TIDMDISH

RNS Number : 3345N

BigDish PLC

29 January 2021

BigDish Plc

( " BigDish " or the " Company")

Financial Report for the Half-Year to 30 September 2020

BigDish Plc (LON: DISH), a technology development company is

pleased to announce the publication of its Financial Report for the

Half-Year period to 30 September 2020 which is laid below this

announcement.

The Company announced on 24 September 2020 securing an agreement

for short term funding of GBP 540,000. The Company requested and

received GBP 200,000 of this funding after the 30 September 2020.

The majority of this amount has yet to be utilised. The Company is

confident that this amount along with the balance of the short term

funding will be more than adequate to stretch the funding runway

beyond the end of the second quarter of 2020.

The Company will provide a further update to the market early

next week with regards to its business.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION EU 596/2014 ("MAR")

Enquiries:

Zak Mir, Digital Communications

Officer, BigDish +44 (0) 7867 527659

zak@bigdish.com

Jonathan Morley-Kirk, Non-Executive jmk@bigdish.com

Chairman

BigDish PLC

Financial Report

For the Half-Year Ended 30 September 2020

(Unaudited)

REPORT OF THE DIRECTORS

The Directors present the report together with the unaudited

interim financial statements for the Group for the half-year ended

30 September 2020.

The Company

BigDish Plc, the parent Company, is registered (registered

number 121041) and domiciled in Jersey. It was incorporated on 11

April 2016.

Principal Activity and Business Review

The Company's principal activity during the period ended 30

September 2020 was a holding company, holding subsidiaries trading

under the " BigDish " brand in United Kingdom and a technology

development centre in the Philippines.

Results and Dividends

The results of the Group for the half-year ended 30 September

2020 show a loss before taxation of GBP 426,142 (30 September 2019

showed a loss of GBP 1,050,255).

No dividends have been paid during the half-year ended 30

September 2020 or during the comparative period.

Operational Activities

The Company continued to develop its technology platform during

the reporting period despite Covid-19 impacting the Company's

progression.

On 12 October 2020, the Company announced a business

diversification in that it was developing a venture builder model

that would develop technology in return for equity stakes in

up-and-coming technology companies.

Principal Risks and Uncertainties

The principal business risks that have been identified are as

below.

COVID-19 Risks

The restaurant sector has experienced significant disruption

from COVID-19. This has impacted the Company's business and the

Company continues to monitor the impact of COVID-19 on an ongoing

basis. The Company announced diversifying its strategy after the

reporting period to mitigate against these risks.

Marketplace Risk

The Company is operating in a competitive market and faces

competition from other companies who do or may in the future

offer a similar service on similar terms. Competitors may have

much greater access to capital than the Company.

If the Company is unable to attract sufficient restaurants and

potential customers at the rate expected, the Company may be

unable to successfully compete in the market which may have a

material adverse impact on its future prospects.

Funding Risk

The Company has not reached breakeven due to the early stage of

business development. This therefore requires that the

Company raises additional capital periodically. On 24 September

2020, the Company announced entering into a short term funding for

GBP 540,000. As of the publication date only GBP 200,000 has been

drawn down from this agreement, which has largely not been

utilised.

Technology Risk

The success of the Company is dependent on the technical

capabilities of its app and appeal to users. If technical issues

arise or the technology is not as appealing as competitors'

technology, this may have a significant impact on the Company's

ability to attract and retain restaurants and attract customers

to use BigDish. The costs associated with remaining competitive may

be disproportionate to the revenues generated by the Company which

may result in an adverse impact on the Company's financial

position.

Key Personnel Risk

The loss of/inability to attract key personnel could adversely

affect the business of the Company. The Company is dependent

on the experience and abilities of its executive Directors and

certain Senior Managers and technology staff. The Company will

continue to look to attract suitably experienced personnel to

mitigate any negative impact on the growth of the business.

Security Risk

Any unauthorised intrusion, malicious software infiltration,

network disruption, denial of service or similar act by a

malevolent party could disrupt the integrity, continuity, security

and trust of the Enlarged Group's platform. These security risks

could create costly litigation, significant financial liability,

increased regulatory scrutiny, financial sanctions and a loss of

confidence

in the Company's business.

