RE: Sales

July 13 2007 - 3:01AM

UK Regulatory

RNS Number:1973A

Derwent London PLC

13 July 2007

13 July 2007

Derwent London plc ("Derwent") announces #175 million of sales

Derwent is pleased to announce the disposal of three non-core assets which were

acquired through the merger with London Merchant Securities plc in February this

year. The sales total #175.0 million, before disposal costs, and achieved

#91.8 million above the 31 January 2007 book value of #83.2 million. The

transactions are:

* Disposal of Greenwich Reach, SE10. Completion has taken place

to Roamquest Limited, part of Galliard Homes, for #111.8 million. This eight

acre cleared site is on the South bank of the Thames, overlooking Canary Wharf.

The site currently has planning consent for 980 residential apartments and

71,155 sq ft of commercial/retail space.

* Contracts have been exchanged on the disposal of 158-166

Brompton Road, Knightsbridge, SW3 to a private purchaser for #45.0 million.

This property comprises retail, office and residential space, totalling 27,000

sq ft and produces a short term income of #0.8 million per annum.

* Contracts have been exchanged on the disposal of 3 & 4 South

Place, EC2 to the Frogmore Group for #18.2 million. Situated close to Broadgate

in the City of London, the properties comprise two adjacent vacant office

buildings totalling approximately 36,000 sq ft.

These sales are the first since Derwent converted to REIT status on 1 July 2007.

Both South Place and Brompton Road are within the tax exempt REIT ringfence

and will therefore not attract tax on their disposal. However, since the

Greenwich property falls outside the REIT ringfence any capital gains arriving

from its sale will be chargeable to tax.

John Burns, Chief Executive of Derwent London commented:

"We are delighted with the substantial premiums achieved which were accomplished

so soon after our REIT conversion, at a level of 110% above book value. The sale

of Knightsbridge and South Place enable the Group to achieve significant

benefits from the REIT status by disposing of two properties, which were not in

our current development programme, in a tax efficient manner. The Greenwich sale

is a non-core disposal as the Group continues to concentrate its efforts on

commercial development, where it considers its expertise are better applied than

residential schemes of this magnitude.

"Proceeds from the sales will be channelled into our substantial pipeline of

refurbishment and redevelopment schemes as well as future acquisitions. Further

disposals of non-core and provincial properties will follow. These sales

endorse the strength of the London property market and Derwent London's

commitment to concentrate on major office and refurbishment schemes within our

chosen Central London villages."

-ENDS-

For further information please contact:

Derwent London Tel: 020 7659 3000

John Burns

Financial Dynamics Tel: 020 7831 3113

Dido Laurimore / Nicole Marino

Derwent London

The merger of Derwent Valley Holdings and London Merchant Securities took place

on 1st February 2007, creating Derwent London plc, a leading central London

office specialist with a combined portfolio valued at #2.4 billion, of which 84%

is located in central London. The combined portfolio offers a wealth of

potential and Derwent London will continue to build on the core strengths of the

combined business, drawing upon the existing strengths of both Derwent Valley

and London Merchant Securities.

Derwent London has an extensive pipeline of development and refurbishment

assets. Continued focus will remain on the central London market where its

established design led philosophy and creative management approach to

development will continue to generate rental and capital growth. However the

synergy created by the merger will also provide the necessary leverage and scale

to allow the new business to undertake significantly larger development

projects. In total, 5.2 million sqft of development or refurbishment projects

are in the pipeline, of which 2.2 million sqft is currently on site and 3

million sqft is scheduled for the future.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCDGGMNVFRGNZG

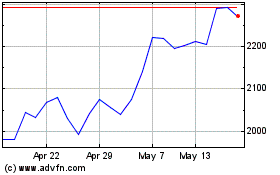

Derwent London (LSE:DLN)

Historical Stock Chart

From Jul 2024 to Aug 2024

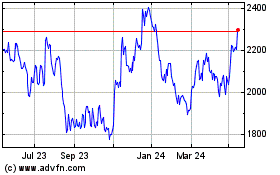

Derwent London (LSE:DLN)

Historical Stock Chart

From Aug 2023 to Aug 2024