TIDMVMUK TIDM91XR

RNS Number : 5216G

Virgin Money UK PLC

27 July 2021

27 July 2021

Virgin Money UK PLC: Third Quarter 2021 Trading Update

Virgin Money UK PLC ("VMUK" or the "Group") confirms that

trading in the three months to 30 June 2021 was in line with the

Board's expectations.

David Duffy, Chief Executive Officer:

"Virgin Money performed well as our strategy continued to

translate into improved financial delivery in a strengthening

environment. We carried our momentum of relationship deposit growth

into the second half, reducing our cost of funds. Our asset quality

remained robust, while capital ratios improved further.

"The positive reaction to our switching incentives and product

launches reflects our focus on transforming customer experience,

backed by the unique advantages of one of the world's

most-recognised brands. We have also advanced our ESG agenda with

our first greener mortgage product and sustainability-linked

business loans.

"We have increased full-year NIM guidance and, while COVID

continues to impact the near-term, we have a strong capital

position and robust provisions. We see great opportunities from

further developing our digital capabilities to deliver an improved

customer experience and greater efficiencies. We are well placed to

grow profitably next year as we play our role to support the UK

economic recovery."

Q3 Summary - Continued financial & strategic momentum; improving

asset quality backdrop

Strong relationship deposit balance growth with stable lending balances

* Relationship deposits increased 3.7% to GBP29.8bn,

whilst overall deposits decreased by (0.8)% to

GBP68.0bn as the Group continued to manage the

deposit mix and reduce funding costs

* Mortgages increased 0.7% to GBP58.7bn benefitting

from strong activity around SDLT deadlines

* Personal lending grew 2.5% to GBP5.2bn driven by

growth in credit cards as activity picked up

* Business lending was (2.4)% lower at GBP8.7bn as BAU

activity remained subdued and Government-backed loans

reduced as anticipated

Continued Net Interest Margin (NIM) momentum

* NIM improved in Q3 to 168bps (Q2: 160bps) benefitting

from a lower cost of funds driven by improvements in

deposit mix and repricing as well as higher hedge

contributions, partially offset by a more competitive

lending backdrop

* Expect NIM to be modestly ahead of 160bps for FY21,

stabilising into Q4, as wholesale funding costs and

increasing competition offset the ongoing deposit

repricing benefits

Ongoing strategic progress; continuing to invest in our future potential

and digital capability

* Further growth in new PCA customers to c110k this

financial year, benefitting from Brighter Money

Bundles campaigns; positive response to credit card

cashback offers with 175k registrations and with

instalment payments launching later in the year

* Relaunched BCA awarded Moneyfacts 5* rating;

innovative Wellness Tracker and Working Capital

Solutions set to launch later this year, leveraging

the capabilities of our fintech partners

* ESG progress: Launched greener mortgage product and

first sustainability-linked business loans

Improving economic outlook and robust asset quality

* Robust credit quality maintained across key

portfolios with no significant specific provisions in

Q3; balance sheet credit provisions of GBP678m (H1

21: GBP721m); coverage of 94bps (H1: 100bps)

* Q3 impairment release of GBP19m driven by lower

modelled ECL from updated macro assumptions

* Quarterly cost of risk of (10)bps (H1 charge: 11bps);

year-to-date cost of risk now 4bps

* If the current strengthening in the economic backdrop

persists, the Group believes there may be an

opportunity for a further reduction in credit

provision levels alongside FY21 results

Improved CET1 ratio with FY outlook improved

* CET1 ratio increased c.40bps to 14.8% (including

c.45bps of software benefit); benefited from

continued strong profitability and benign RWA

backdrop; fully loaded CET1 ratio now 13.7%

* E xpect FY21 CET1 to be broadly stable against Q3

level, including the software benefit; RWA inflation

more likely in FY22

* Solvency Stress Test (SST) outcome and impairment

outlook remain key inputs into our approach to

considering shareholder returns; expect a further

update on our capital framework post-SST

Pioneering Growth

(GBPbn) 30 Sep-20 31 Mar-21 30 Jun-21 Q3 growth YTD annualised

--------------------- ---------- ---------- ---------- ---------- ---------------

Mortgages 58.3 58.3 58.7 0.7% 0.8%

Business 8.9 8.9 8.7 (2.4)% (4.0)%

o/w BBLS 0.8 1.0 0.9 (3.6)% 21%

o/w CBILS/CLBILS 0.4 0.4 0.4 (2.2)% 32%

Personal 5.2 5.1 5.2 2.5% (1.1)%

Customer lending 72.5 72.2 72.5 0.4% 0.1%

Customer deposits 67.5 68.5 68.0 (0.8)% 0.9%

o/w relationship

deposits 25.7 28.7 29.8 3.7% 21.5%

--------------------- ---------- ---------- ---------- ---------- ---------------

The Group continued to manage down the cost of deposits in a

supportive environment with an improvement in mix, as relationship

deposits grew 3.7% during the quarter. Overall deposits reduced

(0.8)% with more expensive term deposit balances declining in line

with expectations as we continued to reprice the portfolio

lower.

