1)

Repayment of non-revolving bank loans (158.5) -

Drawdown of non-revolving bank loans - 67.5

Drawdown of non-revolving loan 81.6 -

Repayment of loan notes (1.1) -

Financial derivative termination costs (6.9) -

Net proceeds of share issues 0.4 -

Dividends paid to minority interest

holder - (0.1)

Dividends paid 21 (30.4) (25.4)

Net cash used in financing activities (31.4) (41.9)

Increase in cash and cash equivalents

in the year 0.9 1.9

Cash and cash equivalents at the beginning

of the year 3.5 1.6

Cash and cash equivalents at the end

of the year 24 4.4 3.5

NOTES TO THE FINANCIAL STATEMENTS

1. Basis of preparation

The financial information does not constitute the Group's

statutory accounts for either the year ended 31 December 2012 or

the year ended 31 December 2011, but is derived from those

accounts. The Group's statutory accounts for 2011 have been

delivered to the Registrar of Companies and those for 2012 will be

delivered following the Company's Annual General Meeting. The

auditor's reports on both the 2011 and 2012 accounts were

unqualified, did not draw attention to any matters by way of an

emphasis, and did not contain any statement under Section 498 of

the Companies Act 2006.

The financial statements have been prepared in accordance with

International Financial Reporting Standards, as adopted by the

European Union (IFRS), IFRIC interpretations and with those parts

of the Companies Act 2006 applicable to companies reporting under

IFRS. The financial statements have been prepared under the

historical cost convention as modified by the revaluation of

investment properties, property, plant and equipment, available for

sale investments, and financial assets and liabilities held for

trading. The accounting policies used are consistent with those

applied in the 2011 annual financial statements, as amended to

reflect the adoption of new standards, amendments and

interpretations which became effective in the year and the

presentational change outlined below.

2. Changes in accounting policies

New standards adopted during the year

The following standards, amendments and interpretations endorsed

by the EU are effective for the first time for the Group's 31

December 2012 year end:

IFRS 7 Financial Instruments Disclosures (amendment) and

IAS 12 Income taxes (amendment);

These had no material impact on the financial statements.

In accordance with best practice guidelines, a presentational

change has been made such that, where the Group acts as a

principal, service charge income and expenditure have been

accounted for separately in the income statement. This has resulted

in an increase in both the previously stated 2011 gross property

and other income and property expenses of GBP23.4m, as shown in

note 5. There is no impact on profit for the year or net

assets.

Standards and interpretations in issue but not yet effective

At the date of authorisation of these financial statements, the

following standards and interpretations applicable to the Group's

financial statements which have not been applied in these financial

statements were in issue but not yet effective at the year end. The

following standards are deemed not relevant to the Group or to have

no material impact on the financial statements of the Group when

the relevant standards come into effect:

IFRS 9 Financial Instruments;

IFRS 12 Disclosure of Interests in Other Entities;

IFRS 13 Fair Value Measurement;

IAS 1 Presentation of Financial Statements (amendment);

IAS 19 Employee Benefits (amendment);

IAS 27 Separate Financial Statements;

IAS 28 Investments in Associates and Joint Ventures; and

IAS 32 Financial Instruments: Presentation.

The following standards will affect the accounting for any

future joint arrangements entered into by the Group:

IFRS 10 Consolidated Financial Statements; and

IFRS 11 Joint Arrangements.

3. Significant judgments, key assumptions and estimates

Some of the significant accounting policies require management