Compliance Risk

The Company may process personal data (names, emails and

telephone numbers), which may be considered sensitive, as part of

its business. The Company may be subject to investigative or

enforcement action by regulatory authorities in the Company's

countries of operations if it acts or is perceived to be acting

inconsistently with the terms of its privacy policy, customer

expectations or the law. The Company will continue to monitor its

policies to ensure on-going compliance with the

General Data Protection Regulation (GDPR) regulations.

Brexit Risk

The main focus of the business is the United Kingdom and the

Company does not expect to be affected adversely by Brexit. Any

on-going risks will be mitigated through on-going review by

Management and reporting of KPIs to the Board for periodic review

and strategy amendment as required.

Events after the Reporting Period

Refer note 9 of the unaudited interim financial statements.

Company Directors

Appointment Date Audit Remuneration

Position Committee Committee

--------------------- ----------------------- ------------------ ----------- -------------

Jonathan Morley-Kirk Non-Executive Chairman 16 April 2016 Chair Member

Simon Perrée* Non-Executive Director 30 July 2018 Member Chair

Aidan Bishop Executive Director 16 April 2016 - -

--------------------- ----------------------- ------------------ ----------- -------------

*Resigned on 24 September 2020

The Directors note that the search for a replacement NED is

on-going and that the process is being hindered by the third UK

Covid-19 lockdown.

Share Capital

At 30 September 2020, the issued share capital of the Company

stood at 373,620,823 - with 24,670,468 new shares having been

issued during the period. The issuances are detailed in note 5 to

the unaudited financial statements.

This Directors' Report was approved by the Board of Directors on

28 January 2021 and is signed on its behalf.

By Order of the Board

Jonathan Morley-Kirk

Chairman

28 January 2021

CONSOLIDATED INCOME STATEMENT

For the half-year ended 30 September 2020

30 Sep 2020 30 Sep 2019

(unaudited) (unaudited)

Note GBP GBP

Income - 11,766

Cost of sales - (696)

Gross profit - 11,070

Administrative expenses (515,875) (735,077)

Impairment loss - (396,277)

Fair value gain 7 89,733 70,029

Loss before taxation (426,142) (1,050,255)

Income tax expense - -

Loss for the period 4 (426,142) (1,050,255)

Earnings per share:

Basic and diluted loss per share 6 (0.0012) (0.0033)

The accompanying notes form an integral part of these financial

statements.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the half-year ended 30 September 2020

30 Sep 2020 30 Sep 2019

(unaudited) (unaudited)

Note GBP GBP

Loss for the period

(426,142) (1,050,255)

Exchange difference on translating foreign operations*

(11,887) (45,195)

Total comprehensive loss for the period

(438,029) (1,095,450)

*To be reclassified to Profit and Loss if the foreign entity is

sold.

The accompanying notes form an integral part of these financial

statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

For the half-year ended 30 September 2020

30 Sep 2020 30 Sep 2019

(unaudited) (unaudited)

Note GBP GBP

Non-current assets

Property, plant and equipment 6,739 13,053

6,739 13,053

Current assets

Trade and other receivables 5 237,346 37,387

Cash and cash equivalents

156,424 1,296,042

393,770 1,333,429

Current liabilities

Trade and other payables (258,180) (205,730)

Borrowings (13,403) (4,744)

( 271,583) (210,474)

Non-current liabilities

Trade and other payables - (3,581)

Borrowings - (1 0, 128)

- (13,709)

Net assets/(liabilities) 128,926 1,122,299

Equity

Issued share capital 6 6,444,670 6,273,887

Retained earnings (7,242,334) (5,916,067)

Other Reserves 8 926,590 764,479

Total equity 128,926 1,122,299

The accompanying notes form an integral part of these financial

statements.

These financial statements were approved by the Board of

Directors.

Jonathan Morley-Kirk

Chairman

28 January 2021

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the half-year ended 30 September 2020

Share Retained

Other Total

Capital Earnings Reserves Equity

GBP GBP GBP GBP

At 31 March 2019 3,239,914

(4,865,812) 879,703 ( 746 ,195)

Loss for the period -

(1,050,255 ) - ( 1,050,255)

Other comprehensive income for the period -

- (45,195) (45,195)

Total comprehensive income for the period -

(1,050,255) (45,195) (1,095,450)

Warrants reserves -

(70,029) (70,029)