Mortgage balances increased in Q3 by 0.7% reflecting higher

volumes of new lending and buoyant market conditions ahead of the

SDLT changes. Spreads tightened during the period as anticipated

and the Group continues to be selective, balancing volumes and

pricing carefully.

Business lending declined (2.4)% in Q3 with a reduction in BAU

and Government-scheme volumes. The BAU book declined (2.2)% given

lower market activity which is expected to improve later in the

calendar year. Following the expiry of the one-year interest free

period for the majority of CBILs and BBLs customers, Government

backed balances declined (3.2)% to GBP1.4bn as some borrowers

started to repay.

Personal lending balances increased 2.5% in Q3. Aggregate credit

card spending levels have recovered to pre-COVID levels but with

more impacted sectors, such as travel, remaining subdued. Overall,

the cards book returned to growth driven by a recovery in both

transaction-based and balance transfer balances. The Personal Loan

and Salary Finance portfolios performed resiliently against

continued subdued market demand.

Group NIM improved 8bps in Q3 to 168bps (YTD: 160bps 9 months

annualised), as the benefit of the structural hedge contribution

and reductions in deposit pricing provided continued momentum,

offsetting a more competitive lending environment. The Group now

expects NIM to be modestly ahead of 160bps for FY21, stabilising

into Q4, as wholesale funding costs and increasing competition

offset the ongoing deposit repricing benefit.

Non-interest income performance remained subdued in the period,

given the timing of restrictions being eased, but with some early

signs of recovery in card spending fees towards the end of the

quarter.

The UK economic outlook improved further in Q3. The rollout of

the vaccination programme and the easing of restrictions supported

further positive revisions to expectations. Stronger GDP growth,

lower unemployment, a robust housing market and greater consumer

confidence are all positive indicators of the improving outlook for

the operating environment. Overall, while risks remain from the

increase in COVID case numbers driven by the new variants and the

impact of the removal of Government support schemes later in the

year, the strengthening backdrop gives scope for greater optimism

about the pace of the recovery.

Delighted Customers and Colleagues

We continued to attract new PCA customers in the quarter, with

accounts opened this financial year now approaching 110,000 in

total (H1: c.80,000) as our Brighter Money Bundles campaign was

launched in November. The third Bundle featuring GBP150 vouchers

for Virgin Experience days has recently been launched, continuing

to offer a differentiated proposition in the market. Credit card

cashback sign-ups have reached 175,000 (H1: 100,000) and we

continue to focus on delivering new propositions such as instalment

payments on credit cards in Q4 and additional rewards for debit

card customers. The Group is focused on delivering a market-leading

customer experience, which will be supported by further investment

in digitising the whole customer journey, driving up advocacy

levels and improving efficiency.

The Virgin Red reward programme continues to gather momentum,

with a growing number of users signed up and over 200 ways to earn

and spend Virgin points across Virgin Group companies and other

retailers. The offer for the Virgin Atlantic Credit Card was

recently launched on the app, to sit alongside the exclusive 15,000

points offer for Red users switching to our M Plus PCA. We are

currently exploring the potential to launch other attractive offers

for Virgin Money products through the Virgin Red programme.

Our new BCA proposition which launched during Q3 has been rated

5* by Moneyfacts. Switching volumes will be supported in the coming

quarters by the launch of our business Wellness Tracker and the

wider Working Capital Health proposition later this year, as well

as our recently launched partnership with Virgin StartUp. After the

end of the quarter, the Group also received notification that with

nearly 16k firms having switched their BCA to VMUK through the BCR

Incentivised Switching Scheme, the Group had been awarded an

additional GBP8.9m to encourage further account switching

activity.

