Derwent London secures Gresse Street pre-let

October 14 2009 - 4:00AM

UK Regulatory

TIDMDLN

RNS Number : 7208A

Derwent London PLC

14 October 2009

14 October 2009

Derwent London plc ("Derwent London" / "Company")

Derwent London secures Gresse Street pre-let

Derwent London has secured a 13,093 sq ft (1,216 sq m) pre-let at the Charlotte

Building, 17 Gresse Street, London, W1 to Unanimis Consulting Limited

("Unanimis"), one of London's largest digital advertising networks.

Unanimis will take the top two floors of the seven-storey, 47,000 sq ft (4,400

sq m) Charlotte Building on a 10-year lease at GBP578,451 per annum.

The rent on the sixth floor is GBP45 per sq ft (GBP484 per sq m) and GBP43.50

per sq ft (GBP468 per sq m) on the fifth floor. These levels are in line with

the June valuation. The tenant has an option to break in December 2013. An

initial rent free period equivalent to 12 months rent was granted with an

additional 10 months if the break is not exercised.

The letting is in advance of the property's launch at the end of the month and

the remaining five floors of this new contemporary building, set around a

landscaped courtyard, are attracting letting interest.

The Charlotte Building together with properties in nearby Fitzrovia, are in a

strategically important area of the West End for Derwent London, where its

holdings total over one million sq ft.. Future plans include the refurbishment

and redevelopment of existing buildings and investment in local services to

regenerate this improving London village.

John Burns, Chief Executive, Derwent London, said:

"We are pleased to have achieved a pre-let in the Charlotte Building to

Unanimis, part of Orange France Telecom. They are existing tenants of the group

occupying 7,400 sq ft (690 sq m) in a nearby property, whose lease was due to

expire at the end of the year. We are delighted that they have decided the

Charlotte Building meets their expansion requirements. This is also a further

step in Derwent London's programme to rejuvenate its buildings to create

desirable spaces in which to live and work."

For further information please contact:

John Burns, Chief Executive, Derwent London: Tel 020 7659 3000

Kate Holgate, James Rossiter, Brunswick Group: Tel 020 7404 5959

Notes to editors:

Derwent London plc

Derwent London plc is the largest central London focussed REIT with an

investment portfolio of GBP1.8 billion as at 30 June 2009. The group is one of

London's most innovative office specialist property regenerators and investors

and is well known for its established design-led philosophy and creative

management approach to development. In April, Derwent London was awarded the

Property Week Property Company of the Year 2009.

Derwent London's core strategy is to acquire and own a portfolio of central

London property that has reversionary rents and significant opportunities to

enhance and extract value through refurbishment and redevelopment. The group

owns and manages an investment portfolio, of which 93% is located in central

London, with a specific focus on the West End and the areas bordering the City

of London. Landmark schemes by Derwent London include: Qube W1, Horseferry House

SW1, Johnson Building EC1, Davidson Building WC2 and Tea Building E1.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCCKNKPABDDOKD

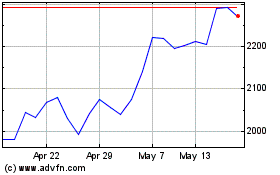

Derwent London (LSE:DLN)

Historical Stock Chart

From Jun 2024 to Jul 2024

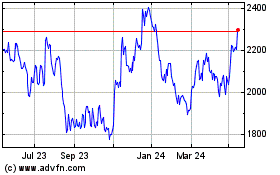

Derwent London (LSE:DLN)

Historical Stock Chart

From Jul 2023 to Jul 2024