Issue of new ordinary shares (net) 3,033,973

- - 3,033,973

Total transactions with owners 3,033,973

(1,050,255) (115,224) 1,868,494

At 30 September 2019 (unaudited) 6,273,887

(5,916,067) 764,479 1,122,299

Loss for the period

- (405,202) - (405,202)

Other comprehensive income for the period -

- 90,558 90,558

Total comprehensive income for the period -

(405,202) 90,558 (314,644)

Warrants reserves

- - 70,029 70,029

Share options reserves

- - 103,144 103,144

Shares to be issued

- - 246,937 246,937

Issue of new ordinary shares (net) - adjustment (300,907)

- - (300,907)

Total transactions with owners

(300,907) (405,202) 510,668 (195,441)

Prior period adjustment

- (494,923) (494,923)

At 31 March 2020

5,972,980 (6,816,192) 1,275,147 431,935

Loss for the period

- (426,142) - (426,142)

Other comprehensive income for the period -

- (11,887) (11,887)

Total comprehensive income for the period -

(426,142) (11,887) (438,029)

Warrants reserves

- - (89,733) (89,733)

Shares to be issued

- - (246,937) (246,937)

Issue of new ordinary shares (net)

471,690 - - 471,690

Total transactions with owners

471,690 (426,142) (348,557) (303,009)

At 30 September 2020

6,444,670 (7,242,334) 926,590 128,926

The accompanying notes form an integral part of these financial

statements.

CONSOLIDATED CASH FLOW STATEMENT

For the half-year ended 30 September 2020

30 Sep 2020 30 Sep 2019

(unaudited) (unaudited)

Note GBP GBP

Cash flows from operating activities

Cash received from customers - 6,875

Cash paid to suppliers & employees

(278,822) (670,921)

Net cash from operating activities (278,822) (664,046)

Cash flows from financing activities

Loan repayments

(2,370) (2,370)

Cash received from loan receivable

50,000 -

Net proceeds from share capital issue

- 1,952,988

Net cash used in financing activities 47,630 1,950,618

Net increase (decrease) in cash (231,192) 1,286,572

Cash and cash equivalents at start of period

387,616 9,470

Cash and cash equivalents at end of the period

156,424 1,296,042

The accompanying notes form an integral part of these financial

statements.

NOTES TO THE FINANCIAL STATEMENTS

For the half-year ended 30 September 2020

1. BASIS OF PREPARATION AND ADOPTION OF INTERNATIONAL FINANCIAL

REPORTING STANDARDS (IFRS)

The consolidated interim financial statements have been prepared

in accordance with the recognition and measurement principles of

International Financial Reporting Standards as endorsed by the

European Union ("IFRS") and expected to be effective at the

year-end of 31 March 2021. The accounting policies are unchanged

from the financial statements for the year ended 31 March 2020. The

interim financial statements, which have been prepared in

accordance with International Accounting Standard 34 (IAS 34) as

adopted by the European Union, are unaudited. Accounts for the year

ended 31 March 2020, prepared in accordance with IFRS, have been

filed. The Auditors' Report on these accounts was unqualified, but

did include a material uncertainty in respect of going concern.

The consolidated interim financial statements are for the six

months to 30 September 2020. The interim consolidated financial

information does not include all the information and disclosures

required in the annual financial statements and should be read in

conjunction with the Group's annual financial statements for the

year ended 31March 2020, which were prepared in accordance with

IFRS's as adopted by the European Union.

2. GOING CONCERN

The balance of the loan from Lloyds Bank loan (GBP 13,403 at 30

September 2020) was repaid this on 16 October 2020.

The Group made a consolidated loss in the half-year ended 30

September 2020 of GBP 426,142. At 30 September 2020, the

consolidated cash held was GBP 156,424 and the Group had

consolidated liabilities of GBP 271,583, which includes GBP 55,982

due to related parties. The related parties liabilities are

expected to be settled via equity under the Company's salary

sacrifice scheme in February 2021.

The Company has entered into a short-term funding agreement for

GBP540,000. As of the publication date of this report, only GBP

200,000 has been drawn down and largely not been utilised. It is

expected that this funding will extend the funding runway beyond

the second quarter of 2021. Further, the Company obtained a Letter

of Intent from an Investor to fund the progression of the BigDish

business via a Special Purpose Vehicle subject to conditions

precedent, which, if met, will be sufficient to fund the business

over the longer term.

Whilst the company is confident that it can stretch the

short-term funding beyond the second quarter of 2021, there remains

material uncertainty and the company will require further funding

at some point during the 12 months from the date of this report.