The Group is also continuing to work on transforming its

operating model, launching the initial phase of our "Life More

Virgin" approach to working. As our colleagues have adapted to the

changing environment, the Group remains focused on enabling a more

flexible approach to work as we disrupt the status quo. The new

approach will support both productivity and wellbeing, improving

collaboration and innovation, driving a great experience for our

colleagues and customers.

In Q3 our ESG agenda continued to gather pace. We launched new

propositions including our first greener mortgage product which we

will develop further over the coming months. In Business banking,

we advanced our first Sustainability-linked loans for commercial

businesses, designed to support businesses whose core activities

proactively help the economy transition to a more sustainable

economic and environmental model. The Group also switched to Biogas

in Q3, saving an estimated c.9 tonnes of carbon emissions per day.

All the energy where the Bank is responsible for supply is now

sourced renewably.

Super Straightforward Efficiency

The Group has made further progress in reducing its cost base in

the third quarter as expected, and continues to anticipate

underlying operating expenses of less than GBP890m for FY21, and

less than GBP430m for H2. Exceptional items in Q3 totalled GBP(34)m

including Integration and Transformation costs of GBP(22)m and

acquisition accounting unwind of GBP(12)m.

As outlined at the interim results in May, the Group continues

to see increasing customer appetite for digital self-service and is

evaluating the opportunities to accelerate its digital strategy to

deliver an improved customer experience and drive additional

efficiencies over time. Our work continues to target (i) increased

customer digital adoption, (ii) greater flexibility in colleague

working arrangements through our "Life More Virgin" programme and

(iii) the potential for further automation. We will give more

detail of the potential benefits and incremental associated

investment required alongside FY21 results.

Discipline & Sustainability

Credit quality remained robust in the period, with the overall

portfolio performing well and no significant specific provisions.

Macroeconomic inputs used in the Group's IFRS9 modelling were fully

refreshed in the quarter with March data from our 3(rd) party

provider Oxford Economics. The Group continues to use a weighted

average of 3 scenarios: (i) Upside 20%, (ii) Base 50%, (iii)

Downside 30%; full details of the weighted average scenario are in

appendix 1. Positive revisions to the key economic inputs and a

more balanced selection for the 'Base' scenario contributed to the

overall reduction in aggregate credit provisions to GBP678m (H1:

GBP721m). The decline was primarily driven by a reduction in

modelled ECL which reduced to GBP327m in the period (H1: GBP462m)

across stage 1 and 2 loans, particularly in Personal and Business

banking.

The Group continues to supplement the modelled output with

expert credit risk judgement applied through post-model adjustments

(PMAs) to account for factors the models cannot incorporate or

where the sensitivity is not as would be expected under the

unprecedented economic stress scenario. Given the uncertain

outlook, the Group decided to increase PMAs, mainly in Business

Banking, taking overall PMAs held to GBP320m (H1: GBP222m). Overall

coverage remains robust, having reduced 6bps to 94bps*.

The Q3 impairment release of GBP19m equates to a net Q3 cost of

risk of (10)bps. The Group remains focused on any potential

implications for customers as Government support is fully removed.

Nonetheless, if the current strengthening in the economic backdrop

persists, the Group believes there may be an opportunity for a

further reduction in credit provision levels alongside FY21

results.

Credit provisions Credit provisions Gross lending Coverage Annualised

at 31 Mar-21 at 30 Jun-21 at 30 Jun-21 ratio (bps) net cost

(GBPm) (GBPm) of risk (bps)

(GBPbn)

Mortgages 132 131 59.0 22 0

Personal 293 261 5.6 528 43

Business 296 286 8.5 379* 6

Total 721 678 73.1 94* 4

o/w stage

2 480 446 9.6 462

o/w stage

3 101 93 0.9 954

------------ ------------------ ------------------ -------------- ------------- ---------------

* Government guaranteed lending balances excluded for purpose of

coverage ratio calculation

VMUK remains strongly capitalised and CET1 improved c.40bps to

14.8% on an IFRS9 transitional basis in the quarter, including

c.45bps of benefit from the treatment of software intangible

assets. Fully loaded CET1 also remained robust in the period

improving to 13.7% (H1: 13.2%). Underlying capital generation in

the quarter more than offset the increase in RWAs, which were 0.5%

higher at GBP24.3bn primarily reflecting the prudent application of

additional PMAs related to economic uncertainty and PD

recalibration, offset by lower RWAs in Business banking. VMUK's

Total Capital and UK Leverage ratios remained resilient at 22.8%

(H1: 21.2%) and 5.4% (H1: 5.2%) respectively. The Group remains

focused on its inaugural Solvency Stress Test participation, ahead

of the bank-by-bank results announcement in December.

