Derwent London PLC Letting Update (9517O)

October 18 2012 - 3:30AM

UK Regulatory

TIDMDLN

RNS Number : 9517O

Derwent London PLC

18 October 2012

18 October 2012

Derwent London secures major letting to Ticketmaster at 10-4

Pentonville Road, London N1

Derwent London plc ("Derwent London" / "the Group") is pleased

to announce that it has let 47,700 sq ft (4,430m(2) ) of office

space at 10-4 Pentonville Road, London N1 to Ticketmaster UK.

Ticketmaster will occupy the whole of 4 Pentonville Road and the

upper five floors of 10 Pentonville Road under a 12-year lease with

no breaks. The tenant will pay GBP1.9 million per annum at this

seven floor building, based on GBP45 per sq ft (GBP484 per m(2) )

on the top floor and GBP42.50 per sq ft (GBP457 per m(2) ) on a

typical mid-level floor, with a rent free period of 30 months.

There are upward-only rent reviews after five and ten years, with a

minimum uplift to GBP2.0 million after five years.

10-4 Pentonville Road is situated in Islington opposite Derwent

London's award winning Angel Building. The regeneration of the

building has recently been completed, unifying the façade of two

former 1980s buildings to create 55,000 sq ft (5,110m(2) ) of

offices, which represents more than 20% uplift in floor area.

John Burns, Chief Executive Officer of Derwent London, said:

"We are pleased to welcome Ticketmaster to our newly regenerated

offices at 10-4 Pentonville Road, another leading business taking

space in this rapidly improving, vibrant location."

-ends-

For further information please contact:

Derwent London 020 7659 3000

John Burns, Chief Executive Officer

Louise Rich, Head of Investor Relations

Brunswick Group

Elizabeth Adams 020 7404 5959

Sheena Shah

Notes to editors

Derwent London

Derwent London plc is the largest central London focused REIT

with an investment portfolio of GBP2.7bn as at 30 June 2012. The

Group is one of London's most innovative office specialist property

regenerators and investors and is well known for its design-led

philosophy and creative management approach to development.

Derwent London's core strategy is to acquire and own a portfolio

of central London property that has reversionary rents and

significant opportunities to enhance and extract value through

refurbishment, regeneration and redevelopment. The Group owns and

manages an investment portfolio of 5.3 million sq ft (490,000m(2)

), as at 30 June 2012, of which 96% is located in central London,

with a specific focus on the West End and the areas bordering the

City of London. Landmark schemes by Derwent London include Angel

Building EC1, 8 Fitzroy Street W1, Qube W1, Horseferry House SW1,

Johnson Building EC1, Davidson Building WC2 and Tea Building

E1.

Derwent London came fifth overall in the 2011 Management Today

awards for 'Britain's Most Admired Companies' and has also recently

won the Estates Gazette Property Company of the Year - Offices

award. In 2011, Angel Building was shortlisted for the RIBA

Stirling Prize following its RIBA London 2011 award and has also

won numerous accolades from organisations such as the British

Council for Offices, the British Construction Industry, the

American Institute of Architects and New London Architecture.

In 2012 the Tea Building won a RIBA regional award and an AJ

Retrofit award for the 'Green Tea' refurbishment to improve the

environmental performance of the building. Derwent London was also

the European listed sector leader for offices in the 2012 GRESB

survey.

For further information see www.derwentlondon.com or follow us

on Twitter at @derwentlondon.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCBKODNOBDDAKD

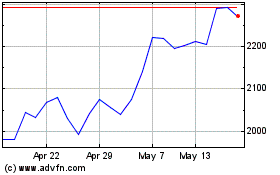

Derwent London (LSE:DLN)

Historical Stock Chart

From Jul 2024 to Aug 2024

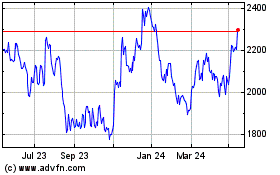

Derwent London (LSE:DLN)

Historical Stock Chart

From Aug 2023 to Aug 2024