The Financial Statements have been prepared on a Going Concern

basis.

3. SEGMENTAL REPORTING

3.1 For the half-year ended 30 September 2020

Income Statement

for the half-year Jersey Hong Kong Indonesia Philippines UK Total

ended GBP GBP GBP GBP GBP GBP

30 Sep 2020 (unaudited)

-------------------------- ------------ ---------- ---------- ------------ ----------- ------------

Revenue - - - - - -

Cost of sales - - - - - -

-------------------------- ------------ ---------- ---------- ------------ ----------- ------------

Gross Profit - - - - - -

Administration

expenses (251,612) - - (114,442) (60,088) (426,142)

-------------------------- ------------ ---------- ---------- ------------ ----------- ------------

Loss for the Period (251,612) - - (114,442) (60,088) (426,142)

-------------------------- ------------ ---------- ---------- ------------ ----------- ------------

Statement of Financial Position

at 30 Sep 2020 Jersey Hong Kong Indonesia Philippines UK Total

(unaudited) GBP GBP GBP GBP GBP GBP

---------------------------- ---------- ---------- ---------- ------------ --------- ----------

Non-current assets - - - 6,739 - 6,739

Trade and other

receivables 207,840 285 - 21,421 7,800 237,346

Cash and cash equivalents 79,489 - - 8,495 68,440 156,424

---------------------------- ---------- ---------- ---------- ------------ --------- ----------

Total assets 287,329 285 - 36,655 76,240 400,509

Current liabilities (95,157) - (5,506) (138,201) (32,719) (271,583)

Non-current liabilities - - - - - -

---------------------------- ---------- ---------- ---------- ------------ --------- ----------

Net assets/(liabilities) 192,172 285 (5,506) (101,546) 43,521 128,926

---------------------------- ---------- ---------- ---------- ------------ --------- ----------

3.2 For the half-year ended 30 September 2019

Income Statement

for the half-year Jersey Hong Kong Indonesia Philippines UK Total

ended GBP GBP GBP GBP GBP GBP

30 Sep 2019 (unaudited)

-------------------------- ------------ ---------- ---------- ------------ ------------ --------------

Revenue - - - - 11,766 11,766

Cost of sales - - - - (696) (696)

-------------------------- ------------ ---------- ---------- ------------ ------------ --------------

Gross Profit - - - - 11,070 11,070

Administration

expenses (532,914) (935) (4,840) (83,396) (112,992) (735,077)

Impairment loss - - - (32,575) (363,702) (396,277)

Fair value gain 70,029 - - - - 70,029

-------------------------- ------------ ---------- ---------- ------------ ------------ --------------

Loss for the Period (462,885) (935) (4,840) (115,971) (465,624) (1,050,255)

-------------------------- ------------ ---------- ---------- ------------ ------------ --------------

Statement of Financial Position

at 30 Sep 2019 Jersey Hong Kong Indonesia Philippines UK Total

(unaudited) GBP GBP GBP GBP GBP GBP

---------------------------- ------------ ---------- ---------- ------------ --------- ------------

Non-current assets - - - 11,891 1,162 13,053

Trade and other

receivables - - - 12,767 24,620 37,387

Cash and cash equivalents 1,263,148 369 - 18,838 13,687 1,296,042

---------------------------- ------------ ---------- ---------- ------------ --------- ------------

Total assets 1,263,148 369 - 43,496 39,469 1,346,482

Current liabilities (93,163) - (6,034) (110,160) (1,117) (210,474)

Non-current liabilities (10,128) - - (3,581) - (13,709)

---------------------------- ------------ ---------- ---------- ------------ --------- ------------

Net assets/(liabilities) 1,159,857 369 (6,034) (70,245) 38,352 1,122,299

---------------------------- ------------ ---------- ---------- ------------ --------- ------------

4. LOSS FOR THE PERIOD BEFORE TAX

30 Sep 2020 30 Sep 2019

(unaudited) (unaudited)

GBP GBP

Loss for the period has been arrived at after charging:

Directors remuneration

80,000 80,000

Staff costs

200,915 252,961

5. TRADE AND OTHER RECEIVABLES

30 Sep 2020 30 Sep 2019

(unaudited) (unaudited)

GBP GBP

Trade and Other Receivables

29,506 37,387

Loan Receivables

207,840 -

Balance at end of period

237,346 37,387

All receivables are current assets and due within 12 months -

GBP 50,000 repayment of the loan receivables was received by the

Company in the half-year to 30 September 2020.