Given the improved economic outlook, the Group has not seen

material RWA inflation as HPI increases have largely offset PD

recalibrations. Potential RWA migration continues to be delayed by

the levels of support available to customers, however the Group is

closely monitoring higher risk customers for any early signs of PD

deterioration. The removal of the c.45bps CET1 benefit from

software intangible treatment is now expected in H1 FY22. Hybrid

mortgage model implementation is currently anticipated in 2022.

Combined with the stronger economic outlook, the Group expects FY21

CET1 to be broadly stable at the Q3 level, including software

benefit; with RWA inflation more likely to occur in FY22.

The Group expects a tax credit for the year driven by the

reassessment of historical losses and reflecting the substantive

enactment of the corporation tax rate change from 19% to 25%,

effective 1 April 2023, although this is not anticipated to have a

material overall capital impact.

Funding and liquidity remain strong, with the LCR stable at 151%

as elevated deposit balances including a higher mix of relationship

deposits and further wholesale issuance in the period were offset,

primarily by TFS repayments. In May the Group successfully issued

EUR500m of MREL senior debt and GBP300m of Tier 2, achieving

significantly tighter pricing than prior issues, with further

tightening in the secondary market. After these transactions, the

IFRS9 transitional MREL ratio improved to 32.7% (H1: 29.3%). This

represents a prudent buffer of c.6% or cGBP1.5bn over the Group's

expected 1-Jan-22 MREL requirement of 26.4% with no further AT1,

Tier 2 or Senior Unsecured issuance anticipated over the remainder

of the calendar year 2021.

Given the improved outlook for the UK economy, since H1 both

S&P and Fitch revised their outlook on the Group's long-term

ratings to Stable, from Negative.

Appendix 1: Key macroeconomic assumptions

Scenario Economic measure 2021 2022 2023 2024 2025

----------- ------------------------ ------- ------- ------- ----- -------

Weighted

Scenario GDP (yoy %) 5.8% 5.1% 1.9% 1.5% 1.7%

-----------

Unemployment (average) 6.1% 5.7% 5.3% 4.9% 4.7%

HPI (Q4 (Dec) yoy

%) (3.0)% (8.6%) (2.3)% 2.4% 4.6%

------------------------------------ ------- ------- ------- ----- -----

Source: VMUK calculations, Oxford Economics March 2021 IFRS9

For further information, please contact:

Investors and Analysts

Richard Smith +44 7483 399 303

Head of Investor Relations richard.smith@virginmoneyukplc.com

Amil Nathwani +44 7702 100 398

Senior Manager, Investor Relations amil.nathwani@virginmoneyukplc.com

Martin Pollard +44 7894 814 195

Manager, Investor Relations martin.pollard@virginmoneyukplc.com

Media (UK)

Matt Magee +44 7411 299477

Head of Media Relations matthew.magee@virginmoneyukplc.com

Simon Hall +44 7855 257 081

Senior Media Relations Manager simon.hall@virginmoney.com

Press Office +44 800 066 5998

press.office@virginmoneyukplc.com

Citigate Dewe Rogerson

Andrew Hey +44 7903 028 448

Media (Australia)

P&L Communications

Ian Pemberton +61 402 245 576

Sue Frost +61 409 718 572

-------------------------------------

Announcement authorised for release by Lorna McMillan, Group

Company Secretary.

Forward looking statements

The information in this document may include forward looking

statements, which are based on assumptions, expectations,

valuations, targets, estimates, forecasts and projections about

future events. These can be identified by the use of words such as

'expects', 'aims', 'targets', 'seeks', 'anticipates', 'plans',

'intends', 'prospects', 'outlooks', 'projects', 'forecasts'