6. SHARE CAPITAL

6.1 Share Capital

30 Sep 2020 30 Sep 2019

(unaudited) (unaudited / re-stated)

Number GBP Number GBP

Opening balance 348,950,355 5,977,980 285,847,519 3,239,914

Audit adjustment - 31 March 2020 -

- - (300,907)

Ordinary shares - new shares issued during the period 24,670,468

471,690

63,102,836 3,033,973

Closing balance 373,620,823 6,444,670 348,950,355 5,977,980

The shares have no par value. At 30 September 2020, included in

the total share issuance of 373,620,823, 24,670,468 shares were

issued as final payment of the Table Pouncer acquisition and to

Directors as settlement of outstanding salaries as at 30 June 2020

under the Salary Sacrifice Scheme. The Group holds 11,000,000

shares in treasury.

6.2 Earnings Per Share

30 Sep 2020 30 Sep

2019 (unaudited)

(unaudited) GBP

GBP

--------------------------------------------------------------- ------------------

Basic and diluted earnings per share (0.0012) (0.0033)

Loss used to calculate basic and diluted

earnings per share (426,142) (1,050,255)

Weighted average number of shares used

in calculating basic and diluted earnings

per share 360,622,075 314,039,187

--------------------------------------------- ----------------- ------------------

Earnings per share is calculated by dividing the loss

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding and shares to be issued

during the period.

In 2020 and 2019, the potential ordinary shares were

anti-dilutive as the Group was in a loss making position and

therefore the conversion of potential ordinary shares would serve

to decrease the loss per share from continuing operations. Where

potential ordinary shares are anti-dilutive a diluted earnings per

share is not calculated and is deemed to be equal to the basic

earnings per share.

The warrants noted in note 7 could potentially dilute EPS in the

future.

7. SHARE WARRANTS

Warrants are denominated in Sterling and are issued for services

provided to the Group or as part of the acquisition of a

subsidiary.

Warrants at 30 September 2020:

No. issued No. outstanding

and exercisable No. exercised No. lapsed and exercisable Expiry date

Exercise price at 01 Apr in period in period at 30 Sep

2020 2020

----------------- ----------------- ---------------- ------------- ----------------- ---------------

4.50p 2,654,585 - - 2,654,585 02 August 2021

9.00p 11,111,111 - (11,111,111) - 02 August 2020

4.50p 444,444 - (444,444) - 02 August 2020

02 February

4.156p 6,851,116 - - 6,851,116 2021

----------------- ----------------- ---------------- ------------- ----------------- ---------------

Closing balance 21,061,256 - (11,555,555) 9,505,701

----------------- ----------------- ---------------- ------------- ----------------- ---------------

The charge for the period to 30September 2020 is GBP nil (30

September 2019: GBP 19,074).

8. RESERVES

30 Sep 2020 30 Sep 2019

(unaudited) (unaudited)

GBP GBP

---------------------------- ------------- -------------

Translation reserve 66,811 (11,860)

Share options reserve 859,779 756,635

Warrants reserve - 19,704

---------------------------- ------------- -------------

Balance at end of period 926,590 764,479

---------------------------- ------------- -------------

9. EVENTS AFTER THE REPORTING PERIOD

The Company announced on 12 October 2020 the development a

Venture Builder model - a technology platform to develop technology

in return for equity in exciting up and coming technology

companies. To facilitate this, the Company announced that the

technology development platform would be moved to India, which has

a lower cost base than the Philippines.

The Company also announced on 16 November 2020 that as a result

of the Venture Builder model, it expected to extend its funding

runway. Changes in management also took place and the Company will

identify a new CEO with suitable experience.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UKSVRAKUAURR

(END) Dow Jones Newswires

January 29, 2021 02:23 ET (07:23 GMT)

Amala Foods (LSE:DISH)

Historical Stock Chart

From Jun 2024 to Jul 2024

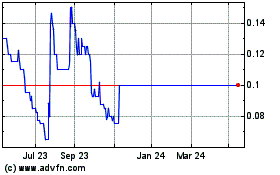

Amala Foods (LSE:DISH)

Historical Stock Chart

From Jul 2023 to Jul 2024