'believes', 'estimates', 'potential', 'possible', and similar words

or phrases. These forward looking statements, as well as those

included in any other material discussed at any presentation, are

subject to risks, uncertainties and assumptions about the Group and

its securities, investments, and the environment in which it

operates, including, among other things, the development of its

business and strategy, any acquisitions, combinations, disposals or

other corporate activity undertaken by the Group (including but not

limited to the integration of the business of Virgin Money Holdings

(UK) plc and its subsidiaries into the Group), trends in its

operating industry, changes to customer behaviours and covenant,

macroeconomic and/or geopolitical factors, the repercussions of the

outbreak of coronaviruses (including but not limited to the

COVID-19 outbreak), changes to its board and/ or employee

composition, exposures to terrorist activity, IT system failures,

cyber-crime, fraud and pension scheme liabilities, changes to law

and/or the policies and practices of the Bank of England, the FCA

and/or other regulatory and governmental bodies, inflation,

deflation, interest rates, exchange rates, changes in the

liquidity, capital, funding and/or asset position and/or credit

ratings of the Group, future capital expenditures and acquisitions,

the repercussions of the UK's exit from the EU (including any

change to the UK's currency and the terms of any trade agreements

(or lack thereof) between the UK and the EU), Eurozone instability,

and any referendum on Scottish independence.

In light of these risks, uncertainties and assumptions, the

events in the forward looking statements may not occur. Forward

looking statements involve inherent risks and uncertainties. Other

events not taken into account may occur and may significantly

affect the analysis of the forward looking statements. No member of

the Group or their respective directors, officers, employees,

agents, advisers or affiliates gives any assurance that any such

projections or estimates will be realised or that actual returns or

other results will not be materially lower than those set out in

this document and/ or discussed at any presentation. All forward

looking statements should be viewed as hypothetical. No

representation or warranty is made that any forward looking

statement will come to pass. No member of the Group or their

respective directors, officers, employees, agents, advisers or

affiliates undertakes any obligation to update or revise any such

forward looking statement following the publication of this

document nor accepts any responsibility, liability or duty of care

whatsoever for (whether in contract, tort or otherwise) or makes

any representation or warranty, express or implied, as to the

truth, fullness, fairness, merchantability, accuracy, sufficiency

or completeness of the information in this document or the

materials used in and/ or discussed at, any presentation.

Certain industry, market and competitive position data contained

in this document and the materials used in and/ or discussed at,

any presentation, comes from official or third party sources. There

is no guarantee of the accuracy or completeness of such data. While

the Group reasonably believes that each of these publications,

studies and surveys has been prepared by a reputable source, no

member of the Group or their respective directors, officers,

employees, agents, advisers or affiliates have independently

verified the data. In addition, certain of the industry, market and

competitive position data contained in this document and the

materials used in and/ or discussed at, any presentation, comes

from the Group's own internal research and estimates based on the

knowledge and experience of the Group's management in the markets

in which the Group operates. While the Group reasonably believes

that such research and estimates are reasonable and reliable, they,

and their underlying methodology and assumptions, have not been

verified by any independent source for accuracy or completeness,

and are subject to change. Accordingly, undue reliance should not

be placed on any of the industry, market or competitive position

data contained in this document and the materials used in and/ or

discussed at, any presentation.

The information, statements and opinions contained in this

document do not constitute or form part of, and should not be

construed as, any public offer under any applicable legislation or

an offer to sell or solicitation of any offer to buy any securities

or financial instruments or any advice or recommendation with

respect to such securities or other financial instruments. The

distribution of this document in certain jurisdictions may be

restricted by law. Recipients are required by the Group to inform

themselves about and to observe any such restrictions. No liability

to any person is accepted in relation to the distribution or

possession of this document in any jurisdiction. The information,

statements and opinions contained in this document and the

materials used in and/ or discussed at, any presentation are

subject to change.

Certain figures contained in this document, including financial

information, may have been subject to rounding adjustments and

foreign exchange conversions. Accordingly, in certain instances,

the sum or percentage change of the numbers contained in this

document may not conform exactly to the total figure given.

Virgin Money UK PLC is registered in England and Wales (company

number: 09595911) and as a foreign company in Australia (ARBN 609

948 281) and has its registered office at Jubilee House, Gosforth,

Newcastle upon Tyne, NE3 4PL

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDKABPOBKDFOB

(END) Dow Jones Newswires

July 27, 2021 02:00 ET (06:00 GMT)

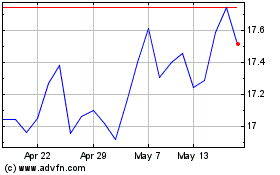

Ve Bionic Etf (LSE:CYBG)

Historical Stock Chart

From Jun 2024 to Jul 2024

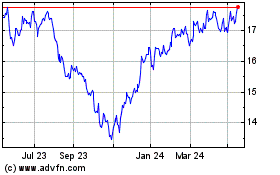

Ve Bionic Etf (LSE:CYBG)

Historical Stock Chart

From Jul 2023 to Jul 2024